Rare earths came to the public’s attention when China began to restrict their export in July, 2010. At the time, China announced a 72% year over year reduction in exports and with 97% of the world’s current supply under their control, the announcement sent rare earth stocks into the stratosphere.

Rare earth elements are crucial in making high-tech electronics products such as highly specialised miniature nuclear batteries, lasers repeaters, superconductors and miniature magnets. The elements are also used to produce automotive catalysts and petroleum cracking catalysts, flints for lighters, pigments for glass and ceramics and compounds for polishing glass. Japan, which accounts for a third of global demand, was particularly effected and has been looking to diversify its supply sources, particularly of heavy rare earths such as dysprosium used in magnets.

According to American rockers Blood Sweat & Tears, what goes up must come down. The European and U.S. debt crisis, a fragile economy and a bear market have been particularly hard on rare earth companies. Across the board the sector has seen a broad sell-off. Then in July, it was announced that prices of some rare earth metals in China dropped for the first time this year. Chinese domestic prices of some of the individual elements were down by up to 7.2 percent at the beginning of July from a month earlier. But taken in context, this is not a significant decline when compared to the dramatic prices increase over the past 18 months.

Wang Caifeng, a former Ministry of Industry and Information Technology official, who is heading up the creation of a rare earth association in China commented, “It is true that prices within China for some rare earth metals have dropped this month. But a drop in some metals prices does not indicate a general decline in the whole rare earth market.”

And today, it was reported that China’s prices for neodymium and praseodymium edged up this week after top producer Inner Mongolia Baotou Steel Rare Earth (Group) said it will build up stocks of praseodymium-neodymium oxide. Excess exports from China’s rare earth industry kept prices artificially low for years, and it is “unrealistic” to expect them to fall back to previous levels as Beijing reins in the sector said a senior industry official at a conference yesterday. Currently, almost half of China’s total production capacity stands idle as inspection teams are working diligently to enforce quotas, industry consolidation targets and new environmental regulations.

For Canadian listed rare earth companies these days no news is good news; in particular, for Avalon Rare Metals (TSX:AVL). Today, the company announced that three of its staff and four visitors were injured in the crash of Arctic Sunwest’s Twin Otter floatplane in Yellowknife on Thursday. Avalon’s management team extended their deepest condolences to the families of the two pilots who died in the crash. Shares of Avalon have been hit very hard over the past 5 months dropping from a high of around $9.50 to under $3 today.

The juniors have also been creamed. Like Avalon, Ucore Rare Metals (TSX-V:UCU) is developing a combined heavy/light rare earth deposit at their Bokan mountain project in southeast Alaska. Jacob Securities analyst Luisa Morena has a price target of $1.09 on Ucore’s shares. The analysts states, “The government may support them by fast-tracking the permitting and giving favorable loans. That would essentially make the government a development partner, at least in the short term.” Ucore’s shares have fallen from over a dollar five months ago to the $0.45 mark. In Nebraska, rare earth explorer Quantum Rare Earth Developments (TSX-V:QRE) has seen its shares slide from $0.69 to $0.19 over the same period.

Rare earth stockpiler Dacha Strategic Metals (TSX-V:DSM) has not escaped the carnage either. Despite the fact the company reported IFRS net earnings of $57.8-million (U.S.) or $0.79 per share for the three months ended June 30, 2011 on total revenue of $60.3-million (U.S.) derived primarily from the gain on its metal investments. This gain was offset by a $1.4-million (U.S.) loss on security investments. Dacha’s management expects that the rare earth oxide market will experience a significant shortfall in available material this fall which could cause a rebound in rare earth prices, particularly for heavy rare earth oxides. Shares of Dacha Strategic Metals are currently trading at $0.64.

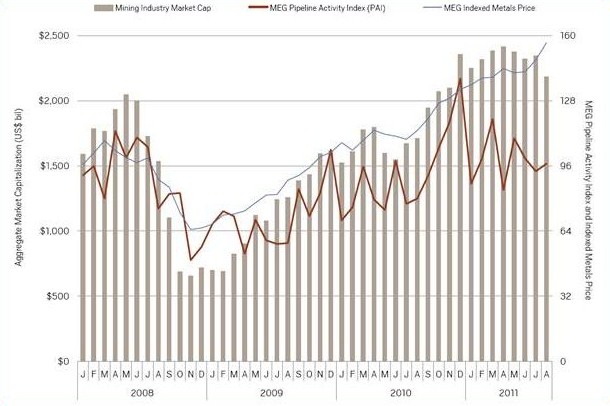

Pipeline Activity Index (PAI) decreased for the second consecutive month in July, then slightly improved in August on the back of a record number of significant drill results. Both months remained below the PAI’s 2011 year-to-date average and well short of the March 2011 high, as the increased exploration activity was not enough to counteract uneasy markets that are making capital raising difficult, particularly for base metals companies.

The industry’s aggregate market cap increased slightly to $2.35 billion in July, before fears of stagnant global economic growth and a potential double-dip recession dragged market caps down to $2.19 billion in August—the lowest level since November 2010.

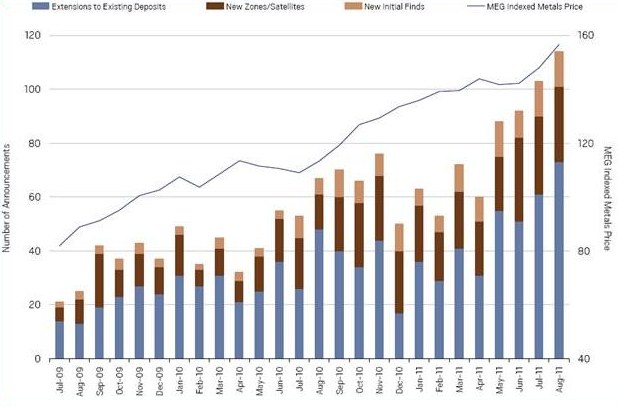

The number of significant drill results announced hit a record high in August, increasing for the fourth consecutive month. Gold explorers continue to be motivated by record-breaking bullion prices, while copper- and silver-focused exploration has helped drive the number of base metals results to their highest levels since before the 2008-09 recession. As has been the case throughout most of 2011, North America and Latin America continue to be the dominant regions for successful drilling, with Africa also contributing significantly to gold results and Australia-Pacific accounting for 25% of the base metals announcements in July and August.

The number of initial resource announcements made in July and August is the lowest two-month total since July-August 2010. This may be partly explained by seasonal factors, such as a focus on summertime exploration programs. Probe Mines’ (TSX-V: PRB) Borden Lake project in Ontario with 4.06 million oz of contained gold and Atacama Pacific Gold’s (TSX-V: ATM) Cerro Maricunga project in Chile with 3.56 million oz were the two largest initial resources announced in the period.

Significant Drill Results Announced

The number of significant financings (US$2 million minimum) completed remained relatively steady in July, before market tumult resulted in only 56 financings closing in August—the lowest one-month total in more than a year.

The two-month total was 10% higher than the May-June total, but included $438 million raised by Detour Gold (TSX:DGC) for development of its 20-million-oz Detour Lake gold project in Ontario. Difficult market conditions had an even stronger impact on base metals companies, as the amount raised in July-August failed to top $1 billion for the first time since January-February 2010.

The MEG Pipeline Activity Index (PAI) measures the level and direction of overall activity in the supply pipeline, incorporating significant drill results, initial resource announcements, project development milestones, and significant financings into a single comparable index. The PAI is featured in the MEG Industry Monitor—a series of comprehensive graphs and charts, with related commentary, illustrating MEG’s analysis of monthly changes and emerging trends in the base and precious metals pipeline. Using information only available from MEG through MineSearch, Exploration Activity Services, and Acquisitions Services, the Industry Monitor tracks developments based on announcements over the past 26 months of significant drill results, initial new resources, project development milestones, significant financings, and acquisitions.

From the article entitled, “Metals Economics Group Pipeline Activity Index, September 2011” by Metals Economics Group. Metals Economics Group (MEG) is a trusted source of global mining information and analysis. With three decades of comprehensive information and analysis, MEG has an unsurpassed level of experience and historical data. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

Demand for gold isn’t only coming from the residents of China and India. There’s been a huge sentiment shift among central banks as well. Toussaint noted how, after many years of selling, central banks have become net buyers of gold. He says, “Western Central banks have essentially shut the tap off, and the vast majority of the buying is coming from Eastern central banks.”

In just the first half of this year, official sector purchases are up three-fold over the 2010 total to 216 tons, accord to the GFMS report. GFMS says the rise is largely due to low sales levels from Central Bank Gold Agreement (CBGA) signatories and the International Monetary Fund (IMF) completing its sales program at the end of 2010. In addition, other countries have gobbled up gold in an effort to diversify reserves away from the U.S. dollar. Scotia Capital estimates central banks’ total purchases of gold will reach 248 tons by year-end.

Some of the big buyers have been Mexico (whose central bank purchased roughly 100 tons of gold earlier this year), Korea (purchased 25 tons in June), Thailand (purchased nearly 19 tons in June) and Russia (which has purchased over 50 tons of gold from its domestic market year-to-date).

Toussaint says Eastern central banks are “catching up with the rest of the world” because their current allocation is tiny right now. However, whenever the WGC discusses these buying habits with the central banks of Korea, Taiwan and other Asian countries, they consistently say that they are interested in gold, and looking to hold it over the long-term. In other words, he says, this is not a “knee-jerk reaction to the direction of the dollar.”

GFMS also believes that this could be just the beginning. In a release announcing the report, Philip Klapwijk, Global Head of Metals Analytics at GFMS, said, “we are in essence in chapter three of the central bank story—we’ve left behind a period of heavy net sales, then a short period of neutrality and we’re now in a new environment of heavy buying.”

From the article entitled, “Perfect Storm Creates Tidal Wave of Gold Demand” by Frank Holmes. Frank Holmes is chief executive officer of U.S. Global Investors – a registered investment adviser that manages approximately $2.8 billion. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

Here are your “Movers and Shakers” for the week ending September 16th, 2011 on the TSX and TSX-V Exchanges. In no particular order, these are the 10 mining companies that caught our eye this week.

Here are your “Movers and Shakers” for the week ending September 16th, 2011 on the TSX and TSX-V Exchanges. In no particular order, these are the 10 mining companies that caught our eye this week.

1. Dalradian Resources Inc. (TSX: DNA)

Dalradian Resources was this week’s top TSX-listed mining stock percentage gainer posting a gain of 27.8%. Dalradian will be added to the S&P/TSX SmallCap Index on Monday, September 19th. Earlier this month, the company announced intersecting 3.2m grading 5.34g/t Au at its Curraghinalt Deposit in Northern Ireland.

2. TerraX Minerals Inc. (TSX-V: TXR)

On the TSX Venture board, TerraX Minerals posted a weekly gain of 37.9% which made it the number one mover this week. On Wednesday, September 14th, the company announced it intersected a porphyry-style alteration with significant sulphides at its Stewart gold-copper property in Newfoundland.

3. Aura Minerals Inc. (TSX: ORA)

Aura Minerals chalked up an 11.6% loss this week which marked the largest decline for a TSX-listed mining stock. Aura closed down $0.20 on Friday to end the week at $1.53. The company has faced a host of operational problems and the loss of its chief executive officer. In July, Dundee Capital Research analyst Ron Stewart noted, “No question in our mind, Aura has had the proverbial stuffing knocked out of it in the market.” At the time, Aura was trading at $2.13 and Stewart issued a $3.00 target on the company’s stock.

4. Copper One Inc. (TSX-V: CUO)

Copper One was off 17.5% this week which marked the biggest drop for any widely traded TSX-V listed mining stock. Volume was up considerably on Friday with over 1.4 million shares traded. The company’s stock was off $0.07 on the day to close at $0.33 on no news. On July 8th, Copper One annouced that exploration work on the Rivière Doré project in Quebec was being put on hold. At the time, the company’s shares were trading at $0.70.

5. Avion Gold Corp. (TSX: AVR)

Avion Gold was the most actively traded issuer on the TSX Exchange on Friday with over 33 million shares trading hands. The company was up $0.08 on the week to close at $2.54. Avion Gold is being added to the TSX Global Gold and Global mining Indexes effective Monday, September 19th, 2011.

6. Silver Wheaton Corp. (TSX: SLW)

Silver Wheaton was the second most actively traded stock on Friday on the TSX Exchange with almost 24 million shares traded. On Monday, September 19, 2011 Silver Wheaton will be added to the TSX 60 Index. Also upcoming, third quarterly cash dividend payment for 2011 of US$0.03 per common share will be paid to holders of record of its common shares as of the close of business on September 20, 2011.

7. Allana Potash Corp. (TSX:AAA)

This week marked the first full week of trading on the TSX for Allana Potash. The company graduated to the TSX on Friday, September, 9th. On Thursday, September 15, Allana Potash announced drill results from the company’s potash project in Ethiopia which included 8 meters of 18.54% KCl. About the news, Company President & CEO Farhad Abasov stated, “Allana management believes that the potash in this region may be amenable to mining by open pit methods and future studies will focus on this potential.”

8. Silvercorp Metals Inc. (TSX: SVM)

Silvercorp Metals was in the headlines all week after the B.C. Securities Commission announced last Friday it was conducting a regulatory investigation into anonymous allegations against the company. A second set of allegations were published on the internet this week and the company’s Chairman Dr. Rui Feng invited the authors responsible for the accusations to “come out of the shadows and participate with the regulators in their investigations“. This week the company bought back over $31 million of its own shares through a normal course issuer bid.

9. Copper Fox Metals Inc. (TSX-V: CUU)

B.C. copper miner Copper Fox intends to raise an additional $2-million via a private placement bringing the total private placement proceeds of its recently announced financing to $5-million. The offering is expected to consist of 3,333,334 units at a purchase price of $1.50 per unit. Each unit consists of one common share of Copper Fox and one-half common share purchase warrant of Copper Fox. Each whole warrant entitles the holder to acquire one common share of Copper Fox at an exercise price of $1.75 for one year.

10. Passport Potash Inc. (TSX-V: PPI)

Passport Potash was also in the B.C. Securities Commission spotlight this week when, on Monday, the regulator expressed concern that the company may be in possession of the results of an economic analysis for the Holbrook project that had not been disclosed through a news release and material change report. The company’s shares are down $0.09 on the week closing at $0.47.

The British Columbia Securities Commission said on Friday it’s conducting a regulatory investigation into anonymous allegations against Silvercorp Metals (TSX: SVM), a Vancouver-based company with silver mines in China.

The regulator said that certain allegations were made against the company in an anonymous letter dated August 29th, 2011 addressed to the Ontario Securities Commission and various media outlets.

“This is a departure from the BCSC’s usual policy of keeping investigations confidential, but we feel it is necessary in order to conduct a balanced and thorough review to publicly ask the author of the complaint to come forward,’’ said Lang Evans, Director of Enforcement for the BCSC. The news of the investigation came after Silvercorp shares fell 6% on Friday to $8.39. In the past year, the stock has traded between $15.60 and $6.92.

On September 2nd, the company issued a statement saying it had received the anonymous letter which was also addressed to the company’s auditors. The company said the central allegation is that while Silvercorp reported a net profit of US$66 million to the U.S. Securities & Exchange Commission in calendar 2010, financials purportedly available from the Chinese State Administration of Industry and Commerce shows Silvercorp reporting a loss of US$500,000 for calendar 2010. The letter also alleges that the company’s cash position is grossly overstated.

“This type of manipulative scheme is baseless and which depresses our share price and harms our shareholders,’’ said Silvercorp Chief Executive Officer Rui Feng. Silvercorp noted there has been a dramatic increase in the short position of its shares over the past two months, approximately 23 million, or 13% of the total outstanding shares.

This is not the first case of questionable accounting to hit a Chinese TSX-listed company. On June 8th, 2011, Sino Forest Corporation (TSX:TRE) confirmed that the Ontario Securities Commission opened an investigation concerning the company and the unusual trading activity and volatility associated with the company’s stock in response to a report issued by Muddy Waters Research.

With three projects in Asia’s leading economy, the company reportedly accounts for roughly 5% of the China’s silver output. The BCSC is asking the author of the complaint, or anyone else who may have information related to the allegations, or the identity of the author, to contact them.

CLICK HERE – for our Silver Issue where Silvercorp Metals was profiled in 10 Most Interesting Silver Stocks.

Gold is making regular headlines these days as global economic uncertainty remains high and the yellow metal recently reached record prices of just over $1,900 per ounce. Since a sharp correct where gold gave back over $200, the price has recovered and gold is currently trading around $1,885 per ounce.

Goldman Sachs said it expects gold prices to continue to climb in 2011. The U.S. based investment bank cited the current low level of U.S. real interest rates, European debt issues, balancing inflation with growth in China, and mixed data from several major economies as drivers for gold’s continued appreciation. “We recommend near-dated consumer hedges in gold,” stated analysts at Goldman Sachs and they expect further price increases later this year and into 2012.

According to Citigroup, a resurgence in investment demand has fueled gold’s rally over the past decade. Investment demand has grown from 4% of total demand for gold in 2000 to over 39% in 2010. “We caution that this very aspect that provided support for gold over this time may result in its downfall going forward,” noted Citigroup. “Even a slowdown, let alone a decline, in net investment flows can have a materially negative impact on the gold price from current levels.” So whether you are a gold bug bull or a gold bubble believer, one thing is for certain, there is no denying gold’s captivating run.

With all the excitement around the price of gold let’s not forget gold equities. Tye Burt, President & CEO of Kinross Gold (TSX:K) may have crystalized the argument for gold equities best when he stated in a recent interview with CNBC, “Gold price is up 25% year-over-year and our earnings effectively doubled. There is a leverage in the gold producers which will play out in their equity prices.”

MiningFeeds.com

In early May silver reached a high of nearly $50 an ounce. Then it seemingly hit a psychological brick wall built by the Hunt brothers and beat a hasty retreat to $32.32. But since its sharp correction, silver has been making a slow and steady comeback and now trades at around $41.50. Eric Sprott, the founder of Sprott Asset Management, calls silver “the best recommendation anyone could make this decade” and sees silver going to $100 an ounce within the next 3 to 5 years.

Sprott’s prognostication must be music to Minefinders’ ears. Minefinders is targeting gold and silver producing assets in Mexico and, after years of hard work, the company has Proven and Probable reserves of 2.34 million ounces of gold and 119 million ounces of silver. Minefinders is unhedged and expects to produce at least 65,000 ounces of gold and 3.3 million ounces of silver in 2011.

With approximately $2.30 per share in cash and little long-term debt the company has a strong balance sheet. Minefinders’ solid performance hasn’t gone unnoticed by the financial markets, the company’s shares last closed at a record high of $17.68 valuing the company at over $1.5 billion. We connected with Mark Bailey, President and CEO of Minefinders, for an exclusive one-on-one discussion.

You position Minefinders as a precious metals mining and exploration company as opposed to a gold company, is it your strategy to expand both gold and silver production going forward?

We have always liked both metals and the diversification that focusing on both brings to our business. At our Dolores Mine, we have excellent exposure to both gold and silver, our La Bolsa development project will be primarily a gold operation but we also have other properties that we have not drilled on since 2006 such as Planchas de Plata and Real Viejo which are silver deposits. We plan to recommence drilling on Planchas de Plata by the end of 2011.

The Dolores Mine is your flagship property, please talk about the property and your plans for further development.

Commercial production was declared at our Dolores Mine in May 2009. The current Reserves are about 2 million ounces of gold and 114 million ounces of silver. In 2011 we have guided to produce 65,000 to 70,000 ounces of gold and 3.3 to 3.5 million ounces of silver at a cash cost of $450 to $500 per gold-equivalent ounce. We are currently well on track to meet or exceed this guidance. Now that Dolores is producing, we are currently looking at expansion plans with the addition of a mill to process high-grade open pit ore as well as the development of an underground mine. Studies on both these projects are currently nearing completion and we expect to be able to provide more details on these projects within the next six months.

We reported the results of a draft pre-feasibility study for a 6,500 tonne per day mill in April 2010 and are finalising an optimization study for the mill with the expectation of finalising the mill size and making a construction decision within the next six month. Secondly, we expect to develop La Bolsa and have a second mine in production by the first quarter of 2013.

The development of an underground mine at Dolores will take some time. Based on our current resource model, there are about 800,000 gold equivalent inferred ounces below the current open pit reserves, which we expect to expand and elevate to reserves through the development of the underground and further exploration, expected to take three to four years. Successful development of the underground will lead to production sometime in 2016 which will further enhance our gold and silver production profile.

Regardless, we’re very pleased with the performance of the current heap leach operation and the addition of a mill and underground operations will only help to speed up recovery and increase our production.

The La Bolsa mine is your most advanced development project, what are some of the salient points?

Aside from our flagship Dolores property, La Bolsa is our current development project. La Bolsa was in fact the first property Minefinders staked in Mexico in 1995 but when we realised that Dolores was going to be a much bigger deposit we put La Bolsa on hold to focus on getting Dolores into production.

La Bolsa is located in northern Sonora state in Mexico and is a gold and silver deposit but will primarily produce gold (as the silver will not leach well) and we expect to produce about 40,000 ounces of gold per annum for the life of the mine which is about five and a half years. Logistically it is in a great location, only 32 kilometres from the town of Nogales (so close to a workforce), and is situated on a private ranch.

We filed a National Instrument 43-101 compliant pre-feasibility study in August 2010 which showed the project to be economically sound and given the current price of gold, putting La Bolsa into production looks even more attractive. With Dolores now in production and performing well we have refocused our efforts on getting La Bolsa into production and are currently finalising permitting and detailed engineering. We expect to make a construction decision by the end of the year and could have it in production within 12 months with an expected capital expenditure of US$32 million.

You note in your presentation that Minefinders has one of the more attractive enterprise values to Proven and Probable gold-equivalent reserve ratios, please expand on this for our readers.

Our share value has typically traded at a discount to our peers. We believe that on the basis of our Proven and Probable reserves alone, we are an attractive investment opportunity when compared to our peers. We believe in using reserves for comparisons, because it is what is currently economically mineable and from our perspective, a more compelling case than just comparing resources, which may or may not ever be economically minable.

You have a pretty aggressive exploration program underway at the La Virgina project. How is that progressing and what major milestones are upcoming?

La Virginia is a very exciting project and the results to date have been encouraging. The La Virginia project covers more than 32,000 hectares containing seven separate target areas, very much a grassroots project that had never been drilled before until we started our first drill program on one of the target areas in April 2010. We recently reported 6.46 grams per tonne gold equivalent over 67 metres and have drilled around 40 holes to date. Our plan is to continue exploring on this target area to improve our understanding and expand the mineralization to develop a resource within the next eighteen months. We will continue with our exploration on the other six target areas and if results are encouraging consider increasing our drilling efforts on these other prospective targets.

With gold and silver trading at record levels and competition in your sector increasing, how do you planning on growing the company and expanding its resources base?

We plan to grow our company through the development of existing assets and focused exploration. As mentioned earlier, we are currently examining the addition of a mill at our Dolores Mine as well as the development of an underground mine at Dolores.

Assuming positive construction decisions for the mill at Dolores and for the construction of a mine at La Bolsa, Minefinders expects to increase its gold equivalent production to around 300,000 ounces by 2015. This represents an 80 to 90 percent increase from current production levels.

Finally, we will leverage our strengths as explorers and continue to explore at La Virginia Property, our other exploration projects and revisit properties such as Planchas de Plata, a silver deposit, which with the current price of silver now makes sense.

In the near-term, Minefinders has a very attractive growth profile and the experience to continue to grow its resource base through exploration. Most importantly, we are fully funded to execute our growth plans for Dolores (for both the mill and the underground development) and la Bolsa. We are very excited about the Company’s future.

This interview is featured in the article 10 Most Interesting Gold Stocks – Part 4 – CLICK HERE to read more.

Another Bema? If B2Gold, a company founded in 2007 by the former executives and management of Bema keeps its current pace, the second time around might be a whole lot quicker. Bema, of course, was acquired by Kinross Gold in 2007 in a friendly takeover valued at CDN$3.5 billion. Surprisingly, B2Gold actually stumbled out of the gate; shares of the company fell from over $2 immediately after going public, to a low of $0.35 during the height of the financial crisis. Since then, however, the company has rebounded and then some. B2Gold expects to produce approximately 135,000 ounces of gold in 2011 and the company’s shares are now trading at just over $4.

A quick look at their growing portfolio of properties shows that B2Gold has inherited Bema’s international flavor; Bema had producing gold mines in Russia, Chile and South Africa as well as development projects in Russia and Chile. The company operates two producing gold mines in Nicaragua and has exploration and development projects in Colombia. This diversification, coupled with the operational track record of B2Gold’s management and lower than expected production cost, led Macquarie Capital analyst Michael Gray to call B2Gold, “One of our top picks amongst mid-tier gold producers”. Gray recently gave the company an “outperform” recommendation.

MiningFeeds.com connected with Clive Johnson to discuss the evolution of Vancouver’s mining capital markets and the prospects for B2Gold.

You’ve been involved in minerals exploration and development for many years now having built your career in Vancouver. Please talk about the evolution of the mining finance business in Vancouver from your early days with the VSE to what is now arguably the mining finance capital of the world.

As you point out in your question, Vancouver has seen significant transformation from a penny stock exploration market in the 70s and 80s to a major force for mining and mining finance. I think there are a few reasons for this. Firstly, there were a number of successful companies like Bema Gold (which we ran for over 20 years) that transitioned from exploration to successful development and production and secondly there were some very successful entrepreneurs putting together Vancouver based mining companies such as the Wheaton River/GoldCorp combination. Finally in the international world of mining a company can have its head office anywhere and Vancouver is one of the top choices for many executives.

B2Gold has a corporate mandate to grow via acquisitions, has the high price of gold affected this strategy in any way?

B2Gold’s growth strategy has always been to grow by exploration and acquisitions (as was Bema Gold’s strategy). As the gold price goes higher, quality acquisitions become harder to find. We are one of the few producers that have a proven exploration team with an impressive track record with significant gold discoveries. The cheapest ounces will always be the ones you find. While acquisitions are more challenging in this gold environment, B2Gold shares have outperformed most of the sector over the last 6 months, which may increase our opportunities for the acquisition of other companies.

To date all of B2Gold’s assets are within the America’s but you’ve focused on some lesser know Latin American countries like Uruguay and Nicaragua to build your portfolio – please explain the benefits of this strategy to our readers.

In the days of Bema and now B2Gold we have always looked for opportunities in countries that are in economic and/or political transition or are under explored. In our current portfolio Nicaragua is a country that is largely unexplored and is in a stage of positive political and economic transition, while Colombia is another country that is largely unexplored and has had a dramatic transition to a safe country to explore in. And finally, Uruguay is a very stable country with great potential that has been under explored.

The rising price of gold has resulted in a plethora of junior and intermediate gold producers now listed on the TSX Exchanges. Why should an investor select B2Gold as an investment choice over many of your counterparts?

B2Gold represents and unusual opportunity for investors because it is a combination of a company with solid profitable gold production with no gold hedging and no debt and has a portfolio of projects to grow from. In addition we have numerous high quality exploration targets and one of the most successful exploration teams in the world.

Your Limon mine experienced a force majeure and flood in late June and underground operations have been suspended. When is the mine expected to be fully operational?

The Limon Mine is expected to be back to full-scale production in September. In the meantime, production has continued from other open pits and stockpiles. The company expects to meet its guidance production for Limon of between 42,000 and 46,000 ounces of gold in 2011.

How is your exploration program progressing and what is on the horizon as we head into 2012?

Exploration programs are continuing in Nicaragua at the Libertad Mine property, Limon Mine property and on the Trebol exploration project. In Colombia, exploration and pre-feasibilty work is underway on the Gramalote property, a 51% AngloGold/49% B2Gold joint venture, and finally, exploration drilling continues on the Cebollati project in Uruguay. B2Gold’s total 2011 exploration budget is over $40 million dollars. The company intends to announce exploration results from its various projects in September, 2011. We anticipate exploration on these properties to continue through 2012.

This interview is featured in the article 10 Most Interesting Gold Stocks – Part 3 – CLICK HERE to read more.

On Monday, the price of gold traded above $1,920 an ounce which marked another record setting day for gold bullion. The record was set after the Swiss National Bank announced it would imposed an exchange rate cap on the soaring Swiss franc to stave off a recession. The Swiss National Bank intends to keep the franc at or above 1.20 to the euro by effectively buying unlimited quantities of other currencies. Profit-taking later pushed bullion down more than $50 the same day and, today, traded briefly below $1,800 an ounce.

In response to the Swiss National Bank’s move, Peter Fertig, a consultant for Quantitative Commodity Research stated, “All in all, Switzerland is now on a quantitative easing policy in the foreign exchange markets. If the Swiss franc is no longer a preferred safe haven due to intervention by the SNB, it will have (a positive) impact on the demand for gold.” And Frank McGhee, head of precious metals trading at Integrated Brokerage Services in Chicago said, “I think gold is headed for $2,000.”

Record gold prices are having a positive effect on many junior and intermediate gold producers. Alacer Gold (TSX:ASR), IAMGOLD (TSX:IMG) and Banro Corporation (TSX:BAA), which is set to head into production later this year, are all trading at or near record highs. But record highs in the price of gold have not translated into “golden days” for some junior gold miners. OceanaGold (TSX:OGC) has yet to make its move despite the fact that earlier today the company provided a progress update on construction activities at the Didipio project located in the Philippines.

Mick Wilkes, managing director and chief executive officer, commented, “We continue to make good progress on construction activities at Didipio, with the key milestone of pouring first concrete on schedule in November, 2011. Mining activity is on track to commence in January, 2012, and we expect to commission the process plant in fourth quarter 2012. This project will transform OceanaGold, producing on average 100,000 ounces of gold and 14,000 tonnes of copper at cash costs net of byproduct credits of $356 (U.S.) per ounce of gold over a 16-year mine life.”

Oceana’s experience at Didipio, located 250 km north of Manila, has been nothing short of a PR nightmare. The company has faced stiff opposition from international human rights groups, such as Oxfam Australia who say that local indigenous peoples are being forced off their land for the project. The opposition actually began in June, 2008 when local residents filed a complaint with the Phillipino Commission on Human Rights (CHR), accusing OceanaGold’s subsidiary in the Philippines of setting on fire and bulldozing 187 houses in the village without a court order. CHR later urged the government to withdraw OceanaGold’s mining rights to the project.

Despite the torrid affair, OceanaGold posted record sales and earnings from its established mines in New Zealand in 2010 and continues to work diligently towards getting the Didipio project off the ground.

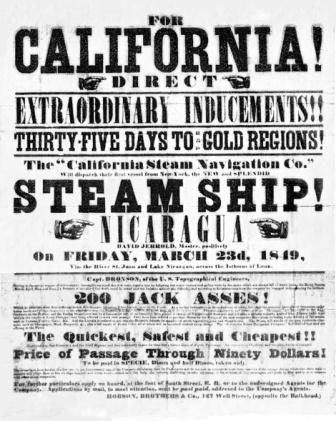

Is this the modern day version of the California gold rush or is gold in the process of forming a bubble?

Erik Sprott from Sprott Asset Management is thinking steam ships and gold pans. In an article entitled, “Debunking the Gold Bubble Myth“, Sprott argues that there has been, and will continue to be, a widely held misconception that a bubble is forming. He argues that gold buyers are not merely speculators buying on emotion with no rationale other than to sell to the ‘greater fool’ at higher prices in the future. This logic, according to Sprott, is flawed because it assumes that gold has no intrinsic value and is simply a speculative asset that has captured investors’ imaginations. Coupled with the fact that gold is actually a surprisingly under-owned asset class leads Sprott to believe that the bull market in gold is far from over.

Ross Norman, CEO of Sharps Pixley, a London-based bullion broker that sells retail physical precious metal coins and bars to UK clients doesn’t see a bubble forming. In a recent interview with Bloomberg, Norman stated, “I don’t think it’s in bubble territory. I do think underneath and underpinning this market are some very strong fundamentals that have taken us here.” Mr. Norman cites fantastic demand growth through the ETFs, the fact that international central bankers have turned from sellers to buyers and flat mine supply as reasons for gold to continue its upward price movement.

1. AuRico Gold Inc. (TSX:AUQ)

AuRico Gold, formerly Gammon Gold, had a reputation for underperformance. Last year the company overhauled much of its board and elected to freshen things up by undertaking a name change. The paperwork was completed this summer and AuRico’s Ocampo mine in Mexico was demonstrating improved results with a 19% increase in gold equivalent production and cash cost of $340 per realized gold equivalent ounce. A supportive board and strong results gave AuRico’s chief executive officer Rene Marion the green light to build the company through acquisitions.

On August 29th, AuRico announced the $1.46-billion take over of Northgate Minerals (TSX:NGX). But apparently investors in AuRico Gold did not like the sound of the deal. On the day of the announcement AuRico shares were down more than 20% and since then millions of shares have exchanged hands. What on the surface appears to be a strategic merger of equals, with the acquisition of Northgate AuRico will increase its gold reserves by more than 80 per cent, some industry analysts seemingly don’t like the deal. Desjardins Securities analyst Brian Christie downgraded his rating to “hold” from “buy” but maintained a $15 price target. His concern is that the merger will dilute the net asset value of the company.

There is a flip side to every story and, despite the sell-off, some analysts are optimistic about the merger. CIBC World Markets analyst Brian Quest upgraded AuRico to “sector outperformer” and, like his counterpart Brian Christie, maintained a price target of $15 per share. Mr. Quest stated in a research note, “…a gold producer operating in Australia, Canada, and Mexico, producing nearly 500,000 ounces of gold in 2012, should garner support in the years to come.”

Perhaps the sell-off in AuRico after the announcement was more a function of the run-up prior to the announcement. Two months ago, shares in the company could be had for as little as $9. But on the day before the announcement, AuRico shares closed at $13.72, just 8.5% shy of both analysts price targets. At press time, the company’s shares are trading at just over $12.00.

Next, we look at the company that lost an epic takeover battle to AuRico Gold, Vancouver-based Timmins Gold.

2. Timmins Gold Corp. (TSX:TMM)

Last September, Timmins Gold made a non-binding proposal to the directors of Capital Gold (TSX:CGC) to merge on a negotiated basis. The proposed value of the transaction was $4.50 per share; shares of Capital Gold were, at the time, trading at $3.89. But from the get-go, Capital Gold’s board was not receptive the proposal. Enter another company featured on our 10 Most Interesting Gold Stocks list, AuRico Gold, and you the stage was set for a contentious 7 month long take-over battle. The final price tag, AuRico’s winning bid was for $6.34 per share. $1.77 more than what was original agreed upon when Capital and AuRico signed their merger agreement.

Since losing the fight for Capital Gold, Timmins has been quiet on the M&A front but has been making noise elsewhere. The company has been continuously drilling and extending the mineralization at its flagship San Francisco gold mine located in Sonora, Mexico. And on August 11th, 2011, the company reported that it sold 17,965 gold ounces during the quarter. This represents a 59-per-cent increase in gold sales over the first quarter of the previous fiscal year. In addition to the San Franciso mine, Timmins also has a collection of interesting gold assets across Mexico. Most notably a 40,000 hectare land package in the Peňasquito area of Mexico that is contiguous to Goldcorp’s 13 million ounce Peňasquito Gold Deposit.

We caught up with Bruce Bragagnolo, President & CEO of Timmins Gold, to discuss some of the company’s past challenges and learn what’s in store for this emerging junior gold producer – CLICK HERE – for the interview.

For 10 Most Interesting Gold Stock – Part 2 – CLICK HERE.

3. Eldorado Gold Corp. (TSX: ELD)

If you were to sum up the story of the bull market in metals in two words, then “Chinese demand” might rank as high as any other pairing. Though, as some point out, Chinese demand won’t support commodity prices forever. China’s GDP growth from 1978 to 2005 was a staggering 9.5% a year.

Yet for all the success that North American miners have had because of China, Vancouver’s Eldorado Gold, in February 2007, became the first North American company to successfully construct and operate a gold mine there when it began production at the Tanjianshan mine in Qinghai Province. This probably didn’t come as a surprise to many Eldorado shareholders as the company has shown an ability to produce at a low cost in various political and economic environments. In addition to China, the company operates in Turkey, Brazil, the United States and Greece, all while keeping its operating costs between $390 and $410 an ounce. Eldorado Gold is a favourite of Desjardins Securities analyst Brian Christie who, last week, raised his price target by $0.75 to $22 (U.S.) and maintained a “buy” rating.

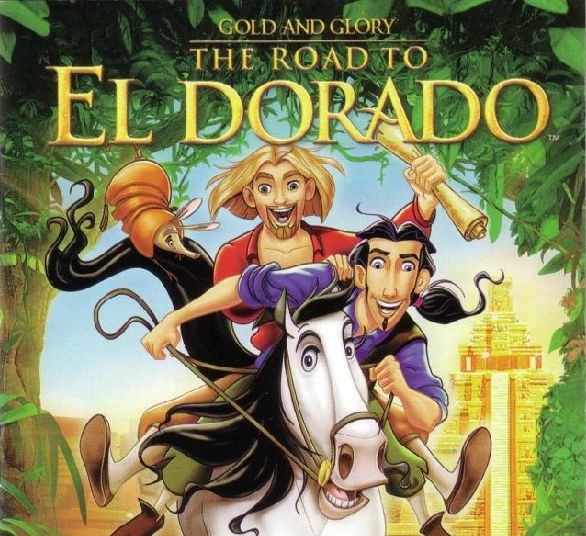

Eldorado’s growth has been remarkable; from just over $179 million in revenue in fiscal 2007 to $791 million in fiscal 2010. The company has also been an earnings machine, putting more than $200 million to the bottom line in 2010. And, 2011 is shaping up to be another stellar year for Eldorado, an emerging intermediate gold producer that takes its name from a legendary city of gold.

4. Guyana Goldfields Inc. (TSX: GUY)

El Dorado, the “Lost City of Gold“, has fascinated and eluded explorers since the days of the Spanish Conquistadors. The story of El Dorado was born through a combination of myths and legends. Dating back to the 1500s, the story originated from the Muisca people who spoke of a golden city hidden in remote South America. The promise of an ancient city of gold enticed European explorers to search for El Dorado for more than two centuries. The geographical location of the mysterious city has morphed along with the myths and legends over the years. Gold coins, precious stones, and streets paved with gold are thought to be located somewhere in Columbia, Venzuela or Guyana.

Sir Walter Raleigh searched for the elusive city in 1595 and reportedly found it. He described El Dorado as a city on Lake Parime far up the Orinoco River in Guyana where “every stone they picked up promised either gold or silver“. The city was actually marked on English maps until its existence was disproved by Alexander von Humboldt during his Latin-America expedition in the early 1800s. Though many have searched and failed to find this city of gold, no evidence of such a place has ever been found.

One TSX listed company, Guyana Goldfields, has certainly not let the past failed efforts to find El Dorado prevent them from finding gold in Guyana. The company has been operating in Guyana successfully for 15 years and now boasts a resource estimate of just over 6.6 million ounces of gold from 2 different projects. UBS analyst Dan Rollins likes the company. On July 25th Rollins wrote, “Given the company’s attractive valuation, market capitalization of less than $1 billion, near-term production potential from Aurora and exploration potential at Aranka, we believe Guyana Goldfields could be an acquisition target for an intermediate or mid-cap producer seeking to expand its presence in South America.”

MiningFeeds.com recently connected with Claude Lemasson, President and COO of Guyana Goldfields, for an exclusive interview – CLICK HERE – to read more.

5. Strike Gold Corp. (TSX-V: SRK)

2G is short for second-generation wireless telephony technology. Three primary benefits of 2G networks over their predecessors were that phone conversations were digitally encrypted; 2G systems were significantly more efficient; and 2G introduced data services for mobile like SMS text messages. What does 2G have to do with a newly listed TSX-V junior? Strike Gold is going after “2 Gs”; specifically, gold and graphite. An interesting proposition considering gold and graphite are two of the hottest sectors in mining today. There is another obscure 2G Strike Gold reference, but we’ll get to that in a moment.

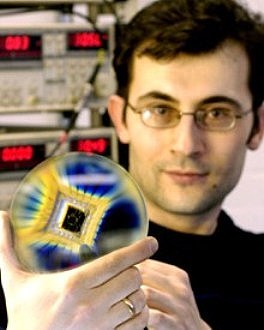

On September 1st, 2011, Strike Gold announced an agreement to acquire a 100% interest in the Deep Bay East and Simon Lake Graphite Properties both located in northern Saskatchewan. Some historic drilling and trenching was completed at Deep Bay East and the exploration identified some high grades of graphite across thick intervals including 35 meters grading 8.58% graphitic carbon. About the acquisition, Geoff Balderson, Strike Gold’s president & CEO, remarked, “We are delighted to have secured these two properties and give our shareholders investment exposure in what many believe to be such a promising resource sector.” The news of the acquisition sent Strike’s shares up 36.8% from $0.24 to $0.38. Perhaps not surprising when you consider Northern Graphite (TSX-V:NGC), a junior exploration company that completed a $0.50 IPO just 4 months ago, last closed at $1.35.

In 2010, scientists at the University of Manchester won the Noble Prize in Physics for isolating graphene. Graphene is a one-atom-thick planar sheet of densely packed carbon atoms; think of it as an atomic-scale chicken wire made of carbon atoms and their bonds. Scientists around the world believe that graphene is a strong candidate to replace silicon and other materials in semiconductor chips. Moore’s Law observes that the density of transistors on an integrated circuit doubles every two years. Transistors run computers and, you guessed it, 2G networks. Science has pushed the capabilities of existing transistor materials to the edge. Silicon transistors, for example, are thought to be close to the minimum size where they can remain effective. Graphene transistors can potentially run at faster speeds and cope with higher temperatures theoretically extending Moore’s Law for many years to come.

Dr. J.T. Janssen, a researcher at UK’s National Physical Laboratory states, “We’ve laid the groundwork for the future of graphene production, and will strive in our ongoing research to provide greater understanding of this exciting material. We have taken a huge step forward, and once the manufacturing processes are in place, we hope graphene will offer the world a faster and cheaper alternative to conventional semiconductors.”

For 10 Most Interesting Gold Stocks – Part 3 – CLICK HERE.

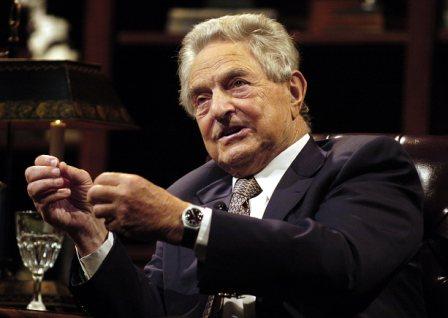

On May 16th, 2011 it was reported that U.S. investment billionaire and former gold advocate George Soros, through Soros Fund Management, sold nearly $800 million of gold during the first quarter after the precious hit a record high of $1,577 an ounce on April 30th, 2011. This roughly accounted for 5.3 million ounces of physical gold and caused some to openly question if this was the transaction that signaled the end of bull market in gold and gold equities.

But not so fast. A little digging shows that Soros’ fund actually added gold equities to their holdings during Q1 2011 including notable Canadian listed companies including Barrick Gold (TSX:ABX), Eldorado Gold (TSX:ELD), and Goldcorp (TSX:G). Soros believes, as do many industry professionals, that gold equities should benefit directly from the marked appreciation in the price of gold by generating strong cash flow from ongoing gold sales. In turn, shareholders of gold equities should enjoy the rising capital value of their shares alongside any dividend streams flowing to those shareholders.

So why have gold equities lagged behind the rising price of the metal itself in term of performance? The reason is that many analysts expect much lower prices for gold over the next three or four years. “People don’t believe that gold prices are staying up,” said Charles Oliver, a portfolio manager at Sprott Asset Management. But Oliver is not a disbeliever. The Sprott fund manager is sticking to his 2008 prediction that the price of bullion will hit $2,000 an ounce by April, 2012.

6. B2Gold Corp. (TSX:BTO)

Another Bema? If B2Gold, a company founded in 2007 by the former executives and management of Bema keeps its current pace, the second time around might be a whole lot quicker. Bema, of course, was acquired by Kinross Gold in 2007 in a friendly takeover valued at CDN$3.5 billion. Surprisingly, B2Gold actually stumbled out of the gate; shares of the company fell from over $2 immediately after going public, to a low of $0.35 during the height of the financial crisis. Since then, however, the company has rebounded and then some. B2Gold expects to produce approximately 135,000 ounces of gold in 2011 and the company’s shares are now trading at just over $4.

A quick look at their growing portfolio of properties shows that B2Gold has inherited Bema’s international flavor; Bema had producing gold mines in Russia, Chile and South Africa as well as development projects in Russia and Chile. The company operates two producing gold mines in Nicaragua and has exploration and development projects in Colombia. This diversification, coupled with the operational track record of B2Gold’s management and lower than expected production cost, led Macquarie Capital analyst Michael Gray to call B2Gold, “One of our top picks amongst mid-tier gold producers”. Gray recently gave the company an “outperform” recommendation.

MiningFeeds.com connected with Clive Johnson to discuss the evolution of Vancouver’s mining capital markets and the prospects for B2Gold – CLICK HERE – for the exclusive interview.

7. Trelawney Mining and Exploration Inc. (TSX-V:TRR)

Made in Ontario. Perhaps that is the mission statement of Trelawney Mining, if not, maybe it should be. Trelawney Mining is not exploring the distant corners of the world looking for the next big discovery. Rather, the company, based in Toronto, Ontario, is very comfortable in their own back yard so to speak. The company’s collection of gold properties, four and counting, are all located in Northern Ontario where the company is actively exploring and mining high-grade narrow vein systems.

Trelawney targets projects that have past expenditures, contain resources that are within trucking distance to custom mills, do not require major capital investment in infrastructure; and, hold the promise of exploration potential. Effectively, Trelawney looks to succeed where others may have failed. Many previous operators of high-grade narrow vein structures in Northern Ontario are thought to have lacked the underground operating experience to develop and operate such resources. And in some cases, these types of assets may have not meet the parameters for large scale operators.

On July 11th, 2011 Trelawney announced the intended takeover of Augen Gold (TSX-V:GLD) a Toronto-based junior that owns the Jerome Mine. The company’s bellwether mine contains a NI 43-101 Inferred gold resource of 1.03 million ounces (18.7 million tonnes grading 1.7 grams per tonne). Trelawney originally offered 0.066 of a Trelawney share for each outstanding share of Augen Gold but has since sweetened the pot to 0.0862 of a Trelawney share. Augen’s board is in support of the deal and recommend that shareholders tender their shares to the increased offer. After the news of the takeover offer, Mark Serdan, a portfolio manager with BMO Asset Management, noted that Trelawney Mining may itself be an attractive takeover candidate given its growing resource base in Northern Ontario. Will a niche strategy focused on the rugged and beautiful land Tom Thomson solemnized in art prove to be of interest to a possible suitor? Like an artist’s legacy, only time will tell.

For 10 Most Interesting Gold Stocks – Part 4 – CLICK HERE.

8. Goldcorp Inc. (TSX:G)

Lean and mean. The bull market in gold, which has, in ten years, moved the yellow metal from $270 to over $1,900 an ounce has obviously been a boon GoldCorp, as it has for many gold producers. But by ridding itself of non-core assets, cutting costs and making practical acquisitions, Goldcorp has pulled their average cost of production below $300 an ounce, and become the envy of the industry. According to management there is a design to GoldCorp’s plan, and that plan may surprise some: the company aims to be a hard hitting middleweight rather than the heavyweight champion of the gold world. As Goldcorp CEO Chuck Jeannes told the Globe and Mail: “We’ve learned from other senior companies that you don’t want to get large just for the sake of being large… you can go out and grow, but unless you do it in a value-added way, all you are doing is getting large for the sake of size. We don’t want to do that.” Not that the company is standing still; 2010 was the seventh consecutive year Goldcorp increased its reserves.

Growth has also been a good thing for the company’s shareholders, Goldcorp raised its dividend payout on February 24, 2011 from $0.36 per share to $0.408 and continues its monthly payout.

9. ATAC Resources Ltd. (TSX-V:ATC)

Visit ATAC Resources website and it won’t take long before you see the term Carlin-type gold discovery. The company is not referring to a gold zone named after the late comedian and political activist George Carlin; rather, the Carlin gold zone in Nevada. Although, George Carlin, for years, has been a pretty strong advocate against the U.S. political system which, perhaps in part, might be responsible for the marked appreciation in the price of gold over the past 11 years we elected to highlight his “lighter side”.

The following video is for entertainment purposes only. Viewer discretion is advised – may not be suitable for work environments.

Now back to our regularly scheduled programming.

The Carlin Trend in Nevada is one of the world’s largest gold zones. Collectively, it’s a belt of gold deposits, primarily containing strata-bound disseminated gold mineralization which occurs in carbonate rocks of Paleozoic age. The Carlin Trend is about 5 miles wide and 40 miles long, extending through the town of Carlin, Nevada. Millions of years ago gold “disseminated” throughout the siltstone and limestone laid down by an ancient ocean. Some of the gold is so fine you can’t even see it under a microscope. Regardless, the Carlin Trend has already produced more than 70 million ounces of gold and is estimated to contain, factoring in past production, well over 100 million ounces of gold. For a detailed overview of the gold deposits associated with the Carlin Trend published by the Nevada Bureau of Mines and Geology – CLICK HERE.

When ATAC Resources began comparing their new gold-bearing zone in Northern Canada to Nevada’s Carlin Trend in late 2010 investors took notice. The company’s shares ran from $1.80 to $9.00 over the course of a few months. Although additional news flow since then has been somewhat dilatory – the Yukon Territories have a notoriously short summer drill season – the stock has held up well and currently trades at $7.40 as the results from this year’s drill programs begin to hit the street.

Macquarie Research analyst Michael Gray concurs with ATAC’s Carlin-type gold model. In a report issued by the brokerage firm, the Vancouver analyst argues “yes” at this early stage and has a price target of $11.00 on the company’s stock.

10. Minefinders Corporation Ltd. (TSX:MFL)

In early May silver reached a high of nearly $50 an ounce. Then it seemingly hit a psychological brick wall built by the Hunt brothers and beat a hasty retreat to $32.32. But since its sharp correction, silver has been making a slow and steady comeback and now trades at around $41.50. Eric Sprott, the founder of Sprott Asset Management, calls silver “the best recommendation anyone could make this decade” and sees silver going to $100 an ounce within the next 3 to 5 years.

Sprott’s prognostication must be music to Minefinders’ ears. Minefinders is targeting gold and silver producing assets in Mexico and, after years of hard work, the company has Proven and Probable reserves of 2.34 million ounces of gold and 119 million ounces of silver. Minefinders is unhedged and expects to produce at least 65,000 ounces of gold and 3.3 million ounces of silver in 2011.

With approximately $2.30 per share in cash and little long-term debt the company has a strong balance sheet. Minefinders’ solid performance hasn’t gone unnoticed by the financial markets, the company’s shares last closed at a record high of $17.68 valuing the company at over $1.5 billion. We connected with Mark Bailey, President and CEO of Minefinders, for an exclusive one-on-one discussion – CLICK HERE – to read more.

For 10 Most Interesting Gold Stocks – Part 1 – CLICK HERE.

In China, gold production has increased for the eleventh consecutive year. China is the world largest gold producer for the third time in history with 345 tonnes of gold produced this year. Among the top gold-producing countries, China, with its increasing gold production, seems to go against the general trend of decreasing gold production. China has already announced that its gold production is expected to increase to up to 400 tonnes within the next three years.

Of the other major gold producing nations, Australia is the world’s second largest gold producer with a gold production of 255 tonnes in 2010 (+15%). However, this remains 20% below its peak level of production of 1998. In the United States, production of gold has been declining since 1998 (-37%) but has stabilized at around 230 tonnes per year over the last 4 years.

Gold production in South Africa, on the other hand, continues to decline. Until 2006, this country was once the world’s top producer but after almost a century of hegemony its ranking declined to the second position in 2007 and now fourth in 2010. Gold production in South Africa has decreased by 80% within the last 40 years. It is interesting to point out that 2010 Chinese gold production represents only a third of South Africa’s peak production in the late 1960s.

In 2010, Russia maintained its gold production at the same level; about 190 tonnes. While gold production in Peru is still below its peak production of 2005 (208 tonnes of gold) now producing just 170 tonnes of gold in 2010. Although one can identify more than three hundred mines in Peru, more than half of Peru’s production comes from two major gold mines. Indonesia produced 120 tonnes of gold in 2010, down 27% since its peak production in 2006. Half of Indonesia’s production is produced by one single company where production declined by 7% in 2010. And Canada also remains well below its peak production levels (166 tonnes of gold in 1941; and 177 tonnes of gold in 1991) with just 90 tonnes of gold produced in 2010.

The share of small gold-producing countries (Argentina, Bolivia, Brazil, Chile, Colombia, Ghana, Kazakhstan, Mali, Mexico, Morocco, Uzbekistan, Papua, Philippines, Tanzania, etc.) now account for more than a third of world gold production in 2010. This figure was less than 10% in 1969. These days, to find new deposits of gold, mining companies must go deeper into challenging territories such as deserts, rainforests and polar regions.

As a result of lower production costs due to 2008 crisis effects there is a temporary increase in the world production of gold. Since the crisis, global production increased by 240 tonnes reaching 2,500 tonnes in 2010 but short of the peak gold production reached in 2001 of 2,600 tonnes. But going forward, in the next 10 or 20 years, gold production will almost certainly decrease because of the lack of quality gold reserves.

For the original article, CLICK HERE.

From the article entitled, “World Production of Gold, 2011” by Dr. Thomas Chaize author of the Mining and Energy Newsletter. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

El Dorado, the “Lost City of Gold“, has fascinated and eluded explorers since the days of the Spanish Conquistadors. The story of El Dorado was born through a combination of myths and legends. Dating back to the 1500s, the story originated from the Muisca people who spoke of a golden city hidden in remote South America. The promise of an ancient city of gold enticed European explorers to search for El Dorado for more than two centuries. The geographical location of the mysterious city has morphed along with the myths and legends over the years. Gold coins, precious stones, and streets paved with gold are thought to be located somewhere in Columbia, Venzuela or Guyana.

Sir Walter Raleigh searched for the elusive city in 1595 and reportedly found it. He described El Dorado as a city on Lake Parime far up the Orinoco River in Guyana where “every stone they picked up promised either gold or silver“. The city was actually marked on English maps until its existence was disproved by Alexander von Humboldt during his Latin-America expedition in the early 1800s. Though many have searched and failed to find this city of gold, no evidence of such a place has ever been found.

One TSX listed company, Guyana Goldfields, has certainly not let the failed efforts to find El Dorado prevent them from finding gold in Guyana. The company has been successfully operating in Guyana for 15 years and now boasts a resource estimate of just over 6.6 million ounces of gold from 2 different projects. UBS analyst Dan Rollins likes the company. On July 25th Rollins wrote, “Given the company’s attractive valuation, market capitalization of less than $1 billion, near-term production potential from Aurora and exploration potential at Aranka, we believe Guyana Goldfields could be an acquisition target for an intermediate or mid-cap producer seeking to expand its presence in South America.”

MiningFeeds.com recently connected with Claude Lemasson, President and COO of Guyana Goldfields for an exclusive interview.

The European myth concerning the gold-paved city of El Dorato originated from the Guianas but gold was actually discovered there years later in the 1840s. Please tell our readers about your gold assets and the geology.

Guyana Goldfields has been operating in Guyana since 1996 and has established a second office in the capital of Georgetown. Throughout the years of operating in the country, we have been able to significantly grow the land position and have accumulated over 417,000 acres. Our main groups of properties are called Aurora, where the Aurora Gold Project can be found with a total measured & indicated resource of 5.34M ounces of gold, and Aranka, where we discovered our newest property called Sulphur Rose hosting an initial gold inferred resource of 460,000 oz. The Aurora Gold Project is currently in the pre-development stage with construction and development slated to begin in the first quarter of 2012. Aurora is comprised of 3 main zones called Rory’s Knoll, Mad Kiss and Aleck Hill. Rory’s Knoll has disseminated pyrite and gold mineralization associated with intense silica-fuchsite-sericite-carbonate alteration found in a tonalite intrusive while the 2 other zones are mesothermal gold veins hosted in the shear zones of metavolcanic and metasedimentary rocks.

What are the current mining policies and regulations in Guyana and what does the royalty or fee structure look like?

We are currently in discussion with Guyana’s government on developing a Mineral Agreement in order to obtain the final Mining License or Permit to operate and build the Aurora Gold Project. Earlier this year the government decreased its Corporate Tax from 35% to 30% for all large foreign mining companies to further attract investment into the country. Historically the royalty was at 5% and we are negotiating the royalty and other terms within the Mineral Agreement. We hope to conclude these discussions very shortly.

It has been reported that a new mining policy is needed in Guyana which takes into account the indigenous Amerindians which represent 7% of the population – what is your take on this situation?

This policy does not effect us as it only effects areas where indigenous Amerindians are located. We do not have any indigenous populations nearby and are developing projects where indigenous Amerindians not located.

You have an advanced project in Guyana, the Aurora project, with a NI 43-101 resource estimate of just over 6.7 million ounce of gold. When do you expect to reach production and estimated costs of production, and what additional hurdles do you have to overcome?

First commercial gold production at the Aurora Gold Project is targeted for the first quarter of 2014, producing an average of 300,000 oz/yr. The current mine plan is a combination of open pit and underground mining for the first 9 years with an average output of approximately 9,500 tpd and approximately 4,400 tpd for years 10-17 from underground feed only. Total mine life is 17 years with operating cash costs in the lower quartile of all producing gold mines at ~US$420/oz. Total planned production is over 4+ million ounces with the resource currently known to date. Exploration drilling continues on geophysic targets within the vast land package that has largely been unexplored.

You are also developing a secondary project, the Aranka project, please tell us about this project.

At the Aranka Properties, currently in advanced staged exploration, drilling of highly prospective targets is ongoing. The Company discovered a new gold zone at Sulphur Rose in early 2010 and identified an initial inferred resource of 460,000 ounces in December 2010. A revised resource estimate will be issued in the fourth quarter of 2011 to take into effect infill drilling conducted earlier this year. We will continue to explore this region and surrounding areas within Aranka.

Have you developed any strategic partnerships to help advance your projects?

We have been partnered with The International Finance Corporation (IFC) of the World Bank Group since 2006 and are following recognized international standards. The IFC is currently the third largest shareholder at 6.3% ownership. We’ve received support from the IFC on our Environmental and Social Impact Assessment work and they have mentioned an interest in potential future financial assistance.

This interview is featured in the article 10 Most Interesting Gold Stocks – CLICK HERE – to read more.

Last September, Timmins Gold made a non-binding proposal to the directors of Capital Gold (TSX:CGC) to merge on a negotiated basis. The proposed value of the transaction was $4.50 per share; shares of Capital Gold were, at the time, trading at $3.89. But from the get-go, Capital Gold’s board was not receptive the proposal. Enter AuRico Gold, and you set the stage for what was a contentious 7 month long take-over battle. The final price tag, AuRico’s winning bid was for $6.34 per share. $1.77 more than what was original agreed upon when Capital and AuRico signed their merger agreement.

Since losing the fight for Capital Gold, Timmins has been quiet on the M&A front but has been making noise elsewhere. The company has been continuously drilling and extending the mineralization at its flagship San Francisco gold mine located in Sonora, Mexico. And on August 11th, 2011, the company reported that it sold 17,965 gold ounces during the quarter. This represents a 59-per-cent increase in gold sales over the first quarter of the previous fiscal year. In addition to the San Franciso mine, Timmins also has a collection of interesting gold assets across Mexico. Most notably a 40,000 hectare land package in the Peňasquito area of Mexico that is contiguous to Goldcorp’s 13 million ounce Peňasquito Gold Deposit.

We caught up with Bruce Bragagnolo, President & CEO of Timmins Gold, to discuss some of the company’s past challenges and learn what’s in store for this emerging junior gold producer.

The economic crisis of 2008 caught a lot of companies off guard and Timmins Gold was no exception – the company’s shares dropped from $1.25 to $0.25. What specific challenges did you face during those difficult times.

The economic crisis caught us at the exact time that we were financing the startup at the mine. At the end of March, 2008 we came out with our initial 43-101 report which recommended the restart of the mine. After March of 2008 there was a softening of the market which we initially attributed to the usual seasonality issue of sell in May and stay away. It turned out that March of 2008 was the precursor to a systemic crash and not just seasonal softness. Despite the softness in the markets we managed to raise $19 million in June of 2008 and the plan was to return to the market in the Autumn and raise an additional $20 million through a combination of debt and equity. By September the market had softened even farther and by October the debt and equity markets dried up completely during the crisis. It was only in April of 2009 that the equity markets recovered enough for us to raise additional funds and eventually the debt market returned as well.

The company’s recovery since 2009 has been nothing short of amazing and your shares are now trading close to $3.00 per share. To what do you attribute this stellar recovery?

I can attribute this to two main reasons. First, the fact that we had a very successful startup period, and second, the high price of gold has increased our operating margins.

Including your flagship San Francisco mine in Sonora, Timmins has six different properties in Mexico. Could you please outline your exploration strategy and development plans heading into 2012?

Right now we are having a lot of success around and beneath the pit at San Francisco. We can not justify moving one of our 11 rigs to go anywhere else at present. We hope this will change in 2012 when we would like to complete at least one drill program on each of our other projects.

Is the company looking at additional projects or is your plate pretty full right now?

No we’re not actively looking, our plate is full.

The price of gold has been on a long term bull trend since 2002. What is your take on the gold market and at what point do you consider hedging production?

I believe the gold market is going much higher. I think you could consider hedging production when gold gets to a price that is so incredible you can’t believe it and, at the same time, the costs of production are dropping.

This interview is featured in the article 10 Most Interesting Gold Stocks – CLICK HERE – to read more.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan