The platinum group metals are composed of six noble, precious metallic elements: iridium, osmium, palladium, platinum, ruthenium, and rhodium. In mining, the most valuable PGMs are platinum and palladium, and rhodium to a lesser degree. Intuitively, the metals are correlated in terms of price movement, and often time track other precious metals, especially gold.

While platinum and gold are correlated (0.85), platinum has historically traded higher than gold, averaging 50% more since 2000. The platinum to gold ratio is currently 0.75, with gold consistently trading higher since the beginning of 2015.

If we shorten the timeframe from 2000 to 2009, the average decreases. However, it still implies that current platinum prices are undervalued relative to gold:

Using the current gold price of $1,300/oz. and the average ratio since 2000, platinum should rebound from its current price of $990/oz. to $1,950. Using the 2009 average of 1.03 still means a significant rebound to $1,360/oz., or a gain of 40% from current levels.

The PGM industry is dominated by the major South African platinum producers, and the largest palladium producer in the world, the Russian-based Norilsk Nickel. Just these two regions account for almost 90% of the World’s platinum and palladium production.

What makes PGM investing even more precarious is that in addition to operating in risky jurisdictions, there are only a handful of public companies. If you filter this to junior companies with a resource, you are down to less than ten.

New Age Metals (CVE:NAM, OTCMKTS:PAWEF)

Current Price: C$0.07

Shares Outstanding: 68.4 million

Market Capitalization: C$4.8 million

Cash: ~C$2.6 million

New Age Metals is one of the few PGM companies that operates in a safe jurisdiction, but is also the cheapest on a per platinum ounce basis. According to our analysis and current market prices, New Age Metal’s River Valley PGM Project hosts a total resource of 3.4 million ounces platinum equivalent. This gives New Age Metals a valuation of C$0.74/oz. Compare this to the average of its comp group, C$40.00/oz.

With platinum poised to return to its median, and New Age Metals trading at a substantial discount to its peers, the optionality in this play is enormous.

New Age Metals is an out of favor companies that has fallen through the cracks because of the decline of platinum. However, the company has raised C$2.6 million and is now more than halfway done its 2017 drilling campaign, focusing on the Dana North (T3) and Pine zone.

In addition, an induced polarization (IP) geophysical survey and borehole geophysics has been completed. The first portion of the drill program was concentrated on follow-up drill testing of the 2015/2016 PGM mineralization at the Pine zone. Drilling will now focus on the geophysical interpretation from the recently completed IP survey.

Six holes were completed at the Pine zone, which is open along strike and at depth. The first batch of assays has been sent to the lab. Results are expected any day now.

The current exploration program will be used to establish the resource base for a preliminary economic assessment (PEA), which the company plans to complete before the end of 2018.

Prior to the current program, the River Valley PGM Project has seen 671 holes drill holes for 152,394 metres and $40 million in total spending. Shares from its last financing became free-trading on August 28, and the stock has sold off in anticipation. In fact, share prices are down more than 50% from its recent high. This bargain price is a nice entry for new investors, especially with an imminent fall commodity rally, and the strong and catalytic news flow on the horizon.

No other PGM company has the torque NAM has, and that is why the company is one of largest holdings in our portfolio.

Cheers,

Sean

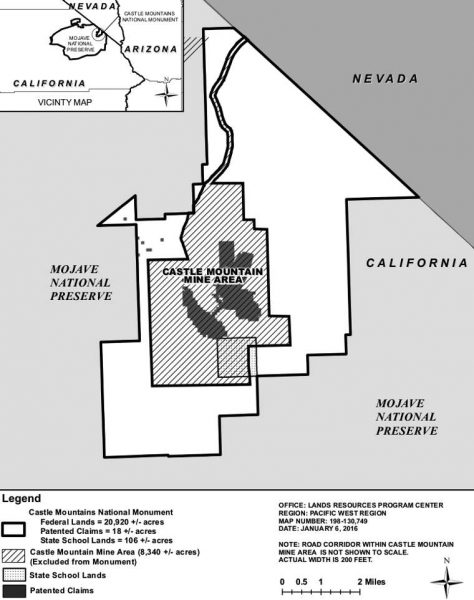

Trump administration review of Obama-era environmental regulation near natural monuments may prove a boon for extraction industries and a pain for conservationists.

Less than a year ago, President Obama designated a new national monument in the eastern Mojave Desert as part of his administration’s broader efforts to keep extractive industries out of environmentally sensitive areas before Donald Trump took office.

The 20,920-acre monument surrounds an open-pit gold mining operation at the southern end of the Castle Mountains. This designation allowed Newcastle Gold Ltd. (TSX: NCA) to proceed with plans to excavate 10 million tons of ore from its 8,300-acre Castle Gold project through 2025.

However, with the election of Donald Trump as president, many Obama-era regulations are coming under scrutiny. In a plan delivered last week to the White House, Interior Secretary Ryan Zinke said he has suggested the president should make changes at “a handful” of monuments. Castle Mountains National Monument was not on the list of 27 sites proposed for status modification or elimination.

According to a report published by the LA Times, NewCastle has been speaking to Zinke. Documents obtained through a Freedom of Information Act request show that Newcastle and Rep. Paul Cook (R-Yucca Valley) have told Zinke the designation was made without sufficient public outreach or input from the company.

NewCastle’s recommended solution is to decrease the size of Castle Mountains National Monument by 50%.

This has surprised conservationists and environmentalists to learn Newcastle’s position shifted after the Trump administration moved to roll back federal protections on many of the monuments created by previous administrations.

The LA Times reports…

“The company gave its word that the deal we struck nearly a year ago was good,” David Lamfrom, director of California and desert wildlife programs for the National Parks Conservation Assn., told the LA Times reporter. “So we’re … furious to learn that the company and its supporters have been secretly complaining that the process was unjust.”

However, George Panneton, CEO and President of NewCastle Gold was more diplomatic when asked about his company’s discussions, in a quote from the LA Times article.

“We’re more than happy to sit down with environmental groups and work out our differences,” he said. “For example, the mine could help subsidize the monument and Mojave National Preserve once it’s up and running and making a profit.”

Panneton said Newcastle plans to resume production next year.

Sources:

“Under Obama, a gold mining firm was fine with a Mojave Desert monument. Under Trump, an about-face.” LA Times, August 28, 2017,

http://www.latimes.com/local/california/la-me-monument-gold-mine-20170828-story.html

Yesterday morning, NewCastle Gold Ltd. (TSX: NCA) reported additional drill results from the southern portion of the Oro Belle Trend within the region of the JSLA pit on its Castle Mountain Gold Project in California.

Highlights from the release include Hole 167 which intersected 148m of 0.89 g/t from 73m, including 31m of 2.45 g/t, and a further 171m of 0.42 g/t from 236m. CMM-161A intersected 180m of 1.01 g/t from 152m, including 20m of 5.79 g/t. Hole CMM-161A was completed as a supplement to hole CMM-161, where 52 samples were previously assigned a zero grade.

Based on recent results, the company will be starting a 10-km follow-up drill program in September. The company plans to complete its pre-feasibility study by the end of the year.

The 2015 resource includes a measured resource of 17.4 million tonnes at 0.86g/t gold for 0.48 million ounces and an indicated 202.5Mt at 0.57g/t gold for 3.71 million ounces.

NewCastle finished June with $3.12 million in cash and equivalents, before closing a bought deal offering on July 13, at $0.95 per share for total proceeds of ~$15 million. The company needs to raise money for preparation work and according to TD Securities, is looking at debt financing, or better alternatives if presented.

According to data collected by the Financial Times, as of last year, six analysts rated NewCastle outperform with one analyst recommending to buy the stock. As of Aug 25, 2017, the consensus forecast improved amongst 11 polled investment analysts covering NewCastle advises that the company will outperform the market. This has been the consensus forecast since the sentiment of investment analysts deteriorated on Apr 22, 2014.

TD Securities rated the shares in the company with a speculative buy, a speculative risk, and a 12-month price target of $2.00. TD assessed the news to have an positive impact on the company’s share price. By TD’s count, there are still results pending from this program.

News of the results pushed the stock up 1 cent to 96 cents on 497,900 shares on August 29.

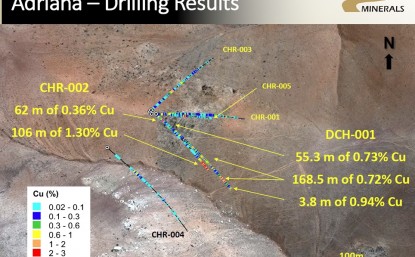

On April 18, 2017, Camino Minerals Corp. (TSX-V: COR) released drill results from its copper exploration project, Los Chapitos in Peru. The company intersected in hole CHR-002 1.30 per cent copper over 106 metres, with the hole ending in mineralization, including a section of 2.12 per cent copper over 38 m and hole CHR-001 intersected 0.47 per cent copper over 76 m, including 0.67 per cent copper over 22 m. These results put the company on the radar as a company to watch. On August 25th, John Kaiser of Kaiser Research Online appeared on the Discovery Watch to discuss Camino’s results, its market activity and future prospects.

According to Kaiser, there were good results but as he studied the data it became apparent to him and the company that there was a magnetic anomaly next to hole CHR-002 which suggested there might be a sulphide body at a 200-metre depth. Combined with the data that hole CHR-002 ended in mineralization, the hope was that once they get into the sulphide body that there would be high tonnage and high grade copper in this anomaly. The next phase of drilling was designed to target this anomaly with drill hole DCH-012 (hole 12).

The results drove the company’s share price to an intraday high of $2.21 settling at $1.24 by the end of the day. However, since then the stock has retreated to 47 cents at time of publication, largely in part because the company did not find what it thought was there.

On Aug. 28, the company released results from the Adriana and Katty zones on the los Chapitos project, that included hole 12. Kaiser said that the results were not what the company was expecting. Hole 12 was great until it hit the anomaly; the mineralization very quickly faded out and the company’s theory did not pan out. As a result, the company is choosing not to use IP anomalies as a targeting-tool on this project. Nonetheless, Kaiser and the company are still optimistic about the results and the project.

The company reported drill highlights for the Adriana zone from DCH-012 which intersected 0.93 per cent copper over 96.5 metres, including 2.03 per cent copper over 19.5 m and 5.01 per cent copper over 4.5 m and which DCH-019 intersected 0.97 per cent copper over 42.0 m, including 3.31 per cent copper over 7.5 m. Some drill highlights from the Katty zone included DCH-010 which intersected 0.70 per cent copper over 43.5 m, including 1.85 per cent copper over 5.6 m and DCH-014 which intersected 1.20 per cent copper over 21.4 m, including 2.70 per cent copper over 7.9 m. It is early in the exploration program and the company has plenty of work coming up.

Kaiser believes it is a still interesting project without the sulphide anomaly. The company has about 8,000 to 10,000 metres of drilling planned at the Adriana Zone plus another 2,000 to 3,000 metres at the Katty Zone. Over the next two to three months as the company drills this trend, they will put together a resource estimate. He feels it may not be that great unless they hit something different from the current trend. In addition, the company is applying for permitting at the Atajo zone.

When Kaiser asked Ken McNaughton, President of Camino, why the company is moving forward so aggressively, McNaughton replied because they are seeing copper in all of the core. Kaiser concludes that Camino results were not as spectacular as he had hoped but the company has the cash and is marching in the right direction.

Source: http://www.howestreet.com/2017/08/25/can-inzinc-get-back-in-sync/

***The author does not own any shares in Camino and provided this report for information purposes. The author was not compensated for this article.

- SPDR fund tonnage (GLD-NYSE) has recaptured the 800 ton mark, and rose to 814 yesterday. This is happening as a steady wave of institutional money managers embrace gold as an important portfolio component.

- It’s also occurring as Indian dealers begin buying for Diwali. The result of this overall ramp-up in demand is a beautiful surge higher in the gold price!

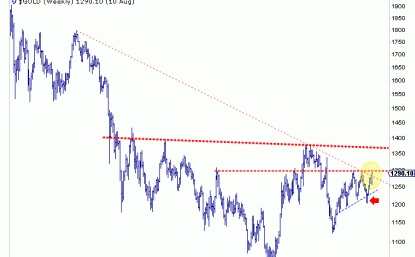

- Please click here now. Double-click to enlarge this important gold chart. I call this my “Road To $1392” chart.

- When the price of an asset arrives at major resistance in a huge chart pattern, a real upside breakout and sustained move higher can only occur if market fundamentals are aligned with the technical set-up.

- The good news is that for gold, this appears to be the case. Please click here now. Double-click to enlarge this monthly gold chart. The $1377 – $1392 price range is the resistance zone of a huge inverse head and shoulders bottom pattern. It is the neckline of the pattern.

- Note the tremendous rise in volume that is occurring as gold makes a beeline to that neckline. The Indian gold market has completed its restructuring, and Western money managers are lining up to add gold to their portfolios.

- The managers are not just making a one-time purchase. They are adding gold as apercentage allocation. That allocation seems to be averaging around 5%. As the funds gather new assets, they buy more gold to maintain that 5% allocation.

- Asian fund managers typically give gold an even higher allocation to gold in their funds than Western managers. As China and India become the main economic empires, Western money managers will tend to play “follow the Chindian leader”.

- That means the current Western money manager allocation to gold that is about 5% could easily rise to 10% or 15% in the coming years. Clearly, all liquidity flow lights for gold…are green!

- My weekly chart roadmap suggests that gold will rise not just to $1392, but to $1526, and $1800. Importantly, the rise will be accompanied by substantial growth in respect for gold as an asset class.

- There’s a huge difference in a rally based on an event like QE and a rally based on a permanent portfolio commitment to the asset class. The latter produces price gains that are sustained.

- Please click here now. Double-click to enlarge this important dollar versus yen chart. The 108 “line in the sand” seems ready to fail. A tumble towards 100 would almost guarantee that gold surges to $1392 and begins the move towards $1526.

- The yen and gold are the two most important risk-off assets for heavyweight FOREX traders. The dollar entered a long-term bear market against the yen in 2016. That defined risk itself as entering a major bear market.

- Please click here now. Double-click to enlarge. That’s a daily chart of the dollar versus the yen. It looks like a train wreck.

- US taxes have not been cut. There’s not even any intention to cut the capital gains rate, let alone abolish it. That makes it almost impossible to attract serious long term investment capital into demographically-disastrous America.

- Trump had a chance to turn the country into a bigger and better version of Switzerland, and oversee a tax-free empire where the citizens age with grace. Instead, a 1929 type of situation now seems imminent.

- An inflationary depression is likely to follow the US government’s launch of what I call Trump’s “Tariffs to Infinity” program. He’s launching a mirror image of Herb Hoover’s tariffs program, and doing it with stocks, bonds, and real estate all in a precarious position.

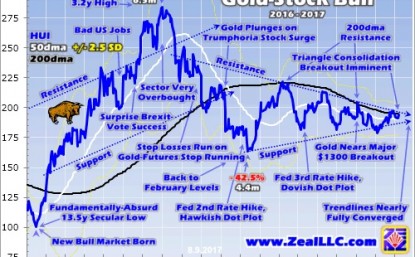

- That’s truly great news for gold stock investors! Please click here now. Double-click to enlarge this fabulous GDX chart. I’ve told gold bugs to watch for a big volume day to send GDX rocketing towards my $26 target, after buying every ten cents decline in the $23 – $18 price zone.

- That volume surge occurred yesterday. Please click here now. Double-click to enlarge. On this two-year chart for GDX, my new $31 target is clear. That’s a key number, because it’s the equivalent of $1392 for gold.

- The 2014 – 2017 period is the most important accumulation zone for gold stock enthusiasts in the history of the gold market, and perhaps in the history of all markets.

- That’s because a reversal in US money velocity is imminent, and the gold stocks versus gold bullion bear market that began in 1995 has ended.

- Tactics? Well, I realize that many gold bugs may have sold their gold stocks in 2014 – 2016 instead of launching the major accumulation program that I adamantly recommended. Some investors bought penny stocks in the general US equity market to try to make back the losses they booked with gold stocks.

- That was obviously a mistake, and those stocks are vulnerable now to a 1929 type of crash. The bottom line is that the current situation of many gold bugs is unfortunate, but just as a car can be repaired, so can a portfolio be repaired.

- Yesterday’s volume bar in GDX is a game changer. So is the growing allocation to gold by institutional money managers, and so is the completed restructuring of the Indian gold market. It’s time for investors to forget the past, move their portfolio cars into the gas station, and fuel up on gold and silver stocks!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.

Thanks! Cheers

Stewart Thomson, Graceland Updates

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

https://www.gracelandupdates.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

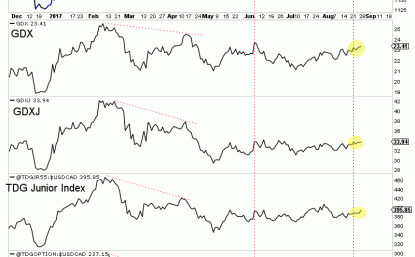

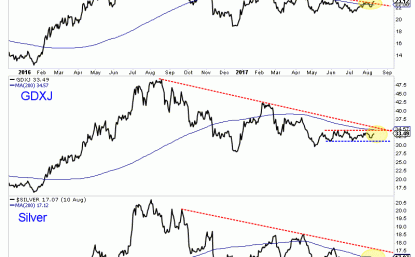

Welcome to the dog days of summer. The low volatility in precious metals continues. Janet Yellen or some other Fed heads said something Friday. Precious Metals sold off but quickly recovered. It appears that not much has transpired in recent weeks as precious metals have grinded higher, albeit slowly. However, while it may be a fledgling development, the miners appear to be leading Gold now.

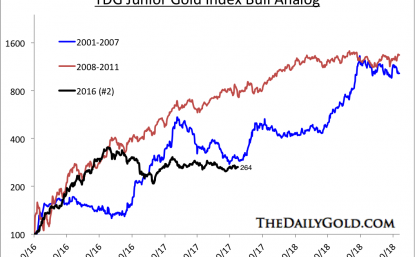

In the chart below we plot a number of markets including Gold, GDX, GDXJ, our 55-stock junior index and our optionality index. We marked three points that help inform our analysis.

From point 1 to point 3, the gold stocks went from underperforming Gold to slightly leading Gold. The gold stocks began to underperform in late winter. They peaked in February and did not even come close to reaching those highs in March while Gold made a higher high. Gold retested that high at point 2 in June while miners made another lower high. However, there has been a change from then to point 3. Gold is at the same level at point 3 as point 2 but so are the miners! Furthermore, in recent days (since point 3) the gold stocks have made higher highs while Gold has not.

The most important recent development in precious metals could be the renewed relative strength in the gold stocks. Volatility has been very low and Gold has yet to break $1300/oz but the gold stocks have managed to reverse their previous underperformance. They were lagging badly from late winter through spring. Ratio charts (not shown) show that the underperformance ended in May and the outperformance began only days ago. If that holds up into September and Gold breaks above $1300/oz then the gold stocks could enjoy strong gains over the weeks ahead.

Jordan Roy-Byrne CMT, MFTA

The junior gold miners’ stocks have spent months grinding sideways near lows, sapping confidence and breeding widespread bearishness. The entire precious-metals sector has been left for dead, eclipsed by the dazzling Trumphoria stock-market rally. But traders need to keep their eyes on the fundamental ball so herd sentiment doesn’t mislead them. The juniors recently reported Q2 earnings, and enjoyed strong results.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Companies trading in the States are required to file 10-Qs with the US Securities and Exchange Commission by 45 calendar days after quarter-ends. Canadian companies have similar requirements. In other countries with half-year reporting, some companies still partially report quarterly.

The definitive list of elite junior gold stocks to analyze used to come from the world’s most-popular junior-gold-stock investment vehicle. This week the GDXJ VanEck Vectors Junior Gold Miners ETF reported $4.0b in net assets. Among all gold-stock ETFs, that was only second to GDX’s $7.5b. That is GDXJ’s big-brother ETF that includes larger major gold miners. GDXJ’s popularity testifies to the great allure of juniors.

Unfortunately this fame has recently created major problems severely hobbling the usefulness of GDXJ. This sector ETF has shifted from being beneficial for junior gold miners to outright harming them. GDXJ is literally advertised as a “Junior Gold Miners ETF”. Investors only buy GDXJ shares because they think this ETF gives them direct exposure to junior gold miners’ stocks. But unfortunately that’s no longer true!

GDXJ is quite literally the victim of its own success. This ETF grew so large in the first half of 2016 as gold stocks soared in a massive upleg that it risked running afoul of Canadian securities law. Most of the world’s junior gold miners and explorers trade in Canada. In that country once any investor including an ETF goes over 20% ownership in any stock, it is deemed a takeover offer that must be extended to all shareholders!

Understanding what happened in GDXJ is exceedingly important for junior-gold-stock investors, and I explained it in depth in my last essay on juniors’ Q1’17 results. GDXJ’s managers were forced to reduce their stakes in leading Canadian juniors. So last year capital that GDXJ investors intended to deploy in junior gold miners was instead diverted into much-larger gold miners. GDXJ’s effective mission stealthily changed.

Not many are more deeply immersed in the gold-stock sector than me, as I’ve spent decades studying, trading, and writing about this contrarian realm. These huge GDXJ changes weren’t advertised, and it took even me months to put the pieces together to understand what was happening. GDXJ’s managers may have had little choice, but their major direction change has been devastating to the junior gold miners.

Investors naturally poured capital into GDXJ, the “Junior Gold Miners ETF”, expecting to own junior gold miners. But instead of buying junior gold miners’ shares and bidding up their prices, GDXJ was instead shunting those critical inflows to the much-larger mid-tier and even major gold miners. That left the junior gold miners starved of capital, as their share prices they rely heavily upon for financing languished in neglect.

GDXJ’s managers should’ve lobbied Canadian regulators and lawmakers to exempt ETFs from that 20% takeover rule. Hundreds of thousands of investors buying an ETF obviously have no intention of taking over gold-mining companies! And higher junior-gold-stock prices boost the Canadian economy, helping these miners create valuable high-paying jobs. But GDXJ’s managers instead skated perilously close to fraud.

This year they rejiggered their own index underlying GDXJ, greatly demoting most of the junior gold miners! Investors buying GDXJ today are getting very-low junior-gold-miner exposure, which makes the name of this ETF a deliberate deception. I’ve championed GDXJ for years, it is a great idea. But in its current sorry state, I wouldn’t touch it with a ten-foot pole. It is no longer anything close to a junior-gold-miners ETF.

There’s no formal definition of a junior gold miner, which gives cover to GDXJ’s managers pushing the limits. Major gold miners are generally those that produce over 1m ounces of gold annually. For years juniors were considered to be sub-200k-ounce producers. 300k ounces per year is a very generous threshold. Anything between 300k to 1m ounces annually is in the mid-tier realm, where GDXJ now traffics.

That high 300k-ounce-per-year junior cutoff translates into 75k ounces per quarter. Following the end of the gold miners’ Q2 earnings season in mid-August, I dug into the top 34 GDXJ components. That is just an arbitrary number that fits neatly into the tables below. While GDXJ had a whopping 73 component stocks in mid-August, the top 34 accounted for 81.5% of its total weighting. That’s a commanding sample.

Out of these top 34 GDXJ companies, only 4 primary gold miners met that sub-75k-ounces-per-quarter qualification to be a junior gold miner! Their quarterly production is highlighted in blue below, and they collectively accounted for just 7.1% of GDXJ’s total weighting. And that isn’t righteous, as these include a 126-year-old silver miner, a mid-tier miner with temporary production declines, and a ramping mid-tier producer.

GDXJ is inarguably now a pure mid-tier gold-miner ETF. That’s great if GDXJ is advertised as such, but terrible if capital investors explicitly intend for junior gold miners is instead being diverted into mid-tiers without their knowledge or consent. The vast majority of GDXJ shareholders have no idea how radically this ETF has changed since early 2016. It is all but unrecognizable, straying greatly from its original mission.

I’ve been doing these deep quarterly dives into GDXJ’s top components for years now. In Q2’17, fully 29 of the top 34 GDXJ components were also GDX components. These ETFs are separate, a “Gold Miners ETF” and a “Junior Gold Miners ETF”. So why on earth should they own many of the same companies? In the tables below I highlighted GDXJ components also in GDX in yellow in the column showing GDXJ weightings.

These 29 GDX components accounted for 74.6% of GDXJ’s total weighting, not just its top 34. They also represented 30.1% of GDX’s total weighting. So three-quarters of the junior gold miners’ ETF is made up of nearly a third of the major gold miners’ ETF! I’ve talked with many GDXJ investors over the years, and have never heard one wish their capital allocated specifically to junior golds would instead go to much-larger miners.

Fully 12 of GDXJ’s top 17 components weren’t even in this ETF a year ago in Q2’16. They alone now account for 40.6% of its total weighting. 15 of the top 34 are new, or 45.3% of the total. In the tables below, I highlighted the symbols of companies actually in GDXJ a year ago in light blue. Today’s GDXJ is a radical departure from a year ago. Analyzing Q2’17 results largely devoid of real juniors was frustrating.

Nevertheless, GDXJ remains the leading “junior-gold” benchmark. So every quarter I wade through tons of data from its top components’ 10-Qs, and dump it into a big spreadsheet for analysis. The highlights made it into these tables. A blank field means a company didn’t report that data for Q2’17 as of that mid-August 10-Q deadline. Companies have wide variations in reporting styles, data presented, and report timing.

In these tables the first couple columns show each GDXJ component’s symbol and weighting within this ETF as of mid-August. While most of these gold stocks trade in the States, not all of them do. So if you can’t find one of these symbols, it’s a listing from a company’s primary foreign stock exchange. That’s followed by each company’s Q2’17 gold production in ounces, which is mostly reported in pure-gold terms.

Many gold miners also produce byproduct metals like silver and copper. These are valuable, as they are sold to offset some of the considerable costs of gold mining. Some companies report their quarterly gold production including silver, a construct called gold-equivalent ounces. I only included GEOs if no pure-gold numbers were reported. That’s followed by production’s absolute year-over-year change from Q2’16.

Next comes the most-important fundamental data for gold miners, cash costs and all-in sustaining costs per ounce mined. The latter determines their profitability and hence ultimately stock prices. Those are also followed by YoY changes. Finally the YoY changes in cash flows generated from operations, GAAP profits, revenues, and cash on balance sheets are listed. There’s one key exception to these YoY changes.

Percentage changes aren’t relevant or meaningful if data shifted from negative to positive or vice versa. Plenty of major gold miners earning profits in Q2’17 suffered net losses in Q2’16. So in cases where data crossed that zero line, I included the raw numbers instead. This whole dataset offers a fantastic high-level fundamental read on how the mid-tier gold miners are faring today. They’re looking quite impressive.

After spending days digesting these GDXJ gold miners’ latest quarterly reports, it’s fully apparent their vexing consolidation this year isn’t fundamentally righteous at all! Traders have abandoned this sector since the election because the allure of the levitating general stock markets has eclipsed gold. That has left gold stocks exceedingly undervalued, truly the best fundamental bargains out there in all the stock markets!

Once again the light-blue-highlighted symbols are GDXJ components that were there a year ago. The white-backgrounded ones are new additions. And the yellow-highlighted GDXJ weightings are stocks that were also GDX components in mid-August. GDXJ is increasingly a GDX clone that offers little if any real exposure to true gold juniors’ epic upside potential during gold bulls. GDXJ is but a shadow of its former self.

VanEck owns and manages GDX, GDXJ, and the MVIS indexing company that decides exactly which gold stocks are included in each. With one company in total control, GDX and GDXJ should have zero overlap in underlying companies! GDX or GDXJ inclusion should be mutually-exclusive based on the size of individual miners. That would make both GDX and GDXJ much more targeted and useful for investors.

GDXJ’s highest-ranked component choices made by its managers are mystifying. This “Junior Gold Miners ETF” has a major primary silver miner as its largest component. Over half of PAAS’s sales in Q2 came from silver. And the next two biggest are large South African gold miners. That country has one of the most anti-shareholder governments in the world now, forcing unconscionable racial quotas on owners.

Since gold miners are in the business of wresting gold from the bowels of the Earth, production is the best place to start. These top 34 GDXJ gold miners collectively produced 3,583k ounces in Q2’17. That rocketed 74% higher YoY, but that comparison is meaningless given the extreme changes in this ETF’s composition since mid-2016. On the bright side, GDXJ’s miners do remain significantly smaller than GDX’s.

GDX’s top 34 components, fully 20 of which are also top-34 GDXJ components, collectively produced 9854k ounces of gold in Q2. So GDXJ components’ average quarterly gold production of 119k ounces excluding explorers was 61% lower than GDX components’ 308k average. So even if GDXJ’s “Junior” name is very misleading, it definitely has smaller gold miners even if they’re well above that 75k junior threshold.

Despite GDXJ’s top 34 components looking way different from a year ago, these current gold miners are faring well on the crucial production front. Fully 19 of these mid-tier gold miners enjoyed big average YoY production growth of 26%! Overall average growth excluding explorers was 12% YoY, which is nothing to sneeze at given gold’s rough year since mid-2016. These elite GDXJ gold “juniors” are really thriving.

Gold production varies seasonally within calendar years partially due to mining-plan timing. Gold-bearing ore was certainly not created equal, with even individual deposits seeing big internal variations in their metal-to-waste-rock ratios. Miners often have to dig through lower-grade ore to get to the higher-grade zones underneath. This still has economically-valuable amounts of gold, so it is run through the mills.

These mills are essentially giant rock grinders that break ore into smaller pieces, vastly increasing its surface area for chemicals to later leach out the gold. Mill capacity is fixed, with limits on ore tonnage throughput. So when miners are blasting and hauling lower-grade ore, fewer ounces are produced. As they transition into higher-grade zones, the same amount of rock naturally yields more payable ounces.

Regardless of the ore grades being blasted and milled, the overall quarterly costs of mining don’t change much. Operations require the same levels of employees, fuel, maintenance, and electricity no matter how rich the rock being processed. So higher gold production directly leads to lower per-ounce mining costs. The big fixed costs of gold mining are spread across more ounces, making this business more profitable.

There are two major ways to measure gold-mining costs, classic cash costs per ounce and the superior all-in sustaining costs per ounce. Both are useful metrics. Cash costs are the acid test of gold-miner survivability in lower-gold-price environments, revealing the worst-case gold levels necessary to keep the mines running. All-in sustaining costs show where gold needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of gold, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q2’17, these top 34 GDXJ-component gold miners that reported cash costs averaged just $628 per ounce. That was indeed down a sizable 1.3% YoY from Q2’16, and 3.0% QoQ from Q1’17.

This was really quite impressive, as the mid-tier gold miners’ cash costs were only a little higher than the GDX majors’ $605. That’s despite the mid-tiers each operating fewer gold mines and thus having fewer opportunities to realize cost efficiencies. Traders must recognize these smaller gold miners are in zero fundamental peril as long as prevailing gold prices remain well above cash costs. And $628 gold ain’t happening!

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain a gold mine as an ongoing concern. AISC include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current gold-production levels.

These additional expenses include exploration for new gold to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee gold mines. All-in sustaining costs are the most-important gold-mining cost metric by far for investors, revealing gold miners’ true operating profitability.

In Q2’17, these top 34 GDXJ components reporting AISC averaged just $879 per ounce. That’s down 0.9% YoY and 4.9% QoQ. That also compares very favorably with the GDX majors, which saw average AISC nearly identical at $867 in Q2. The mid-tier gold miners’ low costs show they are faring far better fundamentally today than everyone thinks based on this year’s largely-disappointing technical stock-price action.

All-in sustaining costs are effectively this industry’s breakeven level. As long as gold stays above $879 per ounce, it remains profitable to mine. At Q2’s average gold price of $1258, these top GDXJ gold miners were earning big average profits of $379 per ounce last quarter! That equates to hefty profit margins of 30%, levels most industries would kill for. The mid-tier gold miners aren’t getting credit for that today.

Unfortunately given its largely-junior-less composition, GDXJ remains the leading benchmark for junior gold miners. In Q2’17, GDXJ averaged $33.30 per share. That was down a sharp 11% from Q1’s average of $37.46. Investors have largely abandoned gold miners because they are captivated by the extreme Trumphoria stock-market rally since the election. Yet gold-mining profits surged in that span.

At Q1’s average gold price of $1220 and Q1’s average top GDXJ components’ AISC of $924, these elite mid-tier miners were earning $296 per ounce on average. That’s already quite healthy. But quarter-on-quarter from Q1 to Q2, these top 34 GDXJ components’ operating profits rocketed 28% higher to $379 per ounce. There’s absolutely no doubt the sharp decline in gold-stock prices in Q2 had nothing to do with fundamentals!

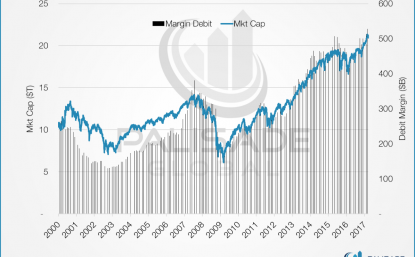

Gold stocks are in the dumps technically because these lofty stock markets keep powering higher. Even though they are in dangerous bubble territory and the Fed is on the verge of starting to suck capital out of the markets via super-bearish quantitative tightening. These record stock markets have really retarded investment demand for gold, which tends to move counter to stock markets. So gold stocks are deeply out of favor.

Gold-stock price levels and psychology are totally dependent on gold, the dominant driver of miners’ profits. Gold stocks enjoy major profits leverage to gold, which gives their stocks big upside potential when gold rallies. Gold-mining costs are essentially fixed during mine-planning stages. Generally the same numbers of employees and equipment are used quarter after quarter regardless of the gold price.

So higher gold prices flow right through to the bottom line, costs don’t rise with them. If gold rallies just another 3.4% from Q2’s average prices to average $1300 in a coming quarter, profits will surge another 11.1% at Q2’s all-in sustaining costs. In a $1400-average-gold quarter, merely 11.3% higher from Q2’s levels, gold-mining profits would soar 37.5% higher. At $1500, those gains surge to 19.3% and 63.9%!

And a 20% gold rally from Q2’s levels is nothing special. Back in roughly the first half of last year after a sharp stock-market correction, gold powered 29.9% higher in just 6.7 months! So if you believe gold is heading higher in coming quarters as these crazy stock markets falter, the gold stocks are screaming buys today fundamentally. Their already-strong profitability will soar, amplifying gold’s mean-reversion upleg.

Since today’s bastardized GDXJ largely devoid of juniors changed so radically since last year, the normal year-over-year comparisons in key financial results aren’t comparable. But here they are for reference. These top-34 GDXJ companies’ cashflows generated from operations soared 57% YoY to $1458m. That was driven by sales up 59% YoY to $3840m. That left their collective cash balances $34% higher YoY at $6140m.

And top-34-GDXJ-component profits skyrocketed 385% YoY to $751m. Again don’t read too much into this since it’s an apples-to-oranges comparison. If GDXJ’s component list and weightings finally stabilize after such extreme tumult, we’ll have clean comps again next year. We can still look at operating cash flows and GAAP profits among this year’s list of top-34 components, which offers some additional insights.

On the OCF front, 10 of these 34 miners reported average YoY gains of 54%, while 13 of them reported average declines of 33%. Together all 23 averaged operating-cash-flows growth of 5%. That isn’t much, but it’s positive. And it’s not bad considering Q2’17’s average gold price was dead flat from Q2’16’s. These mid-tier gold miners are doing far better operationally than their neglected super-low stock prices imply.

On the GAAP-earnings front, the 10 miners that earned profits in both Q2s averaged huge growth of 110% YoY! And out of 14 more miners that saw profits cross zero in the past year, 8 swung from losses to gains. Total annual earnings growth among those zero-crossing swingers exceeded $536m. Make no mistake, these “junior” gold miners are thriving fundamentally even at Q2’s relatively-low $1258 average gold.

So overall the mid-tier gold miners’ fundamentals looked quite impressive in Q2’17, a stark contrast to the miserable sentiment plaguing this sector. Gold stocks’ vexing consolidation this year wasn’t the result of operational struggles, but purely bearish psychology. That will soon shift as stock markets roll over and gold surges, making the beaten-down gold stocks a coiled spring today. They are overdue to soar again!

Though this contrarian sector is despised, it was the best-performing in all the stock markets last year despite a sharp Q4 post-election selloff. The leading HUI gold-stock index blasted 64.0% higher in 2016, trouncing the S&P 500’s 9.5% gain! Similar huge 50%+ gold-stock gains are possible again this year, as gold mean reverts higher as stock markets sell off. The gold miners’ strong Q2 fundamentals prove this.

Given GDXJ’s serious problems, leading to diverting most of its capital inflows into larger gold miners that definitely aren’t juniors, you won’t find sufficient junior-gold exposure in this troubled ETF. Instead traders should prudently deploy capital in the better individual junior gold miners’ stocks with superior fundamentals. Their upside is vast, and would trounce GDXJ’s even if it was still working as advertised.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q2, this has resulted in 951 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +21.2%!

The key to this success is staying informed and being contrarian. That means buying low when others are scared, like late in this year’s vexing consolidation. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on our vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. For only $10 per issue, you can learn to think, trade, and thrive like contrarians. Subscribe today, and get deployed in the great gold stocks on our trading books before they surge far higher!

The bottom line is the mid-tier gold miners that now dominate GDXJ enjoyed strong fundamentals in their recently-reported Q2 results. Despite a flat comp-quarter gold price, they collectively mined more gold at lower costs. That naturally fueled better operating cash flows and profits. Today’s low gold-stock prices and popular bearishness are wildly unjustified fundamentally, an anomaly that doesn’t reflect operations.

As gold itself continues mean reverting higher, these mid-tier gold miners will see their profits soar due to their big inherent leverage to gold. GDXJ now offers excellent exposure to mid-tier gold miners, which will see gains well outpacing the majors. But if you are looking for the extreme upside likely in true junior gold miners, avoid today’s GDXJ and buy individual stocks. GDXJ is no longer a “Junior Gold Miners ETF”!

Adam Hamilton, CPA

August 25, 2017

Copyright 2000 – 2017 Zeal LLC (www.ZealLLC.com)

1. After rallying almost $100 an ounce from the July lows of about $1210 (basis December futures), gold is consolidating its gains.

2. Fundamentally, there isn’t much immediate time frame news from either the fear trade or the love trade. That’s the root cause of this sideways price action, and its healthy.

3. To get some technical perspective on the consolidation, please click here now. Double-click to enlarge this short term gold chart.

4. A small head and shoulders top pattern has appeared, and it suggests more consolidation will occur before the upside action resumes. This scenario would see gold move down towards $1272,

and then rally towards $1330.

5. Please click here now. Double-click to enlarge. On this chart, a slightly bigger head and shoulders pattern is apparent. It suggests a deeper correction to about $1250 may occur.

6. I’ve outlined the $1300 – $1330 price zone as a good place to book some light profits on positions bought into my $1220 – $1200 buy zone. From here, investors should be viewing the $1275 – $1245 price zone as a fresh buy zone.

7. Please click here now. Double-click to enlarge this important dollar versus yen chart.

8. The world’s biggest liquidity movers are major bank FOREX departments, and they tend to aggressively buy the dollar versus the yen when global risk is declining.

9. When global risk rises, they will aggressively sell the dollar against the yen.

10. Both gold and the yen are viewed by these liquidity flow monsters as the world’s most important safe havens. The 108 dollar versus yen price is a very similar “line in the sand” to the $1300 line in the sand for gold.

11. The dollar is consolidating its recent decline in the 108 area as gold consolidates in the $1300 zone. Fundamentals make charts, and earth shaking news in September and October could see the dollar tumble under 108 and gold blast through $1300.

12. The debt ceiling (which I call a floor) debate is one event that could create a major panic in risk-on markets in this critical September-October time frame.

13. That fear trade rubber is going to meet the road just as Indian dealers begin buying gold aggressively for Diwali. They appear to be in pause mode now, which is logical since they don’t tend to chase the price after it has rallied almost $100 an ounce.

14. As I’ve mentioned, all gold bug eyes need to be focused on the $1275 – $1245 buy zone. Perhaps even more importantly, all gold bug hands need to be ready to press the buy button for their favourite gold stocks if gold moves into that key buy zone.

15. On that note, please click here now. Double-click to enlarge this GDX chart. The $26 area for GDX corresponds with $1300 for gold. Gold has traded at the $1300 area numerous times since February, but GDX rallies have not taken it to $26.

16. I understand that most gold bugs are heavily invested in gold stocks. The inability of these stocks to consistently outperform bullion is frustrating, but there is light in that tunnel.

17. To begin to view the light, please click here now. Double-click to enlarge this long term gold chart. Bull markets have rising volume and bear markets have rising volume. Corrective action, up or down, is accompanied by falling volume.

18. Gold has been in a bull cycle since 2002. Volume has risen on major price advances, and dwindled on declines.

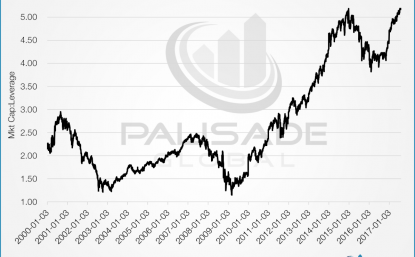

19. Please click here now. Double-click to enlarge. Gold stocks were in a bear cycle against gold from 1995 – 2016.

20. That happened because the Fed lowered rates to make small inexperienced investors move their money out of bank accounts and into risky investments focused on capital gain.

21. The 1995 – 2016 bear market in gold stocks against gold is over. Just as gold based against the dollar in the 1999 – 2001 period before blasting higher on big volume, gold stocks are doing the same thing against gold now.

22. Quantitative tightening in America, Japan, and Europe is coming. Higher rates are in play. This is going to (slowly at first) move money out of global stock markets and government bonds and into the fractional reserve banking system. That will reverse the money velocity bear cycle that corresponded with the gold stocks bear market.

23. It’s a steady process, but it requires investors to be realistic about the time required to create a money velocity bull market… and thus a gold stocks bull market against gold. The bottom line is this:

24. Good gold stock times are not quite here, but they are near!

Thanks!

Cheers

Stewart Thomson

Graceland Updates

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email: stewart@gracelandupdates.com

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

Ontario Premier Kathleen Wynne announced today in Thunder Bay that agreements have been reached with the Webequie, Marten Falls and Nibinamik First Nations to begin construction of a road to the currently difficult to access Ring of Fire mineral belt. The route would go to the proposed Noront Resources Ltd. (TSX-V: NOR) mining project that Queen’s Park hope will give Northern Ontario a much-needed economic boost as well as link remote communities with other highways.

News of this today, sent shares of Noront Resources Ltd. up 8.5 cents to 41.5 cents on massive volume of 9.1 million shares. Noront’s 30-per-cent junior partner at the Big Daddy chromite deposit in the region, KWG Resources Inc. (TSX-V: KWG), saw its shares rise a half cent to 2.5 cents on 10.9 million shares traded.

This provincial announcement may prove to be a surprise for KWG Resources, Vice-President of Exploration, Moe Lavigne, as he has been quoted in the past that even he doubted the government’s intentions to advance the road project.

“I have no confidence that the provincial government is really motivated to make this happen. And the reason is that they’re conflicted because they’ve sold that part of the province to the green movement (with the passage of the Far North Act in 2010). They don’t want to be seen building roads in an area they promised to make a park.”

KWG has long been an advocate for the road but a doubtful one. The company partnered with a Chinese engineering firm to conduct, what amounts to, a pre-feasibility study of KWG’s plans for an ore-haul railway from northwestern Ontario to the James Bay region to carry out chromite for processing.

The company claim-staked a 340-kilometre long rail line running from the CN main line into the Ring of Fire mineral belt and to KWG’s Big Daddy chromite deposit, of which it owns a 30 per cent share with Noront Resources, much to the chagrin of federal and provincial authorities who took to court Noront, Cliff Natural Resources and KWG over the legality of using mining claims to secure surface rights for railroads

This announcement will not change things over night, environmental assessments will begin in January, six months before the June 7 provincial election, and construction is set to start in 2019. However, it has changed the prospects for two juniors miners as they will most likely take the news to raise funds and beat the proverbial drum to attract new investors and appease long time shareholders.

The area lies about 575 km. northeast of Thunder Bay, and west of James Bay. The funding is part of the government’s promise to invest $1 billion in Ring of Fire infrastructure in the region.

It’s estimated there is $60 billion in mineral deposits in the area, including chromite, an essential component in making stainless steel of which China consumes about 50% of the global supply.

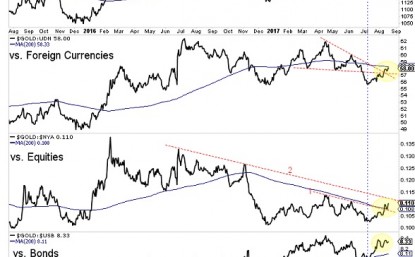

Three weeks ago we discussed how Gold needed to perform considering the US$ index was likely to bounce due to an oversold condition and extreme bearish sentiment.

We wrote: “Simply put, Gold will have to prove itself in real terms if it is going to hold its ground or breakout as the US$ begins a likely bounce.”

The US$ index has enjoyed only a slight rebound but Gold has maintained its 2017 US$ weakness induced gains because of its strong relative performance. Below we plot the daily line chart of Gold and a number of ratios: Gold against foreign currencies (Gold/FC), Gold against Equities and Gold against Bonds. Since the July low, Gold has showed good nominal and relative performance.

The key has been the strong rebound in Gold/FC and the breakout in Gold/Equities. Gold/FC has broken above two trendlines and is now testing its 200-day moving average. Meanwhile, Gold/Equities has broken above one trendline and has regained its 200-day moving average. It would be very bullish for Gold if Gold/FC pushed through its 200-day moving average while Gold/Equities pushed above trendline 2. Those moves would likely accompany a Gold breakout through $1300/oz but more importantly, they would put Gold in a position of trading above its 200-day moving average in nominal terms and against the major asset classes (stocks, bonds, currencies).

Although Gold failed to break above $1300/oz today (Friday), it remains in position to do so because of its renewed strength in real terms. As long as the US$ index does not rally hard, we expect Gold to break above $1300 and reach $1375. The gold stocks as a group have been lagging recently but in the event of a Gold breakout, we foresee significant upside potential as the group could play catch up. Consider learning more about our premium service including our favorite junior exploration companies.

Jordan Roy-Byrne CMT, MFTA

Jordan@TheDailyGold.com

The gold miners’ stocks have spent months adrift, cast off in the long shadow of the Trumphoria stock-market rally. This vexing consolidation has left a wasteland of popular bearishness. But once a quarter earnings season arrives, bright fundamental sunlight dispelling the obscuring sentiment fogs. The major gold miners’ just-reported Q2’17 results prove this sector remains strong fundamentally, and super-undervalued.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Companies trading in the States are required to file 10-Qs with the US Securities and Exchange Commission by 45 calendar days after quarter-ends. Canadian companies have similar requirements. In other countries with half-year reporting, some companies still partially report quarterly.

The world’s major gold miners just wrapped up their second-quarter earnings season. After spending decades intensely studying and actively trading this contrarian sector, there’s no gold-stock data I look forward to more than the miners’ quarterly financial and operational reports. They offer a true and clear snapshot of what’s really going on, shattering the misconceptions bred by evershifting winds of sentiment.

The definitive list of major gold-mining stocks to analyze comes from the world’s most-popular gold-stock investment vehicle, the GDX VanEck Vectors Gold Miners ETF. Its composition and performance are similar to the benchmark HUI gold-stock index. GDX utterly dominates this sector, with no meaningful competition. This week GDX’s net assets are 19.9x larger than the next-biggest 1x-long major-gold-miners ETF!

Being included in GDX is the gold standard for gold miners, requiring deep analysis and vetting by elite analysts. And due to ETF investing eclipsing individual-stock investing, major-ETF inclusion is one of the most-important considerations for picking great gold stocks. As the vast pools of fund capital flow into leading ETFs, these ETFs in turn buy shares in their underlying companies bidding their stock prices higher.

This week GDX included a whopping 50 component “Gold Miners”. That term is used somewhat loosely, as this ETF also contains major silver miners, silver streamers, and gold royalty companies. Still, all the world’s great gold miners are GDX components. Due to time constraints, I limited my deep individual-company research to this ETF’s top 34 components, an arbitrary number that fits neatly into the tables below.

Collectively GDX’s 34 largest components now account for 92.1% of its total weighting, a commanding sample. While the vast majority of gold miners’ Q2’17 results have been released, a few are still coming due to later reporting. GDX includes major foreign gold miners trading in Australia, the UK, and South Africa. These companies report in half-year increments instead of quarterly, so their Q2 data is limited.

The importance of these top-GDX-component gold miners can’t be overstated. In Q2 they collectively produced nearly 9.9m ounces of gold, or 306.5 metric tons. The World Gold Council’s recently-released Q2 Gold Demand Trends report, the definitive source on worldwide supply-and-demand fundamentals, pegged total global mine production at 791.2t in Q2. GDX’s top 34 miners alone accounted for nearly 4/10ths!

Every quarter I wade through a ton of data from these elite gold miners’ 10-Qs, and dump it into a big spreadsheet for analysis. The highlights made it into these tables. If a field is left blank, that means a company didn’t report that data for Q2’17 as of this Wednesday. Companies always try to present their quarterly results in the best-possible light, which leads to wide variations in reporting styles and data offered.

In these tables the first couple columns show each GDX component’s symbol and weighting within this ETF as of this week. While most of these gold stocks trade in the States, not all of them do. So if you can’t find one of these symbols, it’s a listing from a company’s primary foreign stock exchange. That’s followed by each company’s Q2’17 gold production in ounces, which is mostly reported in pure-gold terms.

Most gold miners also produce byproduct metals like silver and copper. These are valuable, as they are sold to offset some of the considerable costs of gold mining. Some companies report their quarterly gold production including silver, a construct called gold-equivalent ounces. I only included GEOs if no pure-gold numbers were reported. That’s followed by production’s absolute year-over-year change from Q2’16.

Next comes the most-important fundamental data for gold miners, cash costs and all-in sustaining costs per ounce mined. The latter determines their profitability and hence ultimately stock prices. Those are also followed by YoY changes. Finally the YoY changes in cash flows generated from operations, GAAP profits, revenues, and cash on balance sheets are listed. There’s one key exception to these YoY changes.

Percentage changes aren’t relevant or meaningful if data shifted from negative to positive or vice versa. Plenty of major gold miners earning profits in Q2’17 suffered net losses in Q2’16. So in cases where data crossed that zero line, I included the raw numbers instead. This whole dataset offers a fantastic highlevel fundamental read on how the major gold miners are faring today. They’re doing pretty darned well!

After spending days digesting these elite gold miners’ latest quarterly reports, it’s fully apparent their vexing consolidation this year isn’t fundamentally righteous at all! Traders have abandoned this sector since the election because the allure of the levitating general stock markets has eclipsed gold. That has left gold stocks exceedingly undervalued, truly the best fundamental bargains out there in all the stock markets!

The elite ranks of the world’s top gold miners haven’t changed much in the past year, seeing only slight shuffling in their GDX weightings. All the usual suspects are here. Since gold miners are in the business of wresting gold from the bowels of the Earth, production is the best place to start. These top 34 GDX gold miners again collectively produced 9,854k ounces in Q2’17. That merely rose 0.5% YoY, essentially flat.

That’s misleading though. GDX’s indexers have long loved the South African gold miners, despite them suffering ongoing heavy depredation by one of the world’s most corrupt and racist governments. Back in 2004, the South African government mandated gold miners increase their black ownership to 26% over the next decade. That was largely accomplished by diluting existing shareholders to give to new ones.

Many of these new black owners soon sold their share windfalls, which forced the unconscionable racial quota lower. Just in mid-June, South African stocks were crushed after their government declared a new black-ownership target of 30%. Even if miners had already hit that previous 26% racial quota, they were given just one year to top back up to 30%. So the entire South African mining industry is reeling in disarray.

Foreign investors being discriminated against for their skin color are fleeing in droves. The South African miners are under so much pressure they are delaying their financial reporting. This week Sibanye Gold was GDX’s 15th-largest holding, and it hadn’t even reported Q2’17 gold production yet. In Q1’17 it ran 330k ounces. So assuming that holds, the top 34 GDX components’ Q2 production is actually running 10,184k ounces. That makes for impressive 3.9% YoY growth!

That latest World Gold Council data shows global mined gold supply slipped 0.3% YoY in Q2. So the major gold miners are using their superior capital firepower to take gold-mining market share from smaller miners. Given the South African government’s openly-racist policies hostile to current shareholders, GDX’s managers should boot all the South African miners from this ETF.

Back in mid-May when I published my analysis of the major gold miners’ Q1’17 results, I discussed an interesting seasonal phenomenon. Between 2011 and 2016, world gold production dropped 8.4% on average from Q4s to Q1s. The drivers of this were explained back in that essay. The relevant part today is that global gold production bounces back dramatically in Q2s and Q3s following those Q1 slumps.

That indeed came to pass again this year despite the lackluster gold-price environment in Q2’17. With that assumed Sibanye Gold Q2 production thrown in, the top 34 GDX gold miners’ Q2 production surged 5.5% quarter-on-quarter from Q1! That’s in line with global gold production’s 6.3% average gain between these two quarters from 2011 to 2016. Everything looks good on the major gold miners’ production front.

Gold production varies seasonally within calendar years partially due to mining plan timing. Gold-bearing ore was certainly not created equal, with even individual deposits seeing big internal variations in their metal-to-waste-rock ratios. Miners often have to dig through lower-grade ore to get to the highergrade zones underneath. This still has economically-valuable amounts of gold, so it is run through the mills.

These mills are essentially giant rock grinders that break ore into smaller pieces, vastly increasing its surface area for chemicals to later leach out the gold. Mill capacity is fixed, with limits on ore tonnage throughput. So when miners are blasting and hauling lower-grade ore, fewer ounces are produced. As they transition into higher-grade zones, the same amount of rock naturally yields more payable ounces.

Regardless of the ore grades being blasted and milled, the overall quarterly costs of mining don’t change much. Operations require the same levels of employees, fuel, maintenance, and electricity no matter how rich the rock being processed. So higher gold production directly leads to lower per-ounce mining costs. The big fixed costs of gold mining are spread across more ounces, making this business more profitable.

There are two major ways to measure gold-mining costs, classic cash costs per ounce and the superior all-in sustaining costs per ounce. Both are useful metrics. Cash costs are the acid test of gold-miner survivability in lower-goldprice environments, revealing the worst-case gold levels necessary to keep the mines running. All-in sustaining costs show where gold needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of gold, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q2’17, these top 34 GDX-component gold miners that reported cash costs averaged just $605 per ounce. That was indeed down a sizable 1.9% YoY from Q2’16, and 2.9% QoQ from Q1’17.

Gold-stock traders are notoriously excitable. Literally everything scares them, the sky is always falling in their worlds. They collectively have little courage in their convictions, always looking for excuses to flee. If they want something real to fear, it’s gold falling below the cash costs of mining it. And at $605 in Q2, that true fundamental disaster isn’t in the cards. Gold miners face no meaningful threats at today’s gold prices!

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain a gold mine as an ongoing concern. AISC include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current gold production levels.

These additional expenses include exploration for new gold to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee gold mines. All-in sustaining costs are the most important gold-mining cost metric by far for investors, revealing gold miners’ true operating profitability.

In Q2’17, these top 34 GDX-component gold miners reporting AISC averaged a level of just $867 per ounce. That’s down 2.1% YoY and 1.3% QoQ. That gold price is effectively this industry’s breakeven level. As long as gold is higher, the major gold miners can collectively earn profits mining. And earnings were already hefty in Q2, with gold’s average price of $1258 remaining $391 above the prevailing AISC levels.

Even today with gold investment demand in tatters thanks to the extreme Trumphoria stock-market rally since the election, the gold miners are thriving. The $391 per ounce they earned on average last quarter was a whopping 14.3% higher than their average profits of $342 in Q1’17. Yet the average gold price only rallied 3.1% QoQ. Thus the major gold miners enjoyed outstanding profits leverage to gold of 4.7x!

Yet you sure wouldn’t know it from gold-stock prices. That leading HUI goldstock index which is closely mirrored by GDX saw its average level actually fall 3.1% QoQ in Q2’17. Despite gold miners’ earnings soaring dramatically, goldstock prices slumped. That proves the gold-stock weakness in Q2 was purely a sentiment thing, it was totally unjustified fundamentally. Today’s low gold-stock prices are an anomaly.

Gold-stock price levels and psychology are totally dependent on gold, the dominant driver of miners’ profits. As these bubble stock markets inevitably roll over, probably soon with the Fed’s quantitative tightening looming, gold investment will return to favor for prudent portfolio diversification. And once gold rallies long enough and high enough to convince traders its strength is sustainable, gold stocks will be off to the races.

The key fundamental reason gold stocks enjoy such massive upside is their profits leverage to gold. Gold-mining costs are essentially fixed during mineplanning stages, when engineers decide which ore bodies to mine, how to dig to them, and how to process that ore. Quarter after quarter, generally the same numbers of employees, haul trucks, excavators, and mills are used regardless of prevailing gold prices.

So higher gold prices flow right through to the bottom line, costs don’t rise with them. If gold rallies just another 3.4% from Q2’s average prices to average $1300 in a coming quarter, profits will surge another 10.7% at Q2’s all-in sustaining costs. In a $1400-average-gold quarter, merely 11.3% higher from Q2’s levels, gold-mining profits would soar 36.3% higher. At $1500, those gains surge to 19.3% and 61.9%!

And a 20% gold rally from Q2’s levels is nothing special. Back in roughly the first half of last year after a sharp stock-market correction, gold powered 29.9% higher in just 6.7 months! So if you believe gold is heading higher in coming quarters as these crazy stock markets falter, the gold stocks are screaming buys today fundamentally. Their already-strong profitability will soar, amplifying gold’s mean-reversion upleg.

Another key measure of gold miners’ fundamental health is their cash flows generated from operations. With Q2’s average gold price only 0.1% lower YoY, and AISC down 2.1%, I expected to see OCF growth last quarter. But it didn’t happen, as these top 34 GDX components reporting Q2 cash flows generated from operations only totaled $3362m. That was down a sharp 17.0% YoY, raining on gold stocks’ Q2 parade.

Of the 29 of the top 34 GDX components reporting Q2 OCFs, a majority 17 were down YoY. I looked at this on a company-by-company basis, but no industrywide trends jumped out. Operating cashflows can vary considerably from quarter to quarter depending on what companies are doing with their operating gold mines. As long as OCFs remain massively positive, the gold miners’ operations are quite profitable.

Between Q1’17 and Q2’17 when average gold prices only climbed 3.1%, the top GDX components’ OCF still surged 11.0% sequentially! So the major gold miners are faring quite well despite all the excessively-bearish psychology arrayed against them. Their GAAP-accounting-profits growth in Q2’17 was nothing short of spectacular, which will directly translate into lower price-toearnings ratios to entice investors back.

The 25 of these top 34 GDX component gold miners reporting Q2 profits earned $2371m. That was a mind-boggling 757% higher YoY! Some of this collective growth wasn’t normal. GDX’s largest component and the world’s largest gold miner is Barrick Gold. In Q2 it reported an enormous gain of $880m on one-time sales of one-half and one-fourth of its interests in a couple major gold projects in Argentina and Chile.

IAMGOLD was another notable outlier, with a colossal $524m gain from reversing impairment charges. But even without these two huge one-off gains, overall GAAP profits for these top 34 GDX gold miners that reported Q2 still soared 250% higher YoY! Note in these tables how most of the miners saw substantial profits growth in Q2, with lots of green and little red in that column. The swings across zero are telling too.

More miners swung from losses a year ago to profits in Q2’17 than the other way around. Again all this profits growth will really bring down prevailing gold-mining price-to-earnings ratios, making this sector look a lot more attractive by that popular fundamental valuation measure. Based on this year’s dismal gold-stock sentiment you’d think these miners were doing terribly, but the opposite proved true again in Q2.

With higher production most of these elite gold miners enjoyed sales growth too, but overall revenues in the top 34 GDX components reporting them last quarter still slipped 2.1% lower YoY. There were two drivers. This year’s Q2’17 results had 27 of these 34 companies report sales compared to 28 a year ago. And these gold miners collectively saw a sharp 8.7% YoY drop in their silver production, weighing on revenues.

Still the $10.7b in collective sales among these top gold miners last quarter is up 3.9% QoQ, in line with the average gold-price gain of 3.1%. Those sales are impressive for gold mining, but serve to reveal just how small this little contrarian sector remains. It only takes a tiny fraction of stock-market capital to slosh into the gold miners’ stocks to fuel enormous gains fast. Gold rallying is the key, which shifts sentiment to bullish.

Finally these top 34 GDX gold miners saw big gains in the cash on their balance sheets in Q2. Weighing in at a hefty $13.7b, it surged 14.1% YoY. The sales of major mining projects likely weren’t a big factor, as most sellers and buyers are in this top-GDX-component list. Overall cash grew 3.5% or $462m QoQ, leaving the major gold miners with lots of firepower to snatch up promising projects and mines from the juniors.

So overall the major gold miners’ fundamentals looked quite impressive in Q2’17, a stark contrast to the miserable sentiment plaguing this sector. Gold stocks’ vexing consolidation this year wasn’t the result of operational struggles, but purely bearish psychology. That will soon shift as the stock markets roll over and gold surges, making the beaten-down gold stocks a coiled spring today. They are overdue to soar again!

Though this contrarian sector is widely despised today, it was the best performing in all the stock markets last year despite that sharp post-election selloff in Q4. The HUI blasted 64.0% higher in 2016, trouncing the S&P 500’s mere 9.5% gain! Similar huge 50%+ gold-stock gains are possible again this year, as gold mean reverts higher on the coming stock-market selloff. The gold miners’ strong Q2 fundamentals prove this.

While investors and speculators alike can certainly play gold stocks’ coming rebound rally with the major ETFs like GDX, the best gains by far will be won in individual gold stocks with superior fundamentals. Their upside will trounce the ETFs’, which are burdened by over-diversification and underperforming gold stocks. A carefully-handpicked portfolio of elite gold and silver miners will generate much-greater wealth creation.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q2, this has resulted in 951 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +21.2%!

The key to this success is staying informed and being contrarian. That means buying low when others are scared, like late in this year’s vexing consolidation. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on our vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. For only $10 per issue, you can learn to think, trade, and thrive like contrarians. Subscribe today, and get deployed in the great gold stocks on our trading books before they surge far higher!

The bottom line is the major gold miners’ fundamentals were very strong in the just-reported second quarter. Production growth drove lower costs, which along with rallying gold prices really helped catapult profits radically higher. This is translating into falling P/E ratios, emphasizing the extreme undervaluation rampant in this deeply-out-of-favor sector. Sooner or later investors will take notice and start returning en masse.

The universally-despised gold stocks are the last dirt-cheap sector in these Trumphoria-inflated stock markets. No one wants anything to do with them, which is the best time to buy low before they soar. All it will take to ignite gold stocks’ overdue mean-reversion rally is gold investment demand returning. The miners’ profits will really leverage gold rallying higher, making gold stocks even more fundamentally compelling. Adam Hamilton, CPA August 18, 2017 Copyright 2000 – 2017 Zeal LLC (www.ZealLLC.com)

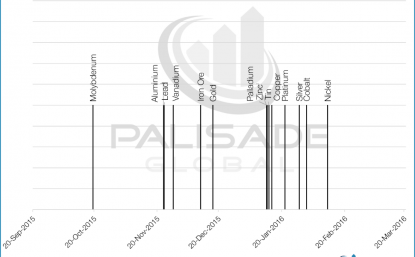

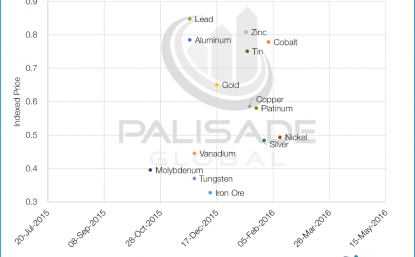

In the last couple of years, we have seen the majority of commodities bottom out, finally seeing some signs of life. The majority of the rebounds occurred from late-2015 to early 2016.

Molybdenum led the pack after its mini-resurgence and subsequent fall, while nickel experienced the same path, bottoming out several months later.

Looking back at the last five years, iron ore fell the hardest, decreasing 67%, while lead remained the most resilient, losing only 15%.

Now that commodities have bottomed, many in just the past year have been performing extraordinarily. Cobalt is heads above the rest, gaining 114%, while vanadium comes in second at 71%. There is quite a difference afterwards, with copper gaining 32% and zinc 27%.

Precious metals have not fared as well. In fact, the past year saw gold, silver, and platinum drop -5%, -15%, and -16%, respectively.

Regardless, there are incredible gains to be seen ahead, especially in precious metals. The bottom for commodities is in and has been for some time. Are you there to take advantage?

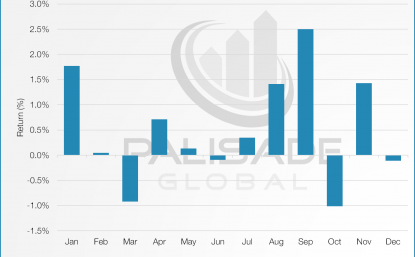

In July, the Rogers International Commodity Index (RICI) had its best month since September, 2016, according to Price Asset Management, a US-based firm that manages a commodity fund based on the RICI index.

The index was up 3.13%, slightly ahead of the benchmark Bloomberg Commodity Index (BCOM) which was up 2.26%.The RICI is a composite, US dollar-based index designed by legendary commodity investor Jim Rogers Jr. in the late 1990’s. Metals continue to be the leading sector as both precious and industrial metals are showing strength as a result of continued strong fundamentals and global disturbances supporting precious metals.