- Today is options expiry day for gold. That’s almost certainly the reason for gold’s pullback today, after it staged a powerful rally yesterday.

- A pause in the price action is normal around these expiry events. The October options contract is expiring, which is recognized by traders as an important one.

- Traders will now focus on December options.

- Please click here now. Double-click to enlarge this short term gold chart.

- For a medium term view of the price action, please click here now. Double-click to enlarge.

- From a technical perspective, all the current price movement in the gold market appears to be “textbook” action. To summarize the recent movement: Gold burst above the $1305 area highs and surged to the “Call-In” day highs in the $1352 area.

- I issued a “book profits now” call as that happened, and the rally promptly died. The pullback took gold back to the breakout zone in the $1305 area.

- Yesterday, gold staged its first rally from that support zone. Gold may soon pull back deeper into that support zone before launching what should be a successful rally above the call-in day resistance zone at $1352 – $1362.

- I’ve laid out two buy zones for investors who want to position themselves to participate in the anticipated breakout above $1362.

- All pullbacks can make investors nervous, and those nervous investors should look at put options for insurance (both emotional and financial).

- Please click here now. That’s a snapshot of the strike price, closing price, change in price, and trading volume for GLD-nyse put options.

- These are December options. Different contract months are available and they can be bought through most stock brokers. Send me an Email to stewart@gracelandupdates.com if you want more information about protective put options and I’ll send you a tactical video. Thanks.

- Buying some put options at the same time as buying long positions in gold, silver, and related stocks can help amateur investors to buy serious price weakness,yet still get a good night’s sleep.

- Please click here now. I’ve annotated this Dimitri Speck seasonal action gold chart. In the case of gold price seasonality, history doesn’t always exactly repeat,but it certainly does rhyme. Note the short term peak that often occurs at the end of September.

- October is generally a pullback month ahead of Diwali, but that pullback may have started a bit earlier than usual this year. So, it should end earlier too, probably within about two weeks. There’s an outside chance that it’s already ended, but I wouldn’t bet real money on that idea.

- My $1305 – $1295 and $1285 – $1270 buy zones should be the focus of gold bugs for now.

- Please click here now. The head of the World Gold Council outlines the case for “peak gold”, and he predicts gold will move to $1400 in 2018 and to all-time highs in “the medium term”.

- He may or may not be correct that the world will never produce as much gold as it produces now, but he’s a very influential man.

- So, the question isn’t so much whether “Peak Gold” is real, but whether institutional money managers think it’s real or even partially real, and they do appear to be believers!

- I predict they will move substantially more money into gold stocks in 2018 than they are moving now, based on the view that supply is unlikely to rise much, if at all.

- My personal focus on all price weakness since 2014 has been gold stocks more than bullion. I will also note that gold mining exploration budgets have fallen about 70% since 2012. It takes a long time to put a gold project into production. All the exploration done in the 2012 period doesn’t seem to be bearing much low hanging fruit in terms of viable new projects.

- Please click here now. Double-click to enlarge this interesting GDX chart. GDX has been staging numerous technical breakouts to the upside, and the latest one is from a large symmetrical triangle.

- The apex of that triangle sits in the $22.50 area. Once option expiry day is out of the way, there is still the US jobs report to deal with next week (October 6, 2017). Gold and gold stocks should make a meaningful seasonal low around that rough time frame. From there, I expect gold to begin a trending move higher into 2018, rising up above key resistance at $1392 and steadily rallying towards $1523.

- GDX should easily hit $37 in 2018, with $55 also being a possible target zone if Western money managers continue to allocate money to the SPDR fund as they have in recent months!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Eight Are Great!” senior gold stocks report! I highlight the price action of eight low and medium priced senior producers, with key buy and sell zones highlighted!

Thanks!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

This week’s landmark Federal Open Market Committee decision to launch quantitative tightening is one of the most-important and most-consequential actions in the Federal Reserve’s entire 104-year history. QT changes everything for world financial markets levitated by years of quantitative easing. The advent of the QT era has enormous implications for stock markets and gold that all investors need to understand.

This week’s FOMC decision to birth QT in early October certainly wasn’t a surprise. To the Fed’s credit, this unprecedented paradigm shift had been well-telegraphed. Back at its mid-June meeting, the FOMC warned “The Committee currently expects to begin implementing a balance sheet normalization program this year”. Its usual FOMC statement was accompanied by an addendum explaining how QT would likely unfold.

That mid-June trial balloon didn’t tank stock markets, so this week the FOMC decided to implement it with no changes. The FOMC’s new statement from Wednesday declared, “In October, the Committee will initiate the balance sheet normalization program described in the June 2017 Addendum to the Committee’s Policy Normalization Principles and Plans.” And thus the long-feared QT era is now upon us.

The Fed is well aware of how extraordinarily risky quantitative tightening is for QE-inflated stock markets, so it is starting slow. QT is necessary to unwind the vast quantities of bonds purchased since late 2008 via QE. Back in October 2008, the US stock markets experienced their first panic in 101 years. Ironically it was that earlier 1907 panic that led to the Federal Reserve’s creation in 1913 to help prevent future panics.

Technically a stock panic is a 20%+ stock-market plunge within two weeks. The flagship S&P 500 stock index plummeted 25.9% in just 10 trading days leading into early October 2008, which was certainly a panic-grade plunge! The extreme fear generated by that rare anomaly led the Fed itself to panic, fearing a new depression driven by the wealth effect. When stocks plummet, people get scared and slash their spending.

That’s a big problem for the US economy over 2/3rds driven by consumer spending, and could become self-reinforcing and snowball. The more stocks plunge, the more fearful people become for their own financial futures. They extrapolate the stock carnage continuing indefinitely and pull in their horns. The less they spend, the more corporate profits fall. So corporations lay off people exacerbating the slowdown.

The Fed slashed its benchmark federal-funds interest rate like mad, hammering it to zero in December 2008. That totally exhausted the conventional monetary policy used to boost the economy, rate cuts. So the Fed moved into dangerous new territory of debt monetization. It conjured new money out of thin air to buy bonds, injecting that new cash into the real economy. That was euphemistically called quantitative easing.

The Fed vehemently insisted it wasn’t monetizing bonds because QE would only be a temporary crisis measure. That proved one of the biggest central-bank lies ever, which is saying a lot. When the Fed buys bonds, they accumulate on its balance sheet. Over the next 6.7 years, that rocketed a staggering 427% higher from $849b before the stock panic to a $4474b peak in February 2015! That was $3625b of QE.

While the new QE bond buying formally ended in October 2014 when the Fed fully tapered QE3, that $3.6t of monetized bonds remained on the Fed’s balance sheet. As of the latest-available data from last week, the Fed’s BS was still $4417b. That means 98.4% of all the Fed’s entire colossal QE binge from late 2008 to late 2014 remains intact! That vast deluge of new money created remains out in the economy.

Don’t let the complacent stock-market reaction this week fool you, quantitative tightening is a huge deal. It’s the biggest market game-changer by far since QE’s dawn! Starting to reverse QE via QT radically alters market dynamics going forward. Like a freight train just starting to move, it doesn’t look scary to traders yet. But once that QT train gets barreling at full speed, it’s going to be a havoc-wreaking juggernaut.

QT will start small in the imminent Q4’17, with the Fed allowing $10b per month of maturing bonds to roll off its books. The reason the Fed’s QE-bloated balance sheet has remained so large is the Fed is reinvesting proceeds from maturing bonds into new bonds to keep that QE-conjured cash deployed in the real economy. QT will slowly taper that reinvestment, effectively destroying some of the QE-injected money.

These monthly bond rolloffs will start at $6b in Treasuries and $4b in mortgage-backed securities. Then the Fed will raise those monthly caps by these same amounts once a quarter for a year. Thus over the next year, QT’s pace will gradually mount to its full-steam speed of $30b and $20b of monthly rolloffs in Treasuries and MBS bonds. The FOMC just unleashed a QT juggernaut that’s going to run at $50b per month!

When this idea was initially floated back in mid-June, it was far more aggressive than anyone thought the Yellen Fed would ever risk. $50b per month yields a jaw-dropping quantitative-tightening pace of $600b per year! These complacent stock markets’ belief that such massive monetary destruction won’t affect them materially is ludicrously foolish. QT will naturally unwind and reverse the market impact of QE.

This hyper-easy Fed is only hiking interest rates and undertaking QT for one critical reason. It knows the next financial-market crisis is inevitable at some point in the future, so it wants to reload rate-cutting and bond-buying ammunition to be ready for it. The higher the Fed can raise its federal-funds rate, and the lower it can shrink its bloated balance sheet, the more easing firepower it will have available in the future.

But QT has never before been attempted and is extremely risky for these QE-levitated stock markets. So the Fed is attempting to thread the needle between preparing for the next market crisis and triggering it. Yellen and top Fed officials have been crystal-clear that they have no intention of fully unwinding all the QE since late 2008. Wall Street expectations are running for a half unwind of the $3.6t, or $1.8t of total QT.

At the full-speed $600b-per-year QT pace coming in late 2018, that would take 3 years to execute. The coming-year ramp-up will make it take longer. So these markets are likely in for fierce QT headwinds for several years or so. At this week’s post-FOMC-decision press conference, Janet Yellen took great pains to explain the FOMC has no intentions of altering this QT-pacing plan unless there is some market calamity.

Yellen was also more certain than I’ve ever heard her on any policy decisions that this terminal $50b-per-month QT won’t need to be adjusted. With QT now officially started, the FOMC is fully committed. If it decides to slow QT at some future meeting in response to a stock selloff, it risks sending a big signal of no confidence in the economy and exacerbating that very selloff! Like a freight train, QT is hard to stop.

With stock markets at all-time record highs this week, QT’s advent seems like no big deal to euphoric stock traders. They are dreadfully wrong. CNBC’s inimitable Rick Santelli had a great analogy of this. Just hearing a hurricane is coming is radically different than actually living through one. QT isn’t feared because it isn’t here and hasn’t affected markets yet. But once it arrives and does, psychology will really change.

Make no mistake, quantitative tightening is extremely bearish for these QE-inflated stock markets. Back in late July I argued this bearish case in depth. QT is every bit as bearish for stocks as QE was bullish! This first chart updated from that earlier essay shows why. This is the scariest and most-damning chart in all the stock markets. It simply superimposes that S&P 500 benchmark stock index over the Fed’s balance sheet.

Between March 2009 and this week’s Fed Day, the S&P 500 has powered an epic 270.8% higher in 8.5 years! That makes it the third-largest and second-longest stock bull in US history. Why did that happen? The underlying US economy sure hasn’t been great, plodding along at 2%ish growth ever since the stock panic. That sluggish economic growth has constrained corporate-earnings growth too, it’s been modest at best.

Stocks are exceedingly expensive too, with their highest valuations ever witnessed outside of the extreme bull-market toppings in 1929 and 2000. The elite S&P 500 component companies exited August with an average trailing-twelve-month price-to-earnings ratio of 28.1x! That’s literally in formal bubble territory at 28x, which is double the 14x century-and-a-quarter fair value. Cheap stocks didn’t drive most of this bull.

And if this bull’s gargantuan gains weren’t the product of normal bull-market fundamentals, that leaves quantitative easing. A large fraction of that $3.6t of money conjured out of thin air by the Fed to inject into the economy found its way into the US stock markets. Note above how closely this entire stock bull mirrored the growth in the Fed’s total balance sheet. The blue and orange lines above are closely intertwined.

Those vast QE money injections levitated stock markets through two simple mechanisms. The massive and wildly-unprecedented Fed bond buying forced interest rates to extreme artificial lows. That bullied traditional bond investors seeking income from yields into far-riskier dividend-paying stocks. Super-low interest rates also served as a rationalization for historically-expensive P/E ratios rampant across the stock markets.

While QE directly lifted stocks by sucking investment capital out of bonds newly saddled with record-low yields, a secondary indirect QE impact proved more important. US corporations took advantage of the Fed-manipulated extreme interest-rate lows to borrow aggressively. But instead of investing all this easy cheap capital into growing their businesses and creating jobs, they squandered most of it on stock buybacks.

QE’s super-low borrowing costs fueled a stock-buyback binge vastly greater than anything seen before in world history. Literally trillions of dollars were borrowed by elite S&P 500 US corporations to repurchase their own shares! This was naked financial manipulation, boosting stock prices through higher demand while reducing shares outstanding. That made corporate earnings look much more favorable on a per-share basis.

Incredibly QE-fueled corporate stock buybacks have proven the only net source of stock-market capital inflows in this entire bull market since March 2009! Elite Wall Street banks have published many studies on this. Without that debt-funded stock-buyback frenzy only possible through QE’s record-low borrowing rates, this massive near-record bull wouldn’t even exist. Corporations were the only buyers of their stocks.

QE’s dominating influence on stock prices is unassailable. The S&P 500 surged in its early bull years until QE1 ended in mid-2010, when it suffered its first major correction. The Fed panicked again, fearing another plunge. So it birthed and soon expanded QE2 in late 2010. Again the stock markets surged on a trajectory perfectly paralleling the Fed’s balance-sheet growth. But stocks plunged when QE2 ended in mid-2011.

The S&P 500 fell 19.4% over the next 5.2 months, a major correction that neared bear-market territory. The Fed again feared a cascading negative wealth effect, so it launched Operation Twist in late 2011 to turn stock markets around. That converted short-term Treasuries to long-term Treasuries, forcing long rates even lower. As the stock markets started topping again in late 2012, the Fed went all out with QE3.

QE3 was radically different from QE1 and QE2 in that it was totally open-ended. Unlike its predecessors, QE3 had no predetermined size or duration! So stock traders couldn’t anticipate when QE3 would end or how big it would get. Stock markets surged on QE3’s announcement and subsequent expansion a few months later. Fed officials started to deftly use QE3’s inherent ambiguity to herd stock traders’ psychology.

Whenever the stock markets started to sell off, Fed officials would rush to their soapboxes to reassure traders that QE3 could be expanded anytime if necessary. Those implicit promises of central-bank intervention quickly truncated all nascent selloffs before they could reach correction territory. Traders realized that the Fed was effectively backstopping the stock markets! So greed flourished unchecked by corrections.

This stock bull went from normal between 2009 to 2012 to literally central-bank conjured from 2013 on. The Fed’s QE3-expansion promises so enthralled traders that the S&P 500 went an astounding 3.6 years without a correction between late 2011 to mid-2015, one of the longest-such spans ever! With the Fed jawboning negating healthy sentiment-rebalancing corrections, psychology grew ever more greedy and complacent.

QE3 was finally wound down in late 2014, leading to this Fed-conjured stock bull stalling out. Without central-bank money printing behind it, the stock-market levitation between 2013 to 2015 never would have happened! Without more QE to keep inflating stocks, the S&P 500 ground sideways and started topping. Corrections resumed in mid-2015 and early 2016 without the promise of more Fed QE to avert them.

In mid-2016 the stock markets were able to break out to new highs, but only because the UK’s surprise pro-Brexit vote fueled hopes of more global central-bank easing. The subsequent extreme Trumphoria rally since the election was an incredible anomaly driven by euphoric hopes for big tax cuts soon from the newly-Republican-controlled government. But Republican infighting is making that look increasingly unlikely.

The critical takeaway of the entire QE era since late 2008 is that stock-market action closely mirrored whatever the Fed was doing. Ex-Trumphoria, all this bull’s massive stock-market gains happened when the Fed was actively injecting trillions of dollars of QE. When the Fed paused its balance-sheet growth, the stock markets either corrected hard or stalled out. These stock markets are extraordinarily QE-dependent.

The Fed’s balance sheet has never materially shrunk since QE was born out of that 2008 stock panic. Now quantitative tightening will start ramping up in just a couple weeks for the first time ever. If QE is responsible for much of this stock bull, and certainly all of the extreme levitation from 2013 to 2015 due to the open-ended QE3, can QT possibly be benign? No freaking way friends! Unwinding QE is this bull’s death knell.

QE was like monetary steroids for stocks, artificially ballooning this bull market to monstrous proportions. Letting bonds run off the Fed’s balance sheet instead of reinvesting effectively destroys that QE-spawned money. QE made this bull the grotesque beast it is, so QT is going to hammer a stake right through its heart. This unprecedented QT is even more dangerous given today’s bubble valuations and rampant euphoria.

Investors and speculators alike should be terrified of $600b per year of quantitative tightening! The way to play it is to pare down overweight stock positions and build cash to prepare for the long-overdue Fed-delayed bear market. Speculators can also buy puts in the leading SPY SPDR S&P 500 ETF. Investors can go long gold via its own flagship GLD SPDR Gold Shares ETF, which tends to move counter to stock markets.

Gold was hit fairly hard after this week’s FOMC decision announcing QT, which makes it look like QT is bearish for gold. Nothing could be farther from the truth. Gold’s post-Fed selloff had nothing at all to do with QT! At every other FOMC meeting, the Fed also releases a summary of top Fed officials’ outlooks for future federal-funds-rate levels. This so-called dot plot was widely expected to be more dovish than June’s.

Yellen herself had given speeches in the quarter since that implied this Fed-rate-hike cycle was closer to its end than beginning. She had said the neutral federal-funds rate was lower than in the past, so gold-futures speculators expected this week’s dot plot to be revised lower. It wasn’t, coming in unchanged from June’s with 3/4ths of FOMC members still expecting another rate hike at the FOMC’s mid-December meeting.

This dot-plot hawkish surprise totally unrelated to QT led to big US-dollar buying. Futures-implied rate-hike odds in December surged from 58% the day before to 73% in the wake of the FOMC’s decision. So gold-futures speculators aggressively dumped contracts, forcing gold lower. That reaction is irrational, as gold has surged dramatically on average in past Fed-rate-hike cycles! QT didn’t play into this week’s gold selloff.

This last chart superimposes gold over that same Fed balance sheet of the QE era. Gold skyrocketed during QE1 and QE2, which makes sense since debt monetizations are pure inflation. But once the open-ended QE3 started miraculously levitating stock markets in early 2013, investors abandoned gold to chase those Fed-conjured stock-market gains. That blasted gold into a massive record-setting bear market.

In a normal world, quantitative easing would always be bullish for gold as more money is injected into the economy. Gold’s monetary value largely derives from the fact its supply grows slowly, under 1% a year. That’s far slower than money supplies grow normally, let alone during QE inflation. Gold’s price rallies as relatively more money is available to compete for relatively less physical gold. QE3 broke that historical relationship.

With the Fed hellbent on ensuring the US stock markets did nothing but rally indefinitely, investors felt no need for prudently diversifying their portfolios with alternative investments. Gold is the anti-stock trade, it tends to move counter to stock markets. So why bother with gold when QE3 was magically levitating the stock markets from 2013 to 2015? That QE3-stock-levitation-driven gold bear finally bottomed in late 2015.

Today’s gold bull was born the very next day after the Fed’s first rate hike in 9.5 years in mid-December 2015. If Fed rate hikes are as bearish for gold as futures speculators assume, why has gold’s 23.7% bull as of this week exceeded the S&P 500’s 22.8% gain over that same span? Not even the Trumphoria rally has enabled stock markets to catch up with gold’s young bull! Fed rate hikes are actually bullish for gold.

The reason is hiking cycles weigh on stock markets, which gets investors interested in owning counter-moving gold to re-diversity their portfolios. That’s also why this new QT era is actually super-bullish for gold despite the coming monetary destruction. As QT gradually crushes these fake QE-inflated stock markets in coming years, gold investment demand is going to soar again. We’ll see a reversal of 2013’s action.

That year alone gold plunged a colossal 27.9% on the extreme 29.6% S&P 500 rally driven by $1107b of fresh quantitative easing from the massive new QE3 campaign! That 2013 gold catastrophe courtesy of the Fed bred the bearish psychology that’s plagued this leading alternative asset ever since. At QT’s $600b planned annual pace, it will take almost a couple years to unwind that epic $1.1t QE seen in 2013 alone.

Interestingly the Wall-Street-expected $1.8t of total QT coming would take the Fed’s balance sheet back down to $2.6t. That’s back to mid-2011 levels, below the $2.8t in late 2012 when QE3 was announced. Gold averaged $1573 per ounce in 2011, and it ought to head much higher if QT indeed spawns the next stock bear. That’s the core bullish-gold thesis of QT, that falling stock prices far outweigh monetary destruction.

Stock bears are normal and necessary to bleed off excessive valuations, but they are devastating to the unprepared. The last two ending in October 2002 and March 2009 ultimately hammered the S&P 500 49.1% and 56.8% lower over 2.6 and 1.4 years! If these lofty QE-levitated stock markets suffer another typical 50% bear during QT, huge gold investment demand will almost certainly catapult it to new record highs.

These QE-inflated stock markets are doomed under QT, there’s no doubt. The Fed giveth and the Fed taketh away. Stock bears gradually unfold over a couple years or so, slowly boiling the bullish frogs. So without a panic-type plunge, the tightening Fed is going to be hard-pressed to throttle back QT without igniting a crisis of confidence. As QT slowly strangles this monstrous stock bull, gold will really return to vogue.

The key to thriving and multiplying your fortune in bull and bear markets alike is staying informed, about broader markets and individual stocks. That’s long been our specialty at Zeal. My decades of experience both intensely studying the markets and actively trading them as a contrarian is priceless and impossible to replicate. I share my vast experience, knowledge, wisdom, and ongoing research in our popular newsletters.

Published weekly and monthly, they explain what’s going on in the markets, why, and how to trade them with specific stocks. They are a great way to stay abreast, easy to read and affordable. Walking the contrarian walk is very profitable. As of the end of Q2, we’ve recommended and realized 951 newsletter stock trades since 2001. Their average annualized realized gain including all losers is +21.2%! That’s hard to beat over such a long span. Subscribe today and get invested before QT’s market impacts are felt!

The bottom line is the coming quantitative tightening is incredibly bearish for these stock markets that have been artificially levitated by quantitative easing. QT has never before been attempted, let alone in artificial QE-inflated stock markets trading at bubble valuations and drenched in euphoria. All the stock-bullish tailwinds from years of QE will reverse into fierce headwinds under QT. It truly changes everything.

The main beneficiary of stock-market weakness is gold, as the leading alternative investment that tends to move counter to stock markets. The coming QT-driven overdue stock bear will fuel a big renaissance in gold investment to diversify stock-heavy portfolios. And the Fed can’t risk slowing or stopping QT now that it’s officially triggered. The resulting crisis of confidence would likely exacerbate a major stock-market selloff.

Adam Hamilton, CPA

September 22, 2017

Copyright 2000 – 2017 Zeal LLC (www.ZealLLC.com)

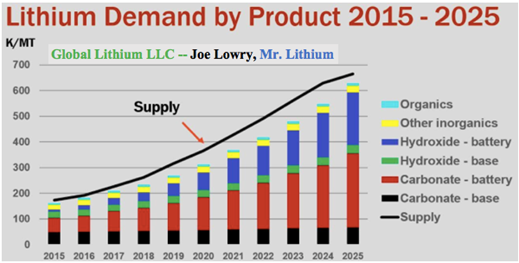

The future is sealed; batteries will rule the automotive industry as more and more countries outlaw combustion engines. Lithium (Li) is the lightest metal with the highest energy density, allowing the metal to supply the maximum charge per kilogram, which, in turn, makes it excellent for battery use.

Current global lithium production is not enough to meet future demand and with countries around the world increasingly shunning fossil fuels, demand for a secure supply of lithium will drive growth of lithium mining companies.

One company is already on its way to commercial production of lithium.

North American Lithium (NAL) acquired and is re-starting one of the only near-term viable hard rock lithium operations globally. North American Lithium is the 100-per-cent owner of the Québec Lithium Mine in Val-d’Or, Quebec, a mine site located within reach of North America’s largest markets and export terminals.

According to the 2016 Fraser Institute Annual Survey Mining Jurisdictions, Québec ranks as one of the top 10 mining jurisdictions in the world, with a low tax rate, low energy costs and a mining friendly government. NAL’s mine is situated about 60 kilometres north of Val-D’Or, a city with a population of 35,000 residents that provides an abundance of skilled mining labor for the region. The site also happens to be serviced by excellent regional and site-based infrastructure with access to natural gas, hydropower, highways, rail, and air. With security of supply a top priority for technology companies, businesses that require lithium will want to source their supply from safe and stable jurisdictions.

NAL’s lithium project is a past-producing mine with approximately $500 million already spent on the development of the property. Previous companies completed the necessary work to advance the project to the brink of commissioning. In addition, over $100 million has been invested by NAL shareholders over the last two years, shortening the timeline to production for a junior mining company.

Previous work at NAL’s mine site revealed significant mineral resource estimates for a long operating life. As of May 2017, the company has measured resources of 13.5 Mt tonnes at 1.08 %Li2, indicated 25.8 Mt at 1.02 %Li2 for a total of measured and indicated of 39.3 Mt tonnes at 1.04 %Li2. Also as of May 2017, the site proved 11.9 Mt at 0.94 %Li2 and probable reserves of 8.9 Mt at 93 %Li2. Infill-drilling confirmed previous drilling data and the 2016 drill campaign shows potential to extend reserve life from material within current mining lease. Currently, the project is fully permitted, in possession of all permits/licenses to restart the mine, processing facility and tailings.

The amount of previous work, in addition to the size of the resource and the improved market demand for lithium prompted NAL to acquire the asset in 2016. NAL is a joint investment venture between Jien International Investments Ltd. and Investissement Québec. Jien has a successful track record in Québec, having invested $1.6 billion in Northern Québec nickel, copper and PGM producer Canadian Royalties Inc. (CRI). The company has strong relationships with China and other Asian markets with an experienced, Canadian-based operational, technical and finance team. Management has experience with turning around mines in Québec and a unique access to Chinese lithium converter markets.

NAL is led by Chief Executive Officer and Director, James Xiang. James Xiang has had a successful track record as an entrepreneur, investor and savvy rescue artist since immigrating to Canada in 2001. In 2005, Xiang began pursuing a career in the resource sector and successfully brought a China-based nickel-copper project, GobiMin Inc, to list on the TSX. In less than one and a half years, GobiMin’s market cap grew by 10 times. Under his management during the financial crisis of 2008, GobiMin was able to sell its main project to a Chinese firm in an all cash-deal which proved his ability to take advantage of both North American market and Chinese markets.

James Xiang was also instrumental in the turnaround of Canadian Royalties Inc. As the company’s CEO, Xiang re-built the company’s senior management and corporate strategy, which was work that ultimately led to a company turnabout that caught the attention of the market, especially Investissment Québec, which partnered with Xiang at NAL.

Future plans for the company include developing and completing the improvement of its existing lithium processing facilities, becoming a commercial producer of lithium carbonate, and looking for expansion and acquisition in Québec and globally.

- Several weeks ago, I surprised most investors by issuing my “Book Profits Now!” call for the precious metals asset class.

- When I did so, head and shoulders top formations immediately formed on gold and GDX, and prices have swooned.

- Rumours of a sudden drop in Indian dealer demand appeared to become a concern for commercial traders on the COMEX.

- India’s monsoon season has turned out to be a bit of a “bust”, with both flooding and drought. Farmers buy gold with a portion of their crop profits. With only another week or two left in the monsoon season, crop sales may not be very good.

- Of further concern to me was the fact that the demand drop was occurring as gold arrived at the $1352 resistance zone. That resistance was created by Modi’s cash call-in that took place in November of 2016.

- The upcoming Fed meeting will probably mark the end of the decline related to those concerns, but there could be additional weakness until the next US jobs report is released.

- Please click here now. Double-click to enlarge.

- For investors, this gold chart tells the entire tactical story. The $1270 – $1260 area is the target of the H&S top pattern.

- Investors should use a two-pronged strategy to profit from the coming rally that should take gold back to the “Call-In Day” resistance around $1352.

- I’ve outlined the $1315 – $1295 price area as the first key buy zone. Eager accumulators can buy right now.

- Janet Yellen’s handling of the imminent launch of quantitative tightening (QT) at this Fed meeting is critical.

- It will almost certainly determine whether gold bounces from the $1315 – $1295 buy zone or first proceeds down to the H&S target zone at $1260 -$1270.

- If gold moves to that lower zone, investors need to consider taking more aggressive buy-side action.

- That’s my personal strategy as well as my recommended one for gold bugs around the world.

- Please click here now. Double-click to enlarge this GDX chart.

- The technical picture for GDX is very similar to gold. Note the small but positive wedge pattern. I’ve highlighted it with thick black trend lines.

- While the target of the H&S top pattern is about $22.50 (similar to the $1260 – $1270 target for gold), the wedge formation could send GDX and most gold stocks higher from current price levels.

- Please click here now. Double-click to enlarge this US dollar versus Japanese yen chart. My important 14,7,7 series Stochastics oscillator is now overbought, and that’s happening just ahead of the Fed meeting.

- Heavyweight analysts at Japanese bank Nomura are predicting a collapse in the dollar down to the 105 – 100 target zone by the end of the year.

- That’s also been my target zone for quite awhile, and it’s because the dollar is trading in a rectangle between 108 and 114.

- The technical odds of a breakdown to 100 -105 are about 67%. Also, rallies tend to be week when oscillators become overbought quickly, and that’s what’s happening now.

- Please click here now. This chart tells the entire story for the precious metals asset class. It’s dramatically under owned, and there’s a beautiful double bottom pattern in play.

- Gold and associated assets are clearly poised for an enormous increase in institutional ownership. I call it “The Golden Wave”. This buying is not event-based. It’s based on portfolio allocation to gold as an asset class, and that means the buying will be sustained.

- Gold bugs around the world can use my key prices zones of $1315 – $1295 and $1260 – $1270 now to get tactically positioned in key gold stocks to surf the golden institutional wave!

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

On Monday Sept. 15, HIVE Blockchain Technologies Ltd. (TSX-V: HIVE) began trading on the TSX Venture Exchange. The company commenced mining operations and began accumulating cryptocurrency the same day. It is providing access to the seemingly complex world of cryptocurrencies in a traditional way, through the public markets. However, it is also providing investors a unique opportunity to get access to the blockchain technology that will change how business is done.

At the very core of the global economy are contracts, transactions and records which define the economic, political and legal systems people operate in. However, the global system has not kept paced with advancements in digital payments systems which is creating massive slowdowns and backlogs for transactions being processed through financial intermediaries; this will have to change.

Blockchain could solve this problem. The technology is at the heart of bitcoin. Blockchain is an open, distributed ledger that can track transactions between two parties in a verifiable and permanent way. The ledger is programmable to trigger transactions automatically.

In a digital world where increasingly two parties never meet and will never meet, there needs to be a way to ensure confidence and the origin of any agreement or payment. When Ronald Reagan was negotiating with Russia over a nuclear arms deal, he often quoted a Russian proverb: “trust but verify.”

Blockchain offers this and helps to remove and reduce much of the insecurity and necessary due diligence with a built-in verifiable method, allowing transactions to quickly proceed with confidence which improves the speed of business to match the booming digital economy.

With blockchain, contracts are embedded in digital code and stored in transparent and open databases, where they are protected from deletion, tampering, and revision.

Every agreement, process, task, and payment would have a digital record and signature that could be identified, validated, stored, and shared. Intermediaries like lawyers, brokers, and bankers might no longer be necessary. Individuals, organizations, machines, and algorithms would freely transact and interact with one another with little friction. Blockchain is a disturbed network, a peer-to-peer network that does not rely on a central authority because of its inherent security. Here lies the massive potential of blockchain technology.

Blockchain was introduced in 2008 as part of bitcoin, a virtual/digital currency that does not rely on a central authority such as a bank or government for issuing the currency, transferring ownership, and confirming transactions. Bitcoin and digital currencies are the first examples of blockchain technology.

E-mail enabled person-to-person messaging, bitcoin with blockchain accounting enables person-to-person financial transactions without going through a financial intermediary.

The development and maintenance of blockchain is open, distributed, and shared. A dedicated team of volunteers around the world maintains the software. Just like e-mail, bitcoin first caught on with a relatively small community. However, the community of supporters is changing as people are realizing the potential.

According to Marco Iansiti and Karim R. Lakhani writing in the Harvard Business Review, at the end of 2016 the value of bitcoin transactions was expected to hit $92 billion. That’s still a fraction compared to the $411 trillion in total global payments, but bitcoin is growing fast and increasingly important with instant payments and foreign currency and asset trading, where the present financial system imposes limitations.

According to a recent IBM study, one-third of C-level executives are using or considering adopting blockchain technology within their organizations. The study found that executives hope to enable new transaction applications that could help create trust, accountability and transparency among their organizations and partners.

Eighty percent of the 3,000 executives surveyed in the IBM study, indicated that they were using or considering blockchain either to develop new business models in response to a changing financial landscape. Furthermore, 71 percent of business leaders who are actively using blockchain believe that industry associations will play a key role in advancing the technology, suggesting widespread creation of industry standards.

The earlier a company is able to develop a business model around blockchain, the better they will be able to control its and its profitability.

Bank of America, JPMorgan, the New York Stock Exchange, Fidelity Investments, and Standard Chartered are testing blockchain technology as a replacement for paper-based and manual transaction processing in such areas as trade finance, foreign exchange, cross-border settlement, and securities settlement. The Bank of Canada is testing a digital currency called CAD coin for interbank transfers. According to the Harvard Business Review, there should be a proliferation of private blockchains that serve specific purposes for various industries.

All this is going to create massive demand for digital currencies to enable the blockchain infrastructure to work. However, there have been many campy and independent solutions created to mine digital currencies however the small scale limits their scalability and corporate adoption. The heavy data requirements limit the average user from mining without incurring massive expenses.

Industrial-scale mining is highly profitable even with cryptocurrency prices far below current levels. Professional-grade, scalable infrastructure is necessary to support a growing blockchain ecosystem.

In 2013, Marco Streng, a 29-year-old German mathematician, saw an opportunity for industrial digital mining and built a privately-owned cloud cryptocurrency mining company, Genesis Mining.

Crypto miners secure transactions on the blockchain and, in exchange for expending considerable computing resources to do so, are rewarded with newly minted cryptocoins.

Genesis’ customers purchase contracts that secure the computer processing power used to create Bitcoins or other cryptocurrencies like Ethereum. The processing power is produced in data centres built in remote northern locations (to keep the computers cool), with access to cheap electricity and great web connectivity. The company’s first industrial data centre was in Eastern Europe, with facilities added in Iceland, Sweden, and more planned locations.

Streng realized something was missing – accessibility. Many people won’t purchase Bitcoins or buy a cloud mining contract because of its complexities–both real and perceived, and yet these same individuals want to invest in what is fast becoming the future of banking and finance.

This is why one company, HIVE Blockchain Technologies Ltd. (TSX-V: HIVE) was created with the goal of building the leading listed blockchain company through the development and ownership of cryptocurrency mining infrastructure and other related blockchain businesses.

“The concept with HiVE is to give Genesis a footprint outside of the cryptocurrency world and build a bridge from the blockchain space to traditional capital markets,” commented Marco Streng said in an interview.

HIVE fills a gap in the equities markets by offering access to the growth of the blockchain sector in a traditional investment vehicle, shares. Shareholders gain exposure to both an operating cryptocurrency mining business and resulting cash-flow and price performance of a growing portfolio of cryptocurrencies generated from mining activities without having to select from the wide variety of currencies being developed.

HIVE is a partnership between Genesis Mining, the world’s largest cloud bitcoin mining company with over 700,000 customers, and Fiore Group, a leading Canadian merchant banking firm led by Frank Giustra, Gord Keep and Brian Paes-Braga.

Frank Holmes serves as the company’s non-executive chairman. Mr. Holmes is the founder and CEO of U.S. Global Investors, an award winning asset management firm specializing in gold and emerging markets.

Bjoern Arzt, Tobias Ebel, and Olivier Roussy Newton have also joined the board of directors of HIVE. Mr. Arzt and Mr. Ebel both advise Genesis and are Managing Partners of Logos Fund, a successful cryptocurrency mining investment fund based in Zug, Switzerland. Mr. Roussy Newton is an investment banker and entrepreneur focused on early stage blockchain and quantum computing firms.

Transformative applications of the blockchain are being developed and it is far from being a mature and established industry. But it makes sense to evaluate their possibilities now and invest in companies developing the technology for commercial purposes.

The long term value in blockchain will be most accretive when tied to a new business model in which to underlying value of the peer-to-peer frictionless transactions detaches from the short sighted use of blockchain for cryptocurrencies.

In the interim, HIVE technologies offers a safe and understandable route to participate and profit in digital currencies and from a technology that is in its formative stage which eventually will change how global payments are done.

The ground floor on blockchain technologies is here.

This is my 4th interview of “Mr. Lithium,” Joe Lowry. Do people still call him that? Following Joe’s advice by paying a pretty penny for his consulting services, or following him for free on Twitter and Linked-In, is one of the absolute best ways to stay on top of the lithium sector. Although Joe does not give investment advice, he sometimes issues PSAs, “public service announcements,” warning followers to be careful not to believe everything they read or hear about lithium juniors! (ask him what he thinks of the dozens of Li juniors heavily focused on projects in Nevada …. actually, don’t)

Still, reading between the lines, it’s been clear which names he has liked over the months and years. Lithium Americas (TSX: LAC) and SQM (NYSE: SQM) are prime examples. It’s truly worth one’s time to follow Joe. Consider that LAC shares have more than doubled from an early July low of C$0.78 (it closed at C$1.70 on September 15th) when rumblings suggested that SQM might not move forward on the LAC/SQM Cauchari-Olaroz project. Joe was among the first to squash those rumors, setting up what turned out to be a highly profitable buying opportunity. SQM is up 120% in the past 12 months (by comparison, the Global X Lithium ETF is up 54%, and the S&P500 Index 16%)

Another key takeaway from reading Joe’s real-time accounts of the lithium industry is that things happen, a lot of things, away from the U.S. & Canada. And, it’s not all about south America’s, “Lithium Triangle” either. China is incredibly important and Australia is a long-time and growing hotspot for hard rock Li mining. Joe has mentioned Chinese and Australian-listed companies that have also had tremendous performance over the past year, Ganfeng Lithium (SHE:002460) + 208% and Tianqi Lithium (SHE:002466) + 97%.

Joe is a fan of Australian-listed Galaxy Resources (ASX: GXY), a company a hard-rock operation in production in Australia, a world-class brine development project (Sal de Vida) in Argentina that has a Bank Feasibility Study on it, and a promising exploration project in Quebec, Canada near Nemaska’s (TSX: NMX) Whabouchi project. GXY is up 60% in just the past 3 months.

Reading my prior 3 interviews of Joe in preparation for this one was quite interesting. Consider what he said in June 2015,

“There’s already significant tightness in the upstream market (both carbonate & hydroxide) that will build over the next 24 months resulting in a significant price rise.”

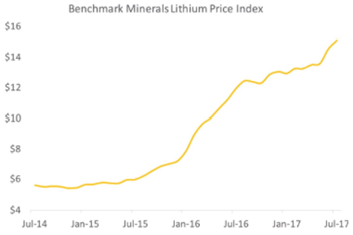

Now, look at this price chart from Simon Moores’ group, Benchmark Mineral Intelligence,

Notice what happened around June, 2015? I always learn a lot from interviewing Mr. Lithium, this time was no different. Please enjoy this latest masterpiece, my fourth, and view links to previous interviews at the bottom of the page. NOTE: (I have no prior or existing financial relationship with Joe Lowry or any of his business interests)

What has been the biggest change in your view of either demand or supply for the next 5 or 10 years?

Since mid-year when I have been asked to speak on lithium supply & demand, I say the following, ‘all the positive surprises have been on the demand side and the negative surprises on the supply side.’ I do a lot of expert consultant calls on the subject of lithium. These calls no longer dwell on the topic of demand — investors seem to recognize that electric transportation demand is real and significant.

The question now is more about speed of EV implementation. On supply, it has been great to see LAC, Pilbara Minerals (ASX: PLS) & Altura Mining (ASX: AJM) get funding, but the continued issues with Albemarle’s (NYSE: ALB) LaNegra II expansion, and Orocobre (ASX: ORE) ramping up to phase 1 capacity of 17,500 tonnes/yr. of lithium carbonate, are further evidence that lithium projects take time and have considerable execution risk.

While most agree with you & Simon Moores that Li prices will remain at or above $10-12k/tonne for years to come, what event(s) could cause prices to fall below $10k/tonne?

Oversupply, which isn’t likely to happen. Also, the global average cost of production is creeping up each year. Even Albemarle in the Atacama salar in Chile has significantly higher cash costs after agreeing to a new royalty regime this year.

What is the most important lithium industry topic that investors are not talking about?

The biggest issue with the retail investor is falling love with a company because its stock price is up, even if the company’s project is poor or marginal.

On the institutional side, many are asking the wrong questions and accepting what some major banks say, that is, in many cases, simply poor quality analysis. I have done calls with hedge funds and institutions that were only willing to look at ALB for a lithium investment. Juniors were not on the table for them because of their size or the exchange they are traded on. I always said to buy SQM, but would get some response about the CORFO issue. Look at the missed opportunity (up 120% in the past year).

Are you receiving more calls from investment fund managers lately? At what point on the investment spectrum are we on in terms of boom-bust / fear-greed, bubble / pop?

Since 2015, the rate I charge for expert consulting calls has tripled, while at the same time, the volume of calls coming in has also tripled. I say we are in, ‘lithium’s 15 minutes of fame‘ which may turn into a 15-year ‘super cycle.’

Companies you’ve spoken favorably on, companies like Tianqi, Ganfeng, SQM, and Lithium Americas are up between 87% & 208% in the past year. Can large lithium companies continue to vastly outperform market indices?

First, let me clarify, Tianqi should be at the end, not the beginning of that list. They have great assets but are not great operators like SQM & Ganfeng. In this cycle I bought SQM at $15/shr. and bought more shares up to $20. It’s at $58 as we speak. I started buying shares of LAC the week of the SQM JV deal in March of 2016. I was public about this only to prove that I, ‘eat my own cooking.‘ At this point in the cycle, SQM may be approaching full valuation, but in my opinion LAC is still significantly undervalued and has a lot of room to run.

NOTE: Howard Klein of RK Equity has excellent commentary on the perceived under-valuation of LAC, and a few other names. He publishes the Lithium-ion Bull newsletter. Twitter: @HowardKlein10

China’s announcement to ban gas & diesel cars is hardly a surprise, yet the market seems to have been blown away by this news. In what year do you think China will start phasing out ICE-powered vehicles?

Much of my business is directly tied to what happens in China. My opinion is that this announcement is both aspirational and significant. I take it as more of an indication that near-term policy decisions will support e-transportation & ESS growth. But, we could easily be talking five years from now about when China is going to turn that pronouncement into reality.

There are > 20 juniors with at least 1 owned or optioned Li brine property in Argentina. Lacking large sums of capital, some are planning to pump brine into evaporation ponds, then ship a 1%-2% Li concentrate to a larger player for processing. Is that a business model that could work?

This idea sounds good, but would be difficult to implement. Most brine assets have significant variations. Salars are dynamic – it’s not just about, ‘pumping brine into ponds‘; expertise is required to manage the mix of brines. This is true on the world’s best brine resource in Chile and wouldn’t be any easier with combined mediocre assets. Blending brines from several salars will increase processing complexity significantly. It may look good on a, ‘white board‘ and make for a good story for investors who don’t understand how lithium processing works, but I’m skeptical to say the least.

You comment periodically about FMC Corp., Albemarle & SQM. Please summarize your views on each.

SQM only fairly recently decided to go ‘all-in’ on lithium, as evidenced by the LAC and Kidman Resources (ASX: KDR) deals and their expansion in Chile. SQM is now the, ‘lithium superpower.’ Yes, they still have to work out issues with CORFO, but the Chilean government does not want to kill the golden goose.

Albemarle has great assets, but are, at best, mediocre operators. They have a very poor record of executing on capital projects. Their announcement on September 15th about new technology was a typical PR move, but likely lacks substance – they highlighted a technology that even they say is not ready for commercial use. ALB has issues with their brine operation that are starting to be recognized based on their limited output vs. SQM. In one sentence; ALB is a company run by a lawyer trying to compete in a world where operations are key.

FMC Corp. (NYSE: FMC) has allowed their franchise to atrophy by not investing in resource capacity. They have a very good, but small upstream operation in Argentina. They have a very old processing plant in North Carolina, and an old downstream plant in the UK. Their newly announced tolling operation is what I have called a ‘House of Cards‘ – your readers can find my posts on Linked-In. From a top 3 producer in years past, FMC will be #6 globally in LCE production in 2018.

Joe, I notice that you mention a company named Nano One, ticker NNO.v from time to time. What can you tell us about that company?

Nano One Materials (TSX-V: NNO) has an extremely interesting technology. The primary focus is to lower the cost of producing cathode by eliminating process steps. In addition, Nano’s process may enable the use of non ‘battery-grade‘ lithium materials in cathode production. Another benefit of the process is the ability to use lithium carbonate to produce high nickel compounds such as NCA that currently require lithium hydroxide.

SQM has operations or projects in Chile, Argentina & Australia. It’s been reported that they’re looking for a fourth jurisdiction to operate in. Any thoughts on where they are looking?

I have very clear thoughts on this, but I will keep them to myself. Clearly SQM is now “all-in” on lithium and part of what I call the, ‘Lithium Star Alliance‘ along with LAC, Ganfeng, Kidman & PLS (via Ganfeng’s interest)

You & Simon Moores say that the lithium supply chain is in need of funding from additional sources, presumably battery makers & EV manufacturers. Has there been any evidence of this yet?

Absolutely, there is evidence, but valuation is a major issue. I am speaking with interested parties across the supply chain (from cathode to car makers). The problem is that car and battery companies want to negotiate from strength and tend to be bullies when dealing with their suppliers. They are trying to price shop in a seller’s market. It will take time for them to realize the reality of the lithium market – lithium suppliers are in the driver’s seat.

Thanks Joe, very good stuff, as always. Great catching up with you!

Gold has surged dramatically to major breakouts since its usual summer-doldrums lows. That’s naturally rekindled interest in this leading alternative investment, despite the record-high stock markets. Investors are starting to return to gold again to prudently diversify their stock-heavy portfolios. That’s very bullish for gold, as investment capital inflows can persist for months or even years. This shift is most evident in GLD.

The American SPDR Gold Shares is the world’s leading and dominant gold exchange-traded fund. Since its birth way back in November 2004, it has acted as a conduit for the vast pools of stock-market capital to migrate into and out of physical gold bullion. The marginal gold investment demand, and sometimes supply, via GLD can be big and varies wildly. Thus GLD-share trading is often gold’s primary short-term driver.

The definitive arbiter of global gold supply and demand is the venerable World Gold Council. It publishes highly-anticipated quarterly reports called Gold Demand Trends. They offer the best reads available on global gold fundamentals. At first glance, it’s not apparent why gold-ETF demand plays such a massive role in driving gold’s price action. But digging a little deeper makes this crucial-to-understand relationship clearer.

According to the WGC, over the past 5 years from 2012 to 2016 jewelry demand averaged about 54% of overall global gold demand. Total investment demand including physical bars and coins in addition to gold ETFs averaged just 26%. Breaking that category down further into bars and coins separate from ETFs, they weighed in at averages of 28% and -2% of world gold demand respectively over the past 5 years.

The key to ETFs’ outsized impact on gold prices is in the extreme variability of their demand. Across that same span, total gold demand only varied 10% from the midpoint of its worst year to best year. For jewelry that variance ran 27%, as gold’s largest demand category is relatively inelastic to gold’s price. Variability for bar-and-coin investment was higher at 49%. But that’s still nothing compared to ETFs’ wild swings.

Global gold-ETF demand between 2012 to 2016 varied radically from a low of -914.3 metric tons in 2013 to a high of +534.2t in 2016! The percentages don’t work with a negative number, but that 5-year variance of 1448.6t is vast beyond belief. Despite global gold-ETF demand averaging just -2% of total world gold demand over that span compared to 54% for jewelry, in raw-tonnage terms ETFs’ variability ran 2.2x jewelry’s!

Gold prices are set at the margin, and capital inflows and outflows via gold ETFs dwarf changes in every other gold demand category. The extreme volatility in gold investment demand through ETFs from stock traders overpowers everything else. When stock investors are buying gold-ETF shares faster than gold itself is being bought, gold rallies. That investment buying fuels major uplegs and entire bull markets in gold.

The mission of gold ETFs including GLD is to mirror the gold price. But the supply and demand of ETF shares is independent from gold’s own. So when stock investors buy gold-ETF shares faster than gold is being bid higher, those share prices threaten to decouple to the upside. Gold-ETF managers only have one way to prevent this tracking failure. They issue new gold-ETF shares to offset that excess demand.

Selling new gold-ETF shares to stock investors raises capital, which is then plowed into physical gold bullion held in trust for shareholders that very day. This process effectively shunts excess demand for gold-ETF shares into the underlying gold market, bidding gold higher. Gold ETFs including GLD could not track the gold price if this mechanism for equalizing differential capital flows between them didn’t exist.

The opposite happens when gold-ETF shares are sold faster than gold itself is being sold. That forces the shares to disconnect from gold to the downside. Gold ETF managers avert that failure by stepping in to buy back those excess shares offered. They raise the capital necessary to sop up this excess supply by selling some of the gold bullion underlying their ETF. Gold ETFs are a capital conduit between stocks and gold!

Because of the massive size of the US stock markets, GLD capital flows are more important to gold than all of the other gold ETFs around the world combined. GLD’s managers are very transparent, publishing its physical-gold-bullion holdings daily. That offers a far-higher-resolution read on what’s going on in gold investment than the WGC’s quarterly fundamental reports. GLD’s holdings are the key to gold’s fortunes.

When GLD’s holdings are rising, that means American stock-market capital is flowing into the global gold market. When GLD’s holdings are falling, investors are pulling capital back out of gold. There is nothing more important for gold’s overall price trends than these GLD capital flows. From extremes gold-futures speculators can overpower GLD’s influence on gold from time to time, but these eclipsing bouts don’t last long.

I’ve actively studied GLD’s dominating influence on gold prices for many years now. The hard data on this is crystal-clear, as we’ll discuss shortly. But unfortunately many if not most speculators and investors in gold, silver, and their miners’ stocks still don’t understand this. You can’t really grasp what’s going on in gold, and therefore the entire precious-metals complex, if you don’t closely follow GLD’s holdings daily.

This week’s chart looks at GLD’s physical gold bullion held in trust for its shareholders superimposed over the gold price since 2015. When American stock-market capital is flowing into gold via differential GLD-share buying, gold rallies. When that capital heads back out, gold falls. These gold-investment trends often take many months to play out, and a major new GLD-share buying spree is just getting underway.

Like always in the markets, understanding what’s going on today requires perspective. If you don’t know where we’ve been and why, you’re not going to be right on where we’re going. I broke the performances in gold and GLD’s holdings into calendar quarters here for easier analysis. Back in late 2015, gold was pounded lower heading into the Fed’s first rate hike in nearly a decade in the terminal phase of a brutal bear.

In Q3’15, gold fell 4.8% on a 3.4% or 24.0t GLD draw. American stock investors continued jettisoning gold via GLD shares in Q4’15. In that bear-trough quarter, gold fell 4.9% on a 6.6% or 45.1t GLD draw driven by heavy differential selling of GLD shares. The resulting 7.3-year secular low in GLD’s physical-gold-bullion holdings held in trust for shareholders drove gold to a parallel 6.1-year low on the very same day.

Overall between late-January 2015 and mid-December 2015, gold plunged 19.3% on a 14.9% or 110.3t GLD draw. When American stock traders are paring their gold exposure by dumping GLD shares faster than gold itself is being sold, gold is going to head lower. Per the WGC, total 2015 gold demand slumped just 0.8% or 35.6t year-over-year. That was entirely due to total ETF demand falling 128.3t, led by GLD’s 66.6t drop.

But everything changed dramatically in early 2016 because the lofty US stock markets plunged sharply in their biggest correction since mid-2011. Stock investors generally ignore gold until stock markets start to sell off materially. Then they rush to redeploy in this ultimate alternative investment. Gold is effectively the anti-stock trade, a rare asset that moves counter to stock markets. So investment demand soars in selloffs.

After being universally despised in hyper-bearishness just a couple weeks earlier, gold demand started to return in January 2016. The leading S&P 500 stock index suffered a series of dramatic down days, including separate 1.5%, 2.4%, 2.5%, 2.2%, and 1.6% losses within weeks. So scared stock investors remembered gold, and started to flood back into GLD shares far faster than gold itself was being bid higher.

Their differential GLD-share buying single-handedly ignited a new gold bull! In Q1’16, gold rocketed up 16.1% on an epic 27.5% or 176.9t GLD build. According to the latest WGC Q2’17 GDT, total global gold demand in Q1’16 only rose 179.2t YoY. That means American stock investors’ heavy GLD-share buying alone was responsible for a staggering 98.7% of global gold demand growth! GLD’s gold-price influence is huge.

Q2’16 was similar, with gold powering another 7.4% higher on another big 16.0% or 130.8t GLD build. The WGC reports that worldwide gold demand only grew 134.7t YoY that quarter, so the GLD holdings build driven by stock investors’ differential share buying accounted for 97.1%! Love or hate GLD, the hard truth is gold’s new bull market never would’ve existed if stock investors hadn’t rushed into gold via that ETF.

In essentially the first half of 2016, gold had powered 29.9% higher on a stunning 55.7% or 351.1t GLD-holdings build. That gold surge naturally fueled much more investment buying, both in physical bars and coins and other gold ETFs around the world. But without that American stock-market capital flowing into gold through the GLD conduit, odds are little of that parallel buying would’ve happened. GLD is the key to gold.

Gold then stalled out in Q3’16 because new record stock-market highs slammed the door on GLD capital inflows. Stock investors generally want nothing to do with gold when stocks are soaring. And they did in the wake of the Brexit surprise on hopes for more central-bank easing. So gold just consolidated high that quarter, slipping 0.4% on a 0.2% or 2.1t GLD draw. Gold’s bull halted the moment differential GLD buying did!

GLD’s dominance reasserted itself in Q4’16, but going the other way. Opening up a direct gold conduit for the vast pools of stock-market capital is a double-edged sword. GLD’s holdings started plummeting in the wake of Trump’s surprise election victory. The resulting Trumphoria on hopes for big tax cuts soon fueled surging record stock markets. So investors once again felt no need to prudently diversify with gold.

That quarter gold plunged 12.7% on a 13.3% or 125.8t GLD draw. The WGC’s latest data shows global gold demand fell 117.3t YoY in that quarter. So the heavy differential GLD-share selling was responsible for more than all of it! For better or for worse, the rise of ETF investing to market dominance has made GLD the overpowering driver of gold’s fortunes. Nothing else has wielded such huge price influence in recent years.

Unfortunately many traditional gold investors and speculators still ignore GLD’s holdings. Many don’t like GLD because it’s paper gold, inferior to physical bars and coins held in your own immediate possession. I certainly empathize with that. I’ve been continuously recommending physical gold coins to all investors since May 2001 when gold was at $264. I’ve never recommended GLD shares to our subscribers as investments.

But regardless of whether you think GLD is an anti-gold conspiracy or a great new way to entice stock-market capital into gold, this behemoth can’t be ignored. Following GLD’s vast impact on gold prices has nothing to do with making a statement on its fitness. To be successful traders, we have to set our own emotions and opinions aside. All that matters is what’s driving the markets and why, not whether we approve.

Between gold’s early-July-2016 initial bull peak and its mid-December-2016 trough, gold plunged 17.3% on a 14.2% or 138.9t GLD draw. While that was a massive correction, it technically wasn’t a bear market because it didn’t cross that -20% threshold. This means gold has remained continuously in a young bull market since early 2016. And that bull has reasserted itself this year just as I predicted at its post-election bottom.

In Q1’17 gold indeed powered 8.5% higher out of those deep Trumphoria lows. But interestingly GLD capital flows weren’t a material factor, as this ETF only experienced a minor 1.2% or 10.2t build. Asians had stepped in to buy gold aggressively, usurping the gold-driving helm from American stock investors. It was remarkable gold climbed so much, as overall global demand fell 212.7t YoY. Q1 was something of an anomaly.

Some of that was unwound in Q2’17, the last quarter for which comprehensive gold fundamental data is now available. Gold slid 0.5% despite a 2.4% or 20.2t GLD build. That compared to overall world gold demand falling 102.3t YoY. Despite the record US stock-market highs driven by Trumphoria, American stock investors were bucking the global trend of selling gold-ETF shares. Overall ETF demand dropped 181.4t YoY.

But despite GLD apparently exiting gold’s driver seat, the red gold-price line above continued to generally mirror GLD’s holdings. The only reason GLD’s influence faded in the first half of this year is there wasn’t much differential buying or selling of GLD shares by American stock investors. The major Trumphoria stock rally left them largely indifferent to gold. That made room for other gold drivers to temporarily eclipse GLD.

Last year the absolute value of GLD’s quarterly holdings changes averaged 108.9t. But so far in the first couple quarters of 2017, that has collapsed 86% to a mere 15.2t average! Realize when stock investors start buying or selling GLD shares much faster than gold itself again, GLD’s dominance of gold’s price will come roaring back with a vengeance. Its extreme volatility overwhelmingly drives gold at the margin.

And that brings us to the current quarter where things are really getting interesting. Following that huge post-election draw, GLD’s holdings finally bottomed at 799.1 metric tons in late January. That low held until late July, when they started falling to a new post-election low of 786.9t by early August. That was the result of very-bearish sentiment fueled by gold’s usual summer-doldrums lows, its weakest time of the year.

Despite this summer seasonal lull being well-known, it inevitably freaks out traders. So they succumb to their fears and sell low at exactly the wrong time, right before gold’s major autumn rally. That started to power higher out of the early-July low right on schedule. But stock investors didn’t take notice until gold had already surged 6.4% higher to $1290 in just 5 weeks. Then they finally started buying GLD shares again.

GLD’s holdings initially bottomed on August 7th before stalling there for an entire week. The day after gold challenged $1290, August 14th, stock investors started to return. Their differential buying drove a 0.5% holdings build that day, the first in 7 weeks. That GLD-share buying pressure really accelerated in late August and early September, where separate major build days of 1.1%, 1.8%, and 1.1% were witnessed.

By September 5th, GLD’s holdings had powered 6.8% or 53.2t higher in less than a month! That helped drive a parallel 6.5% gold rally, catapulting it from $1257 to $1339 over that short span. These new gold capital inflows from stock investors via GLD are very exciting. This is the biggest and sharpest GLD build seen since well before the election, since back in Q2’16. Something big and very bullish is afoot in gold investment.

American stock investors are starting to return to gold despite the stock markets remaining near or at all-time record highs. There’s certainly been no correction or even series of major down days. Investors are returning to gold without that typical stock-selloff catalyst. And once swelling gold investment demand starts driving gold higher, its rally tends to become self-feeding and run for months on end before petering out.

Investors love chasing winners, nothing drives buying like higher prices. The more investors bid up gold through differential GLD-share buying, the more its price rallies. The more gold rallies, the more other investors want to join in to ride the momentum. Buying begets buying. To see this starting to happen in these euphoric stock markets is extraordinary. The inevitable overdue major selloff will supercharge gold buying.

These lofty Fed-goosed stock markets are long overdue for a major correction or more likely a new bear market. Once they roll over sooner or later here, gold investment demand is going to explode just like it did back in early 2016 during the last correction. That stock selling could start soon, as next week the Fed is widely expected to unveil quantitative tightening. That’s every bit as bearish for stocks as QE was bullish!

Resurgent gold investment demand will once again almost certainly propel gold dramatically higher, as it did in the first half of 2016. This bull market’s latest growing upleg can be played with GLD, but that will only pace gold’s gains. Far greater upside can be found in the gold miners’ stocks, where profits amplify gold’s gains. The gold stocks recently enjoyed major breakouts, but remain deeply undervalued relative to gold.

The key to riding any gold-stock bull to multiplying your fortune is staying informed, both about broader markets and individual stocks. That’s long been our specialty at Zeal. My decades of experience both intensely studying the markets and actively trading them as a contrarian is priceless and impossible to replicate. I share my vast experience, knowledge, wisdom, and ongoing research in our popular newsletters.

Published weekly and monthly, they explain what’s going on in the markets, why, and how to trade them with specific stocks. They are a great way to stay abreast, easy to read and affordable. Walking the contrarian walk is very profitable. As of the end of Q2, we’ve recommended and realized 951 newsletter stock trades since 2001. Their average annualized realized gain including all losers is +21.2%! That’s hard to beat over such a long span. Subscribe today and get invested before gold stocks really start running!

The bottom line is gold investment demand is resuming after its massive post-election slump. Differential GLD-share buying, the dominant driver of gold’s young bull, just enjoyed its biggest and fastest surge in over a year. American stock investors are starting to prudently diversify back into gold, despite the stock markets still near record highs. Worries are mounting that the long-delayed major stock selloff is looming.

When that fateful event inevitably arrives, gold investment demand is going to explode again just like it did in early 2016. That will catapult gold, silver, and their miners’ stocks dramatically higher. Seeing gold investment demand surge recently even without a stock-selloff catalyst highlights the big latent interest in gold. Usually moving counter to stocks, it remains the ultimate portfolio diversifier every investor needs to own.

Adam Hamilton, CPA

September 15, 2017

Copyright 2000 – 2017 Zeal LLC (www.ZealLLC.com)

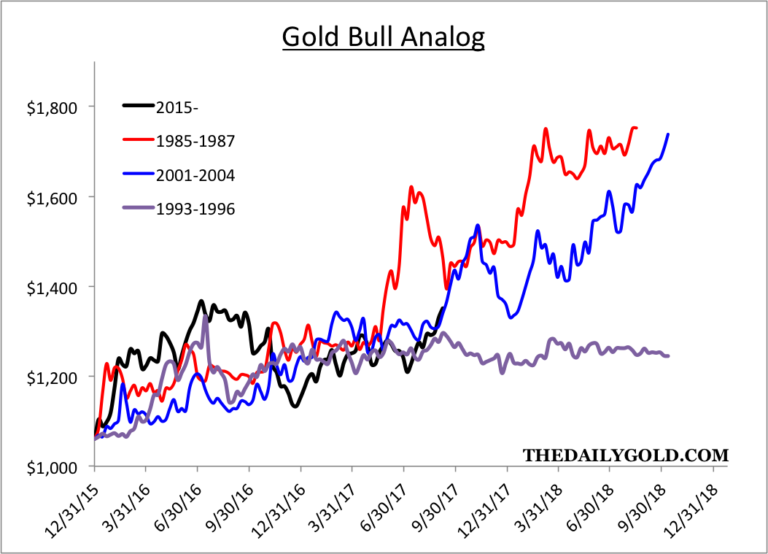

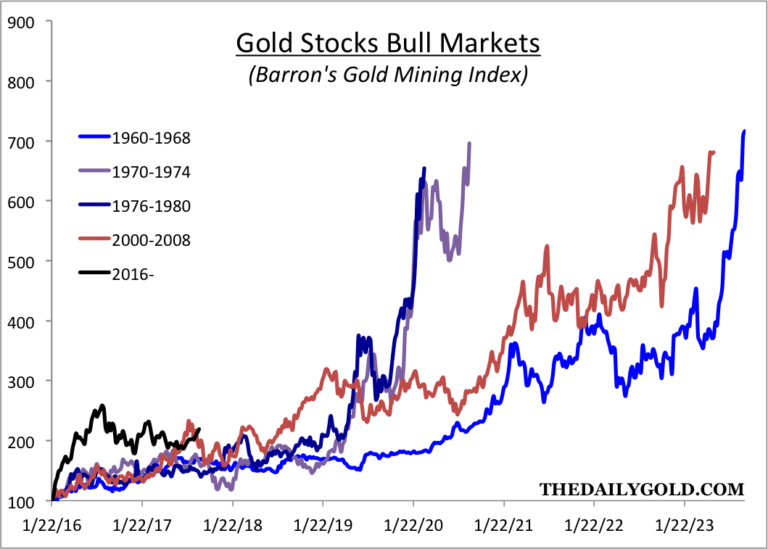

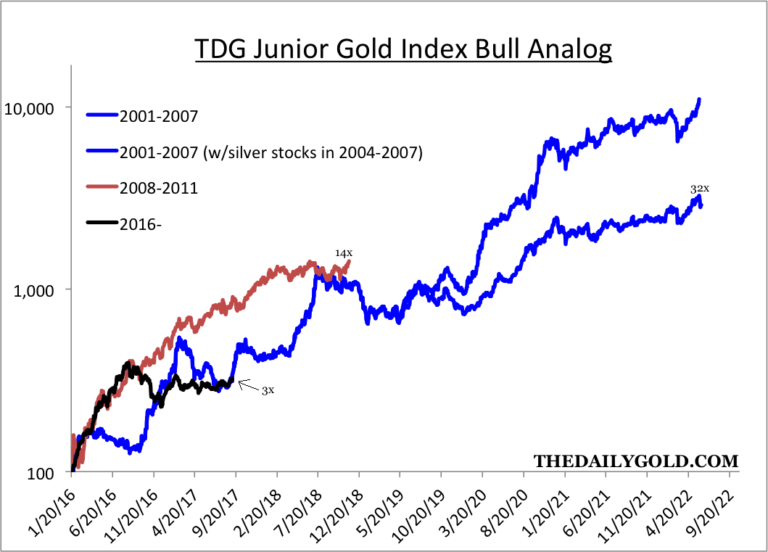

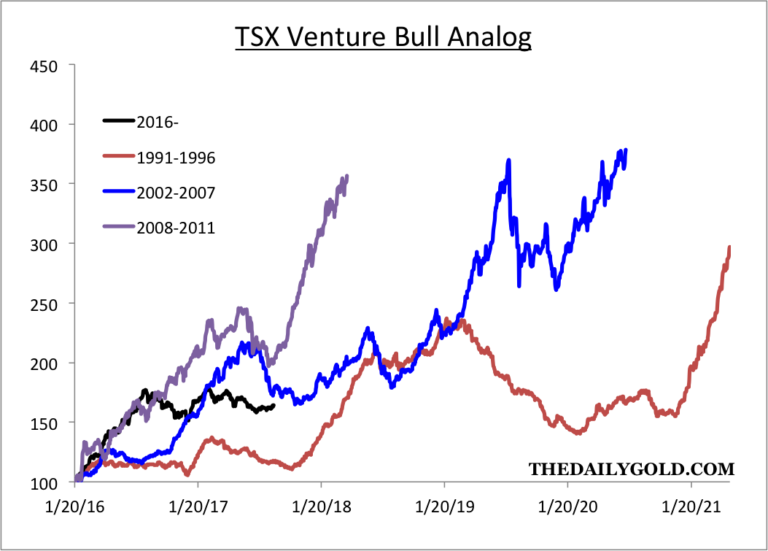

We started employing analog charts during the latter stages of the seemingly forever bear market in precious metals. Comparing current to past trends by using price data is not considered technical analysis but it is extremely valuable because history tends to repeat itself. It also helps us identify extremes as well as opportunities. For example, in 2015 it was clear the epic bear market in gold stocks was due for a major reversal. Today, precious metals appear to be in the early innings of a cyclical bull market and the analogs suggest there is plenty of room to run to the upside.

The first chart compares the current recovery in Gold to past recoveries. In recent quarters we had anticipated a similar, explosive rebound like in 2008 and 1976. However, with 18 months of evidence we can now say the current rebound most resembles the rebounds that started in 1985 and 2001. Both of those rebounds imply Gold could reach $1700/oz by Q4 of 2018. However, if Gold cannot takeout the resistance around $1375 then it could end up following the path of the 1993 rebound.