It takes hard work and perseverance to succeed in the mining industry. Glen McKay, the chairman of the board of directors and founder of leading explosives manufacturer, Newfoundland Hard-Rok Inc, has both these qualities, starting his career as a deckhand in the fishing industry in Newfoundland and Labrador before leading businesses in a range of industries, including finance, construction and, yes, mining.

“Motivation and determination are essential attributes of any successful entrepreneur,” Glen McKay explained in a recent interview. “These are attributes that can be unlocked only from inside a person, not by external influences. A desire to learn and cultivating the ability to be insightful are necessary in assessing business opportunities.”

Newfoundland Hard-Rok Inc.

In 1985, McKay became the Dupont Explosives distributor in Newfoundland and Labrador and used the Newfoundland Hard-Rok division of his company MRO Supplies Ltd. to operate the explosives business. In 1987 Newfoundland Hard-Rok Inc. was incorporated as a separate entity by McKay, who then sold part of it to two employees of MRO Supplies Ltd., Carl Foss and Keith Phelan, who were then looking after the explosives division of the company. The drilling, blasting and explosives company has grown since then. In 1994 Newfoundland Hard-Rok Inc. built an ANFO manufacturing plant near Corner Brook, NL and acquired a fleet of hard rock drilling rigs. In May of 2009, Newfoundland Hard-Rok Inc. commissioned its newly constructed, state of the art Bulk Emulsion explosives manufacturing facility west of Corner Brook. It is now the premier supplier of explosives and drilling blasting services in the region.

Newfoundland Hard-Rok Inc. formed wholly owned subsidiary Dyno Nobel Labrador Inc. in 2004, and wholly owned subsidiary Dyno Nobel Baffin Island Inc. in 2013, with McKay serving as the Chair of the Board of Directors of Newfoundland Hard-Rok Inc. and managing the company’s finances and administration.

Dyno Nobel Labrador Inc. was awarded the contract from Vale (formerly Voisey’s Bay Nickel Company) in 2005 to design, build and operate a bulk emulsion (blasting agent) manufacturing plant supplying the needs of the open pit mine at Voisey’s Bay. Recently, Dyno Nobel Labrador Inc. was awarded an additional second contract for the underground delivery of loading equipment and related services at the mine. Vale’s mine site is in Northern Labrador along the coast near the community of Nain. The mine primarily produces nickel ore with some copper and cobalt and is accessible via air and sea only.

As Newfoundland and Labrador Premier Dwight Ball explains, a five-year construction project at Voisey’s Bay will extend the mine’s life by 15 years. Once operational, Ball estimates the underground mine will create an additional 1,700 jobs both at the mine and at the Long Harbour, NL, processing plant. The mining operation in northeastern Labrador opened in 2005 and currently employs about 500 people, Canadian Press reported.

Dyno Nobel Baffin Island Inc. is a wholly owned subsidiary of Newfoundland Hard-Rok Inc. and was formed in 2013 to service the Baffinland Iron Mines, Mary River Project. Dyno Nobel Baffin Island Inc. has been awarded a multi-year contract to supply explosives for the construction and mining phases. A state of the art modular emulsion manufacturing plant was constructed on site in 2014. The operations involve the manufacturing of bulk emulsion, loading, and firing the blast holes. The Mary River Mine is in the remote northern part of Baffin Island within the Arctic Circle. This remote cold location poses many challenges to shipping and logistics, equipment operation and working outdoors.

Cornerstone Capital Resources

But Dyno Nobel Labrador Inc was not Glen McKay’s first foray into the mining industry. In 1997, he co-founded Cornerstone Capital Resources Inc, a mineral exploration company best known for its Cascabel copper-gold project in Ecuador, which was acquired in 2011 during his tenure. While McKay was with Cornerstone, he served as president, chief executive officer and vice chair. He still owns shares in the company and keeps a close eye on its activities.

On July 13, 2018, Cornerstone released an update on the exploration program at its Cascabel copper-gold porphyry joint venture exploration project in northern Ecuador, in which the company has a 15% interest financed through to completion of a feasibility study. Cornerstone has several other projects in Ecuador and Chile.

“The Cascabel project increases in size with each round of drilling and an aggressive drilling campaign continues,” McKay posted on LinkedIn. “I think that they are probably 18-24 months away from a feasibility study, but I also expect that one of the majors will buy out the current owners (SolGold and Cornerstone) before then.”

SolGold owns the other 85% of Cascabel and is funding 100% of the exploration as the operator of the project. Cornerstone is spinning off its assets (except for its interest in Cascabel, shares of SolGold and the joint venture with the Ecuadorian state mining company) into a new company called Cornerstone Exploration, which will own several drill ready projects in Ecuador and Chile. Cornerstone will be re-named Cascabel Gold & Copper.

Apex Construction

That’s not the end of McKay’s entrepreneurial resume. In 1987, he provided the capital for Apex Construction Specialties Inc, which grew to become the largest supplier of commercial construction products in Newfoundland and Labrador. McKay remained as a shareholder and board member until the company was sold in 2017.

In his 40 years of business experience, McKay has learned a lot about people. In his own businesses, he looked for self motivated, bright, hard-workers who had the ability to be a part of a team. The simple but effective premise is that if you really value your people, they in turn will increase the value of your business.

Although precious metals have not rebounded too strongly yet, the long awaited summer rally could be underway (at least in Gold). Gold is oversold and its sentiment is overly bearish. But it is holding important support in the low $1200s. Silver has begun to rally after breaking down from a triangle consolidation. The gold stocks held up well during recent carnage in the metals but are struggling around very important support levels. The nature of their potential rebound is important as they try and maintain current support.

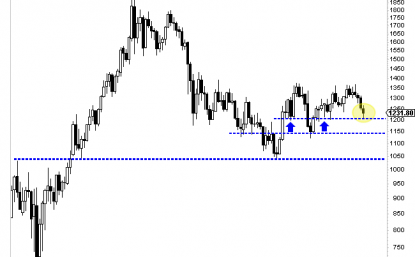

In recent days Gold has bounced from strong monthly support at $1200-$1210/oz. As the chart shows, that level was monthly support in early 2016 as well as the middle of 2017. It is the key support level between Gold and roughly $1140/oz. Look for this support to hold at least into September.

On the sentiment front, last week Gold’s net speculative position hit 13.9% (as a percentage of open interest) which is a +2-year low. Friday’s report may show a reading close to 10%. Within the context of a downtrend, this is the kind of sentiment (sub 15%) that can be deemed as extreme. Pair that with the strong monthly support at $1200-$1210 and its likely Gold holds this level for at least a few months.

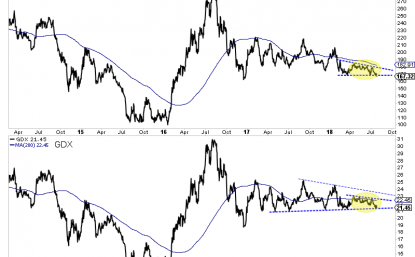

Turning to the gold stocks, while they have held up well in recent months, the technicals suggest some potential trouble if they do not rebound soon.

The HUI Gold Bugs Index which contains only gold miners (no royalty companies) is losing key support within a descending triangle pattern. The pattern projects to a downside target of 149. Upon a close below 163 (which is less than 3% away from current levels), the HUI would hit a 2.5-year low and not have good support until 140.

GDX, meanwhile is showing less weakness but is vulnerable to a decline if it loses support at $21. If that break comes to fruition then GDX has a measured downside target of roughly $16.50-$17.00.

Even though the miners have struggled and Gold has not rallied much in recent days, the path of least resistance for the remainder of the summer should be higher. Gold should continue to hold support in the low $1200s and eventually rally back to $1260 perhaps. While the gold stocks are struggling to hold above support, I’m not sure there is enough selling pressure at the moment to drive them lower.

1. In 2013 and 2014 I predicted the Fed would lead the ECB and the BOJ in a slow but steady reversal of central bank policy, from QE/low rates to QT and relentless rate hikes. Even more shockingly, I predicted this would create a money velocity bull cycle in most Western countries. I also suggested that during this process the world’s greatest asset (gold) would regain its position as the most respected asset.

2. Please click here now. Double-click to enlarge. I’m predicting that the ECB joins the Fed in substantial balance sheet contraction in 2019, and the BOJ won’t be far behind.

3. As that happens, I expect the dollar will resume its long-term bear market against gold and experience a substantial decline against the yen.

4. Institutional money managers are becoming concerned about the decline in liquidity in many bond markets around the world. I would suggest this is only the tip of the inflationary iceberg.

5. Please click here now. Double-click to enlarge. From a technical perspective, the US government bond market looks like a train going off the tracks on the side of Mount Everest!

6. There’s a massive head and shoulders top in play. Bond market money managers are trying to talk the market higher in the face of Powell’s significant balance sheet contraction and rate hike actions. Those money managers will likely fail, and fail badly.

7. Japanese banks will become must-own stocks as the BOJ begins rate hikes and QT. Their ability to make a profit has been severely hampered by the BOJ’s crazed QE and ultra-low rates policy.

8. What’s particularly interesting is that Japan’s citizens are massive savers. They will move significant funds into the banking system as the BOJ tightens. Japan will soon become a major exporter of inflation to America and to the rest of the world. The same thing will happen in Europe as the ECB begins QT and rate hikes.

9. Please click here now. Double-click to enlarge this key gold chart. When the weekly chart Stochastics oscillator (14,3,3 series) becomes substantially oversold in July or December, as it is now, gold becomes a “must-buy” for gold asset enthusiasts.

10. Please click here now. The smart money commercial traders are often aggressive buyers of gold on the COMEX in July.

11. Clearly, this year is no exception to that golden rule! The commercials bought about 24,000 contracts (basis the latest reporting period). I’m predicting they will buy an additional 25,000 to 75,000 contracts if gold trades in the $1200 – $1180 area.

12. It’s very important for gold asset enthusiasts to focus on buying gold-related items in July like shopping for groceries in a grocery store. The commercial traders are simply adding modestly to their long positions, and that’s what gold bugs must do too.

13. Many technical analysts appear to be trying to outsmart the commercial traders using their charts. They are looking for lower prices some kind of “final low.” I don’t endorse that type of approach to building wealth in the gold market.

14. It’s far more rational to simply go shopping with a grocery cart when the sale is ongoing (now) than to try to identify the final day or hour of this price sale.

15. Morgan Stanley’s analysts have predicted that India’s central bank will likely raise rates at the August 1, 2018 meeting. A rate hike there would likely create a rally in the rupee and lower the price of gold in India. That would likely create substantial buying by jewellers and dealers. I’m quite sure this is what the COMEX commercial traders are focused on now.

16. A rate hike by Powell in September is also positive for gold. It could roil US stock, bond, and currency markets.

17. Please click here now. Double-click to enlarge this long-term gold chart. The giant inverse head & shoulders bottom is near completion. Perfect symmetry would be achieved with a dip to the $1200 – $1180 zone. All gold market investors should be very enthusiastic now, as the rally from this pattern could be record-breaking in terms of its relentlessness.

18. Please click here now. Double-click to enlarge. Gold is the world’s greatest asset, and bitcoin is the most exciting! Some call it digital gold. Some call it a fad. Some call it in need of regulation. I call it headed for my $40,000 target!

19. You won’t see heavyweight mainstream analysts talking about “sky high” price targets for gold (and rightly so) but many of the best ones do it with bitcoin. Tom Lee is one of the world’s most respected equity market analysts. His ultimate target for bitcoin is above $200,000. His year-end target of $30,000 is slightly below mine, but still very solid. These high price targets are achievable with bitcoin as opposed to gold, because the total supply of gold grows slowly but still grows, whereas the supply of bitcoin is absolutely fixed at around 21 million coins.

20. In terms of market capitalization, bitcoin makes up almost 50% of the entire crypto asset class. The forks appear to produce no significant dilution. They are more like corporate spin-offs than dilutions of this mighty coin!

21. A week ago, I urged investors to buy bitcoin in advance of the inverse head and shoulders bottom pattern breakout. Just hours later, bitcoin blasted through the neckline of that pattern. I then advised investors to do further buying with their eyes closed. I did that because it’s pointless to wait for minor pullbacks when a major buy signal is in play. That call is working out very well.

22. With the involvement of banks, hedge funds, and regulators, it’s becoming quite likely that bitcoin is here to stay. Eager wealth builders can get in on the blockchain/crypto action (mining and investment) with my www.gublockchain.com newsletter.

23. Please click here now. Double-click to enlarge this important GDX versus gold chart. I’ve suggested that while the outperformance of GDX against gold during this substantial gold bullion price sale is due for a pause, I think it’s only a very short pause that will end after the Indian central bank meeting next week.

24. Please click here now. Double-click to enlarge. Against the dollar, GDX has continued to build an enormous base in my buy zone of $23 – $18. The $21 area is the “meat and potatoes” of that zone. Investors who have gone shopping for gold stocks on a weekly or monthly basis in this price zone should be sitting happily on some great core positions, and ready for some great upside action that appears to be imminent!

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan