Stock markets are forever cyclical, an endless series of alternating bulls and bears. And after one of the greatest bulls in U.S. history, odds are a young bear is now gathering steam. It is being fueled by record Fed tightening, bubble valuations, trade wars, and mounting political turmoil. Bears are dangerous events driving catastrophic losses for buy-and-hold investors. Different strategies are necessary to thrive in them.

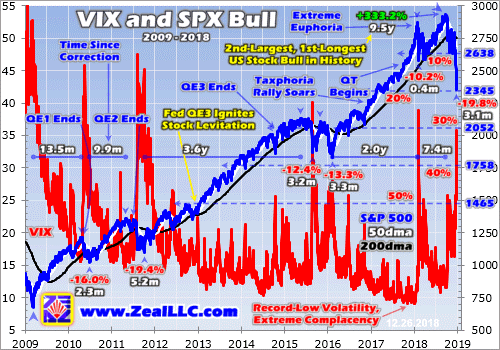

This major inflection shift from exceptional secular bull to likely young bear is new. By late September, the flagship US S&P 500 broad-market stock index (SPX) had soared 333.2% higher over 9.54 years in a mighty bull. That ranked as the 2nd-largest and 1st-longest in U.S. stock-market history! At those recent all-time record highs, investors were ecstatic. They euphorically assumed that bull run would persist for years.

We humans naturally extrapolate present conditions lasting way out into the indefinite future. But long centuries of stock-market history have painfully proven that no bull lasts forever. Eventually they all lead to inherently-unsustainable fundamental, technical, and sentimental excesses. These can only be bled away and ultimately normalized by bear markets. So bull markets have always been followed by bears.

Bulls and bears are easily defined technically, 20%+ SPX moves uninterrupted by opposing 20%+ moves. The greatest stock bull in US history was the SPX’s 417.0% run over 9.46 years between October 1990 to March 2000. That climaxed in the tech-stock bubble, when wild optimism about stock-market fortunes reigned. Yet that soon gave way to tears as the subsequent bear mauled the SPX 49.1% lower in 2.6 years!

Stock investors suffering their wealth getting cut in half is typical in major bears. But the losses extend well beyond capital into far-more-scarce time. After that turn-of-the-century secular-bull peak, the SPX wouldn’t power decisively above those levels again until 12.9 years later in early 2013! That’s nearly a third of the 40 years average investors have between the ages of 25 to 65 to generate wealth to finance retirement.

If you can’t afford to lose half your stock-market wealth, and you don’t have time to wait for well over a decade for stock prices to fully recover, you better take this quarter’s market developments very seriously. Something snapped in the U.S. stock markets in early Q4’18, and the price action and volatility since reeks of a young new bear. While that diagnosis can’t be certain until the SPX falls 20%+, the signs are ominous.

As Q4’18 dawned, the U.S. Federal Reserve ramped its quantitative-tightening campaign to full speed. QT is necessary to start unwinding 6.7 years of quantitative easing ending in October 2014, during which the Fed conjured $3625b out of thin air to monetize bonds! QE was considered necessary to stimulate the economy after the Fed forced interest rates to zero in December 2008 during the first stock panic in a century.

Those trillions of dollars of QE capital injected by the Fed directly levitated the stock markets, artificially inflating an already-mature bull market to monstrous proportions. All those bonds accumulated on the Fed’s balance sheet, which skyrocketed 427% higher over that relatively-short QE span! The Fed can’t maintain $3.6t of bonds on its books forever, so it finally started letting them gradually roll off at maturity in Q4’17.

That unprecedented QT capital destruction started small, but was ratcheted up each quarter until Q4’18 when it reached its terminal velocity of $50b per month. The SPX achieved its latest all-time record high in late September, and then October was the first month ever of full-speed QT. The QE-levitated stock markets wilted under this QT onslaught, which was inevitable sooner or later. I warned about all this in advance.

Just a week after the SPX peaked in late September, I published one of my most-important essays ever. I unambiguously titled it “Fed QT is Bull’s Death Knell”, and it explained the stock-market impact of Fed QE in depth and why full-speed QT was certain to slay this bull. With the SPX just 0.6% under its recent record high on that final day of Q3’18, that warning fell on deaf ears. Maybe investors will pay attention now.

Fed QT is no flash in the pan, it is a long-term persistent threat to these lofty stock markets. In order to merely unwind half of that unfathomable $3.6t of Fed QE, full-speed QT at $50b per month will have to run for 30 months starting in Q4’18. Heading into 2019 the stock markets face another 27 months of this! And the Fed is loath to slow or stop its QT now underway on autopilot, as that could unleash panic-grade selling.

The Fed has long asserted the reason it is undertaking QT and has hiked rates 9 times since December 2015 is the US economy is strong. It wants to rebuild easing-ammunition stores to use in the inevitable coming recession. If the Fed caves on QT before its balance sheet shrinks much lower, traders will assume the Fed fears the US economy is in serious trouble. So they would flee stocks pummeling them far lower.

The die is cast on Fed QT, guaranteeing the long-overdue next stock bear. And the losses seen so far are just a small vanguard of what’s to come. This first chart superimposes the mighty SPX bull of the past decade on its so-called fear gauge, the VIX S&P 500 implied-volatility index. The recent Q4 trading action in both is unlike anything yet seen in this entire bull. It is looking far-more bear-market-like in character.

Major stock-market selloffs are defined based on size. Anything under 4% isn’t worth classifying, it is just normal market noise. Then from 4% to 10%, selloffs become pullbacks. In the 10%-to-20% range they grow into corrections. And of course beyond that at 20%+ they are in formal bear-market territory. This selloff snowballed darned close to beardom on Christmas Eve, the SPX plunging to a 19.8% loss over 3.1 months!

Just 4 trading days earlier before the latest FOMC decision, it was only down 13.1%. While that latest Fed rate hike was expected, the future-rate-hike outlook among top Fed officials wasn’t dovish enough for stock traders. Despite all the market carnage since the previous dot plot, their effective forecast for future rate hikes was merely lowered from 4 more to 3. So the SPX plunged 7.7% over the next 4 trading days!

Even before that this selloff hasn’t behaved like a normal bull-market correction. Their purpose is to vent excessively-bullish sentiment, rapidly bleeding off greed. Sharp selloffs are necessary to do that. Traders don’t get worried until stocks fall fast enough and far enough to shatter their complacency. So normal bull-market corrections are usually front-loaded with sharp selloffs that trigger soaring levels of fear.

Prevailing fear levels are inferred by the VIX, which technically measures the implied volatility in 1-month SPX options. Before last peaking in late September, the SPX suffered 5 bull-market corrections within its epic secular bull. Heading into July 2010 the SPX fell 16.0% in 2.3 months. That spawned some real fear, as evident in the VIX soaring to a 45.8 peak. The effective fear ceiling outside of panics and crashes is a 50 VIX.

The next SPX correction cascaded 19.4% lower over 5.2 months ending in October 2011. Despite its long span, the VIX skyrocketed as high as 47.5 in its midst. That was real fear, the kind necessary to slay exuberant greed and rebalance sentiment to keep an ongoing stock bull healthy. After that the SPX went a near-record 3.6 years without a single correction-grade selloff in an extraordinary levitation driven by the Fed.

That’s when its unique open-ended third quantitative-easing campaign was in full swing. QE3’s peak year was 2013 which saw the Fed monetize a staggering $1020b of bonds! The SPX soared 29.6% higher that year on such vast liquidity injections. But 2014 saw QE bond buying collapse to $450b as the Fed tapered QE3. The SPX only rallied 11.4% that year, its gains shrinking 62% in proportion with QE3’s 56% decline.

The QE3-goosed stock markets wouldn’t correct again until well after QE3 ended, the SPX sliding 12.4% over 3.2 months into August 2015. Again the VIX surged to 40.1, which is up in the very-high fear zone. The next debatable correction followed right after. The SPX didn’t achieve new highs after the previous one, so it was technically one compound correction instead of two separate ones. Analysts render it both ways.

That second correction or second part of the longer one saw the SPX fall 13.3% over 3.3 months into February 2016. That was the only bull-market exception that didn’t see a high VIX, it merely climbed to 28.1 at best. But since the VIX had just recently surged over 40 in a fear climax, another one apparently wasn’t necessary. That rolling-over SPX action into early 2016 actually looked more bear-like than bull-like.

Provocatively it took fully 13.7 months after that May 2015 topping for the SPX to finally hit new highs confirming its bull was alive. The thing that short-circuited what felt like a young bear was hopes for more European Central Bank easing after the UK’s surprise Brexit vote in late June 2016. Then the SPX again exploded higher in November 2016 after Trump’s surprise presidential victory with Republicans controlling Congress.

Optimism and greed exploded on hopes for big tax cuts soon, fueling a powerful stock-market surge into early 2018. The SPX then corrected sharply into early February with a 10.2% plunge in just 0.4 months. The VIX shot up to 38.8 on that, showing real fear. All bull-market corrections with the lone exception of the second part of that compound one exhibited telltale fear spikes averaging VIX peaks way up at 43.1.

But the recent SPX selloff of Q4’18 coinciding with the first-ever full-speed Fed QT looks way different. It has been mostly an orderly, gradual selloff generating modest fear. The highest VIX close between late September and pre-FOMC in mid-December was merely 25.8! Even on Christmas Eve it only hit 35.8. These are too low for normal sharp bull-market corrections, this fear profile is looking more like a bear downleg.

While bull-market corrections are supposed to shock and scare, bear-market downlegs start more subtlety. Instead of plunging fast then stabilizing, bear selloffs start slow then gather steam later. Bears begin in stealth mode, only gradually rolling over to prevent fear from spiking. Without big fear to wake them up and scare them out, investors complacently stay deployed as their losses slowly and inexorably mount.

Like the proverbial frog slowly being boiled alive, investors don’t realize the peril their capital is in during bear markets until way too late. The lack of normal bull-market-correction fear spike during this latest correction-grade selloff disturbingly suggests a new bear has awoken. And coming after such a massive and largely-artificial QE-inflated stock bull, the fearsome bear QT has to spawn should be proportionally large.

On Christmas Eve the SPX was forced close to a 20% bear-cub loss at 2345. That level was first seen in February 2017, and represents nearly 3/4ths of the post-Trump-election taxphoria rally being wiped out. 30% would drag the SPX back down to 2052, which were November 2014 levels right after the QE3 bond monetizations ended. 40% would crush the SPX to 1758, back to October 2013 levels killing 4.9 years of gains.

But after one of the biggest and longest stock bulls in U.S. history, it would be shocking if the subsequent bear didn’t lop off at least 50%. Especially given this bull’s artificial QE-inflated nature in an era where QE-conjured capital is being destroyed by QT. A 50% SPX loss from late-September’s peak would leave it at 1465. Those levels were first seen in this bull all the way back in September 2012, 6.0 years earlier.

While a 50%+ bear warning may sound sensational or overly dramatic, it’s actually fairly conservative. The SPX already suffered two bear markets since the tech-stock bubble peaked in March 2000. The first one ending in October 2002 mauled the SPX 49.1% lower over 2.6 years. The second one climaxing in the first stock panic in a century drove a far-worse 56.8% SPX decline in just 1.4 years ending in March 2009.

50% bears are totally normal after large bulls, even when they don’t have the amplifying dynamics of the first-ever colossal-scale Fed QE and QT. This overdue next bear has a great chance of growing bigger than normal after such a monstrously-grotesque bull. Most investors won’t figure this out until too late. Unlike bull-market corrections, high-fear VIX spikes soaring into the 40-to-50 range don’t ignite until later in bears.

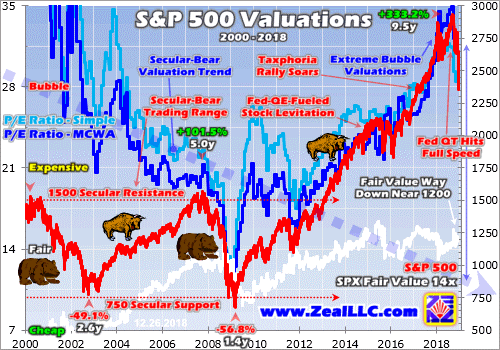

While the extreme Fed tightening under this unprecedented full-speed QT campaign could easily drive a major stock bear alone, so could excessive valuations. When the SPX peaked in late September, its 500 elite stocks were collectively trading at literal bubble valuations! Extreme valuations are what usually cause stock bears, which exist to force stock prices back into line with corporations’ underlying earnings.

The classic honest way to measure valuations is through trailing-twelve-month price-to-earnings ratios. These take companies’ last four quarters of actual hard GAAP earnings, add them up, and divide them by companies’ prevailing stock prices. Unlike fictional forward earnings, real past results aren’t mere guesses about the future. Over the past century and a quarter or so, the U.S. stock markets averaged a 14x TTM P/E.

That’s long-term historical fair value, which is logical and reasonable. The reciprocal yield of 14x is 7.1%, an interest rate that is mutually beneficial to both pay and be paid for investment capital. Twice that at 28x earnings is the formal bubble threshold. As of the end of September just after the SPX peaked, its elite companies averaged a TTM P/E well into bubble territory at 31.4x earnings. They were dangerously overvalued.

This next chart looks at average SPX valuations in TTM P/E terms over the past couple decades or so. The 500 SPX components’ simple-average P/E is rendered in light blue. The dark-blue line shows it instead weighted by companies’ market capitalizations. The SPX is superimposed over the top in red, while a hypothetical fair-value SPX at 14x earnings is shown in white. This valuation picture is ominously damning.

The bubble valuations around the SPX’s late-September peak were nothing new. They had been above that 28x threshold continuously for 14 months since July 2017. Stocks were already expensive before Republicans swept the November 2016 elections kindling those exuberant big-tax-cuts-soon hopes. But they got a lot more expensive after that as stock prices soared way faster than corporate earnings since.

Again excessive valuations are what normally spawn stock bears. Stock prices get bid up too fast during bull markets for underlying earnings to justify. So bears follow bulls to drag stocks lower or just sideways for long enough for corporate profits to catch up with prevailing stock prices. These mean reversions after large bulls usually see valuations overshoot towards the opposite extreme before bears give up their ghosts.

So odds are this young stock bear won’t head back into hibernation until the stock markets’ average TTM P/E ratio per the elite SPX components actually falls under 14x. Major bears usually bottom with the SPX P/E in the 7x-to-10x earnings range, the former being half fair value when stocks are very cheap and screaming buys. Late in the last stock bear climaxing in March 2009, the SPX’s TTM P/E slumped to 12.6x.

But let’s be conservative and just assume this next bear, even with Fed QT, merely mauls stocks long enough to force a fair-value 14x P/E with no overshoot. Assuming corporate earnings don’t grow much which is a real possibility during a serious stock bear, that implies 51% downside from the SPX’s late-November levels. That was the latest month-end valuation data available when this essay was published.

Historical fair value sans earnings growth implies a bear-market bottom near SPX 1356, or 53.7% under late September’s peak! That’s right in line with historical major bear markets, nothing unusual. As bears generally last a couple years or so, modest underlying corporate-profits growth could lift that valuation-based bottoming target maybe 10% or so. That still implies a 49.1% total bear which isn’t to be trifled with.

The combination of wildly-unprecedented full-speed Fed QT slamming QE-inflated stock markets trading at bubble valuations is incredibly menacing. Seeing bear-market-like rolling-over selling behavior without big fear spikes in recent months strongly argues the overdue bear has awoken. But since all that selling has been concentrated fully within a single quarter, odds are most investors don’t realize how bad things are.

The biggest group of investors with the most capital are casual retirement investors who don’t closely follow the markets. They avoid much work and stress by paying other people to manage their money. These investors get statements showing their portfolios’ fortunes after every calendar quarter. At the end of Q3’18, everything still looked awesome with the SPX just 0.6% under its all-time high of a week earlier.

So the Q4’18 statements due out in January could prove shocking, spawning fear and galvanizing bearish psychology. The most-widely-held stocks in investment funds are the biggest and best ones led by the market-darling mega techs. While they were radically overvalued at the end of Q3, no one cared at that point. Everyone owned the largest US stocks including Apple, Amazon, Microsoft, Alphabet, and Facebook.

Add in the last FANG Netflix, and these 6 stocks alone commanded over 1/6th of the entire market cap of the SPX just before the Q4 selling started! Their average TTM P/E was a scary 80.2x earnings, 2.6x the entire SPX’s. Yet these beloved companies were believed to have such amazing businesses that they should be immune to economic slowdowns or stock-market selloffs. That myth was obliterated in Q4.

This SPX selloff first hit 10%+ correction territory on Black Friday with a 10.2% loss from its peak. On that same day, mighty Apple, Amazon, Microsoft, Alphabet, Facebook, and Netflix had collapsed 25.8%, 26.4%, 10.8%, 19.9%, 39.4%, and 38.2% from their recent all-time highs! They averaged 26.8% losses, or 2.6x the SPX’s. Many if not most investors’ Q4’18 portfolio results are going to look even worse than the SPX.

Will they start fleeing and adding to the selling pressure when these gaping holes in their precious capital are revealed? And while record Fed tightening and a mean reversion lower out of bubble valuations are the primary bear-market risks, they aren’t the only ones. The trade wars between the US and China and other countries are intensifying, and U.S. political turmoil will soar next year with Democrats controlling the House.

The epic corporate stock buybacks that helped levitate the stock markets in recent years will wane as the Fed forces interest rates higher. Trillions of dollars of these buybacks were debt-financed over the past decade. And as stock markets fall, Americans will feel poorer and spend less. This negative wealth effect will really weigh on record corporate profits, potentially driving them lower forcing valuations even higher.

The Fed’s QT isn’t the only howling central-bank headwind stock markets face. The European Central Bank is also halting its own massive QE bond monetizations starting in January! That will suck even more capital out of the system. Many of these bearish factors for stocks feed on each other too, with all combined wreaking more havoc on sentiment and stock prices than individual ones ever could in isolation.

Investors really need to lighten up on their stock-heavy portfolios, or put stop losses in place, to protect themselves from this young bear market. It’s only just beginning, with sub-20% SPX losses at worst a far cry from 50%+. Cash is king in bear markets, since its buying power grows. Investors who hold cash during a 50% bear market can double their stock holdings at the bottom by buying back their stocks at half-price.

Put options on the leading SPY S&P 500 ETF which perfectly mirrors the SPX can also be used to hedge downside risks. But options trading is risky, with 100% losses possible if the timing doesn’t work out. And cash doesn’t appreciate in value. So the best bear-market investment is gold, which tends to rally on surging investment demand as stock markets weaken. Gold investment grows wealth during stock bears.

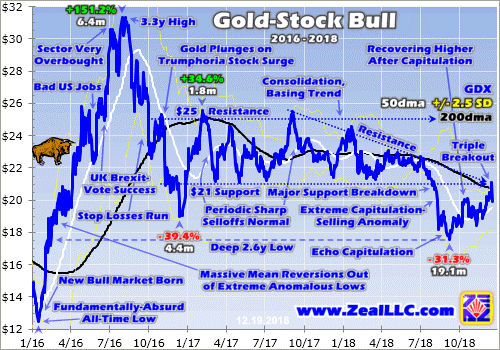

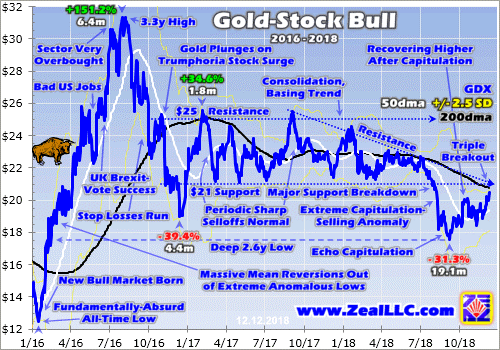

Gold surged 30% higher in essentially the first half of 2016 in a new bull initially sparked by those late-2015 and early-2016 SPX corrections. Investors fled burning stocks and flocked to gold. And the gold miners’ stocks really leveraged those gains, rocketing 151% higher in that same timeframe. The gold stocks are not only wildly undervalued, but just breaking out technically which should accelerate their upside.

Absolutely essential in bear markets is cultivating excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. While Wall Street will deny the growing stock-market bear all the way down, we will help you both understand it and prosper during it.

We’ve long published weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q3, we’ve recommended and realized 1045 newsletter stock trades since 2001. Their average annualized realized gain is +17.7%! That’s double the long-term stock-market average. For just $12 per issue, you can learn to think, trade, and thrive like contrarians. Subscribe today!

The bottom line is a young stock bear sure looks to be awakening. Q4’s rolling-over stock-market selling without big fear spikes is ominously classic bear-market behavior. And after such a monster bull, the next bear is long overdue. Unprecedented full-speed Fed QT colliding with bubble-valued U.S. stock markets artificially inflated by long years and trillions of dollars of Fed QE can’t end well. The reckoning is upon us.

Major bear markets follow major bull markets, often cutting stock prices in half over a couple years or so. And these inexorable bull-bear cycles are very unforgiving, as it can take over a decade for stock markets to regain bull highs once a bear starts ravaging. Gold is the refuge of choice, seeing investment demand surge as stock markets swoon. Prudent investors deploying in gold can grow their wealth during stock bears.

Adam Hamilton, CPA

December 31, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

Weary investors who endured the September and October stock market “crash season” felt they should be richly rewarded for their incredible patience… with a wondrous Santa Claus rally

Please click here now. The traditional Santa Claus rally has morphed into a hideous Santa Claws mauling of millions of US stock market price chasers. It’s a gruesome sight. The good news, clearly, is that my prediction has come true and both gold and senior miners have leaped into the limelight.

They are happily basking in their new role as safe haven beacons of safety for smart money investors. Please click here now. Double-click to enlarge this “Queen of Assets” gold chart.

While the stock market incinerates, gold is in a mighty uptrend. Note the fabulous flat line event taking place now on my 14,7,7 Stochastics oscillator at the bottom of the chart. This type of technical action is extremely positive. The world’s mightiest metal is poised to surge above the uptrend channel supply line and roar straight to my $1300 target price zone!

Please click here now. Double-click to enlarge. Silver has held its own against the dollar and higher price enthusiasts will likely get the rally they deserve in 2019. Because silver is used extensively in industrial applications, it tends to lag gold as the business cycle peaks. Demoralized stock market investors don’t see signs of aggressive growth in inflation yet, so they leave silver alone.

Once inflation begins to pick up more aggressively and US GDP growth contracts more substantially, silver will start to rally as aggressively as gold and the senior miners are rallying now.

I see that happening by the second half of 2019, but a three-day close over $15.20 would be a strong indication that commercial traders anticipate stagflation and are getting invested in this superb metal ahead of time.

As 2018 got underway, I urged investors to focus on President Trump’s success in the private sector and use his fabulous work ethic, organization, and planning skills as an inspiration to act professionally in the major markets.

Unfortunately, many investors believed that Trump’s power as president gave them a free pass to act unprofessionally in the major markets.

They believed the incredible success that America achieved in the 1880s “Golden Age” and the 1950s could be re-created by Trump… even though America’s demographics are now essentially the opposite of what they were in those two glorious time frames.

These investors essentially devolved into maniacal US stock market price chasers, and they ignored the clear “safehavenization” of senior gold stocks that was taking place.

The bottom line: Investors will always pay a price for sloppy actions in the market and they will always reap incredible rewards for high-level professionalism.

Please click here now. Double-click to enlarge. I developed the STL (Stewart’s Traffic Lights) system to provide clear green and amber light signals for an array of assets over both the short and long term.

Horrifically, the Dow Jones Industrial Average is now flashing a weekly chart amber STL. Amateur investors like to “wait for a rally” to sell. I like to obey traffic lights.

If the light turns amber, I don’t race my stock market car through the intersection, especially when a quantitative tightening freight train on central bank “auto pilot” is barrelling through that intersection. I don’t predict when the STL will turn green. I wait for it to turn green, and then I buy.

At my guswinger.com swing trade service, I have the “party people” short USD versus the yen, long GDX via triple-leveraged NUGT, and short the stock market via SDOW. It’s certainly a very Merry Christmas today for all the GU Swinger partygoers!

This year, America awakes on Christmas day with the socialist “demorats” back in control of the House, the stock market on a major sell signal… and with gold and the senior miners acting like the brightest Christmas lights in town!

Please click here now. Double-click this superb GDX “chart of champions”. As the Dow tumbled 600 points, GDX surged above the $21 resistance zone on a closing basis!

Note the enormous rise in volume. There’s also a flat line event taking place with the Stochastics oscillator. From a technical perspective, this chart is a bullish masterpiece that looks like Michelangelo created it.

Santa Claws came to U.S. stock market town, but Santa Claus came down every gold bug’s chimney with wondrous higher priced gold and senior miner tidings! Enjoy! Enjoy, because the current market themes in play are poised to dramatically accelerate in 2019. Best wishes to the entire global community!

Stewart Thomson

Graceland Updates

Email:

stewart@gracelandupdates.com

stewart@gracelandjuniors.com

stewart@guswinger.com

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

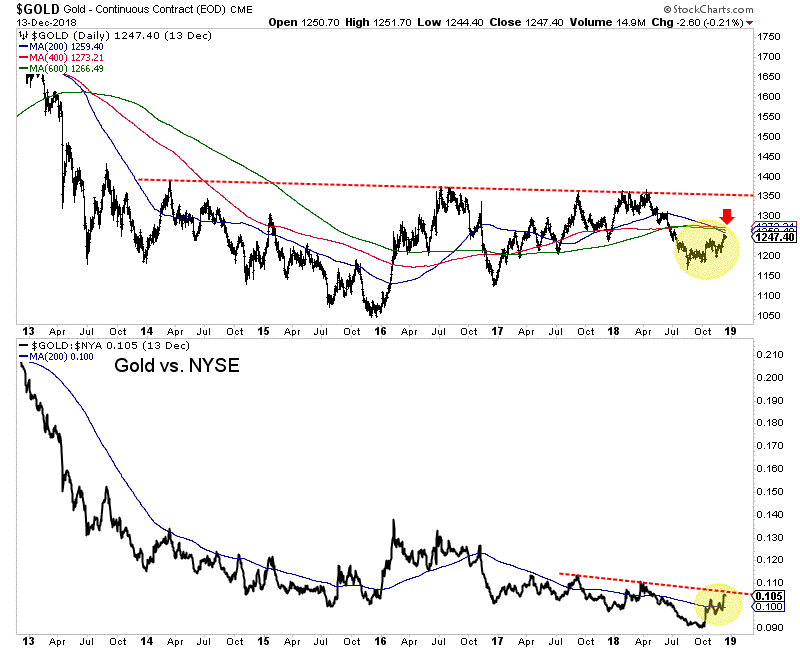

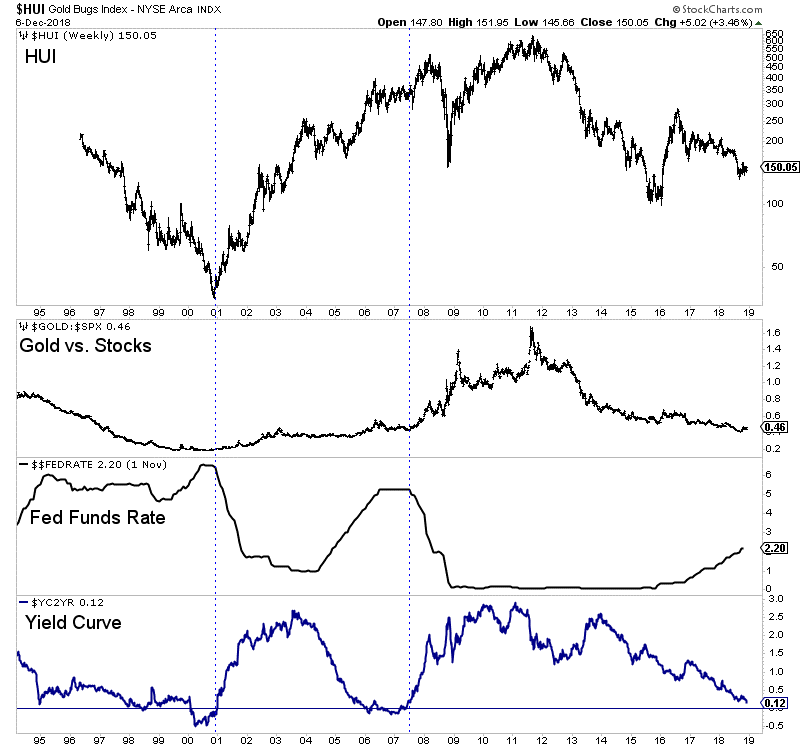

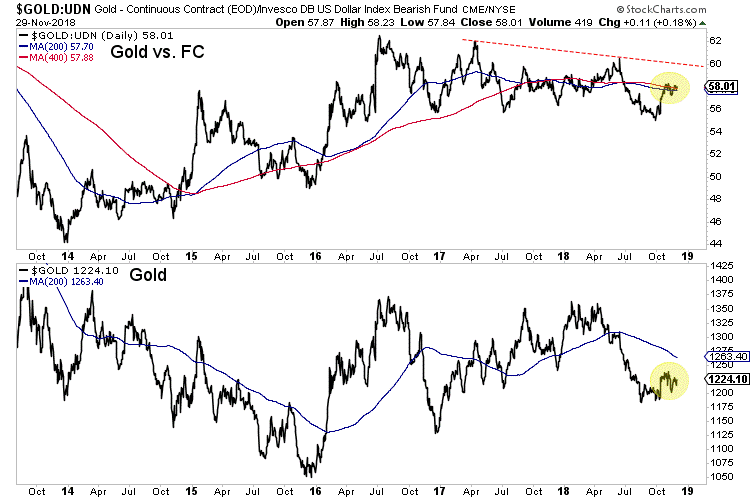

As we’ve been saying, the stock market will have great influence on Gold. It has been easy to see in recent months.

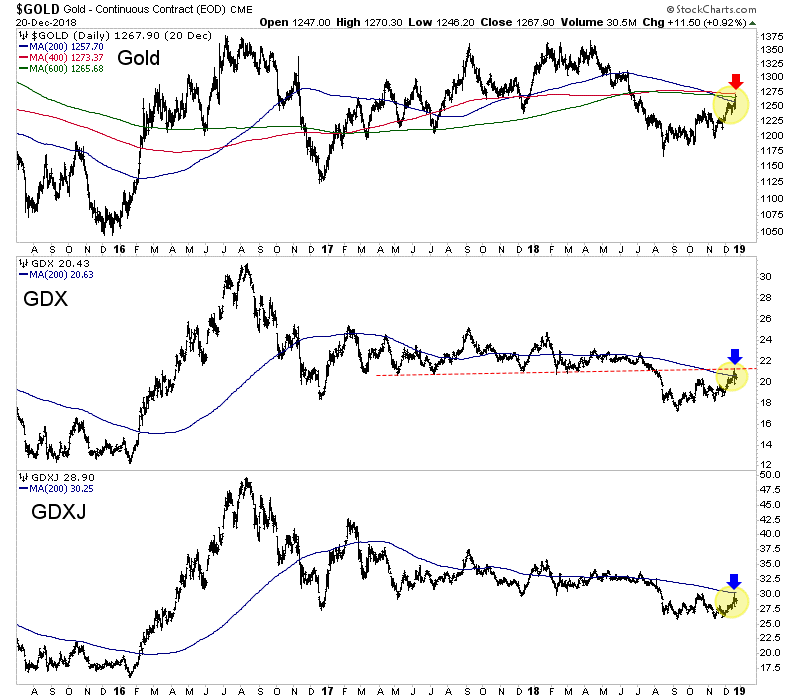

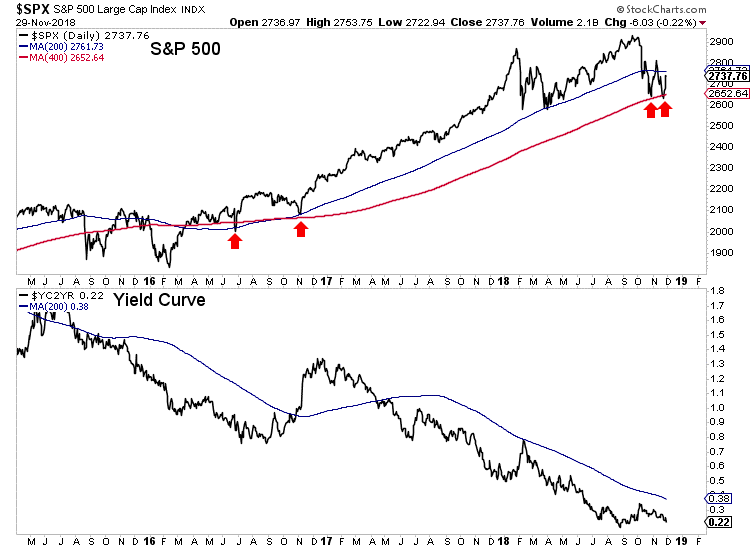

The S&P 500 has cracked, losing both its 200-day and 400-day moving averages. Gold and gold stocks have benefitted and gained in recent months even with a stable to rising U.S. Dollar.

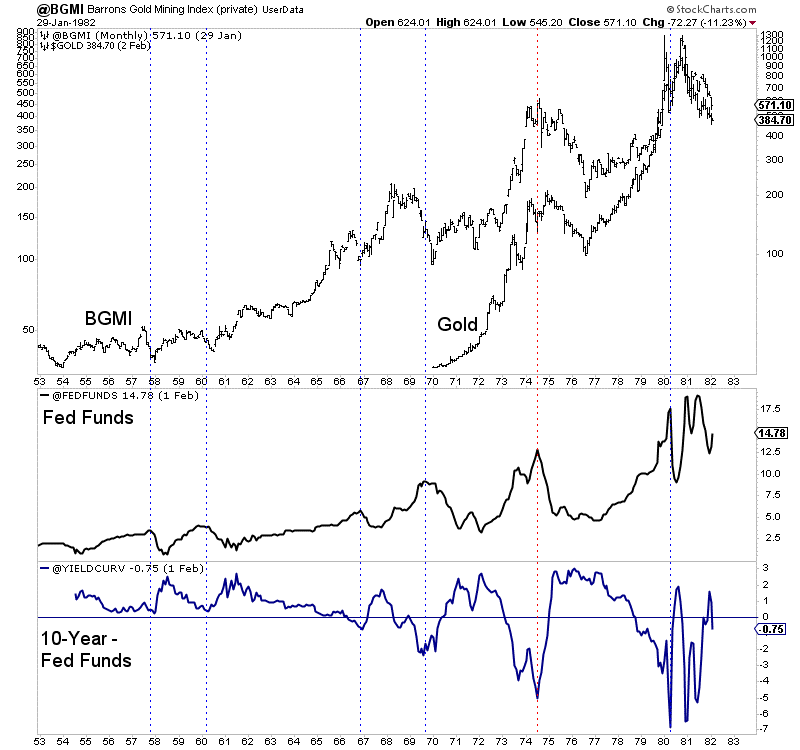

The past 65 years of history shows us that in almost any context (but not all) the time between the Fed’s last rate hike and first rate cut is exactly when you want to buy gold stocks.

We don’t know if December is the last rate hike. No one does.

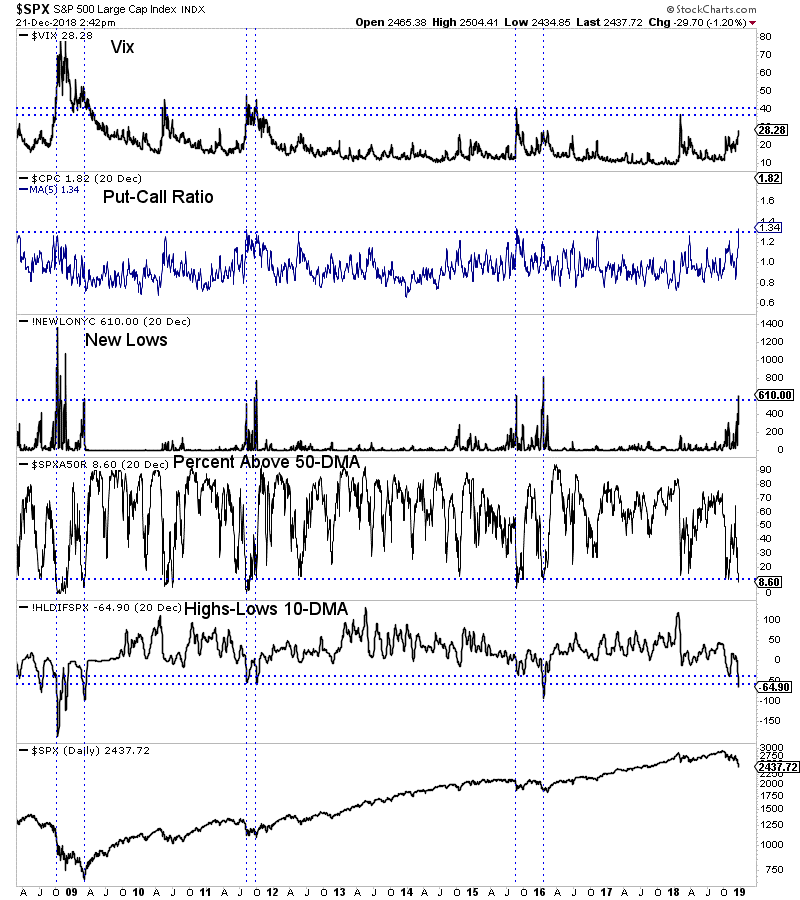

What we do know is the stock market is approaching an extreme oversold condition and is likely to begin a counter trend rally very soon.

In the chart below we plot five indicators that can help define an extreme oversold condition. These include the Vix, the put-call ratio and several breadth indicators. All but the Vix are in extreme oversold territory.

As we pen this article, the S&P 500 is trading at 2436.

The 40-month moving average, which has provided key support and resistance over the past 20 years (including the 2016 and 2011 lows) is at 2395 while the 50% retracement of the 2016 to 2018 advance is at 2380.

The setup for a bullish reversal is in place.

Meanwhile, despite the recent carnage in stocks, precious metals have been unable to surpass resistance.

Gold is set to close the week right below a confluence of resistance at $1260-$1270. Perhaps it will close right on its 200-day moving average at $1258.

The gold stocks (GDX, GDXJ) have been strong since Thanksgiving but appear to have been turned back at their 200-day moving averages.

So in recent days the selloff in the S&P 500 accelerated but precious metals (at least to this point) failed to capitalize in a bullish fashion.

If the S&P 500 is within one or two days of a rally then we should not expect much more upside in Gold and GDX in particular. Those were the markets that benefited most from weakness in the S&P 500.

As we noted last week, the weakness in the stock market (and the economy) has not done enough to change Fed policy yet.

Over the past 65 years, the start of bull markets and big rallies in gold stocks coincided with the start of rate cuts. When the market sniffs the first rate cut, we will know precious metals are beginning a sustained advance and not another false start.

Until Gold proves its in a bull market (and the market begins pricing in a rate cut) it would not be wise to chase strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

The dovish Federal Reserve lit a fire under gold and its miners’ stocks this week. As universally expected the FOMC hiked rates for the 9th time in this cycle. But it also lowered its 2019 rate-hike outlook bowing to the stock-market selloff. Traders dumped gold initially thinking that wasn’t dovish enough. But market reactions to the FOMC formed over a couple days, and gold surged overnight. Its post-Fed rally has great potential.

Gold-futures speculators dominate gold’s short-term trading action. They punch way above their weight in capital terms thanks to the extreme leverage inherent in gold futures. This week, the minimum margin for trading each 100-ounce contract controlling $125,000 worth of gold at $1250 was just $3400! These traders can run crazy maximum leverage as high as 36.8x, compared to the stock markets’ legal limit of 2x.

At 10x, 20x, or 30x leverage, every dollar of capital deployed in gold futures has 10x, 20x, or 30x more price impact on gold than a dollar invested outright. Further compounding speculators’ hegemony over gold prices, gold’s world reference price derives directly from US gold-futures trading. Naturally extreme leverage means extreme risk. At 37x a mere 2.7% gold move against positions wipes out 100% of capital risked!

In order to survive, gold-futures traders are forced to have an ultra-short-term focus. Their time horizons are measured in hours, days, and maybe weeks instead of months and years. And there is nothing that motivates them to trade aggressively like meetings of the Fed’s Federal Open Market Committee. Gold volatility often surges in their wakes, as speculators watch the U.S. dollar’s reaction and do the opposite in gold.

Gold-futures speculators are convinced Fed rate hikes are bearish for gold because they are bullish for the US dollar. They logically reason that the higher prevailing US interest rates, the more attractive the US dollar becomes relative to other currencies. And a stronger dollar usually means weaker gold since they are competing currencies. That all sounds rational, but the big problem is history doesn’t bear this out.

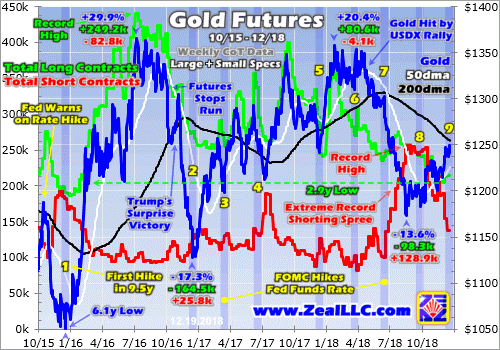

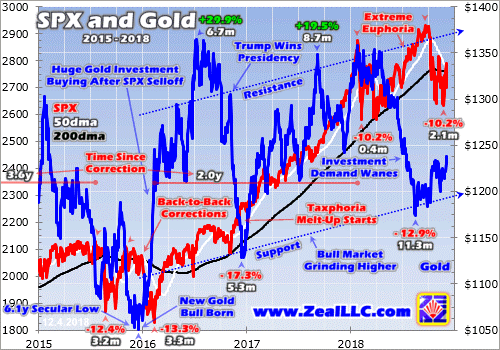

The FOMC started today’s rate-hike cycle way back in mid-December 2015, raising the federal-funds rate for the first time in 9.5 years. Gold-futures speculators fled leading into that, ultimately crushing gold to a deep 6.1-year secular low of $1051 the day after. But that oversold extreme marked the birth of a new bull market that would catapult gold 29.9% higher over the next 6.7 months! That same bull persists today.

In the 3.0 years since which includes this week’s 9th Fed rate hike of this cycle, gold is still up 18.1% and the US Dollar Index is down 2.1%. That’s no anomaly either. This is actually the Fed’s 12th rate-hike cycle since the early 1970s. During the exact spans of the prior 11, gold averaged strong gains of 26.9%! That was an order of magnitude higher than the stock markets’ 2.8% average gains per the flagship S&P 500.

Gold-futures speculators either don’t know market history or their extreme leverage forces them to run as a herd no matter how irrational that stampede is. They can’t afford to be wrong for long or risk suffering catastrophic losses. This week they apparently expected the FOMC to prove even more dovish on future rate hikes than it was. That led to volatile gold action surrounding this latest critical Fed decision on rates.

The FOMC meets 8 times per year, about every 6 weeks. But up until now, only every other meeting was accompanied by a Summary of Economic Projections and followed by the Fed chairman holding a press conference. That meant the Fed was only “live”, likely to hike rates, once a quarter at that every-other meeting. Incidentally Jerome Powell will start holding press conferences after every meeting starting in January.

That decision was made in mid-June, it had nothing to do with the recent stock-market volatility. Since the Fed doesn’t want to spook traders and ignite selloffs, rate hikes are well-telegraphed in advance. 3 weeks after each FOMC meeting, its full minutes are released. They are long and detailed, offering all kinds of clues about whether top Fed officials are thinking about hiking rates at the next FOMC meeting.

Market-implied Fed-rate-hike odds are always available through federal-funds futures trading. The big wildcard at each live FOMC meeting is a part of the SEP known as the “dot plot”. It collates where each individual top Fed official personally expects the federal funds rate to be in each of the next several years and beyond. It’s literally a bunch of dots plotted on a table, hence the name. It can really move gold futures.

Though Powell and other FOMC members stress the dot plot is not an official rate-hike forecast or outlook by the Fed, traders universally use it as such. A hawkish dot plot implies more future rate hikes than the previous one, and dovish less. Gold, currency, and stock-index futures speculators trade aggressively based on the quarterly changes in the dot plot. FOMC statements and press conferences also play roles.

At the FOMC’s previous meeting accompanied by a dot plot in late September, those forecasts implied top Fed officials expected this week’s rate hike, another 3 in 2019, and 1 final one in 2020. But market conditions were way different then. That decision came just 4 trading days after all-time record highs in the lofty euphoria-drenched U.S. stock markets. Top Fed officials are boldly hawkish when stocks look awesome.

In early October Powell doubled down on this hawkishness, saying in an evening speech that the federal-funds rate was “a long way from neutral at this point, probably” and that “We may go past neutral.” The very next day the stock markets started sliding and haven’t looked back since. By this Monday that selloff had gradually mushroomed into a moderate 13.1% correction in the S&P 500. Many blame it on Fed hawkishness.

Facing withering criticism led by president Trump himself, Powell tried to walk back his own many-more-rate-hikes-to-come outlook in late November after the S&P 500 had passed the 10% correction threshold. Powell said “Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy…” Stock selling was softening the Fed.

While traders fully expected the rate hike of this cycle Wednesday, they were sure the dot-plot outlook of future rate hikes would be far more dovish than late September’s 5 including this week’s. Gold rallied nicely in anticipation, climbing from $1214 before Powell’s second speech to $1249 the day before this latest FOMC meeting. In the hours before this new dot plot’s release, gold was bid to a new upleg high of $1261.

Market expectations were for just 1 rate hike in 2019 compared to the previous 3 implied, followed by an actual rate cut in 2020! That seemed excessive, so I figured top Fed officials would kill one of the hikes next year leaving 2 in 2019 and remove 2020’s lone hike as well. While this latest dot plot was indeed dovish as expected, it wasn’t dovish enough. 2019’s outlook shrunk to 2 more hikes, and 2020’s kept that final one.

So instead of going from 4 future hikes down to 1 or 2 as hoped, the dot plot only retreated from 4 to 3. Both dollar-futures and gold-futures speculators expected more dovishness, leading to moderate gold selling after the dot plot. Gold fell from $1251 just before its release to $1242 a couple hours later, and closed 0.6% lower on the day. Stock markets fared worse, the S&P 500 falling 1.5% to a new correction low!

But the impact of FOMC decisions usually takes a day or two to settle out. They are released at 2pm New York time when Asian and European markets are closed. So until foreign traders get their chances to react to the Fed, the market outcome isn’t known. Even American traders have to get past their initial kneejerk reactions, so the next trading day following the FOMC is crucial as actual implications sink in.

Gold was slowly bid heading into Thursday in Asian markets, heading back up near $1248 by the time Europe was opening. And then gold quickly surged to $1256, a new closing upleg high. In U.S. afternoon trading the day after this FOMC decision, gold surged as high as $1266! Top Fed officials’ future rate-hike outlook falling from 4 to 3 might not have been dovish enough, but it was still certainly dovish absolutely.

Seeing the Fed waver on future rate hikes in response to the mounting stock-market selloff this quarter is super-bullish for gold and its miners’ stocks going forward. Both gold-futures speculators and normal investors remain way under-deployed in gold, with vast room to buy. Odds are this week’s dovish FOMC will accelerate major gold and gold-stock uplegs. That’s happened after past Fed rate hikes in this cycle too.

This first chart superimposes gold prices over the total gold-futures long and short contracts speculators hold, which are rendered in green and red respectively. All 9 Fed rate hikes of this cycle are highlighted in blue. Gold has often surged strongly on gold-futures buying in recent years following FOMC rate-hiking decisions, or more precisely dot-plot changes in the future rate-hike outlook. Gold is set up to surge again.

Again, this entire gold bull was born the day after the Fed’s first rate hike of this cycle, resulting in that big initial 29.9% gold upleg over 6.7 months in essentially H1’16. That left gold overbought so it started to correct like normal. But that was greatly exacerbated by Trump’s surprise election victory which ignited a monster stock-market rally on hopes for big tax cuts soon. Investors aggressively fled gold to chase stocks.

But gold bottomed in mid-December 2016 the day after this cycle’s second rate hike, and soon started surging sharply higher. Yet gold-futures speculators didn’t learn their lesson, and continued to dump gold heading into FOMC decisions with expected rate hikes. Gold rallied strongly immediately out of the 3rd, 5th, and 6th hikes of this cycle, and soon after the 4th and 8th. Rate hikes have definitely proven bullish for gold!

The 7th rate hike in mid-June 2018 was a major exception. Gold fell sharply in subsequent days as gold-futures speculators lapsed into a stunning extreme record orgy of short selling. Initially sparked by a U.S. dollar rally, that epic gold-futures shorting soon took on a life of its own driving total short contracts to their highest levels ever by far! That ultimately blasted gold to a deep and unsustainable 19.3-month low in mid-August.

Most of that shorting spree has been covered since, fueling most of gold’s young upleg since. But the long-side gold-futures speculators who control much more capital than short-side guys have barely started to buy. Short covering is legally mandated to repay the debts incurred by borrowing to short sell. But long buying is totally voluntary, speculators have to believe gold is heading higher to make leveraged bets on it.

At the end of November the day before Powell’s about-face on how far rates were from neutral, the total gold-futures longs held by speculators had crumbled to just 204.9k contracts. That was a serious 2.9-year low, levels last seen in late January 2016 just as this gold bull was starting to march higher. So gold-futures speculators are nearly as under-deployed in gold as they were near the end of its last secular bear!

That leaves vast room for them to buy to reestablish normal positions. Back in essentially the first half of 2016, speculators added 249.2k longs while covering 82.8k shorts to help catapult gold 30% higher. It’s amazing to see similar long-buying potential today, with speculators’ total longs running just 7% up into their past year’s trading range. We’re nearing the tipping point where short covering ignites far-bigger long buying.

Gold bull uplegs have 3 distinct stages that trigger and unfold in telescoping fashion. They all start out of major lows with that mandatory gold-futures short covering, the first stage. That eventually pushes gold high enough for long enough to entice long-side gold-futures speculators to return, the second stage. I suspect this week’s dovish FOMC meeting could prove the catalyst that ignites big stage-two gold buying.

This latest dot plot may not have been dovish enough for traders, but Fed dovishness will snowball with stock-market weakness. The lower the stock markets slide, whether or not Fed hawkishness is really to blame, the more pressure on the FOMC to slow or even stop its future-rate-hike tempo. Gold-futures speculators will crowd into gold to chase its upside momentum with their feared rate-hike boogeyman fading.

But all the stage-one and stage-two gold-futures buying that fuels young gold uplegs is just the prelude to far-larger stage-three investment buying. After gold’s upleg grows large enough and lasts long enough to spawn investor interest, their capital inflows soon dwarf anything the gold-futures speculators could ever manage. There’s also precedent in this cycle for Fed rate hikes soon leading to surging gold investment demand.

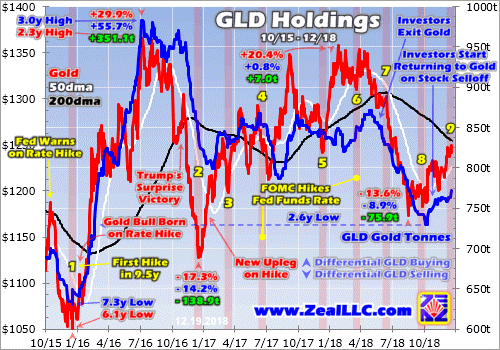

A great high-resolution proxy for gold investment-demand trends is the amount of physical gold bullion held in trust by the dominant GLD SPDR Gold Shares gold ETF. It effectively acts as a conduit for the vast pools of American stock-market capital to slosh into and out of gold. Just a couple weeks ago I wrote an essay on how GLD works and why it is critically important to gold prices, especially during stock selloffs.

This next chart looks at GLD’s holdings superimposed over the gold price, with all 9 Fed rate hikes of this cycle highlighted. While gold-futures trading usually dominates gold prices, it is still easily overpowered by material flows of American stock-market capital into or out of gold via GLD. Investors have started to return to gold again on the stock-market selloff, and this prudent reallocation should accelerate on Fed dovishness.

The last time American stock investors were worried enough about stock-market selloffs to redeploy into gold for refuge was that first half of 2016. Since gold is a rare counter-moving asset that tends to rally as stock markets weaken, investment demand soars when the S&P 500 slides long enough to ignite serious concerns. We’re certainly getting to that point again, as worries are mounting about this latest major selloff.

Gold went from being left for dead in mid-December 2015 to surging 29.9% higher in just 6.7 months solely on American stock investors returning! This is no generalization, the hard numbers prove it without a doubt. The world’s best gold fundamental supply-and-demand data comes from the venerable World Gold Council. It releases fantastic quarterly reports detailing the global buying and selling happening in gold.

Gold blasted higher on stock weakness in Q1’16 and Q2’16. According to the latest data from the WGC, total world gold demand climbed 188.1 and 123.5 metric tons year-over-year in those key quarters. That was up 17.1% and 13.2% YoY respectively! But the real stunner is exactly where those major demand boosts came from. It wasn’t from jewelry buying, central-bank buying, or even physical bar-and-coin investment.

In Q1’16 and Q2’16, GLD’s holdings alone soared 176.9t and 130.8t higher on American stock investors redeploying into gold after back-to-back S&P 500 corrections. Incredibly this one leading gold ETF accounted for a staggering 94% of overall global gold demand growth in Q1’16 and 106% in Q2’16! So there’s no doubt without American stock investors fleeing into gold via GLD this gold bull never would’ve been born.

Gold was holding those sharp gains throughout 2016 until Trump’s surprise presidential victory unleashed a monster stock-market run on hopes for big tax cuts soon. Gold was pummeled in Q4’16 as American stock investors pulled capital back out to chase the newly-soaring S&P 500. That quarter total global gold demand per the WGC fell 103.4t YoY or 9.0%. GLD’s 125.8t Q4’16 holdings draw accounted for 122% of that!

Fast-forward to summer 2018, and investors again started shifting out of gold to chase euphoric U.S. stock markets nearing new record highs. That forced GLD’s holdings to a deep 2.6-year low, investors hadn’t been so underinvested in gold since early in this bull market when they started flooding back in helping to catapult gold sharply higher. That gives them massive room to buy back in since their allocations are so low.

This mass exodus of American stock-market capital out of gold via GLD ended in mid-October the exact day the S&P 500 started plunging in what’s grown into this newest correction-grade selloff! Ever since GLD’s holdings have continued recovering on more capital inflows, helping to drive gold higher. This trend should only accelerate as stage-two gold-futures long buying on Fed dovishness further lifts gold prices.

Investors are often as momentum-driven as futures speculators, but over much-longer time horizons. So as this young gold upleg grows, gold is going to look much more attractive to them. Their desire to chase its upside performance is really intensified by material stock-market weakness. That makes gold stand out as not just a safe-haven capital-preservation hedge, but a way to grow wealth while everything else burns.

And as goes gold, so go the stocks of its miners. Last week I wrote a whole essay detailing the imminent major upside triple breakout in gold stocks likely to be triggered by a dovish FOMC. That indeed started to happen this week before the Fed, as this updated GDX chart shows! The GDX VanEck Vectors Gold Miners ETF is the leading gold-stock investment vehicle and benchmark, and remains poised for massive gains.

Three major resistance zones have converged at GDX $21. They include its 200-day moving average, past-year descending-triangle overhead resistance, and the old consolidation basing trend’s support. In anticipation of a gold rally on a dovish Fed, GDX closed above $21 on Tuesday. And in the hours before that FOMC decision Wednesday, it hit $21.47 intraday which was very-bullish decisive-breakout territory.

But when futures speculators bid the U.S. dollar higher and pushed gold lower on this latest dot-plot rate-hike outlook not being dovish enough, the gold stocks reversed hard. GDX plummeted a staggering 7.3% intraday across that FOMC decision! It closed 5.4% lower, making for absurd 9.0x downside leverage to gold’s small 0.6% Fed Day loss. That was a wildly-irrational downside anomaly that never should’ve happened.

In trying to figure out why after Wednesday’s close, I waded through dozens of gold stocks to see if there was some adverse news besides a not-dovish-enough FOMC. There was nothing. But provocatively in after-hours trading soon after the U.S. stock-market close, many if not most of the gold stocks had already regained 2/3rds to 3/4ths of that day’s crazy losses! So traders realized that kneejerk selloff wasn’t righteous.

Indeed right out of the gates Thursday GDX surged 4.1% higher erasing over 7/10ths of the extreme Fed Day losses. Remember market reactions to FOMC decisions usually aren’t fully apparent until the entire next trading day, after the implications have sunk in and overseas traders have reacted. Gold stocks’ major-upside-breakout thesis portending a powerful new upleg remains intact, the Fed likely accelerated it.

The beaten-down gold miners’ stocks remain the last cheap sector in the entire stock markets, a coiled spring ready to soar as gold returns to favor. The more shorts covered and longs bought by gold-futures speculators, and the more capital investors allocate back into gold, the greater the upside the gold miners’ stocks have as gold powers higher. Their potential gains are enormous, dwarfing anything else in 2019.

Again the last time major stock-market weakness rekindled gold investment demand was essentially the first half of 2016, when gold powered 29.9% higher. That drove a parallel monster 151.2% gold-stock upleg per GDX, making for huge 5.1x upside leverage. The gains in major gold stocks generally amplify gold upside by 2x to 3x, and smaller mid-tier miners with superior fundamentals tend to do much better than that.

The key to riding any gold-stock bull to multiplying your fortune is staying informed, both about broader markets and individual stocks. That’s long been our specialty at Zeal. My decades of experience both intensely studying the markets and actively trading them as a contrarian is priceless and impossible to replicate. I share my vast experience, knowledge, wisdom, and ongoing research through our popular newsletters.

Published weekly and monthly, they explain what’s going on in the markets, why, and how to trade them with specific stocks. They are a great way to stay abreast, easy to read and affordable. Walking the contrarian walk is very profitable. As of Q3, we’ve recommended and realized 1045 newsletter stock trades since 2001. Their average annualized realized gains including all losers is +17.7%! That’s double the long-term stock-market average. Subscribe today and take advantage of our 20%-off holidays sale!

The bottom line is this week’s FOMC decision is very bullish for gold and its miners’ stocks going forward. While only seeing 1 of 3 projected 2019 rate hikes axed wasn’t considered dovish enough, it still showed the Fed’s hawkish resolve is cracking. That dovishness will mount the longer stock markets remain weak, further shortening and shrinking this rate-hike cycle. That green lights capital returning to gold in a big way.

There is massive room to buy back in, with both speculators’ gold-futures longs and stock investors’ gold held via GLD just modestly above major multi-year lows. Dovish Fedspeak, weaker stock markets, and higher gold prices will really motivate them to reestablish normal gold positions and portfolio allocations. The gold miners’ stocks will be the major beneficiaries of higher gold prices, nicely leveraging gold’s gains.

Adam Hamilton, CPA

December 21, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

- The U.S. stock market continues to implode. At the same time, precious metals, bitcoin, and the Indian stock market are acting as superb safe havens.

- Please click here now. Double-click to enlarge this great short term gold chart.

- Note the positive bounce from buy-side support at $1237, and the inverse H&S bottom pattern. A fresh rate hike from the Fed tomorrow could crush the stock market again, but if there’s no rate hike, that could also crash the stock market.

- That’s because money managers would believe the Fed thinks the supposed “world growth leader” economy is too weak to handle even a 2.5% Fed funds rate!

- This Fed meeting could be an important catalyst that makes institutional money managers start to get serious about viewing gold as a respected asset class… that is here to stay.

- On that note, please click here now. While an overdue import duty cut remains elusive, the citizens of India (and China) are the clear leaders in the quest to make gold the world’s most respected asset class.

- On the government side, the Chinese government has been a leader in building gold market infrastructure to move price discovery from the dingy trading rooms of the Western fear trade to the more positive love trade environment of the East.

- The Indian government is beginning to play “catch-up”, and that’s very good news for gold investors around the world.

- Please click here now. There are currently about 400 million Indians who have internet access, and that is expected to double to 800 million quite quickly.

- The World Gold Council (WGC) estimates that 3 million Indians buy gold online, and they predict that number will soon quintuple to 15 million!

- In 2014 I predicted a “gold bull era” was being born and it would be founded on a gargantuan ramp-up in Chindian online gold demand.

- Indians can already get physical delivery from most of the online platforms when total purchases reach just one gram of online-purchased gold.

- Warren Buffett is buying into one of the platforms (Paytm). This man is an elephant hunter!

- Please click here now. Double-click to enlarge this magnificent big picture gold chart.

- An almost surreal array of positive love trade and inflation trade price drivers are converging at the same time.

- This is happening as gold bullion begins a majestic ascent from the right shoulder low of a gargantuan inverse head and shoulders bull continuation pattern.

- Sadly, to view something much less than majestic, please click here now. Double-click to enlarge. My proprietary “Graceland Traffic Light” on the weekly Dow chart has just turned amber.

- This is a rare and ominous event. U.S. stock market investors who ignore these major traffic light signals risk tremendous portfolio damage.

- If the signal stays amber as of Friday’s close, I’ll consider it a full U.S. stock market sell signal, and any positions bought above the Dow 10,000 level should be sold.

- In global stock market downturns like the current one, Canadian money managers will throw the junior mining stocks baby out with the stock market bathwater.

- Most of the smaller junior miners trade on the Canadian CDNX exchange, so it’s very important for all gold market investors to be properly diversified in what is obviously the world’s greatest asset class. Junior mining stock investors should own some of the bigger miners to get that diversification.

- Please click here now. Double-click to enlarge this spectacular GDX chart. GDX put in another day of strong upside action yesterday, and it did so as the Dow fell almost 500 points!

- On Saturday I urged my gublockchain.com subscribers to buy bitcoin (and some “alts”)… right before the latest upside blast that I predicted would be “explosive”. It was explosive, and I have the excited investors in profit booking mode now.

- I’ll boldly predict that a few more daily closes above $20.50 are going to produce an equally explosive price surge for GDX and a huge array of individual gold stocks!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Juniors With The Juice!” report. While most junior miners have a lot of hurdles to overcome, I highlight six that are likely poised for five bagger gains in 2019! I include daily chart buy and sell points for each stock.

Stewart Thomson

Graceland Updates

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

If we want to know where Gold is going we should follow Gold. Right?

How about following gold stocks? At times, they lead Gold.

What about the U.S. Dollar? Wrong!

In 2019, one market more than any other will impact Gold.

That is the stock market.

History argues (within the current context) that when the Federal Reserve ends its rate hikes, Gold’s downtrend will be over and when the Fed cuts rates, the bull market shall begin.

Fed policy is dictated by economic data and financial conditions which of course can be reflected by the stock market, which is also a reflection of corporate profits.

Extended weakness in the stock market should bring the Fed that much closer to rate cuts. However, if the stock market is able to mount a decent counter trend rally in 2019, it could raise the possibility of another hike. Right now, the market expects no hikes in 2019 and even half of a quarter point cut in 2020.

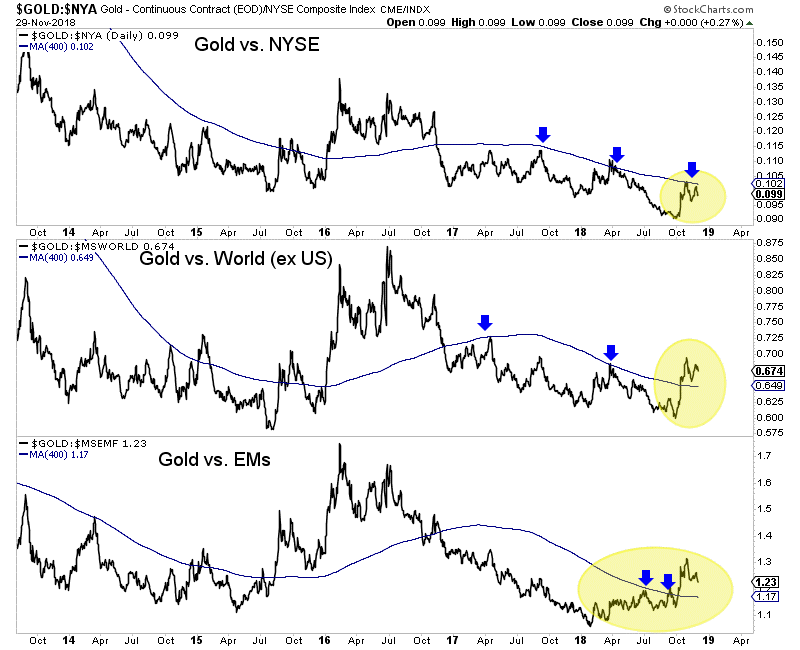

Other than the cyclical bull market of 1985 through 1987, Gold has never enjoyed a real bull market without outperforming the stock market.

Below we plot Gold and Gold against the broad stock market (NYSE). Gold is still trading below a confluence of resistance ($1260-$1270) and the Gold to stock market ratio, while trading above its 200-day moving average has not broken out of its downtrend yet.

As we pen this, the stock market is breaking lower but Gold is also down and remains below a confluence of resistance at $1260-$1270/oz.

Is our thesis wrong?

The current weakness in equities has not completely changed Fed policy yet. Sure, the weakness in the equity market definitely could cause the Fed to pause its rate hikes and the market has already discounted that for 2019.

However, for the bull market in Gold to be ignited the Fed needs to move from a pause to the start of rate cuts. The current talk is about a pause, not rate cuts.

Hence, Gold is catching a bid and starting to perform better in real terms but has not reached bull market status yet.

Until Gold proves its in a bull market (and the market begins pricing in a rate cut) it would not be wise to chase strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

The beleaguered gold stocks are recovering from their late-summer capitulation, enjoying a solid young upleg as investors gradually return. Their buying has pushed the leading gold-stock ETF near a major triple breakout technically. That event should really boost capital inflows into this sector, accelerating the rally. A major gold and gold-stock buying catalyst is likely imminent too, a more-dovish Fed this week.

The gold miners’ stocks have always been a small contrarian sector, a little-watched corner of the stock markets. But they’ve been even more unpopular than usual in recent months. That pessimistic sentiment is driven by price action, which has mostly proven poor in 2018. That’s really evident in the performance of the flagship gold-stock investment vehicle, the GDX VanEck Vectors Gold Miners ETF which is struggling.

As of the middle of this week, GDX was down 12.0% year-to-date. That leveraged gold’s YTD decline of 4.4% by 2.7x, which is perfectly normal. Because gold-stock earnings are heavily dependent on prevailing gold levels, gold-stock prices tend to amplify gold’s moves by 2x to 3x. That’s a double-edged sword, really profitable when gold rallies but cutting deeply when it retreats. The drawdowns are challenging to weather.

But gold stocks’ inherent leverage to gold is starting to work again on the upside, portending big gains ahead. This first chart looks at the major gold stocks’ technicals through the lens of GDX over the past several years. This sector soared in a new bull market, plunged with gold after Trump’s surprise election win goosed the stock markets, consolidated sideways to base, and then suffered an extreme capitulation selloff.

Investors and speculators often forget how explosive gold-stock upside is when gold is powering higher in an upleg. In largely the first half of 2016, GDX skyrocketed 151.2% higher in just 6.4 months! Capital just flooded back into the gold miners driven by a new gold bull’s parallel 29.9% upleg. That catapulted GDX to very-overbought levels and a 3.3-year high in mid-2016. So a normal correction got underway soon after.

GDX found support at its critical 200-day moving average, which is often the strongest support zone seen in ongoing bull markets. But that failed in November 2016 after an anomalous surprise. Trump defied the polling and odds to win the presidency while Republicans controlled both chambers of Congress. So the stock markets soared in that election’s wake on euphoric hopes for big tax cuts soon. Gold wilted on that rally.

So the gold stocks naturally followed it lower, again mirroring and amplifying its price action. After it had enjoyed stellar 5.1x upside leverage to gold in its powerful H1’16 upleg, GDX dropped 39.4% over the next 4.4 months. That leveraged gold’s own correction by 2.3x, relatively low in that usual 2x-to-3x range. GDX soon bounced sharply with gold and established a new consolidation trading range between $21 to $25.

The major gold stocks mostly meandered within that GDX range for 21.5 months. While it was vexing at times to see upside-breakout attempts fail, basing consolidations are very bullish. They provide time for bullish newer investors to acquire shares from bearish exiting ones, establishing new price norms well above previous bear-market lows. And the $23 midpoint of that GDX trading range proved relatively high.

This gold-stock bull was born out of fundamentally-absurd lows of GDX $12.47 in mid-January 2016. It peaked at $31.32 in early August that year. Oscillating around $23 on balance, GDX was basing 4/7ths up into its young bull’s entire range. The major gold stocks GDX holds were biding their time waiting for another major gold upleg to catapult them higher. They nearly broke out above $25 in early-September 2017.

But that attempt’s failure damaged psychology so traders gradually sold, this small contrarian sector left for dead. The subsequent lower highs over the next 10.4 months into mid-July 2018 formed a downward-sloping resistance line. Gold-stock prices were being compressed into a bearish descending triangle, as lower highs slumped ever closer to that major $21 support. This sector really needed a major gold rally.

Unfortunately the opposite happened this past summer, gold got hammered crushing the weakened gold stocks. The US stock markets were powering higher trying to regain record highs in July and August 2018, heavily retarding gold investment demand. On top of that the U.S. Dollar Index was surging too, both on expectations for more Fed rate hikes and an emerging-markets currency crisis led by the Turkish lira.

So gold-futures speculators started short selling gold at extreme record levels, blasting their aggregate downside bets far up into anomalous territory never before witnessed. Gold fell sharply on that record gold-futures shorting spree, dragging the struggling gold stocks down with it. So in early August GDX plunged and knifed through its longstanding $21 support. That major breakdown spawned self-feeding selling.

Gold stocks are an exceptionally-volatile sector not for the faint of heart. So it is essential to run loose trailing stop losses on gold-stock positions. While these protect investors from excessive losses, they greatly exacerbate selloffs. The lower gold stocks fell this past summer, the more stop losses were hit. These mechanical automatic sell orders then add to the downside pressure, pushing gold stocks lower still.

That vicious circle of selling begetting selling snowballed into an extreme capitulation in gold stocks, as GDX plummeted in August and early September. In just 5 weeks GDX collapsed 17.0%, far worse than gold stocks should’ve performed with gold merely slipping 1.4% lower in that span. That devastated already-shaky sentiment, leaving most investors and speculators to throw up their hands in disgust and flee.

But with GDX being pummeled to a deep 2.6-year low, the major gold stocks were wildly oversold. I explained all this in depth in an essay on gold stocks’ forced capitulation in mid-September. They were due to mean revert dramatically higher after that extreme selling anomaly. And that process has indeed been underway ever since. The gold stocks have been recovering, clawing their way out of those deep lows.

As usual gold stocks’ dominant primary driver has been gold, which has been grinding higher in its own young upleg as speculators cover their record gold-futures shorts. Investors started returning too when the lofty US stock markets began rolling over hard in mid-October. As of the middle of this week, GDX just hit a new upleg high of $20.45 on close. That extended gains since the capitulation low to 16.4% in 3.0 months.

Although considerable, the gold stocks’ rally still hasn’t grown large enough to return to the radars of contrarian investors. That could be about to change though as a rare triple breakout looks imminent! GDX, the leading gold-stock investment vehicle, is on the verge of simultaneous upside breakouts from its 3 major upper-resistance zones. That will likely unleash big gold-stock buying from technically-oriented traders.

These major resistance levels have all converged near $21. The first and most important is GDX’s key 200-day moving average, which was $20.78 this week. 200dmas are seen as the dividing line between bull and bear markets. When prices surge back above 200dmas after long periods underneath them, the upside momentum often explodes. Traders love chasing gains and 200dma breakouts portend big ones.

The past few years have several examples of gold stocks surging dramatically after 200dma breakouts. The main one was in early February 2016, when GDX rocketing back over its 200dma after deep lows confirmed a new bull market was underway. The great majority of its initial massive 151.2% upleg came after that 200dma upside breakout. Another upleg surged after a 200dma breakout in mid-August 2017.

The latest one came in late December 2017, although that was truncated early by gold stalling out. Realize that no technical line is more important to traders than 200dmas. When they see major gold stocks power decisively back over their 200dma as measured by GDX, they are likely to rush to buy in to ride the momentum. Like selling, buying begets buying. The more gold stocks rally, the more traders want them.

That imminent 200dma breakout will be all the more potent as a new-upleg signal because 2 other major resistance lines have converged there. That downward-sloping resistance line of the descending triangle has also extended right on $21. So once GDX powers decisively above it, this past year’s vexing trend of lower highs will end. Traders will see that as evidence the major gold-stock trend is reversing to higher.

The final resistance line of that triple breakout is the major $21 support of GDX’s consolidating basing range that held rock solid for over a year-and-a-half. When prices fall, old support zones often become new overhead resistance. Traders tend to want to sell again when those old support levels near. So when GDX decisively breaks back out above $21, technical fears of that former support level will vanish.

Once back over $21, GDX will return to its multi-year consolidation basing trend between $21 to $25. So the triple breakout above that old support line, downward-sloping resistance line, and 200dma would set the stage for a sharp surge back towards the top of that old trading range. While GDX $25 isn’t very high in absolute terms, it’s still another 22.2% above this week’s levels. Such a rally would spark some excitement.

Because historical gold-stock uplegs have been so enormous, generating life-changing wealth, there is always latent gold-stock interest lurking. Contrarian investors and speculators alike sour on gold stocks when they are weak, but quickly return when they show technical signs of life. A GDX triple breakout sure qualifies as that! And much-higher gold-stock prices are certainly justified fundamentally, long overdue.

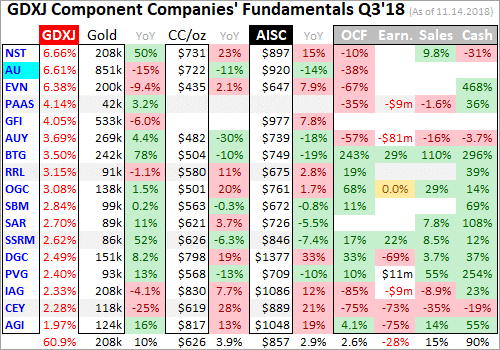

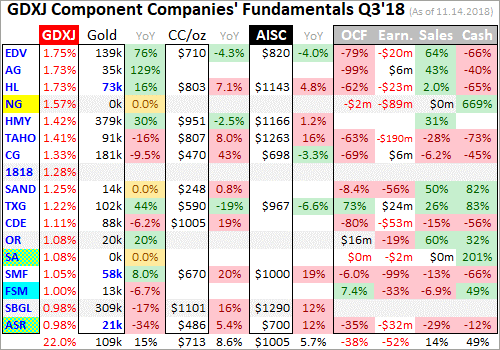

Gold miners’ earnings and thus ultimately stock prices are largely a function of gold levels. Mining costs are essentially fixed during mine-planning stages. So higher gold prices flow directly through to bottom lines in amplified fashion. This is easy to understand with an example. A month ago I waded through the Q3’18 results of GDX’s major gold miners. Their average all-in sustaining costs weighed in at $877 per ounce.

That is what it costs them to produce and replenish gold, and $877 was right in line with their previous 4 quarters’ average of $867. Those collective costs will remain stable even as gold’s upleg accelerates. At gold’s own extreme-futures-short-selling-driven bottom of $1174 in mid-August, the major gold miners of GDX were still earning about $297 per ounce. Such solid levels prove that capitulation wasn’t righteous.

Last Friday gold hit a new upleg high of $1248, up 6.3% from its anomalous late-summer lows. Imagine this young upleg grows to 30% like the H1’16 one, which is quite small by historical standards. That would leave gold near $1525. At those $877 average GDX AISCs, the major gold miners’ profits would rocket to $648 per ounce. That’s 118% higher on a 30% gold upleg! Big gold-stock upside is fundamentally justified.

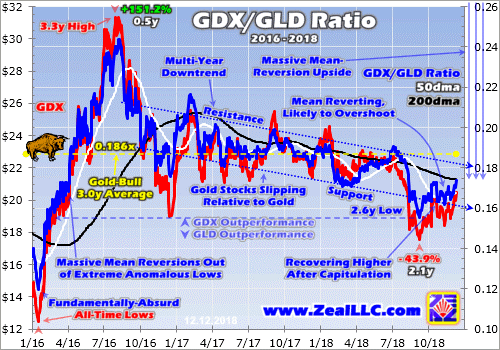

The ratio between the closing prices of GDX and the dominant GLD SPDR Gold Shares gold ETF is an easy approximation of the critical fundamental relationship between gold-stock prices and gold levels. This last chart is updated from a mid-October essay where I explained why gold stocks are the last cheap sector in all the stock markets. The GDX/GLD Ratio shows gold stocks have vast room to mean revert higher.

This GGR construct has averaged 0.186x during the 3.0 years of this current gold bull so far. This week the GGR clawed back to 0.174x, hitting its own 200dma. But at the gold stocks’ deep capitulation low in mid-September, the GGR plunged all the way down to 0.155x. That’s 0.031x below normal for this bull. After GGR extremes in either direction, this key ratio tends to mean revert the other way and overshoot proportionally.

That argues GDX is easily likely to surge far enough leveraging gold’s gains to regain a 0.217x GGR. That’s certainly not a high level even in the modest context of this gold bull. At this week’s $1245 gold levels which translated near $118 in GLD terms, GDX would have to surge to $25.56 to accomplish that normal mean-reversion overshoot. That’s another 25.0% higher, which would make for a solid upleg well worth riding.

And that GGR target is still incredibly low in longer secular context. In the 2 years before 2008’s first stock panic in a century, the GGR averaged 0.591x. Though gold stocks plummeted in the extreme fear that panic spawned, the GGR rebounded to average 0.422x in the 2 years after that epic anomaly. Over a longer 4-year post-panic span, it averaged 0.381x. So seeing it regain 0.217x is nothing, it should go far higher.

The bigger gold’s own upleg, the more the gold stocks will outperform by the usual 2x to 3x and force the GGR higher. At $1525 gold after a relatively-small 30% upleg, that 2009-to-2012 post-panic-average GGR of 0.381x would yield a GDX upside target around $55 per share. That’s 169% higher from this week’s levels, even without an overshoot! Gold-stock profits growth from higher gold prices justifies huge gains.

And rather conveniently on the verge of that GDX triple breakout, a major gold-buying catalyst is likely this week. On Wednesday December 19th, the Fed’s FOMC meets to decide on whether or not to hike rates for the 9th time in this cycle. That rate hike has been universally expected for months now, it is fully baked in. But the thing gold-futures and dollar-futures traders are really watching is the rate-hike forecast.

While the FOMC meets 8 times per year, at every other meeting it releases something called the dot plot. That summarizes where top Fed officials making the decisions think the federal-funds rate should be in coming years. The last dot plot was published on September 26th when the S&P 500 remained just 0.8% under its all-time record high from a week earlier. Fed officials are boldly hawkish when stocks are high.

But the stock markets soon fell apart in Q4’18, the first in history seeing full-speed quantitative-tightening monetary destruction by the Fed! Various Fed officials including the chairman have waxed more dovish since stocks started sliding. Fearing a negative wealth effect adversely impacting the US economy, their resolve to hike rates withers. So there’s a good chance this week’s dot plot will be more dovish than the last one.

Late September’s had effectively forecast 5 more Fed rate hikes including at next week’s meeting. So if this new dot plot shows less than 4 total rate hikes forecast in 2019 and 2020, dollar-futures speculators will likely sell motivating gold-futures speculators to buy aggressively. Fewer expected rate hikes are very bullish for gold, as proven in past dot plots. A great example was the 5th hike of this cycle in December 2017.

A year ago this week the FOMC hiked, but its dot-plot rate-hike forecast was dovish. Instead of upping it to 4 rate hikes in 2018 as traders expected, Fed officials left it at 3. So over the next 6 weeks, gold shot up 9.2% to $1358 on heavy gold-futures buying by speculators. A similar rally after next week’s meeting if the dot plot forecasts fewer rate hikes than the last one would drive gold right back up near $1360 again.

That’s on the verge of a major bull-market breakout which would likely unleash massive new investment buying. And any material gold rally will light a big fire under the gold stocks, rapidly driving them higher. That would put GDX’s triple breakout in the bag with haste. Nothing drives big capital inflows into the gold stocks faster than seeing them decisively rally. They are perfectly set up for major gains in coming months!

A big mean-reversion rebound higher is inevitable and likely imminent. While traders can play it in GDX, that’s mostly a bet on the largest gold miners with slowing production. The best gains by far will be won in smaller mid-tier and junior gold miners with superior fundamentals. A carefully-handpicked portfolio of elite gold and silver miners will generate much-greater wealth creation than ETFs dominated by underperformers.

The key to riding any gold-stock bull to multiplying your fortune is staying informed, both about broader markets and individual stocks. That’s long been our specialty at Zeal. My decades of experience both intensely studying the markets and actively trading them as a contrarian is priceless and impossible to replicate. I share my vast experience, knowledge, wisdom, and ongoing research through our popular newsletters.