Back during the bear market years (it’s nice to be able to write that now), I regularly would compare the declines in Gold, Silver and gold stocks to their past history. It gave us a visual representation of just how bad the forever bear market was and helped us decipher when it might end.

Thankfully that is all behind us.

Now it’s time to compare recent bullish moves to past iterations.

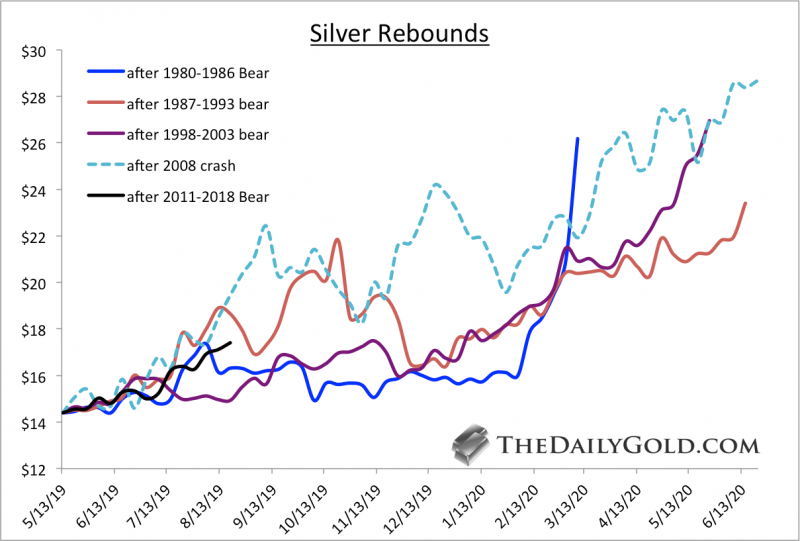

First is Silver.

The recent low in Silver has several good comparisons, which include the lows in 1986, 1993 and 2003. We also included the 2008 low.

If Silver’s rebound were simply an average of the four rebounds shown then it would reach nearly $24 by the end of March 2020.

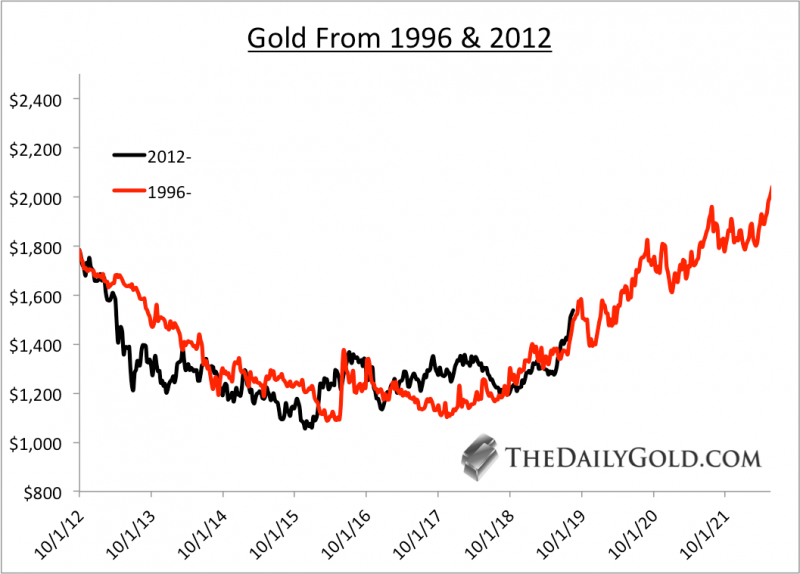

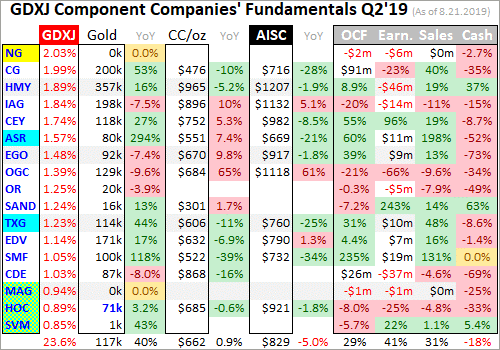

Gold is tricky because there is not an obvious bull comparison. Its major lows were essentially in 1970, 1985 and 1999 to 2001.

However, when we consider the preceding bear market, the best comparison to the recent bear and current bull is the late 1990s and early 2000s.

Mind you, we aren’t forecasting or predicting that 2003 to 2006 will be duplicated over the next three years. It’s possible, but we are simply arguing that the 2012 to 2019 period most resembles 1996 to 2003.

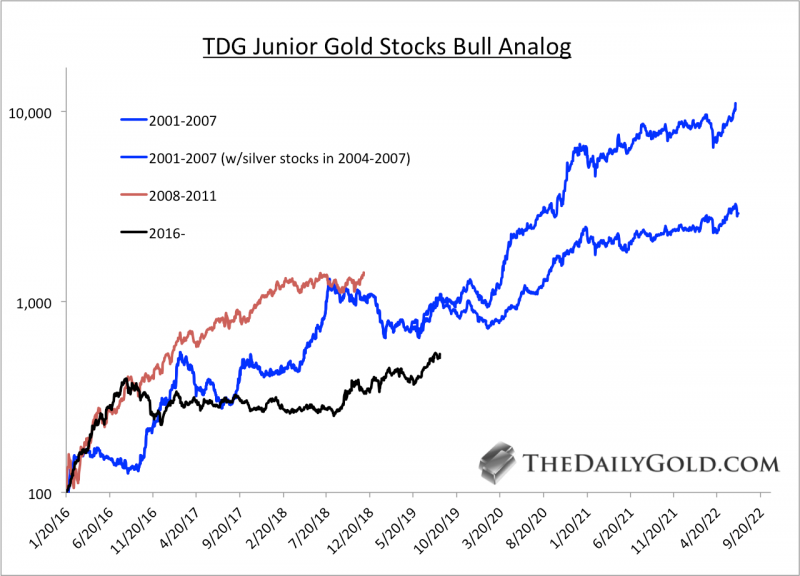

Turning to the gold stocks and specifically the junior gold stocks, here is how the 2016 bottom compares to the bottoms in 2001 and 2008.

Note that the basket of 20 stocks we used is quite strong compared to GDXJ. In other words, we erred on the side of positive performance.

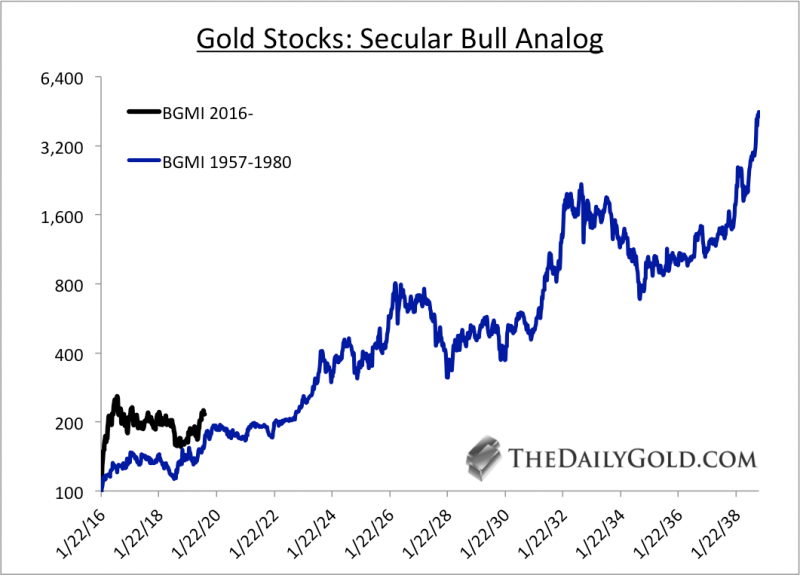

In our new book (available at TheDailyGold.com), we argue that the 2016 low in gold stocks was very similar to the 1957 low.

There are numerous similarities between today and the early to mid 1960s. That includes the gold stocks and their incredible long-term value at the start of a major inflationary cycle.

Below we compare the 1957 and 2016 lows with data from the Barron’s Gold Mining Index, which appreciated over 40-fold from its 1957 low to the peak in 1980.

As you can see, if Gold remains in a real bull market then significant upside potential remains in place across the precious metals complex.

Fundamentally, Gold could remain in a bullish trend until the next economic recovery gains traction. That could be anywhere from a few to four years away.

If gold continues to follow the pattern of the early 2000s then it could reach $3000/oz by the start of 2023.

Jordan Roy-Byrne CMT, MFTA

August 28, 2019

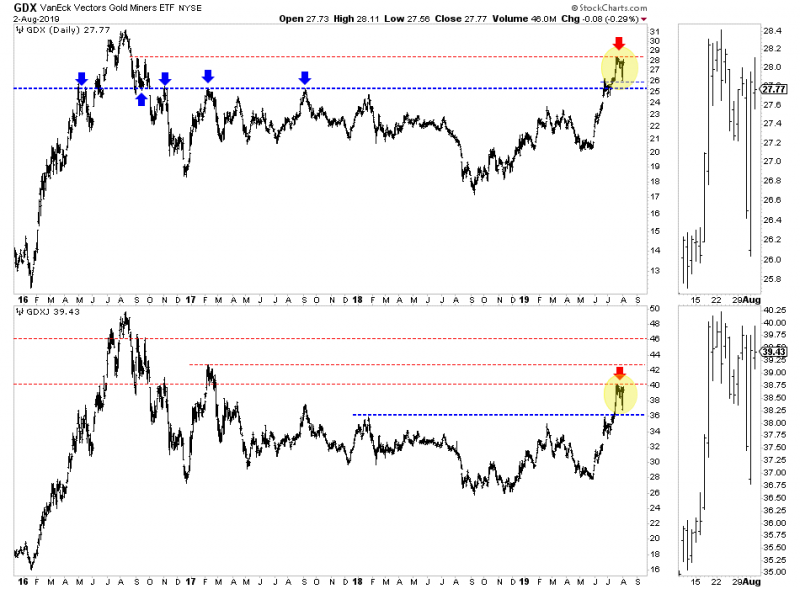

- A year ago, I predicted that any U.S. stock market sell-off would be accompanied by a dramatic surge in the price of GDX an GDXJ.

- That’s exactly what happened; the stock market tanked and key gold stocks soared.

- This year, I’m predicting that any major U.S. stock market crash will again be accompanied by the soaring price of the gold producers…

- But I’m also predicting that most CDNX-listed junior explorers are set to soar too!

- Please click here now. America’s top money printing cheerleader (President Trump) brags that his government essentially has the Chinese government cowering in a corner. He claims they are ready to throw in the white towel in the trade war. Reality check:

- It’s obvious that major money managers are becoming very concerned about these tariff taxes.

- Please click here now. Double-click to enlarge this horrifying U.S. stock market chart.

- On the one hand, private enterprise must be respected. Great companies exist and prosper in the socialist nations of Europe and in China. They will continue to prosper.

- The drive of entrepreneurs must never be underestimated, even in the harshest conditions.

- On the other hand, when governments unveil growth-negative policies like tariff taxes and money printing, stock markets can experience dramatic declines. These declines are usually temporary, but they are very painful.

- Please click here now. Double-click to enlarge this important gold stocks versus gold chart.

- I call it the “Just buy” chart, because there really isn’t much else to do here except buy, buy, and buy!

- That’s especially true for core position enthusiasts. Gold stocks are incredibly cheap compared to gold bullion.

- Also, I believe investors can make the most money in the market buying when their analysis has gone awry. On that note, please click here now. Double-click to enlarge my “Golden Beeline” chart.

- Many gold analysts have tried to “top call” gold since the rally from about $1167 began. This has been a mistake and I believe it will continue to be a mistake in the months ahead.

- A gargantuan bull continuation pattern is forming on the weekly gold chart. It’s an inverse H&S pattern with a potential neckline in the $2000 area.

- This is not a time to sell gold or top call it. It’s a time to buy, sit back, and watch those positions fly! Here’s why:

- Institutional money managers are adding gold to their portfolios. These are not highly leveraged hedge funds gambling on the COMEX.

- They are unleveraged institutions. They are serious players who understand the destructive nature of the Trump tariff taxes. These taxes are being implemented as the business cycle peaks and with relentless ramp-up of U.S. government spending and debt.

- This horrifying scenario has superstar managers like Ray Dalio predicting serious inflation and potential rioting in the streets.

- Please click here now: Top money managers are concerned that stagflation is emerging as the Fed is forced to print money and cut rates to offset the taxes. They are not buying gold, silver, and the miners for a “quick flip”. This is long-term allocation.

- Please click here now. Double-click to enlarge this fabulous GDX chart.

- Profit-lock enthusiasts can buy a breakout over $30 and place a stoploss at $27.50. A move above $30 opens the door for a violent surge to $37-$39.

- From there, core positions can be added on a pullback to about $30. Nervous investors can buy put options to manage their emotions, but everyone else should be in “Buy & Fly!” mode alongside the institutional money managers. Today’s Superman is a man of gold and looking at GDX today, I believe he would say… Up, up, and away!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Golden Junior Rockets!” report. I highlight junior miners trading under $2/share that are beginning to soar, with key buy and sell prices for each stock.

Thanks,

Stewart Thomson

Graceland Updates

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

The mid-tier gold miners’ stocks have soared in recent months on gold’s decisive bull-market breakout. They are this sector’s sweet spot for stock-price upside potential, with room for strong production growth which investors love. That’s an attractive contrast to the stagnating major gold miners. The mid-tiers’ recently-reported Q2’19 results reveal whether their fundamentals justify their strong surge this summer.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the U.S. Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

The global nature of the gold-mining industry complicates efforts to gather this important data. Many mid-tier gold miners trade in Australia, Canada, South Africa, the United Kingdom, and other countries with quite-different reporting requirements. These include half-year reporting rather than quarterly, long 90-day filing deadlines after year-ends, and very-dissimilar presentations of operating and financial results.

The definitive list of mid-tier gold miners to analyze comes from the GDXJ VanEck Vectors Junior Gold Miners ETF. Despite its misleading name, GDXJ is totally dominated by mid-tier gold miners and not juniors. GDXJ is the world’s second-largest gold-stock ETF, with $4.5b of net assets this week. That is only behind its big-brother GDX VanEck Vectors Gold Miners ETF that includes the major gold miners.

Major gold miners are those that produce over 1m ounces of gold annually. The mid-tier gold miners are smaller, producing between 300k to 1m ounces each year. Below 300k is the junior realm. Translated into quarterly terms, majors mine 250k+ ounces, mid-tiers 75k to 250k, and juniors less than 75k. GDXJ was originally launched as a real junior-gold-stock ETF as its name implies, but it was forced to change its mission.

Gold stocks soared in price and popularity in the first half of 2016, ignited by a new bull market in gold. The metal itself awoke from deep secular lows and surged 29.9% higher in just 6.7 months. GDXJ and GDX skyrocketed 202.5% and 151.2% higher in roughly that same span, greatly leveraging gold’s gains! As capital flooded into GDXJ to own junior miners, this ETF risked running afoul of Canadian securities laws.

Canada is the center of the junior-gold universe, where most juniors trade. Once any investor including an ETF buys up a 20%+ stake in a Canadian stock, it is legally deemed a takeover offer. This may have been relevant to a single corporate buyer amassing 20%+, but GDXJ’s legions of investors certainly weren’t trying to take over small gold miners. GDXJ diversified away from juniors to comply with that archaic rule.

Smaller juniors by market capitalization were abandoned entirely, cutting them off from the sizable flows of ETF capital. Larger juniors were kept, but with their weightings within GDXJ greatly demoted. Most of its ranks were filled with mid-tier gold miners, as well as a handful of smaller majors. That was frustrating, but ultimately beneficial. Mid-tier gold miners are in the sweet spot for stock-price-appreciation potential!

For years major gold miners have struggled with declining production, they can’t find or buy enough new gold to offset their depletion. And the stock-price inertia from their large market capitalizations is hard to overcome. The mid-tiers can and are boosting their gold output, which fuels growth in operating cash flows and profitability. With much-lower market caps, capital inflows drive their stock prices higher much faster.

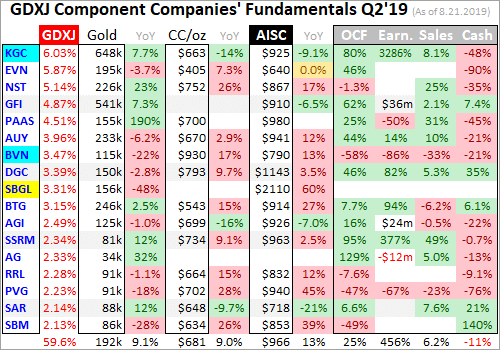

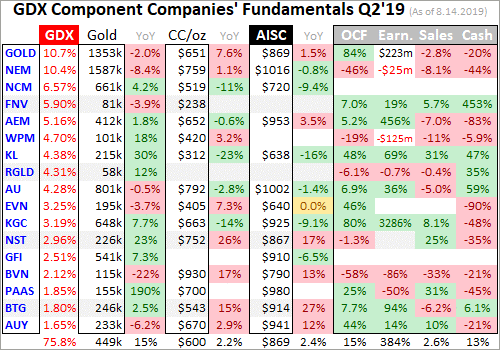

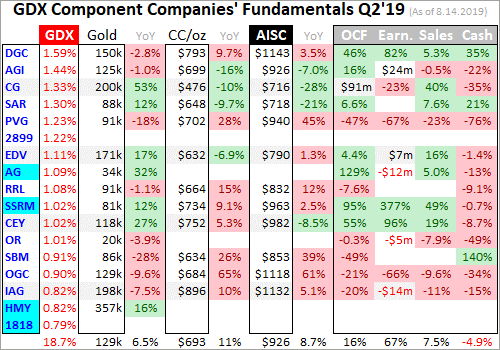

Every quarter I dive into the latest results from the top 34 GDXJ components. That’s simply an arbitrary number that fits neatly into the tables below, but a commanding sample. These companies represented 83.2% of GDXJ’s total weighting this week, even though it contained a whopping 70 stocks! 3 of the top 34 were majors mining 250k+ ounces, 24 mid-tiers at 75k to 250k, 5 “juniors” under 75k, and 2 explorers with zero.

These majors accounted for 12.8% of GDXJ’s total weighting, and really have no place in a “Junior Gold Miners ETF” when they could instead be exclusively in GDX. These mid-tiers weighed in at 60.9% of GDXJ. The “juniors” among the top 34 represented just 6.6% of GDXJ’s total. But only 1 of them at a mere 0.9% of GDXJ is a true junior, meaning it derives over half its revenues from actually mining gold.

The rest include 2 primary silver miners, a gold-royalty company, and a gold streamer. GDXJ is actually a full-on mid-tier gold miners ETF, with modest major and tiny junior exposure. Traders need to realize it is not a junior-gold investment vehicle as advertised. GDXJ also has major overlap with GDX. Fully 29 of these top 34 GDXJ gold miners are included in GDX too, with 23 of them also among GDX’s top 34 stocks.

The GDXJ top 34 accounting for 83.2% of its total weighting also represent 39.8% of GDX’s own total weighting! The GDXJ top 34 mostly clustered between the 10th- to 40th-highest weightings in GDX. Thus nearly 5/6ths of GDXJ is made up by almost 4/10ths of GDX. But GDXJ is far superior, excluding the large gold majors struggling with production growth. GDXJ gives much-higher weightings to better mid-tier miners.

The average Q2’19 gold production among GDXJ’s top 34 was 157k ounces, a bit over half as big as the GDX top 34’s 299k average. Despite these two ETFs’ extensive common holdings, GDXJ is increasingly outperforming GDX. GDXJ holds many of the world’s best mid-tier gold miners with big upside potential as gold’s own bull continues powering higher. Thus it is important to analyze GDXJ miners’ latest results.

So after each quarterly earnings season I wade through all available operational and financial reports and dump key data into a big spreadsheet for analysis. Some highlights make it into these tables. Any blank fields mean a company hadn’t reported that data as of this Wednesday. The first couple columns show each GDXJ component’s symbol and weighting within this ETF as of this week. Not all are U.S. symbols.

19 of the GDXJ top 34 primarily trade in the U.S., 5 in Australia, 8 in Canada, and 2 in the U.K. So some symbols are listings from companies’ main foreign stock exchanges. That’s followed by each gold miner’s Q2’19 production in ounces, which is mostly in pure-gold terms excluding byproducts often found in gold ore like silver and base metals. Then production’s absolute year-over-year change from Q2’18 is shown.

Next comes gold miners’ most-important fundamental data for investors, cash costs and all-in sustaining costs per ounce mined. The latter directly drive profitability which ultimately determines stock prices. These key costs are also followed by YoY changes. Last but not least the annual changes are shown in operating cash flows generated, hard GAAP earnings, revenues, and cash on hand with a couple exceptions.

Percentage changes aren’t relevant or meaningful if data shifted from positive to negative or vice versa, or if derived from two negative numbers. So in those cases I included raw underlying data rather than weird or misleading percentage changes. In cases where foreign GDXJ components only released half-year data, I used that and split it in half where appropriate. That offers a decent approximation of Q2 results.

Symbols highlighted in light blue newly climbed into the ranks of GDXJ’s top 34 over this past year. And symbols highlighted in yellow show the rare GDXJ-top-34 components that aren’t also in GDX. If both conditions are true, blue-yellow checkerboarding is used. Production bold-faced in blue shows any rare junior gold miners in GDXJ’s higher ranks, under 75k ounces quarterly with over half of sales from gold.

This whole valuable dataset compared with past quarters offers a fantastic high-level read on how mid-tier gold miners are faring fundamentally as an industry. This last quarter was interesting, as gold’s awesome breakout surge to major new secular highs didn’t get underway until just before quarter-end. So the mid-tier gold miners had to contend with flat gold prices, with Q2’19’s average of $1309 merely 0.2% higher YoY.

The shuffling in the ranks of GDXJ’s top 34 components continued over this past year, with major gold miner Kinross Gold added. It, Gold Fields, and Harmony Gold really should be shifted exclusively into GDX since their production is way into major-dom. Gold miners of that scale just defeat the purpose of a “Junior Gold Miners ETF”, retarding its upside potential and eroding traders’ confidence in its managers’ competence.

Most of the other new additions are good though, including mid-tiers Buenaventura, Alacer Gold, and Torex Gold. While Hochschild Mining was technically a junior last quarter, it will likely soon grow into a mid-tier mining 75k+ ounces of gold quarterly. But there’s one GDXJ component that reported such an extreme quarter that it skews most of the year-over-year comparisons. That is South Africa’s Sibanye-Stillwater.

SBGL is actually a primary platinum-group-metals miner, which drove nearly two-thirds of its implied revenue based on average metals prices in Q2! Its shrinking South African gold operations are a total mess, just emerging from a 5-month-long strike organized by a violent Marxist union. That crippled its gold mines, and left at least 9 people dead! Sibanye-Stillwater also has to fight South Africa’s absurdly-corrupt government.

Even though that hellish strike ended in mid-April, very early in Q2, SBGL’s gold production plummeted a catastrophic 47.9% YoY last quarter! That catapulted its all-in sustaining costs to a ridiculous $2110 per ounce, up an extreme 60.5% YoY from already-high levels. This shocking anomaly needs to be excluded in GDXJ comparisons. I wouldn’t invest in this company if it was the last miner on earth, it is a nightmare.

Production has always been the lifeblood of the gold-mining industry. Gold miners have no control over prevailing gold prices, their product sells for whatever the markets offer. Thus growing production is the only manageable way to boost revenues, leading to amplified gains in operating cash flows and profits. Higher production generates more capital to invest in expanding existing mines and building or buying new ones.

Thus gold-stock investors have long prized production growth above everything else, as it is inexorably linked to company growth and thus stock-price-appreciation potential. In Q2’19 these GDXJ-top-34 gold miners collectively produced 5.0m ounces of gold. That was actually down 1.2% YoY, which is worse than the 0.7% shrinkage the top 34 GDX majors reported last quarter after being adjusted for mega-mergers.

But excluding SBGL’s mayhem, the rest of the GDXJ top 34 actually managed to grow their total output by an impressive 1.7% YoY to 4.9m ounces! That not only trounced the majors, but narrowly bested the world’s aggregate production growth in Q2. According to gold’s leading fundamental authority, the World Gold Council, total world output grew 1.6% YoY last quarter to 28.4m ounces. The mid-tiers are thriving.

The GDXJ mid-tiers were able to enjoy strong production growth because this ETF isn’t burdened with many struggling major gold miners that dominate GDX. Again GDXJ’s components start at the 10th-highest weighting in GDX. The 9 above it averaged colossal Q2 production of 585k ounces, which is 3.7x bigger than the GDXJ top 34’s average! Gold mining’s inherent geological limitations make it very difficult to scale.

The more gold miners produce, the harder it is to even keep up with relentless depletion let alone grow their output consistently. Large economically-viable gold deposits are getting increasingly difficult to find and ever-more-expensive to develop, with low-hanging fruit long since exploited. But with much-smaller production bases, mine expansions and new mine builds generate big output growth for mid-tier golds.

The majors don’t only face that large-base growth problem with their production scales, but also with their stocks’ market capitalizations. The GDXJ top 34 companies averaged $2.5b in the middle of this week, compared to $6.9b in the GDX top 34 when I analyzed their Q2 results last week. With the mid-tiers generally around a third as big as the majors, their stock prices have much less inertia restraining them.

With gold returning to favor since late June’s awesome decisive bull-market breakout, the mid-tier-filled GDXJ is already outperforming the major-dominated GDX. Since its year-to-date low in late May, GDXJ surged as much as 52.1% higher by early August! That was considerably better than GDX’s 46.2% rally in the same timeframe. The longer gold-bull uplegs persist, the bigger the mid-tier outperformance grows.

The mid-tier gold miners continue to prove all-important production growth is achievable off smaller bases. With a handful of mines or less to operate, mid-tiers can focus on expanding them or building a new mine to boost their output beyond depletion. But the majors are increasingly failing to do this from the super-high production bases they operate at. As long as majors are struggling, it is prudent to avoid them.

Also interesting on the mid-tier production front was silver. Last quarter the GDXJ-top-34 miners’ silver output blasted 42.8% higher YoY to 28.2m ounces! Some of these companies indeed saw exploding silver production, led by Yamana Gold’s rocketing up 65.8% YoY to 2.2m ounces and SSR Mining’s soaring a similar 55.8% YoY to 1.5m ounces. But new GDXJ-top-34 components drove most of the silver growth.

Buenaventura and Hochschild Mining produced 5.5m and 4.3m ounces of silver last quarter, and they weren’t in GDXJ’s top 34 in Q2’18. Excluding them, the rest of these mid-tier gold miners actually saw their total silver output slump 5.1% YoY. I’ll discuss the serious challenges silver mining faces in next week’s essay, which will wade through the results of the top silver miners of the leading silver miners’ ETF.

In gold mining, production and costs are generally inversely related. Gold-mining costs are largely fixed quarter after quarter, with actual mining requiring about the same levels of infrastructure, equipment, and employees. So the higher production, the more ounces to spread mining’s big fixed costs across. Thus Q2’19’s solid production growth among the GDXJ top 34 ex-SBGL should’ve yielded proportionally-lower costs.

There are two major ways to measure gold-mining costs, classic cash costs per ounce and the superior all-in sustaining costs per ounce. Both are useful metrics. Cash costs are the acid test of gold-miner survivability in lower-gold-price environments, revealing the worst-case gold levels necessary to keep the mines running. All-in sustaining costs show where gold needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of gold, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q2’19 these top-34-GDXJ-component gold miners that reported cash costs averaged $672 per ounce. That actually rose a sharp 6.6% YoY, and was worse than the GDX-top-34 majors’ $641 mean.

Sibanye-Stillwater didn’t report Q2 cash costs, so that wasn’t a factor. But a couple of other anomalous situations dragged up this average. Buenaventura has been struggling with weaker production, resulting in extreme $930 cash costs last quarter. And Harmony Gold, a South African miner facing that country’s miserable operating environment, had even-worse $965 cash costs in Q2’19! Those are crazy-high.

Excluding them, the rest of the GDXJ top 34 averaged $650. That’s towards the lower end of the GDXJ-top-34 average range of $612 to $730 in the 13 quarters I’ve been advancing this deep-quarterly-results research thread. As long as cash costs remain far below prevailing gold prices, which was certainly true in Q2, the gold miners face no existential threat. Gold returning to favor is really widening that key survival gap.

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain gold mines as ongoing concerns. AISCs include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current gold-production levels.

These additional expenses include exploration for new gold to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee gold mines. All-in sustaining costs are the most-important gold-mining cost metric by far for investors, revealing companies’ true operating profitability.

The GDXJ-top-34 AISC picture in Q2’19 looked much like the cash-cost one, with average AISCs surging 6.1% YoY to $941 per ounce. That was on the higher side of the past 13 quarters’ range from $855 to $1002, but way below Q2’s average gold price of $1309. That implies GDXJ’s mid-tier gold miners were already earning sizable $368 profits last quarter. But this AISC read was heavily skewed by SBGL’s mess.

Again that cursed gold miner’s AISCs skyrocketed 60.5% YoY to an unbelievable $2110! That was as high as I’ve ever seen, and SBGL tried to bury this deep in its Q2 reporting. The strike was blamed, even though it ended in early Q2. But remove that wild outlier from the pool, and the rest of the GDXJ-top-34 gold miners averaged AISCs of $896 per ounce. That’s actually right in line with the GDX top 34’s $895.

With gold rocketing back over $1500 earlier this month to hit 6.3-year secular highs, it is easy to assume the gold miners must be thriving fundamentally. And they likely are. But realize the lion’s share of the recent huge gold gains didn’t start until late June when gold decisively broke out to new bull-market highs. So these Q2 results don’t yet reflect these new higher gold prices. But Q3’s are on track to look spectacular.

Gold’s lofty $1446 average price so far this quarter is a whopping 10.5% higher quarter-on-quarter than Q2’s! So the current likely profitability of the gold miners post-gold-breakout is far higher than seen last quarter. Assuming the GDXJ top 34’s average all-in sustaining costs hold flat near $941 this quarter, that implies Q3 profits running $505 per ounce. That’s up a massive 37.2% QoQ from what was seen in Q2!

This incredible profits leverage to gold is what makes gold stocks so alluring during major gold uplegs. Their earnings grow so darned fast, 3.5x gold’s advance in this example, that big stock-price gains are usually fundamentally-justified. In Q2’19, GDXJ averaged $30.46 per share. That’s when you should’ve been buying gold stocks, when they were low and out of favor. I explained their bullish outlook in early April.

So far in Q3 which is more than half over, GDX has averaged $38.43 which is 26.2% higher QoQ. That is still lagging big expected profits growth among mid-tier gold miners this quarter given the much-higher prevailing gold prices. So gold stocks’ strong gains in recent months are fundamentally-righteous, supported by underlying earnings growth and sustainable as long as gold holds over $1446 into quarter-end.

The mid-tier gold miners reported good accounting results last quarter even before gold reignited. The GDXJ top 34’s total revenues soared 23.0% YoY to $6.6b! While that is certainly overstated given the new inclusion of major gold miner Kinross Gold, without it the rest of these companies still saw strong 7.3% YoY growth. That’s impressive given Q2’19’s dead-flat average gold price, up a trivial 0.2% YoY.

These strong operations drove exploding operating-cashflow generation, with the GDXJ top 34’s total blasting 44.2% higher YoY to $2.3b! Even without KGC they still rose 23.6% YoY. And these elite mid-tier gold miners were investing some of this new capital in expanding their mines, which investors always like to see. Their collective cash hoards sunk 12.6% YoY to $6.0b, which remains healthy given mid-tiers’ sizes.

The GDXJ top 34’s profits under Generally Accepted Accounting Principles radically improved as well. Together they earned $291m last quarter, which was a colossal improvement from Q2’18’s $410m loss. Even though $384m of that resulted from an impairment charge by a single component miner that quarter, the mid-tiers’ profits picture still greatly improved. And that was even with last quarter’s still-anemic $1309 gold.

Imagine how awesome these numbers will look in this current quarter given all the gold fireworks since the end of Q2! The mid-tier gold miners generally report their results 4 to 6 weeks after quarter-ends, so Q3’19 fundamental performance will be revealed in the first half of November. As long as gold sentiment remains decent, these Q3 results should really impress and attract in legions of new investors to this sector.

That being said, gold and gold stocks have soared really far really fast this quarter. Sentiment quickly grew greedy as really-overbought levels were reached. Couple that with today’s menacing overhang of huge potential gold-futures selling, and a healthy bull-market correction is likely. But now is the time to do your homework before buying lower later, to ferret out the high-potential gold miners with superior fundamentals.

All portfolios need a 10% allocation in gold and its miners’ stocks! This is more important than ever with gold finally waking up from its long slumber while lofty central-bank-goosed stock markets are looking increasingly precarious. The better mid-tier gold miners are the place to be. Unlike the majors, they are actually growing their production and have far-higher upside coming from lower-market-capitalization bases.

To multiply your capital in the markets, you have to trade like a contrarian. That means buying low when few others are willing, so you can later sell high when few others can. In the first half of 2019 well before gold’s breakout, we recommended buying many fundamentally-superior gold and silver miners in our popular weekly and monthly newsletters. We’ve recently realized big gains including 109.7%, 105.8%, and 103.0%!

To profitably trade high-potential gold stocks, you need to stay informed about the broader market cycles that drive gold. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off summer-doldrums sale! The biggest gains are won by traders diligently staying abreast so they can ride entire uplegs.

The bottom line is the mid-tier gold miners are thriving fundamentally. Their Q2 results were good, even before gold’s powerful bull-market breakout. They are growing production while holding the line on costs. That means their earnings will soar as gold powers higher on balance in its resurgent bull market. That will support much-higher gold-stock prices in the future, and attract traders back to this long-neglected sector.

Gold’s bull market will flow and ebb as always, so gold-stock positions should be accumulated relatively low in post-selloff troughs. There’s no need to buy high at crests when everyone is excited. But you have to prepare in advance, monitoring the markets and researching the gold miners to be ready to pounce at opportune times. Capital allocations should be focused on mid-tier gold miners with superior fundamentals.

Adam Hamilton, CPA

August 26, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

- More powerful money managers are stepping forward to recommend gold in a negative real rates environment.

- Please click here now. The focus of these elite money managers and analysts is mainly on bullion.

- Many of the more speculative junior miners that trade on the CDNX have yet to participate in this gigantic rally, but that may indicate that the rally is only in the earliest stages.

- Please click here now. Double-click to enlarge this daily chart. Numerous bull flags have been forming on the charts for gold, silver, and ETFs like GDX and GOAU.

- Please click here now. Double-click to enlarge this USD vs Chinese yuan chart. It’s almost comical that since the US government launched a “trade war” against China in early 2018, the dollar has rallied relentlessly against the yuan.

- Instead of working to reduce the dollar-yuan price, the American government has launched a tidal wave of tariff taxes. That has pushed the dollar higher.

- This policy has increased the Chinese trade surplus with America and the US government’s silly response has been to threaten to impose even more tariff taxes on all Chinese exports to America.

- Money managers are very concerned and flocking to gold!

- In India it could be argued that the Modi government has essentially taken over the central bank and is forcing the bank to begin a long-term rate cutting policy. That policy is designed to reduce the growth-destructive actions of tariff taxes on gold and demonetization.

- I believe the US government plans to follow the Indian populist government’s lead and take it to another level. I’m predicting that in the next downturn, QE and zero-level interest rates will not boost growth at all. The US government is simply too big and carries too much debt.

- Roosevelt launched a socialist “New Deal” policy, purportedly to manage the negative effects of the Great Depression. A “New Deal 2.0” could involve the US government launching a new form of QE that involves student loans, credit card debt, and UBI (universal basic income).

- Money would be printed but the central bank would be ordered to buy consumer debt with the money, in addition to buying government debt.

- Gold would skyrocket but the stock market could also do well if the Fed follows the lead of the Swiss central bank and buys a lot of US stocks with some of the printed money.

- This would sow the seeds of hyperinflation, but I don’t think it will become a real concern until the use of the dollar in global financial transactions falls under 40%. It’s still about 60%.

- What about Jackson Hole? Well, from Thursday to Sunday the world’s central bankers gather there to discuss the global economy and markets. Could key statements from these power brokers trigger a significant reaction in gold?

- Please click here now. Double-click to enlarge this monthly gold chart.

- Fundamental news like tariff tax relief or positive statements from power brokers at Jackson Hole could cause a reaction from the $1500 resistance zone, but that’s a possibility and not a guarantee. Here’s why:

- Central bankers are very concerned about the refusal of governments (especially the American government) to reduce their footprint in the global economy. This is likely why central banks continue to claim that 1% euro zone and 2% American GDP growth is “robust”. It’s not robust, but claiming it is allows the banks to make a case for not cutting rates or renewing QE.

- The central bankers know that higher rates would incentivize commercial banks to lend and force debt-obsessed governments and citizens to reduce their debt loads. That would allow GDP growth to rise over the long-term in a sustained manner.

- Unfortunately, most Western governments want lower rates so they can “borrow to infinity” while claiming that lower rates and QE are helping the common man.

- Regardless, lower rates and QE are not going away and may soon become part of fiscal policy, targeting consumer debt. All roads obviously lead to gold!

- Please click here now. Double-click to enlarge. GDX has pulled back to some minor support. Is there cause for concern? I don’t think so. Money managers are excited but not greedy. That should instill confidence in all amateur gold stock investors.

- Please click here now. Double-click to enlarge. For investors who are unsure of what comes next for gold stocks, one approach is to use my guswinger.com signals to trade ETFs like NUGT and DUST with limited drawdowns. We booked some nice profits yesterday and we’re ready for anything that Jackson Hole brings!

- Another approach for eager gold stock investors would be to buy the $28-$26 range for GDX, with an optional stoploss placed just under $26. If gold does pullback from $1500 on Jackson Hole or tariff tax news, money managers will be buyers of both bullion and gold stocks. It’s a healthy market!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Safehavenization of Gold Stocks” report. I highlight key gold stocks that are becoming safe havens for money managers in a negative rates environment that appears to be here to stay! I include money making tactics to reduce drawdowns and enhance gains.

Thanks,

Cheers

Stewart Thomson

Graceland Updates

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Last week we wrote that near-term risk in precious metals (Gold and GDX especially) was rising and a correction could begin soon.

As Gold nearly reached major resistance at $1550/oz, the miners already began to correct. That negative divergence is an ominous signal for the sector in the short term.

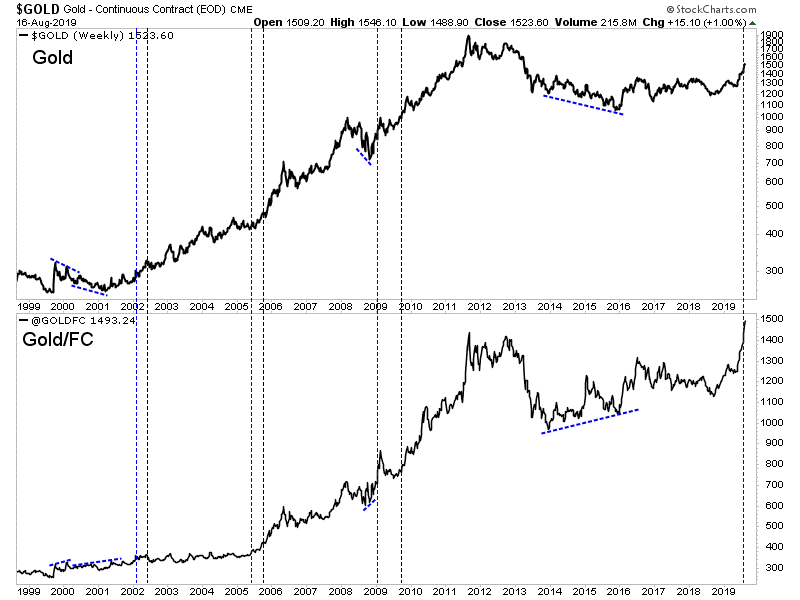

However, the good news is, at least at present, Gold remains very strong in real and intermarket terms.

The first example of that is Gold’s strength against foreign currencies (Gold/FC). Gold/FC made a new all time high a few weeks ago and is now 4% above the previous all time high.

In the chart below we mark the points when Gold/FC made a new high first in blue and Gold’s new highs in black. Note that when Gold/FC makes a new high first, Gold tends to follow.

Also, we should note that Gold’s false new high in 1996 and cyclical bull market from 1985 to 1987 were never confirmed by Gold/FC, which showed a negative divergence both instances.

Elsewhere, Gold is very strong against global equity markets and has reached important resistance relative to the S&P 500.

In all of these charts, including Gold against the S&P 500, the market is well above long-term moving averages and support. We do expect Gold to correct soon in both nominal and real terms but it does have plenty of breathing room.

Unlike in 2016, Gold against foreign currencies is at an all time high and the Federal Reserve has started a new cycle of rate cuts.

However, be advised that even within primary uptrends Gold and gold stocks have often consolidated and corrected for several months.

If you missed the recent run, then it is best to be patient, buy value and wait for weakness in the high quality juniors that appear extended. The best time to buy the leaders is during a correction. New opportunities will also emerge. To learn the stocks we own and intend to buy during this weakness that have 3x to 5x potential, consider learning more about our premium service.

The major gold miners’ stocks have soared in recent months, fueled by gold’s decisive breakout to new bull-market highs. Nothing motivates traders like performance, so interest in this long-neglected sector has exploded. While gold stocks’ technicals and sentiment have greatly strengthened, their just-reported Q2’19 results reveal whether their underlying fundamentals support their powerful surge and further upside.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the US Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

The definitive list of major gold-mining stocks to analyze comes from the world’s most-popular gold-stock investment vehicle, the GDX VanEck Vectors Gold Miners ETF. Launched way back in May 2006, it has an insurmountable first-mover lead. GDX’s net assets running $11.8b this week were a staggering 44.0x larger than the next-biggest 1x-long major-gold-miners ETF! GDX is effectively this sector’s blue-chip index.

It currently includes 44 component stocks, which are weighted in proportion to their market capitalizations. This list is dominated by the world’s largest gold miners, and their collective importance to this industry cannot be overstated. Every quarter I dive into the latest operating and financial results from GDX’s top 34 companies. That’s simply an arbitrary number that fits neatly into the tables below, but a commanding sample.

As of this week these elite gold miners accounted for fully 94.5% of GDX’s total weighting. Last quarter they combined to mine 297.6 metric tons of gold. That was 33.7% of the aggregate world total in Q2’19 according to the World Gold Council, which publishes comprehensive global gold supply-and-demand data quarterly. So for anyone deploying capital in gold or its miners’ stocks, watching GDX miners is essential.

The major gold miners dominating GDX’s ranks are scattered around the world. 20 of the top 34 mainly trade in US stock markets, 6 in Australia, 5 in Canada, 2 in China, and 1 in the United Kingdom. GDX’s geopolitical diversity is excellent for investors, but makes it more difficult to analyze and compare the larger gold miners’ results. Financial-reporting requirements vary considerably from country to country.

In Australia, South Africa, and the UK, companies report in half-year increments instead of quarterly. The big gold miners often publish quarterly updates, but their data is limited. In cases where half-year data is all that was made available, I split it in half for a Q2 approximation. While Canada has quarterly reporting, the deadlines are looser than in the States. Some Canadian gold miners drag their feet in getting results out.

While it is challenging bringing all the quarterly data together for the diverse GDX-top-34 gold miners, analyzing it in the aggregate is essential to see how they are doing. So each quarter I wade through all available operational and financial reports and dump the data into a big spreadsheet for analysis. The highlights make it into these tables. Blank fields mean a company hadn’t reported that data as of this Wednesday.

The first couple columns of these tables show each GDX component’s symbol and weighting within this ETF as of this week. While most of these stocks trade on US exchanges, some symbols are listings from companies’ primary foreign stock exchanges. That’s followed by each gold miner’s Q2’19 production in ounces, which is mostly in pure-gold terms. That excludes byproduct metals often present in gold ore.

Those are usually silver and base metals like copper, which are valuable. They are sold to offset some of the considerable expenses of gold mining, lowering per-ounce costs and thus raising overall profitability. In cases where companies didn’t separate out gold but lumped all production into gold-equivalent ounces, those GEOs are included instead. Then production’s absolute year-over-year change from Q2’18 is shown.

Next comes gold miners’ most-important fundamental data for investors, cash costs and all-in sustaining costs per ounce mined. The latter directly drives profitability which ultimately determines stock prices. These key costs are also followed by YoY changes. Last but not least the annual changes are shown in operating cash flows generated, hard GAAP earnings, revenues, and cash on hand with a couple exceptions.

Percentage changes aren’t relevant or meaningful if data shifted from positive to negative or vice versa, or if derived from two negative numbers. So in those cases I included raw underlying data rather than weird or misleading percentage changes. Companies with symbols highlighted in light-blue have newly climbed into the elite ranks of GDX’s top 34 over this past year. This entire dataset together is quite valuable.

It offers a fantastic high-level read on how the major gold miners are faring fundamentally as an industry. In Q2’19 the world’s larger gold miners continued their longstanding struggle against declining production. Last quarter was another major transition one with this past year’s gold-stock mega-mergers finally settled out. They’ve considerably altered major gold miners’ global landscape, ramping concentration risks in GDX.

Since Q2’19 was effectively the first quarter with those gold-stock mega-mergers complete, we have to start with them. In late September 2018, the world’s second-largest gold miner Barrick Gold rocked this small contrarian sector. It declared it was buying competitor Randgold in an all-stock acquisition worth $6.5b! That deal was to make Barrick the world’s largest gold miner, and was finalized in early January 2019.

But Barrick’s arch-rival Newmont wasn’t willing to lose the pole position, so within weeks it responded with a bigger salvo. In mid-January it announced it was buying its own major gold miner Goldcorp, which was about twice as large as Randgold in gold-output terms! Size does matter for elite gold-mining executives. This massive $10.0b all-stock deal wasn’t consummated until mid-April, encompassing most of Q2’19.

So last quarter was the first one where these new bigger and badder gold-mining behemoths dominated this sector and therefore GDX. Understanding these mega-mergers and their implications is essential for gold-stock traders. Back in mid-February I wrote a comprehensive essay explaining these deals and why they were done. They were desperate and expensive attempts to mask flagging production at both giants.

By the end of 2018, Barrick had suffered colossal annual production declines in 7 of the last 9 quarters averaging 12.4% year-over-year! It had proven incapable of growing its own operations organically, and thus had to resort to buying more. While Newmont had done a far-better job of maintaining its massive gold output, that too shrunk by an average of 5.9% YoY in 2018’s first three quarters. That trend was concerning.

I doubt Newmont’s managers would’ve bought Goldcorp if Barrick hadn’t forced their hand. But seeing their largest competitor gobble up a major gold miner was a shrill wake-up call. New gold deposits that are large enough to support operations at these giants’ huge scales are almost impossible to find, and take over a decade to develop. So buying production is the only way they can maintain their mining tempos.

But sadly for Barrick and Newmont shareholders, these mega-mergers look like an epic boondoggle! Both Randgold and Goldcorp were also suffering shrinking production as I outlined in that mega-merger essay. Combining two sets of major gold miners where all four already struggled to maintain their outputs wouldn’t fix this intractable problem. The mergers just mask it, and only for the first four quarters post-deals.

Narrowly the world’s largest gold miner by market cap, Barrick Gold reported its Q2’19 results on August 12th. Its mega-merger was trumpeted as “building a business that would be a model of value creation for the mining industry.” Barrick’s Q2 gold production rocketed 26.8% higher YoY. But if Randgold’s from Q2’18 is added in to those comparable results, the combined giant actually saw a 2.0% YoY decline in output!

The inexorable depletion-driven shrinkage continues, which will become glaringly apparent when Q1’20 rolls around after 2019’s four quarters of pre-merger to post-merger comparisons. Barrick sure looks to have squandered $6.5b of shareholders’ capital on four quarters of production growth! They should have been furious. If Barrick failed to grow its own output for years, how can it grow that from Randgold’s mines?

So in these tables the year-over-year comparisons show the new post-merger Barrick versus the smaller pre-merger Barrick and Randgold combined in Q2’18. I did the same thing for Newmont and Goldcorp, comparing the newly-merged giant’s Q2’19 results with the total of both its predecessors in Q2’18. It is really important investors and speculators understand that these gold-mining behemoths are not growing.

The new Newmont Goldcorp released its Q2 results on July 25, touting its mega-merger as having “positioned Newmont Goldcorp as the world’s leading gold business for decades to come.” And not surprisingly Newmont’s quarterly gold production soaring 36.6% YoY looked amazing. With gold stocks surging with gold in the month or so before that release, the financial media celebrated Newmont’s huge growth.

Yet shockingly when this post-merger giant’s Q2’19 production is compared to both its predecessors’ from Q2’18, it actually plunged 8.4% YoY! One-upping Barrick, Newmont’s managers apparently blew $10.0b of their investors’ holdings to show four quarters of big trans-merger production growth through Q1’20. But once Q2’20 arrives, all the comparisons will be post-merger and the shrinkage will again become apparent.

These new gold-mining giants are dominating and really distorting their sector. This week Newmont and Barrick commanded a total market capitalization of $63.4b, or 28.7% of the GDX top 34’s total! In terms of GDX weighting, they now account for 21.2% together. That compares to 16.4% in Q2’18 for just the two acquiring companies, and 26.1% for all four major gold miners. GDX is very concentrated in these giants.

Together Barrick and Newmont controlled 30.7% of the total Q2’19 gold production of the GDX top 34. If either of these colossi stumble in coming quarters hurting their stock prices, GDX will get dragged down with them. Traders need to realize GDX is more risky and less diversified than it was before these gold-stock mega-mergers. If you have doubts that Barrick and Newmont can grow, be wary of owning GDX!

Prior to last quarter, the primary theme of the major gold miners was inexorably declining production. I’ve discussed it extensively in earlier essays in this series, including the ones on Q1’19’s and Q4’18’s results from the GDX top 34. The gist of their core problem is large economically-viable gold deposits are getting ever-harder to find, and increasingly-expensive and time-consuming to exploit. Gold’s scarcity is mounting.

The world has been scoured for gold for centuries, with the low-hanging fruit long since picked. Really compounding these challenges, the low gold-stock prices in recent years left these companies largely starved of capital. So their exploration budgets cratered, further pinching their pipelines of new deposits to develop into new mines to replace current depleting ones. Thus Q2’s production growth looked amazing.

Together these elite top-34 GDX majors reported mining 9.6m ounces in Q2’19, which was up a big 5.6% YoY! If we could celebrate this as the potential start of a new production-growth trend, these latest results would have a very different tone. Unfortunately this higher collective gold output is another distortion from the mega-mergers. They combined four Q2’18 GDX component stocks into two, making room for two more.

One of the replacement GDX-top-34 components that climbed into these ranks is Harmony Gold, South Africa’s third-largest gold miner. It shot from being GDX’s 44th-largest holding a year earlier to 33rd this week. Harmony produced 357k ozs of gold in Q2’19 now included in the GDX-top-34 total, while none of its was in Q2’18’s. Excluding it alone collapses the GDX top 34’s output growth to 1.7% YoY, relatively flat.

The silver miners First Majestic Silver and SSR Mining were also newly included, producing 34k and 81k ozs of gold in Q2’19. Another traditional major silver miner Pan American Silver diversified heavily into gold over this past year, buying Tahoe Resources. So Tahoe’s former gold output not included in the GDX top 34’s in Q2’18 was added to Pan American’s in Q2’19, which nearly tripled it to 155k ozs last quarter.

Adjust for these new inclusions into GDX’s top-34 ranks, and their total Q2’19 gold production among the comparable companies actually shrunk a modest 0.7% YoY! The major gold miners’ long-vexing growth problems certainly haven’t gone away. And gold-stock investors have long prized production growth above everything else, as it is inexorably linked to company growth and thus stock-price-appreciation potential.

Sooner or later global peak-gold production will be reached, after which it starts declining on balance as major gold miners fail to find enough new deposits to replace depleting ones. That will leave smaller mid-tier gold miners able to consistently grow their output far more attractive for investors than the stagnating larger majors. So the major-dominated GDX isn’t the best way to deploy investment capital in this sector.

The production-cost front in Q2’19 highlighted the majors’ challenges. Gold-mining costs are mostly fixed quarter after quarter, with production generally requiring the same levels of infrastructure, equipment, and employees. These big fixed costs are largely determined during mine-planning stages, when engineers and geologists decide which gold-bearing ores to mine, how to dig to them, and how to recover their gold.

Because these ongoing mining costs are spread across quarterly production, gold output and unit costs are usually inversely proportional. The richer the gold ores fed through fixed-capacity mills, the more gold produced. The more gold produced, the more ounces to bear mining costs which lowers per-ounce costs and thus increases profitability. Q2’19’s slightly-lower gold output should’ve led to slightly-higher costs.

There are two major ways to measure gold-mining costs, classic cash costs per ounce and the superior all-in sustaining costs per ounce. Both are useful metrics. Cash costs are the acid test of gold-miner survivability in lower-gold-price environments, revealing the worst-case gold levels necessary to keep the mines running. All-in sustaining costs show where gold needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of gold, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q2’19 these top-34-GDX-component gold miners that reported cash costs averaged $641 per ounce. Bucking the production trend, this was actually up a sharp 5.2% YoY from Q2’18’s read!

Neither of the new mega-miners helped, with Barrick and Newmont seeing cash costs climb by 7.6% and 1.1% YoY to $651 and $759 respectively. Dragging the average higher was Peru’s Buenaventura, which continues to struggle with production issues. Its gold mined in Q2’19 plunged 22.0% YoY, forcing cash costs up 16.7% to an extreme $930! Excluding that wild outlier, the rest of GDX’s top 34 averaged $630.

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain gold mines as ongoing concerns. AISCs include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current gold-production levels.

These additional expenses include exploration for new gold to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee gold mines. All-in sustaining costs are the most-important gold-mining cost metric by far for investors, revealing gold miners’ true operating profitability.

These GDX-top-34 gold miners reported average AISCs of $895 per ounce in Q2’19, surging 4.6% higher YoY despite slightly-lower production! Those were relatively high absolutely too, the highest seen out of all 13 quarters since Q2’16 when I started this deep-quarterly-results research thread. Plenty of major gold miners are seeing their own costs rise as their production declines, ratcheting up the industry average.

$895 certainly isn’t a problem with gold prices averaging $1309 in Q2’19, enabling hefty profit margins around $414 per ounce. But the trend of rising production costs among the majors leaves them relatively less attractive going forward compared to their smaller peers gradually lowering their costs through higher outputs. This rising-cost trend needs to be watched, as it will retard the majors’ profits growth if it persists.

With gold rocketing back over $1500 in the last couple weeks to hit 6.3-year secular highs, it is easy to assume the gold miners must be thriving fundamentally. And they likely are. But realize the lion’s share of the recent huge gold gains didn’t start until late June when gold decisively broke out to new bull-market highs. So these Q2 results don’t yet reflect these new higher gold prices. That will come in Q3’s results.

Gold’s lofty $1436 average price so far this quarter is a whopping 9.7% higher quarter-on-quarter than Q2’s! So the current potential profitability of the gold miners post-gold-breakout is far higher than seen last quarter. Assuming the GDX top 34’s average all-in sustaining costs hold flat near $895 this quarter, that implies Q3 profits running $541 per ounce. That’s up a massive 30.7% QoQ from what was seen in Q2!

This incredible profits leverage to gold is what makes gold stocks so alluring during major gold uplegs. Their earnings grow so darned fast, 3.2x gold’s advance in this example, that big stock-price gains are usually fundamentally-justified. In Q2’19, GDX averaged $22.03 per share. That’s when you should’ve been buying gold stocks, when they were low and out of favor. I explained their bullish outlook in early April.

So far in Q3’19 which is about half over, GDX has averaged $27.32 which is 24.0% higher QoQ. That is right in line with expected profits growth among the major gold miners this quarter given the much-higher prevailing gold prices. So gold stocks’ strong gains in recent months are likely fundamentally-righteous, supported by underlying earnings growth and sustainable as long as gold holds over $1436 into quarter-end.

The GDX top 34’s accounting results in Q2’19 didn’t match their slight production decline when adjusted for the mega-mergers. Interestingly their total revenues of $11.0b were dead flat compared to Q2’18’s, despite average gold prices being 0.2% better. A material factor in the relatively-weak sales was silver, with the GDX top 34 mining 11.3% less than they did in Q2’18. Miners are increasingly diversifying out of silver.

With its price languishing at miserable lows compared to gold for years now, it has been nowhere near as profitable to mine as gold. Silver recently started outperforming again after gold’s bull-market breakout, which began to improve precious-metals sentiment. But silver’s upside will have to exceed gold’s on balance for years to convince gold miners to invest in gold deposits with significant silver byproducts again.

Those $11.0b of sales the GDX-top-34 gold miners did yielded hard GAAP earnings of $621m in Q2, for a pathetic 5.7% profits margin. Some impairment charges contributed, led by Wheaton Precious Metals writing down $166m on a streaming agreement it overpaid for. Hedging was also a factor, as some of these major gold miners lock in future selling prices. That’s going to kill their profits in Q3 after gold’s surge.

The new monster gold miners had divergent earnings pictures last quarter. Barrick reported $223m in net profits, 35.9% of the entire GDX top 34’s! That was without any unusual gains either, clean operating results after its second merged quarter. Its $869 AISCs contributed, which were a long way below the average gold price in Q2. That was a vast improvement from Q2’18, when Barrick and Randgold lost $18m.

The newly-merged Newmont on the other hand reported a $25m loss last quarter, which was also clean with no unusual charges. Probably thanks to that $10.0b buyout of Goldcorp, expenses skyrocketed 55.1% YoY despite the flat gold prices! Shareholders should be getting out the torches and pitchforks. In Q2’18, together Newmont and Goldcorp reported decent profits of $161m. Did the merger impair that potential?

The operating-cash-flow front looked much better, with the GDX top 34’s total climbing 10.5% YoY to $3.2b in Q2’19. Strong OCF generation is essential to funding future growth, both expanding existing gold mines and adding new ones. Every single GDX-top-34 component reporting OCFs had positive ones, with 18 of those 29 seeing growth despite the flat gold prices. That’s an encouraging sign for the majors.

These elite gold miners collectively reported $10.1b of cash in their coffers at the end of Q2. While that was down 20.0% YoY, it is still a healthy treasury. The gold miners tap into their cash hoards when they are building or buying mines, so declines in overall cash balances suggest more investment in growing future production. They desperately need to do that to slow their depletion inexorably shrinking their output.

Overall the major gold miners of GDX reported a solid Q2’19, which again was mostly before gold surged in its powerful breakout rally of recent months. Unless gold collapses in the next 6 weeks, Q3’19 results should prove radically better. While the risks of a normal healthy short-term gold correction are high due to gold-futures speculators’ excessively-bullish positioning, gold-stock fundamentals support higher prices.

A quarter ago when I published my GDX Q1’19 results essay, GDX had slumped 1.6% year-to-date and no one wanted to buy gold stocks low despite their huge opportunities. That has sure changed as I forecast it would, with GDX soaring to 34.7% YTD gains as of the middle of this week! Since traders love chasing winners, gold stocks are way more popular. GDX definitely isn’t the best way to own this sector though.

This ETF’s potential upside is really retarded by large gold miners struggling to grow their production. So the smart investment capital will seek out the smaller mid-tier and junior gold miners actually able to increase their outputs. Investing in excellent individual miners with superior fundamentals has far-greater upside potential. While some are included in GDX, their relatively-low weightings seriously dilute their gains.

To multiply your capital in the markets, you have to trade like a contrarian. That means buying low when few others are willing, so you can later sell high when few others can. In the first half of 2019 well before gold’s breakout, we recommended buying many fundamentally-superior gold and silver miners in our popular weekly and monthly newsletters. We’ve recently realized big gains including 109.7%, 105.8%, and 103.0%!

To profitably trade high-potential gold stocks, you need to stay informed about the broader market cycles that drive gold. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off summer-doldrums sale! The biggest gains are won by traders diligently staying abreast so they can ride entire uplegs.

The bottom line is the major gold miners’ just-reported Q2’19 earnings season was solid. Gold didn’t take off until late June, so they hadn’t yet materially benefitted from its breakout surge. With the recent mega-mergers finally settling out, gold stocks saw slightly-lower production at materially-higher costs. That hit accounting profits, but operating-cash-flow generation was strong. Higher gold will greatly improve Q3 results.

That being said, the major gold miners are still struggling to grow their production. The mega-mergers will help mask that for one year, but the intractable underlying problem persists. That leaves smaller mid-tier gold miners with superior fundamentals much more attractive for future upside potential. That is where investors should focus their capital allocations to gold stocks, which should approach 10% in all portfolios.

Adam Hamilton, CPA

August 19, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

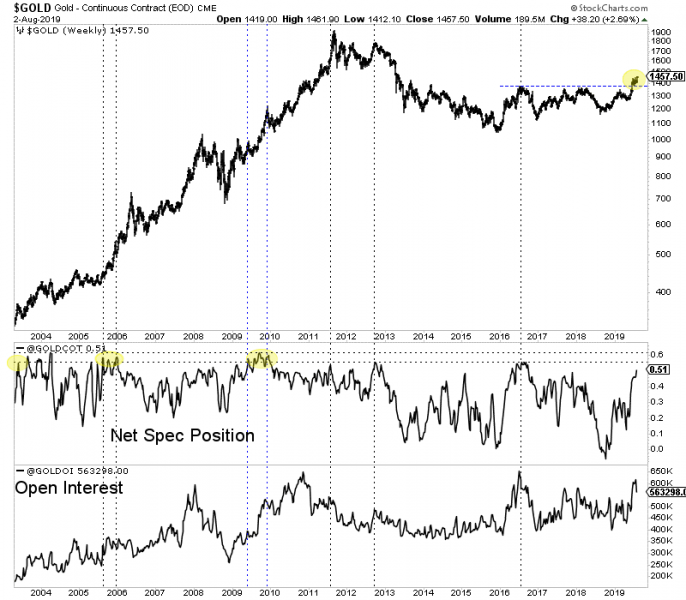

Corrections are inevitable, but current conditions support a prolonged rally in the gold market, TD Securities says in an equity research report.

“Before we restate our bullish thesis for precious metals, we should acknowledge that positioning in the gold market is at extreme levels, with Comex net longs near all-time highs and trading volumes at near double the averages of last year,” the report says.

This type of market posture, with everyone enthusiastically lined up in one direction, often precedes a reversal and a gold correction now could be exacerbated by the magnitude of the move required to restore normalcy to the market, TD says.

Of course, the macro picture is anything but normal. TD notes that there is now broad consensus around the idea that the deteriorating U.S. and global economic outlook will mean that Fed Chair Powell’s ‘mid-cycle adjustment’ in July will turn into an extended cutting cycle, with the bond market pricing in 25-50 bps of cuts by year-end.

TD Global Rates, which called for cuts ahead of the market, is calling for 50 bps of additional easing in 2019, followed by an additional 75 bps of easing in 2020. In many countries, real rates are already negative, and the discussion is around tiering (allowing more deeply-negative yields), QE, and the potential for competitive currency devaluation, TD says,

Despite Rally, Gold Equities Undervalued vs. Gold

The GDX (large-cap) index has rallied around 35% YTD, while the GDXJ (small-cap) is up only about 31% despite having outperformed its larger brother since the beginning of June. Gold, for reference, is up around 19% YTD.

Despite this, gold equities as measured by the S&P/TSX Gold Index are lagging their historical relationship to gold, both when compared with the most recent peak in 2016 and with the peak of the last bull market in 2011, TD notes.

Rotations Key to Maximizing Returns in Prolonged Rally

In a note published in June, TD called the technical breakouts of both gold and silver from their downtrends (corrections within the bull market that began in early 2016). Both metals rallied strongly from that point, with gold up 15% and silver up 16% since then.

TD had also forecast at that time that silver will lag and then outperform gold on a continuation of the rally. Indeed, we saw the gold/silver ratio climb to multi-decade highs above 93 in mid-July before falling to 86 and since then partially retracing that move.

TD’s preferred name for high beta and liquidity, which was highlighted in the June note, was First Majestic Silver, which has rallied approximately 59% since then, strongly outperforming its peers.

TD will publish more on the gold/silver ratio when the retracement/consolidation pattern is complete as TD analysts ultimately expect much stronger gains in silver before the precious metals bull market is over.

- Please click here now. Double-click to enlarge this chart.

- Another glorious day for gold investors is underway.

- Please click here now. Double-click to enlarge.

- The only better-looking chart than gold right now is… silver!

- Years ago, I coined the term “flagification” to describe the formation of multiple flags on the gold and silver charts.

- This technical action is rare and outrageously bullish.

- Because it happens with technical indicators overbought and the commercial traders adding seemingly overwhelming short positions on the COMEX, even the best top callers need to use caution in this type of market.

- I’ve described the current events in America as resembling a hybrid of what occurred in 1929, 1937, 1968, and 2008.

- Stagflation, tariff taxes, US-China empire transition, populist worship of debt-obsessed politicians, and a peaking global business cycle all appear to be in play… at the same time.

- Please click here now. Double-click to enlarge this horrifying US stock market chart.

- Flagification may soon be in play, but not in a good way! A huge bear flag has already formed on this short-term hourly chart.

- I always recommend that US stock market investors go to the sidelines at the start of August with some of their capital. As the business cycle matures, the danger of a crash in September or October increases exponentially.

- Please click here now. Double-click to enlarge. The weekly chart action of the Dow is ominous, while gold and silver accelerate their upside action.

- What’s happening now in both gold and the stock market is reminiscent of the late 1960s when American stagflation began.

- Please click here now. Double-click to enlarge.

- The gold stocks versus gold monthly ratio chart probably is the best illustration of the emerging stagflation theme.

- In 2007 gold stocks were at a high price in relation to gold. Now they are very low and basing.

- Mainstream analysts have suggested different interest rates that would represent “normalization”. Likewise, some gold stock analysts have suggested that GDX would be “normalized” at a price of about $40.

- I would agree with that number if deflation was still the theme rather than emerging stagflation and empire transition. Looking at the long-term ratio chart, a case can be made that GDX would now only be “normalized” at a price somewhere between $100 and $300 a share.

- Even after the huge rally in 2019, GDX is still trading below its 2008 lows on the GDX versus gold ratio chart. The bottom line:

- In a stagflationary environment, the upside potential for gold is fabulous and for gold stocks versus gold it is mind boggling.

- Please click here now. Double-click to enlarge this key GDX daily chart.

- The stoploss is set at $28 but if GDX moves above $30 (and it could happen today) eager accumulators can add to positions and raise the stop to about $27.70.

- In a powerful market featuring such events as “flagification” and a US President who engages in regular QE worship, there’s no point in setting any target price at this early stage in the upside game. My suggestion is just to move stoplosses higher and higher as GDX makes one fresh and glorious minor trend high after another!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Get Jacked With Gold!” report. I focus on key miners trading in the $2-$5 price range. I include key buy and sell action points in a video that can be viewed on a smart phone!

Thanks,

Cheers

Stewart Thomson

Graceland Updates

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

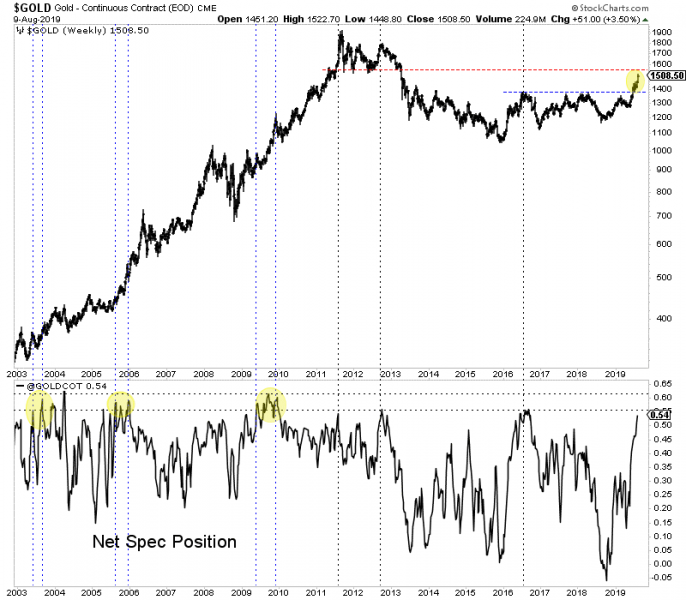

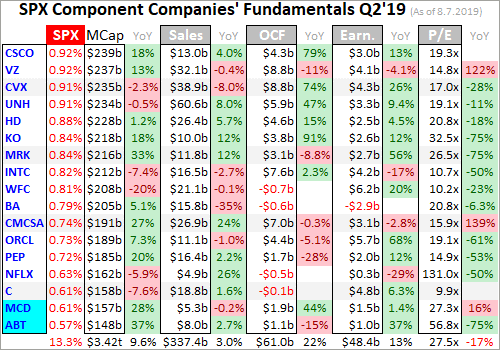

Last week was another strong one for the precious metals sector.

Gold gained a whopping $51/oz or 3.5%. The gold stocks (GDX, GDXJ) advanced by roughly 6%. Silver gained 4%.

Momentum in the sector began to build once Gold surpassed resistance at $1420-$1425/oz. We had noted the lack of resistance from $1425 to $1525-$1550/oz.

Gold has not reached $1550/oz yet but as it inches higher, some technical and sentiment indicators are urging caution.

Gold’s net speculative position of 54% is very close to the peaks of 55% to 60% seen since 2000. It’s possible the commercial hedgers will start covering at some point like they did in 2006 and 2010 but for now we have to assume they won’t if $1550/oz holds as resistance.

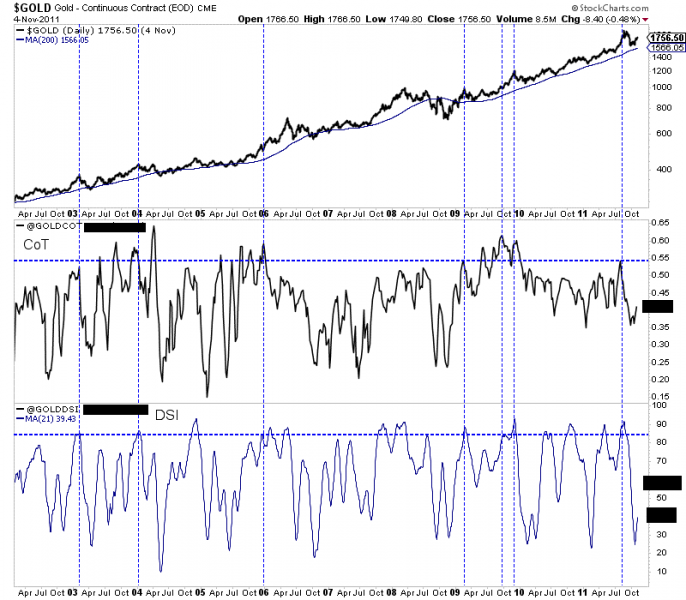

In the next chart we plot Gold’s net speculative position (51%) and the 21-day average of the daily sentiment index (DSI) from 2002 to 2011 (84%).

During that strong 10-year period, those figures of 51% and 84% were reached seven times. Five of those seven times Gold corrected or consolidated for at least a few months.

Turning to the gold stocks (and GDX specifically), we find a fairly overbought condition while the market approaches multi-year resistance at $31-$32.

The bullish percentage index (BPGDM) and a 20-day moving average of new highs in GDX are approaching the levels they peaked at in July 2016.

The trend in precious metals is strong and the fundamentals are bullish but there can obviously be corrections and consolidations within strong trends.

Sentiment indicators are becoming a concern and Gold and gold stocks (GDX) are approaching obvious resistance levels at $1550/oz and $31-$32.

This is not the time to be placing aggressive bets on Gold or the senior gold stocks. If there is a sector correction, those areas figure to be hit harder than Silver or junior mining stocks which are not as extended.

If you missed the recent run then it is best to be patient, buy value and wait for weakness in anything that is strong but too extended. New opportunities will emerge. To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

By Jordan Roy-Byrne CMT, MFTA

August 14, 2019

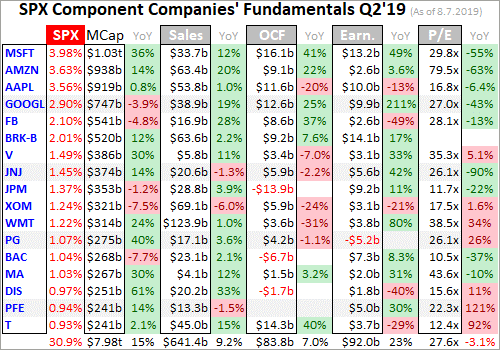

The U.S. stock markets are becoming more unstable, fueling mounting anxiety about what’s likely coming. After surging to new all-time-record highs in late July, stocks plunged in a sharp pullback as the US-China trade war escalated. Stock markets’ resiliency in the face of bearish news is partially determined by how companies are faring fundamentally. The big U.S. stocks’ just-reported Q2’19 results illuminate these key indicators.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the US Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

The deadline for filing 10-Qs for “large accelerated filers” is 40 days after fiscal quarter-ends. The SEC defines this as companies with market capitalizations over $700m. That easily includes every stock in the flagship S&P 500 stock index (SPX), which contains the biggest and best American companies. The middle of this week marked 38 days since the end of Q2, so almost all the big US stocks have reported.

The SPX is the world’s most-important stock index by far, with its components commanding a staggering collective market cap of $25.8t at the end of Q2! The vast majority of investors own the big US stocks of the SPX, as some combination of them are usually the top holdings of nearly every investment fund. That includes retirement capital, so the fortunes of the big U.S. stocks are crucial for Americans’ overall wealth.

The huge ETFs that track the S&P 500 dominate the increasingly-popular passive-investment strategies as well. The SPY SPDR S&P 500 ETF, IVV iShares Core S&P 500 ETF, and VOO Vanguard S&P 500 ETF are the 3 largest ETFs in the world. This week they reported colossal net assets running $258.5b, $179.3b, and $115.8b respectively! The big SPX companies overwhelmingly drive the entire stock markets.

Q2’19 proved quite volatile in the U.S. stock markets, leading to increasing unease. The SPX surged 3.9% higher in April, hitting 4 new record closing highs. That capped an unbelievable 25.3% rocketing over just 4.2 months, a crazy move higher. That was driven by extreme Fed dovishness, as it panicked following the SPX’s severe 19.8% near-bear correction that bottomed in late December. Euphoria reigned supreme.

But the big US stocks couldn’t stay at such lofty heights, so the SPX fell on balance through May on the way to a 6.8% pullback by early June. China reneged on major trade commitments it made to the US over a year through 10 rounds of high-level trade talks. So Trump ramped tariffs on a $200b tranche of annual Chinese imports into the US from 10% to 25%. US-China trade-war news was a key market driver in Q2.

That considerable selloff was reversed by a hyper-dovish Fed riding to the rescue. First its chairman said the Fed was ready to start cutting rates again, and later top Fed officials’ collective outlook for future rates shifted from one hike to one cut. The SPX blasted 7.6% higher in a few weeks on that, achieving another new record high in late June. The US-China trade war and Fed jawboning and actions will keep fueling volatility.