Summary

- Gold stocks’ setup leading into their October seasonal plunge is quite bearish this year. They recently enjoyed a major upleg, leaving them very overbought technically and laden with greedy enthusiasm.

- That makes a healthy rebalancing correction necessary. Gold stocks have avoided that so far, generally consolidating high. But very-weak seasonals will add to mounting downside pressure.

- October is gold stocks’ weakest month seasonally by far. When gold itself rolls over, it will drag the gold stocks with it. It has been very overbought recently as well.

The gold miners’ stocks have largely ground sideways in the last couple months, consolidating their big mid-summer gains. That drift is slowly bleeding away greedy sentiment, but this sector remains really overbought. Gold stocks’ dominant driver, gold, is even more overbought, and still facing a massive gold-futures-selling overhang. This makes October gold stocks’ weakest month seasonally by far, particularly risky.

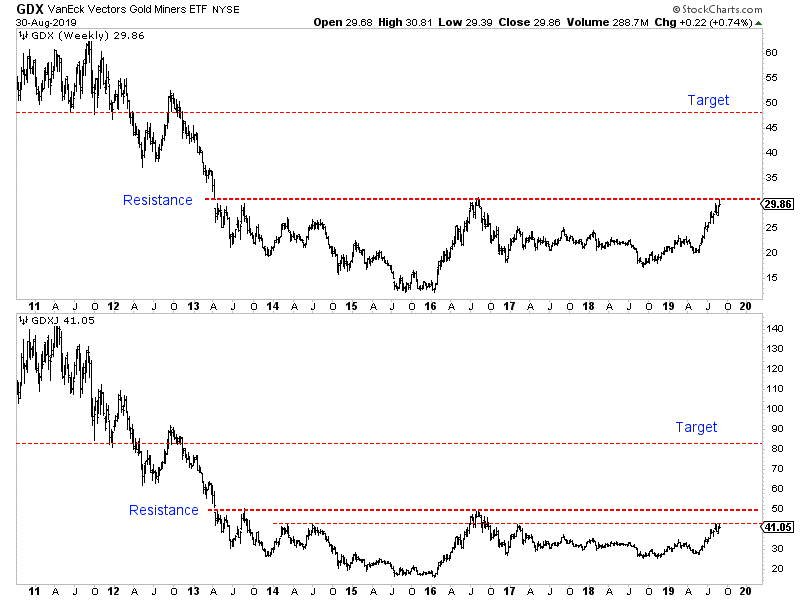

The gold stocks have enjoyed a big run since late May. Their leading benchmark and trading vehicle is the VanEck Vectors Gold Miners ETF (GDX). Birthed way back in May 2006, its first-mover advantage has proven insurmountable. This week, GDX’s $12.0b in net assets were a colossal 36.4x, larger than its next-biggest 1x-long major-gold-miners-ETF competitor! GDX is the most popular metric to track sector performance.

The past five months’ gold-stock action is a case study in the value of contrarian trading. Back in early May, GDX slumped to $20.17. That was down 4.4% year-to-date, and you couldn’t even give away gold stocks. I was pretty lonely beating the contrarian drum on them, arguing about their major upside potential when their temporarily stalled young upleg resumed. But the vast majority of traders couldn’t care less.

That’s the time to buy low, when sectors are out of favor and apathy reigns. Multiplying your fortune in high-potential gold stocks requires deploying capital when it feels bad, and nearly everyone else is bearish. If the gold miners have already rallied far enough with strong inertia to stoke excitement, it’s too late to buy low. Buying high to chase momentum sometimes works, but it is much riskier with smaller gains.

Gold-stock prices are totally dependent on gold’s fortunes, with miners’ profits amplifying underlying gold moves by at least 2x to 3x. As usual it was a series of gold surges starting in late May that catapulted gold stocks much higher. At the end of May gold surged after Trump threatened Mexico with tariffs to pressure it to greatly slow illegal immigration across the US southern border. That woke the miners’ stocks.

Their initial strong upside momentum was fading a couple weeks later until the mid-June meeting of the Fed’s Federal Open Market Committee. The top Fed officials’ collective outlook for the future interest-rate trajectory reversed from hiking to cutting, a sea-change shift. That dovishness unleashed huge gold-futures buying, propelling gold to its first decisive breakout to new bull-market highs in several years!

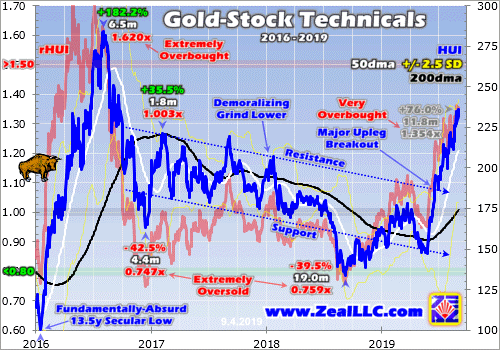

Gold stocks exploded higher on all that newfound excitement and interest in gold, with GDX rocketing to $28.25 by mid-July. That made for huge 40.1% gains in just 2.5 months! This first chart showing GDX’s technicals highlights how violent that mid-summer gold-stock surge was. GDX had been trapped under vexing $25 upper resistance for almost several years, but that was shattered with gold finally breaking out.

Such a big-and-fast move left the gold miners’ stocks very overbought. GDX had stretched way up to 1.313x its 200 dma. When prices run too far too fast, the excitement they generate sucks in all available near-term buying power. When those pulled-forward capital inflows are exhausted, the sector rolls over into a pullback or correction. So gold stocks weakened, leading into an ugly 4.8% GDX plunge on July 31st.

That was the next FOMC decision following that hiking-to-cutting-shift one that lit a fire under gold and its miners’ stocks. Though the Fed cut rates for the first time in 10.6 years, the Fed chairman disappointed by reining in traders’ hyper-dovish expectations. In his post-decision press conference, he declared that cut was not “the beginning of a lengthy cutting cycle”, but a “midcycle adjustment”. Gold fell 1.2% on that.

Gold stocks are essentially leveraged plays on gold, so you have to follow the metal if you are interested in the miners. And unfortunately FOMC decisions and Fed officials’ collective outlooks on the future rate trajectory can really bully gold around. They also really affect the US dollar, which gold-futures speculators look to for trading cues. I analyzed the Fed’s big impact on this gold bull in-depth in last week’s essay.

Gold and gold stocks were rolling over hard as August dawned until they were savagely whipsawed back up on another Trump tariff surprise. He more than doubled the amount of annual Chinese imports subject to US taxes. GDX soared a neck-snapping 7.4% from intraday lows before Trump’s tariff tweet, and closed 5.1% higher! This gold-stock upleg was back to the races again, flagging momentum reversed.

About a week later GDX crested at $29.77, up a massive 47.6% in just 3.2 months. But the serious overboughtness in this sector worsened, with GDX hitting a lofty 1.343x multiple of its 200dma. These 200-day moving averages offer a slow-moving baseline from which to gauge technical overboughtness and oversoldness. The higher gold stocks stretch above their 200 dmas, the more near-term downside risk exists.

GDX started rolling over again as gold’s latest tariff-hike-sparked surge stalled out. By mid-August, GDX had slumped 6.2%, but much residual excitement remained after such a powerful upleg. Gold was still mostly holding the psychologically heavy $1,500 level after finally regaining it in early August for the first time since April 2013. Gold-stock traders were rightfully anticipating far-higher profits going forward.

With interest and excitement high, gold-stock buying ignited again on a minor gold up-day. That built into another 10.8% GDX rally over the next couple weeks or so into early September. The resulting upleg high of $30.95 was this ETF’s best level in 3.1 years. But as you can see above, gold stocks were still really stretched relative to GDX’s 200 dma. GDX was way up at 1.338x its own, showing a very-far very-fast run.

That proved this gold-stock upleg’s high-water mark, extending GDX’s total gains to 76.2% in 11.8 months! The smaller mid-tier and junior gold miners’ stocks with superior fundamentals to the majors did much better, with plenty enjoying huge gains way over 100%! That is where we focus our gold-stock trading to ride these major uplegs. But gold stocks can’t and won’t rally forever, and eventually major corrections follow.

The writing has been on the wall on this for some time. Despite GDX’s surges to higher highs in both early August and early September, it has generally been grinding sideways on balance. This Wednesday GDX was trading at $28.43, not much over mid-July’s $28.25. GDX’s average price since then has only been $28.57. This sector’s strong upside momentum in June and July largely stalled in August and September.

GDX’s 76.2% upleg gain was right in line with historical precedent. The last secular gold-stock bull ran from November 2000 to September 2011. GDX wasn’t around for the first half of that bull, so we have to revert to an older metric to study it. Before GDX, the HUI NYSE Arca Gold BUGS Index was the leading sector benchmark for decades. It closely mirrors GDX now, as it holds most of the same major miners.

The HUI skyrocketed a stupendous 1,664.4% higher over those 10.8 years, the best-performing sector in all the stock markets that decade! The wealth generated riding that bull was epic, showing why contrarian traders put up with gold stocks’ outsized volatility. During that bull the gold stocks saw 11 major uplegs excluding the anomalous post-2008-stock-panic rebound one. They averaged 80.7% gains over 7.9 months.

So by early September, GDX’s 76.2% upleg was right back up in that past range. Major gold-stock uplegs are always followed by major corrections, which are necessary to rebalance sentiment. During that last secular gold-stock bull, these averaged 26.1% losses over 2.8 months. That’s the magnitude of downside the major gold stocks are facing. The fact red October is nearly upon us really ramps selloff risks.

The primary short-term drivers of gold and its miners’ stocks are technicals and sentiment. They are both stretched, surging to really-overbought levels by historical standards spawning serious exuberance and greed. So a rebalancing selloff is highly likely soon regardless of seasonality. Seasonals add additional pressure on top of technicals and sentiment, acting like retarding headwinds or spurring tailwinds for prices.

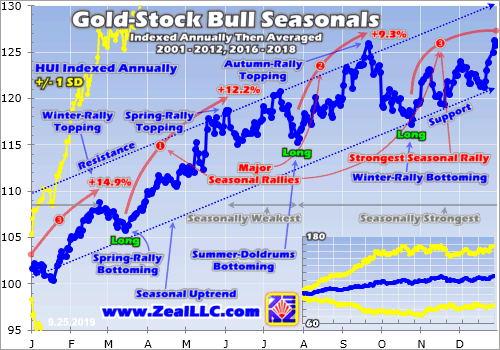

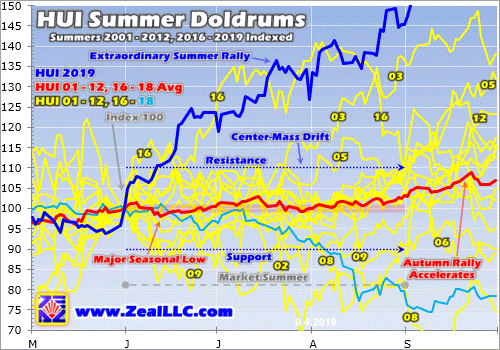

So an inevitable and essential gold-stock selloff after a major upleg is likely to be bigger and sharper when it lines up with weak seasonals. Enter October, the weakest month of the year for gold stocks! This next chart distills out gold-stock bull seasonals in all modern gold-bull-market years. Those ran from 2001 to 2012 before a subsequent bear, then resumed in 2016 to 2018. 2019 is excluded, as it’s still a work in progress.

Again the HUI has to be used for this long-term data-crunching, as GDX is way too young. Each calendar year’s gold-stock price action is individually indexed to its final close of the preceding year, which is set at 100. Then all gold-stock price action that following year is recalculated off that common baseline. This is necessary to normalize all years in percentage terms regardless of prevailing price levels, which vary widely.

Then all years’ individual indexes are averaged together into the blue line. If you want more background on gold-stock seasonals which are driven by gold’s own, I wrote my latest essay on that thread in early August. For our purposes today, note the sharp seasonal plunge gold stocks have tended to suffer in red October. This is the only time when prices fall from above seasonal resistance to below seasonal support!

Gold stocks’ sharpest seasonal plunge of the year technically isn’t October proper, but runs from late September to late October. On average in these modern bull-market years, the major gold stocks peak on September’s 14th trading day. That happened to be last Friday the 20th this year, when GDX was rebounding out of a sharp 13.9% September correction. This seasonal plunge divides autumn and winter rallies.

On average it has lasted until October’s 19th trading day, which is Friday the 25th this year. During that span, the HUI has averaged 6.9% seasonal pullbacks in these modern gold-bull-market years. That may not sound bad, but remember it smoothes out 15 years of data. Of those 15 years, gold stocks bucked this seasonal plunge to rally in 5. Those averaged modest 5.1% gains, usually related to their October lead-ins.

Going forward here, I’m going to use “October” to reference that late-September to late-October gold-stock swoon. The gold miners tended to buck this seasonal selloff a minority of the times when they were flattish or weaker heading into it. When gold stocks are down leading into October, some of their selling momentum has been expended. That leaves technicals and sentiment less supportive of more weakness.

In the other 10 years or 2/3rds of the time, gold stocks plunged 12.5% on average in Octobers which is serious. This seasonal selloff killing the gold stocks’ autumn rally before paving the way for the winter one is only five weeks long. So average corrections of that magnitude compressed into such a short span of time hammer sentiment. They eradicate preceding greed much more effectively than slow selloffs.

The biggest seasonal drops tend to come after gold stocks have powered higher leading into Octobers, when technicals grew overbought and sentiment exuberant with relatively-high gold-stock prices. 2016 was a recent case in point. Somewhat like this year, the gold stocks had soared heading into the market summer. Though peaking earlier, after an initial selloff, they generally consolidated fairly high into October.

Yet, through that whole seasonal-plunge span, GDX fell 14.9%. At worst in mid-October, GDX was down 19.1% in just a few weeks from late September’s seasonal peak! It wouldn’t surprise me at all to again see the major gold stocks drop 20%ish sometime in the next month here. Based on gold stocks’ latest upleg peak in early September, that translates into $24.76 in GDX terms. The rationale behind this is simple.

Remember gold almost exclusively drives gold-stock fortunes. A couple weeks ago, I wrote about its ominous massive gold-futures-selling overhang. The extreme-leveraged gold-futures speculators utterly dominate gold’s short-term price action. But their capital is finite, as that is a crazy-risky game to play. Their collective bets were and have stayed excessively bullish, nearly all-in longs and all-out shorts.

That leaves them little room to buy more gold futures, but vast room to sell big on the right catalyst. And because the leverage in gold-futures trading is so extreme, selloffs soon cascade and take on lives of their own. Thus a 6% to 12% selloff in gold is highly likely. Based off its latest upleg high of $1,554 back in early September, that implies a bottoming level of $1,367 to $1,460 also likely in this red-October time frame.

Normally gold slumps around October because there’s a gap between outsized seasonal drivers. That’s when Asian buying including for Indian wedding season winds down, but before Western holiday buying spins up. This year gold has been heavily influenced by trade-war and Fed-rate-cut news. On the former front, high-level US-China trade talks are coming in mid-October. Like usual those will spawn happy talk.

Even though little or no progress has been made on the tough issues between the US and China for a year and a half, after all high-level meetings officials wax optimistic. That breeds bullish headlines for stocks, which are bearish for gold. And on the Fed-rate-cut front, top Fed officials need to rein in traders’ crazy expectations for more cutting before the FOMC’s next meeting in late October. They must talk hawkish.

So the coming few weeks are likely to see major catalytic news motivating gold-futures speculators to unwind their excessively-bullish bets. If that selling snowballs as usual, it will slam gold. The major gold stocks tend to leverage gold’s moves by 2x to 3x. So GDX is looking at 12% to 36% downside on a 6% to 12% gold selloff. The middle of that range is 24%, in line with the last secular gold-stock bull’s 26.1% mean.

While the actual gold and gold-stock selloffs could prove smaller or larger based on other developments in the markets, like how the S&P 500 fares, the odds definitely favor imminent selloffs. That coupled with still-overbought gold stocks and general enthusiasm for this sector is a big warning sign. It isn’t prudent to add material gold-stock positions heading into red October’s sharp seasonal plunge. Why risk tempting fate?

Gold-stock traders need to stay wary. Any current positions should be protected with relatively-tight stop losses to maximize gains in the event of a major selloff. And cash from trades already stopped out or sold should be held, not plowed right back in. Buying high with stretched technicals and popular excitement is risky any time, but even more so when stiff seasonal headwinds can hasten and intensify any selling.

If this seasonal selloff comes to pass, late October should prove an excellent time to redeploy at much-lower gold-stock price levels. GDX should be much closer to its 200 dma, and that is just before the bulk of gold miners’ Q3’19 results are released. Gold-stock earnings should rocket higher, with gold averaging $1,473 so far in Q3, which is up an amazing 12.5% quarter-on-quarter! We just have to weather a selloff first.

The bottom line is gold stocks’ setup leading into their October seasonal plunge is quite bearish this year. They recently enjoyed a major upleg, which left this sector very overbought technically and laden with greedy enthusiasm. That makes a healthy rebalancing correction necessary. Gold stocks have avoided that so far, generally consolidating high. But very-weak seasonals will add to mounting downside pressure.

When gold itself rolls over, it will drag the gold stocks with it. It has been very overbought heading into its own seasonal drop between its autumn and winter rallies. And with gold-futures speculators’ bets remaining excessively bullish, they have little capital firepower left to buy more but vast room to sell. That selling will ignite and likely snowball on the right catalyst, like positive US-China trade-war talk or Fed hawkishness.

Copyright 2000-2019 Zeal LLC (www.ZealLLC.com)

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

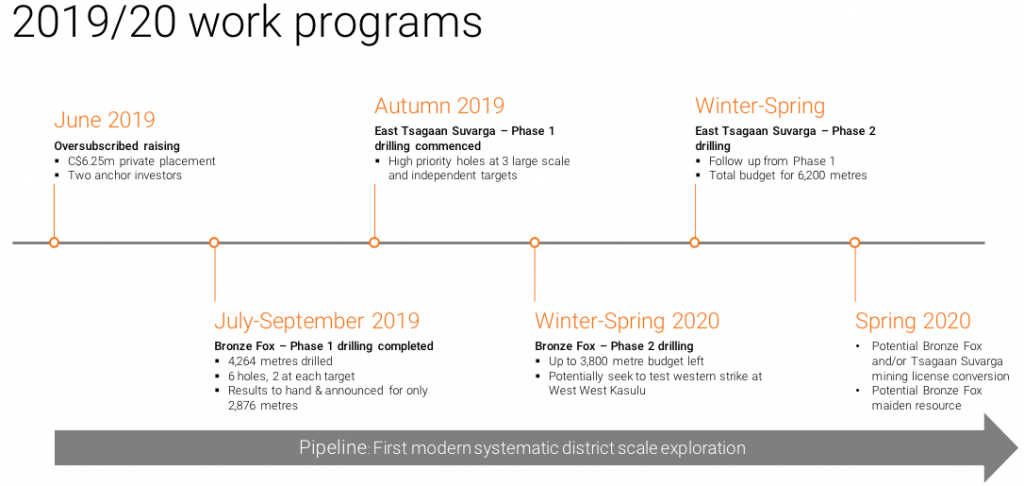

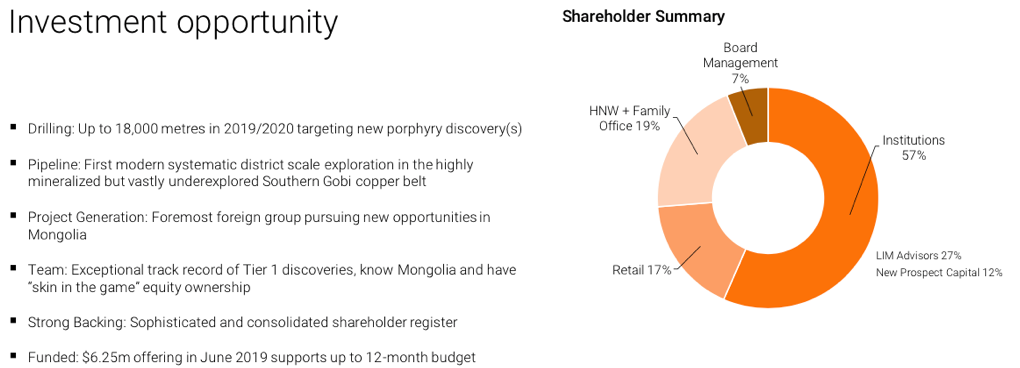

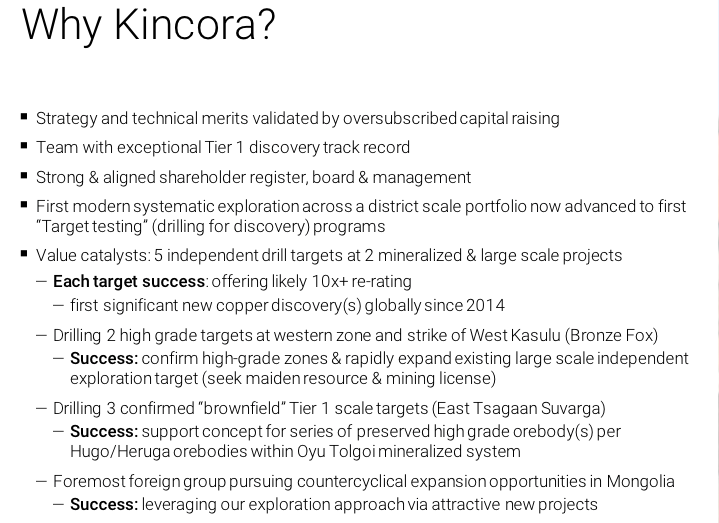

On September 10th Kincora Copper Ltd. (TSX-V: KCC) provided the first drilling update at its 100%-owned copper-gold porphyry projects in the Southern Gobi region of Mongolia. This update comes after an oversubscribed $6.25 million equity raising in late June.

First phase drilling at Bronze Fox consisted of 4,264 m at two targets. Results for 2,876 m were announced in the press release. To put this into content, that’s ~16% of a total of 18,000 m planned across multiple projects / prospects in multiple phases.

The market did not like initial results…..

I understand the disappointment, but was the very negative share price reaction warranted for results that although not great, were not horrible? Readers should know that 84% of the estimated meters to be drilled & assayed, on programs that stretch well into 2020, are yet to be reported.

Three drill holes at Bronze Fox’s West West Kasulu (“WWK“) returned extensive lower-grade mineralization and a few higher-grade zones increasing towards the west. Some shareholders exited stage left on these mediocre results, sending the share price 50% lower in subsequent days to $0.07.

Highlights include drill hole F103, which returned 20m @ 0.64% CuEq. from 140m; and 120m @ 0.41% CuEq. from 700m. While 0.64% CuEq. is a decent grade, the 20m width hardly stands out. And, while a 140m intercept is wide, 0.41% CuEq. is nothing to write home about.

Partial results from drill hole F107 at WWK showed more of the same, no blockbuster, conclusive, “discovery” type intervals combined with high-grade copper. F107 contained 8m @ 0.25% Cu (1.26% CuEq.) from 528m; 10m @ 0.54% CuEq. from 630m; 22m @ 0.55% CuEq. from 654m; 30m @ 0.50% CuEq. from 702m; 10m @ 0.79% CuEq. from 828m and 2m @ 0.22% Cu (1.14% CuEq.) from 880m.

The market is looking to see intervals boasting 1%+ CuEq., that are much wider than the 2 – 8 meter higher-grade segments reported in hole F107, and/or tens of meters of 0.5%+ CuEq. near-surface.

Gold’s not driving this story, but at ~1/6 the economics, it’s not trivial

Something worth remembering is that Mining Associates stated about 16% of the in-situ value is represented by gold from the WWK mineralized system, defined before this drill program started, as a total conceptual exploration target of 1.3-1.5 million tonnes of CuEq. metal.

Otherwise mediocre drill results showed pockets of fairly strong gold mineralization. For instance, hole F107 was gold-rich. It had an eight meter intercept grading 0.25% Cu that was 1.26% CuEq.

About 16% of overall value is being driven by a gold price that’s up 16% year-to-date, and 23% in the past 12 months. In US$, gold is near a 6.5-year high. Perhaps weighing on bullish gold sentiment is a weak copper price.

I remain bullish on copper due to its essential need in multiple new paradigms (green energy, high-tech, the building / rebuilding of global infrastructure, and the electrification of passenger & commercial vehicles).

Kincora’s wholly-owned East TS project is 10 to 15 km east of the Tsagaan Suvarga porphyry Cu/Au project, under development on the western margin of the Tsagaan Suvarga intrusive complex. TS has had over US$370-million invested in it and is forecast to produce 316,000 tonnes copper per year.

The market has heard a great deal about Kincora from its CEO Sam Spring. I reached out to SVP of Exploration Peter Leaman to learn more about his views on the projects, and new drilling to date.

Can you please provide an overview of your background and your role at Kincora?

Yes. I have 40 years’ exploration experience, 28 with BHP, and I’m still involved with PanAust (since 2010). I’ve witnessed firsthand multiple copper & gold discoveries, including the Reko Diq deposit. My current role at Kincora is senior vice president of exploration.

I joined Kincora in late 2016, after the Company consolidated the dominant position in the Southern Gobi copper-gold belt and regained full access to the Bronze Fox project. I am a member of the technical committee including Chairman John Holliday.

John is a very seasoned and successful explorer. He, CEO Sam Spring and I oversee a hard-working, skilled Mongolian team of geologists. We also have a strong network of technical advisors, including my old colleague Barry de Wet.

I feel I have unfinished business in this belt and in Mongolia. I ran the BHP Falcon JV with Ivanhoe in the 2000’s, which was the last district-scale exploration in the region (before Kincora). I was involved, at the development stage, in the BHP review team of Oyu Tolgoi.

In carefully reviewing the data on Kincora’s projects, I saw, and continue to see, the potential for globally significant discoveries.

Thanks Peter, what are your thoughts on the current Kincora exploration program?

Kincora announced initial exploration results from the first phase of drilling at Bronze Fox, and drilling has commenced at our 2nd priority target, a brownfield project, East Tsagaan Suvarga. Multiple-phase programs are underway at both projects. We are undertaking the first modern, systematic exploration & drilling at district-scale in the Southern Gobi.

Kincora is implementing a sophisticated exploration approach, testing targets in a way that the Majors would. We are testing targets with significant scale potential and improving the odds, as best we can. Importantly, we are using methods that are significantly improved from my time at the Falcon JV period.

That said, we are all very mindful of the fact that, as a junior, the market judges you press release by press release. We are undertaking high-risk, high-reward exploration, and we recognize that we need to get good results with the current 12-month program & budget.

How do you see last weeks’ exploration update? Were first phase results at Bronze Fox disappointing? Have you drilled the best targets?

Bronze Fox is a large, lower-grade system with zones of higher-grade copper & gold. Its size and relative lack of extensive drilling, with complementary geophysics done since the last drill campaign, suggests that a deeper & higher-grade core could be present at depth. An analogy is the Red Chris deposit in British Columbia, Canada.

We have better defined the system and greatly improved our understanding of the new geophysics, lithological controls and depth profile of the target zone. Like all shareholders, we wanted to see more high-grade from the initial results. Everyone wants a discovery yesterday — that’s what we’re looking to do — discover a new high-grade zone.

But, we have to continue in a systematic & unemotional way. Merely adding confidence & tonnage to the system is not our goal, the clear goal is to provide compelling evidence of a high-grade system & core.

In the end, we don’t have to drill hundreds of holes ourselves, just tee it up for bigger players to take notice. SolGold in Ecuador is a prime example of a Tier 1 discovery that attracted cornerstone investments by BHP & Newcrest.

I will shortly lead the team reviewing these results in the field, with the critical element being the area to the west where there is sufficient scale for a large system. We want to revisit the original concept of a preserved monzodiorite system being an attractive and higher grade target. So far, Phase 1 drilling supports the most prospective part of the system being away from the regional fault to the west.

Phase 1 is providing valuable results and insights to help us better understand the system correlating to the new geophysics, thereby assisting and informing our plans for Phase 2. Our focus on Mongolia is to find globally significant new discoveries, not average-to-low-grade results or deposits.

Can you provide an update on current activities?

Yes, we have drilled ~4,200 m of up to 18,000 m, with assay results outstanding on a third of the initial ~4,200 m at Bronze Fox, and we have moved the rigs to a project that we call East TS – East Tsagaan Suvarga.

We are now testing a number of large-scale targets that may be caused by blind and potentially high-grade porphyry copper mineralization. This is a project that has me very excited given its location, age and scale potential, but it’s early stage.

In addition to drilling at East Tsagaan Suvarga we are also continuing with project generation activities, which we believe is very important for any sustainable exploration strategy at our stage.

With that in mind, in the next several weeks I will be reviewing various projects identified by our team that could strategically fit within our exploration portfolio. In the past 18 months, we have walked over 200 projects / targets in the field as part of our due diligence.

Separately, we have just made an application for a new exploration license prospective for gold-rich copper porphyries – large size, good location, previous drilling (limited), but including a > 1% copper hit, that was inadequately followed up on. We are looking to leverage the strong team we have in place and our systematic exploration approach.

What final message would you like to pass on to investors?

I am a significant shareholder in Kincora, as is most of our senior team. We are true believers in new discoveries continuing to be made in Mongolia. I have confidence in the rigorous, systematic exploration approach the Company has adopted for undercover exploration.

We have assembled a strong team, particularly for a junior with our tiny enterprise value, and our demonstrated ability to make globally significant discoveries. We have a highly prospective portfolio of targets that are finally getting the meters they deserve, and a project generation strategy that I am confident will yield positive results with continued hard work.

Thank you Peter. I look forward to seeing the results from drilling over the next year!

Disclosures / disclaimers: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock in Kincora Copper, and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

GoGold Resources (GGD.TO, C$0.71) is a company with assets in Mexico, both a producing and an exploration-stage project. Led by a management team that has over 27 years of experience in the country. The team developed 4 projects/companies that eventually got sold with at a good to hefty premium. Examples are: Gammon Gold ($1.5B merge with Alamos), Mexgold (sold for $375M), Nayarit ($80M, bought for $40M) and recently, the Santa Gertrudis project they sold to AEM for $96M (bought for $11M).

CEO Brad Langille is the second largest shareholder and holds 9.5% of outstanding shares. Biggest shareholder is Fred George, who was founding member of Gammon Gold. He led the development of the Ocampo project from exploration stage to one of the biggest silver and gold projects in Mexico, currently operated by Minera Frisco. Fred George owns about 14% of outstanding shares. Management combined owns over 30%.

Financial position is strong as they had C$9M in liquidity (cash + Metalla shares) at the end of the second quarter. After finishing the sale of the Santa Gertrudis project, they decided to pay off their remaining debt which leaves them debt-free.

Parral

After the sale of Santa Gertrudis, GoGold has two projects left. One of them is the young producing heap leaching mine of Parral, which is right next to the Mexican city of Chihuahua. This mine started its fifth year and is currently on a record streak: For the second consecutive quarter a beat in production and well on its way to reach 1.8Moz of silver equivalent. AISC is declining and currently sits at US$13.61/oz. Their realized silver price for the quarter was US$14.55, which gave them a 6.9% margin in Q2. As silver is a lot higher now than in Q2, we can assume a conservative realized price of US$17/oz for Q3. If AISC remains the same, their margin would rise to 24.9% or an increase of 261% quarter over quarter.

In June of this year, the company announced the build of a SART installation at their Parral mine. This will help lower costs of heap leaching and provide a saleable copper concentrate. This plant will see its first full operational quarter in Q1 of 2020. This should give a substantial decrease in AISC and add some revenue through the copper concentrate.

Their Parral mine will allow them to internally finance their exploration. Shareholders are protected from dilution through capital raises. In coming quarters, production will continue to rise towards 550-600Koz AgEq. Q2 saw 440Koz so we can expect further “records” in coming headlines. During my contact with management I received the following words:

“The cashflow we produce form Parral will fund our operations, G&A, and our exploration at Los Ricos and this is why we say we are a self-funding junior and do not need to raise money for the foreseeable future.”

Parral has a remaining mine life of 8 years and the proportion silver/gold in dollar value is about 55% silver and 45% gold. So despite of what you might read in their name, GoGold is mostly a silver producer.

Los Ricos

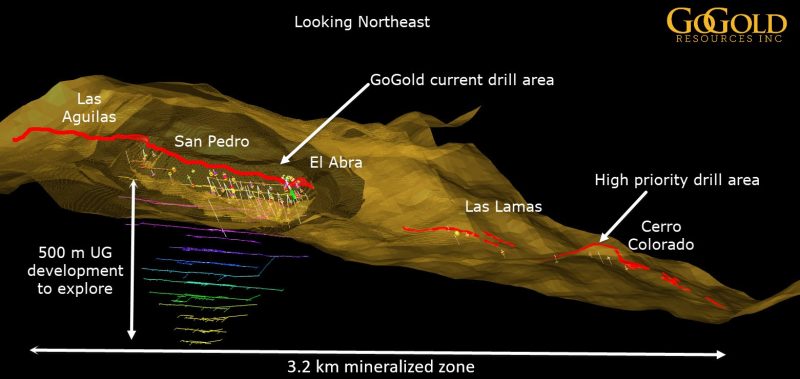

The Los Ricos project is my main reason to hold GoGold in my portfolio. The project has seen commercial production between 1908-1929. Production has been terminated at the start of the Great Depression. At the time of production, they kept track of the production data. Through this data we learn that the project was mined to a depth of 500m on different levels. Average values of 800g/t silver and 4g/t gold.

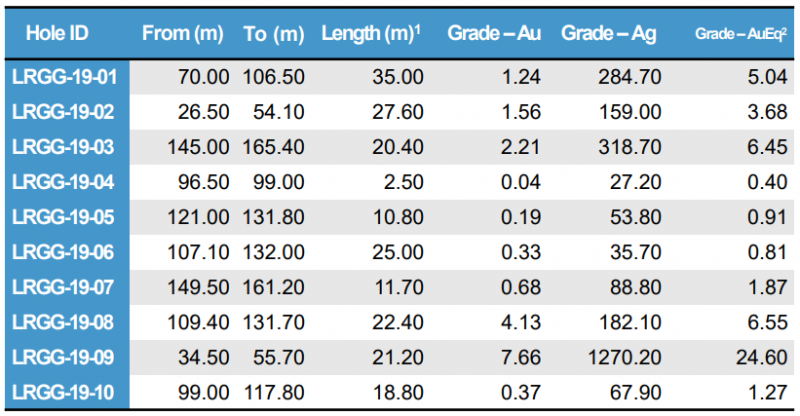

The project has about 65 historic drill results, which GoGold is trying to confirm with their own drill program. Up until today, they are succeeding well in this. Best hit: 21m of 7.66g/t gold and 1,270g/t silver (or 21m of 24.6g/t AuEq). Below I added the results of the first 10 drill holes by GoGold. Note that these are all 10 of them and not one has been left out mysteriously. By now the project has expanded to 37 drill results. I looked at all of these: Not one miss and on average thick mineralization with high values of gold and silver.

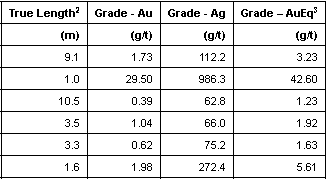

I recently felt an urgency to buy this company and this had nothing to do with silver taking off. In May, the company announced trenching results from a 3.2km strike. In this news release, GoGold told investors they would move a drill to the Cerro Colorado zone. This area has the ‘high priority drill area’ tag attached in the image below. Cerro Colorado is at the end of this strike and 1,500m away from the edge of the main zone.

These first results of the Cerro Colorado zone seem to point to a big system. All 7 of these drill results show more high grade and thick gold and silver mineralization. As you can see in the image (above), there’s the ‘Las Lamas’ zone in between that 1,500m stepout. Below you find the results of the trenching GoGold did there. Management confirmed they would drill that target as well.

Since GoGold purchased the Los Ricos project, their share price has tripled. The silver price is largely a cause of this, but nonetheless an outperformance in the silver space. The Los Ricos project is a mere 6 months in their posession and the market is starting to notice. Should be, considering these drill results and potential. CEO Brad Langille recently noted that he’s been following this project for over 8 years and feels this is the most exciting project of his carreer. Talk is cheap of course, but seeing he upped his stake by 500,000 shares this year, is reason to take note.

The company is working on a maiden resource for Los Ricos, which they plan on delivering in the first quarter of 2020. Recently, they uploaded a VRIFY model on their website (link: https://gogoldresources.com/properties/los-ricos). CEO Langille wants to roll out this project on the Precious Metals Summit and Denver Gold Forum. Personally I believe this company will get some interest over the course of the next weeks. These presentations should be the start of this.

CEO Langille sees the Los Ricos project as an open pit mine with multi million ounces of high grade gold and silver. According to him this will be of similar, if not bigger size than the Ocampo mine which he helped build and eventually was valued at US$750M. Again, quotes like these are only to be given weight if supported by elevated insider ownership and preferably insider open market purchases. I see both here.

There’s only 1 analyst following this. HC Wainwright that has a current price target of C$0.80/share. Note that this is based on a realized silver price of US$15/oz, gold price of U$1,300 and doesn’t ascribe any value to the Los Ricos project.

Conclusion

- I upped my stake in this company after their Cerro Colorado drill results. I’m comfortable here because of the following reasons:

- Management with proven track record and a lot of their own money in the company

- A producing asset which is seeing rising production and margins

- No need for financing so no dilution

- Big players have to buy in the market, which was confirmed by management

- Los Ricos could be a world class deposit

- Lots of catalysts nearby:

exploration results - promotion of Los Ricos

- rising earnings at ParrJonas De Roose

September 18, 2019

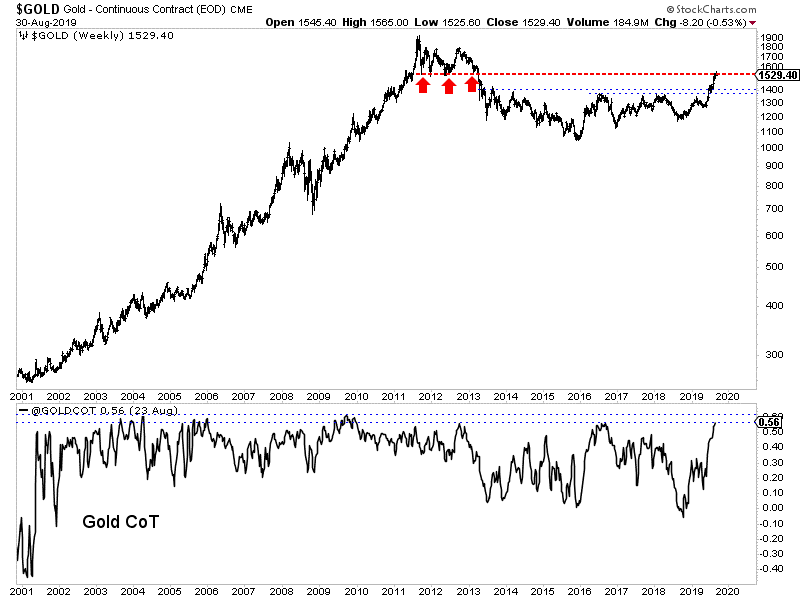

Gold reversed hard last week after blasting higher for a month, leaving traders wondering why and what that portends. The answers are found in gold’s dominant short-term driver, speculators’ collective trading in gold futures. Their positioning has grown excessively bullish, they are essentially all-in betting on more gold upside. That spawned a massive and ominous gold-futures-selling overhang, which needs to be normalized.

Since gold-futures trading is so esoteric, most investors and speculators ignore it. That’s a big mistake, as gold’s near-term price action is overwhelmingly driven by what speculators are doing in gold futures. Their buying and selling heavily impacts gold, and those moves are amplified in both silver and the stocks of precious-metals miners. Trading anything in this realm without watching gold futures is like flying blind.

The reason gold, silver, and their miners’ stocks soared between early August to early September was heavy spec gold-futures buying. That exhausted these traders’ sizable-but-still-limited capital firepower, which is why gold’s powerful upleg stalled out last week. Then gold began falling as specs started to unwind some of their excessively-bullish bets. Gold’s recent action is largely a tale of spec futures trading.

Despite being relatively small compared to the broader gold market, gold futures exert disproportional outsized impacts on gold prices. Unfortunately the gold-futures tail usually wags the gold dog, mostly due to a couple key factors. Gold-futures trading allows extreme leverage far beyond anything seen in normal markets, and the resulting gold-futures price is gold’s global reference one that heavily influences sentiment.

Investors normally buy gold outright, so $1 of capital allocated exerts $1 of price pressure which makes for no leverage at 1.0x. Since 1974, the legal maximum allowed in the US stock markets has been 2.0x. So an investor using maximum margin could buy the world’s leading gold exchange-traded fund, the GLD SPDR Gold Shares, at 2.0x. That would effectively double the price impact of $1 of capital deployed to $2.

But gold futures are in an extreme league of their own for leverage. Each COMEX gold-futures contract controls 100 troy ounces of gold, which is worth $150,000 at $1500 gold. Yet this week the maintenance margin required to hold each contract is only $4,500. That’s all the cash traders are required to have in their accounts, enabling crazy maximum leverage as high as 33.3x! $1 of capital can exert $33 of price pressure.

Gold-futures speculators punch way above their weights in moving gold prices because the price impact of their trading is amplified by up to 33.3x! That juiced gold-futures capital radically outguns investors over short periods of time. Traders can choose to use less leverage, and many do. But even at 10x or 20x, significant spec gold-futures activity drowns out everything else. This has big negative side effects.

At 33.3x, traders can’t afford to be wrong for long or risk catastrophic losses. A mere 3.0% gold move against their bets would obliterate 100% of their capital deployed! That forces these guys into extreme myopia. Their gold outlook isn’t measured in weeks and months, but in hours and days. All they can care about bearing such ridiculous risks is piling on and riding gold’s immediate momentum. Nothing else matters.

The extreme leverage inherent in gold futures also enables gold-price-manipulation attempts. Relatively-small amounts of capital can be blitzed into gold futures at full amplification in very-short timeframes to artificially move gold prices. Often these huge buy and sell orders are rapidly placed then cancelled before they can be executed, which is known as spoofing. This fraud is finally leading to criminal convictions.

Gold prices would be far-less volatile, and vastly more reflective of underlying global supply and demand, without that 30x+ gold-futures capital bullying them around. Gold futures’ impact is multiplied even more since that COMEX gold-futures price is the world reference one. That is what investors and speculators watch around the globe, heavily influencing their own gold sentiment and outlooks which affects their trading.

So what speculators are doing in gold futures changes how investors perceive gold in real-time. They love chasing performance, tending to add gold positions on strength while selling on weakness. Thus heavy gold-futures selling amplified through extreme leverage hammering the gold price lower curtails investment buying and spawns selling. The psychological impact of that reference gold-futures price is sweeping!

There’s no doubt gold would be far better off without hyper-leveraged futures trading, which ought to be banned. These speculators should be bound by the same 2x that has served stock markets well for nearly a half-century. The crazy risks and perverse incentives of running 10x, 20x, 30x+ leverage are really contrary to the core mission of futures markets, which is enabling actual physical users to hedge prices.

But we must trade the markets we have, not the ones we want. And gold futures’ current wildly-outsized price impact on gold makes watching speculators’ trading activity essential for gaming gold’s near-term price action. Every week the collective spec trading in gold futures is summarized in the CFTC’s famous Commitments of Traders reports. They are current to Tuesdays closes, but not published until late Fridays.

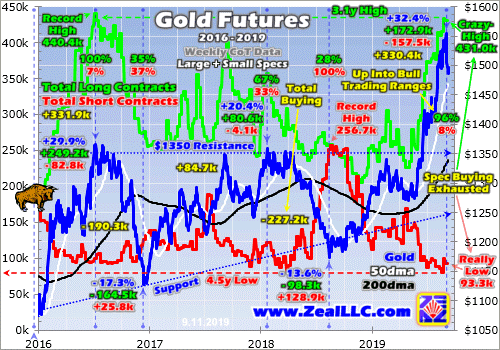

This chart superimposes the current gold bull over speculators’ total long and short positions in gold-futures contracts. The green long line shows their total upside bets each CoT week, while the red short one tracks their downside ones. Gold powers higher when these leveraged traders are buying, and falls when they are selling. Gold, silver, and their miners’ stocks can’t be successfully traded without following this.

This secular gold bull was born in mid-December 2015, and its maiden upleg was powerful and exciting. Gold soared 29.9% in just 6.7 months, a sea change after languishing in the prior bear market for years! Heavy spec gold-futures buying was the key driver of that mighty move. During that relatively-short span, speculators bought 249.2k gold-futures long contracts while buying to cover another 82.8k short ones.

That added up to a huge 331.9k contracts of total buying in largely the first half of 2016! That is the equivalent of 1032.3 metric tons of gold, or almost 2/3rds of the world’s total mined gold supply that half-year. The other primary driver of gold is investment demand, which was dominated by GLD in that upleg. But GLD’s holdings merely grew 352.6t in that same upleg span, just over a third of gold-futures buying.

The vertical blue lines divide this gold bull into its major uplegs and corrections. Note that uplegs require the green spec-gold-futures-longs line to rise and their red shorts line to fall. Gold can’t consistently rally when these guys aren’t buying. And when they are selling as evidenced by falling longs and rising shorts, gold heads lower in corrections. Speculators’ leveraged gold-futures trading dominates gold’s price action!

Fast-forward to today, where gold has powered 32.4% higher over 12.6 months in its biggest upleg of this bull so far. This move was largely driven by massive spec gold-futures long buying and short covering. This upleg was born last August when these traders were exceedingly bearish on gold. Their longs were relatively low, and their shorts had soared to an all-time-record high of 256.7k contracts. That was super-bullish!

I explained this at the time, writing an essay on specs’ record gold-futures shorts just over a year ago as gold traded under $1200. I concluded then “…gold and silver soon soared on short-covering buying following all past episodes of excessive and record short selling. There’s nothing more bullish for gold and silver than extreme shorts! … Record futures shorts are the best gold and silver buy signals available.”

Because of the extreme risks inherent in gold futures, the group of traders willing to bear these is always fairly small. The capital they collectively command is finite and relatively minor by market standards. So though their price-moving firepower is greatly amplified by radical leverage, their buying and selling soon exhausts itself. Once specs have bought or sold all the gold futures they are able to, gold is going to reverse.

All-time records in spec longs or shorts are easy to identify as extremes not likely to be sustainable for long. Spec longs hit their record high of 440.4k contracts in early July 2016, as this gold bull’s powerful maiden upleg peaked. Spec shorts crested at that 256.7k contracts in late August 2018, which is what birthed today’s strong upleg. But how can we decide what is relatively high or relatively low outside of records?

We want to aggressively buy gold and gold stocks when speculators’ gold-futures positioning grows too bearish, when their longs are low and shorts high. And we need to prepare to sell the resulting winning trades when their collective bets get excessively bullish, evidenced by high longs and low shorts. I’ve tried various approaches to analyzing this over the years, and finally developed a simple one that works.

Every week I game the near-term outlook in gold, silver, and their miners’ stocks by looking at how spec gold-futures longs and shorts are trading relative to their own bull-market-to-date trading ranges. These are expressed as percentages. When gold bottomed in mid-August 2018, total spec longs were 28% up into that range while total spec shorts were at 100% of their own. There was way more room to buy than sell.

The most-bullish-possible gold-futures positioning is specs being all-out, represented by 0% longs and 100% shorts. That means about all they can do is buy, both by adding new longs and buying to cover and close existing shorts. The lower spec longs and higher spec shorts, the more bullish gold’s near-term outlook and the bigger the coming gains as these traders buy to normalize their excessively-bearish positions.

Indeed gold’s latest upleg was driven by massive spec long buying and short covering over the past year or so. During that entire 12.6-month span ending last week where gold climbed 32.4%, total spec longs soared 172.9k contracts while total spec shorts collapsed 157.5k. That adds up to 330.4k contracts of gold-futures buying, the equivalent of 1027.7t. That’s nearly identical to the 331.9k bought in this bull’s first upleg!

Today’s upleg’s latest interim gold high of $1554 came last Wednesday September 4th. The latest weekly CoT report available before this essay was published was current to the previous day’s close. At that point before gold reversed hard and started falling, total spec longs were running 96.3% up into their gold-bull-market trading range since mid-December 2015. Total spec shorts were just 7.6% up into their own range.

The most-bearish-possible gold-futures positioning is specs being all-in, which happens at 100% longs and 0% shorts. Their capital firepower is exhausted, they are tapped out and just can’t materially add to their excessively-bullish bets any more. At that point all they can do is sell, beginning to normalize their lopsided positioning. And gold-futures selling quickly cascades due to the extreme leverage in these trades.

Last Tuesday as gold exuberance mounted, total spec longs ran 431.0k contracts. That was the third-highest on record, after the prior CoT week’s 433.0k and early July 2016’s 440.4k! There wasn’t much room for material new buying with longs so excessive. No matter how excited traders get after a strong gold run, the ranks of gold-futures speculators won’t swell much since the risks they bear are so extreme.

Gold not only faced virtually no more spec long buying last week, but little potential short-covering buying. The total spec shorts of 93.3k contracts weren’t much above their lowest levels seen in this gold bull just a couple CoT weeks earlier. Spec shorts never go to zero, there’s always a floor no matter how big and fast gold rallies. In this bull that has run around 90k or so. This upleg’s huge short covering was out of steam.

When gold-futures speculators’ potential buying exhausts itself, gold has to stall and top out. There’s just no more high-octane leveraged fuel to keep driving it higher. And at that point with specs essentially all-in longs and all-out shorts, it’s only a matter of time until some catalyst sparks selling. Early last Thursday it happened to be news the US-China trade talks are back on and better-than-expected US private-sector jobs.

Neither headline would’ve moved gold much had spec gold-futures positioning not been so extreme. But the only thing these traders could do was sell, and that soon snowballed. Again at 33.3x leverage, gold only has to move 3.0% against speculators’ bets to wipe out 100% of their capital risked. So they have to sell fast or risk ruin. And the more they sell the quicker gold falls, triggering still more selling by other traders.

Now that this gold-futures selling is underway, the extreme gold-futures-selling overhang that led into it has to be largely wiped out. That is likely to take at least a couple months coming from such near-record extremes. That portends a major correction in gold as specs dump their excessive longs and ramp up their barely-existent shorts. This gold bull’s own precedent is certainly ugly, as we saw after its maiden upleg.

In early July 2016 after gold soared 29.9% in 6.7 months, total spec longs and shorts were running 100% and 7% up into their bull trading ranges. By the time the necessary gold-futures selling to rebalance those positions ran its course, gold plunged 17.3% over the next 5.3 months! Just last week specs’ total longs and shorts stretched a similar 96% and 8% up into their bull-market trading ranges, which is menacing.

While gold is in for a major correction, thankfully it isn’t likely to challenge that H2’16 extreme. That was really exacerbated by an exceptional one-off anomaly. Trump’s surprise election win goosed the stock markets on hopes for big tax cuts soon, leading to extraordinary gold selling. Before Trump won, gold had decisively bottomed down just 8.3% before rallying again for weeks. That’s about what’s probable this time.

Speculators’ gold-futures positioning is so important to follow that I always discuss it in our weekly and monthly newsletters for subscribers. Since they graciously fund our business, they get this critical data and analysis well before I consider writing essays on it. I warned about all this in our new September newsletter published early on August 31st. That was before gold cracked on the inevitable gold-futures selling.

My conclusion then was “Gold is overextended, due for a healthy bull-market correction over the near-term. Its technicals are way too overbought, and its sentiment way too greedy. Too many buyers have flooded in too quickly, exhausting gold’s near-term upside potential. My best guess is a 6%-to-12% gold selloff, which the major gold stocks will leverage like usual by 2x to 3x.” That works out to 12% to 36%.

Gold-futures-selling overhangs can’t be taken lightly, as extreme spec positioning never lasts for long. The resulting gold corrections are very healthy for bulls, restoring balance to sentiment and technicals. But there’s no need to get trapped in them and see big prior-upleg gains in gold stocks just evaporate. When gold stocks are very overbought like last week, stop losses should be tightened to protect gains.

To multiply your capital in the markets, you have to trade like a contrarian. That means buying low when few others are willing, so you can later sell high when few others can. In the first half of 2019 well before gold’s breakout, we recommended buying many fundamentally-superior gold and silver miners in our popular weekly and monthly newsletters. We’ve recently realized big gains including 109.7%, 105.8%, and 103.0%!

To profitably trade great gold stocks, you need to stay informed about speculators’ positioning in gold futures which drives gold. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off sale! Get onboard now so you can mirror our coming trades for gold’s next upleg after this correction.

The bottom line is gold stalled and reversed hard because speculators’ leveraged gold-futures bets had grown too excessively bullish. Their longs were way up just under all-time-record highs, and their shorts were way down just over bull-market lows. These gold-dominating traders were effectively all-in longs and all-out shorts, leaving them little room to keep buying but vast room to sell on the right catalyst hitting.

Such gold-futures-selling overhangs resulting from specs waxing too bullish need to be normalized before gold bulls can resume. That only happens through heavy selling, both jettisoning exaggerated longs and ramping up meager shorts. This forces gold into major corrections, which are both necessary and healthy between major bull-market uplegs. They lead to the best buying opportunities seen within ongoing bulls.

Adam Hamilton, CPA

September 16, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

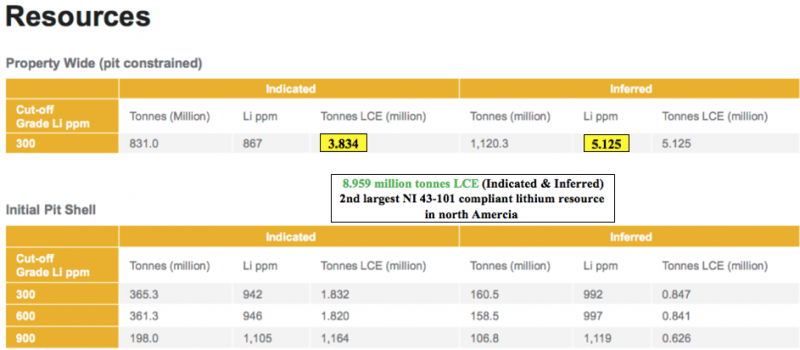

On August 29, Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF) announced the successful completion of slurry rheology & filtration studies that are an integral part of the Pre-Feasibility Study (PFS) for the Clayton Valley clay-hosted lithium project, located immediately adjacent to Albemarle Corp.’s Silver Peak brine processing facilities in Nevada.

Management believes its U.S. location will become an increasingly valuable attribute. While many junior lithium companies like to name drop “Albemarle” and “Silver Peak,” Cypress owns 100% of one of just a few projects in Nevada that Albemarle might actually be interested in.

More promising results from Cypress’ expert technical team

Back to the latest news…. the outcome was the result of months of testing by laboratories and a detailed review with consultants & equipment vendors. This news represents a major milestone in the project because the results simplify the process flow sheet.

Cypress CEO Dr. Bill Willoughby commented in the press release,

“A critical step for us at Clayton Valley is the separation of solids & liquids. A viable process is dependent upon the ability to separate the process leach solution (PLS) from the leached residue whether by thickeners, filters, or other means. Significant test work has allowed Cypress to identify a commercially viable process, based on filtration, to take the solid-liquid separation from the laboratory benchtop to the operational scale.”

Readers may recall that Cypress released positive results from the first & second phases of its PFS metallurgical program in February & July. Since then, work has continued on other aspects of the PFS, including recovery & concentration of lithium from solution through mechanical evaporation, membrane filtration, and ion-exchange processes.

CEO Willoughby continued,

“The Cypress technical team discovered the Clayton Valley clays behave differently at varying leach conditions. By looking at the electro-kinetic potential of the clays we can select the optimal reagents & equipment. We also know under what conditions the rheology of the slurries becomes a limitation, and can design the flow sheet accordingly. With this new knowledge, we are confident we can simplify a significant portion of the leaching flow sheet.”

Cypress is looking at additional steps to simplify plant design with the goal to further streamline the production process and lower costs. With metallurgical & materials handling studies completed, Cypress expects to publish a PFS during the fourth quarter.

Next major milestone is a PFS in 4th quarter

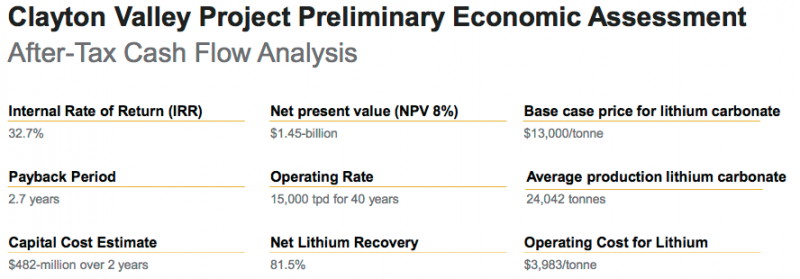

It appears the PFS has been pushed back a few months. After a recent capital raise the company is comfortably funded through delivery of a PFS later this year. Come to think of it, what’s the rush? Investor sentiment remains very weak for lithium, cobalt, vanadium & graphite juniors. As long as Cypress is funded, let them keep carrying out studies to improve the PFS! Below are some highlights from the PEA.

It’s important at this point to reiterate the considerable strength of management, the Board, technical advisers & retained consultants. All of these impressive people and groups are being effectively led by CEO Willoughby, who has a Doctorate in Mining Engineering & Metallurgy from the Univ. of Idaho.

Who on earth could possibly be better to run this show than a PhD in engineering & metallurgy!?! He knows what he’s doing, and he’s a driving force behind the very good results and progress his technical team is delivering.

I asked Dr. Willoughby about last week’s news, he said,

“It’s a major technical problem to separate ultrafine clays particles < 5 microns from a leach solution. Our solution could put us in the forefront of clay-hosted lithium projects globally.”

Demand keeps increasing, supply increasingly uncertain

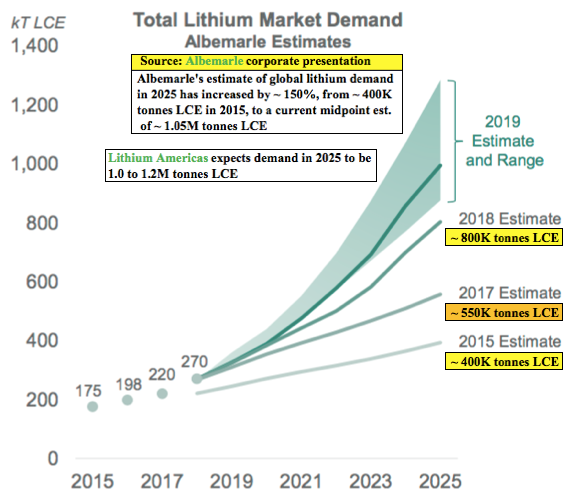

There’s a massive disconnect in the lithium world. For years, demand forecasts have been going up. The demand side of the equation — driven by both energy storage & the electrification of passenger & commercial vehicles — is likely to increase at a Compound Annual Growth Rate (CAGR) of at least 15%, perhaps 20% or more. For example, at a 20% CAGR from Albemarle’s 270K tonne figure in 2018, demand would reach 967K tonnes in 2025.

Albemarle has a particularly good graphic depicting this unmistakable trend. Four years ago they expected ~400K tonnes LCE demand in 2025. Now, Albemarle is forecasting demand of about 1 million tonnes in 2025. Likewise, Lithium Americas is forecasting between 1.0 to 1.2 million tonnes LCE demand in 2025, a range it says comes from industry producers & publicly reported forecasts.

, Finally, Fastmarkets expects LCE demand to grow from ~300K tonnes in 2019 to “at least” 1.1 million tonnes in 2025. So, a lot of forecasts in and around the one million tonne mark, but even if it turns out to be less, I think it will be a major challenge for supply to approach that level in the next six years.

The longer the project delays in Argentina / Chile brine projects, and the more project mishaps like at Nemaska, the more room there is for unconventional projects such as Cypress Development’s Clayton Valley. The market will take every battery-grade tonne of lithium chemicals produced by any company that can supply them. Lithium juniors who can make it across the production finish line will be richly rewarded.

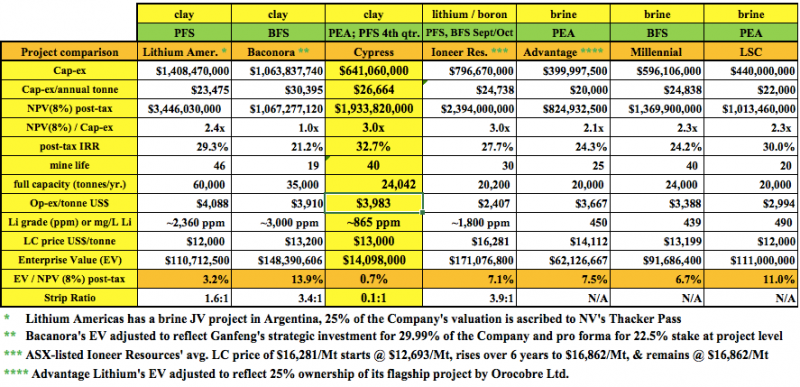

Despite significant fiscal & political challenges in Argentina that could further delay brine projects there, and continued slow movement in project development & production expansions in Chile, unconventional projects are still meaningfully undervalued compared to brine projects.

For example, Cypress Development Corp.’s enterprise value (“EV“) is less than 1% of the after-tax NPV found in its PEA. Compare that to the average 8.2% EV/NPV on the chart below. Cypress’ EV/cap-ex ratio of 3.0 times (3.0x) is 40% better than the 2.1x average of the other unconventional projects.

Cypress has the highest after-tax IRR on the chart at 32.7%, compared to an average of 26.1% among the others. And, the company’s cap-ex at C$641 million is 21% lower than the peer average.

Finally, readers should note that the Clayton Valley project has a strip ratio of 0.1 to 1. The other three projects with strip ratios average 3.0 to 1. Cypress has 1/30th the strip ratio of its unconventional peers!

That’s a big reason why the company has attractive op-ex & cap-ex, despite having lower grade Li to work with. Another reason is the mineralogy; the Clayton Valley project’s lithium abundance is hosted in a friendlier clay than that at some of the other projects. Friendlier meaning easier and less costly to liberate the lithium into solution.

The extreme weakness in the vast majority of lithium juniors is actually great news. Great news for any lithium company hopeful that can produce lithium next decade. Great news for investors who may want to average down in their favorite battery metals names.

Brine projects have gone from, “can’t go wrong,” to “can’t fund”

A funny thing happened over the past two years. Brine projects went from no-brainers; (lowest cost, best understood, most reliable) — to the exact opposite. Solar evaporation ponds are getting less and less popular by the week, day, hour! And, unusually rainy weather in the Puna region of Argentina has negatively impacted pond yields. Speaking of Argentina….. well just read the headlines, it’s not pretty.

Chile imposed an onerous sliding-scale royalty on realized lithium prices from production in the Atacama salar. Albemarle’s & SQM’s best, lowest cost lithium brine operations…. the world’s best, may no longer the world’s lowest cost.

Brine projects were sure things and clay-hosted lithium projects were, “maybe in 10 years.” Now? Most brine projects are dead in the water, some of them never coming back to life. Even the top-quartile, most advanced projects are not getting funded. By contrast, the prospects for clay-hosted lithium projects are better than they were two years ago, albeit also difficult to fund.

Investors would be crazy not to consider unconventional assets. Brine projects, with evaporation ponds attached, will themselves be unconventional at some point in the future. The only question is when.

In early August, Glencore announced it was shutting a major cobalt / copper mine in Africa at the end of the year. Three weeks later, cobalt prices are up 30-35%. It might not take that much to get lithium prices back on an upswing. If prices were to improve, juniors like Cypress Development Corp., trading at under 1% of third-party derived after-tax NPVs, could do quite well.

Peter Epstein

September 13, 2019

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker / dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this interview was posted, Peter Epstein owned shares of Cypress Development Corp., and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any future events & news, or write about any particular company, sector or topic. [ER] is not an expert in any company, sector or investment topic.

- Is the gold price reaction over?

- Well, since the rally began in the $1170 area, corrections have not lasted very long.

- After rallying to the $1566 area, gold has pulled back to about $1500. Please click here now: https://gracelandupdates.com/wordpress/wp-content/uploads/2019/09/2019sep10gold1.png Double-click to enlarge. Strong trend line support is already in play.

- Investors need to keep an open mind; it’s possible that the $1500 area is now support rather than resistance, and gold is set to rally towards the $1600-$1700 area.

- Please click here now: https://gracelandupdates.com/wordpress/wp-content/uploads/2019/09/2019sep10gold2.png Double-click to enlarge. Note the lows in the $1526 area in the 2011-2012 timeframe.

- Those lows may now be functioning as support as gold reacts from the $1566 area highs. Also, $1500 is a key round number that may now be functioning as support rather than resistance for institutional money managers.

- Indian festival buying may be picking up as well. Indians have been waiting for a decent pullback for months, and now it is here.

- Please click here now: https://gracelandupdates.com/wordpress/wp-content/uploads/2019/09/2019sep10trustydusty.png Double-click to enlarge this GDX swing trade chart.

- I recommend that most gold investors should consider allocating some capital to a swing trade program.

- My guswinger.com system has been in DUST-NYSE as GDX been “spanked”, and it’s now time to book solid profit on at least a portion of the position.

- Note the key low on the GDX chart at $27.61. If it’s violated, GDX could decline to the $26.04 area. Having said that, proper tactics can reduce investor risk dramatically.

- My suggestion to core position enthusiasts is to buy some gold stock now, and more if there is a deeper reaction. A stop order can be placed just under the $27.61 low.

- Investors who don’t like stops can also buy the $27.61 area…with very small size.

- Please click here now: https://gracelandupdates.com/wordpress/wp-content/uploads/2019/09/2019sep10gdx1.png Double-click to enlarge. If the inverse H&S bottom on this weekly GDX chart is legitimate, the current reaction is likely to be very shallow and may already be ending.

- The target of the pattern is about $50. The biggest risk investors face now is not drawdowns, but rather missing out on a major run higher in most of the world’s quality miners!

- Please click here now: https://gracelandupdates.com/wordpress/wp-content/uploads/2019/09/2019sep10trade1.png The global economy continues to weaken, and politicians do nothing but spend, borrow, and beg for more QE and negative rates.

- That’s pouring gas on the fire. Negative rates and QE incentivize governments to go even deeper into debt.

- Please click here now: “In the next credit cycle downturn, then, the generally lower credit quality of today’s speculative-grade population means that the default count could exceed the Great Recession peak of 14% of all rated issuers….” – Christina Padgett, Moody’s VP, Sep 9, 2019.

- This is spectacular news for gold!

- Please click here now: https://gracelandupdates.com/wordpress/wp-content/uploads/2019/09/2019sep10gdxj1.png Double-click to enlarge this GDXJ chart.

- As expected, GDXJ looks a bit more vulnerable than GDX in the short-term. Having said that, it’s important for investors to be as open to a surge above $43 as to a pullback to $33-$35.

- An upside breakout would open the door to a massive run higher, and whether investors pay a “ticket price” of $33 or $43 for their GDXJ ride really doesn’t matter.

- The rise of China and India is not going away. The decline of the West is not going away. These forces are destabilizing the dollar and ushering in a bull era for gold, silver, and associated miners.

- It’s no longer as important to avoid price reactions as it is to stay invested and buy breakouts. As stagflation grows, this gold market will become very similar to the 1970s market… on a much bigger scale!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Super Seniors On The Move” report. I highlight key senior miners that are trading under $20 that are showcasing fabulous relative strength versus the gold ETFs. I include important wealth building tactics for investors!

Stewart Thomson

September 11, 2019

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

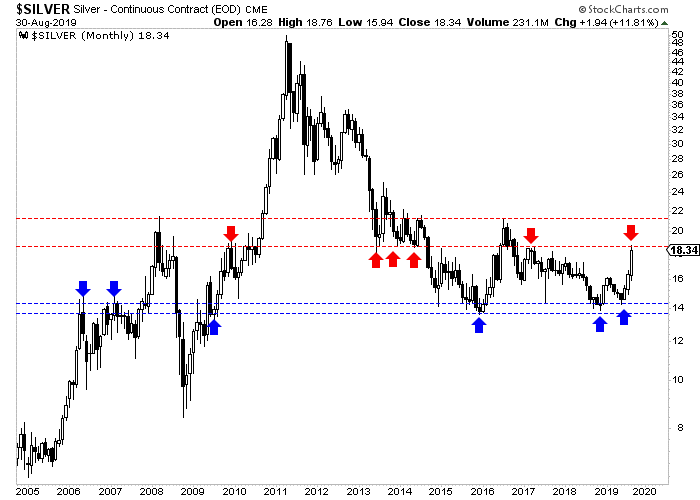

It has taken a few weeks to play out but our warning of a correction in precious metals (first on August 18) is coming to pass.

Last week Gold, Silver and GDX all formed big bearish reversals at multi-year resistance levels. Yes, these resistance levels (Gold $1550, Silver $18.50, GDX 31) date back to 2013.

Bonds and precious metals have benefitted from the shift in Fed policy as well as fears of recession and growth in negative interest rate bonds.

These drivers could pause or shift temporarily and that would be supportive of stocks and not precious metals. Let me explain.

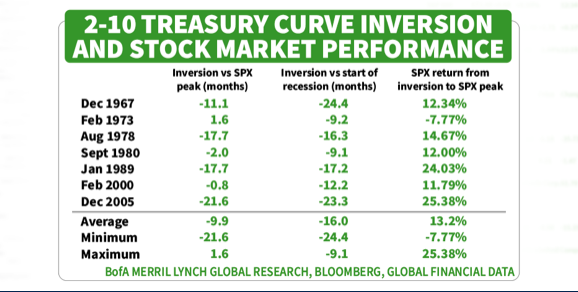

First, the fears of recession are driven by the inversion of the yield curve. But the problem is the timing.

There is a lag between the inversion and the peak in the stock market, and stocks tend to perform well during that lag period. The data below shows an average gain of 13% and an average lag time of 10 months.

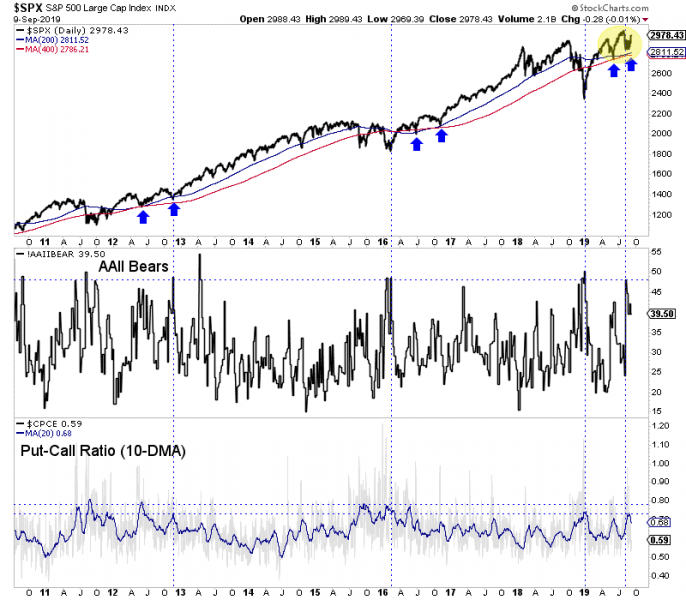

The U.S. stock market has held up very well despite growing recession fears and persistent bearish sentiment. In the chart below we plot the S&P 500 along with two sentiment indicators.

In recent weeks, the number of AAII Bears and the put-call ratio together hit their third highest level in nearly the past seven years. Despite that sentiment, the S&P appears to be emerging from its recent lows in the manner it did in 2012 and 2016.

A sustained rally in the stock market is going to allay some recession fears and suck some capital out of bonds thereby leading to higher yields.

This will cause precious metals to correct but that is no surprise given what the charts are already showing us. How much and how long of a correction will depend on Fed policy.

If the Fed continues to cut rates well into 2020 then that is bullish for precious metals even if the long end of the yield curve is rising. If the Fed cuts in September and stands pat until March 2020 then precious metals will continue to correct and digest recent gains.

Ultimately, the mix of a stronger dollar, inverted yield curve and political pressure is more likely than not to lead to continued rate cuts over the next 15 months.

Therefore if you missed the recent run in precious metals, don’t panic. It’s best to be patient and let this correction run its course. Better value and new opportunities will emerge. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

by Jordan Roy-Byrne CMT, MFTA

September 10, 2019

The gold miners’ stocks have grown very overbought after soaring dramatically higher in recent months. Blasting really far really fast has left this sector really stretched technically and sentimentally. Excessive gains and greed always soon lead to major corrective selloffs, which are necessary to restore balance. All bull markets, even the most powerful, flow and ebb. Big uplegs are inevitably followed by corrections.

With gold and gold stocks plunging hard Thursday morning, the timing of this research thread is certainly lucky. My weekly-web-essay workflow is well-defined, this happens to be the 877th I’ve written. I have to decide on each week’s topic by early Wednesdays, to do the research and build necessary spreadsheets and charts that day.

Even before this latest bout of selling erupted, the serious downside risks facing overbought gold stocks were readily apparent. According to virtually every technical indicator out there, this sector was looking ever-more extreme in recent weeks. The longer and farther gold stocks surged, the greater the odds for a selloff. I warned about this Saturday morning in the conclusion to our latest monthly newsletter for subscribers.

Before the selling hit I wrote, “Gold is overextended, due for a healthy bull-market correction over the near-term. Its technicals are way too overbought, and its sentiment way too greedy. Too many buyers have flooded in too quickly, exhausting gold’s near-term upside potential. My best guess is a 6%-to-12% gold selloff, which the major gold stocks will leverage like usual by 2x to 3x.” That works out to 12% to 36%!

Stock prices can’t soar higher without material interruptions indefinitely. Even strong uplegs eventually burn themselves out, attracting in all interested buyers over the near-term. They rush to buy to ride the upside momentum, basking in the warm greed. But once their capital firepower is exhausted, price gains stall and peak. That leaves nothing but sellers, and their resulting downside momentum feeds on itself.

The massive gains gold miners’ stocks enjoyed in recent months have truly been extraordinary, stoking widespread greed. This first chart is a seasonal one, rendering this sector’s price action in like indexed terms during every summer in modern bull-market years. Normally gold and gold stocks face seasonal drifts to slumps in market summers, the dreaded summer doldrums. This summer’s monster rally defied that.

Traders use two major benchmarks to measure gold-stock prices, the popular GDX VanEck Vectors Gold Miners ETF and the venerable HUI NYSE Arca Gold BUGS Index. Both of these track the major gold miners’ stocks. While GDX has gradually usurped the HUI in prominence, it remains too young for long-term studies. GDX was born in May 2006, roughly halfway through the last secular gold and gold-stock bull.

So the HUI has to be used to distill all gold-stock summer action from 2001 to 2012 and 2016 to 2019, the modern gold-bull-market years excluding intervening bear years. Every summer is individually indexed to its final May close, which is set at 100. Then its June, July, and August price action is recast from that common baseline. All these individual-summer indexes averaged together show the summer-doldrums drift.

The center-mass trend of this spilled-spaghetti chart is a sideways grind, within 10% either direction of the final May close. This summer’s breakout gold-stock rally is rendered in dark blue, and it proved an utter monster. By the end of August, the HUI had skyrocketed 45.3% higher during the three calendar months of the market summer! The seasonal average in modern gold-bull-market years before 2019 was a 3.2% gain.

The gold miners just soared to their best summer performance in recent decades! The only comparable year was 2016, making its example important for gaming today’s overboughtness. The gold stocks spent the last few months racing higher neck-and-neck with the summer of 2016, trading the lead back and forth multiple times. It wasn’t until the last couple weeks that 2019 injected the nitrous and screamed past.

By the end of July 2016, the HUI had soared 36.3% summer-to-date compared to 2019’s considerably-smaller 26.9% gains in that same span. But by the end of August 2016, those had collapsed back down to +10.1% over that entire summer. This summer’s strong finish after a powerful multi-month rally is truly in a league of its own. Only 2003 rivaled it with 36.9% summer gains, but those started well later mid-summer.

Overboughtness is a relative thing, it can’t be defined absolutely since prevailing price levels gradually change over time. But the biggest summer gold-stock rally in modern history certainly raises concerns of running too far too fast. Gold stocks soaring by about half in several months is a huge move even by their wild standards! This mighty gold-stock surge looks even more extreme considered in longer-term context.

This next chart encompasses the current gold-stock bull since early 2016, which was driven by gold’s own parallel secular bull. Professional institutional investors have often gamed this bull with that leading and dominant GDX ETF, so it is used here rather than the older HUI. While the gold miners’ stocks achieved much technically this summer, there’s no doubt they soared to super-overextended levels which is ominous.

As of this past Wednesday’s close, the data cutoff for this essay, GDX had powered up 76.2% in 11.8 months. Interestingly that’s right in line with the last secular gold-stock bull’s average upleg gain. From November 2000 to September 2011, the HUI skyrocketed 1664.4% higher over 10.8 years! Those gains accrued in 12 separate uplegs. Excluding an anomalous post-stock-panic-recovery one, they averaged 80.7% gains.