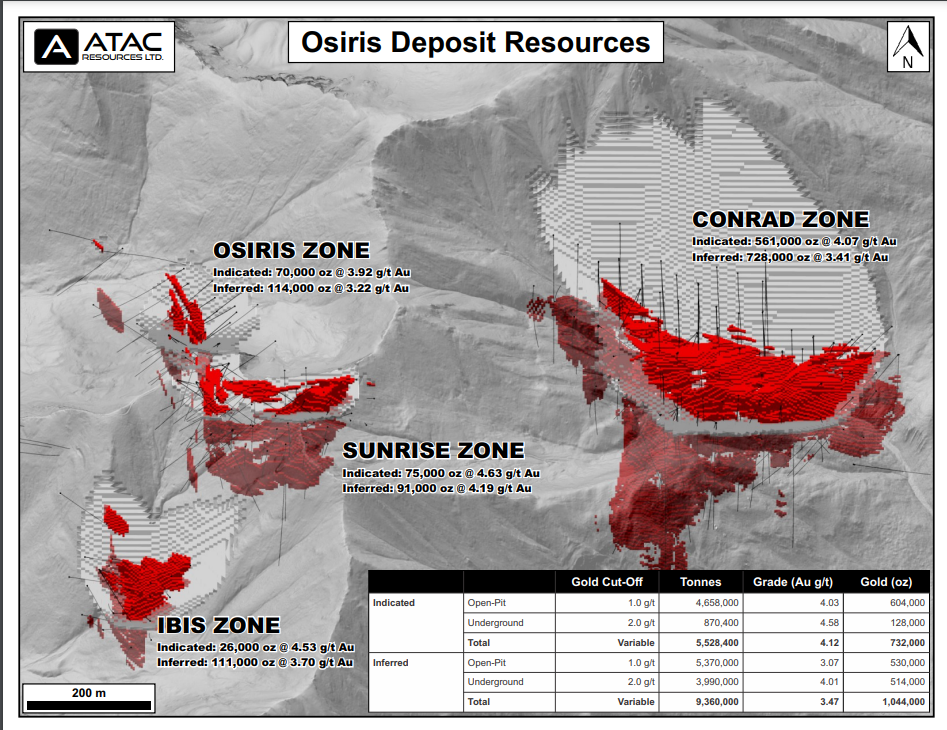

ATAC Resources (TSXV:ATC) has announced it has completed an updated mineral resource estimate at the Osiris Deposit at the Rackla Gold Property in Yukon, Canada. The 100%-owned property demonstrates a significant conversation of resources from the Inferred to Indicated category at the Osiris Deposit. This mineral resource estimate updates data from the previously released 2018 Osiris Resources. The company has since done additional geological modelling, geotechnical studies, and metallurgical test work since then. The cut-off grades for the deposit have also been modified to reflect current gold prices.

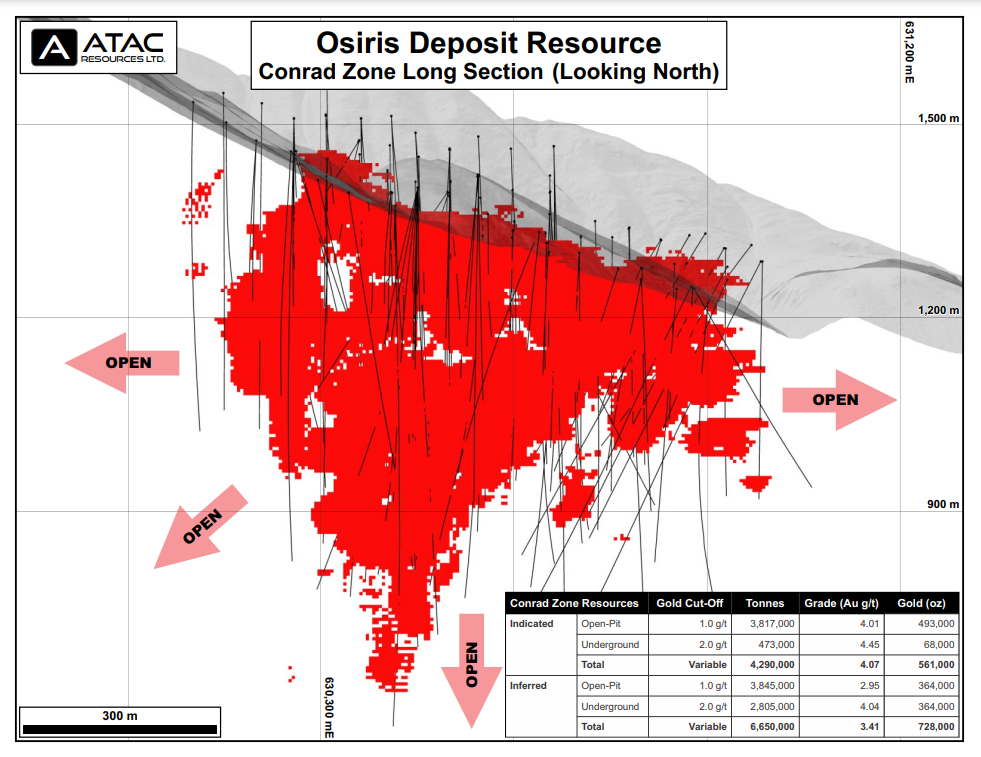

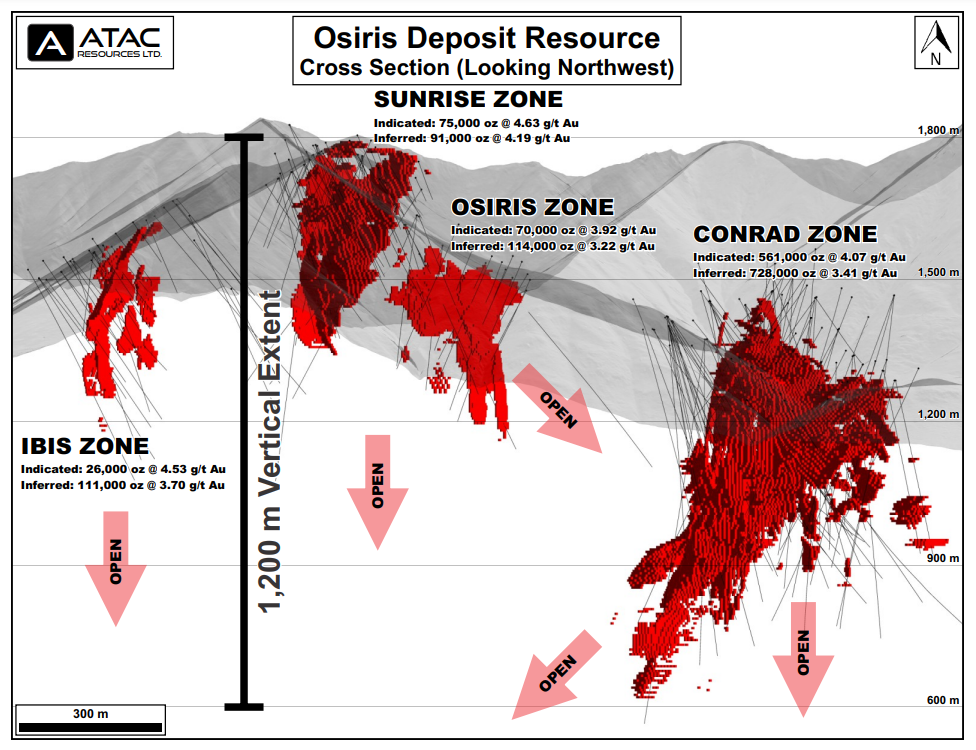

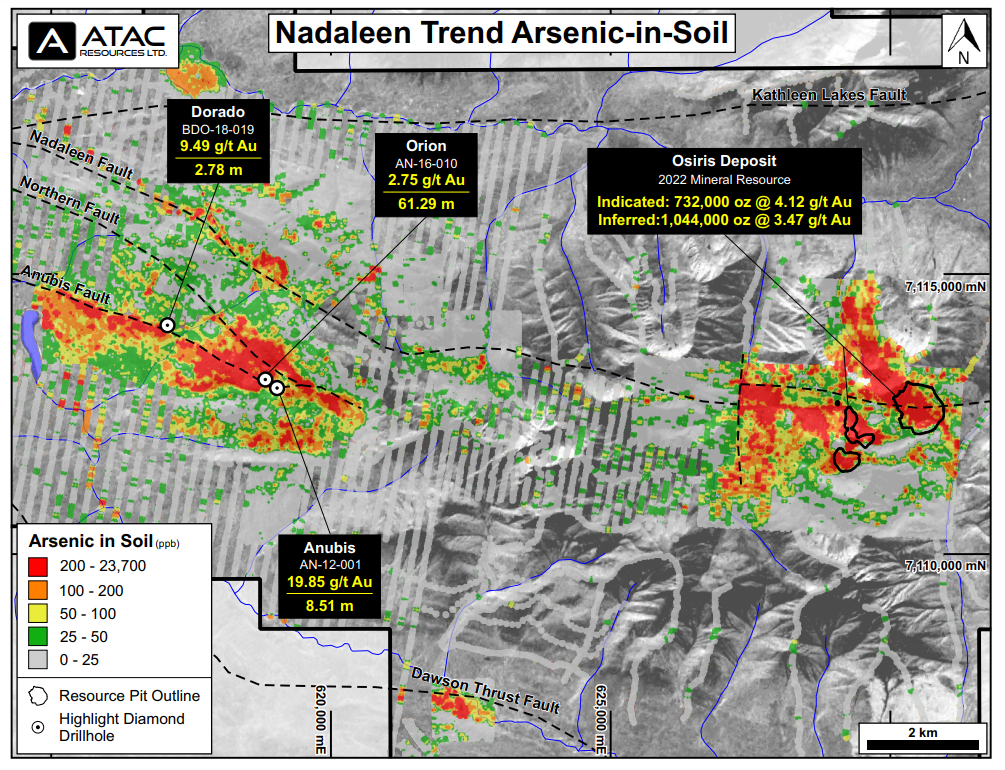

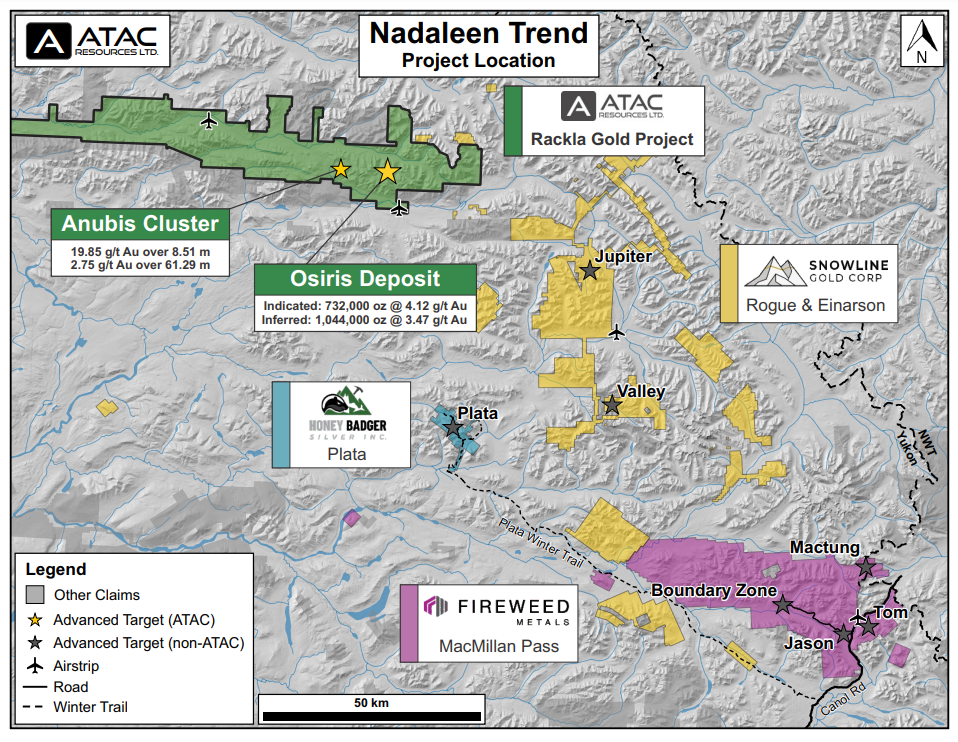

The Osiris Deposit is located at the eastern end of ATAC Resources’ Nadaleen Project. The deposit has four zones: Conrad, Sunrise, Osiris, and Ibis. All four of the zones remain open in multiple directions. The company also has additional targets at the pre-resource stage.

Graham Downs, President and CEO of ATAC Resources, commented in a press release: “We are very pleased to demonstrate significant conversion of resources from the Inferred to Indicated category at Osiris. This continues to demonstrate the confidence we have in this extensive, high-grade Carlin-style system that hosts some of the best gold intervals ever reported in Yukon. Work over the past two years has focused on technical studies and modeling, leading to growth of the deposit and improved classification of part of the resources at Osiris. We have recently completed 1,500 m of drilling stepping out on open near-surface parts of the resource and look forward to releasing those results when available.”

Highlights from the Deposit Resource Update include:

- Indicated Mineral Resource of 732,000 ounces gold at an average grade of 4.12 g/t (in 5.5 Mt), including pit-constrained resources of 604,000 ounces gold at 4.03 g/t (in 4.7 Mt);

- Inferred Mineral Resource of 1,044,000 ounces gold at an average grade of 3.47 g/t (in 9.4 Mt), including pit-constrained resources of 530,000 ounces gold at 3.07 g/t (in 5.4 Mt);

- Conversion of 43% of the 2018 maiden Inferred Resource (1,685,000 ounces at 4.23 g/t) to the Indicated category;

- All zones remain open to extension along strike and at depth; and

- Metallurgical testwork confirms >80% gold recoveries, and viable processing paths with flotation, pre-treatment by either pressure oxidation or roasting, and cyanide leaching.

Osiris Deposit – Mineral Resource Estimate Summary1,2,3

| Classification | Type | Gold Cut-off

(Au g/t) |

Tonnes | Grade

(Au g/t) |

Gold (ounces) |

| Indicated | Open-Pit3 | 1.0 | 4,658,000 | 4.03 | 604,000 |

| Underground | 2.0 | 870,400 | 4.58 | 128,000 | |

| Total | Variable | 5,528,400 | 4.12 | 732,000 | |

| Inferred | Open-Pit3 | 1.0 | 5,370,000 | 3.07 | 530,000 |

| Underground | 2.0 | 3,990,000 | 4.01 | 514,000 | |

| Total | Variable | 9,360,000 | 3.47 | 1,044,000 |

| 1. | CIM definition standards were used for the Mineral Resource. The Qualified Person is Steven Ristorcelli, C.P.G., associate of MDA. |

| 2. | Numbers may not add due to rounding. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 3. | Open-Pit material was constrained using a Whittle™ optimization at US$1,800/oz gold price. |

Figure 2 – Conrad Long Section

Figure 3 – Osiris Long Section

Figure 4 – Nadaleen Trend

Figure 5 – Nadaleen Project Location

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.