Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

The back-and-forth trading in the USD Index ended as it pierced through the short-term resistance and also above this year’s high. As we have emphasized many times previously, the U.S. currency is after long-, medium- and short-term breakouts so the surprises should be to the upside. Consequently, yesterday’s rally was not unexpected. What was surprising was the lack of real decline in the precious metals sector. Does this mean that the USD rally won’t hurt gold and silver investors? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

Click here for reference chart.

The above chart clearly shows that there was indeed a breakout. At the moment of writing these words, the USD Index is slightly above the 82 level. Is this the time to get excited about the strength of the U.S. dollar? Not really. The breakout will need to be confirmed first. We would like to see 2 additional closes above the broken resistance before we think that the continuation of the rally is very probable. It’s already probable, but the odds will increase once we see a confirmation.

Please note that the U.S. currency was strong enough not to really decline at the most recent cyclical turning point. Instead, we saw only a small local top that was followed by a consolidation. This type of flat correction is something that characterizes strong uptrends, so it seems quite likely to us that the rally will be continued. The odds will further increase if yesterday’s breakout becomes confirmed.

Consequently, the USD Index will likely put bearish pressure on the precious metals sector and once the breakout is confirmed, this will become very likely. Gold and silver are currently at a critical juncture and this pressure might be the thing that “helps metals to decide in which way to go”.

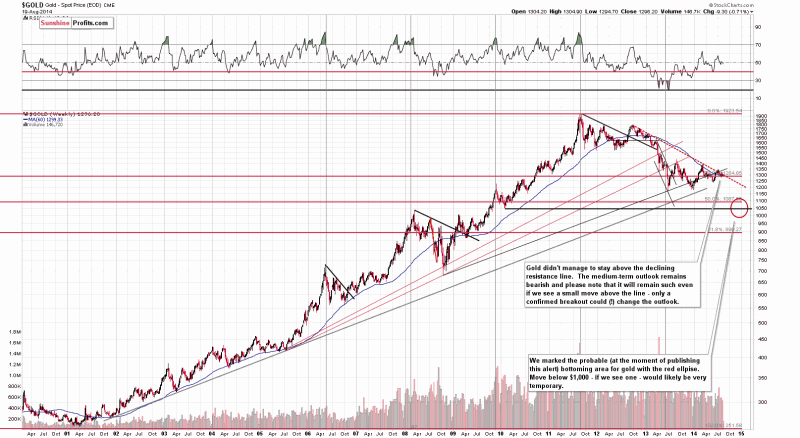

The critical juncture is created by 2 lines that we see in gold and silver. In gold, we have the declining medium-term resistance line. It was broken a few times, but only temporarily – gold moved back below it shortly. Gold would need to verify a breakout (and actually break out first) above this line before a move higher would become probable.

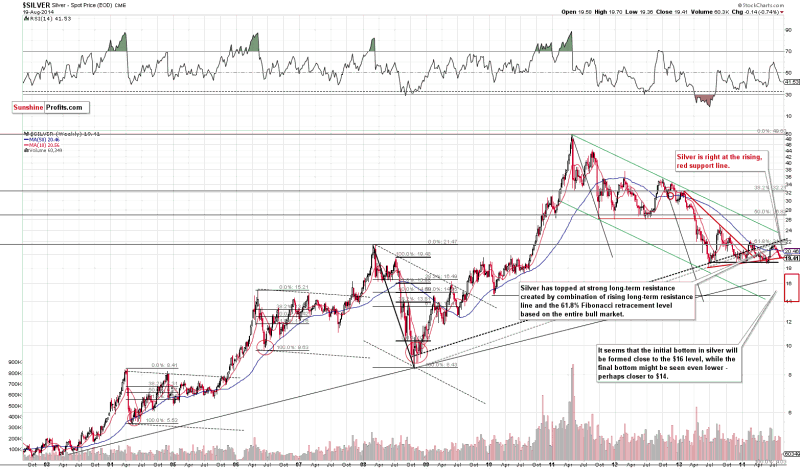

Silver, on the other hand, provides the support line. The white metal is not (yet) at its previous lows, but it’s already at the support line that is created by connecting these lows. Once this support is broken, the decline is likely to accelerate. If silver breaks below the previous lows, we could see a very sharp move into our target area. Will this happen soon? There are no certainties, but it’s becoming more and more likely that we will see this type of action in the following weeks or months.

What’s the most likely outcome for the following days? In our opinion we could see a verification of the breakout in the USD Index in the form of a pullback, which would cause a temporary upswing in gold and – especially – silver. Then the rally in the USD would continue and so would the decline in the precious metals sector. Of course, there are no guarantees, but the above is our best guesstimate at the moment.

The above-mentioned corrective upswing in metals could provide a confirmation that the big decline is about to start – for instance if we see silver’s outperformance and/or miners move higher on tiny volume.

Summing up, the situation in the precious metals market still remains too unclear to open any positions in our view, but it seems that we won’t have to wait too long before things clarify and the risk/reward ratio becomes favorable enough to open a trading position.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.