NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

VANCOUVER, BC / ACCESSWIRE / June 11, 2021 / Great Atlantic Resources Corp. (TSXV.GR) (the "Company" or "Great Atlantic"), is pleased to announce that it has closed its private placement offering (the "Offering") for aggregate gross proceeds of approximately $2,060,000, consisting of: (i) $1,360,000 in flow-through units of the Company (the "FT Units") at a price of $0.68 per FT Unit, and (ii) $700,000 in units of the Company (the "Units") at a price of $0.50 per Unit.

Each FT Unit is comprised of one common share of the Company that will qualify as a "flow-through share" within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the "Tax Act") (a "FT Common Share") and one common share purchase warrant of the Company (a "Warrant"). Each Unit is comprised of one common share of the Company (a "Common Share") and one Warrant. Each Warrant entitles the holder to purchase one Common (a "Warrant Share") at an exercise price equal to $0.75 at any time up to 36 months from closing of the Offering.

The gross proceeds from the sale of FT Units (other than the minimal amount allocable to the Warrants) will be used for exploration expenses on the Company's mining projects as permitted under the Tax Act to qualify as Canadian Exploration Expenses ("CEE") as defined in the Tax Act. The FT Common Shares, Common Shares and the Warrant Shares to be issued under the Offering have a hold period of four months and one day closing of the Offering.

In a second-step transaction, and part and parcel of the completion of the Offering, Eric Sprott, through 2176423 Ontario Ltd., a corporation that is beneficially owned by him, acquired 2,000,000 Units for approximate consideration of $1,000,000. Subsequent to the closing of the offering, Mr. Sprott beneficially owns or controls 2,000,000 Common Shares of the Company and 2,000,000 Warrants, representing approximately 9.2% of the issued and outstanding common shares of the Company on a non-diluted basis and approximately 16.9% of the issued and outstanding common shares of the Company on a partially diluted basis, assuming exercise of the Warrants forming part of the Units acquired. Prior to the offering, Mr. Sprott did not beneficially own or control any securities of the Company.

The Units were acquired by Mr. Sprott for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of Great Atlantic Resources, including on the open market or through private acquisitions, or sell securities of the company, including on the open market or through private dispositions in the future, depending on market conditions, reformulation of plans and/or other factors that Mr. Sprott considers relevant from time to time.

A copy of Mr. Sprott's early-warning report will be filed under Great Atlantic's profile on SEDAR and may also be obtained by calling Mr. Sprott's office at 416-945-3294 (200 Bay St., Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

In connection with the Offering, the Company issued Units and broker warrants to a finder. Each broker warrant is exercisable to acquire one Unit at $0.50 per Unit for a period of 36 months from the issuance date thereof.

On Behalf of the board of directors

"Christopher R Anderson"

Mr. Christopher R. Anderson "Always be positive, strive for solutions, and never give up"

President CEO Director

604-488-3900 – Dir

Investor Relations:

Please call 604-488-3900

About Great Atlantic Resources Corp.: Great Atlantic Resources Corp. is a Canadian exploration company focused on the discovery and development of mineral assets in the resource-rich and sovereign risk-free realm of Atlantic Canada, one of the number one mining regions of the world. Great Atlantic is currently surging forward building the company utilizing a Project Generation model, with a special focus on the most critical elements on the planet that are prominent in Atlantic Canada, Antimony, Tungsten and Gold.

Forward-looking statements: This press release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address future exploration drilling, exploration activities and events or developments that the Company expects, are forward looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include exploitation and exploration successes, continued availability of financing, and general economic, market or business conditions.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Great Atlantic Resource Corp

888 Dunsmuir Street – Suite 888, Vancouver, B.C., V6C 3K4

SOURCE: Great Atlantic Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/651392/Great-Atlantic-Completes-20-Million-Offering-Backed-by-Mr-Eric-Sprott

There are a few key trends to look for if we want to identify the next multi-bagger. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Antofagasta's (LON:ANTO) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Antofagasta is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.11 = US$1.6b ÷ (US$17b – US$1.6b) (Based on the trailing twelve months to December 2020).

So, Antofagasta has an ROCE of 11%. In absolute terms, that's a pretty standard return but compared to the Metals and Mining industry average it falls behind.

View our latest analysis for Antofagasta

In the above chart we have measured Antofagasta's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Antofagasta.

What Can We Tell From Antofagasta's ROCE Trend?

Antofagasta is displaying some positive trends. Over the last five years, returns on capital employed have risen substantially to 11%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 24%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

Our Take On Antofagasta's ROCE

In summary, it's great to see that Antofagasta can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. Therefore, we think it would be worth your time to check if these trends are going to continue.

Antofagasta does have some risks though, and we've spotted 2 warning signs for Antofagasta that you might be interested in.

While Antofagasta may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

TORONTO, Jun 11, 2021–(BUSINESS WIRE)–Americas Gold and Silver Corporation ("the "Company") (TSX:USA; NYSE American: USAS) is pleased to report that shareholders voted in favour of all items of business including the election of each of the nominees listed in its management information circular ("Circular") dated April 30, 2021 at its annual and special meeting of shareholders held on June 10, 2021. Detailed results from the election of directors are set out below.

|

Nominee |

Votes For |

% For |

Votes Withheld |

% Withheld |

||||||

|

Alex Davidson |

32,027,448 |

78.97% |

8,529,659 |

21.03% |

||||||

|

Darren Blasutti |

35,023,999 |

86.36% |

5,533,108 |

13.64% |

||||||

|

Alan Edwards |

34,863,041 |

85.96% |

5,694,066 |

14.04% |

||||||

|

Bradley R. Kipp |

35,021,779 |

86.35% |

5,535,328 |

13.65% |

||||||

|

Gordon Pridham |

32,481,343 |

80.09% |

8,075,764 |

19.91% |

||||||

|

Manuel Rivera |

35,029,162 |

86.37% |

5,527,945 |

13.63% |

||||||

|

Lorie Waisberg |

23,090,842 |

56.93% |

17,466,265 |

43.07% |

The biographies of directors and further details about the Company’s corporate governance practices are available at www.americas-gold.com.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company owns the Relief Canyon mine in Nevada, USA, the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also owns the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210611005102/en/

Contacts

Stefan Axell

VP, Corporate Development & Communications

Americas Gold and Silver Corporation

416-874-1708

Darren Blasutti

President and CEO

Americas Gold and Silver Corporation

416‐848‐9503

TORONTO, June 11, 2021 (GLOBE NEWSWIRE) — Noront Resources Ltd. (TSXV: NOT) ("Noront" or the "Company") has completed its previously-announced private placement financing (the "Private Placement") of 21,659,385 common shares of the Company ("Common Shares") at a price of $0.283 per Common Share (the "Issue Price") for gross proceeds of approximately $6.1 million, excluding the Wyloo Top-Up Shares (as defined below).

In connection with the Private Placement, Wyloo Canada Holdings Pty Ltd. ("Wyloo Canada") exercised its top-up right to maintain its pro rata equity interest in the Company (the "Wyloo Top-Up") by subscribing for an additional 12,744,363 Common Shares at the Issue Price (the "Wyloo Top-Up Shares") for additional gross proceeds of approximately $3.6 million.

Accordingly, the Company issued an aggregate of 34,403,748 Common Shares at the Issue Price for gross proceeds of approximately $9.7 million pursuant to the Private Placement and the Wyloo Top-Up.

In addition, Baosteel Resources International Co. Ltd. ("Baosteel") has a right to maintain its pro rata equity interest in the Company by acquiring an additional 1,966,125 Common Shares at the Issue Price (the "Baosteel Top-Up Shares") for additional gross proceeds of approximately $0.55 million. Baosteel has until July 5, 2021 to exercise its top-up right to acquire the Baosteel Top-Up Shares.

The Common Shares issued pursuant to the Private Placement were distributed in offshore jurisdictions pursuant to Ontario Securities Commission Rule 72-503 – Distributions Outside Canada and, as such, will not be subject to a statutory hold period in accordance with applicable securities laws. The Wyloo Top-Up Shares are subject to a hold period of four months and one day from the date of issuance.

TD Securities Inc. acted as agent and financial advisor to Noront in connection with the Private Placement and received a cash commission equal to 3% of the gross proceeds raised from the Private Placement.

The Private Placement remains subject to the final approval of the TSX Venture Exchange (the "Exchange").

Wyloo Canada is a "related party" of Noront as Wyloo Canada is a person that has beneficial ownership of, and control or direction over, directly or indirectly, securities of Noront carrying more than 10% of the voting rights attached to all of Noront's outstanding voting securities. As a result, the issuance of the Wyloo Top-Up Shares is a "related party transaction" pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"), incorporated by reference into Policy 5.9 – Protection of Minority Security Holders in Special Transactions of the Exchange. Noront is relying on (i) the exemption set forth in sections 5.5(a) and (b) of MI 61-101 from the formal valuation requirement, and (ii) the exemption set forth in section 5.7(a) of MI 61-101 from the "minority approval" requirement, in connection with the issuance of the Wyloo Top-Up Shares.

About Noront Resources

Noront Resources Ltd. is focused on development of its high-grade Eagle’s Nest nickel, copper, platinum and palladium deposit and the world class chromite deposits including Blackbird, Black Thor, and Big Daddy, all of which are located in the James Bay Lowlands of Ontario in an emerging metals camp known as the Ring of Fire. www.norontresources.com

CAUTIONARY LANGUAGE AND FORWARD-LOOKING STATEMENTS

This news release includes certain statements that may be deemed "forward-looking statements". Except for statements of historical fact relating to Noront, information contained herein constitutes forward-looking information, including any information related to Noront's strategy, plans or future financial or operating performance. Forward-looking information is characterized by words such as "plan", "expect", "budget", "target", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may", "will", "could" or "should" occur. In order to give such forward-looking information, the Company has made certain assumptions about its business, operations, the economy and the mineral exploration industry in general on each of the foregoing. Forward-looking information is based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those described in, or implied by, the forward-looking information. Although Noront has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in, or implied by, the forward-looking information, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding Noront's expected performance and Noront's plans and objectives and may not be appropriate for other purposes. All forward-looking information contained herein is given as of the date hereof, as the case may be, and is based upon the opinions and estimates of management and information available to management of the Company as at the date hereof. The Company undertakes no obligation to update or revise the forward-looking information contained herein and the documents incorporated by reference herein, whether as a result of new information, future events or otherwise, except as required by applicable laws.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities laws or pursuant to available exemptions therefrom.

For Further Information Contact:

Greg Rieveley

Chief Financial Officer

greg.rieveley@norontresources.com

(416) 367-1444

Shareholders:

Laurel Hill Advisory Group

1-877-452-7184 (toll-free in North America) or 1-416-304-0211 (collect call outside North America)

assistance@laurelhill.com

Media:

Ian Hamilton

ihamilton@longviewcomms.ca

(905) 399-6591

Janice Mandel

janice.mandel@stringcom.com

(647) 300-3853

VANCOUVER, British Columbia, June 11, 2021 (GLOBE NEWSWIRE) — International Consolidated Uranium Inc. (“CUR” or the “Company”) (TSXV: CUR) is pleased to provide the following updates on the option agreement (the “Option Agreement”) with U3O8 Corp. (“U308”) (TSXV: UWE.H) that was previously announced on December 14, 2020, providing CUR with the option to acquire a 100% undivided interest in the Laguna Salada project (“Laguna Salada” or the “Property”) located in Chubut Province, Argentina.

Following receipt of conditional approval of the TSXV Venture Exchange (“TSXV”), the Option Agreement has become effective as of June 11, 2021. As a result of the Option Agreement having been made effective, CUR will deliver consideration to U308 comprised of (i) $125,000 to be satisfied by the issuance of 56,306 common shares in the capital of the Company (the “Common Shares”), at a deemed price of $2.22 per share (based on the 5-Day VWAP of the Common Shares up to June 9, 2021, being the second business day prior to the Option Agreement being made effective), and (ii) a cash payment of $225,000, of which $50,000 is to be utilized for expenditures on the Property.

In addition, CUR has provided notice to U308 of its exercise of the option to acquire the Property, for consideration of $1,500,000 to be satisfied by the issuance of 675,675 Common Shares, at a deemed price of $2.22 per share based on the 5-Day VWAP of the Common Shares up to June 9, 2021, being the second business day prior to the option being exercised). Upon issuance, it is anticipated that the 675,675 Common Shares will be held in escrow pending closing of the acquisition. In addition, as a result of the exercise of the option, U308 will be entitled to receive certain future payments contingent upon the attainment of certain milestones tied to the spot price of uranium, as described in the Company’s press release dated December 14, 2020.

Philip Williams, President and CEO commented “Exercising the Laguna Salada option is a logical next step for the Company given the improving market interest in the uranium sector. Our strategy when entering the Option Agreement, as well as our other option agreements, was to exercise when we were confident that the value to be derived by the Company in owning the project outright would be greater than the cost of acquisition. We believe that time is now and, given our outlook for uranium prices, as well as the exploration and development potential we see at Laguna Salada, we see this as a great opportunity to enhance value for CUR shareholders”.

Closing of the acquisition remains subject to satisfaction of certain closing conditions customary for a transaction of this nature. All securities issued in connection with the Option Agreement are subject to final approval of the TSXV and will be subject to a hold period expiring four months and one day from the applicable date of issuance.

About International Consolidated Uranium

International Consolidated Uranium Inc. (TSXV: CUR) is well financed to execute its strategy of consolidating and advancing uranium projects around the globe. The Company has acquired a 100% interest or has entered into option agreements to acquire a 100% interest in seven uranium projects, in Australia, Canada, and Argentina, each with significant past expenditures and attractive characteristics for development. CUR has entered into option agreements with Mega Uranium Ltd. (TSX: MGA) to acquire a 100% interest in the Ben Lomond and Georgetown uranium projects in Australia; with IsoEnergy Ltd. (TSXV: ISO) to acquire a 100% interest in the Mountain Lake uranium project in Nunavut, Canada; with a private individual to acquire a 100% interest in the Moran Lake uranium and vanadium project in Labrador, Canada; and with U3O8 Corp. (TSXV: UWE.H) to acquire a 100% interest in the Laguna Salada uranium and vanadium project in Argentina. CUR has also acquired a 100% interest in the Dieter Lake uranium project and entered into an agreement to acquire a 100% interest in the Matoush uranium project, both in Quebec, Canada. The option agreement with IsoEnergy for Mountain Lake and the option agreement with U3O8 Corp. for Laguna Salada both remain subject to regulatory approval.

Philip Williams

President and CEO

International Consolidated Uranium Inc.

+1 778 383 3057

pwilliams@consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future, closing of the acquisition of the Property, the value to be derived from the Property and other projects over which the Company holds an option; satisfaction of the conditions to closing of the acquisition including final approval of the TSXV, the Company’s outlook on uranium prices and market interest in the uranium sector. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

DALLAS, June 11, 2021 /PRNewswire/ — Cushing® Asset Management, LP, and Swank Capital, LLC, announce today the upcoming rebalancing of The Cushing® 30 MLP Index (the "Index") as part of normal index operations. After the markets close on June 18, 2021, the 30 constituents of the Index will be rebalanced, and the following changes will become effective on June 21, 2021:

Constituents added:

Alliance Resource Partners, L.P. (NASDAQ: ARLP)

Cheniere Energy, Inc. (NYSE: LNG)

Oasis Midstream Partners LP (NASDAQ: OMP)

Constituents Removed:

Delek Logistics Partners, LP (NYSE: DKL)

NGL Energy Partners LP (NYSE: NGL)

Suburban Propane Partners, L.P. (NYSE: SPH)

ABOUT THE CUSHING® 30 MLP INDEX

The Cushing® 30 MLP Index tracks the performance of 30 publicly traded midstream energy infrastructure companies, including master limited partnerships (MLPs) and non-MLP energy midstream corporations (each, a "Midstream Company" and collectively, "Midstream Companies"). Constituents of the Index are selected by using a formula-based proprietary valuation model developed by Cushing® Asset Management, LP to rank Midstream Companies for potential inclusion in the Index. The Index price level is calculated by S&P Dow Jones Indices and reported on a real-time basis under the Bloomberg ticker "MLPX".

ABOUT CUSHING® ASSET MANAGEMENT AND SWANK CAPITAL

Cushing® Asset Management, LP ("Cushing"), a subsidiary of Swank Capital, LLC, is an SEC-registered investment adviser headquartered in Dallas, Texas. Cushing serves as investment adviser to affiliated funds and managed accounts, providing active management in markets where inefficiencies exist.

Cushing is also dedicated to serving the needs of investors by sponsoring a variety of benchmarks, including The Cushing® 30 MLP Market Cap Index (Bloomberg Ticker: CMCI) and The Cushing® MLP High Income Index (Bloomberg Ticker: MLPY). For more information, please visit http://www.cushingasset.com/indices.

Contact:

Jon Abel

214-692-6334

www.cushingasset.com

The Cushing® 30 MLP Index (the "Index") is the property of Swank Capital, LLC, and Cushing Asset Management, LP, which have contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Index is not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, "S&P Dow Jones Indices"). S&P Dow Jones Indices will not be liable for any errors or omissions in calculating the Index. "Calculated by S&P Dow Jones Indices" and the related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Cushing Asset Management, LP. S&P® is a registered trademark of Standard & Poor's Financial Services LLC ("SPFS"), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones").

View original content:http://www.prnewswire.com/news-releases/cushing-asset-management-and-swank-capital-announce-rebalancing-of-the-cushing-30-mlp-index-301310517.html

SOURCE Cushing Asset Management, LP and Swank Capital, LLC

ENDEAVOUR ANNOUNCES SCHEME OF ARRANGEMENT

BECOMES EFFECTIVE

London, June 11, 2021 – Endeavour Mining (TSX: EDV, LSE: EDV, OTCQX: EDVMF) announces that the scheme of arrangement to establish Endeavour Mining plc as the parent company of the Endeavour Mining group (the “Scheme”) has now become effective.

Each shareholder in Endeavour Mining Corporation at the effective time of the Scheme has received one share in Endeavour Mining plc for each share held in Endeavour Mining Corporation at such time. The entire issued share capital of Endeavour Mining Corporation has transferred to Endeavour Mining plc.

It is expected that admission of the shares of Endeavour Mining plc to listing on the premium segment of the Official List of the Financial Conduct Authority and admission to trading on the London Stock Exchange will take place at 8:00 am (BST) on June 14, 2021. To facilitate the settlement of outstanding trades in shares in Endeavour Mining Corporation, trading in the shares of Endeavour Mining plc is expected to commence on the Toronto Stock Exchange (“TSX”) at 9:30 am (ET) on June 16, 2021. Trading in the shares of Endeavour Mining Corporation will continue on the TSX until such time.

Shares of Endeavour Mining plc will trade on both exchanges under the ticker symbol “EDV”.

CONTACT INFORMATION

|

Endeavour Mining |

Brunswick Group LLP in London Carole Cable, Partner Vincic Advisors in Toronto John Vincic, Principal +1 (647) 402 6375 |

|

CORPORATE BROKERS Barclays Morgan Stanley |

UK AND EUROPEAN BROKING ADVISERS Berenberg Stifel |

ABOUT ENDEAVOUR MINING PLC

Endeavour is one of the world’s senior gold producers and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso and a strong portfolio of advanced development projects and exploration assets in the highly prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to the principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is listed on the Toronto Stock Exchange, under the symbol EDV.

For more information, please visit www.endeavourmining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This press release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including but not limited to statements regarding the plans, intentions, beliefs and current expectations of Endeavour with respect to future business activities and operating performance. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions and includes information regarding Endeavour’s expectations regarding the benefits of a premium listing in the UK with shares traded on the LSE including deeper access to a diverse investor pool with strong understanding of its key operating jurisdictions across West Africa and increased demand for its shares on the assumption that it will qualify for inclusion in the FTSE UK Index Series as well as the MSCI Europe Index, Endeavour’s ability to create sustainable shareholder value over the long term, the potential for continued or future dividends, the approval of the proposed Admission by the FCA and the LSE and the expected timing of the FCA’s approval of Admission; and admission to listing and posting for trading on the Toronto Stock Exchange.

Investors are cautioned that forward-looking information is not based on historical facts but instead reflect Endeavour management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although Endeavour believes that the expectations reflected in such forward-looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of Endeavour. This forward-looking information may be affected by risks and uncertainties in the business of Endeavour and market conditions.

This information is qualified in its entirety by cautionary statements and risk factor disclosure contained in filings made by Endeavour with the Canadian securities regulators, including Endeavour’s annual information form for the financial year ended December 31, 2020 and financial statements and related MD&A for the financial year ended December 31, 2020 filed with the securities regulatory authorities in certain provinces of Canada and available at www.sedar.com.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Endeavour has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Endeavour does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this press release.

Attachment

By Ernest Scheyder

(Reuters) – Lithium Americas Corp has delayed plans to excavate its Thacker Pass lithium mine site in Nevada, according to court filings, while a federal judge considers whether the former Trump administration erred in approving the project that opponents say could threaten sage grouse and other wildlife.

The delay is the latest setback for the U.S. critical minerals industry as environmentalists pressure courts and regulators to block mining projects from a slew of companies including ioneer Ltd , Antofagasta Plc , Rio Tinto and others, even if those mines produce metals key to fighting climate change.

Thacker Pass, if completed, would be the largest lithium mine in the United States, producing 30,000 tonnes of lithium annually – enough to make more than 475,000 electric vehicle (EV) batteries.

The court case, though, is likely to push back the company's development timeline and an adverse ruling could seriously imperil it.

Mine opponents have asked a federal judge to rule by next month on whether Vancouver-based Lithium Americas may dig at the northern Nevada site.

The company had intended to start digging at the site on June 23, several months earlier than initially planned.

Opponents requested a temporary injunction to block excavation while the court considers the broader case, which centers on whether the U.S. Bureau of Land Management (BLM) erred in approving the project in January less than a week before U.S. President Donald Trump left office.

Thacker Pass has been under review for more than a decade.

Lithium Americas this week agreed to pause digging through late July, according to filings.

SAGE GROUSE

Environmentalists filed the suit after that BLM decision, arguing in part that regulators did not abide by federal statues designed to protect sage grouse. The company and BLM disagree, according to filings.

"These sage grouse protections are the law of the land and we feel we have a strong case with our injunction motion," Roger Flynn, an attorney representing conservation groups, told Reuters.

Chief Judge Miranda Du of the federal court in Reno, who is overseeing the case, has in the past ruled in favor of preserving sage grouse habitats.

If Du grants the injunction, Lithium Americas would not be able to develop the site while she considers the broader question of whether the Trump administration erred in approving the mine. A ruling on that is expected later this year or in 2022.

In a statement, Lithium Americas said it is "confident the BLM's extensive and approved environmental impact statement will withstand judicial scrutiny."

Lithium Americas told the court that blocking the mine would harm national security and impede President Joe Biden's plan to wean the U.S. economy off fossil fuels.

Reuters reported last month that Biden plans to look abroad for most supplies of EV metals, part of a strategy designed to placate environmentalists.

Lithium Americas has an unlikely ally in Glenn Miller, who founded the environmental group Great Basin Resource Watch, which is one of the conservationist groups suing to block the mine.

Miller said he disagrees with the group's opposition to the project and resigned from its board earlier this week.

"Everyone is deeply concerned about climate change. It's a question about values, and I go with the need for lithium," said Miller, a retired professor at the University of Nevada. "This is one of the least-impactive mine plans I've ever seen."

(Reporting by Ernest Scheyder; editing by Amran Abocar and Marguerita Choy)

VANCOUVER, BC, June 11, 2021 /PRNewswire/ – NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE MKT: NXE) is pleased to announce the voting results from all business items considered at its Annual Meeting of Shareholders ("Meeting"), held on June 10, 2021. All matters of business were passed, and all nine director nominees were elected representing a total of 238,833,198 or 50.74% of the Company's outstanding shares. The details of the proxy voting for directors are set out below:

|

Nominee |

Votes For |

% For |

Votes Withheld |

% Withheld |

|

Leigh Curyer |

202,844,997 |

99.94% |

127,467 |

0.06% |

|

Christopher McFadden |

188,910,590 |

93.07% |

14,061,874 |

6.93% |

|

Richard Patricio |

142,312,647 |

70.11% |

60,659,817 |

29.89% |

|

Trevor Thiele |

190,853,953 |

94.03% |

12,118,511 |

5.97% |

|

Warren Gilman |

144,454,289 |

71.17% |

58,518,175 |

28.83% |

|

Sybil Veenman |

200,534,861 |

98.80% |

2,437,603 |

1.20% |

|

Karri Howlett |

202,551,613 |

99.79% |

420,851 |

0.21% |

|

Brad Wall |

197,784,135 |

97.44% |

5,188,329 |

2.56% |

|

Don Roberts |

195,151,199 |

96.15% |

7,821,265 |

3.85% |

Detailed voting results for all matters considered at the meeting will be available on SEDAR at www.sedar.com.

About NexGen

NexGen is a British Columbia corporation with a focus on developing the Rook I Project located in the southwestern Athabasca Basin, Saskatchewan, Canada into production. Rook I hosts the Arrow Deposit that hosts Measured Mineral Resources of 209.6 M lbs of U3O8 contained in 2.18 M tonnes grading 4.35% U3O8, Indicated Mineral Resources of 47.1 M lbs of U3O8 contained in 1.57 M tonnes grading 1.36% U3O8, and Inferred Mineral Resources of 80.7 M lbs of U3O8 contained in 4.40 M tonnes grading 0.83% U3O8. Arrow's development is supported by a NI 43-101 compliant Feasibility Study which outlines industry leading 'next generation' designs implementing elite environmental performance as well as industry leading strong economics.

NexGen has a highly experienced team of uranium industry professionals with a successful track record in the discovery of uranium deposits and in developing projects through discovery to production. The Company is the recipient of the 2018 PDAC Bill Dennis Award for Canadian mineral discovery and the 2019 PDAC Environmental and Social Responsibility Award.

Forward-Looking Information

The information contained herein contains "forward-looking statements" within the meaning of applicable United States securities laws and regulations and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to mineral reserve and mineral resource estimates, the 2021 Arrow Deposit, Rook I Project and estimates of uranium production, grade and long-term average uranium prices, anticipated effects of completed drill results on the Rook I Project, planned work programs, completion of further site investigations and engineering work to support basic engineering of the project and expected outcomes. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Statements relating to "mineral resources" are deemed to be forward-looking information, as they involve the implied assessment that, based on certain estimates and assumptions, the mineral resources described can be profitably produced in the future.

Forward-looking information and statements are based on the then current expectations, beliefs, assumptions, estimates and forecasts about NexGen's business and the industry and markets in which it operates. Forward-looking information and statements are made based upon numerous assumptions, including among others, that the mineral reserve and resources estimates and the key assumptions and parameters on which such estimates are based are as set out in this news release and the technical report for the property, the results of planned exploration activities are as anticipated, the price and market supply of uranium, the cost of planned exploration activities, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment, supplies and governmental and other approvals required to conduct NexGen's planned exploration activities will be available on reasonable terms and in a timely manner and that general business and economic conditions will not change in a material adverse manner. Although the assumptions made by the Company in providing forward looking information or making forward looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate in the future.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements of NexGen to differ materially from any projections of results, performances and achievements of NexGen expressed or implied by such forward-looking information or statements, including, among others, the existence of negative operating cash flow and dependence on third party financing, uncertainty of the availability of additional financing, the risk that pending assay results will not confirm previously announced preliminary results, conclusions of economic valuations, the risk that actual results of exploration activities will be different than anticipated, the cost of labour, equipment or materials will increase more than expected, that the future price of uranium will decline or otherwise not rise to an economic level, the appeal of alternate sources of energy to uranium-produced energy, that the Canadian dollar will strengthen against the U.S. dollar, that mineral resources and reserves are not as estimated, that actual costs or actual results of reclamation activities are greater than expected, that changes in project parameters and plans continue to be refined and may result in increased costs, of unexpected variations in mineral resources and reserves, grade or recovery rates or other risks generally associated with mining, unanticipated delays in obtaining governmental, regulatory or First Nations approvals, risks related to First Nations title and consultation, reliance upon key management and other personnel, deficiencies in the Company's title to its properties, uninsurable risks, failure to manage conflicts of interest, failure to obtain or maintain required permits and licences, risks related to changes in laws, regulations, policy and public perception, as well as those factors or other risks as more fully described in NexGen's Annual Information Form dated March 11, 2020 filed with the securities commissions of all of the provinces of Canada except Quebec and in NexGen's 40-F filed with the United States Securities and Exchange Commission, which are available on SEDAR at www.sedar.com and Edgar at www.sec.gov.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or statements or implied by forward-looking information or statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned not to place undue reliance on forward-looking information or statements due to the inherent uncertainty thereof.

There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

View original content:http://www.prnewswire.com/news-releases/nexgen-announces-voting-results-and-election-of-directors-from-annual-meeting-of-shareholders-301311131.html

SOURCE NexGen Energy Ltd.

(All amounts in US$ unless otherwise specified)

VANCOUVER, British Columbia, Jun 11, 2021–(BUSINESS WIRE)–Capstone Mining Corp. ("Capstone" or the "Company") (TSX:CS) is pleased to announce that it has filed a preliminary base shelf prospectus (the "Shelf Prospectus") with the securities commissions in each of the provinces and territories of Canada.

The Shelf Prospectus, upon a receipt for the final base shelf prospectus, would allow Capstone to make offerings up to C$500,000,000 of common shares, warrants, subscription receipts, units, debt securities, share purchase contracts, or any combination thereof, from time to time over a 25-month period. The specific terms of any future offering of securities (if any) will be set forth in a shelf prospectus supplement. Capstone has filed this base shelf prospectus for future financial flexibility and has no immediate intentions to undertake an offering. As reported in its quarterly financial statements ending March 31, 2021, Capstone had a cash position of $44.81 million and was debt-free2. Subsequent to March 31, 2021, Capstone received $30 million as an upfront deposit on the Wheaton Precious Metals Gold Stream Agreement.

This news release shall not constitute an offer to sell, or a solicitation of an offer to buy, any securities nor shall there be any sale of securities in any jurisdiction in which an offer, solicitation or sale would be unlawful prior to registration or qualifications under the securities laws of any such jurisdiction.

A copy of the preliminary Shelf Prospectus, and copies of the final base shelf prospectus and any shelf prospectus supplements that may be filed in the future, can be found under the Company's SEDAR profile at www.sedar.com, or may be obtained by request to Wendy King, Senior Vice President, Risk, ESG, General Counsel and Corporate Secretary, Suite 2100 – 510 West Georgia Street, Vancouver, BC, V6B 0M3, info@capstonemining.com.

Filing of Pinto Valley Technical Report

In addition, the Company has filed on SEDAR a technical report titled "NI 43-101 Technical Report on the Pinto Valley ("PV") Mine, Arizona, USA" (the "Technical Report") updating the PV3 life of mine plan.

The Technical Report was prepared in accordance with the Canadian Securities Administrator’s National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"), and is available for review under the Company’s profile on SEDAR at www.sedar.com and on the Company’s website at capstonemining.com.

The Company expects to release an updated NI 43-101 Technical Report in 2022 presenting the results of several initiatives aimed at increasing the value of the Pinto Valley Mine, including a PV4 pre-feasibility study and studies of Eriez Hydrofloat coarse particle flotation and Jetti catalytic technology.

1.Cash and cash equivalents and short-term investments of $44.8 million as at March 31, 2021

2.Debt Free is in reference to zero long term debt balance as at March 31, 2021

ABOUT CAPSTONE MINING CORP.

Capstone Mining Corp. is a Canadian base metals mining company, focused on copper. We are committed to the responsible development of our assets and the environments in which we operate. Our two producing mines are the Pinto Valley copper mine located in Arizona, US and the Cozamin copper-silver mine in Zacatecas State, Mexico. In addition, Capstone owns 100% of Santo Domingo, a large scale, fully permitted, copper-iron-gold project in Region III, Chile, as well as a portfolio of exploration properties. Capstone's strategy is to focus on the optimization of operations and assets in politically stable, mining-friendly regions, centred in the Americas. Our headquarters are in Vancouver, Canada and we are listed on the Toronto Stock Exchange (TSX). Further information is available at www.capstonemining.com.

This news release has been reviewed and approved by Brad Mercer, P. Geol., Capstone's Senior Vice President and Chief Operating Officer, a Qualified Person and the person who oversees operational and exploration activities at Pinto Valley Mine.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This document contains "forward-looking information" within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, "forward-looking statements"). These forward-looking statements are made as of the date of this document and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation.

Forward-looking statements relate to future events or future performance and reflect our expectations or beliefs regarding future events and the impacts of the ongoing and evolving COVID-19 pandemic. Forward-looking statements include, but are not limited to, statements with respect to the filing of a final base shelf prospectus, future offerings of securities and updated technical reports or technical information. In addition, the potential effects of the COVID-19 pandemic on our business and operations are unknown at this time, including Capstone’s ability to manage challenges and restrictions arising from COVID-19 in the communities in which Capstone operates and our ability to continue to safely operate and to safely return our business to normal operations. The impact of COVID-19 to Capstone is dependent on a number of factors outside of our control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, and the evolving restrictions relating to mining activities and to travel in certain jurisdictions in which we operate. In certain cases, forward-looking statements can be identified by the use of words such as "anticipates", "approximately", "believes", "budget", "estimates", expects", "forecasts", "guidance", intends", "plans", "scheduled", "target", or variations of such words and phrases, or statements that certain actions, events or results "be achieved", "could", "may", "might", "occur", "should", "will be taken" or "would" or the negative of these terms or comparable terminology. In this document certain forward-looking statements are identified by words including "anticipated", "expected", "guidance" and "plan". By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, amongst others, risks related to inherent hazards associated with mining operations and closure of mining projects, future prices of copper and other metals, compliance with financial covenants, surety bonding, our ability to raise capital, Capstone’s ability to acquire properties for growth, counterparty risks associated with sales of our metals, use of financial derivative instruments and associated counterparty risks, foreign currency exchange rate fluctuations, market access restrictions or tariffs, changes in general economic conditions, availability of water, accuracy of Mineral Resource and Mineral Reserve estimates, operating in foreign jurisdictions with risk of changes to governmental regulation, compliance with governmental regulations, compliance with environmental laws and regulations, reliance on approvals, licenses and permits from governmental authorities and potential legal challenges to permit applications, contractual risks including but not limited to, our ability to meet the completion test requirements under the Cozamin Silver Stream Agreement with Wheaton Precious Metals, our ability to meet certain closing conditions under the Santo Domingo Gold Stream Agreement with Wheaton Precious Metals, acting as Indemnitor for Minto Exploration Ltd.’s surety bond obligations post divestiture, impact of climate change and changes to climatic conditions at our Pinto Valley and Cozamin operations, changes in regulatory requirements and policy related to climate change and GHG emissions, land reclamation and mine closure obligations, risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of Capstone relating to the unknown duration and impact of the COVID-19 pandemic, uncertainties and risks related to the potential development of the Santo Domingo Project, increased operating and capital costs, increased cost of reclamation, challenges to title to our mineral properties, increased taxes in jurisdictions the Company operates or is subject to tax, changes in tax regimes we are subject to and any changes in law or interpretation of law may be difficult to react to in an efficient manner, maintaining ongoing social license to operate, dependence on key management personnel, potential conflicts of interest involving our directors and officers, corruption and bribery, limitations inherent in our insurance coverage, labour relations, increasing energy prices, competition in the mining industry including but not limited to competition for skilled labour, risks associated with joint venture partners, our ability to integrate new acquisitions and new technology into our operations, cybersecurity threats, legal proceedings, and other risks of the mining industry as well as those factors detailed from time to time in the Company’s public filings, including the Shelf Prospectus, which are filed and available for review under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause our actual results, performance or achievements to differ materially from those described in our forward-looking statements, there may be other factors that cause our results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate, as our actual results, performance or achievements could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on our forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210611005489/en/

Contacts

Jerrold Annett, SVP, Strategy and Capital Markets

647-273-7351

jannett@capstonemining.com

Kettina Cordero, Director Investor Relations & Communications

604-262-9794

kcordero@capstonemining.com

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term Aurelia Metals Limited (ASX:AMI) shareholders would be well aware of this, since the stock is up 232% in five years. It's also good to see the share price up 11% over the last quarter. But this could be related to the strong market, which is up 7.5% in the last three months.

View our latest analysis for Aurelia Metals

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Aurelia Metals moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Aurelia Metals' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Aurelia Metals, it has a TSR of 254% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Aurelia Metals shareholders are down 6.4% for the year (even including dividends), but the market itself is up 33%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 29% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Aurelia Metals is showing 3 warning signs in our investment analysis , you should know about…

Aurelia Metals is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Under the guidance of CEO Diana Hu, Eastern Platinum Limited (TSE:ELR) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 17 June 2021. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Eastern Platinum

Comparing Eastern Platinum Limited's CEO Compensation With the industry

According to our data, Eastern Platinum Limited has a market capitalization of CA$49m, and paid its CEO total annual compensation worth US$393k over the year to December 2020. We note that's an increase of 26% above last year. In particular, the salary of US$288.4k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below CA$242m, reported a median total CEO compensation of US$124k. This suggests that Diana Hu is paid more than the median for the industry.

|

Component |

2020 |

2019 |

Proportion (2020) |

|

Salary |

US$288k |

US$280k |

73% |

|

Other |

US$105k |

US$31k |

27% |

|

Total Compensation |

US$393k |

US$311k |

100% |

Speaking on an industry level, nearly 93% of total compensation represents salary, while the remainder of 7% is other remuneration. In Eastern Platinum's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion – which is generally tied to performance, is lower.

A Look at Eastern Platinum Limited's Growth Numbers

Eastern Platinum Limited has seen its earnings per share (EPS) increase by 24% a year over the past three years. It achieved revenue growth of 22% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Eastern Platinum Limited Been A Good Investment?

With a total shareholder return of 13% over three years, Eastern Platinum Limited shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude…

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Eastern Platinum (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Eastern Platinum, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

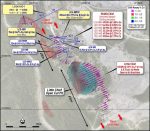

VANCOUVER, British Columbia, June 09, 2021 (GLOBE NEWSWIRE) — Imperial Metals Corporation (the “Company”) (TSX:III) reports expanded high grade mineralization in the newly discovered East Ridge zone.

Results from East Ridge drill hole RC688, located 100 metres east of hole RC684, returned 344 metres of 0.70 g/t gold and 0.75% copper from a depth of 776 metres including 170 metres of 1.1 g/t gold and 1.1% copper.

Brian Kynoch, President of Imperial Metals, said, “This exciting new discovery at the East Ridge is located outside the envelope of the current mineral resource and has the potential to increase the already large mineral resource at Red Chris.”

In the Main Zone, hole RC683 returned 300 metres grading 0.41g/t gold and 0.51% copper from a depth of 260 metres, including 114 metres of 0.67g/t gold and 0.85% copper from a depth of 390 metres, and 22 metres of 1.1 g/t gold and 1.4% copper from a depth of 464 metres. Drilling in the Main Zone continues to confirm the potential to define further zones of higher-grade mineralization.

Red Chris – Significant results:

|

Hole ID |

From (m) |

To (m) |

Width (m) |

Gold (g/t) |

Copper (%) |

|

RC683 |

260 |

560 |

300 |

0.41 |

0.51 |

|

including |

390 |

504 |

114 |

0.67 |

0.85 |

|

including |

464 |

486 |

22 |

1.1 |

1.4 |

|

RC684 |

814^ |

1066^ |

252^ |

0.46 |

0.53 |

|

including |

962^ |

1060^ |

98^ |

0.85 |

0.86 |

|

including |

970^^ |

986^^ |

16^^ |

1.2 |

1.2 |

|

RC688 |

776 |

1120 |

344 |

0.70 |

0.75 |

|

including |

892 |

1062 |

170 |

1.1 |

1.1 |

|

including |

894 |

972 |

78 |

1.1 |

1.3 |

^ updated intercept or ^^ previously reported.

During the 2nd Quarter, there were up to eight diamond drill rigs in operation and an additional 15,342 metres of drilling was completed in 11 drill holes, with all drill holes intersecting mineralization (except for two dedicated geotechnical holes). Since Newcrest acquired its interest in the joint venture 111 drill holes, for a total of 136,631 metres of drilling, have been completed. The planned exploration program includes approximately 50,000 metres of drilling this year.

Jim Miller-Tait, P.Geo., Imperial Metals Vice President Exploration, is the designated Qualified Person as defined by National Instrument 43-101 for the Red Chris exploration program and has reviewed this news release. Red Chris samples for the 2020 drilling reported were analysed at Bureau Veritas Mineral Laboratories in Vancouver. A full QA/QC program using blanks, standards and duplicates was completed for all diamond drilling samples submitted to the labs. Significant assay intervals reported represent apparent widths. Insufficient geological information is available to confirm the geological model and true width of significant assay intervals.

Cross section and plan view maps are available on imperialmetals.com.

About Imperial

Imperial is a Vancouver based exploration, mine development and operating company. The Company, through its subsidiaries, owns a 30% interest in the Red Chris mine, and a 100% interest in both the Mount Polley and Huckleberry copper mines in British Columbia.

Company Contacts

Brian Kynoch | President | 604.669.8959

Darb Dhillon | Chief Financial Officer | 604.488.2658

Jim Miller-Tait | Vice President Exploration | 604.488.2676

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release are not statements of historical fact and are “forward-looking” statements. Forward-looking statements relate to future events or future performance and reflect Company management’s expectations or beliefs regarding future events and include, but are not limited to, statements regarding the Company’s expectations with respect to the current and planned drilling programs at Red Chris, including plans to define the extent and continuity of the mineralization in the East Ridge Zone and statements regarding the potential to increase the mineral resources at the Red Chris mine site.

In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "outlook", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative of these terms or comparable terminology. By their very nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In making the forward-looking statements in this release, the Company has applied certain factors and assumptions that are based on information currently available to the Company as well as the Company’s current beliefs and assumptions. These factors and assumptions and beliefs and assumptions include, the risk factors detailed from time to time in the Company’s interim and annual financial statements and management’s discussion and analysis of those statements, all of which are filed and available for review on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended, many of which are beyond the Company’s ability to control or predict. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and all forward-looking statements in this news release are qualified by these cautionary statements. Such information is given only as of the date of this news release. The Company does not assume any obligation to update its forward-looking information to reflect new information, subsequent events or otherwise, except as required by law.

The proven Zacks Rank system focuses on earnings estimates and estimate revisions to find winning stocks. Nevertheless, we know that our readers all have their own perspectives, so we are always looking at the latest trends in value, growth, and momentum to find strong picks.

Considering these trends, value investing is clearly one of the most preferred ways to find strong stocks in any type of market. Value investors use tried-and-true metrics and fundamental analysis to find companies that they believe are undervalued at their current share price levels.

Zacks has developed the innovative Style Scores system to highlight stocks with specific traits. For example, value investors will be interested in stocks with great grades in the "Value" category. When paired with a high Zacks Rank, "A" grades in the Value category are among the strongest value stocks on the market today.

ANGLO AMER ADR (NGLOY) is a stock many investors are watching right now. NGLOY is currently sporting a Zacks Rank of #2 (Buy), as well as a Value grade of A. The stock holds a P/E ratio of 7.05, while its industry has an average P/E of 8.21. Over the past year, NGLOY's Forward P/E has been as high as 12.90 and as low as 5.86, with a median of 8.49.

Another valuation metric that we should highlight is NGLOY's P/B ratio of 2.15. The P/B ratio is used to compare a stock's market value with its book value, which is defined as total assets minus total liabilities. This stock's P/B looks attractive against its industry's average P/B of 3.37. Within the past 52 weeks, NGLOY's P/B has been as high as 2.32 and as low as 1, with a median of 1.52.

These figures are just a handful of the metrics value investors tend to look at, but they help show that ANGLO AMER ADR is likely being undervalued right now. Considering this, as well as the strength of its earnings outlook, NGLOY feels like a great value stock at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ANGLO AMER ADR (NGLOY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

A drive by mining companies to hire more women has stalled, leaving the industry as one of the world’s most male-dominated professions and exacerbating a looming recruitment crisis in many key roles.

MONTREAL, June 09, 2021 (GLOBE NEWSWIRE) — (TSX-V: GMN) GobiMin Inc. held its Annual General Meeting on June 9 2021. All matters placed before the shareholders were approved. The current members of the board, comprised of Messrs. Felipe Tan, Joyce Ko, Duncan Hancock, Hubert Marleau, Dominic Cheng, Maxime Lemieux and Ma Jianqing were re-elected as directors of the Company.

For further information, please contact:

|

Felipe Tan, Chief Executive Officer |

||

|

Tel: (852) 3586-6500 |

||

|

Email: felipe.tan@gobimin.com |

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”

To receive GobiMin press releases by email, send a message to info@gobimin.com and

specify “GobiMin press releases” on the subject line

To unsubscribe GobiMin press releases, please send a message to unsubscribe@gobimin.com

Confirms Dominant Position in the Thunder Bay Silver District

TORONTO, June 10, 2021 (GLOBE NEWSWIRE) — Honey Badger Silver Inc. (TSX-V: TUF) (“Honey Badger Silver” or the “Company”) is pleased to announce that it has signed the Definitive Agreement (the “Agreement”) with Romios Gold Resources Inc. (“Romios Gold”; CVE: RG) to acquire an 80% interest and control of an additional 1,870 hectares (4,620 acres) in 87 mining claims covering historic silver properties in the Thunder Bay Silver District. The Agreement succeeds the Letter of Intent entered into by the parties announced on April 27, 2021.

The new claims comprise substantial portions of the historic Victoria Mine and Federal Mine silver properties, plus the Lily of the Valley, Caribou and Cloud Bay prospects.

“This acquisition solidifies Honey Badger Silver’s dominant position in this historic high-grade silver camp and furthers our strategy to create a high-value, high-growth silver company leveraging our regional positioning in world-class silver districts,” said Chad Williams, Executive Chairman.

In consideration for an 80% interest in the project, Honey Badger Silver has agreed to: a) issue shares of the Company to Romios Gold for a value of C$150,000 at a price equal to the volume weighted average price of its common shares, trading on the TSXV for the thirty trading days immediately preceding the date of the transaction’s announcement, subject to the maximum discounted price allowed under the policies of the TSXV and b) free-carry all costs and expenses related to the maintenance and advancement of the project to pre-feasibility. Immediately after completion of the pre-feasibility study, the parties shall enter into a joint venture agreement to continue advancing the project towards commercial production.