Introduction

Global fertilizer prices remain under pressure due to low prices of major crops and global economic uncertainty. These factors have squeezed farmers’ margins and lowered the demand for fertilizers. Currency volatility between different regions is also affecting the fertilizer trade, decreasing demand from developing countries, where currencies have generally weakened.

This trend may change, however with the upcoming El Nino. Some crop prices are likely to strengthen but some will weaken further as this weather phenomenon has different impacts on different commodities in different regions.

Background

Fertilizers are chemical compounds, which when applied to plants provide essential nutrients for plant growth and yield. They can be divided into organic (carbon based and derived from plants/animals) and inorganic or commercial (non-carbon based and derived from minerals and industrial processes). Fertilizers generally provide three main nutrients: nitrogen, phosphorus and potassium, as well as a number of other secondary and micronutrients.

Nitrogen-based fertilizers (ammonia, urea) are the largest fertilizer market. They are produced from natural gas and nitrogen sourced from the air. Major exporting countries for nitrogen derived fertilizers are Russia, China and Ukraine. The second largest fertilizer is phosphates, which are derived from phosphate rock with its, deposits mostly located in North Africa and China. The major exporter of phosphate fertilizers is China, followed by USA, Russia and Morocco. Potash (potassium chloride) is also a mined fertilizer and its major exporters are Canada, Russia and Belarus – accounting for about 70% of the entire potash market.

Crop prices

Major crop commodities prices have declined in recent years in many key growing regions. The crops using the biggest volume of fertilizers are grains, followed by oilseeds then fruits and vegetables.

Asia consumes the largest volume of fertilizers, however low rice and wheat prices here have caused a fall in demand recently. Rice prices are expected to rise from forecasted lower global stocks and El Niño reducing production. Although wheat prices have also been falling; the outlook is opposite as prices are likely to fall further as El Nino can have a beneficial effect.

In the US, fertilizer is most commonly used on maize (corn) crops (about 44%). The price of maize has been falling due to high production over the past few years. Maize prices are expected to stay on a downward trend due to continuing good production, with production in 2015/16 forecast to be above average. In addition, global demand for US exports is expected to continue to fall due to the strong USD.

Sugar prices had fallen by 15% since the beginning of the year, before rising again in September. Previously good production estimates had kept the price low; recently however, wet weather delays to the harvest in Brazil’s key sugarcane belt and forecasts for more rainfall has caused concerns. Add in the BRL rallying against the USD and sugar prices have risen recently as a result.

Fertilizer prices

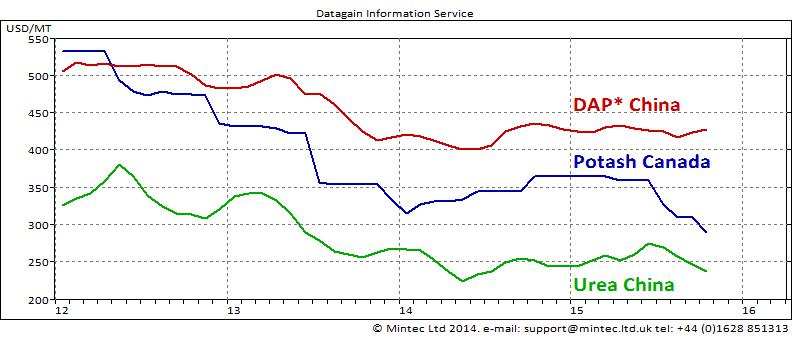

The prices of major fertilizers, as seen on the graph below, had started to recover last year from the downward trend seen in 2012/2013. The trends stayed relatively stable till the middle of this year, when the prices have started to drop again for all fertilizers apart from phosphate market.

* DAP – Diammonium phosphate

In the nitrogen fertilizers market, ammonia prices have fallen in the US and China, but stabilized at lower levels in Europe in recent months due to lower production cost. Prices of urea are also falling due to lower production cost and increased capacities. Export volumes of urea from Iran, Algeria and Saudi Arabia have also recently increased, as new production units came online. Moreover, exports from China in the first half of the year were up by 28% y-o-y, increasing supplies on the global market.

Phosphates prices haven’t fallen with other fertilizers, as some companies experienced production issues, which restricted price falls. Further price movements will largely depend on production output from major producing countries like Morocco and China. Weak monsoon rains in India has decreased buying activity and poses fears for even further demand deterioration.

Potash prices also fell due to low demand. In North America, demand in first half of 2015 fell by as much as 25-30% y-o-y, whilst global supply remains high. Moreover, the fall of Chinese, Indian and Brazilian currencies will likely reduce potash import demand from these major consumers. Chinese demand is also expected to fall due to recent VAT changes, as from 1st of September this year the tax has been re-introduced for domestic and import markets.

On the other hand, crop soils are low on potash due to low application and new varieties of crops, which remove more nutrients from the soil, which might be a factor limiting the drops in demand in the future.

Conclusions

With a mixed picture for the future price trends of major commodities, the development of demand for fertilizers and therefore their prices remains unclear. It will impact the margins of the producers of fertilizers, , as although they do have some other uses, there are not many.

And what about El Nino? The forecast are for it to be strong this year. Historically, it has had a positive effect on soyabeans and maize production in the US, while oilseeds crops in Indonesia and Malaysia were negatively affected. What will really happen cannot be predicted, as the effects on crops are not the same every time there is an El Nino. Some surprises might still be on the way.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.