Galantas Gold Corporation (TSXV:GAL) has announced progress from its partnership with mining contractor QME Mining Services Ltd. Ireland for the company’s Omagh Gold Project in Northern Ireland. QME has delivered a contract mining plan which utilizes their skilled workforce and original equipment manufacturer (OEM) mining equipment.

Mario Stifano, CEO of Galantas, commented in a press release: “We are looking forward to having QME begin development work at Omagh, as it has the workforce and equipment to quickly commence development and mining with a plan to provide a sustainable 5,000 tonnes per month of mill feed. As we’ve kicked off drilling at the Joshua Vein from surface, we will focus on resource expansion at the Joshua and Kearney veins to expand known resources with a goal to increase the mill capacity from 180 tonnes per day to 500 tonnes per day. In addition, with the recent successful drilling at the Gairloch Project, including hole 23-GL-02 intersecting 1.88 g/t gold, 1.23% copper, 0.51% zinc, 0.01% cobalt and 4.64 g/t silver over 33 metres1, we will look to expand our exploration efforts in northern Scotland.”

QME has prior mining experience across Europe and was notably involved in the development and bulk sampling of Dalradian’s nearby gold project, situated 20 km from Omagh. This background makes them a suitable partner for this project.

The mining plan outlines that QME will begin with development mining at the Kearney and Joshua veins, expecting a period of 9 months, before anticipated ramping up to about 5,000 tonnes per month of both development and production mineralized material within 12 months of start-up. The estimated cost of development before steady-state production is approximately US$12 million.

Galantas plans to mine the high-grade dilation zones, aiming for a monthly production of 1,200 to 1,400 gold ounces post-development. Multiple mine levels have been developed at both the Joshua and Kearney veins. Together with QME’s experienced underground workforce, the Company is considering an expansion to the existing permitted mill to increase the targeted annual production to 30,000 to 35,000 gold ounces per annum.

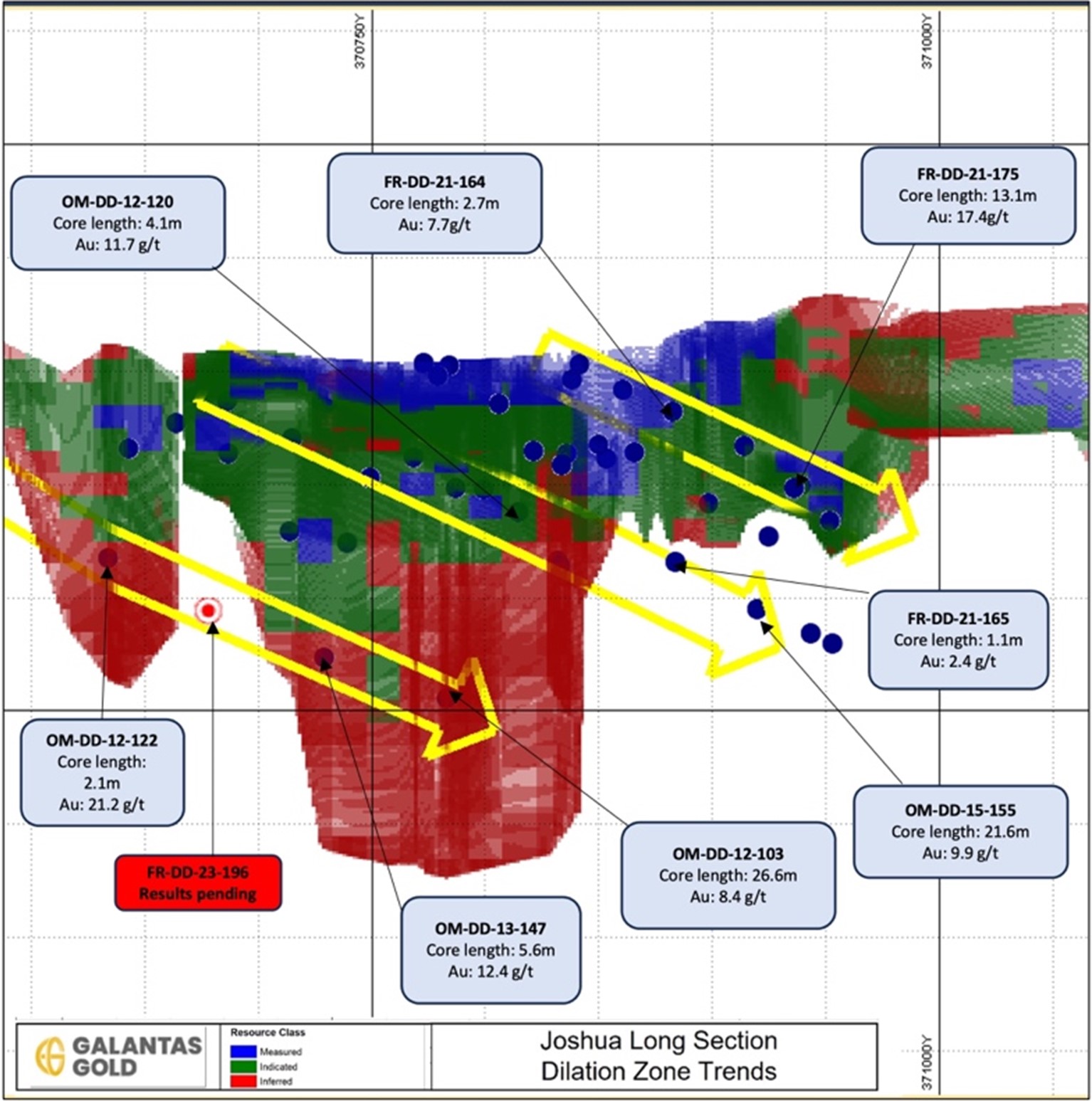

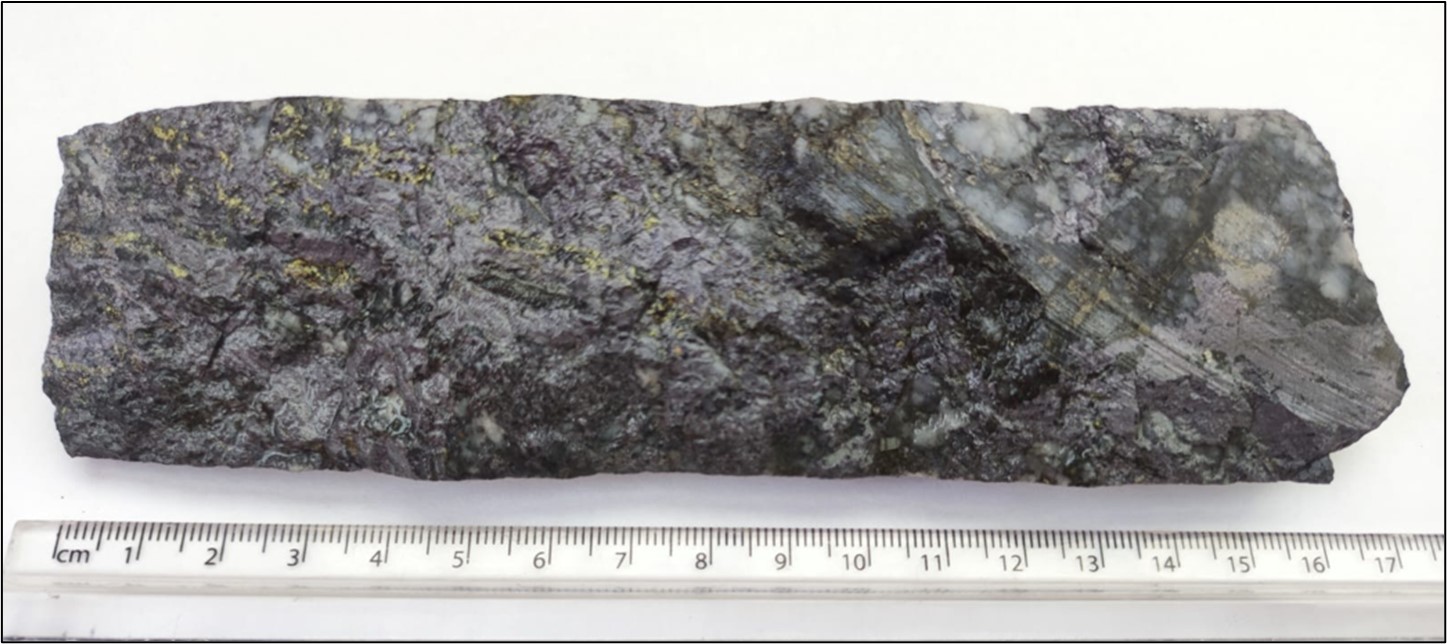

Galantas has also reported success in intersecting massive sulphides in drill hole FR-DD-23-196 at the Joshua Vein, marking the first exploration hole drilled from the surface in 19 months. This fills a significant gap in the earlier resource model. Assay results for this hole are pending.

The Joshua Vein’s high-grade dilation zones remain open along strike and down-plunge. Previously, the Company identified multiple wide high-grade intersections at Joshua, including 9.9 g/t gold over a 21.6-metre intersection, 8.4 g/t Au over 26.6 metres, and 17.4 g/t Au over 13.1 metres. More details can be found in Galantas’ news releases dated June 11, 2012, January 25, 2016, and January 31, 2022.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.