VANCOUVER, British Columbia, Sept. 29, 2021 (GLOBE NEWSWIRE) — Fortuna Silver Mines Inc. (NYSE: FSM) (TSX: FVI) is pleased to announce that the Board of Directors of the company has made a decision to proceed with the construction of an open pit mine at the Séguéla gold Project in Côte d’Ivoire. The company is ready to immediately commence construction with long lead items procured, and development teams established on the ground. In July 2021, Fortuna completed the acquisition of Roxgold Inc. which was advancing the Séguéla Project (see Fortuna's news release dated July 2, 2021, “Fortuna and Roxgold complete combination to create a global premier growth-oriented intermediate gold and silver producer”). For specific details on the Séguéla Project feasibility study, please refer to the technical report entitled “NI 43‐101 Technical Report, Séguéla Project, Feasibility Study, Worodougou Region, Côte d’Ivoire” dated May 26, 2021.

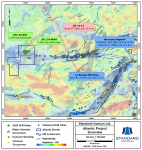

Jorge A. Ganoza, President and CEO of Fortuna, commented, “With a nine year mine life in reserves, 130,000 ounces of annual gold production in the initial six years, and compelling economics, Séguéla is planned to become our fifth operating mine with first gold by mid-2023.” Mr. Ganoza added, “Fortuna is in a solid financial position to fund the remaining $162 million initial capital investment and our teams in West Africa are primed and ready to start.” Mr. Ganoza concluded, “Parallel to construction, the company plans to continue with well funded drill programs to test multiple remaining targets on the Séguéla property, where over the last 12 months, the exploration team has successfully delivered gold discoveries at the Koula, Sunbird and Gabbro North prospects.”

Paul Criddle, COO – West Africa of Fortuna, commented, “The decision to commence construction of the still growing Séguéla Project, marks an exciting milestone for the company.” Mr. Criddle continued, “The team has further derisked the project by advancing detailed design and commencing procurement of long lead items, including the SAG mill and the execution of critical path agreements including the EPC agreement with Lycopodium for the processing plant. This has allowed Séguéla's critical path to be protected as well as managing the cost risk by locking in substantial components of the initial capex in fixed price contracts.” Mr. Criddle added, “Bulk earthworks contractors have been mobilized and will break ground at the plant site in October with the accommodation village expected to be completed in November of 2021.”

The updated Séguéla Project total initial capital investment is $173.5 million. $11.5 million of this amount has previously been approved by the Board for early works items. The anticipated construction schedule is approximately 20 months, with ramp-up to name plate capacity expected in the third quarter of 2023.

Séguéla Project feasibility study economic highlights1,5,6

The following table sets out the economic highlights from the Séguéla feasibility study:

Operating Metrics

|

Units |

Results |

|||

|

Life of mine |

Years |

8.6 |

||

|

Total mineralized material mined |

Tonnes |

12,064,000 |

||

|

Contained gold in mined resource |

Oz |

1,088,000 |

||

|

Strip ratio |

waste to ore |

13.9:1 |

||

|

Throughput @ start-up |

million tonnes |

1.25 |

||

|

Throughput @ peak |

Mtpa |

1.57 |

||

|

Head grade |

g/t Au |

2.8 |

||

|

Recoveries |

% |

94.5 |

% |

|

|

Gold Production |

||||

|

Total production over life of mine (LOM) |

Oz |

1,028,000 |

||

|

Annual production over LOM |

Oz |

120,000 |

||

|

Annual production over first 6 years |

Oz |

133,000 |

||

|

Operating Costs over LOM |

||||

|

Total mining costs |

$/t (mined) |

$2.79 |

||

|

Mining costs (sustaining capital) |

$/t (mined) |

$0.78 |

||

|

Mining costs (operating costs) |

$/t (mined) |

$2.01 |

||

|

Processing |

$/t (processed) |

$12.57 |

||

|

G&A |

$/t (processed) |

$5.30 |

||

|

Total operating costs |

$/t (processed) |

$47.83 |

||

Financial Metrics

|

Units |

Results |

|||||||||

|

Cash costs2 |

||||||||||

|

Average cash costs over LOM |

$/oz |

$567 |

||||||||

|

Average cash costs over first 6 years |

$/oz |

$528 |

||||||||

|

AISC2 |

||||||||||

|

Average AISC2 over LOM |

$/oz |

$832 |

||||||||

|

Average AISC2 over first 6 years |

$/oz |

$797 |

||||||||

|

Valuation |

||||||||||

|

Gold price |

$/oz |

$1,600 |

$1,800 |

|||||||

|

NPV @ 5% discount rate (after-tax)(3) |

$M |

$380 |

478 |

|||||||

|

After-tax IRR |

% |

49 |

% |

58 |

% |

|||||

|

Payback period |

years |

1.7 |

1.4 |

|||||||

|

Average EBITDA2 over LOM |

$M |

$107 |

$127 |

|||||||

|

Average EBITDA2 over first 6 years |

$M |

$130 |

$153 |

|||||||

Environmental Data

|

Units |

Results |

||

|

Greenhouse gas emissions intensity |

tCO2e/oz |

0.58 |

|

|

Energy intensity |

GJ/oz |

4.39 |

Notes:

-

Please refer to the technical report entitled “NI 43‐101 Technical Report, Séguéla Project, Feasibility Study, Worodougou Region, Côte d’Ivoire” dated May 26, 2021 co-authored by Paul Criddle, FAusIMM, Hans Andersen, MAIG, Paul Weedon, MAI, Dave Morgan, AIMM, CPEng, Geoff Bailey, FIEAust, CPEng, NPER-3, REPQ, Shane McLeay FAUSIMM and Niel Morrison Peng filed on SEDAR under the Roxgold Inc. issuer profile

-

Cash costs, all-in sustaining cash costs and EBITDA are non-IFRS financial measures. Refer to Non-IFRS Financial Measures at the end of this news release

-

Attributable to Fortuna’s 90% interest; the Government of Côte d’Ivoire holds a 10% carried interest

-

The Project economics are subject to the assumptions as detailed in the Feasibility Study

-

All references to dollar amounts in the table and in this news release are expressed in US dollars

-

The financial metrics in the table are based upon an initial capital expenditure of $142 million as set out in the Feasibility Study

Construction at Séguéla will incorporate protocols to ensure the health and safety of employees, contractors and host communities in respect of COVID-19.

The company will continue to provide construction updates as progress is made at Séguéla in the upcoming months.

Qualified Person

Paul Criddle, FAusIMM, Chief Operating Officer, West Africa for the company, is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has reviewed and approved the scientific and technical information pertaining to the Séguéla Project contained in this news release and has verified the underlying data.

About Fortuna Silver Mines Inc.

Fortuna Silver Mines Inc. is a Canadian precious metals mining company with four operating mines in Argentina, Burkina Faso, Mexico and Peru, and an advanced development project in Côte d’Ivoire. Sustainability is integral to all our operations and relationships. We produce gold and silver and generate shared value over the long-term for our shareholders and stakeholders through efficient production, environmental protection, and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com

Forward-looking statements

This news release contains forward-looking statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements of historical fact, are forward-looking statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements. The Forward-looking statements in this news release may include, without limitation, statements about the company’s plans for the construction of an open pit mine at the Seguela project in Cote D’Ivoire; the economics for the construction of the mine at the Seguela project as set out in the feasibility study; the estimated construction capex for the project; the timelines and schedules for the construction of the mine; the estimated internal rate of return on production; the estimated net present value of the project and estimates of production; estimated EBITDA; the ability of the company to continue its exploration at the Séguéla project; the company’s plans for its mines and mineral properties; the company’s anticipated performance in 2021; estimated production forecasts; estimated production costs and all-in sustaining cash costs; the success of the company’s exploration activities at its mines and development projects; the timing of the implementation and completion of sustaining capital investment projects at the company’s mines; the duration and impacts of COVID-19 on the company’s construction plans at Seguela, production, workforce, business, operations and financial condition; metal price estimates, estimated metal grades; the timing of the signing of construction contracts for the Séguéla Project; the company’s business strategy, plans and outlook; the merit of the company’s mines and mineral properties; mineral resource and reserve estimates; production costs; timelines; the future financial or operating performance of the company; expenditures; approvals and other matters. Often, but not always, these forward-looking statements can be identified by the use of words such as “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”, “anticipated”, “estimated” “containing”, “remaining”, “to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company to be materially different from any results, performance or achievements expressed or implied by the forward-looking statements. Such uncertainties and factors include, among others, changes in general economic conditions and financial markets; changes in the construction schedule at Seguela; the impact of the COVID-19 pandemic on the company’s mining operations and construction activities; the duration and impacts of COVID-19 on the company’s production, workforce, business, operations and financial condition, and the risks relating to a global pandemic, which unless contained could cause a slowdown in global economic growth; uncertainties related to the impacts of COVID-19 which may include: changing market conditions, changing restrictions on the mining industry in the countries in which the company operates, the ability to operate as a result of government imposed restrictions, including restrictions on travel, the transportation of concentrates and doré, access to refineries, the impact of additional waves of the pandemic or increases of incidents of COVID-19 in the countries in which we operate; the duration of any suspension of operations at the company’s mines as a result of COVID-19 which may affect production and the company’ business operations and financial condition; changes in prices for gold, silver and other metals; changes in the prices of key supplies; technological and operational hazards in Fortuna’s mining and mine development activities; risks inherent in mineral exploration; the ability of the current exploration programs to identify and or expand mineral resources, operational risks in exploration and development; delays or changes in plans with respect to exploration or development projects; uncertainties inherent in the estimation of mineral reserves, mineral resources, and metal recoveries; changes to current estimates of mineral reserves and resources; changes to production and cost estimates; governmental and other approvals; maintaining, obtaining or renewing environmental permits; changes in government, political unrest or instability in countries where Fortuna is active; fluctuations in currencies and exchange rates; the imposition of capital control in countries in which the company operates; labor relations issues; as well as those factors discussed under “Risk Factors” in the company's Annual Information Form. Although the company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to the accuracy of the company’s current mineral resource and reserve estimates; that the company’s activities will be in accordance with the company’s public statements and stated goals; that there will be no material adverse change affecting the company or its properties; that the reconciliation of mineral reserves at the company’s mines remains consistent with the mineral reserve model; changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing, and recovery rate estimates and may be impacted by unscheduled maintenance, labor and contractor availability and other operating or technical difficulties); the duration and impacts of COVID-19 on the company’s production, workforce, business, operations and financial condition, and the risks relating to a global pandemic, which unless contained could cause a slowdown in global economic growth; government mandates in Peru, Mexico, Argentina, Burkina Faso and Côte d’Ivoire with respect to mining operations generally or auxiliary businesses or services required for the company’s operations; government and the company’s attempts to reduce the spread of COVID-19 which may affect may aspects of the company’s operations, including transportation of personnel to and from site, contractor and supplier availability and the ability to sell or deliver concentrate and doré; the expected trends in mineral prices and currency exchange rates; that the company’s activities will be in accordance with the company’s public statements and stated goals; that there will be no material adverse change affecting the company or its properties; that all required approvals will be obtained for the company’s business and operations; that there will be no significant disruptions affecting operations and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

For readers to fully understand the information in this news release, they should read the technical report entitled “NI 43‐101 Technical Report, Séguéla Project, Feasibility Study, Worodougou Region, Côte d’Ivoire” dated May 26, 2021 (the “Technical Report” in its entirety, including all qualifications, assumptions and exclusions that relate to the information set out therein which qualifies the technical information contained in the Technical Report. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context).

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.

Non-IFRS Financial Measures

This news release also refers to non-IFRS financial measures, such as cash costs, all-in sustaining cash cost and EBITDA. These measures do not have a standardized meaning or method of calculation, even though the descriptions of such measures may be similar. These performance measures have no meaning under International Financial Reporting Standards (IFRS) and therefore, amounts presented may not be comparable to similar data presented by other mining companies. For additional information regarding non-IFRS measures, including reconciliations to the closest comparable IFRS measures, see "Non-GAAP Financial Measures" in Fortuna’s annual MD&A, which is available under Fortuna's SEDAR profile.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.