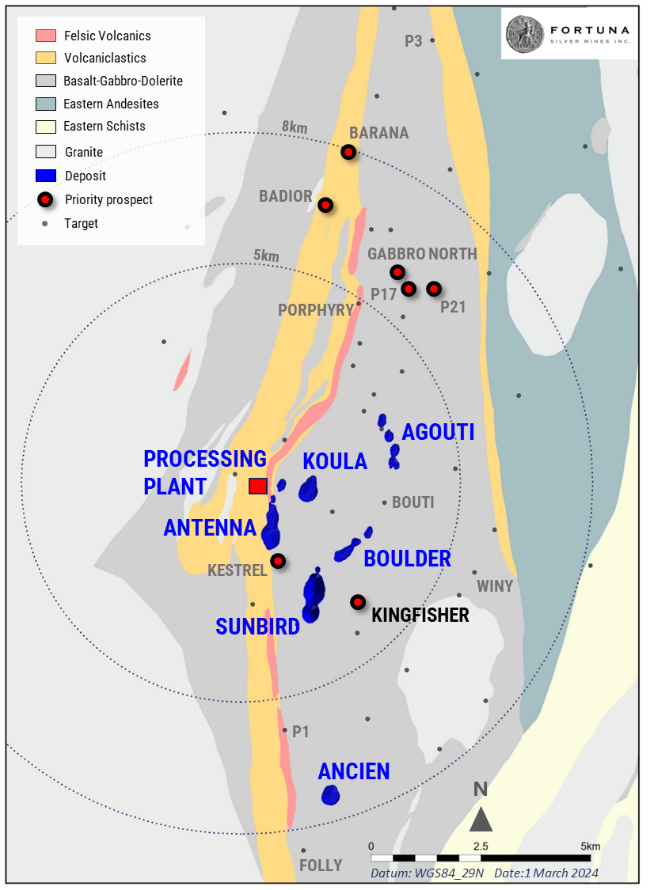

Fortuna Silver Mines (TSX:FVI) released an update on its exploration programs at the Séguéla Mine in Côte d’Ivoire and the recently acquired Diamba Sud Gold Project in Senegal.

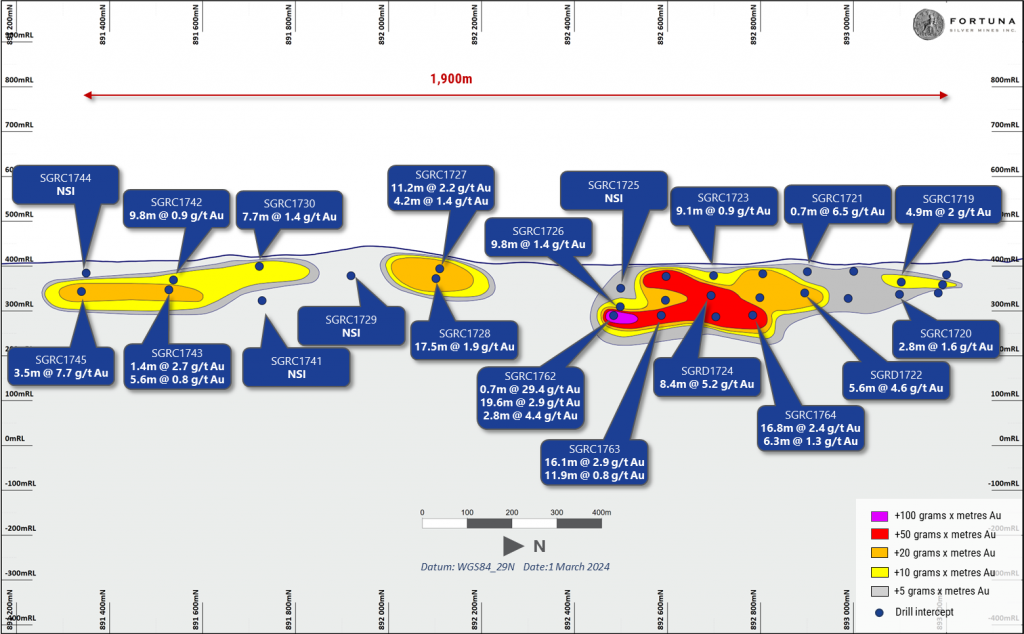

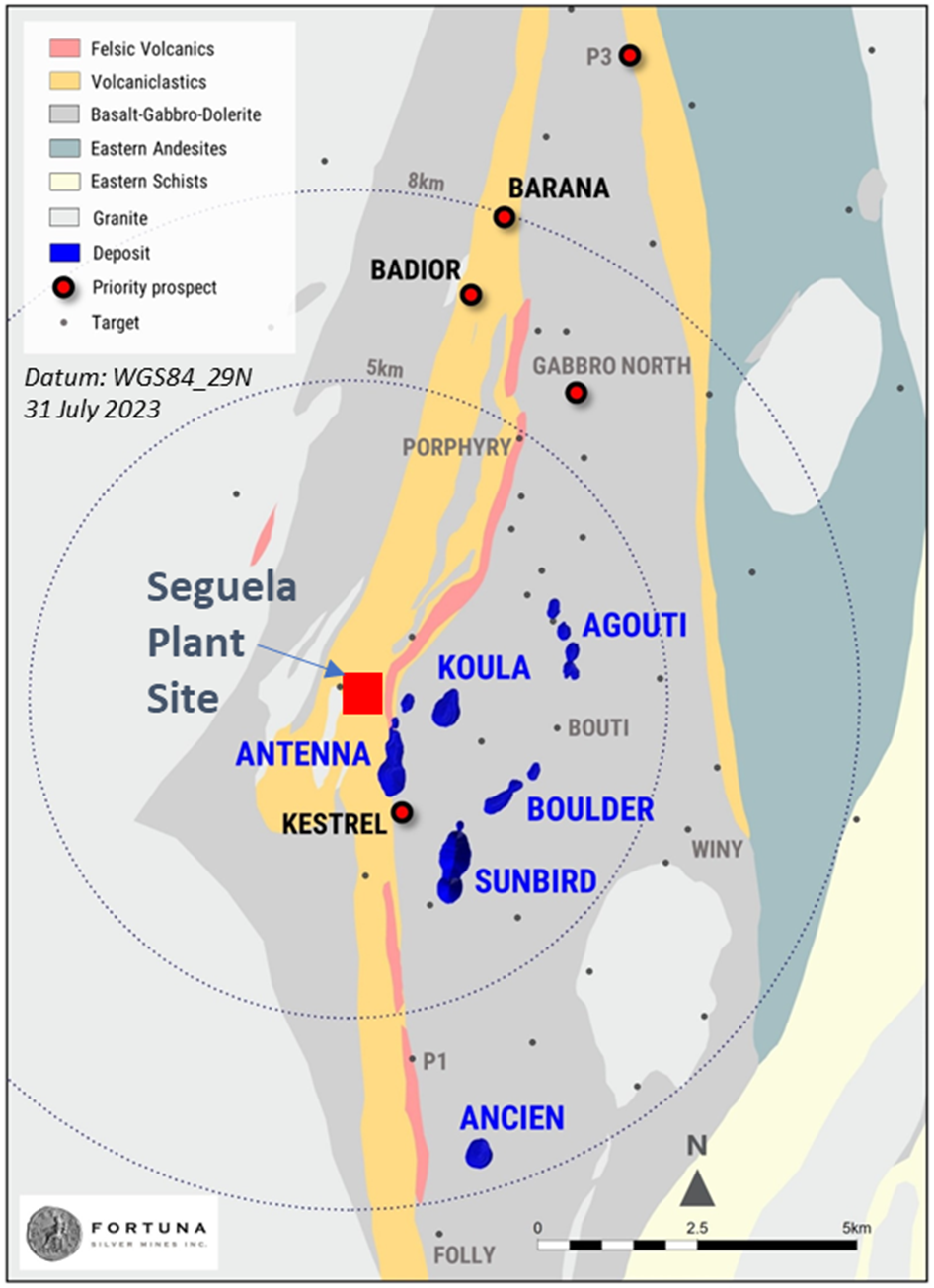

At the Séguéla Mine in Côte d’Ivoire, a 2,040-meter, 20-hole program was completed at the newly discovered Kingfisher prospect, identifying three lodes along a 1.9-kilometer strike, all of which remain open along strike and at depth. Notable results include drill hole SGRC1762 intersecting 2.9 g/t Au over an estimated true width of 19.6 meters from 106 meters downhole, and drill hole SGRC1763 intersecting 2.9 g/t Au over an estimated true width of 16.1 meters from 136 meters downhole. The Kingfisher prospect is hosted in a set of quartz veins along a moderately sheared contact between a series of basalt-dolerite units, which also hosts the Boulder and Agouti deposits, one and three kilometers, respectively, to the north, with a steep easterly dip consistent with the majority of other deposits at Séguéla. Additional drilling at Kingfisher is scheduled in the second quarter of 2024 to further test its strike and depth potential.

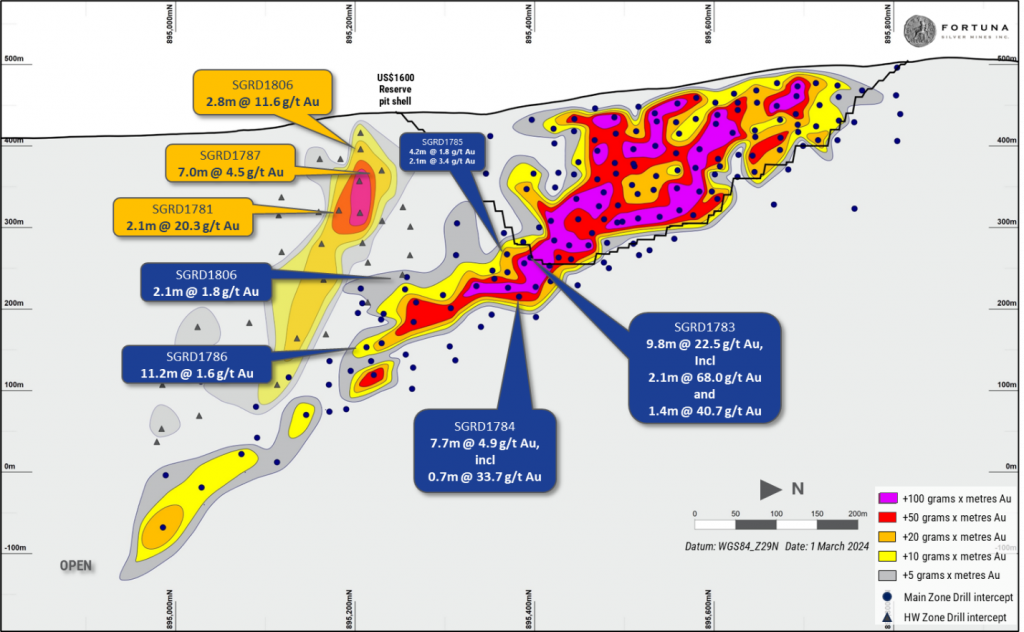

Paul Weedon, Senior Vice President of Exploration at Fortuna, commented in a press release: “Emphasizing the exploration potential at Séguéla, the team has continued their impressive run-rate of discoveries with the new Kingfisher prospect. This follows the Barana, Badior and Kestrel discoveries made during 2022 and 2023.” Mr. Weedon continued, “In addition to the exploration success at Kingfisher, drilling for Koula underground mining potential has resulted in several high-grade intersections. This includes 68.0 g/t Au over an estimated true width of 2.1 meters in SGRD1783, as part of a larger interval of 22.5 g/t Au over an estimated true width of 9.8 meters, highlighting the opportunity for underground mining. With the initial campaign of confirmatory drilling wrapping up at Area A and Area D, exploration focus is progressing towards testing the satellite opportunities. Early success at the Moungoundi, Western Splay, and Kassasoko satellite prospects highlight the potential of Diamba Sud.” Mr. Weedon continued, “In addition to improving the confidence at Area A, Area D, and Karakara, drilling intersected several mineralized zones extending beyond the historic pit optimization shells. These extensions will be incorporated into a resource model to be prepared later in 2024.”

A 3,106-meter, 12-hole program was also completed at the Koula deposit in December 2023. As part of the support for potential underground mining, the program was designed to infill and further improve the understanding of the structural controls on the central and hanging wall high-grade lodes. Results such as 22.5 g/t Au over an estimated true width of 9.8 meters from 208 meters downhole, including 68.0 g/t Au over an estimated true width of 2.1 meters from 215 meters downhole in drillhole SGRD1783, highlight the potential of Koula. Drilling continues to expand Koula’s underground potential and the further delineation of the hanging wall lodes.

At the Diamba Sud Gold Project in Senegal, the initial 10,945-meter, three-drill rig drilling program, which started on October 8, 2023, was extended into the 2024 budget of $9.2 million, consisting of a 42,700 meter RC and diamond drilling campaign. The current program has seen the completion of 181 drill holes totaling 23,170 meters since December 2023. The objectives of the 2024 drilling program are to conduct selected confirmatory drilling to improve resource confidence at Area A, Area D, and Karakara, drill to test for extensions to the existing historic resource in support of project development and advancing further economic studies, advance prospective areas such as Moungoundi, Kassasoko, Western Splay, Area A North, and others, and improve understanding of key geological controls including controlling structures, favorable lithologies, alteration, and secondary enrichment zones.

Early-stage drilling returned encouraging results from Moungoundi, located approximately two to four kilometers south of Karakara. Hosted in a shear zone traversing a sediment/granite contact, Moungoundi remains open at depth where additional follow up drilling is planned in the second quarter of 2024. Results include 2.1 g/t Au over an estimated true width of 20.3 meters from 31 meters in drill hole DSR551, and 5.4 g/t Au over an estimated true width of 6.8 meters from 88 meters in drill hole DSR558. Encouraging results were also received from first pass drilling at Kassasoko, with highlights including 1.0 g/t Au over an estimated true width of 18.75 meters from 29 meters in drill hole DSR613 and 1.5 g/t Au over an estimated true width of 11.25 meters in drill hole DSR604. Similar results were also returned from first pass drilling at Western Splay, including 2.1 g/t Au over an estimated true width of 13.5 meters from drill hole DSR584, and 7.4 g/t Au over an estimated true width of 7.5 meters from drill hole DSR598.

Highlights from the results are as follows:

Séguéla Mine, Côte d’Ivoire – Kingfisher prospect

| SGRD1724: | 5.2 g/t Au over an estimated true width of 8.4 meters from 98 meters, including 14.8 g/t Au over an estimated true width of 2.1 meters from 100 meters |

| SGRC1728: | 1.9 g/t Au over an estimated true width of 17.5 meters from 41 meters |

| SGRC1762: | 2.9 g/t Au over an estimated true width of 19.6 meters from 106 meters |

| SGRC1763: | 2.9 g/t Au over an estimated true width of 16.1 meters from 136 meters |

| SGRC1764: | 2.4 g/t Au over an estimated true width of 16.8 meters from 125 meters, including 19.2 g/t Au over an estimated true width of 1.4 meters from 147 meters |

Koula deposit

| SGRD1781: | 20.3 g/t Au over an estimated true width of 2.1 meters from 110 meters |

| SGRD1783: | 22.5 g/t Au over an estimated true width of 9.8 meters from 208 meters, including 68.0 g/t Au over an estimated true width of 2.1 meters from 215 meters, and 40.7 g/t Au over an estimated true width of 1.4 meters from 220 meters |

| SGRD1784: | 4.9 g/t Au over an estimated true width of 7.7 meters from 268 meters, including 33.7 g/t Au over an estimated true width of 0.7 meters from 276 meters |

| SGRD1806: | 11.6 g/t Au over an estimated true width of 2.8 meters from 36 meters |

Diamba Sud Gold Project, Senegal – Area A

| DSR515: | 3.5 g/t Au over an estimated true width of 23.4 meters from 74 meters |

| DSDD140: | 6.2 g/t Au over an estimated true width of 11.2 meters from 126.6 meters |

| Area D | |

| DSDD163: | 6.0 g/t Au over an estimated true width of 32.0 meters from 7 meters, including 39.4 g/t Au over an estimated true width of 2.2 meters from 31 meters |

| DSDD173: | 3.5 g/t Au over an estimated true width of 44.8 meters from 8 meters |

| DSDD176: | 4.4 g/t Au over an estimated true width of 15.6 meters from 36 meters, including 20.6 g/t Au over an estimated true width of 2.4 meters from 38 meters |

| DSDD196: | 6.3 g/t Au over an estimated true width of 18.4 meters from 3 meters, including 20.9 g/t Au over an estimated true width of 1.6 meters from 16 meters |

| DSDD206: | 4.6 g/t Au over an estimated true width of 19.0 meters from 48 meters, including 70.7 g/t Au over an estimated true width of 0.8 meters from 63 meters |

|

Karakara |

|

| DSDD205: | 2.0 g/t Au over an estimated true width of 6.8 meters from 20 meters, and 5.2 g/t Au over an estimated true width of 14.4 meters from 74 meters |

| DSDD207: | 8.5 g/t Au over an estimated true width of 9 meters from 79 meters, including 36.2 g/t Au over an estimated true width of 1.5 meters from 80 meters |

| DSR541: | 4.2 g/t Au over an estimated true width of 12.8 meters from 92 meters |

| DSR546: | 2.8 g/t Au over an estimated true width of 14.3 meters from 79 meters, and 4.5 g/t Au over an estimated true width of 11.3 meters from 117 meters |

| Moungoundi | |

| DSR551: | 2.1 g/t Au over an estimated true width of 20.3 meters from 31 meters |

| DSR558: | 5.4 g/t Au over an estimated true width of 6.8 meters from 88 meters |

| DSR563: | 2.7 g/t Au over an estimated true width of 14.2 meters from 45 meters |

| DSR568: | 30.7 g/t Au over an estimated true width of 11.3 meters from 46 meters, including 146.0 g/t Au over an estimated true width of 2.25 meters from 46 meters |

| Kassasoko | |

| DSR604: | 1.5 g/t Au over an estimated true width of 11.3 meters from 29 meters |

| Western Splay | |

| DSR584: | 2.1 g/t Au over an estimated true width of 13.5 meters from 17 meters |

| DSR598: | 7.4 g/t Au over an estimated true width of 7.5 meters from 56 meters, including 19.6 g/t Au over an estimated true width of 1.5 meters from 61 meters |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Fortuna Silver Mines (TSX:FVI) has completed its acquisition of Chesser Resources Limited, according to official statements. Under the terms of the deal, Fortuna acquired all of Chesser’s fully paid ordinary shares, exchanging 0.0248 of one Fortuna common share for each share of Chesser. At the close of the transaction, Fortuna issued 15,545,368 shares in return for Chesser’s shares. These newly issued shares account for approximately 5.1% of Fortuna’s total issued and outstanding shares on an undiluted basis.

Jorge A. Ganoza, President and CEO of Fortuna, commented in a press release: “With the acquisition of Chesser, Fortuna continues to strengthen its presence in West Africa. Senegal is a mining friendly and highly prospective jurisdiction, and we are excited about the growth potential that Chesser’s Diamba Sud Gold Project provides. We look forward to integrating Diamba Sud into our global portfolio, focusing on exploration to unlock value, and partnering with the local communities and stakeholders as we continue to advance the project.”

The acquisition was conducted via a statutory scheme of arrangement, compliant with Part 5.1 of the Australian Corporations Act 2001. As a result of the transaction, Chesser Resources is now a wholly-owned subsidiary of Fortuna Silver Mines, and its shares are expected to be delisted from the ASX within one to two business days. The purchase expands Fortuna’s operations into West Africa, adding the Diamba Sud Gold Project in Senegal to its portfolio. Chesser had held approximately 872 square kilometers of prospecting ground in Senegal, which is close in proximity and similar in geological features to other significant gold mines in the region. The Diamba Sud project itself contains four open-pittable high-grade gold deposits, as well as several untested anomalies. Fortuna plans to focus initially on exploration to expand the mineral resources at Diamba Sud, before moving the project to the development stage.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

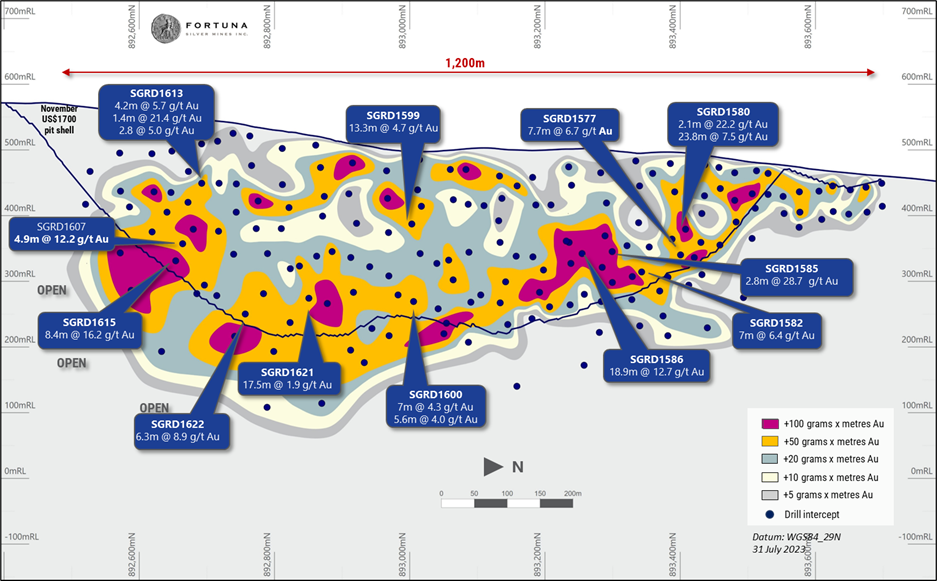

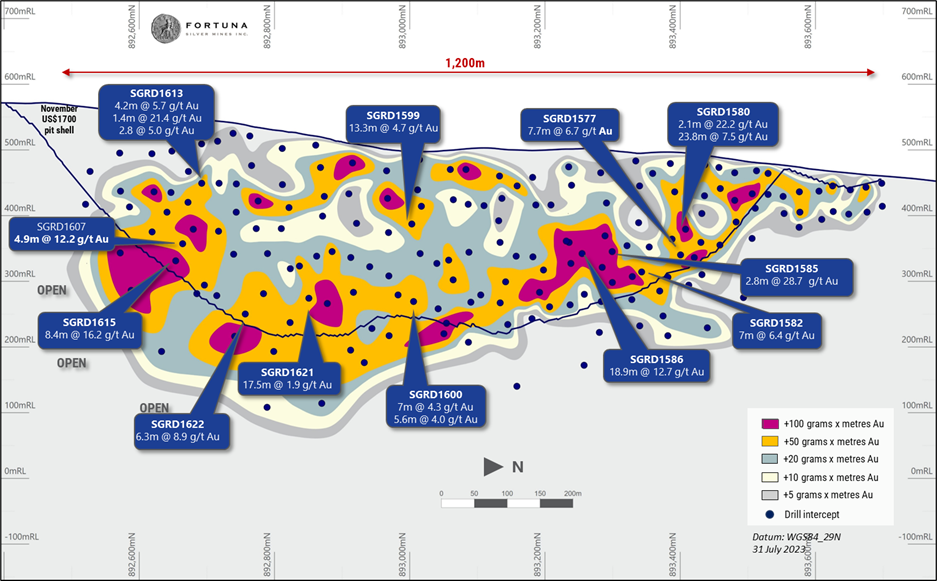

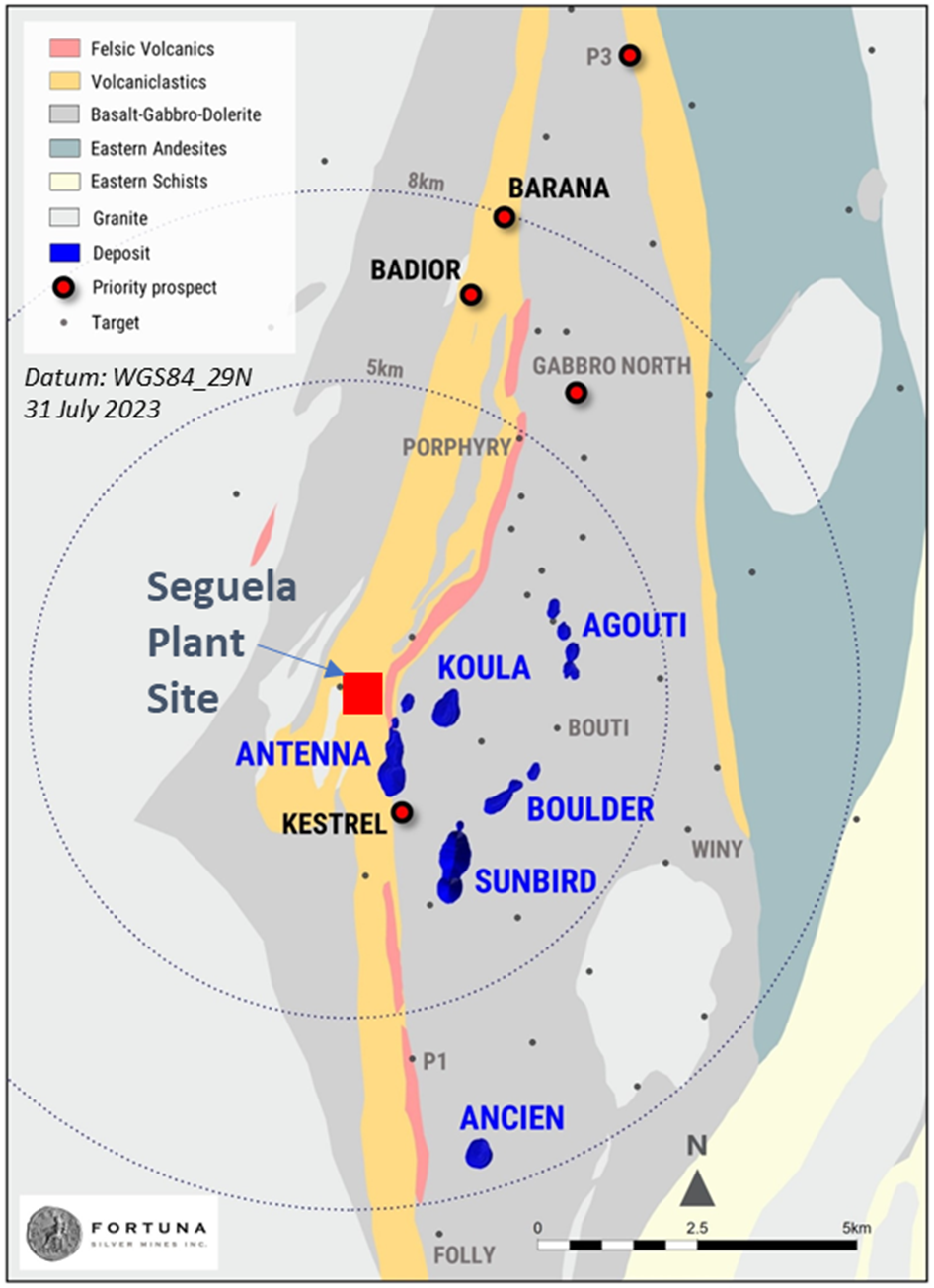

Fortuna Silver (TSX:FVI) has released details and results from its exploration program at multiple sites, including the Séguéla Mine in Côte d’Ivoire, the Yaramoko Mine in Burkina Faso, and the Baborigame Project in Mexico. In the Sunbird Deposit, infill drilling has been conducted to expand geological confidence, with 47 holes drilled that total 11,075 meters of a larger 15,126-meter program. This expansion is due to consistently positive results, up from the initially planned 9,500 meters. The drilling identified high-grade mineralization near the pit optimization limit, including significant intersections in drill holes SGRD1580 and SGRD1281. The findings will be utilized in an updated Mineral Resource and Mineral Reserve estimate, planned for release in the fourth quarter of 2023. Further drilling to investigate the depth potential of the southerly plunging high-grade shoots is scheduled for the latter half of 2023.

Paul Weedon, Senior Vice President of Exploration at Fortuna, commented in a press release: “Infill drilling at the Sunbird Deposit to upgrade geologic confidence has concluded, with the next phase of estimation, optimization, and design having commenced as part of reserve development and expected life-of-mine extension for the Séguéla Mine. With this underway, the focus has returned to generating new anomalies and testing prospects, with positive near surface results at Barana emphasising the regional potential; such as drill hole SGRD1647 intersecting 90.9 g/t Au over an estimated true width of 1.8 meters. Recent drilling of Zone 55 at the Yaramoko Mine has identified high grade mineralization extending at least 130 meters beyond the current resource envelope to the west, confirmed by recent mine development in the area, with intervals such as 32.8 g/t Au over an estimated true width of 3.1 meters in drill hole YRM-23-GCDD-203.

“In addition to the encouraging results from West Africa, first pass drilling to test geological concepts at our Baborigame Project in Mexico was successful in testing several vein arrays, intersecting multiple mineralized zones such as 2.7 g/t Au and 155 g/t Ag over an estimated true width of 4.04 meters in drill hole BAB-22-004.”

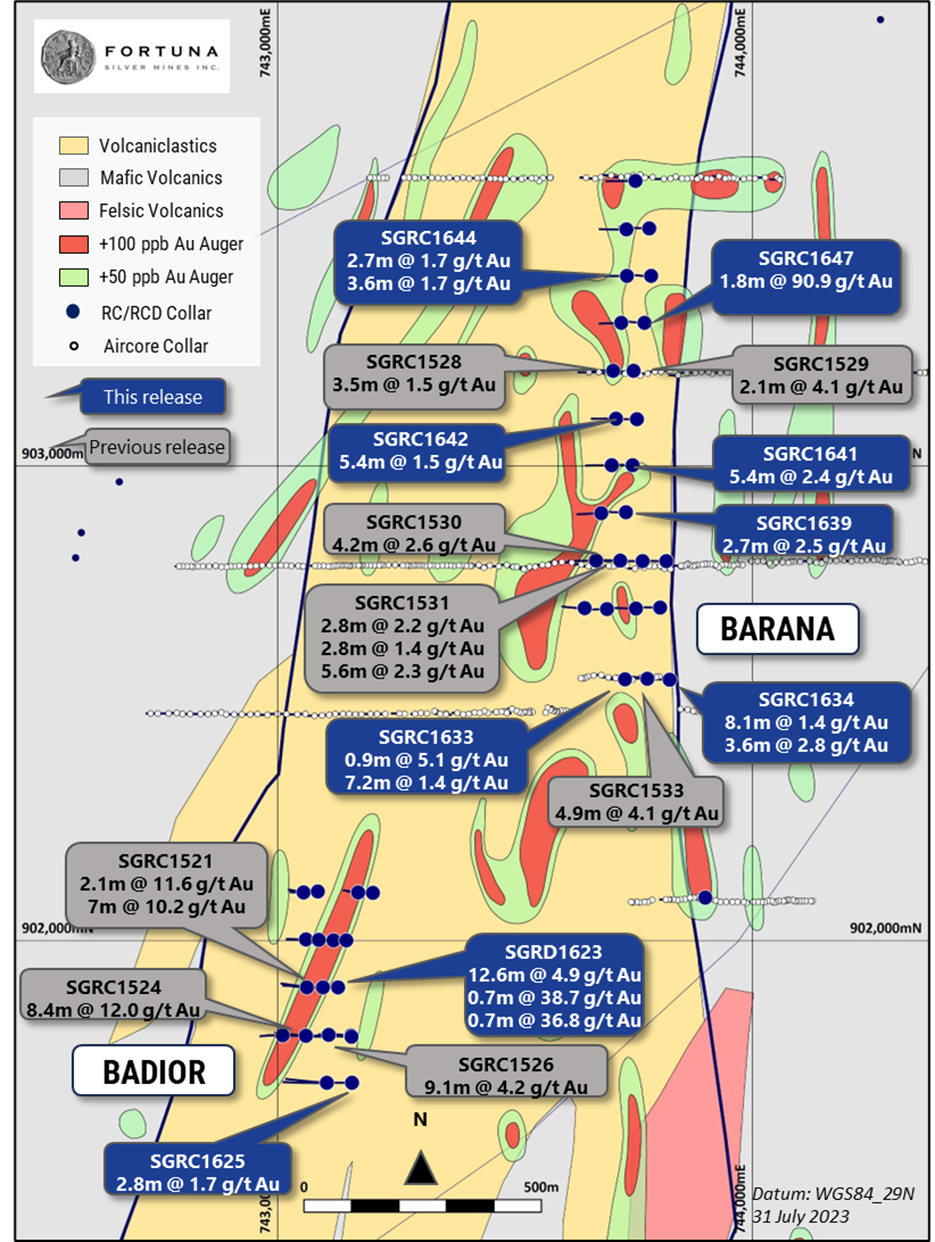

At the Barana and Badior prospects, a total of 30 holes equaling 3,907 meters have been drilled. The objective was to examine the strike extent and continuity of mineralization and to enhance understanding of the structures associated with mineralization controls. More drilling is expected later in the year.

The Yaramoko Mine saw the completion of a 29-hole drilling program, amounting to 7,011 meters, testing various extents of high-grade extensions. Positive results have led to an expectation for an updated Mineral Resource and Mineral Reserve estimate for Yaramoko before year’s end. Drilling also revealed new high-grade mineralization beyond the 2022 Mineral Resource boundary and will continue to test depth potential in the second half of the year.

Additional drilling to the east has also discovered the Zone 55 mineralized structure beyond the previous limits, with promising results, including drill hole GCDD-224’s return of 8.9 g/t Au. Further exploration is planned for later in 2023.

At the Baborigame Project in Mexico, 14 diamond drill holes across two phases totaling 3,902 meters were carried out as part of an evaluation. Located in southwestern Chihuahua, the exploration focused on key structural zones. Of the 14 drill holes, 10 returned positive exploration findings and further exploration is planned for the second half of 2023.

Highlights from the results are as follows:

Séguéla Mine, Cote d’Ivoire

Sunbird Deposit drilling highlights:

- SGRD1586: 12.7 g/t Au over an estimated true width of 18.9 meters from 147 meters

- SGRD1580: 22.2 g/t Au over an estimated true width of 2.1 meters from 115 meters and 7.5 g/t Au over an estimated true width of 23.8 meters from 128 meters

- SGRD1615: 16.2 g/t Au over an estimated true width of 8.4 meters from 270 meters

- SGRD1585: 28.7 g/t Au over an estimated true width of 2.8 meters from 151 meters

- SGRD1599: 4.7 g/t Au over an estimated true width of 13.3 meters from 81 meters

- SGRD1281: 10.7 g/t Au over an estimated true width of 5.6 meters from 199 meters (re-entered hole)

Barana and Badior drilling highlights:

- SGRD1647: 90.9 g/t Au over an estimated true width of 1.8 meters from 43 meters (Barana)

- SGRD1634: 1.4 g/t Au over an estimated true width of 8.1 meters from 77 meters (Barana)

- SGRD1641: 2.4 g/t Au over an estimated true width of 5.4 meters from 67 meters (Barana)

- SGRD1623: 4.9 g/t Au over an estimated true width of 12.6 meters from 110 meters (Badior)

Zone 55 drilling highlights:

- YRM-22-GCDD-184: 9.6 g/t Au over an estimated true width of 5.5 meters from 254.10 meters

- YRM-23-GCDD-203: 32.8 g/t Au over an estimated true width of 3.1 meters from 287.90 meters

- YRM-23-GCDD-205: 13.2 g/t Au over an estimated true width of 4.6 meters from 302.28 meters

- YRM-23-GCDD-224: 8.9 g/t Au over an estimated true width of 8.2 meters from 120.95 meters

- YRM-23-GCDD-227: 8.8 g/t Au over an estimated true width of 8.6 meters from 140.10 meters

Baborigame drilling highlights:

- BAB-22-004: 2.7 g/t Au and 155 g/t Ag over an estimated true width of 4.04 meters from 192.00 meters

- BAB-23-010: 3.3 g/t Au and 538 g/t Ag over an estimated true width of 1.20 meters from 191.00 meters

- BAB-23-009: 2.4 g/t Au and 314 g/t Ag over an estimated true width of 2.04 meters from 188.15 meters

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Fortuna Silver’s strong 2021 production and financial results were tainted by permitting issues at the San Jose mine in Oaxaca, Mexico.

Although the San Jose issue was resolved in December, recent political developments in Burkina Faso may mean Fortuna (NYSE:FSM | TSX:FVI) maintains an elevated perceived risk profile into 2022.

Production results and outlook

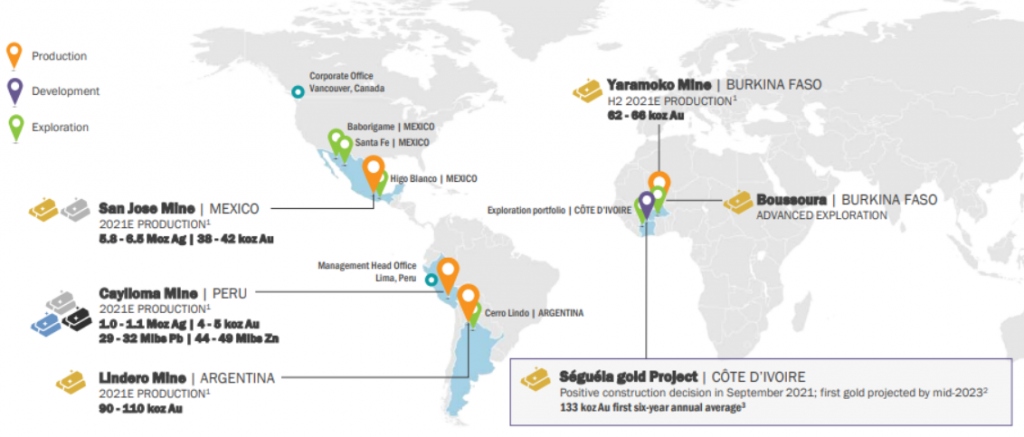

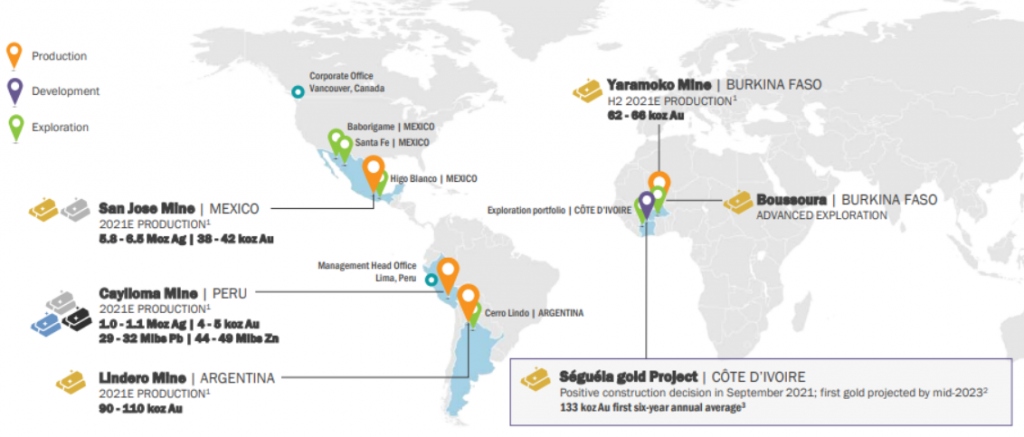

Fortuna has 4 operating mines in Mexico, Peru, Argentina, and Burkina Faso with a total production of about 306,000 oz Au eq.

Gold production surged 274% last year. This was largely due to the Lindero mine in Argentina, which saw its first gold pour in October 2020 and had a full year of production in 2021 with 104,000 oz. The acquisition of the Yaramoko gold mine in Burkina Faso also added 57,500 oz.

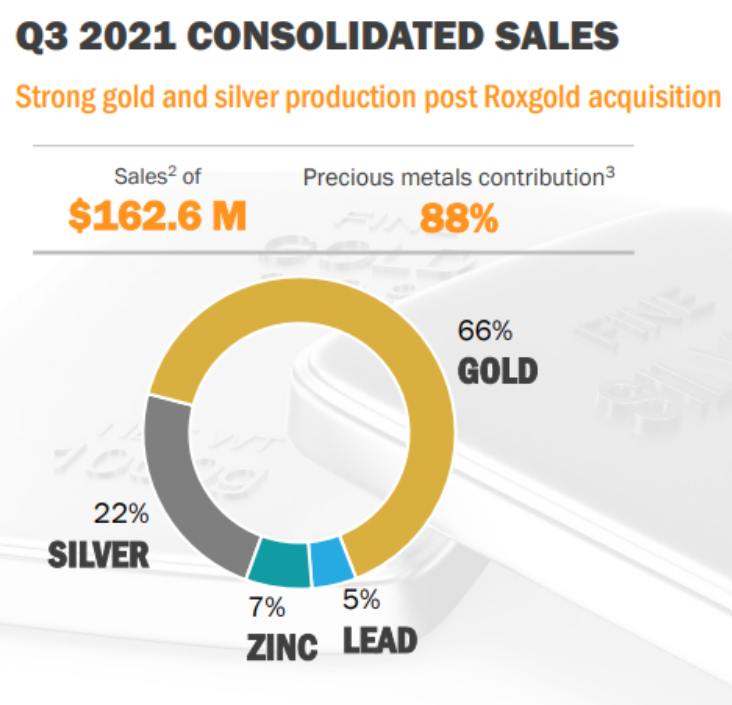

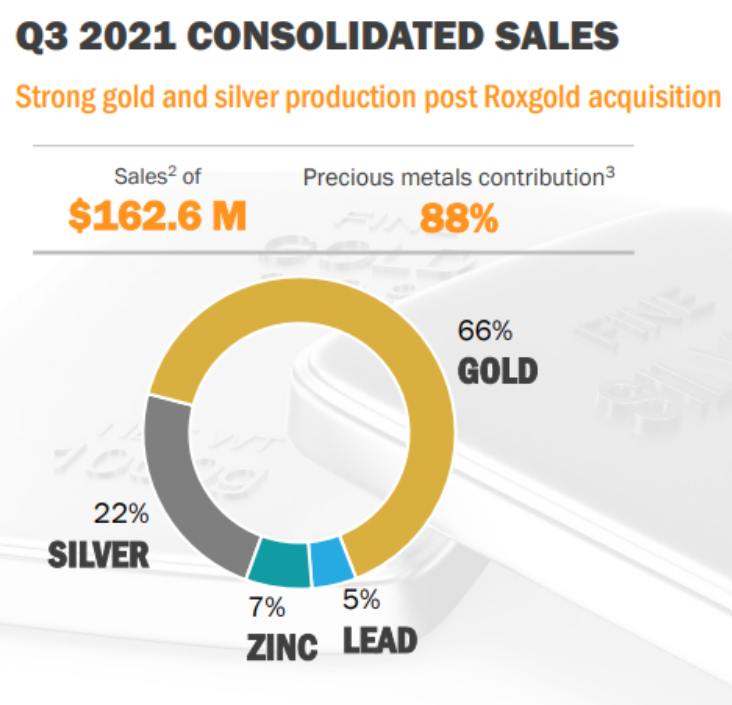

The San Jose mine, among the largest silver mines in Mexico, output over 6.4 million ounces in 2021. The Caylloma Mine in Peru added about 1.1 million ounces as well as lead and zinc production which together accounted for 12% of Q3 sales.

San Jose and Caylloma had AISC of 12.2-14.5 and 19.4-23.0 $/oz Ag eq. respectively. AISC at Lindero and Yaramoko were 1,010-1,190 and 990-1,150 $/oz Au.

A production increase of 7-21% Au eq. is projected for 2022. The Séguéla project in Côte d’Ivoire is expected to start producing in mid-2023 and is forecasted to add 130,000-140,000 oz Au. These assumptions, together with stable precious metal prices, would allow Fortuna to surpass $800M in annual sales within about 2 years.

Possible oversell in reaction to San Jose news

Fortuna’s stock had a sharp selloff in Q4 on the prospect that the 10-year environmental permit for the San Jose mine would not be renewed by Mexican regulators.

With San Jose accounting for roughly 20% of revenues, the market had more than priced in a mine shut down by mid-December 2021. Fortuna was down over 40% from Nov. high to Dec. low, while the Global X Silver Miners ETF (NYSEARCA:SIL) was down about 18% over the same period.

Fortuna recovered somewhat since the San Jose permit was granted on Dec. 20, but remains down about 30% since November highs, which is about a 10% average underperformance versus industry peers. It’s possible the market over-discounted for the San Jose risk. Another consideration is recent events in Burkina Faso, which highlight geopolitical risks for West African producers.

West Africa and post-pandemic resource nationalism

A military coup d’etat ousted the president of Burkina Faso on January 24, continuing a wave of coups in the West African region in recent months.

Some commentators have pointed out that, in comparison with the previous generation of coups culminating in the 1990s, there is a heightened discourse of national sovereignty surrounding more recent events. The prospect that this could lead to assertions of national control over natural resources may lead to a chilling effect on investment. The risks include increased royalties and taxes as well as regulations and capital controls.

However, the surge in post-pandemic resource nationalism is countered by the imperative of policymakers to provide stable jobs and boost foreign currency reserves. Headlines may overshadow the extent to which mining is core to regional economies and will continue regardless of political shifts.

As Fortuna CEO Jorge A. Ganoza points out, “West Africa is an established mining jurisdiction. You have all the industry clusters that support the efficient running of the business…. Even though we have geographic dispersion, that dispersion is in areas where you can effectively and efficiently run mines.”

West Africa is, after China, the second-largest gold-producing region in the world. While others may be questioning investments in the region, Fortuna is doubling down on exploration and production. By establishing itself as a reliable partner in economic development with a long-term stakeholder approach, Fortuna could be positioning itself for the years to come.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CRD.V | +200.00% |

|

HBK.V | +50.00% |

|

VMC.AX | +38.00% |

|

VMC.AX | +38.00% |

|

GMV.V | +34.38% |

|

MRQ.AX | +33.33% |

|

NEV.V | +33.33% |

|

CASA.V | +30.00% |

Gold Resource Corp Gold Resource Corp |

GORO | +25.31% |

Gold Resource Corp. Gold Resource Corp. |

GORO | +25.31% |