Nevada King Gold (TSXV:NKG) has announced that its Phase II resource expansion and definition drilling program at the 5,166-hectare Atlanta Gold Mine project will be increased. The project is located in the Battle Mountain Trend 264km northeast of Las Vegas, Nevada, and is 100%-owned by Nevada King Gold.

The company is the third largest mineral claim holder in the state, just behind Nevada Gold Mines (Barrick/Newmont) and Kinross. In 2016, the company began staking large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines.

Initially, these areas were selected for their potential for hosting multi-million-ounce gold deposits and were then staked after a detailed geological evaluation. Projects in the company’s portfolio include the Atlanta Mine, the Lewis and Horse Mountain-Mill Creek projects, and the Iron point project. Nevada King Gold continues to be well funded with approximately $14.5 million in cash as of November 2022.

Exploration Manager Cal Herron, P.Geo., commented in a press release: “Since our last update two weeks ago, the drills have advanced down the west pit wall stepping closer to the high-grade zone hit in last year’s drilling along the pit floor. Expanding the program and running it into the winter months will allow us to maintain our current momentum targeting further definition and expansion of the high-grade gold mineralization targets defined so far which remain open in all directions, as well as to test target areas not drilled to date. We are continually surprised by the complicated faulting and rapidly changing alteration patterns revealed with each step-out exploration hole. When examined in detail, the Atlanta gold system is proving to be very complex and difficult to decipher, which in itself is a hallmark of many large deposits. We anticipate a flurry of assays to start arriving shortly, which will allow us to update our modelling and continue to fine tune the targeting in on-going drilling program leading to an updated resource estimate.”

Highlights from the update are as follows:

- On November 1, 2022, the Company announced a 20% expansion to its Atlanta Mine Phase II drill program, from the originally planned 13,100m (100 holes) to 16,000m of combined core and reverse-circulation (“RC“) drilling.

- Drilling productivity has exceeded expectations with the Company having now completed 16,450m (138 holes).

- Based on assay results received to date, drill hole logging and ongoing geological interpretation based on this work, target areas at Atlanta continue to grow and the Company has decided to again expand the Phase II program another 25% to 20,000m, and to extend the program into the winter months.

- A track-mounted RC drill capable of accessing and drilling in harder to reach areas is being added to the program, with this rig scheduled to arrive on site within the next two weeks. Utilizing equipment already on-site, including the recent addition of water tank heaters, infrastructure is now in place to keep the drill program running into the winter months, with at least two rigs active.

- To date, the Company has reported assays from 2,455m of drilling, while assay results from 13,995m of drilling are currently pending.

Phase II Drilling Highlights are as follows:

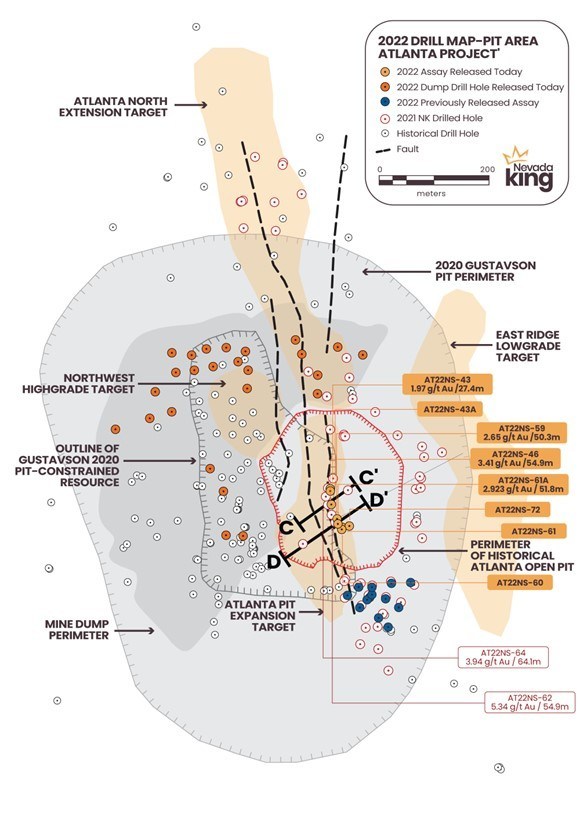

- The Company reported initial assay results on September 13, 2022 and October 18, 2022. The results included high-grade oxide-hosted intervals of 120.4m of 1.49 g/t Au and 57.9m of 1.38 g/t Au, located south and southeast of the Atlanta pit, and 54.9m of 3.41 g/t Au, 50.3m of 2.65 g/t Au, and 51.8m of 2.23 g/t Au, starting from surface at the bottom of the Atlanta pit.

- Drilling continues to target high-grade gold mineralization along the Atlanta Mine Fault Zone (“AMFZ“), westward and southwestward from last year’s drilling. Assays from these target areas returned high-grade intercepts including 41.2m of 3.94 g/t Au, 64m of 3.35 g/t Au, and 54.9m of 5.34 g/t Au, also starting at surface from within the Atlanta pit (see January 20, 2022, news release).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Nevada King Gold Corp (TSXV:NKG) released an update on the drill program at the 100% owned Iron Point Gold Project, Nevada King Gold Corp. The Iron Point Gold Project is located 35 km east of Winnemucca, Nevada, and is one of the remaining Carlin-scale gold exploration targets in Nevada. The project is located between the Battle Mountain and Getchell gold belts and on trend with other world-class gold mines including Twin Creeks and Turquoise Ridge.

In January 2022, Nevada King commenced the five-hole exploration program at and 4000 m depth at Iron Point with the objective of finding more Carlin-type gold mineralization reserved in the lower plate carbonate rocks below Roberts Mountain Thrust, which has remained largely unexplored. This hole resulted in 5.8 m of intercepted mineralization grading 0.17 g/t Au associated with very high pioneer elements.

Cal Herron, Nevada King’s Director of Exploration, stated, “We look forward to the results of this drilling. Our 2019 intercept at the bottom of VM-008C within a lower plate, thin-bedded silty carbonate host, was a major technical success and immediately focused the Company’s attention on Iron Point’s deep gold potential. The discovery of this Carlin-type gold mineralization within this lower plate host rock type, anywhere within the Carlin, Battle Mountain and Getchell gold trends, demands follow-up investigation. This combination of mineralization style and host rock type is known to produce elephant gold deposits throughout northern Nevada.

“By taking a step beyond this technical success with deeper drilling, we hope to identify the “fire” that produced the enormous amount of gold-arsenic-mercury “smoke” found within the upper plate rocks throughout the Iron Point district. Although significant exploration has been carried out at Iron Point in the past, this is the first time an aggressive, deep drilling program focused on the Carlin-type mineralization hosted in the lower plate has been carried out.”

Iron Point

Iron Point has been explored since the mid-1960s by numerous companies seeking commodities such as gold and vanadium. In 1966 they began the search at Newmont and continued with Mirando Goldo in 2008. However, the explorations did not go beyond 300 m depth as they focused exclusively on the upper plate. And so the potential of the Lower Plate rocks beneath Robert Mountain has remained largely intact.

Highlights include:

Three of the five pre-collis are located near a deep north-south-directed structural break (the “Range Front Zone” or “RFZ”) along the eastern margin of the Iron Point mining district.

The first RFZ forebay, IP22-003, has been completed and cased to a depth of 365m. The second RFZ pre-core, IP22-004, is currently being drilled. IP22-003 and IP22-004, with collars 250m apart in a north-south direction, serve as 350m stopes to the ENE and ESE of deep drill hole VM-008C drilled in 2019.

As noted, VM-008C has bottomed at 5.8m grading 0.17 g/t Au accompanied by elevated levels of As, Sb and Hg in “dirty” silicified Lower Plate limestone with a similar appearance to the Roberts Mountain Formation. This zone is considered to have good potential for higher grade gold mineralization at depth. IP22-004 is located approximately 90 m northwest of historic hole CH-IP88-03 drilled by Chevron in 1988 which intersected 7.62 m grading 1.59 g/t Au from 353.57 m depth, including 1.54 m grading 3.68 g/t Au at 355 m. CH-IP88-03 drilled 305 m of alluvium before entering bedrock, but the gold-bearing rock unit is unknown at this time.

Proposed RFZ pre-collar IP22-005, located 600m NNE of drill hole VM-008C, is a 265m step-out from mineralization encountered in 2019 drill hole EG-001C. Grade thickness contours from nearby historic drilling indicate an ENE orientation of Au mineralization in the siliciclastic rocks of the upper plate, a vector that coincides with a steep shoulder in the gravity dataset. EG-001C intersected the following zones of low grade gold mineralization:

- 25.9m grading 0.198 g/t Au from 22.9-48.8m downhole associated with brecciated quartzite, strong sulfide veining, and intrusive dikes

- 10.7m grading 0.303 g/t Au and 50.4 g/t Ag, from 172.2-182.9m downhole hosted in quartzite with intrusive dikes, breccia, and quartz-sulfide veining

- 18.3m grading 0.309 g/t Au from 358.1-376.4m downhole hosted in granodiorite and endoskarn

EG-002, the fourth planned deep test along the RFZ, is a 265m step-out to the south of VM-008C. This drill hole was pre-collared to 305m during the 2019 program but a core tail was not drilled at that time. A 610m core tail is planned during the 2022 program, bringing the total planned depth of this hole to 915m. This hole is situated within the same structural block as VM-008C and is expected to fully test prospective Lower Plate stratigraphy in this area west of the RFZ.

Source: Nevada King Gold Corp.

Nevada King also announced a Phase II drill program for 2022 at its Atlanta Gold Mine property, located 264 km northwest of Las Vegas south of the Battle Mountain Trend.

Highlights include:

This Phase II program will step-out and test the new high-grade discovery below the old Atlanta pit; which returned 5.34 g/t Au over 54.9m, 3.94 g/t Au over 41.2m, and 3.35 g/t Au over 64.1m from 3 holes all starting at surface. The program will also test additional high-priority targets over 1.2km of strike.

Nevada King’s 2022 drill program consists of 13,100 m in 100 holes, divided into 10,000 m of vertical RC drilling and 3,100 m of vertical coring drilling.

Source: Nevada King Gold Corp.

This new program will be largely focused on expanding high-grade mineralization along and west of the Atlanta Mine Fault Zone, starting in high-grade holes drilled in 2021 and moving progressively along strike and down dip to the west. Nevada King drilling in 2022 also involves re-drilling these breccias within the overall resource zone, tying into adjacent high grade intersections as numerous historic holes failed to fully penetrate the higher grade core zones at depth.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan