Lupaka Gold’s (TSX-V: LPK) Invicta Gold Project is on the brink of production, set to become Peru’s next producing gold mine.

However, everything is not going to plan…for the better.

What has been quietly observed is that (1) the grades are coming in higher than the PEA and (2) the company is already making plans to increase production above the PEA throughout rate of 350 tpd. All this means higher levels of production and cash flow once the actual mining commences later this year.

Recent underground sampling of mineralization is revealing an asset that offers more than originally outlined in the company’s April 2018 Preliminary Economic Assessment (“PEA”) which gives investors additional upside for any increases in mine output, improvement of grade and additional ounces to the overall resource.

The April 2018 PEA for the Invicta Mine outlined a mineral resource of 3 million tonnes of Indicated Mineral Resources at 5.78 grams per tonne (“g/t”) gold equivalent (“AuEq”) ounces using a 3.5-g/t cut-off grade (“COG”), and 600,000 tonnes of Inferred Mineral Resources at 5.49 g/t AuEq.

Within that resource the Company has a PEA that outlines an initial 6-year mine life that will produce produce a total of 669,813 tonnes of mineralized material processing 350 tonnes per day (“tpd”) at an average grade of 8.6 g/t Au-Eq. Lupaka’s grades included estimated metallurgical recoveries, and the true grade will likely be even higher than 8.5 g/t AuEq.

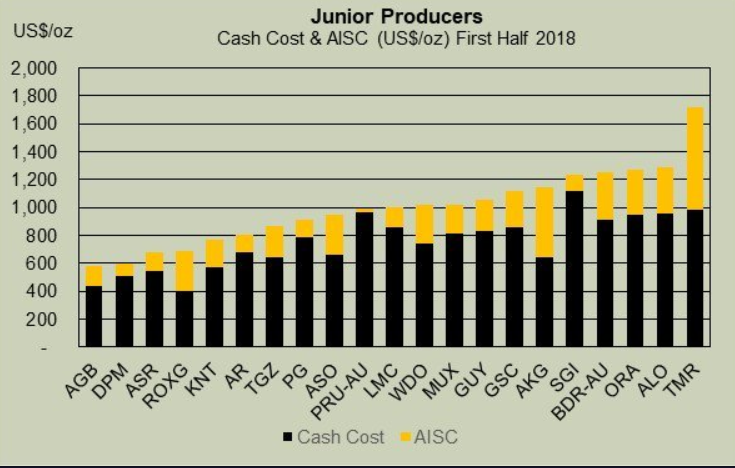

Just to highlight, with an all in sustaining cost (“ASIC”) of $575 per gold ounce equivalent, Lupaka Gold will be one of the lowest cost junior producers.

Source: AuCu Consulting, Ron Stewart (@RonStew12139302)

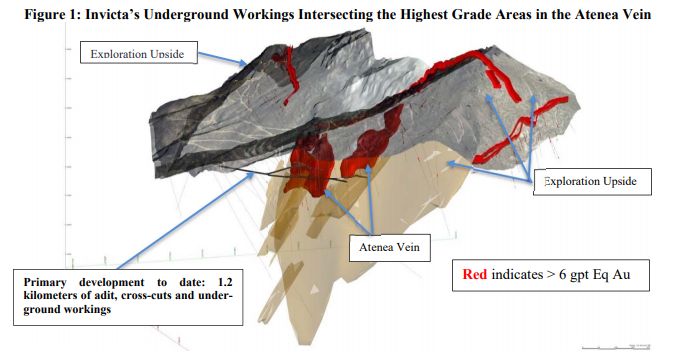

As part of the development work to put Invicta into production, Lupaka has been conducting channel sampling every 5 metres on all workings during development.

The results have demonstrated continuity of the high grade mineralization and additional potential that the Aetnea vein hosts.

In March 2018, the company released preliminary sample results:

- Sample assay values over the footwall vein averaged 9.86 g/t AuEq over 130 metres, with an average width of 6.1 metres (“m”);

- Sample assay values over the hanging wall split averaged 7.00 g/t AuEq over 70 m, with an average width of 6 m.

In June, Lupaka released further results from a underground sampling program on the newly developed 3430 production sublevel.

- 9.22 g/t AuEq over a strike length of 130 m, with an average sample width of 4.2 m.

The company provided additional results in July:

- Channel sample assay values from across the strike of the Atenea vein, within the raise development, returned an average of 23.45 g/t AuEq over a vertical height of approximately 30 m;

- Sampling returned significant grades such as sample number 2606E which returned 227.77 g/t AuEq over a width of 1.2 m.

In addition to the sampling, development and rehabilitation of the Invicta mine has provided ~6,500 tonnes of mineralized material from the 3400 Level and when sampled on surface returned an average grade of 7.21 g/t AuEq.

Grade consistency is always a problem with mining. However, it is appearing that the Invicta PEA outlined a muted gold grade on a smaller area of the known mineralization which does not highlight the potential for higher grade zones and the prospectivity of the area.

Higher grades could improve the bottom line as mining proceeds through the Aetnea vein and into the other zones around the current area of operational focus.

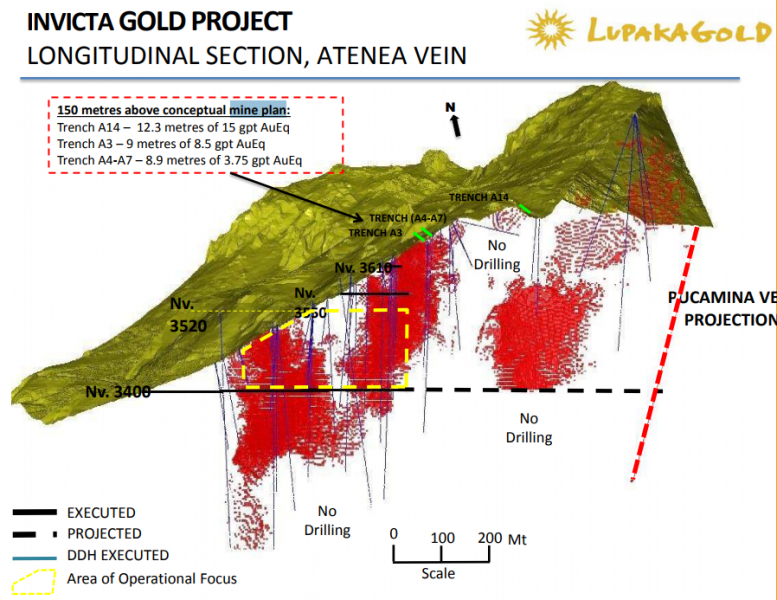

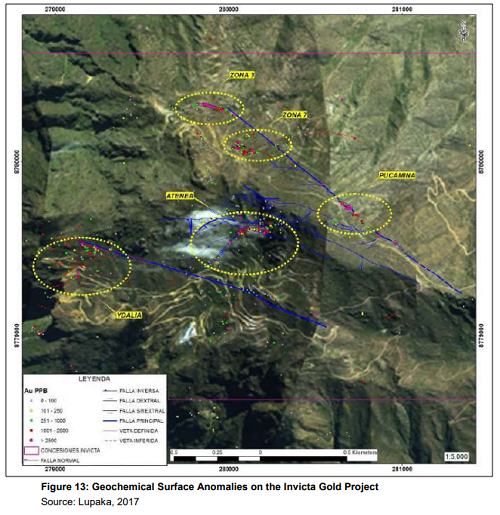

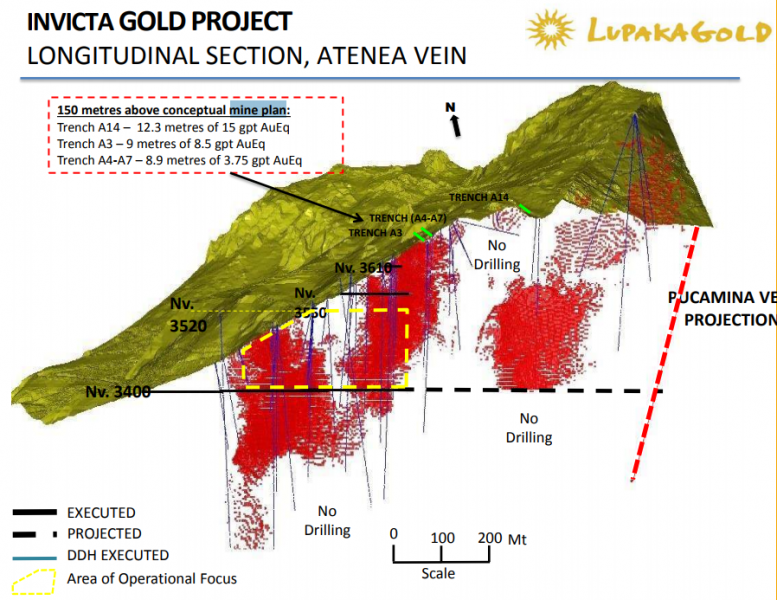

Past exploration at the Invicta mine property indicates that the property has considerable potential for mineral resource expansion through exploration.

Structural studies, geophysical and geochemical work conducted to date strongly suggest the potential for mineral resource expansion along existing mineralized structures.

Past sampling around Invicta revealed the exploration potential with many areas reporting grades greater than 6 g/t AuEq. mine

All in all, the focus on a smaller area for the PEA and initial mine plan reveals that the company’s plan has been to bring production online with a well defined resource with the Aetnea vein through underground mining with minimal capital expenditures, rather than trying to finance and build a large scale operation off the back.

With the commencement of limited toll mining in September, and the beginning of full scale production hopefully in October, Lupaka will have the necessary cash flow to conduct exploration and prove up more ounces in the ground and significantly alter the assumptions of the April 2018 PEA to extend the life of mine.

The next milestone is the final mining exploitation licence, which requires an inspection by the Peruvian Ministry of Mines and Energy.

The inspection will be performed before the end of October and upon receipt of the exploitation licence, the company will have the go ahead to produce at a rate of 400 tonnes per day, or 12,000 tonnes per month.

However, with the permit to operate at 400 tpd, the company could see its potential production increase by 14% from the 350 tpd production assumption outlined in the PEA, boosting the project’s cash flow.

Currently, shares in Lupaka gold are trading near year-lows which discounts a years’ worth of work and development that has improved access to the mine, defined a PEA, divestment of non primary assets, cash flow from initial toll mining and on the cusp of full scale mining.

The company laid out a plan to bring into production the Invicta mine with a small area of operational focus and a humble gold grade in comparison to recent sampling.

The plan is working and it is starting to reveal that there is more to the story than initially outlined…a good thing for investors.

*The author of this article was compensated for the creation of this article in cash. The author picked up shares in the public market, ranging from prices of 14 cents to 20 cents over the past year. This article is meant to serve informational and marketing purposes only and not a technical report and does not constitute a buy recommendation. As always, please do your own diligence.

*The Mineral Resource Statement for the Invicta Project is tabulated to a cut-off grade of 3.0 g/t Au-Eq. Cut-off grades are based on a price of US$1,250 per ounce of gold, US$17.00 per ounce of silver, US$3.00 per pound of copper, US$1.05 per pound of lead and US$1.20 per pound of zinc. The equivalent gold calculation assumes mill recoveries of 85 percent for gold, 80 percent for silver, 82 percent for copper and lead and 77 percent for zinc

With the recent close of the sale of the company’s Crucero property to GoldMining (TSX-V: GOLD), Lupaka Gold Corp. (TSX-V: LPK) has secured the funds to take the next step with its Invicta Gold project. Today, the company announced the commissioning of a Preliminary Economic Assessment “PEA” for the Invicta Gold Project.

With the backing of Pandion Finance and its gold purchase agreement providing the necessary funding, Lupaka is motivated to meet its obligations which makes now an exciting time for the company and its shareholders.

The company has hired SRK to prepare the PEA. This provides a continuity of project knowledge as the project’s 2012 resources estimate was prepared by SRK and the company’s own internal mining studies of Invicta were prepared with assistance from SVS Ingenieros of Lima “SVS”, Peru, a subsidiary of the SRK Consulting Group. The company plans the completion of the PEA technical report in the first quarter of 2018.

The initial six-year mine plan that was developed and prepared by SVS, which outlined ~735,000 tonnes at a grade of ~6.1 g/t AuEq. for 23,000 oz. of gold equivalent a year, according to a rough calculation. The plan was developed from the 3,400-metre level and extends up 120 metres.

Drill results indicated that the mineralization extends at least as far below the 3,400 level as it does above. In addition, there is a well-defined section of measured and indicated directly along strike to the northeast that is within a few hundred metres, and of the same characteristics as the segment in the mine plan.

The first bulk sample in October 2015 produced a copper, lead and zinc concentrate that was sold to an off-taker. The concentrate was exceptionally clean and was absent of any penalty elements, so buyers could pay well for it because they can mix it with less clean concentrate and blend it.

The company completed its second run-of-mine bulk test in February 2016 and achieved good recoveries in concentrate streams — returning 87.5% gold, 91.2% silver, 91.5% copper, 90.03% lead and 90.1% zinc. The sample was a blend of approximately 80 % run-of-mine material and 20 % from a low grade stockpile derived from development.

The bulk sample was processed with the prime objective of producing a saleable concentrate and no effort was made to optimize content of specific metals, according to the company. The resulting concentrate was clean, with few penalty elements which is ideal for sale and blending with other concentrates.

Once in production, the hope is that cash flow from Invicta will be used to grow the operation. There are numerous zones outside of the Atenea vein that contain mineralization, and the targeted Atenea resource could increase, as development offers access to high-grade intercepts and underground drill sites. In addition, based on gold and copper within the under-explored quartz-sulphide vein zones, the company believes the Invicta resource could expand.

At 350 tonnes per day, Invicta could operate for between 10 and 15 years based on the current measured and indicated resource in the Atenea zone. However, the project is permitted to operate at 1,000 tonnes per day and the company would like to increase their resources through drilling, expand operations to the 1,000 tpd rate and build their own mill on site but for the time being will use third party transport and processing contractors. All of this could take production to over 70,000 AuEq. oz/yr, according to a cocktail napkin calculation.

Proceeds from Invicta will also be used for more exploration at its other projects in Peru — Josnitaro which is a whole other story, worthy of an update of its own.

***MiningFeeds was compensated to provide marketing services. As always, do your own diligence. The writer of this article, Nicholas LePan does own shares.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Manhattan Corporation Limited Manhattan Corporation Limited |

MHC.AX | +100.00% |

|

MEX.V | +71.43% |

|

VO.V | +35.29% |

|

AAZ.V | +33.33% |

|

BEA.V | +33.33% |

|

ENT.AX | +33.33% |

|

CASA.V | +30.00% |

|

ZEN.V | +29.21% |

|

SRI.V | +25.00% |

|

MTB.V | +25.00% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan