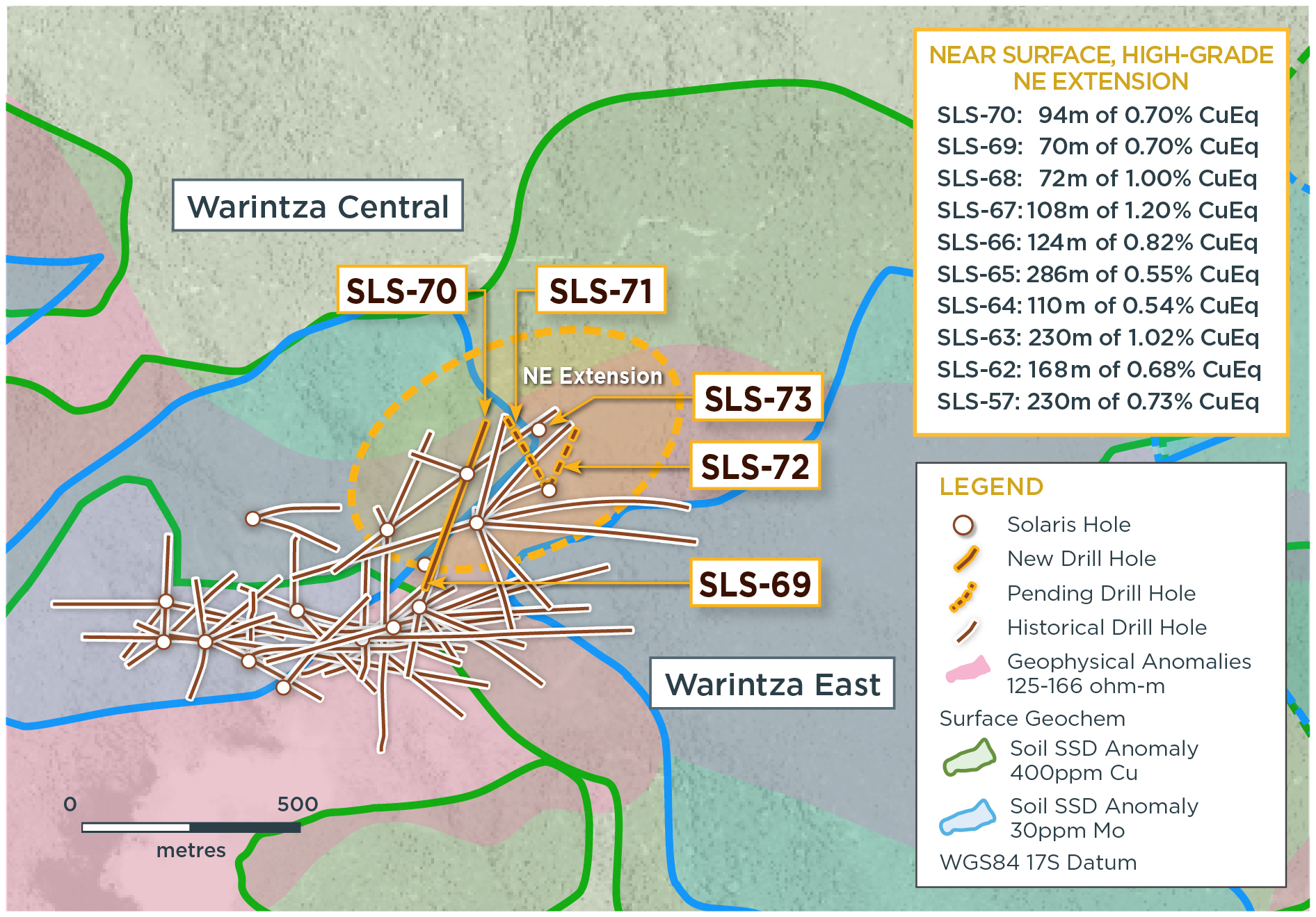

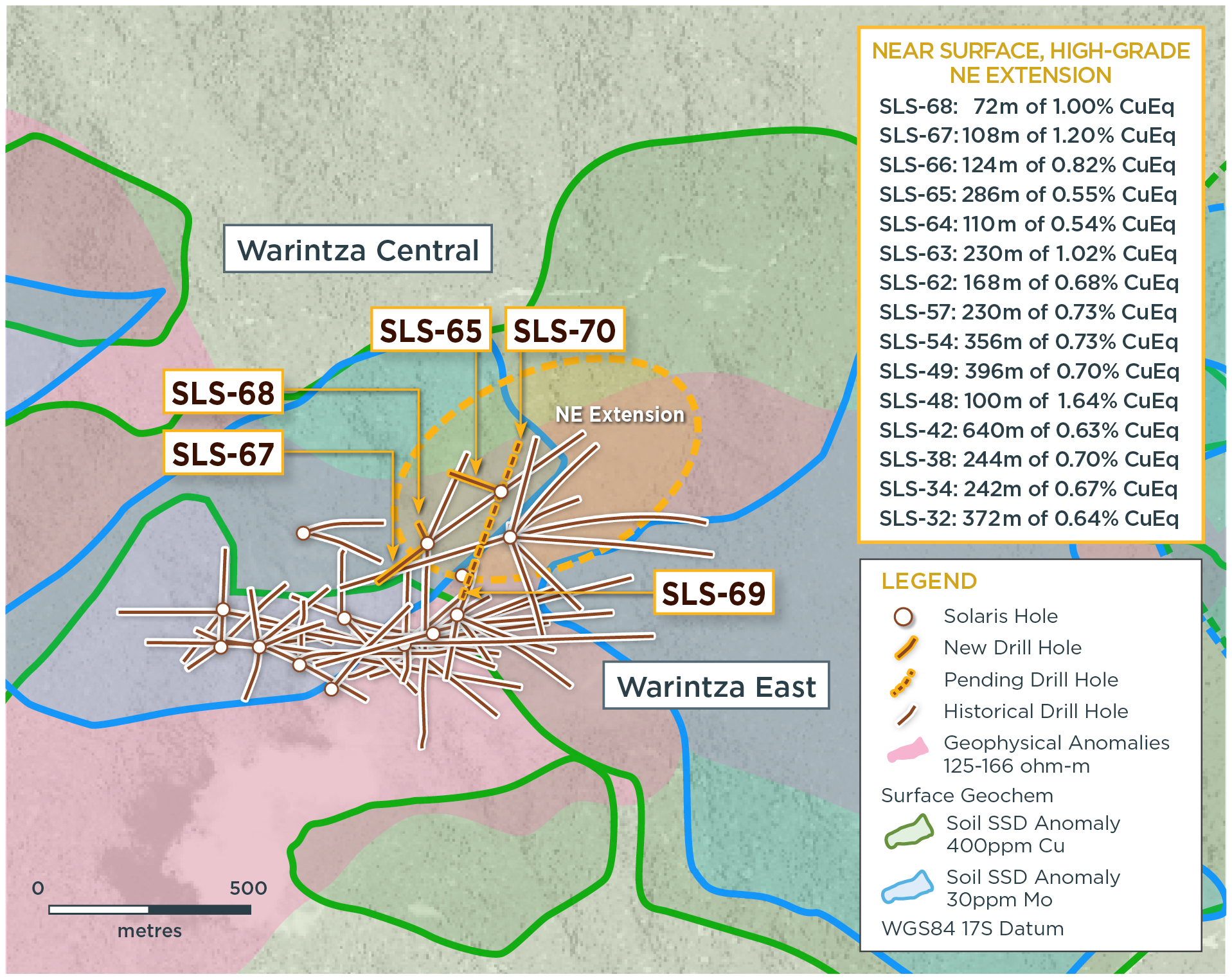

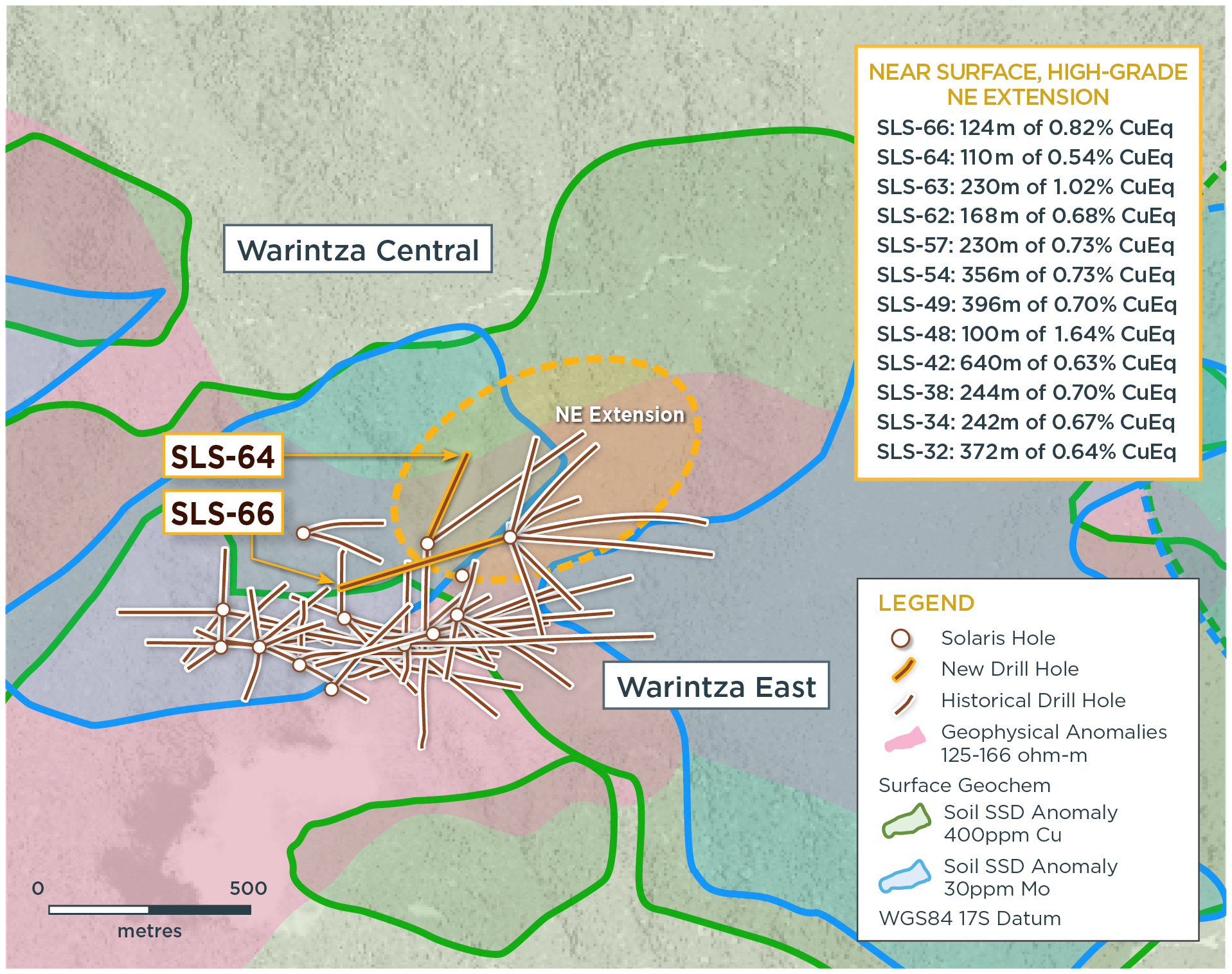

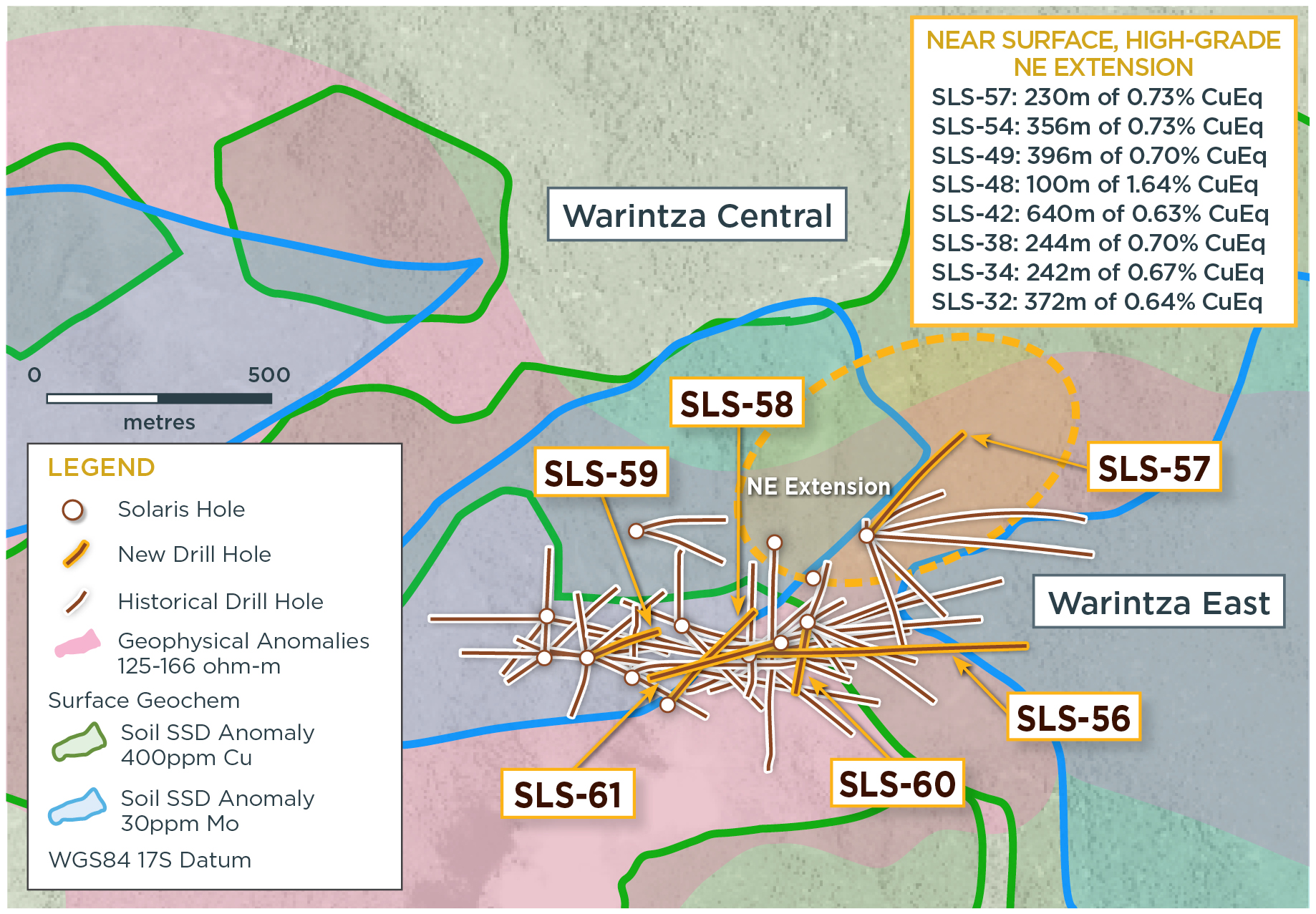

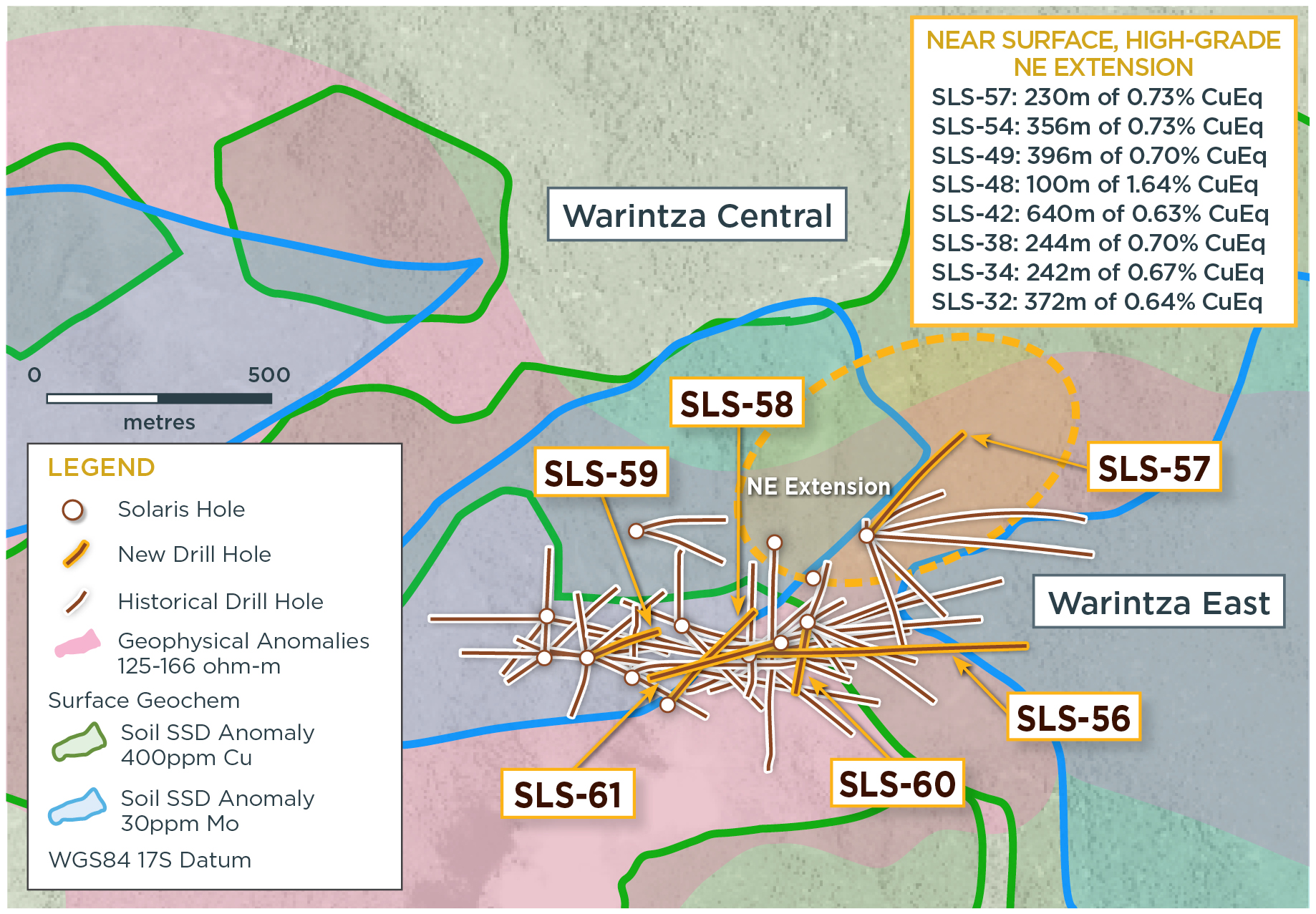

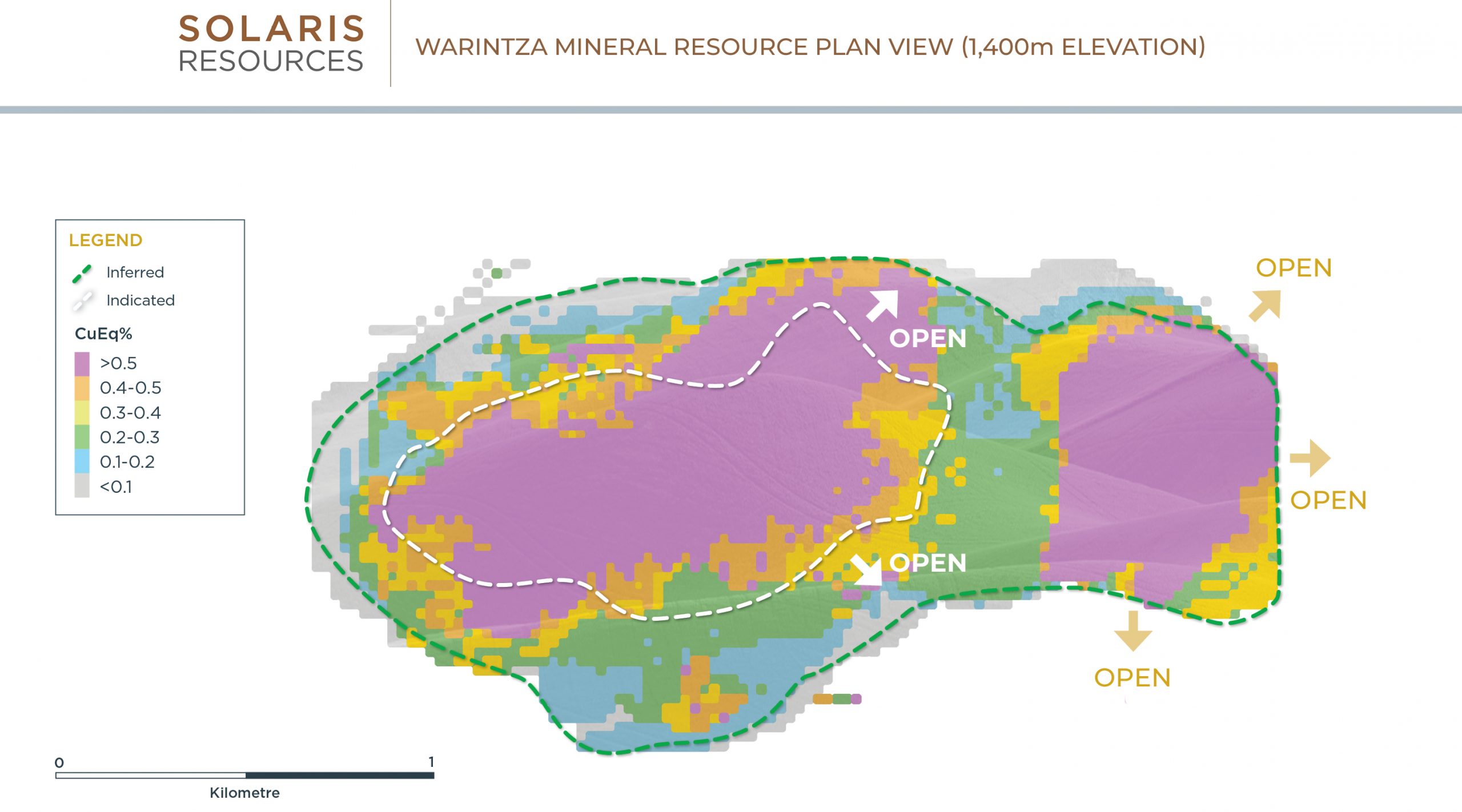

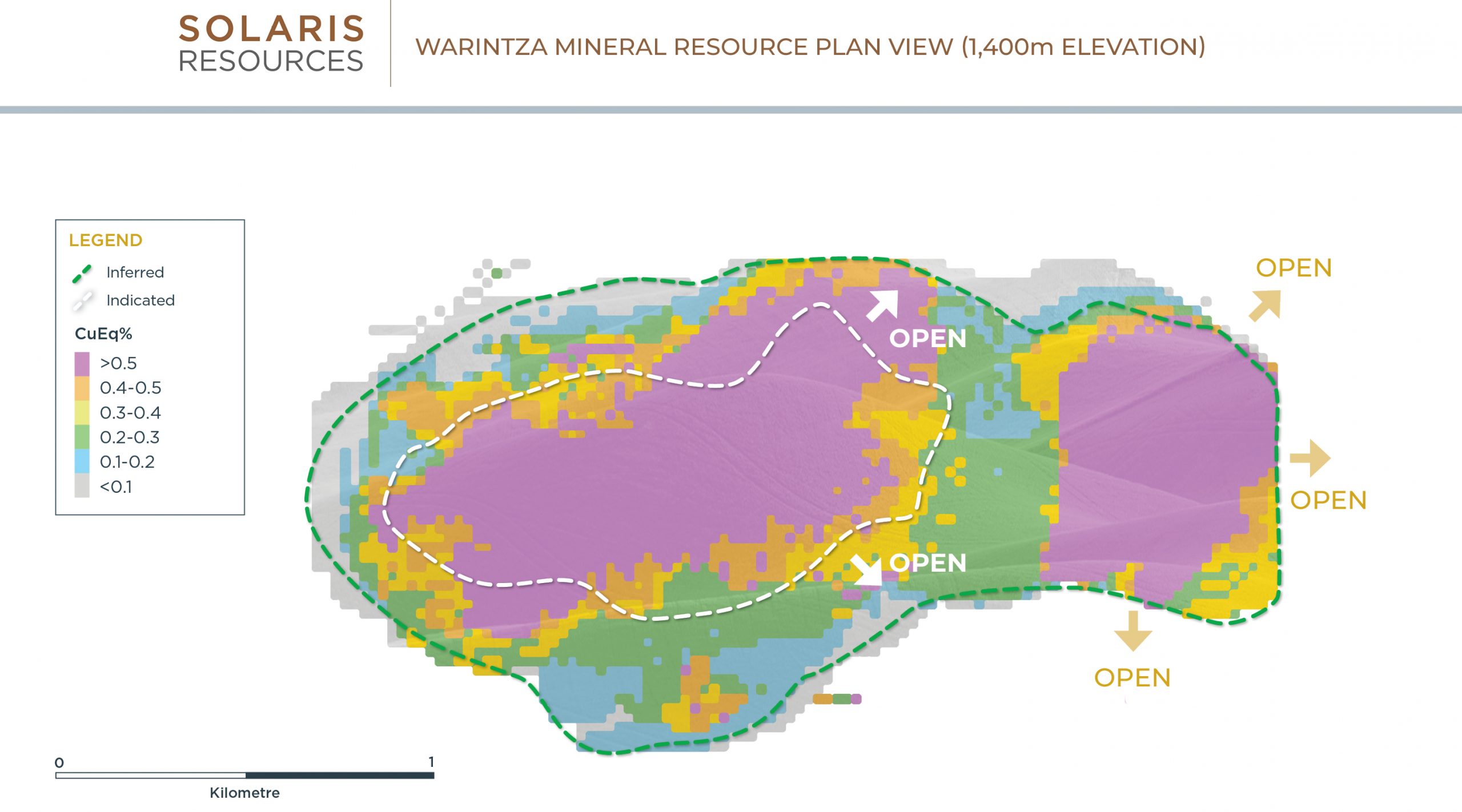

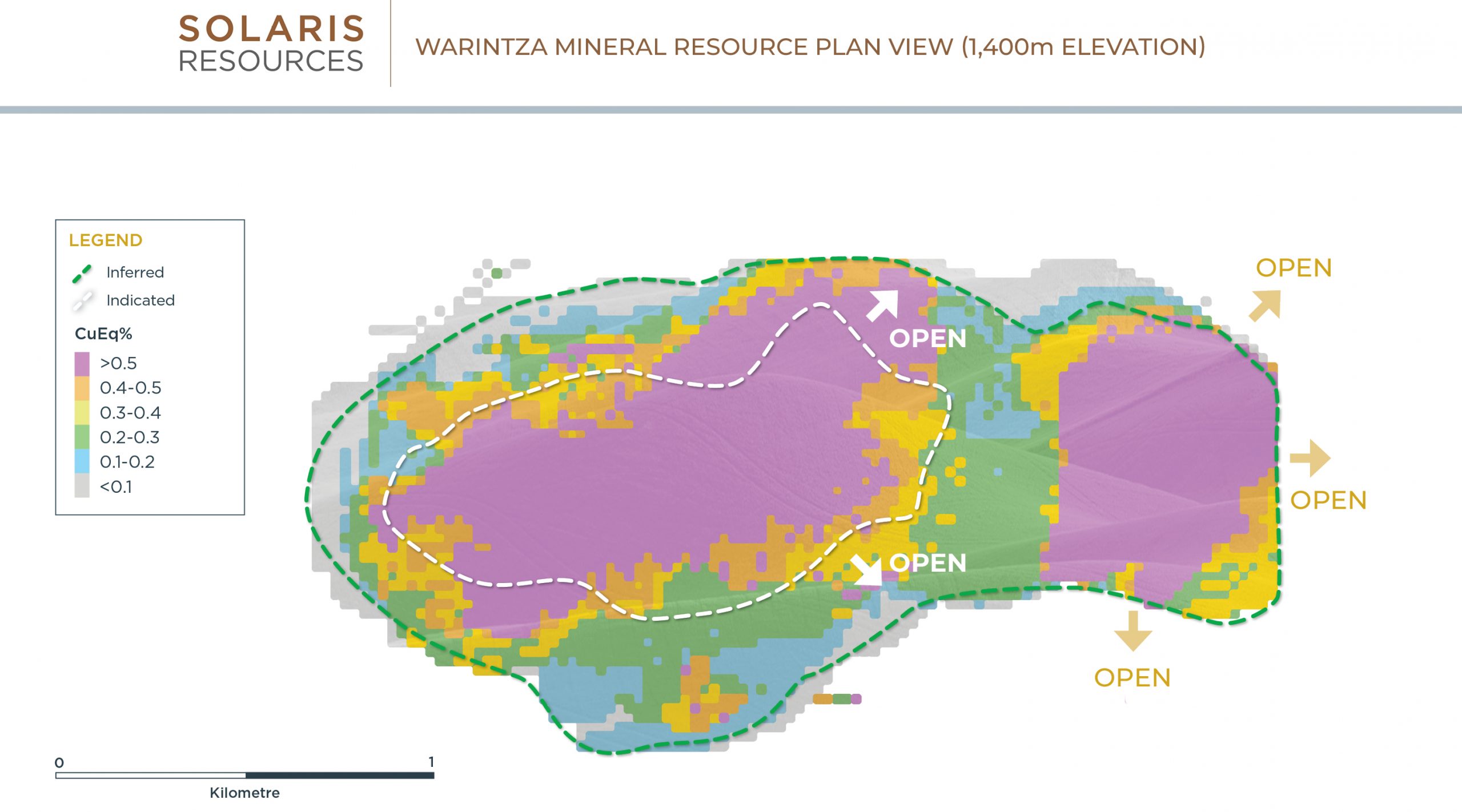

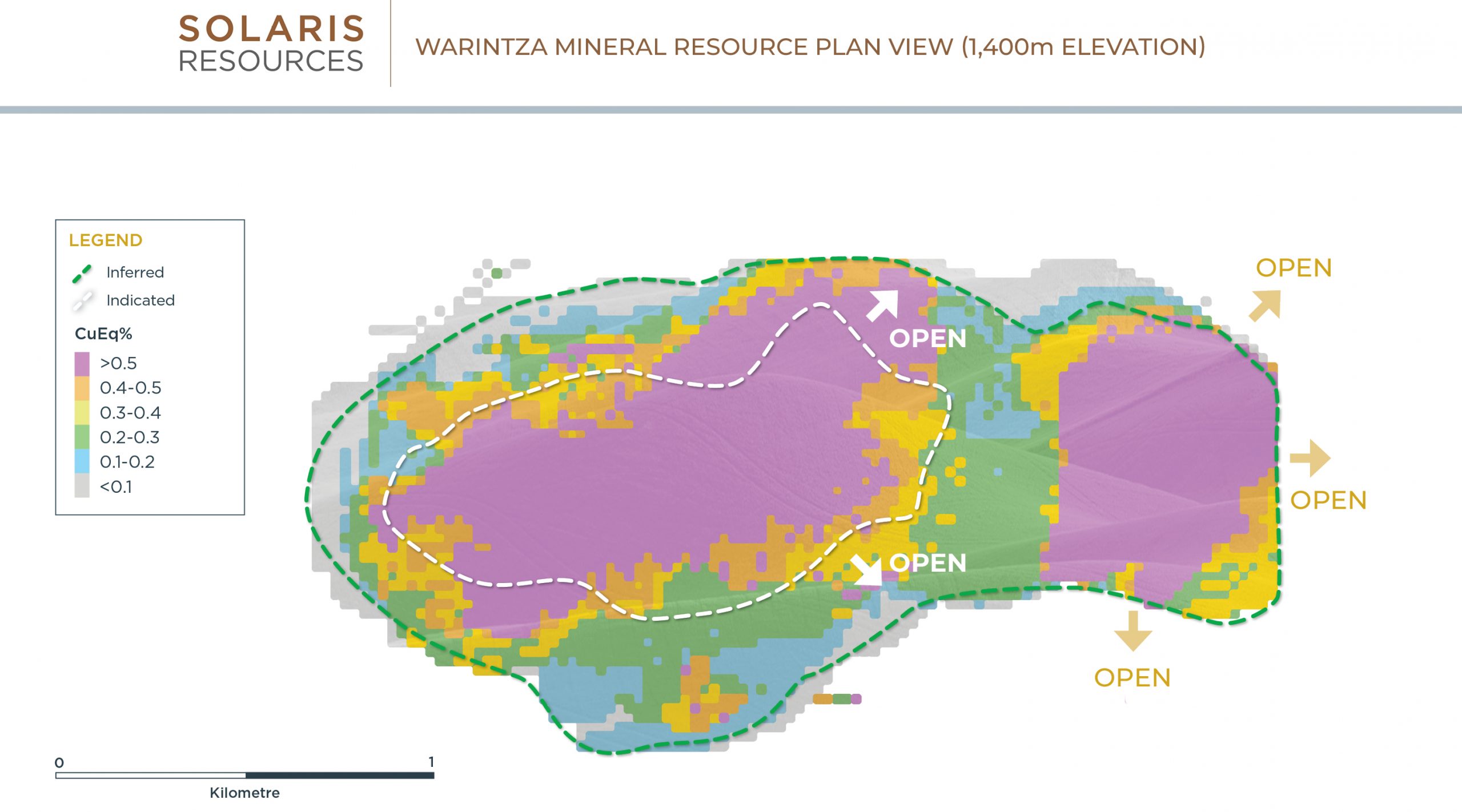

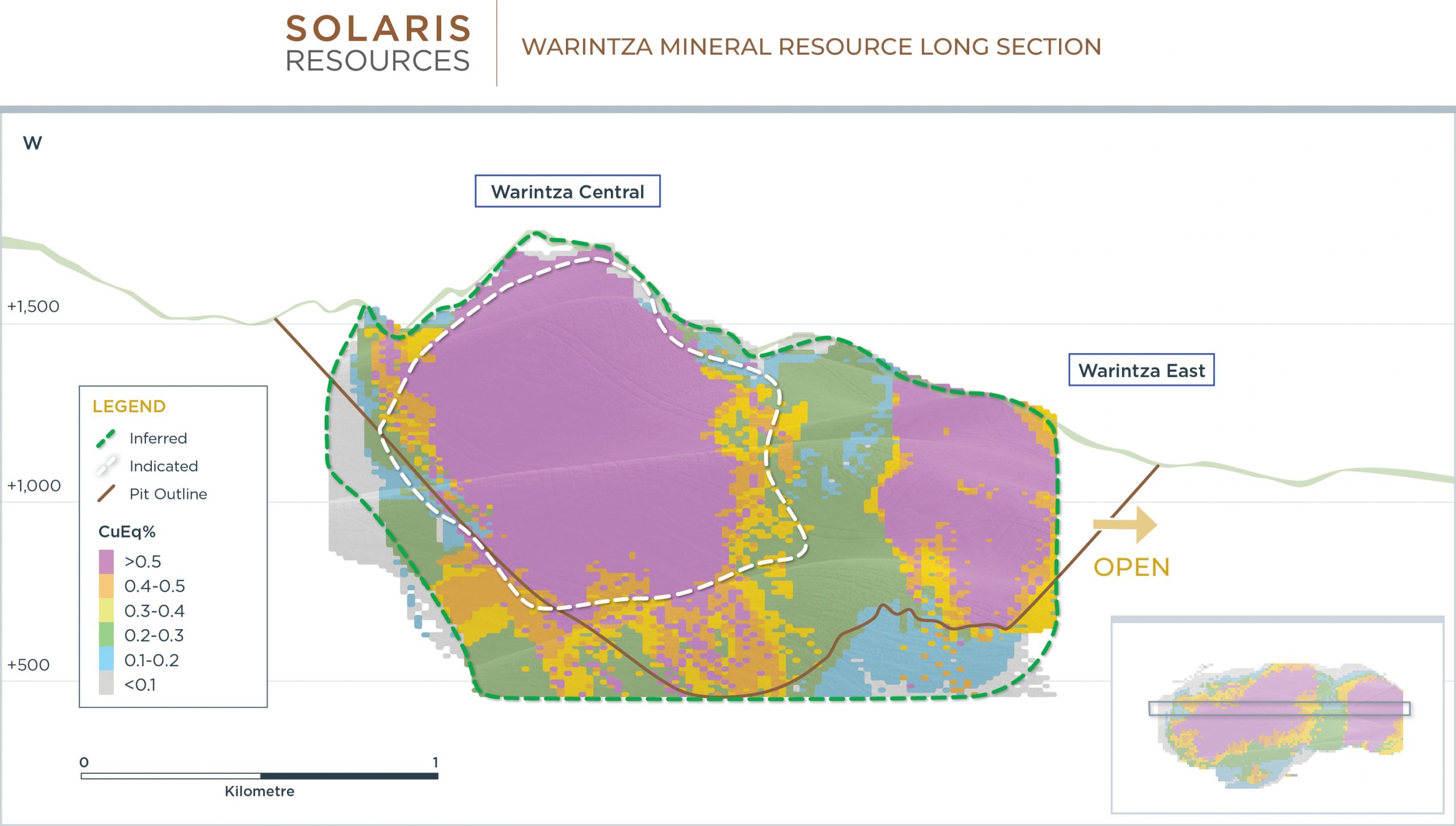

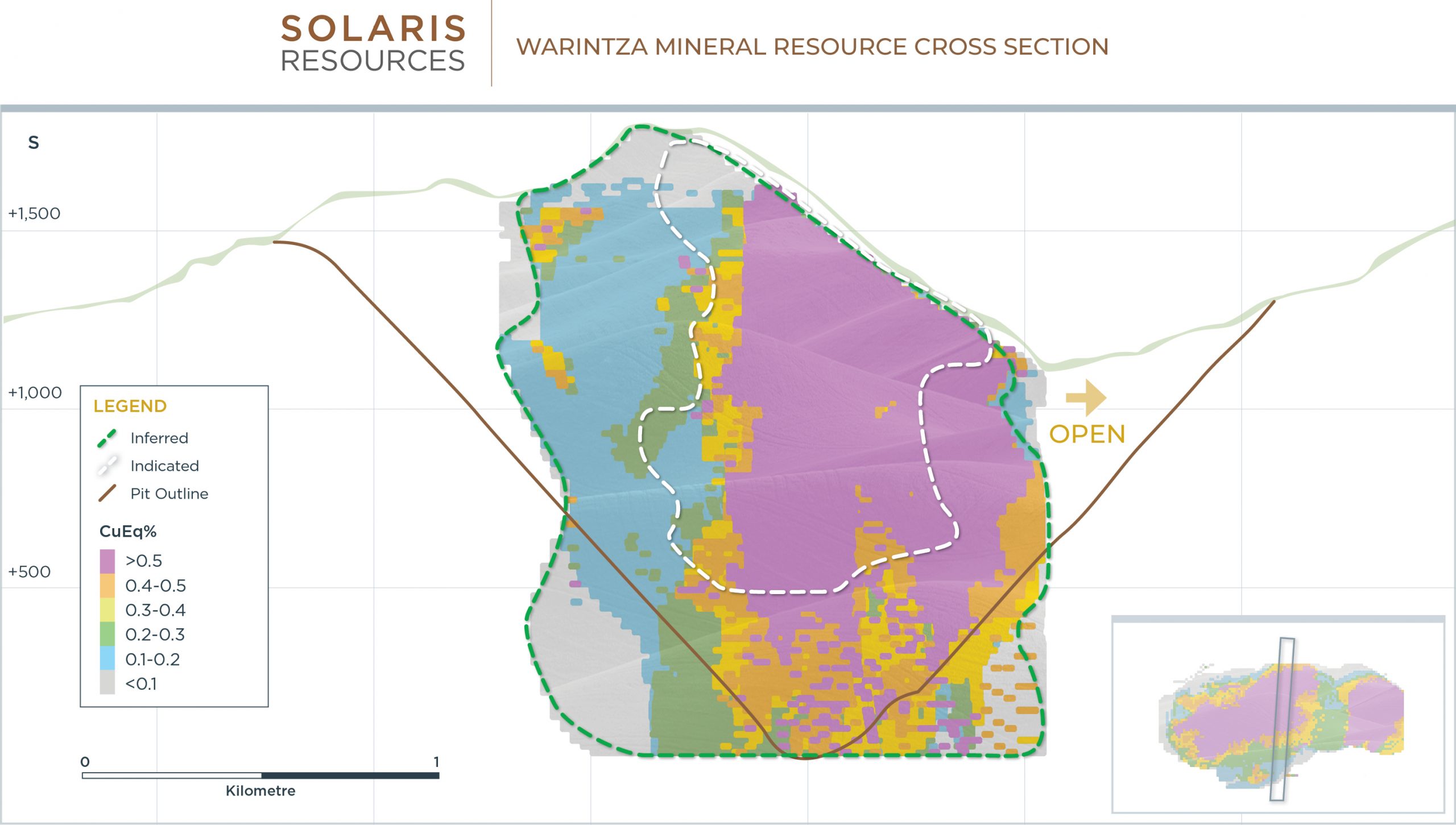

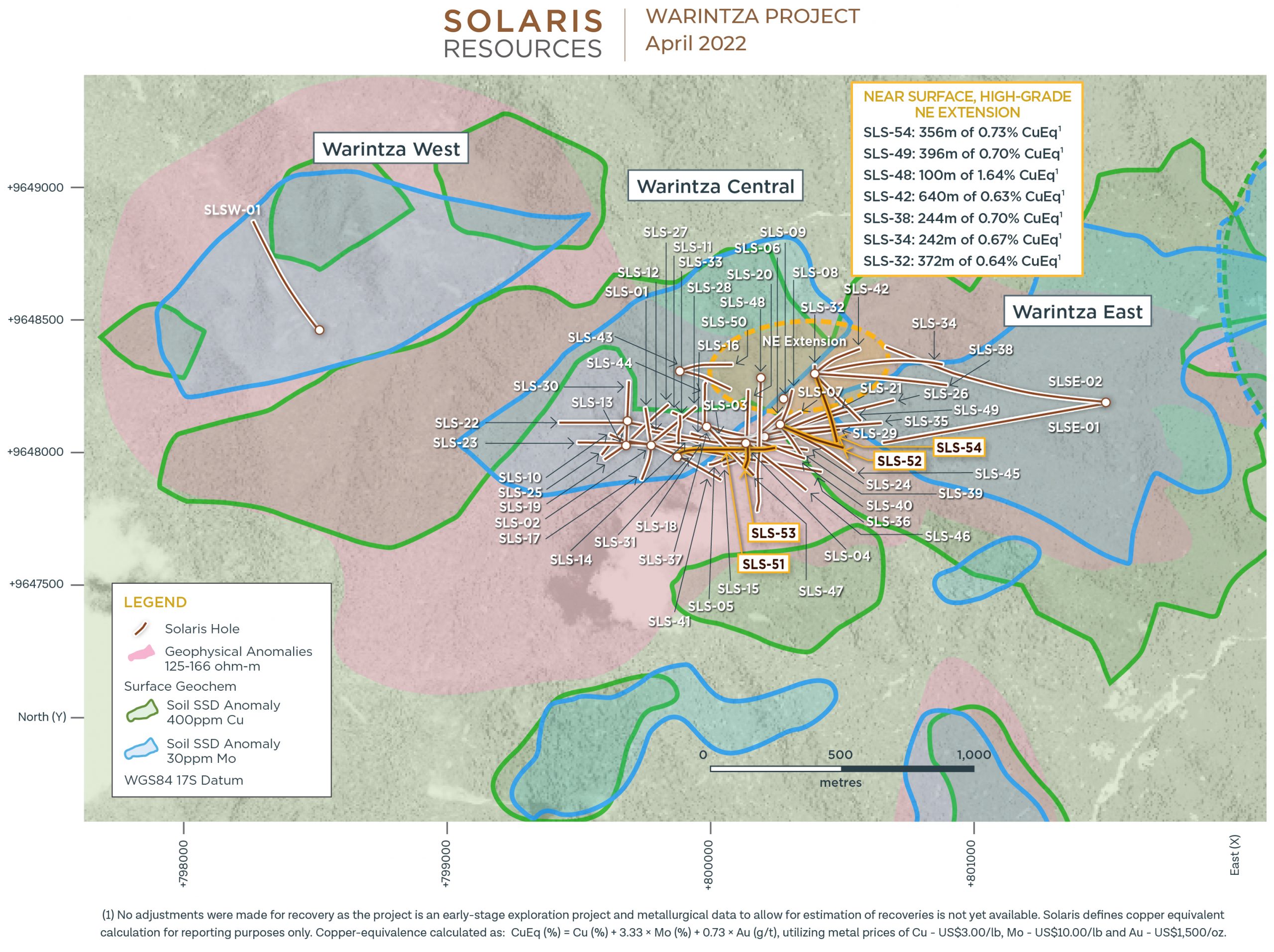

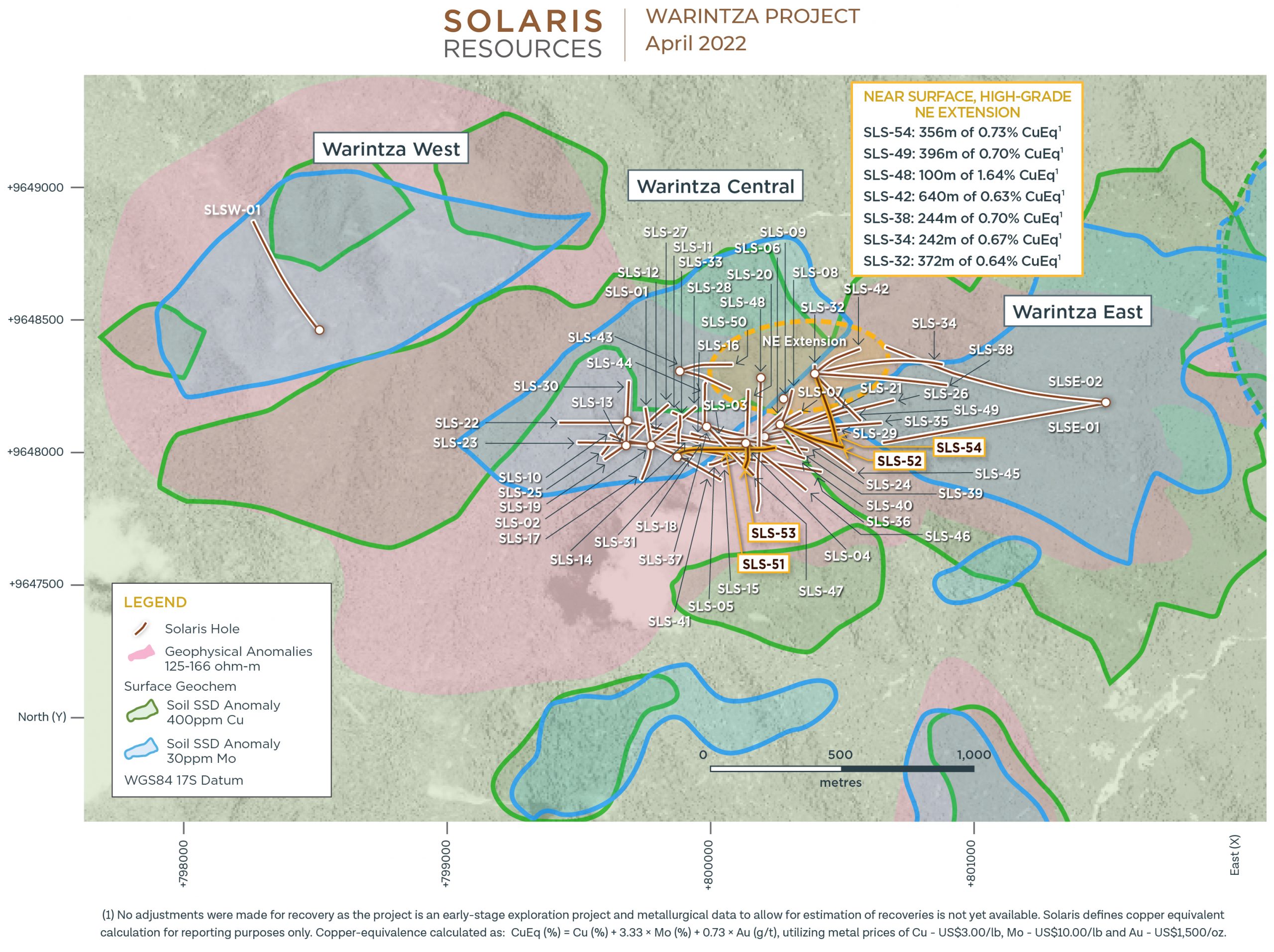

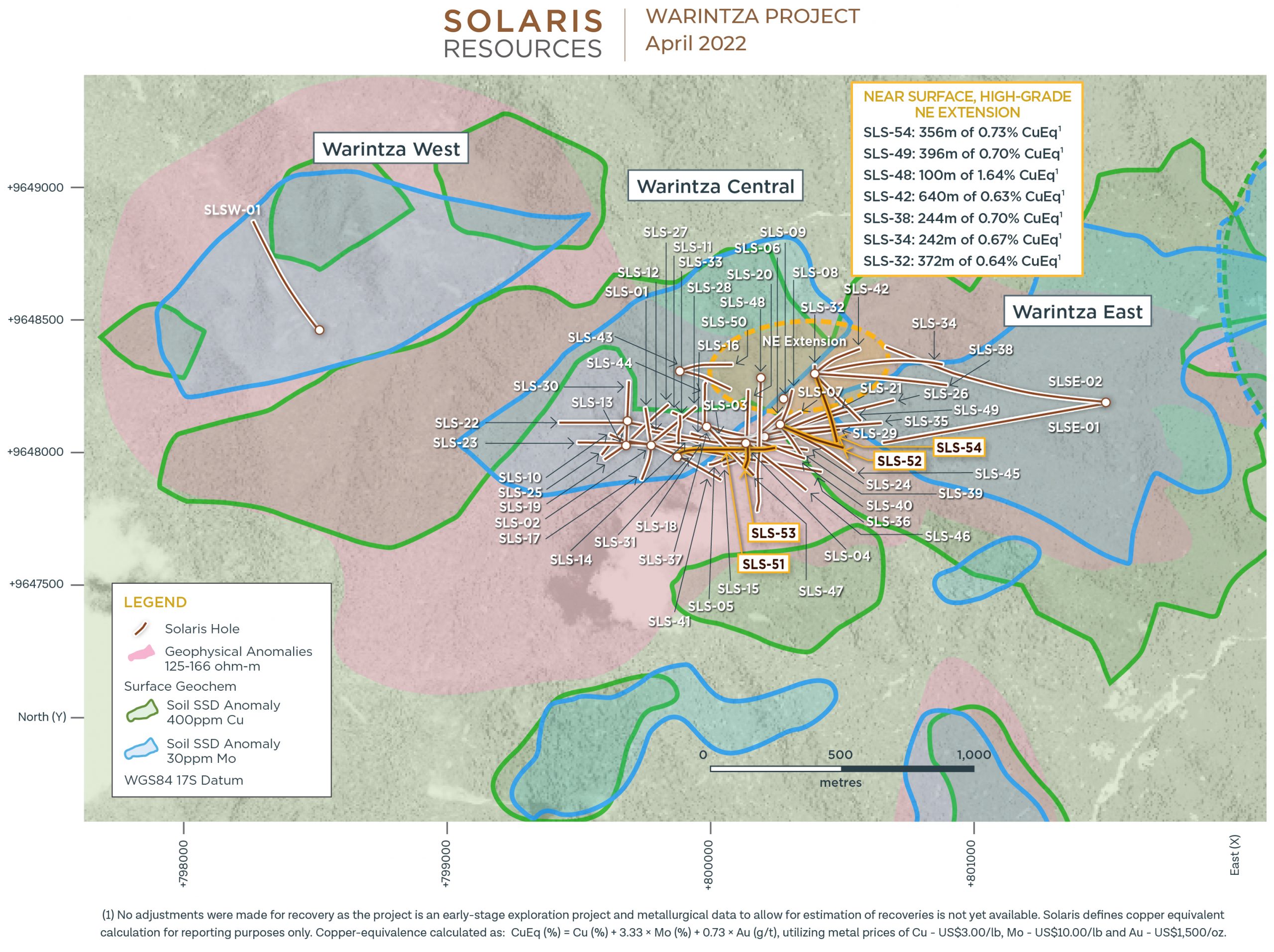

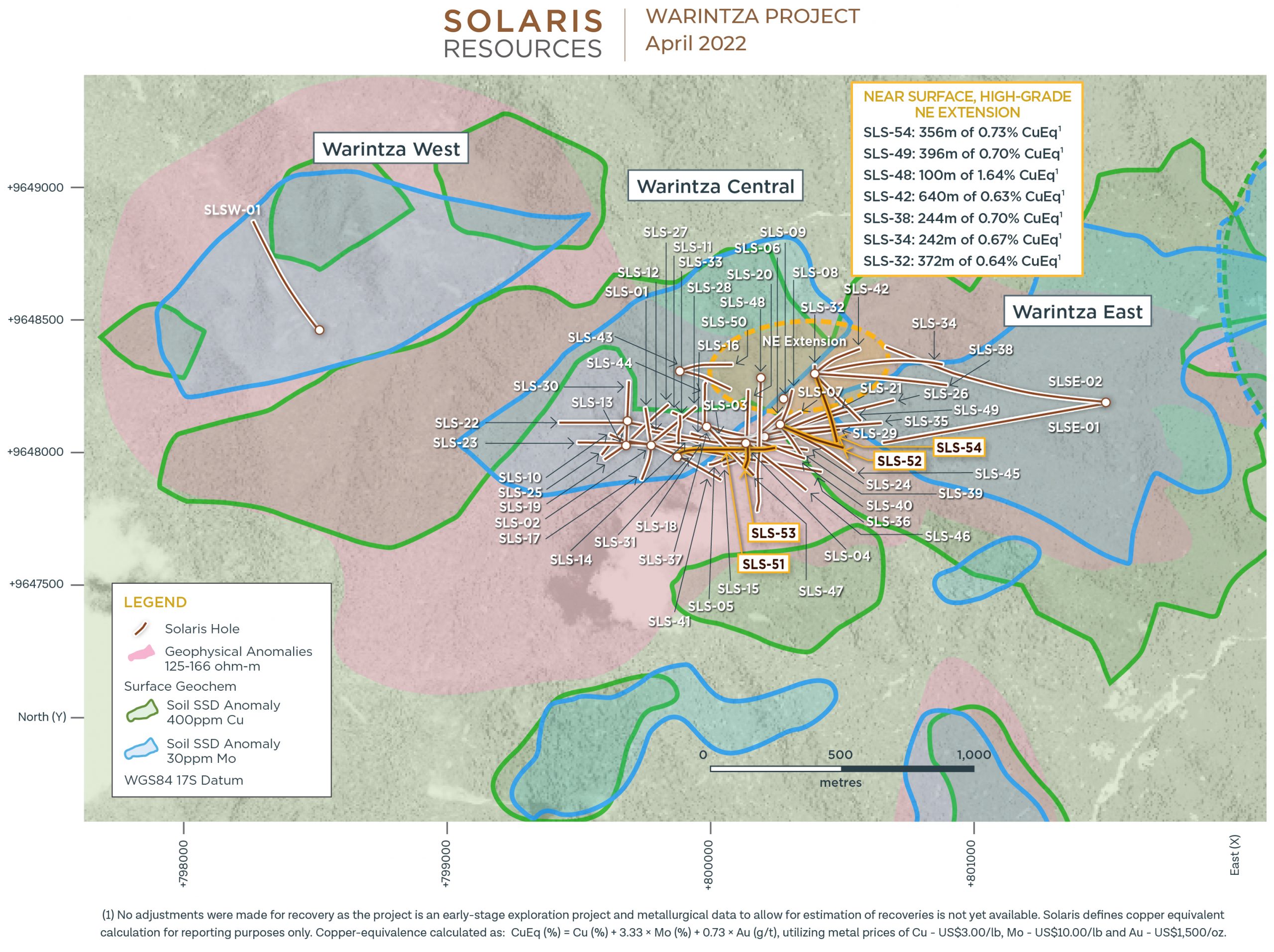

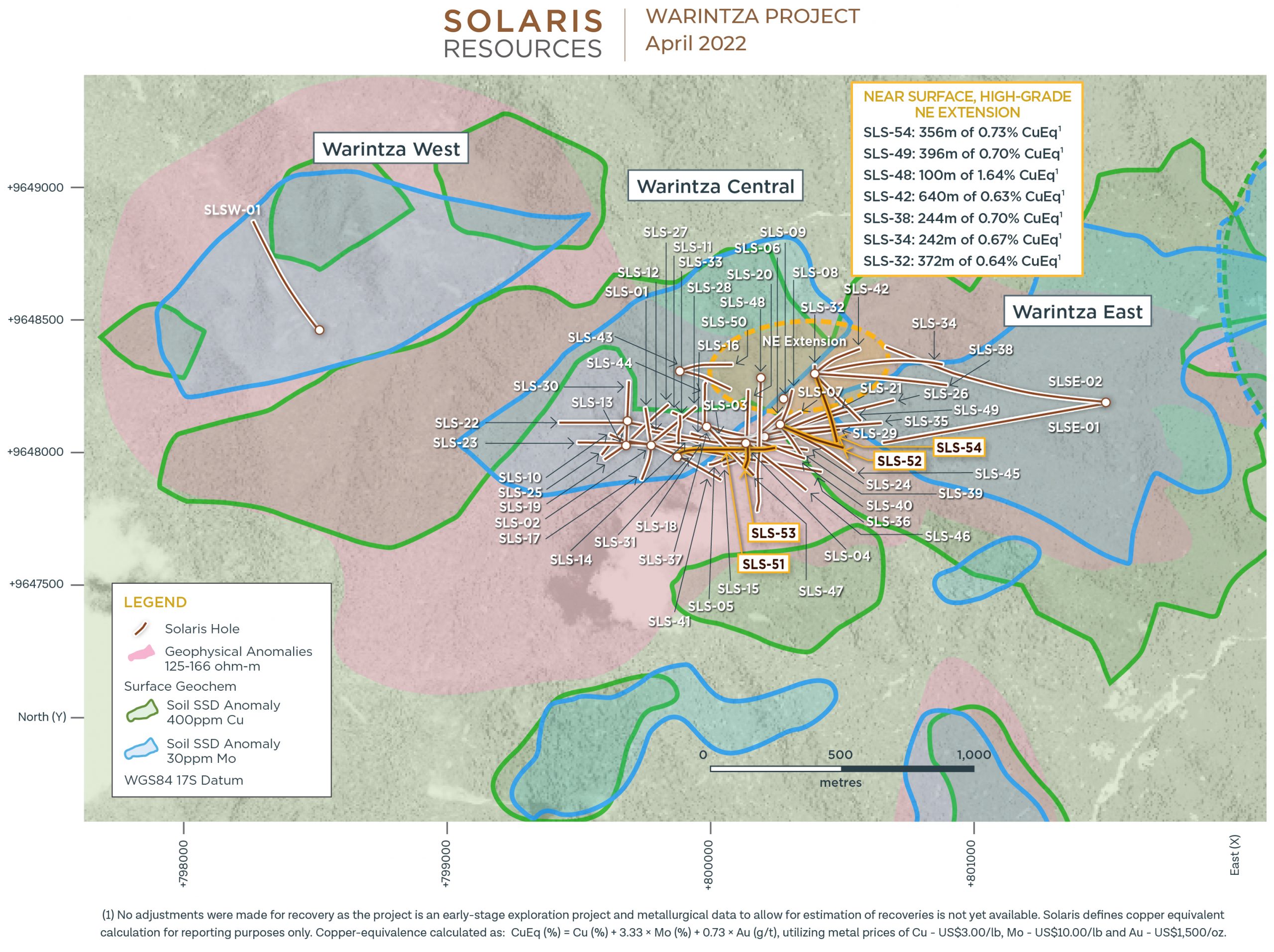

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has reported new assay results from a series of holes aimed at growing the Northeast Extension of the “Indicative Starter Pit” at the Warintza Project, with further resource expansion growing the area of near-surface, high-grade mineralization estimated at estimated at 180 Mt at 0.82% CuEq¹ (Indicated) and 107 Mt at 0.73% CuEq¹ (Inferred) within the Warintza Mineral Resource Estimate. The company is currently waiting on assays from follow-up step-out drilling, and has additional platforms planned for construction at the project.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “The Northeast Extension represents a significant area of focus for growing the ‘Indicative Starter Pit’, one of the two key goals for the follow-on drilling program from the 2022 MRE, with the other being major resource growth at Warintza East, where extensional and step-out holes are due shortly. In addition, a major program of reconnaissance sampling that commenced last summer has identified new areas of well mineralized outcrop in previously inaccessible terrain adjacent to the Warintza Central and Warintza East deposits that present opportunities for additional discoveries, with further details to be released shortly.”

Highlights from the results are as follows:

- SLS-70 was collared at the northeastern limit of Warintza Central and drilled northeast into an open volume, returning 186m of 0.64% CuEq¹ from near surface within a broader interval of 264m of 0.55% CuEq¹, expanding the zone to the north where it remains open

- This hole follows from SLS-65, drilled approximately 90 degrees to the northwest from the same platform, which returned 286m of 0.55% CuEq¹ from near surface (refer to press release dated December 5, 2022)

- SLS-69, collared from the same platform and drilled the opposite direction to the southwest, returned 156m of 0.60% CuEq¹ from 52m depth within a broader interval of 846m of 0.30% CuEq¹, connecting the Northeast Extension to Warintza Central

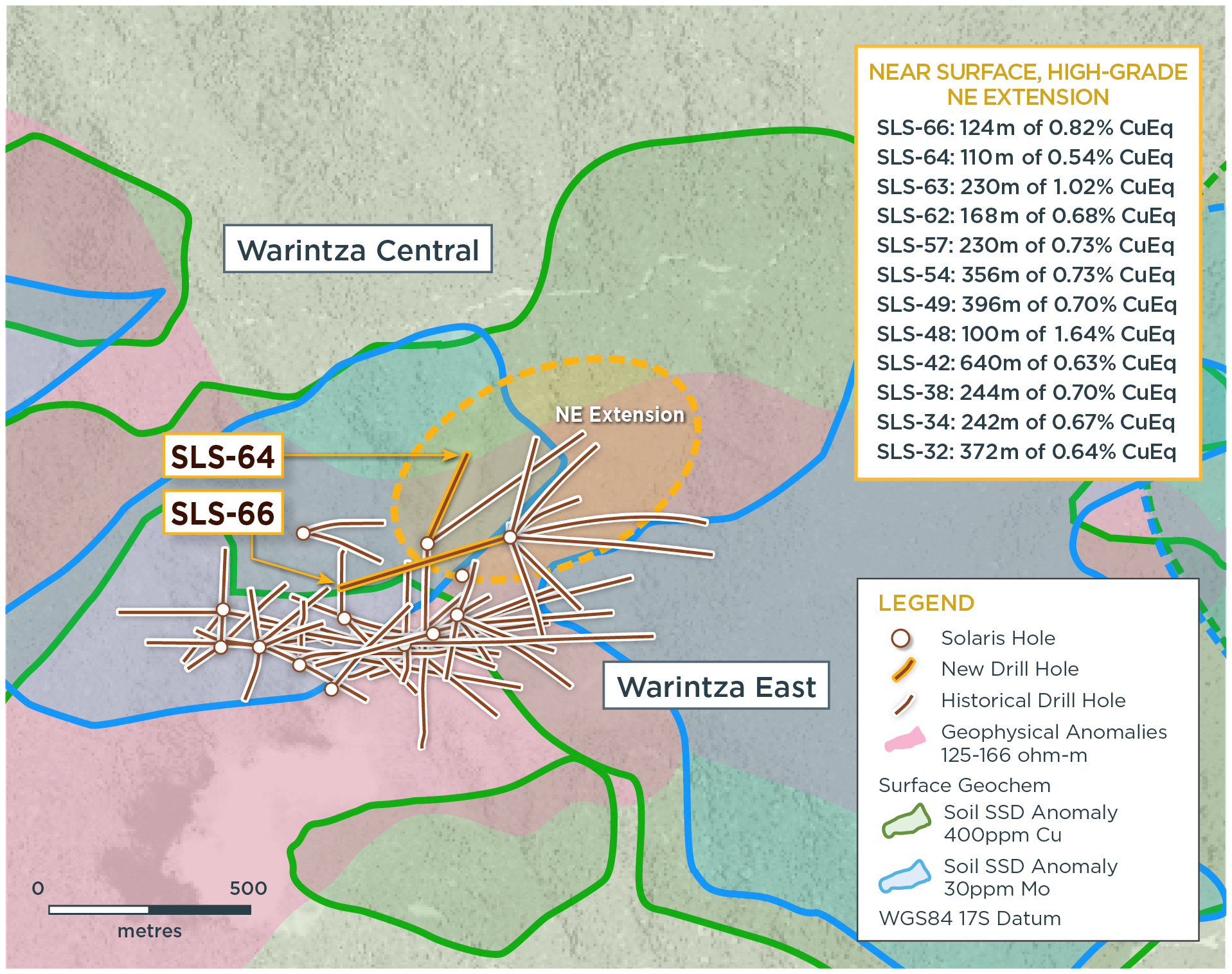

- Prior hole SLS-66, drilled west-southwest, returned 124m of 0.82% CuEq¹ from near surface within a broader interval of 622m of 0.42% CuEq¹ (refer to press release dated September 7, 2022) from a platform to the south where a follow-up southwest-oriented hole is planned to better connect the Northeast Extension to Warintza Central

- Assays are pending from two newly constructed 250m step-out platforms testing the zone further to the northeast, with additional platforms planned for construction as the weather improves

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-70 | Mar 13, 2023 | 26 | 290 | 264 | 0.38 | 0.03 | 0.11 | 0.55 |

| Including | 104 | 290 | 186 | 0.48 | 0.03 | 0.11 | 0.64 | |

| Including | 104 | 198 | 94 | 0.53 | 0.03 | 0.11 | 0.70 | |

| SLS-69 | 52 | 898 | 846 | 0.20 | 0.02 | 0.03 | 0.30 | |

| Including | 52 | 208 | 156 | 0.48 | 0.02 | 0.08 | 0.60 | |

| Including | 52 | 122 | 70 | 0.56 | 0.03 | 0.06 | 0.70 | |

| Notes to table: True widths of the mineralized zone are not known at this time. | ||||||||

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-70 | 800350 | 9648417 | 1356 | 291 | 20 | -65 |

| SLS-69 | 800350 | 9648417 | 1356 | 944 | 200 | -70 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work. The ‘Indicative Starter Pit’ is based on the same assumptions as the MRE except utilized metal prices of US$1.00/lb Cu, US$7.50/lb Mo, and US$750/oz Au. The ‘Indicative Starter Pit’ is comprised of Indicated mineral resources of 180 Mt at 0.82% CuEq (0.67% Cu, 0.03% Mo, 0.07 g/t Au) and Inferred mineral resources of 107 Mt at 0.73% CuEq (0.64% Cu, 0.02% Mo, 0.05 g/t Au) above a 0.6% CuEq cut-off grade. No economic analysis has been completed by the Company and there is no guarantee an ‘Indicative Starter Pit’ will be realized or prove to be economic.

- Refer to Solaris’ technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- For additional details on “Near Surface, High-Grade, NE Extension” intervals, refer to press release dated May 26, 2022 for SLS-57: 230m of 0.73% CuEq (0.59% Cu, 0.03% Mo, 0.08 g/t Au), refer to press release dated July 20, 2022 for SLS-62: 168m of 0.68% CuEq (0.51% Cu, 0.03% Mo, 0.07 g/t Au) and SLS-63: 230m of 1.02% CuEq (0.87% Cu, 0.02% Mo, 0.12 g/t Au), refer to press release dated September 7, 2022 for SLS-64: 110m of 0.54% CuEq (0.38% Cu, 0.04% Mo, 0.03 g/t Au) and SLS-66: 124m of 0.82% CuEq (0.71% Cu, 0.02% Mo, 0.09 g/t Au), refer to press release dated December 5, 2022 for SLS-65: 286m of 0.55% CuEq (0.38% Cu, 0.04% Mo, 0.06 g/t Au) and SLS-68: 72m of 1.00% CuEq (0.88% Cu, 0.02% Mo, 0.06 g/t Au).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

South America is home to some of the largest copper deposits in the world, and several exploration companies are working hard to discover new resources and expand existing ones. Here are the top three copper exploration companies in South America, along with some of their most notable intercepts.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF)

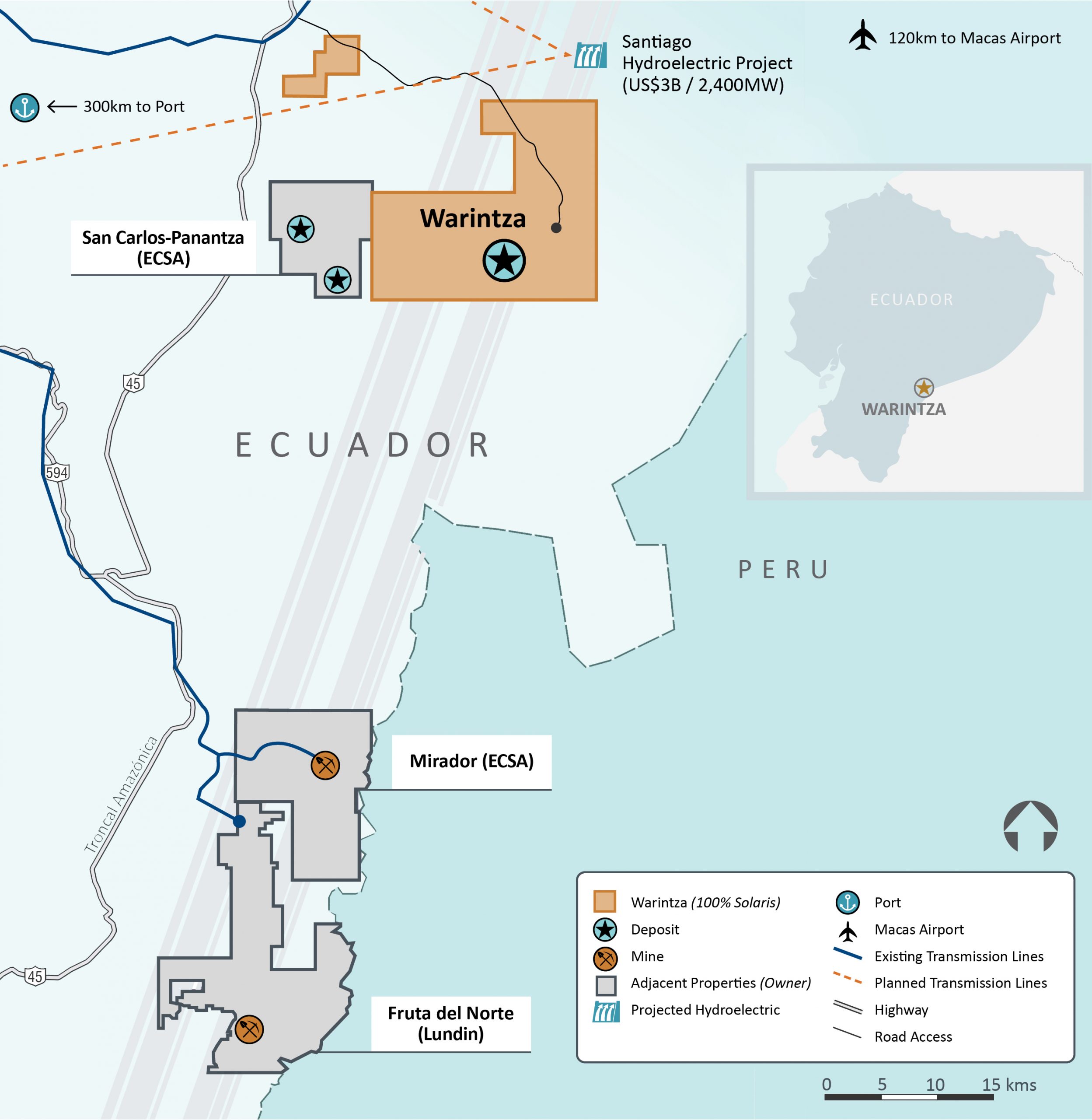

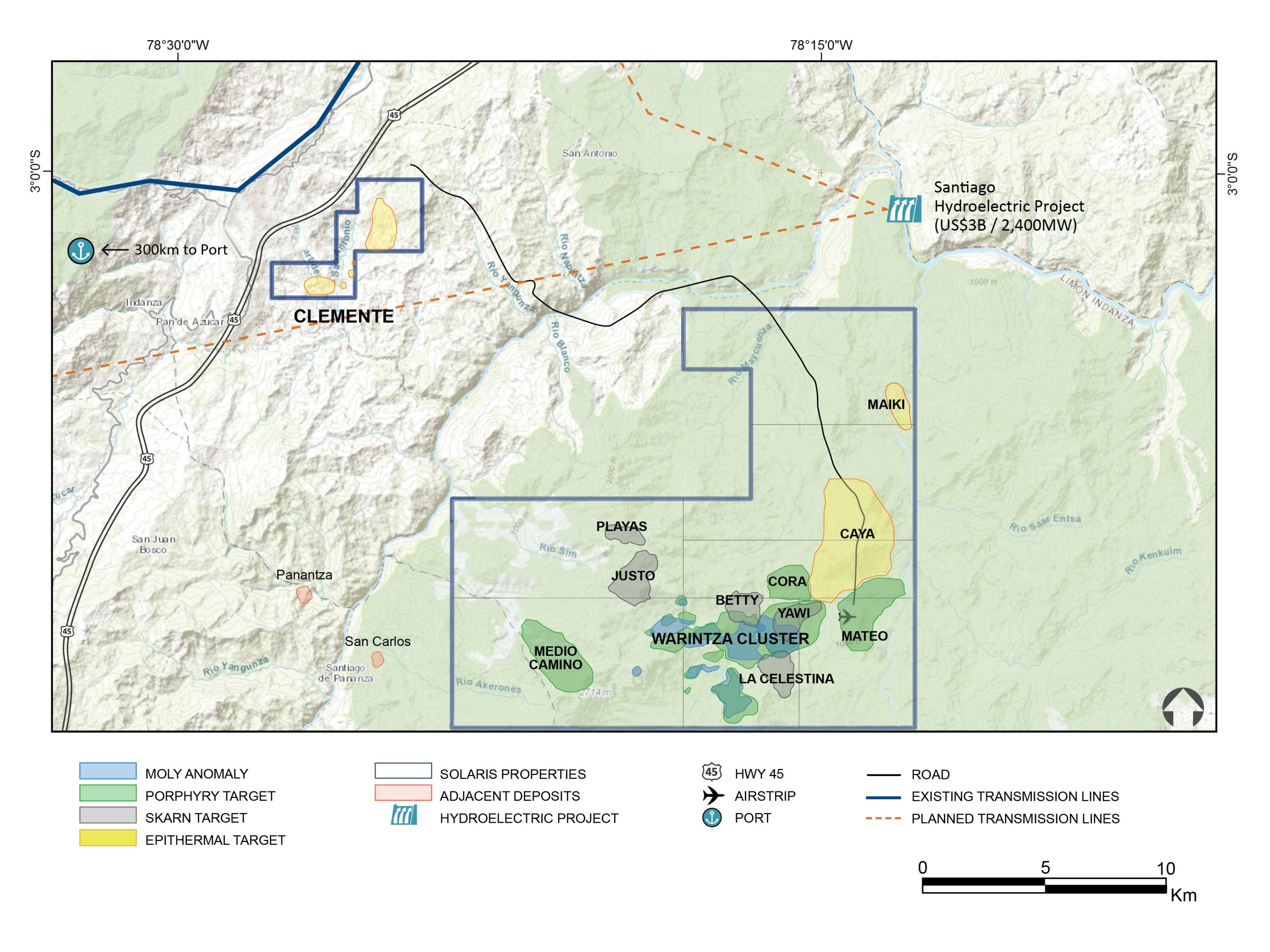

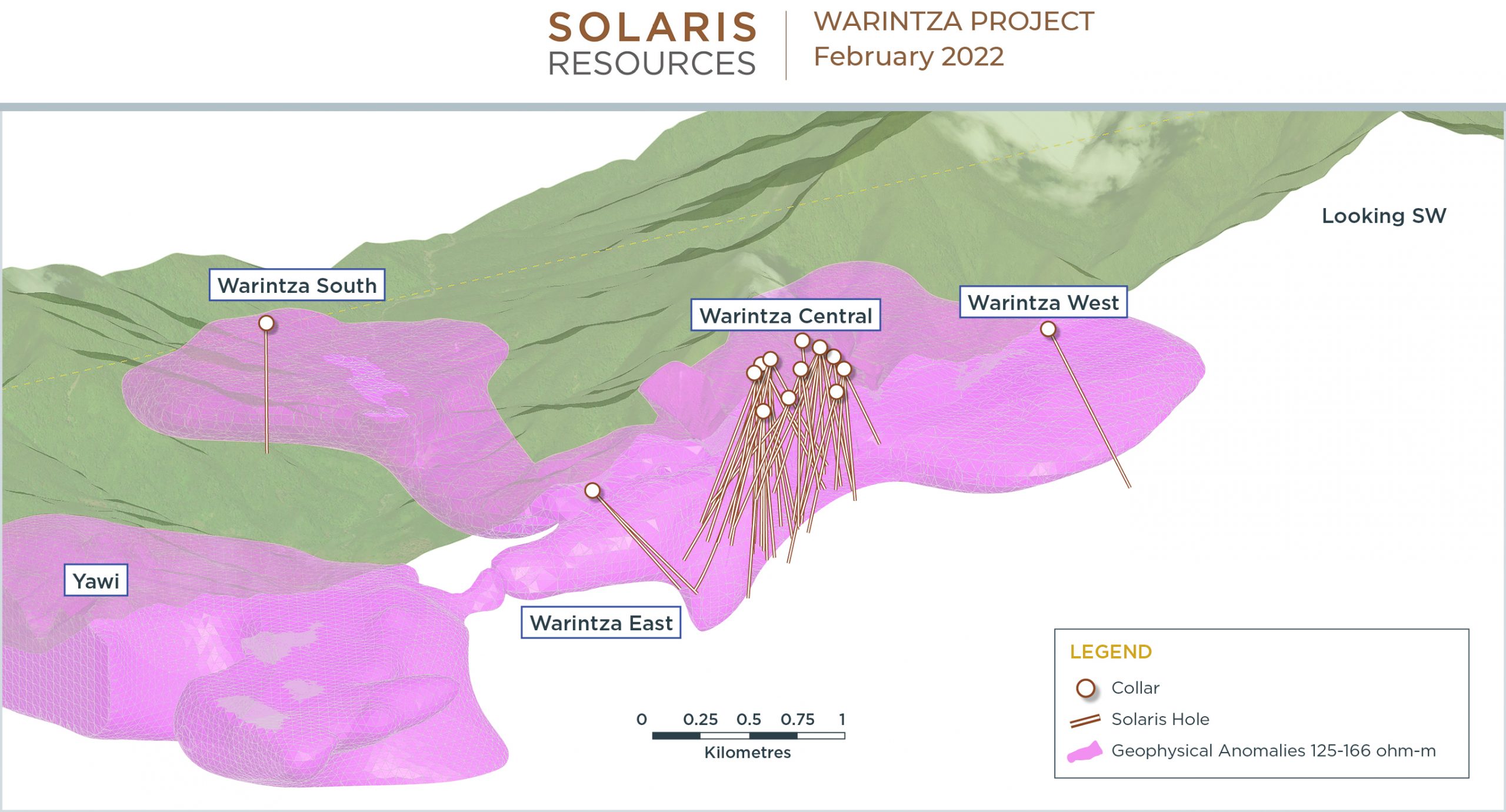

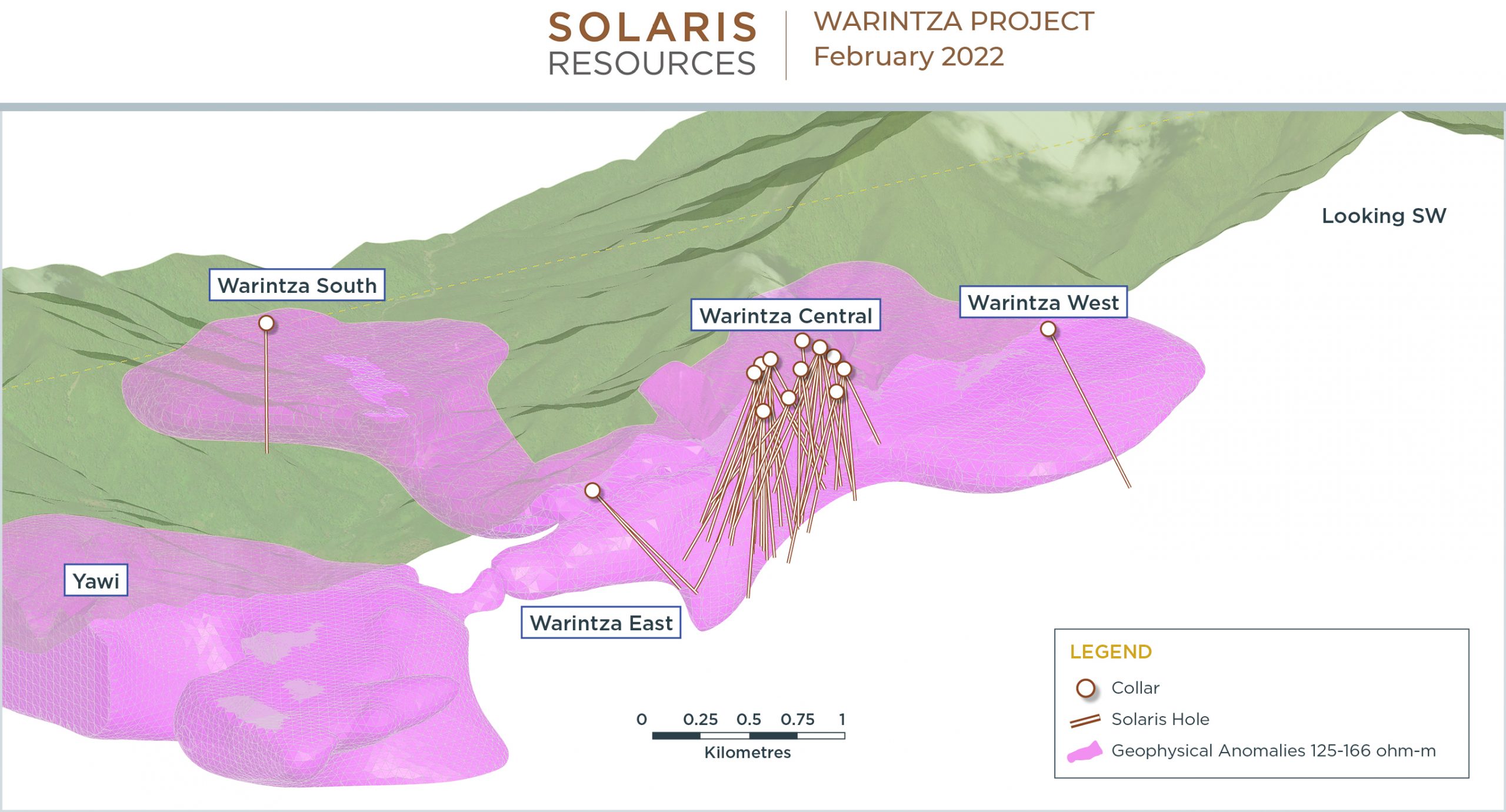

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) is a Canadian copper exploration company focused on the discovery and development of copper and gold deposits in the Americas. The company has a strong presence in South America, where it is actively exploring for copper and gold deposits in Ecuador and Peru.

The company continues to report regular exploration results expanding on its discoveries at what has been called a potential “superpit”.

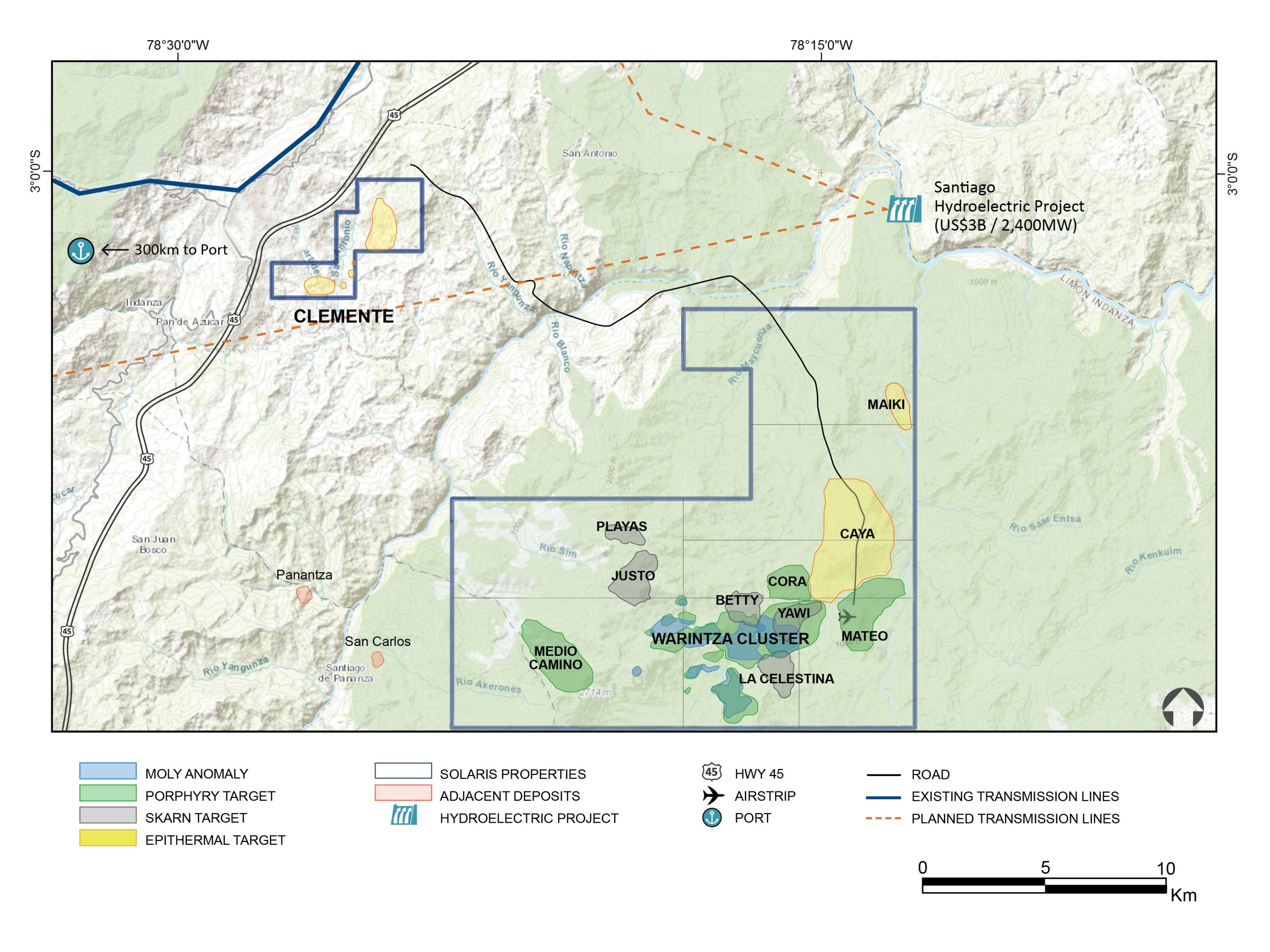

Warintza is considered a take-out target as the Company has defined a large 1.5Bt copper inventory, featuring a high-grade starter pit and low strip ratio, within a mining district offering major structural advantages from highway access, abundant and low-cost hydroelectric power, fresh water, labour and low elevation. The Company has de-risked the project by locking in a social license through an IBA signed with the communities, and freezing in place the regulatory and fiscal framework by signing an Investment Contract with the Government in December. The final de-risking item is completing project permitting, which is ongoing and expected in 2024 with the project being designated a “strategic priority project” by the Government.

First Quantum Minerals (TSX:FM)

First Quantum Minerals (TSX:FM) is a Vancouver-based mining company with operations in Africa, Australia, and South America. Its flagship copper mine is the Cobre Panama project, located in Panama. The company has been exploring the region for years and has made several significant copper discoveries.

First Quantum has reported several impressive drill intercepts at Cobre Panama. One of the most notable was a 136-meter intersection of copper and gold mineralization, grading 0.63% copper and 0.35 grams per tonne of gold. This intercept was found in the southeast extension of the Cobre Panama deposit, and the company believes it has the potential to significantly increase the mine’s resources.

Anglo American (LSE:AAL)

Anglo American (LSE:AAL) is a multinational mining company with operations in Africa, Europe, and the Americas. Its copper operations are located in Chile, where it owns a 50% stake in the Los Bronces mine and a 100% stake in the Mantoverde mine.

Anglo American has reported several impressive drill intercepts at Los Bronces. One of the most significant was a 95-meter intersection of copper and molybdenum mineralization, grading 0.67% copper and 0.022% molybdenum. This intercept was found in the north zone of the mine, and the company believes it has the potential to increase the mine’s resources.

Teck Resources (NYSE:TECK)

Teck Resources (NYSE:TECK) is a Canadian mining company with operations in Canada, the United States, and Chile. Its copper operations are located in Chile, where it owns a 90% stake in the Quebrada Blanca mine.

Teck reported several intercepts at Quebrada Blanca since exploration began. One of the most biggest was in 2021; a 129-meter intersection of copper mineralization, grading 0.39% copper. This intercept was found in the QB2 deposit, which is currently under construction and expected to begin production in 2022. The company believes that QB2 has the potential to become a significant copper producer, with a projected mine life of over 25 years.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

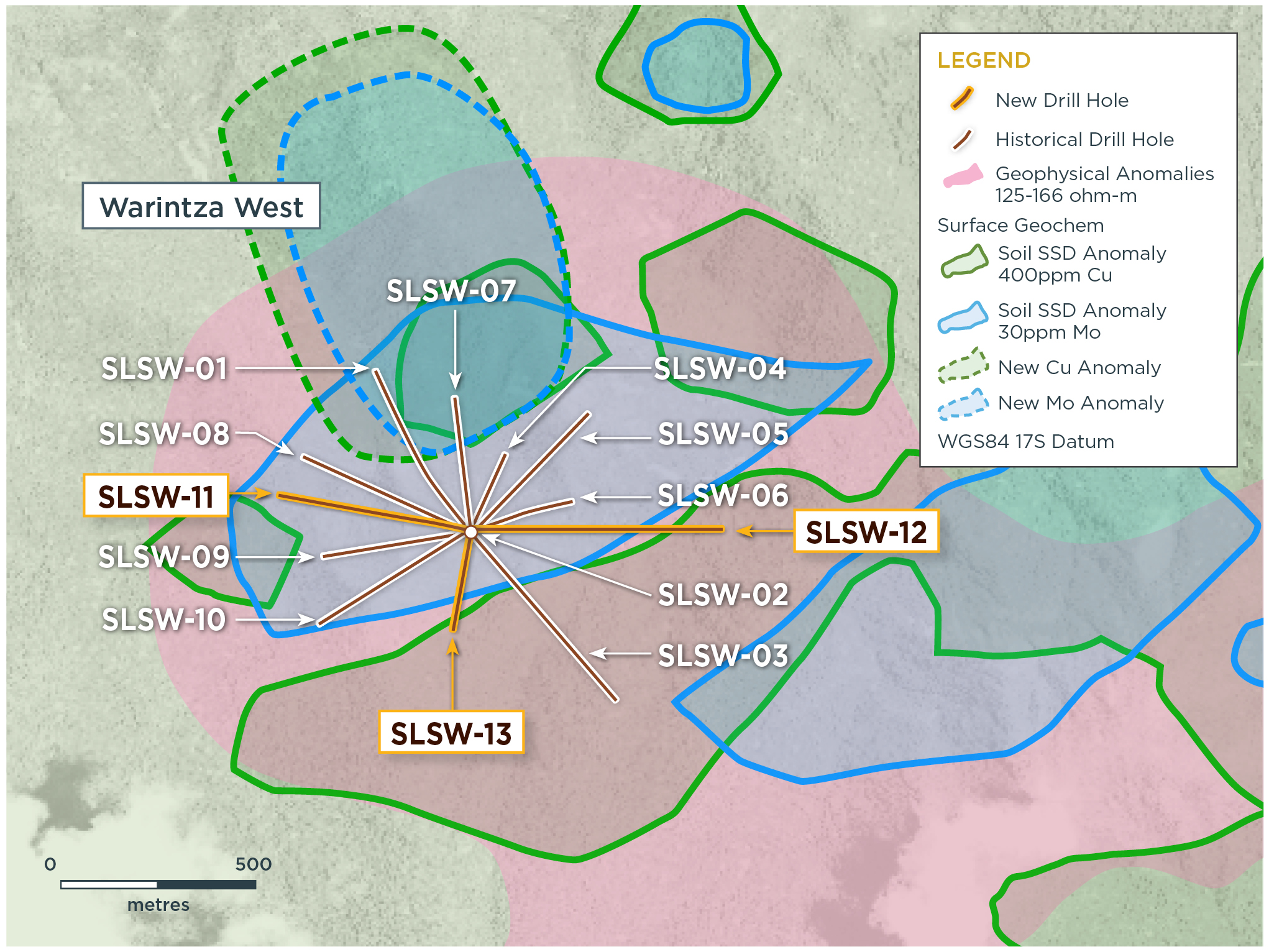

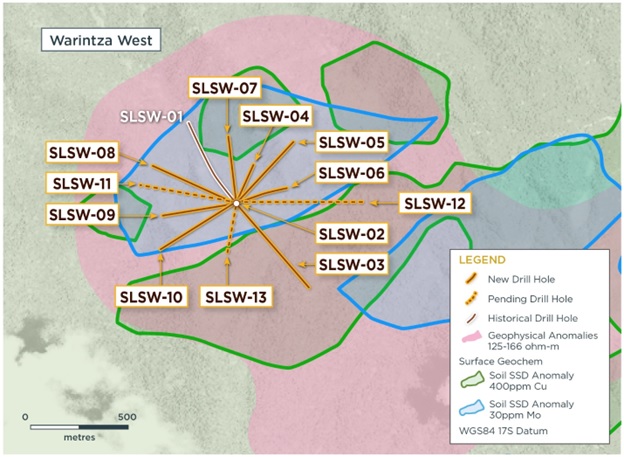

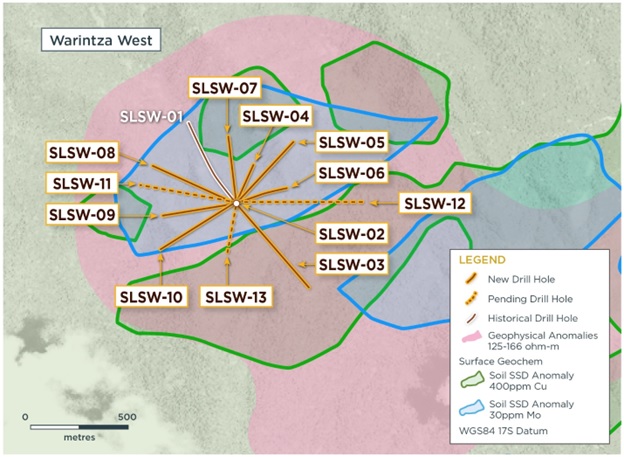

Solaris Resources (TSX:SLS) has reported new updated geochemical sampling and assay results from follow-up holes at Warintza West within the Warintza Project in Ecuador. The company has identified new potential at the zone, which was one of four discoveries made to-date in the Warintza porphyry cluster located 1km west of and outside the Warintza Mineral Resources (MRE).

The company has performed reconnaissance drilling with the initial holes from the centralized platform outlining a broad zone of porphyry mineralization measuring 1200m z 700m, and remains open. Geochemical sampling provided vectors toward more potential higher-grade mineralization to the north for step-out drilling, expanding on Warintza’s potential for further future discoveries.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “First pass reconnaissance drilling at Warintza West outlined a broad zone of porphyry mineralization, with subsequent sampling identifying new potential for higher-grade mineralization to the north for future step-out drilling. The ongoing drill program is targeting MRE growth within the high-grade starter pit at Warintza Central, where results are expected shortly, and expanding the Warintza East discovery which adjoins Warintza Central.”

Highlights from the results are as follows:

- Recent geochemical sampling has identified a new area of strong overlapping copper and molybdenum anomalies to the north measuring approximately 1000m x 500m with soil samples averaging 600 ppm Cu and 80 ppm Mo – this contrasts with the anomaly surrounding the original platform that is defined by strong Mo values at 65 ppm but weaker Cu below 400 ppm

- This new area of strong soil anomalism represents a potential target for higher-grade mineralization beyond the northern margin of prior exploration drilling (refer to press releases dated Oct 13, 2022 and Feb 16, 2021), including:

- SLSW-07 (drilled north) returned 686m of 0.46% CuEq²

- SLSW-04 (drilled northeast) returned 264m of 0.44% CuEq²

- SLSW-01 (drilled northwest) returned 260m of 0.42% CuEq³

- New drill results returned to the south, include SLSW-13, which was drilled southwest and returned 320m of 0.50% CuEq² from near surface within a broader interval of 496m of 0.40% CuEq², extending mineralization to the south where it remains open, and requires step-out drilling

- This hole expands on previously reported SLSE-10, which was drilled from the same platform to the southwest and returned 220m of 0.41% CuEq² from near surface (refer to press release dated Oct 13, 2022)

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq² (%) |

| SLSW-13 | Feb 13, 2023 | 24 | 520 | 496 | 0.32 | 0.02 | 0.03 | 0.40 |

| Including | 24 | 344 | 320 | 0.40 | 0.02 | 0.03 | 0.50 | |

| SLSW-12 | 58 | 592 | 534 | 0.15 | 0.01 | 0.01 | 0.20 | |

| Including | 58 | 246 | 188 | 0.24 | 0.01 | 0.02 | 0.30 | |

| SLSW-11 | 20 | 648 | 628 | 0.17 | 0.005 | 0.02 | 0.20 | |

| Including | 30 | 288 | 258 | 0.22 | 0.005 | 0.03 | 0.26 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSW-13 | 798507 | 9648465 | 1519 | 530 | 190 | -60 |

| SLSW-12 | 798507 | 9648465 | 1519 | 1005 | 90 | -50 |

| SLSW-11 | 798507 | 9648465 | 1519 | 708 | 280 | -46 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Refer to technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- Copper-equivalence for the MRE and drill holes SLSW 2-13 calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of US$3.00/lb Cu, US$10.00/lb Mo, and US$1,500/oz Au. No adjustments were made for recovery prior to the updated MRE, as the metallurgical data to allow for estimation of recoveries was not yet available. Solaris defined CuEq for reporting purposes only.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Ecuador has become one of the most attractive countries for mining investments in Latin America, with a favourable investment climate, attractive legal and tax frameworks, and a wide variety of mineral deposits. With this in mind, here are some of the mining companies in Ecuador to watch in 2023.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF)

Solaris Resources is a junior mining company based in Canada, with its flagship Warintza Project located in southeastern Ecuador. The company has enjoyed multiple successful discoveries at the Warintza Project while building a positive relationship with the government and signing an important investment contract protecting the project.

On December 22, 2022, Solaris and the government of Ecuador signed an investment contract ratifying the Investment Protection Agreement announced on June 9, 2022. The important contract marked a major milestone for the company and displays how important the project is to the country. Some of the highlights of the agreement surrounding protections and incentives for the duration of the title of the Project which extends with renewal to 2066 are as follows:

- Security of investment

- Stability of mining law

- Stability of taxes at a reduced income tax rate of 20% (25% previously)

- Exemption from capital outflow tax (5% previously)

- Exemption from import duties (up to 5% previously)

- Detailed procedures for dispute resolution and international arbitration protection

Solaris also recently announced results from metallurgical test work at the project conducted by FLSmidth USA with high recoveries of over 90% copper and 80% molybdenum. The test work revealed and confirmed that the project holds further potential for high-grade copper discoveries and more.

Luminex Resources (TSXV:LR)

Luminex Resources recently reported new drill results from its Condor copper-gold project in Ecuador. Drilling confirmed a strike length of 350 metres, and the anomaly has now been mapped at surface for more than 500 metres at the Cuyes West step-out holes.

Highlights from the results are as follows:

- CU22-12 – 2.5 metres grading 18.54 g/t Au Eq

- CU22-13 – 36.0 metres grading 2.29 g/t Au Eq

- CU22-14 – 4.0 metres grading 19.35 g/t Au Eq; including 2.0 metres grading 36.59 g/t Au Eq

- CU22-15 – 17.5 metres grading 3.07 g/t Au Eq

Lundin Gold’s Fruta Del Norte mine in southeast Ecuador has also seen results from ongoing drilling. The company reported results from the 2022 near-mine expiration program identifying new zones of mineralization to the south and at depth of FDN’s currently defined Mineral Resources.

Highlights from the results are as follows:

- Drillhole FDN2022-009 intersected 5.11 g/t Au over 30.3m from a depth of 267.7m, including;

- 9.79 g/t Au over 14.0m from 284.0m

- Drillhole FDN2022-006 intersected 3.99 g/t Au over 4.8m from 181.7m, and 4.40 g/t Au over 8.1m from 213.9m

Highlights from holes drilled under the southern portion of the FDN mineral resource envelope:

- Drillhole UGE-DD-22-008 intersected 4.11 g/t Au over 23.0m from 197.7m, including;

- 6.03 g/t Au over 10.0m from 202.7m

- Drillhole UGE-DD-22-005 intersected 3.53 g/t Au over 44.9m from 134.8m, including;

- 5.25 g/t Au over 12.9m from 134.8m, and;

- 4.32 g/t Au over 15.0m from 164.7m

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

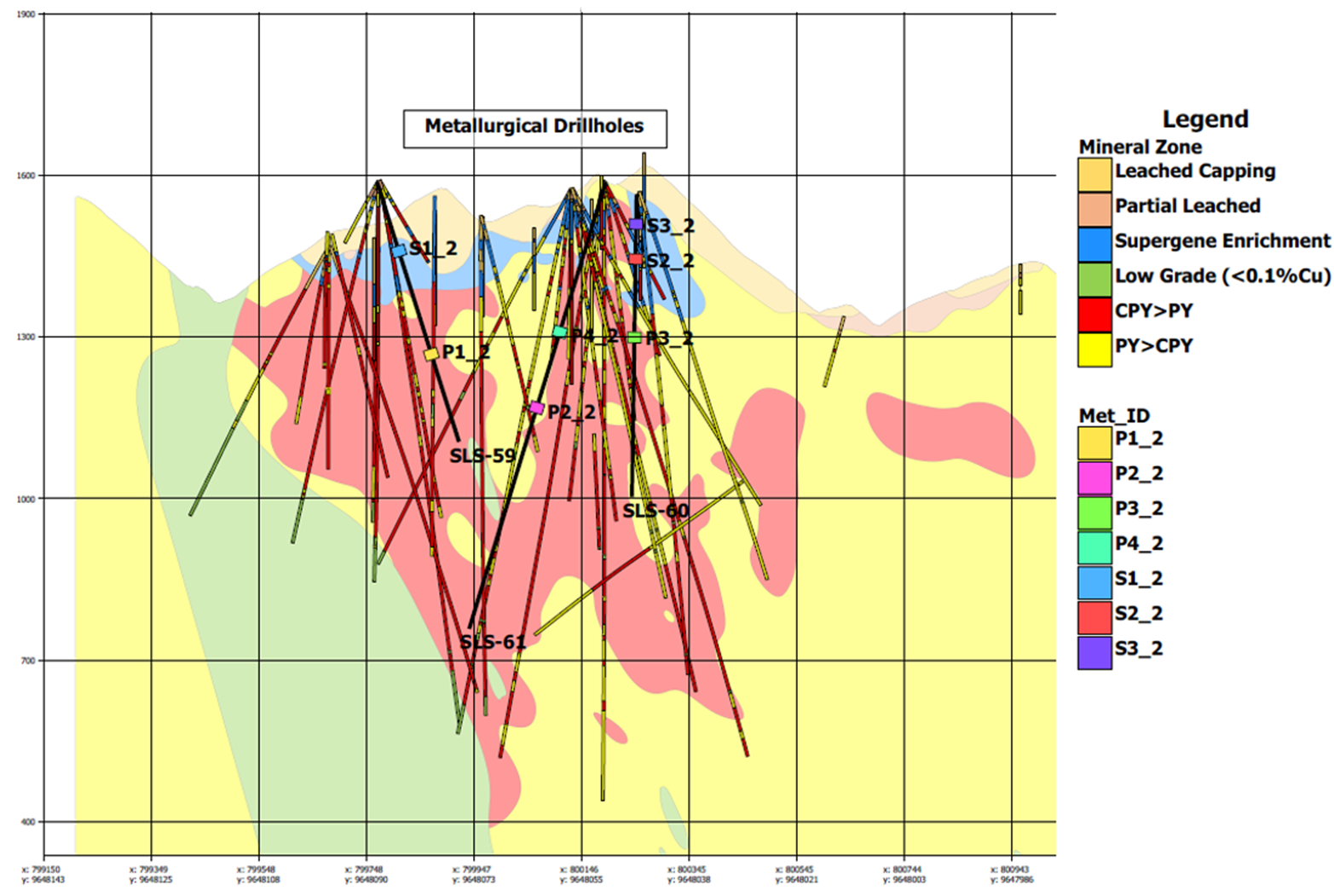

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has reported new results from metallurgical test work at the Warintza Project in Ecuador, showing high recoveries of copper, molybdenum, and gold in rougher flotation, cleaner flotation, and locked cycle testing. The company commissions FLSmidth USA Inc. to perform all comminution and metallurgical flotation test work programs.

Mr. Daniel Earle, President & CEO, commented in a press release: “Warintza is blessed with simple metallurgy that readily returns high recoveries of critical minerals from standard flotation processes into high-grade concentrates free of deleterious elements. Historical testing reported high recoveries of over 90% for copper and 70% for gold; our testing has reproduced these results and established high recoveries for molybdenum of over 80% at a time when molybdenum prices recently eclipsed $30/lb due to structural supply issues in the sector.”

Highlights from the results are as follows:

- High recoveries for copper (“Cu”), molybdenum (“Mo”) and gold (“Au”) in rougher flotation, cleaner flotation and locked cycle testing

- Low reagent dosages and short flotation times over a wide range of pH levels, and requiring only moderate to coarse grind sizes for both supergene and hypogene samples

- High copper concentrate grades expected from both supergene material at 40% Cu and hypogene material at 22% Cu with both concentrates containing in excess of 1 g/t Au

- High molybdenum concentrate grades expected to meet or exceed 51% Mo independent of feed type given excellent liberation of coarse grained molybdenite

- For context, the Warintza Mineral Resource Estimate (“MRE”)¹ includes a molybdenum byproduct estimate containing 150 kt Mo grading 0.03% Mo (Indicated) and 130 kt Mo grading 0.01% Mo (Inferred), in addition to gold

- Concentrates free of deleterious elements, with no significant values of arsenic, antimony, bismuth or mercury

- Optimization testing with larger sample sizes planned for hypogene material aimed at further increasing recoveries

Metallurgical Test Work Program Scope

The metallurgical test work program at FLS included comminution grind studies on two master composites, ore characterization, grinding indices, rougher and cleaner flotation tests, locked cycle testing and variability rougher kinetics flotation tests. The objective of the test work was to evaluate the metallurgical flotation response of the master composites and variability samples, establish metal recoveries, evaluate if any deleterious elements were present, and assess whether clean, high-grade concentrates could be produced with industry standard processing practices and reagents.

Sample Selection

The metallurgical samples were taken from three drill holes specifically drilled for metallurgical test work. The hole depths range from 500m to 960m with sample selection ranging from 46m below surface to a depth of 450m. Seven samples which consisted of 20m intervals of half core were selected for the test work program for a total weight of 651kg of sample material. The samples were selected from the Warintza Central deposit to represent the mineralization, metal grades, and lithology type which formed the first pit phases of the MRE.

Table 1: Sample Selection

| Met ID | Hole ID | From (m) | To (m) | Interval (m) | Mineralization |

| S1_2 | SLS-59 | 126 | 146 | 20 | Supergene |

| S2_2 | SLS-60 | 112 | 132 | 20 | Supergene |

| S3_2 | SLS-60 | 46 | 66 | 20 | Supergene |

| P1_2 | SLS-59 | 330 | 350 | 20 | Hypogene |

| P2_2 | SLS-61 | 428 | 448 | 20 | Hypogene |

| P3_2 | SLS-60 | 260 | 280 | 20 | Hypogene |

| P4_2 | SLS-61 | 280 | 300 | 20 | Hypogene |

| Total | 140 |

Table 2: Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-61 | 800191 | 9648065 | 1573 | 967 | 255 | -72 |

| SLS-60 | 800258 | 9648097 | 1559 | 873 | 190 | -80 |

| SLS-59 | 799765 | 9648033 | 1571 | 513 | 65 | -70 |

| Notes to Table 2: The coordinates are in WGS84 17S Datum. | ||||||

The metallurgical samples were combined by mineralization type and classified as supergene and hypogene which formed two master composites (“MC”) for the flotation test work program. MC #1 represents the supergene material and MC #2 represents the hypogene material. Each MC was assayed to confirm the metal grades are within range of the grades expected in the first phases of a potential mine plan. The head grades for each MC can be found in Table 3.

Table 3: Master Composite Head Grade

| Composite | Head Grade | ||

| Cu, % | Mo, % | Au, g/t | |

| Supergene | |||

| MC #1 | 1.22 | 0.03 | 0.07 |

| MC #1B | 1.13 | 0.04 | 0.07 |

| Hypogene | |||

| MC #2 | 0.66 | 0.03 | 0.06 |

| MC#2B | 0.58 | 0.03 | 0.07 |

Rougher Flotation Testing

FLS completed six rougher flotation tests on MC #1 and five rougher flotation tests on MC #2. In both composites, the copper recovery does not appear to be influenced significantly by pH, grind size, or collector dosages. The rougher flotation tests focused on primary grind size, pH, and collector dosage as the variables for influencing the flotation behavior. The collector used in all tests is Cytec Aero 8989 for copper and burner oil as a molybdenum collector. Below is a summary of MC #1 and #2 tests at various grind sizes and pH.

Table 4: Rougher Recoveries and Grades

| MC #1 – Supergene | |||||||

| Actual Grind Size, µm | pH | Recovery | Grade | ||||

| Cu, % | Mo, % | Au, % | Cu, % | Mo, % | Au, g/t | ||

| 117 | 6.8 | 91.7 | 89.3 | 80.3 | 9.63 | 0.24 | 0.38 |

| 122 | 8.5 | 91.7 | 88.6 | 78.2 | 7.74 | 0.19 | 0.43 |

| 143 | 8.5 | 91.0 | 90.7 | 77.3 | 12.32 | 0.31 | 0.65 |

| 144 | 9.8 | 91.0 | 92.3 | 68.2 | 13.41 | 0.32 | 0.85 |

| 144 | 9.2 | 91.9 | 91.5 | 71.7 | 12.95 | 0.30 | 0.92 |

| 167 | 8.8 | 91.1 | 86.6 | 74.0 | 12.53 | 0.30 | 0.62 |

| Average | 91.4 | 89.8 | 75.0 | ||||

| MC #2 – Hypogene | |||||||

| Actual Grind Size, µm | pH | Recovery | Grade | ||||

| Cu, % | Mo, % | Au, % | Cu, % | Mo, % | Au, g/t | ||

| 98 | 8.5 | 95.0 | 94.4 | 78.0 | 4.39 | 0.20 | 0.38 |

| 129 | 8.6 | 95.1 | 91.6 | 78.8 | 4.37 | 0.20 | 0.39 |

| 177 | 8.6 | 94.5 | 93.9 | 78.7 | 4.32 | 0.18 | 0.39 |

| 147 | 9.4 | 95.5 | 91.4 | 70.0 | 4.44 | 0.15 | 0.45 |

| 147 | 8.9 | 94.8 | 91.6 | 68.8 | 4.78 | 0.18 | 0.47 |

| Average | 95.0 | 92.6 | 74.8 | ||||

Cleaner and Locked Cycle Flotation Testing

Batch cleaner tests were conducted to ensure that bulk concentrates could be produced without significant cleaner losses. One cleaner test was conducted on MC #1 and four cleaner tests were conducted on MC #2, with regrind size being the most significant variable tested. A second set of master composites were created with the same blend of variability samples as the original master composites labeled MC #1B and MC #2B and were used for seven locked cycle tests and copper-molybdenum separation tests. Batch cleaner and locked cycle testing produces high recoveries for the supergene composite of 90% Cu and 83% Mo and hypogene composite of 89% Cu and 75% Mo. FLS concluded that higher recoveries could be achieved for MC #2 and #2B with reagent optimization, which will be incorporated into the next phase of testing.

Copper-Molybdenum Concentrate Separation Test

The second set of master composites, MC #1B and MC #2B, were used for the copper-molybdenum separation of the bulk concentrates. The test work only included a rougher stage molybdenum float that was carried out for both MC #1B and MC #2B due to the size of the remaining sample. The molybdenum separated from the copper successfully into a rougher concentrate for both master composites given excellent liberation characteristics and coarse grain size for molybdenum, with the majority of grains by mass > 200 microns in size. Flotation testing of the supergene samples produced a copper concentrate grading approximately 40% Cu and containing in excess of 1 g/t Au. Flotation testing of the hypogene samples produced a copper concentrate grading approximately 22% Cu and containing in excess of 1 g/t Au. Molybdenum concentrate grades at 51% Mo independent of feed type.

Endnotes

- Refer to Solaris’ technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

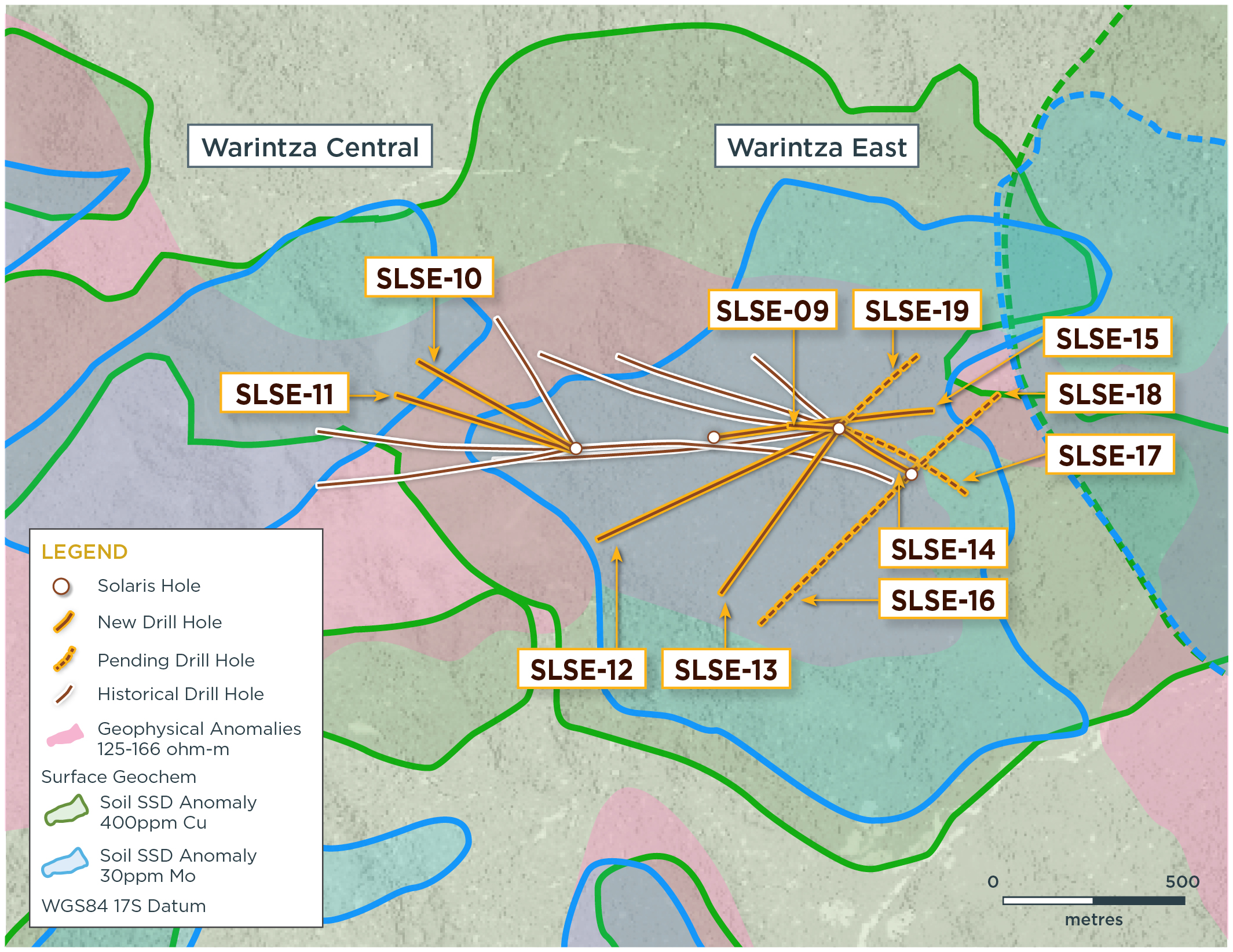

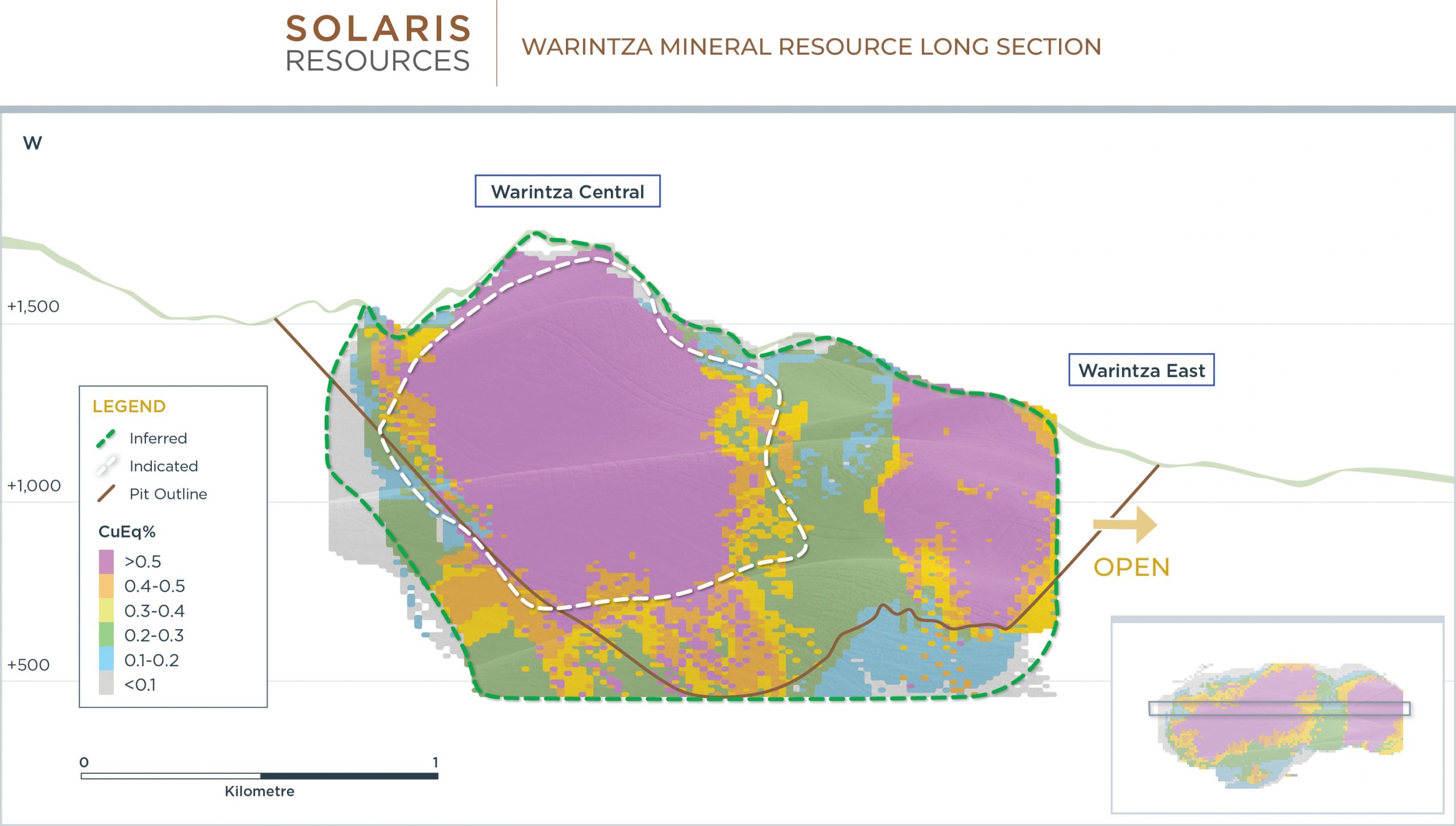

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has reported new assay results from a series of holes at the Warintza East Discovery aimed at growing mineral resources at the Warintza Project in Ecuador. The company made the initial discovery in July 2021, with a total of eight holes covering the overlapping periphery. These were included in the Warintza Central Mineral Resource Estimate (MRE) released in April 2022.

These new results expand the drilled dimensions of the Warintza East footprint to the northeast, east, and south. The deposit still remains open in those directions, with particularly strong soil anomalism to the south.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “Warintza East’s largely undrilled footprint is a target for major mineral resource growth in the ongoing drilling program where only minimal drilling was included in the MRE and adjoins with Warintza Central. Assays are pending from further extensional holes to the north and east and targeting strong soil anomalism in step-out drilling to the south.”

Highlights from the results are as follows:

- SLSE-16 was collared at the eastern limit of the grid and drilled southwest into an open volume, returning 108m of 0.57% CuEq² within a broader interval of 712m of 0.45% CuEq² from surface, extending mineralization to the south and southeast where it remains open

- This hole was collared approximately 250m to the southeast of SLSE-13 (refer to Company press release dated Nov 14, 2022), which previously returned 104m of 0.45% CuEq² from surface within a broader interval of 618m of 0.29% CuEq²

- SLSE-17 was collared in the middle of the Warintza East drill grid and drilled southeast into an open volume, returning 144m of 0.52% CuEq² from surface within a broader interval of 914m of 0.40% CuEq², extending mineralization to the east where it remains open

- This hole extends the drilled dimensions further to the east beyond SLSE-14 (refer to Company press release dated Nov 14, 2022), which previously returned 292m of 0.50% CuEq² from near surface within a broader interval of 694m of 0.40% CuEq²

- SLSE-19 was collared in the middle of the Warintza East drill grid and drilled northeast into an open volume, returning 270m of 0.40% CuEq² from surface within a broader interval of 580m of 0.31% CuEq², expanding the footprint to the northeast where it remains open

- Drilling to date confirms Warintza East as a significant porphyry deposit that adjoins Warintza Central and remains open for expansion, with assays pending from a series of extensional holes to the north, east, south and southeast

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq² (%) |

| SLSE-19 | Jan 17, 2023 | 0 | 580 | 580 | 0.24 | 0.01 | 0.03 | 0.31 |

| Including | 0 | 270 | 270 | 0.31 | 0.02 | 0.04 | 0.40 | |

| SLSE-18 | 30 | 524 | 494 | 0.16 | 0.01 | 0.04 | 0.20 | |

| SLSE-17 | 0 | 914 | 914 | 0.32 | 0.01 | 0.04 | 0.40 | |

| Including | 0 | 144 | 144 | 0.45 | 0.01 | 0.05 | 0.52 | |

| SLSE-16 | 8 | 720 | 712 | 0.36 | 0.02 | 0.05 | 0.45 | |

| Including | 76 | 184 | 108 | 0.46 | 0.02 | 0.06 | 0.57 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSE-19 | 801485 | 9648192 | 1170 | 816.48 | 48 | -65 |

| SLSE-18 | 801684 | 9648074 | 1221 | 1018.74 | 48 | -65 |

| SLSE-17 | 801485 | 9648192 | 1170 | 1011.39 | 105 | -70 |

| SLSE-16 | 801684 | 9648074 | 1221 | 844.61 | 225 | -45 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has announced that a major Investment Contract for the Warintza Project has been signed. The contract ratifies the Investment Protection Agreement announced on June 9, 2022. The IPA provides a strong foundation of certainty for the company as it relates to the legal framework governing the project, including stable mining regulations, security of title and investment, and new tax incentives to accelerate development.

It includes specific protections related to the prohibitions of all forms of confiscation, non-discriminatory treatment, legal security, and tax stability. The agreement notes a 5% income tax reduction, fixes the income tax rate at 20% and includes an exemption from capital outflow tax and import duties for the import of goods needed for new investments. It also includes important detailed procedures for the dispute resolution process and stipulations for international arbitration protection.

Mr. Daniel Earle, President & CEO, commented: “We are very grateful to the Government of Ecuador and our host communities for their support in reaching this major milestone. The Investment Contract provides a foundation of certainty, significantly de-risking the Warintza Project by securing a stable regulatory and fiscal framework with international legal protections for the Project while also enhancing its returns through permanent new tax incentives.”

Mr. Julio José Prado, Minister of Production, Foreign Trade, Investment, and Fisheries of the Government of Ecuador, stated, “I want to thank Solaris for the commitment with the country and with Morona Santiago, it is an example of sustainable mining, responsible with the environment and the communities. Since the first contacts in the Ecuador Open for Business event, we have worked for a year and today we signed the Investment Contract. The Warintza Project has a very important influence, and they are working with the community in an exemplary manner; this will allow more development and prosperity for the zone and for Ecuador.”

Mr. Fernando Santos Alvite, Minister of Energy and Mines of the Government of Ecuador, stated, “I wish the best of success to the Warintza Project. This is a very important project for the country in terms of scale and investment. It is also important for what it represents, which is a great commitment and understanding between the communities and the Company.”

Mr. Vicente Tsakimp, Lead Coordinator of the Warintza Project Strategic Alliance, stated, “The Warints and Yawi Shuar Centers are glad that the Warintza Project is advancing and that we are part of it. Our work and coordination with the Company are an example that participatory mining can be done, and we are proud of everything we have achieved.”

Highlights from the agreement are as follows:

The Investment Contract provides for the following protections and incentives for the duration of the title of the Project which extends with renewal to 2066:

- Security of investment

- Stability of mining law

- Stability of taxes at a reduced income tax rate of 20% (25% previously)

- Exemption from capital outflow tax (5% previously)

- Exemption from import duties (up to 5% previously)

- Detailed procedures for dispute resolution and international arbitration protection

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

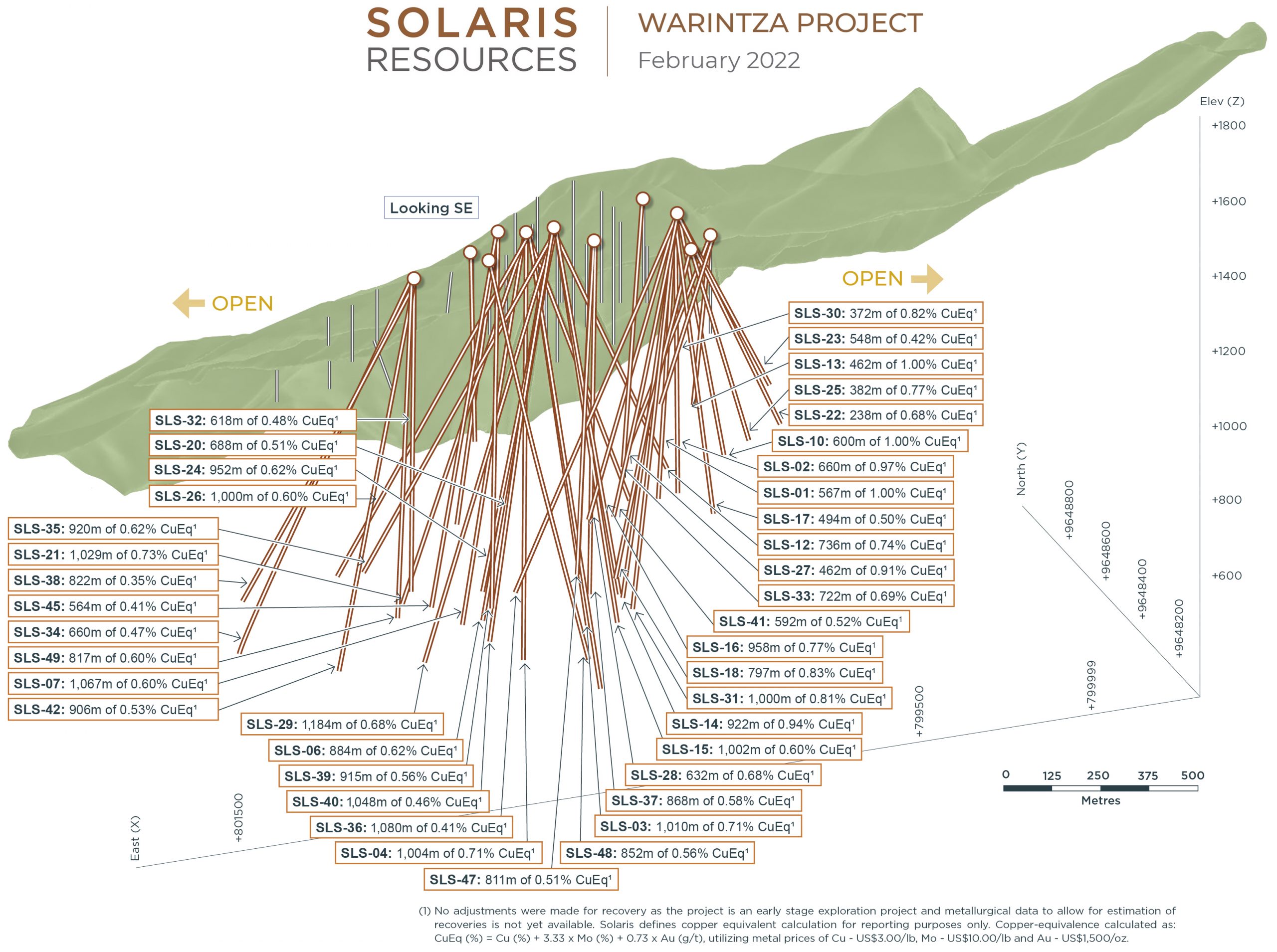

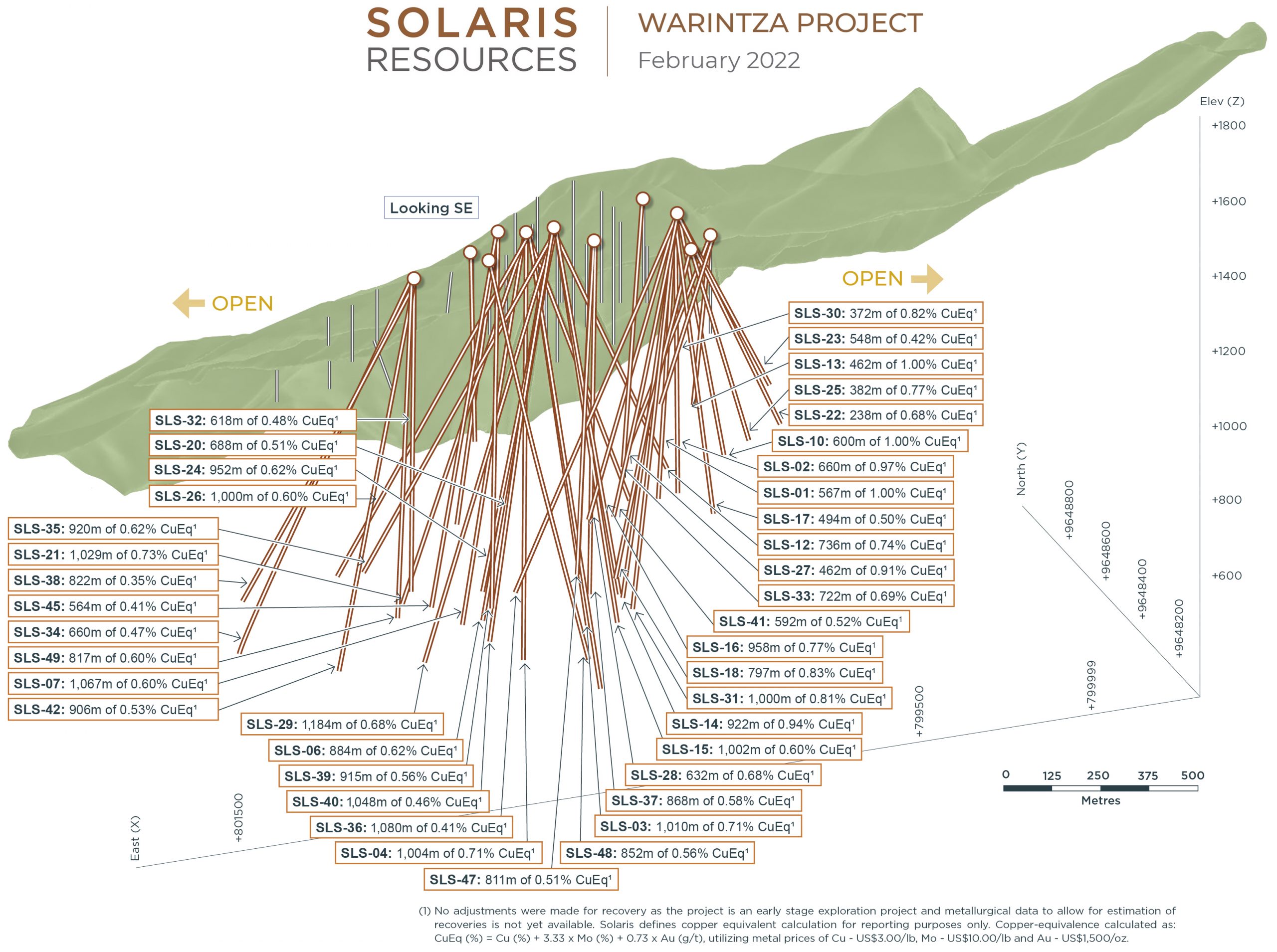

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has reported assay results from a series of holes aimed at growing the Northeast Extension of its ‘Indicative Starter Pit’ at the Warintza Project. The company has defined a 1.5Bt copper inventory in an open pit with a low strip ratio at the Warintza Central deposit, and within that, a high-grade starter pit driving really robust economics, which makes it one of the best greenfield development copper opportunities available globally.

The newest results from the project continue to build on past successes of four significant discoveries, and expand the ‘Indicative Starter Pit’ previously estimated at 180Mt at 0.82% CuEq.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “The Northeast Extension remains open to the north with assays pending from recently completed holes. Further extensional drilling is planned with a 200m step-out platform on the northeastern margin of the drill grid aimed at expanding the zone in this direction. We’re also expecting assays from the remaining holes drilled from the discovery platform at Warintza West outlining a mineralized porphyry with minimum dimensions of 900m x 600m and open outside the MRE for future resource drilling, and the next series of holes targeting the expansion of Warintza East.”

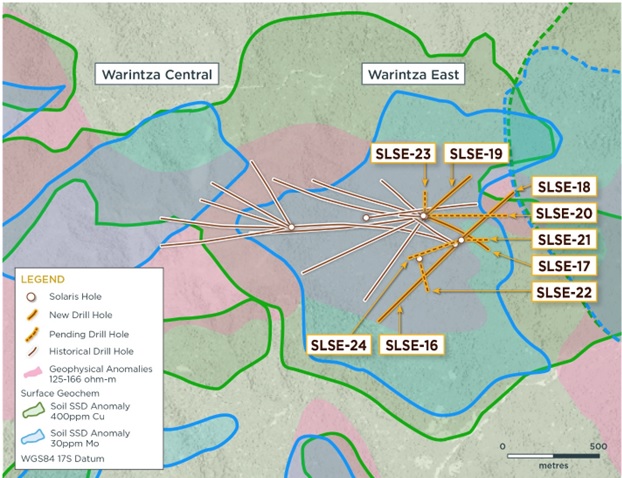

Highlights from the results are as follows:

Resource expansion drilling continues to build on the Northeast Extension of the ‘Indicative Starter Pit’ which was estimated at 180 Mt at 0.82% CuEq¹ (Indicated) and 107 Mt at 0.73% CuEq¹ (Inferred) within the Warintza Mineral Resource Estimate² (“MRE”) based on drilling to the end of 2021. Follow-up drilling this year has significantly expanded the dimensions of the zone as a priority for high-impact growth with further drilling ongoing.

- SLS-67 was collared at the north-central limit of Warintza Central and drilled southwest into a partially open volume, returning 108m of 1.20% CuEq¹ within a broader interval of 604m of 0.51% CuEq¹ from near surface

- This hole expands on the area of high-grade near surface mineralization in combination with SLS-48 which was collared from the same platform but drilled south, returning 100m of 1.64% CuEq³ within a broader interval of 852m of 0.56% CuEq³ from near surface (refer to press release dated Feb 28, 2022)

- SLS-68 was collared from the same platform as SLS-67 and drilled steeply to the northwest into an open volume, returning 72m of 1.00% CuEq¹ within a broader interval of 616m of 0.44% CuEq¹ from near surface, expanding this area of higher-grade mineralization from near surface

- SLS-65 was collared from a recently constructed 250m step-out platform at the northeast limit of the Warintza Central grid and drilled northwest into a partially open volume, returning 286m of 0.55% CuEq¹ from near surface

- Assays are pending from a series of holes from this new drill platform aimed at further expanding resource growth in the Northeast Extension zone, with additional extension and step-out drilling underway

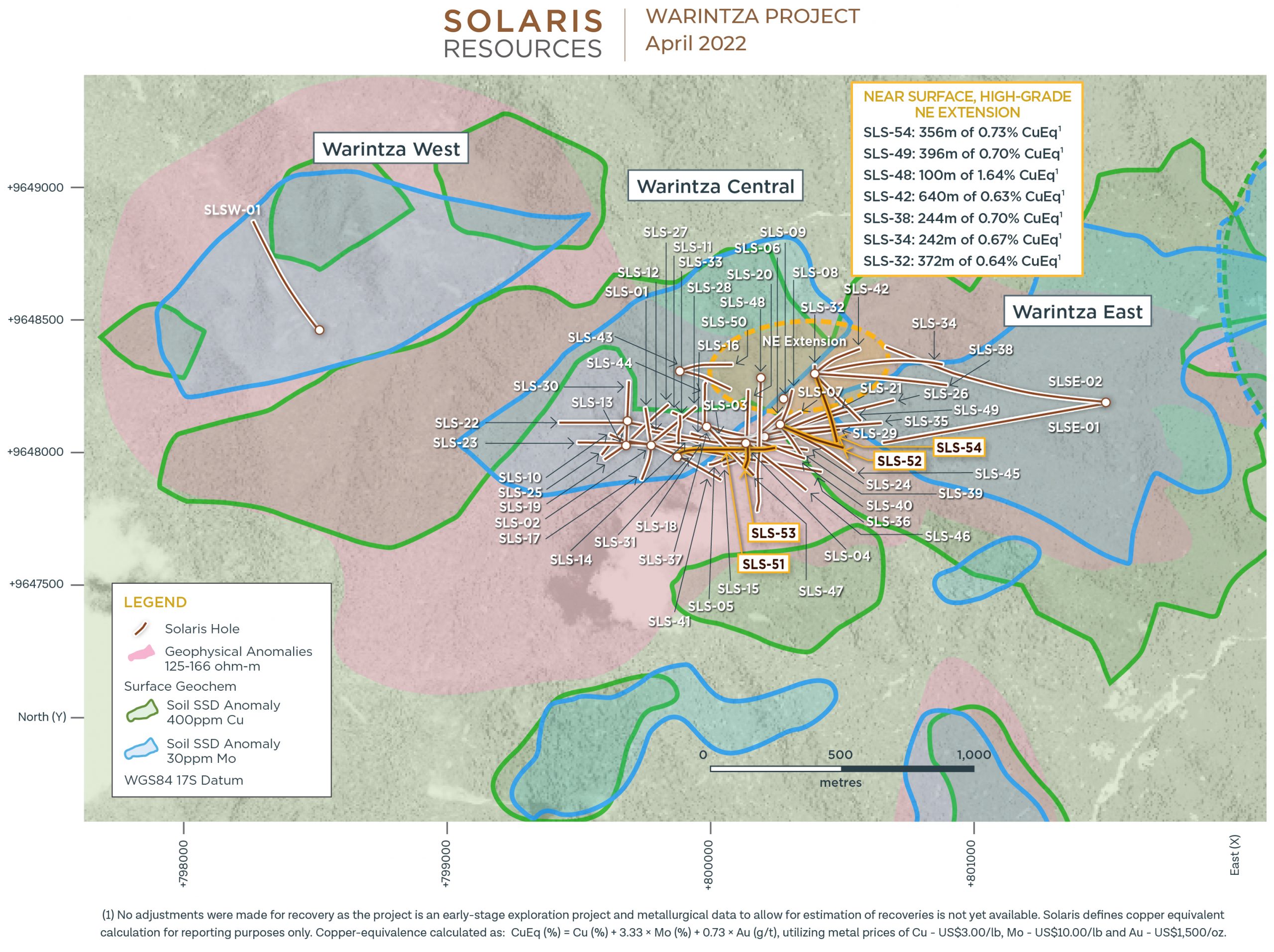

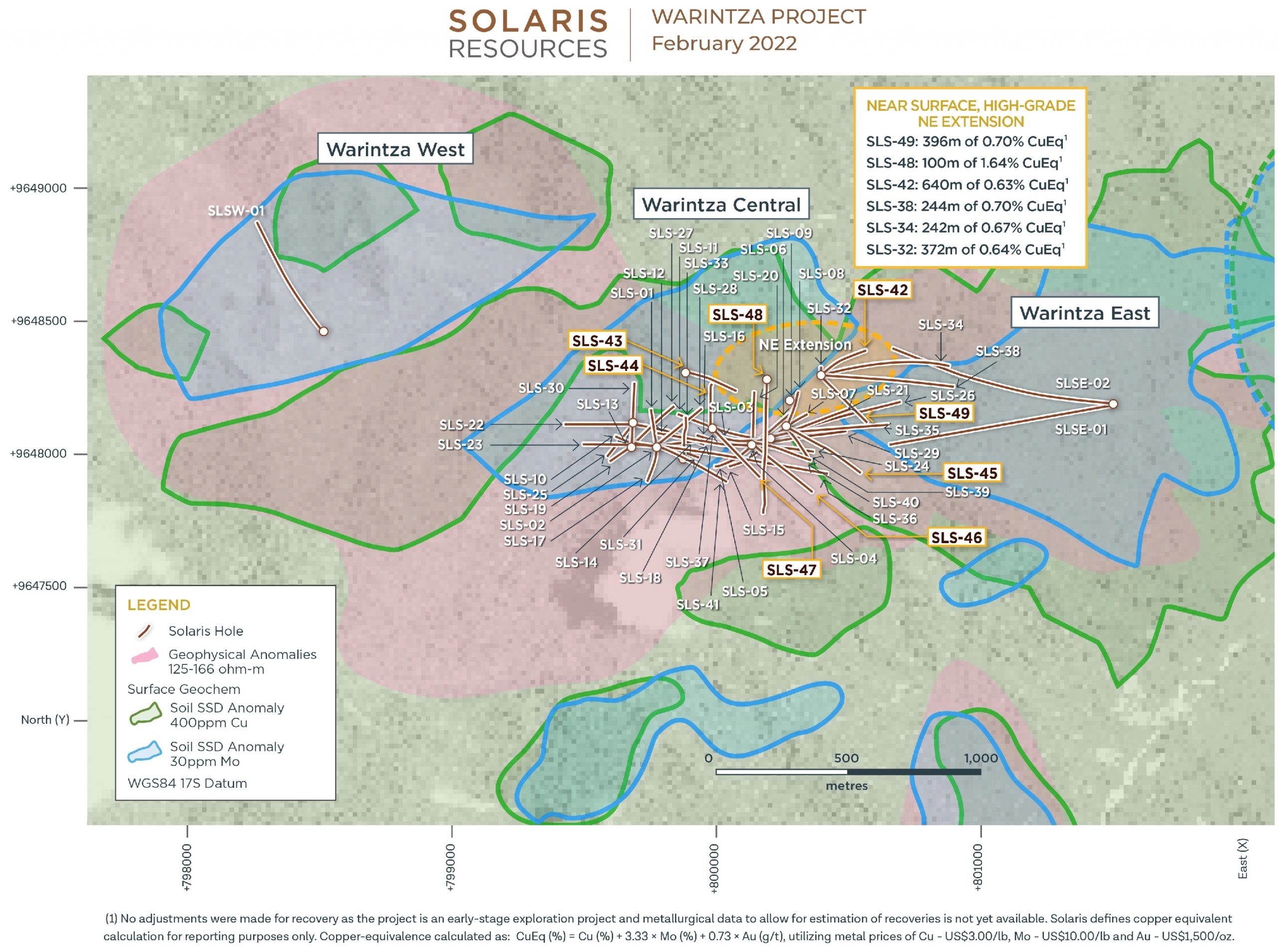

Figure 1 – Plan View of Warintza Central Drilling Released to Date

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-68 | Dec 5, 2022 | 44 | 660 | 616 | 0.34 | 0.02 | 0.04 | 0.44 |

| Including | 68 | 140 | 72 | 0.88 | 0.02 | 0.06 | 1.00 | |

| SLS-67 | 42 | 646 | 604 | 0.40 | 0.02 | 0.05 | 0.51 | |

| Including | 42 | 150 | 108 | 1.06 | 0.03 | 0.09 | 1.20 | |

| SLS-65 | 88 | 374 | 286 | 0.38 | 0.04 | 0.06 | 0.55 | |

| Notes to table: True widths of the mineralized zone are not known at this time. | ||||||||

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-68 | 800178 | 9648285 | 1439 | 662 | 332 | -85 |

| SLS-67 | 800178 | 9648285 | 1439 | 673 | 230 | -76 |

| SLS-65 | 800347 | 9648415 | 1346 | 401 | 290 | -70 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The mining sector has put itself in a difficult position, underinvesting in new copper projects when copper demand is rising. The good news for those looking for a copper investment is that there are still a number of new copper projects in the works.

One of these projects is the Warintza copper project in southeastern Ecuador. Warintza is a world-class large-scale resource with expansion and discovery potential. There have been four major discoveries since the project started and the Mineral Resource Estimate at the project has been expanded from earlier in 2022. Most recently, Canadian mining company Solaris Resources (TSX:SLS) (OTCQB:SLSSF), which owns Warintza, reported new assay results from a series of holes aimed at delineating resources at the Warintza East discovery.

Highlights from the results are as follows:

Warintza East was discovered in July 2021, with eight holes covering the overlapping periphery included in the Warintza Central Mineral Resource Estimate (“MRE”)¹ in April 2022. These follow-up drilling results significantly expand the drilled dimensions of the Warintza East footprint to the east and southwest, with the deposit remaining entirely open towards strong soil anomalism to the northeast and southeast.

- SLSE-15 was collared in the middle of the Warintza East grid and drilled east into a partially open volume, returning 204m of 0.60% CuEq² within a broader interval of 910m of 0.40% CuEq² from near surface, extending mineralization to the east where it remains open

- SLSE-14, stepped out approximately 250m from the eastern limit of the grid and drilled northwest into an open volume, returning 292m of 0.50% CuEq² within a broader interval of 694m of 0.40% CuEq² from near surface, extending mineralization in this direction where it remains open

- SLSE-12 was collared at the eastern limit of the grid and drilled southwest into an open volume, returning 48m of 0.53% CuEq² within a broader interval of 508m of 0.40% CuEq² from surface, extending mineralization in this direction

- SLSE-13 was collared from the same platform and drilled southwest into an open volume, returning 104m of 0.45% CuEq² within a broader interval of 618m of 0.29% CuEq² from surface, expanding the footprint to the south where it remains open

- SLSE-10 and SLSE-11 were collared in the overlapping portion with Warintza Central and drilled northwest into partially open volumes, returning 282m of 0.53% CuEq² and 270m of 0.55% CuEq², respectively, within broader intervals from near surface

- Drilling to date confirms Warintza East as a significant porphyry deposit which remains open for expansion in multiple areas, with assays pending from a series of extensional holes to the northeast, east and south

Warintza stands out in an environment where under-investment in new copper mines and exploration is jeopardizing the metal-intensive energy transition. Massive amounts of copper will be needed for everything from electric vehicles to renewable energy infrastructure.

Companies have instead focused on expanding mines with stronger guarantees of shareholder returns, playing it safe, but in turn, neglecting to invest in new projects. This focus on short-term shareholder returns and paying out dividends or using cash for share buybacks has left the discoveries to junior mining companies that are developing some of the most promising projects in the world. New copper mines take decades to achieve commercial production, and only exploration being done at projects right now has a chance of coming online in time for it to make a difference for future production levels.

Additionally, new discoveries have typically been of lower grades, making the Warintza Project an exceptional outlier in an environment when alarms are sounding for supply and demand dynamics. Lower grades ultimately make the copper more expensive to extract, but the potential for the high-grade “superpit” at Warintza is exactly what companies are looking for.

The future of copper is bright, but only if we see more investments in new projects like Warintza. Solaris Resources is one of the few mining companies that is making such investments, and the prospects for the Warintza project look very promising.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

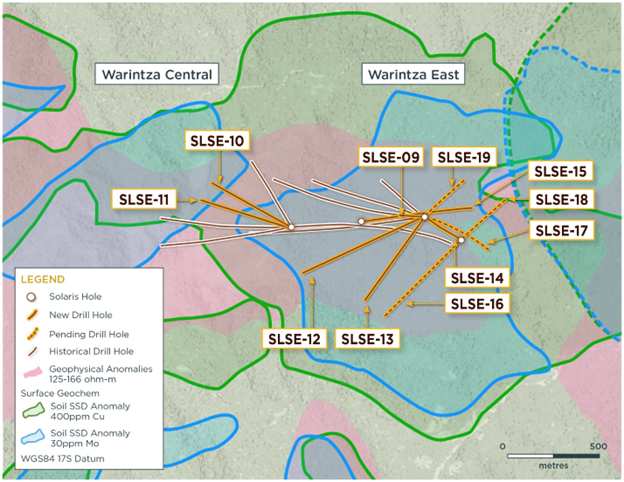

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has reported assay results from a series of holes aimed at delineating resources at the Warintza East discovery at the Warintza Project. These results significantly expand the Warintza East discovery originally discovered in July 2021, and included eight holes covering the overlapping periphery included in the Warintza Central Mineral Resource Estimate from April 2022. The results expand the dimensions of the Warintza East footprint to the east and southwest, and the deposit remains open towards strong soil anomalism to the northeast and southeast.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “Drilling to date covers only a small portion of the Warintza East discovery, which represents a target for major resource growth. Further extensional and step-out drilling is planned to the east and southeast with a 400m step-out platform located on the southern margin of the drill grid targeting strong soil anomalism in this area.”

Highlights from the results include:

- SLSE-15 was collared in the middle of the Warintza East grid and drilled east into a partially open volume, returning 204m of 0.60% CuEq² within a broader interval of 910m of 0.40% CuEq² from near surface, extending mineralization to the east where it remains open

- SLSE-14, stepped out approximately 250m from the eastern limit of the grid and drilled northwest into an open volume, returning 292m of 0.50% CuEq² within a broader interval of 694m of 0.40% CuEq² from near surface, extending mineralization in this direction where it remains open

- SLSE-12 was collared at the eastern limit of the grid and drilled southwest into an open volume, returning 48m of 0.53% CuEq² within a broader interval of 508m of 0.40% CuEq² from surface, extending mineralization in this direction

- SLSE-13 was collared from the same platform and drilled southwest into an open volume, returning 104m of 0.45% CuEq² within a broader interval of 618m of 0.29% CuEq² from surface, expanding the footprint to the south where it remains open

- SLSE-10 and SLSE-11 were collared in the overlapping portion with Warintza Central and drilled northwest into partially open volumes, returning 282m of 0.53% CuEq² and 270m of 0.55% CuEq², respectively, within broader intervals from near surface

- Drilling to date confirms Warintza East as a significant porphyry deposit which remains open for expansion in multiple areas, with assays pending from a series of extensional holes to the northeast, east and south

Figure 1 – Plan View of Warintza East Drilling Released to Date

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq² (%) |

| SLSE-15 | Nov 14, 2022 | 124 | 1,034 | 910 | 0.31 | 0.02 | 0.04 | 0.40 |

| Including | 252 | 456 | 204 | 0.50 | 0.02 | 0.05 | 0.60 | |

| SLSE-14 | 24 | 718 | 694 | 0.29 | 0.02 | 0.04 | 0.40 | |

| Including | 24 | 316 | 292 | 0.40 | 0.02 | 0.05 | 0.50 | |

| SLSE-13 | 4 | 622 | 618 | 0.22 | 0.01 | 0.03 | 0.29 | |

| Including | 0 | 104 | 104 | 0.31 | 0.03 | 0.03 | 0.45 | |

| SLSE-12 | 0 | 508 | 508 | 0.29 | 0.02 | 0.04 | 0.40 | |

| Including | 0 | 48 | 48 | 0.46 | 0.01 | 0.04 | 0.53 | |

| SLSE-11 | 112 | 600 | 488 | 0.30 | 0.01 | 0.03 | 0.38 | |

| Including | 330 | 600 | 270 | 0.43 | 0.03 | 0.04 | 0.55 | |

| SLSE-10 | 78 | 576 | 498 | 0.33 | 0.01 | 0.05 | 0.39 | |

| Including | 294 | 576 | 282 | 0.44 | 0.01 | 0.06 | 0.53 | |

| SLSE-09 | 0 | 773 | 773 | 0.18 | 0.03 | 0.03 | 0.30 | |

| Including | 0 | 212 | 212 | 0.30 | 0.02 | 0.04 | 0.42 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSE-15 | 801134 | 9648177 | 1382 | 1070 | 85 | -62 |

| SLSE-14 | 801684 | 9648074 | 1221 | 872 | 300 | -75 |

| SLSE-13 | 801481 | 9648205 | 1170 | 800 | 215 | -45 |

| SLSE-12 | 801485 | 9648192 | 1170 | 981 | 245 | -46 |

| SLSE-11 | 800749 | 9648146 | 1282 | 862 | 285 | -60 |

| SLSE-10 | 800749 | 9648146 | 1282 | 691 | 300 | -50 |

| SLSE-09 | 801485 | 9648192 | 1170 | 774 | 271 | -80 |

| Notes to table: The coordinates are in WGS84 17S Datum. |

Endnotes

- Refer to Solaris’ press release dated April 18, 2022 and technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

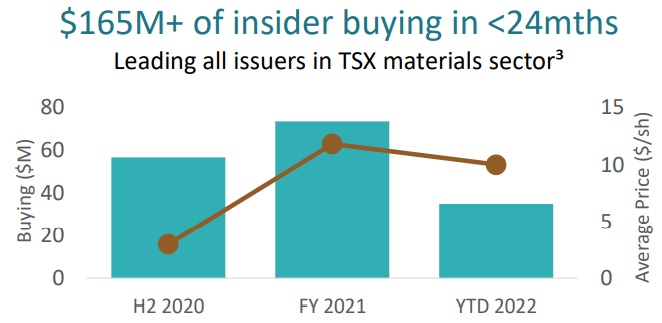

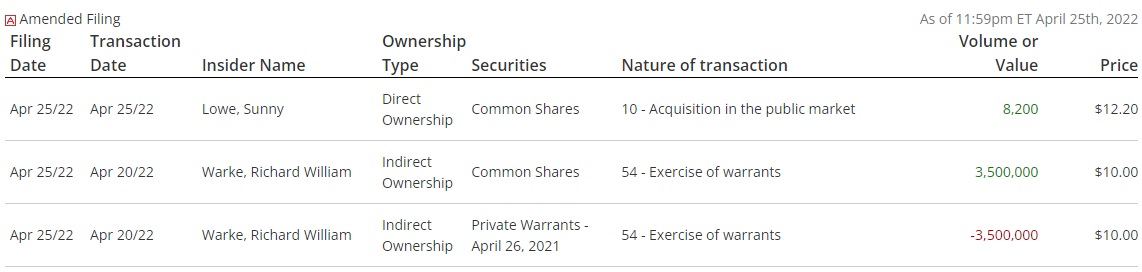

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has announced that it received exercises of common share purchase warrants for a total of C$18.7 million since the last quarterly results dated August 9, 2022. Mr. Richard Warke represented the majority of the warrants exercised, and exercised 2.3 million at a price of C$6.75, a 37% premium to the close of trading on Friday, October 28, 2022. On top of those warrants, Mr. Warke also exercised 0.6 million warrants at C$1.20 for proceeds of C$0.7 million.

More warrants remain outstanding and are set to expire by the end of 2022. There are 3.1 warrants at a price of C$1.20 and 0.2 million warrants at a price of C$6.75 outstanding which would generate proceed of C$4.9 million. 50% of those warrants are held by company insiders. By May 2023, 25 million warrants will expire at C$1.20, which if exercised in full, would generate C$30 million, with 98% of those warrants held by company insiders.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The copper market has been on a tear in recent years and is expected to continue to do well in the near future. This is good news for Warintza Project’s (TSX:SLS) (OTCQB:SLSSF) copper project, as it will take advantage of the market’s tailwinds in a way that most other junior mining companies’ projects won’t be able to. Solaris recently published results from Warintza West, marking the fourth discovery within the Warintza porphyry cluster.

Located just 1 kilometre west of the Warintza Central Mineral Resource Estimate (MRE), the discovery was reported with the results of SLSW-01. Another big discovery for the company, it outlines a broad porphyry deposit of at least 900m x 600m and till open and miles adjacent to but not included within the MRE. This significantly expands the opportunities at the project which has the potential to be a “super-pit”.

Exciting results from the report included:

- SLSW-07 (drilled north) returned 686m of 0.46% CuEq¹ within a broader interval of 912m of 0.41% CuEq¹ from near surface

- SLSW-02 (drilled vertically) returned 246m of 0.47% CuEq¹ from near surface

- SLSW-09 (drilled west) returned 202m of 0.45% CuEq¹ within a broader interval of 444m of 0.36% CuEq¹ from near surface

- SLSW-08 (drilled northwest) returned 78m of 0.56% CuEq¹ within a broader interval of 812m of 0.32% CuEq¹ from near surface

- SLSW-04 (drilled northeast) returned 264m of 0.44% CuEq¹ from near surface

- SLSW-10 (drilled southwest) returned 220m of 0.41% CuEq¹ from near surface

- SLSW-03 (drilled southeast) returned 102m of 0.39% CuEq¹ within a broader interval of 911m of 0.24% CuEq¹ from near surface

- SLSW-05 (drilled northeast) returned 272m of 0.38% CuEq¹ within a broader interval of 570m of 0.30% CuEq¹ from near surface

- SLSW-06 (drilled east) returned 732m of 0.32% CuEq¹ from near surface

These results and the project also stand out for a few reasons:

The project is located in a key copper-producing region

The project is located in a key copper-producing region The project is located in a key copper-producing region of southeastern Ecuador.

The company has committed to fully transparent disclosure

With a good copper price forecast and a commitment to fully disclose all exploration results, Warintza Project is well-positioned to benefit from the market’s current momentum and investor enthusiasm through each new discovery.

ESG strategy

Solaris Resources has a strong environmental, social and governance (ESG) strategy. This includes consultation with local communities and sustainable mining practices.

A project developed at just the right time

As the green energy transition gains momentum, copper is becoming an increasingly important component of sustainable infrastructure. Copper is also a critical component of many modern technologies, including renewable energy and electric vehicles.

While spot copper prices are all over the place due to larger market forces, the long-term trend remains strongly in place. As potentially one of the largest new projects of its kind, Warintza Project and Solaris Resources are ideally situated to capitalize.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

100% sustainable energy is the goal of environmentalists and lawmakers alike. However, a sticking point in achieving this goal is finding enough raw materials to create solar panels without damaging the environment. This is where Solaris Resources (TSX:SLS) (OTCQB:SLSSF) comes in. Solaris Resources is a copper mining company that specializes in finding and extracting copper, one of the key metals in the renewable energy transition, with minimal impact on the environment.

Solaris’ flagship Warintza project in Ecuador is operated according to the most stringent of ESG principles, without compromising the performance of the drill program. The company has just made its fourth discovery at the project of a broad porphyry deposit of at least 900m x 600 m and still open. This deposit is adjacent to and is not included in the Mineral Resource Estimate (MRE) from Warintza Central. The project is also set to be supplied by the Electric Corporation of Ecuador with low-cost, locally-sourced hydroelectric power.

Copper projects are set to power the increase in manufacturing for solar panels, however, new projects are scarce, and shortages threaten to drive up prices. Solaris Resources is working to alleviate this issue by mining copper in a way that is respectful of the environment. Those same shortages could even delay the transition to renewable energy.

Despite this, the growth in solar power has been exponential in recent years, with the market projected to grow by over a hundred billion dollars in the coming years.

Copper at the Crossroads

Renewable energy sources, such as solar and wind, rely on certain metals to create electrical currents. Copper is one of the key metals that is needed in large quantities to make these sources of energy work. Copper is one of the most important metals in this area, as it is not just critical to solar power but all of the energy infrastructure, putting it at an important crossroads.

The infrastructure that is needed to support renewable energy is also reliant on copper. Copper cables, for example, are essential for transmitting power from the solar panels to the places where it is needed. Copper is also used in batteries to store energy.

The material used to create solar panels is also important. Solar panels are made from a variety of materials, but the most common is polysilicon. Polysilicon is a type of plastic that is used to create solar panels. Polysilicon is made from a variety of materials, but the most common is silicon. Silicon is not suffering the same shortages as other minerals and metals.

The shortage of copper has also driven up the price of copper. If the price of copper continues to increase, it could delay the transition to renewable energy.

Mining Industry Scramble

Rising prices, tight markets, and environmental concerns have all contributed to the unprecedented scramble by the mining industry to bring new projects to production. The first way this is being done is through exploration. Exploration is when miners look for new deposits to extract copper from. This is an expensive and time-consuming process, so it is often only done when there is a good chance that a deposit will be profitable.

Another way that the mining industry is trying to bring new projects to production is by renegotiating contracts. When a company has a contract to produce copper, it may be able to renegotiate the contract to produce other materials as well. For example, a company may have a contract to produce copper, but if the price of copper increases, it may be able to renegotiate the contract to produce aluminum.

The mining industry is also trying to bring new projects to production faster by investing in new technologies. This is often done by investing in new mining equipment. For example, the mining industry is trying to bring new projects to production by investing in new hydraulic fracturing technology. hydraulic fracturing is a process that is used to break down rocks to extract minerals.

As the mining industry scrambles to bring new projects to production, it is important that the regulators are aware of these efforts and are able to provide the necessary permits and licenses. If the regulators are not aware of these efforts, it could lead to delays in the production of the new projects. Concerns in the United States that permitting laws are not changing fast enough to move in lockstep with growing investment in battery metal and copper mining projects also remain.

However, projects around the world, including the Warintza Project in southeastern Ecuador, are moving forward with a focus on sustainability and social responsibility. Solaris Resources is one of the few mining companies that have a long track record of operating according to the most stringent of ESG principles, without compromising the performance of its drill programs.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) has reported new assay results today from the first series of drill holes during follow-up drilling on the discovery of Warintza West. The results outline a new deposit that remains open in the Warintza cluster, just adjacent to the Mineral Resource Estimate (MRE) the company published in April 2022.

These follow-up holes fan out in all directions, outlining a broad porphyry deposit of at least 900m x 600m and still open and lies adjacent to and not included within the MRE. The company is focusing on targeting growth for the high-grade starter pit at Warintza Central and expanding the Warintza East discovery next while continuing the planned drilling at Warintza West. The Warintza Project is located in southeastern Ecuador, and Warintza West is the fourth and latest discovery at the project.

Highlights from the results are as follows:

Warintza West is one of four discoveries made to date within the Warintza porphyry cluster and is located 1km west of the Warintza Central Mineral Resource Estimate (“MRE”)¹ reported in April. The discovery was reported with the results of SLSW-01 (see press release dated February 16, 2021) – these follow-up holes fan out in all directions, outlining a broad porphyry deposit of at least 900m x 600m and still open and lies adjacent to and not included within the MRE. Follow-up drilling to test the further extent of the deposit is planned after priority drilling at Warintza Central aimed at expanding the starter pit and higher-grade resource expansion potential at Warintza East.

- SLSW-07 (drilled north) returned 686m of 0.46% CuEq¹ within a broader interval of 912m of 0.41% CuEq¹ from near surface

- SLSW-02 (drilled vertically) returned 246m of 0.47% CuEq¹ from near surface

- SLSW-09 (drilled west) returned 202m of 0.45% CuEq¹ within a broader interval of 444m of 0.36% CuEq¹ from near surface

- SLSW-08 (drilled northwest) returned 78m of 0.56% CuEq¹ within a broader interval of 812m of 0.32% CuEq¹ from near surface

- SLSW-04 (drilled northeast) returned 264m of 0.44% CuEq¹ from near surface

- SLSW-10 (drilled southwest) returned 220m of 0.41% CuEq¹ from near surface

- SLSW-03 (drilled southeast) returned 102m of 0.39% CuEq¹ within a broader interval of 911m of 0.24% CuEq¹ from near surface

- SLSW-05 (drilled northeast) returned 272m of 0.38% CuEq¹ within a broader interval of 570m of 0.30% CuEq¹ from near surface

- SLSW-06 (drilled east) returned 732m of 0.32% CuEq¹ from near surface

- Drilling at Warintza West confirms the interpretation of a broad porphyry deposit that remains open in all directions, with assays pending from a series of three additional holes testing the zone further to the west, east and south

- Step-out drilling is planned targeting high-grade surface sampling

Figure 1 – Plan View of Warintza West Drilling Released to Date

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLSW-10 | 24 | 244 | 220 | 0.36 | 0.01 | 0.02 | 0.41 | |

| SLSW-09 | 24 | 468 | 444 | 0.31 | 0.01 | 0.03 | 0.36 | |

| Including | 24 | 226 | 202 | 0.41 | 0.01 | 0.03 | 0.45 | |

| SLSW-08 | 32 | 844 | 812 | 0.26 | 0.01 | 0.02 | 0.32 | |

| Including | 32 | 110 | 78 | 0.51 | 0.01 | 0.02 | 0.56 | |

| SLSW-07 | 24 | 936 | 912 | 0.32 | 0.02 | 0.03 | 0.41 | |

| Including | Oct 13, 2022 | 30 | 716 | 686 | 0.37 | 0.02 | 0.03 | 0.46 |

| SLSW-06 | 34 | 766 | 732 | 0.25 | 0.01 | 0.02 | 0.32 | |

| SLSW-05 | 34 | 604 | 570 | 0.23 | 0.01 | 0.02 | 0.30 | |

| Including | 34 | 306 | 272 | 0.31 | 0.01 | 0.02 | 0.38 | |

| SLSW-04 | 38 | 302 | 264 | 0.36 | 0.02 | 0.03 | 0.44 | |

| SLSW-03 | 38 | 949 | 911 | 0.19 | 0.01 | 0.02 | 0.24 | |

| Including | 40 | 142 | 102 | 0.33 | 0.01 | 0.03 | 0.39 | |

| SLSW-02 | 24 | 270 | 246 | 0.38 | 0.02 | 0.02 | 0.47 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSW-10 | 798507 | 9648465 | 1519 | 713 | 238 | -51.25 |

| SLSW-09 | 798507 | 9648465 | 1519 | 767 | 260 | -60.31 |

| SLSW-08 | 798507 | 9648465 | 1519 | 974 | 295 | -60.50 |

| SLSW-07 | 798507 | 9648465 | 1519 | 945 | 352 | -70.56 |

| SLSW-06 | 798507 | 9648465 | 1519 | 767 | 70 | -70.72 |

| SLSW-05 | 798507 | 9648465 | 1519 | 807 | 45 | -60.73 |

| SLSW-04 | 798507 | 9648465 | 1519 | 455 | 22 | -60.89 |

| SLSW-03 | 798507 | 9648465 | 1519 | 949 | 140 | -55.50 |

| SLSW-02 | 798507 | 9648465 | 1519 | 1227 | 0 | -90.00 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Refer to Solaris’ press release dated April 18, 2022 and technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The global demand for minerals has placed a spotlight on the need for a stronger industrial base, one that includes more domestic production and processing of metals that are critical for a modern society. Energy security is strongly linked to mining, as minerals are essential ingredients in the production of energy technologies. Despite the critical role of minerals in securing economic futures and the protection of our planet, the U.S. continues to delay many high-value mining projects while deepening import dependence on the materials they provide.

Current energy disruptions have made it even more clear that a mineral and metals supply chain that relies heavily on a handful of countries can make the whole chain weak. Since Russia’s invasion of Ukraine, the U.S. and EU have looked for ways to reduce their dependence on Russian natural gas. One promising solution is to develop shale gas resources in the United States, which would help create jobs and reduce greenhouse gas emissions. However, this process requires large amounts of minerals, such as sand, clay, and limestone – all of which are in short supply.

Copper is another tight market being squeezed due to other supply chain issues that were exacerbated during the COVID-19 pandemic. New projects are in short supply, so companies are often eager to acquire new high-grade copper projects when they become available. The Warintza Project in southeastern Ecuador is operated by Solaris Resources (TSX:SLS) a junior mining company that is currently advancing the project towards production.

The Warintza Project has the potential to fill some of the gaps in the current copper market. The project is expected to produce approximately 100 million pounds of copper per year, making it one of the largest copper mines in Ecuador. In addition, the Warintza Project has been called a potential “super pit”, and has released a mineral resource estimate for a significant ‘Indicative Starter Pit’. The company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) at the time. Most recently, Solaris reported assay results from a series of holes aimed at growing the Northeast Extension of the ‘Indicative Starter Pit’.

Copper is another area the United States and many other countries are looking to lower import dependence. Companies like Tesla, a large consumer of copper for car and battery technology, have been vocal about their desire to source minerals from North America. The Warintza Project could play a role in meeting this demand, as it is located in an area with good infrastructure and a skilled workforce.

The vulnerability of the energy industry has accelerated the calls for renewable energy sources that would reduce or eliminate the dependence on oil and gas from other countries. To bolster domestic supply, it will require projects like the Warintza Project to fill the demand that continues to grow faster than supply. Junior mining companies will play a larger role in a future of energy security than ever before.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As the world becomes increasingly digitized and reliant on technology, the demand for copper continues to grow. Copper is used in everything from smartphones to power grids, and the mining and production of this valuable metal has a significant environmental impact. However, thanks to recent innovations in mining and production technology, we may be able to meet this growing demand without harming the environment.

Companies engaged in copper exploration are currently leading the charge toward a greener future for the industry. One such company is Rio Tinto, which has been working on developing a new method of extracting copper from ore that doesn’t require smelting. Smelting is a process that releases harmful greenhouse gases into the atmosphere, so eliminating it would be a major step forward in terms of reducing the environmental impact of copper mining.

Another great example is Solaris Resources (TSX:SLS) which has signed a Memorandum of Understanding with Electric Corporation of Ecuador (“CELEC EP”) to supply low-cost, locally sourced hydroelectric power to the Warintza Project (“Warintza” or “the Project”) in southeastern Ecuador.

CELEC EP will source hydroelectric power from the National Transmission System in Ecuador to provide primary power required for the Warintza Project. This initiative is consistent with the “Ecuador Zero Carbon Program” developed by the Ministry of Environment, Water and Ecological Transition and Solaris was the first mining signatory of September 2021.

Solaris wants to make the most of this efficient, renewable, and cheap energy source by investigating how to electrify infrastructure like mobile mining equipment (e.g., drills, trucks), goods transportation (including gravity-assisted solutions), and processing and pumping systems.

Daniel Earle, President & CEO, commented in a press release: “The MOU with CELEC supports our vision to study the potential for electrified operations that maximize the structural benefits of the Warintza Project within an infrastructure-rich mining district with the aim of lowering costs, increasing efficiencies, reducing emissions, and broadly positioning the Project as a leading development opportunity across a range of financial and ESG metrics in the industry.”

Supplying power for the infrastructure and mining activities at Warintza with renewable energy will help to offset the environmental impact of the project, and could set a precedent for other mines in the area.

Other companies have also looked at switching transportation to a net-zero emissions model, in which electric vehicles are powered by renewable energy sources. This would not only reduce emissions from the mining process itself, but also from the transportation of copper ore to processing plants.

Considering copper is one of the key elements powering the transition to renewable energy, it’s encouraging to see the exploration and production industry working hard to reduce its environmental impact. With continued research and development, companies like Solaris Resources are driving the mission toward net-zero forward faster than ever.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

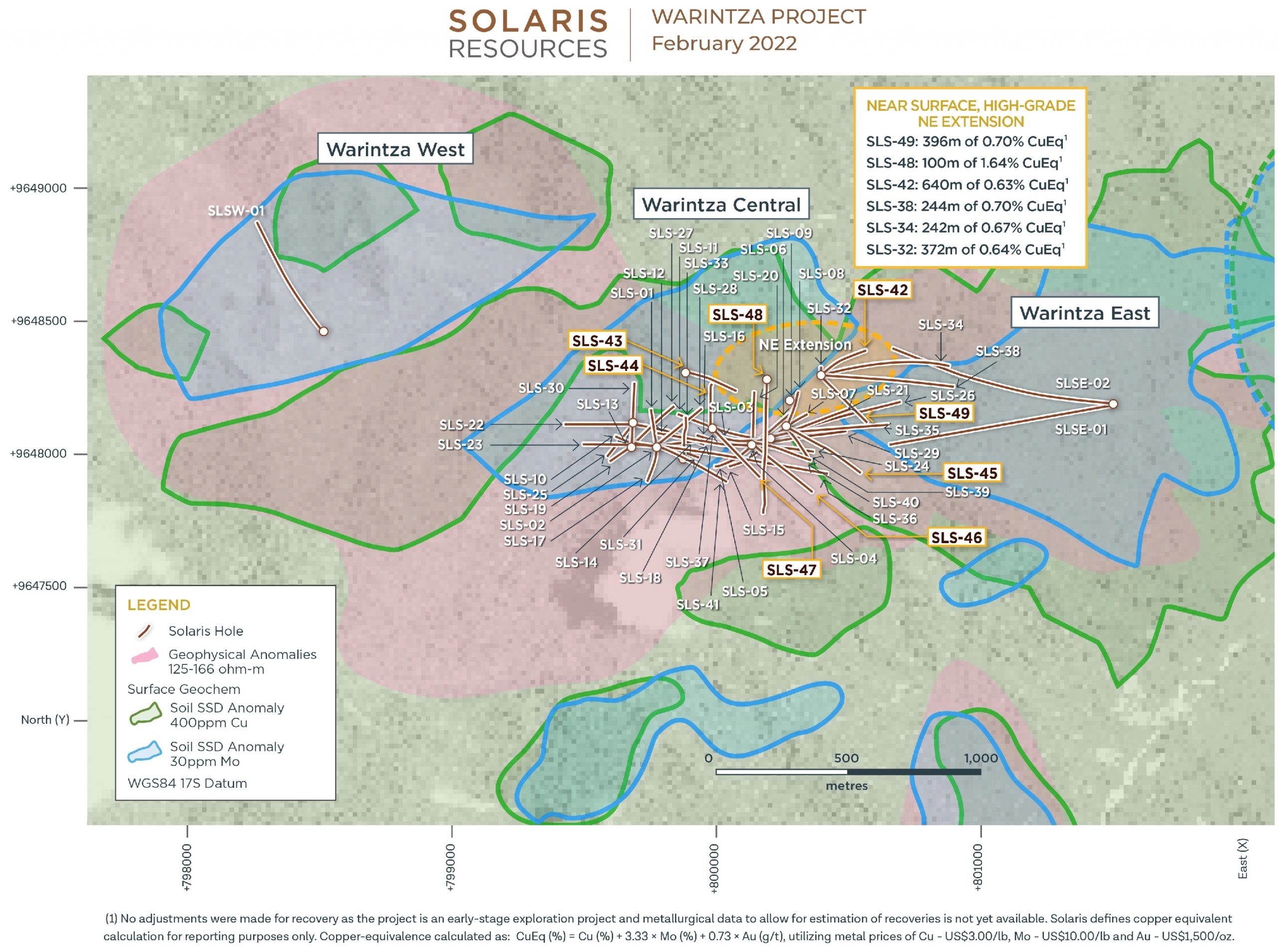

Solaris Resources (TSX:SLS) has reported new assay results from a series of holes at the Warintza Project in southeastern Ecuador. The holes are aimed at growing the Northeast Extension of the previously announced “Indicative Starter Pit”. The company is moving forward with drilling platforms in the Northeast Extention that are set to drive the latest high-grade results from the project.

Mr. Jorge Fierro, Vice President of Exploration, commented in a press release: “Drilling from existing and recently-completed platforms in the Northeast Extension zone is a key driver in the expansion of the ‘Indicative Starter Pit’, and we look forward to reporting the next set of results in the near future as the backlog of assays pending is now resolved.”

The “Indicative Starter Pit” was noted in an April 18, 2022 announcement from the company in a mineral resource estimate for the Warintza Central Deposit, in which the company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) for the “Indicative Starter Pit”.

Solaris also intends to spin out its non-core assets in Ecuador outside of the Warintza porphyry cluster, Peru, Chile, and Mexico into a new incorporated wholly-owned subsidiary of Solaris named Solaris Exploration Inc. Following the internal re-organization, it is expected that 100% of the common shares of Solaris Exploration Inc. will be spun out to shareholders of Solaris relative to their shareholdings.

Figure 1 – Plan View of Warintza Central Drilling Released to Date

Highlights from the results are as follows:

Additional drilling has expanded the Northeast Extension of the ‘Indicative Starter Pit’ recently estimated at 180 Mt at 0.82% CuEq¹ (Indicated) and 107 Mt at 0.73% CuEq¹ (Inferred) within the Warintza Mineral Resource Estimate² (“MRE”). This zone is characterized by near surface, high-grade mineralization and remains open for further growth with follow-up drilling underway.

- SLS-66 was collared on a platform at the northeastern limit of the Warintza Central grid and drilled southwest into an open volume, returning 124m of 0.82% CuEq¹ within a broader interval of 622m of 0.42% CuEq¹ starting from surface

- SLS-66 follows from previous holes SLS-63 and SLS-54, which were drilled from the same pad to the north and southeast and respectively returned high-grade intervals of 230m of 1.02% CuEq¹ and 356m of 0.73% CuEq³ within broader intervals (refer to press releases dated Jul 20, 2022 and Apr 4, 2022 for details)

- SLS-64 was collared on a platform at the northern limit of Warintza Central and drilled north-northeast into an open volume, returning 110m of 0.54% CuEq¹ from near surface within a broader interval of 440m of 0.48% CuEq¹, extending and broadening the zone to the north in this area

- SLS-64 follows from previous holes SLS-62 and SLS-48, which were drilled from the same pad to the northeast and south and respectively returned high-grade intervals of 168m of 0.68% CuEq¹ and 100m of 1.64% CuEq³ within broader intervals (refer to press releases dated Jul 20, 2022 and Feb 28, 2022 for details)

- SLS-65, which is a step out hole from a new platform 200m to the north, has now been completed after operational delays with adjustments to the platform for drilling and assays are expected within the next four weeks

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-66 | Sep 07, 2022 | 0 | 622 | 622 | 0.32 | 0.02 | 0.05 | 0.42 |

| Including | 66 | 190 | 124 | 0.71 | 0.02 | 0.09 | 0.82 | |

| SLS-64 | 78 | 518 | 440 | 0.32 | 0.04 | 0.04 | 0.48 | |

| Including | 78 | 188 | 110 | 0.38 | 0.04 | 0.03 | 0.54 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-66 | 800383 | 9648303 | 1412 | 689 | 255 | -48 |

| SLS-64 | 800178 | 9648285 | 1439 | 571 | 26 | -66 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

- Refer to Solaris’ technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of US$3.00/lb Cu, US$10.00/lb Mo, and US$1,500/oz Au. No adjustments were made for recovery prior to the updated Warintza Mineral Resource Estimate, as the metallurgical data to allow for estimation of recoveries was not yet available. Solaris defined CuEq for reporting purposes only.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has announced this morning new assay results from a series of holes aimed at growing the Northeast Extension of the “Indicative Starter pit” at the Warintza Project. The “Indicative Starter Pit” was noted in an April 18, 2022 announcement from the company in a mineral resource estimate for the Warintza Central Deposit, in which the company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) for the “Indicative Starter Pit”. The company has been targeting high-grade extensions and major growth in cluster at the project, with ongoing drilling focused on open extensions of near surface, high-grade mineralization to the northeast and southeast of Warintza Central.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “Ongoing drilling from existing and newly constructed platforms aims to expand on the Northeast Extension zone, which is one of the key target areas for the expansion of the ‘Indicative Starter Pit,’ along with higher grade, near surface mineralization being targeted at Warintza East, where results are pending.”

Highlights from the results are as follows:

Additional drilling has expanded the Northeast Extension of the ‘Indicative Starter Pit’ recently estimated at 180 Mt at 0.82% CuEq1 (Indicated) and 107 Mt at 0.73% CuEq1 (Inferred) within the Warintza Mineral Resource Estimate² (“MRE”). This zone is characterized by near surface, high-grade mineralization and remains open for further growth with follow-up and step-out drilling underway.

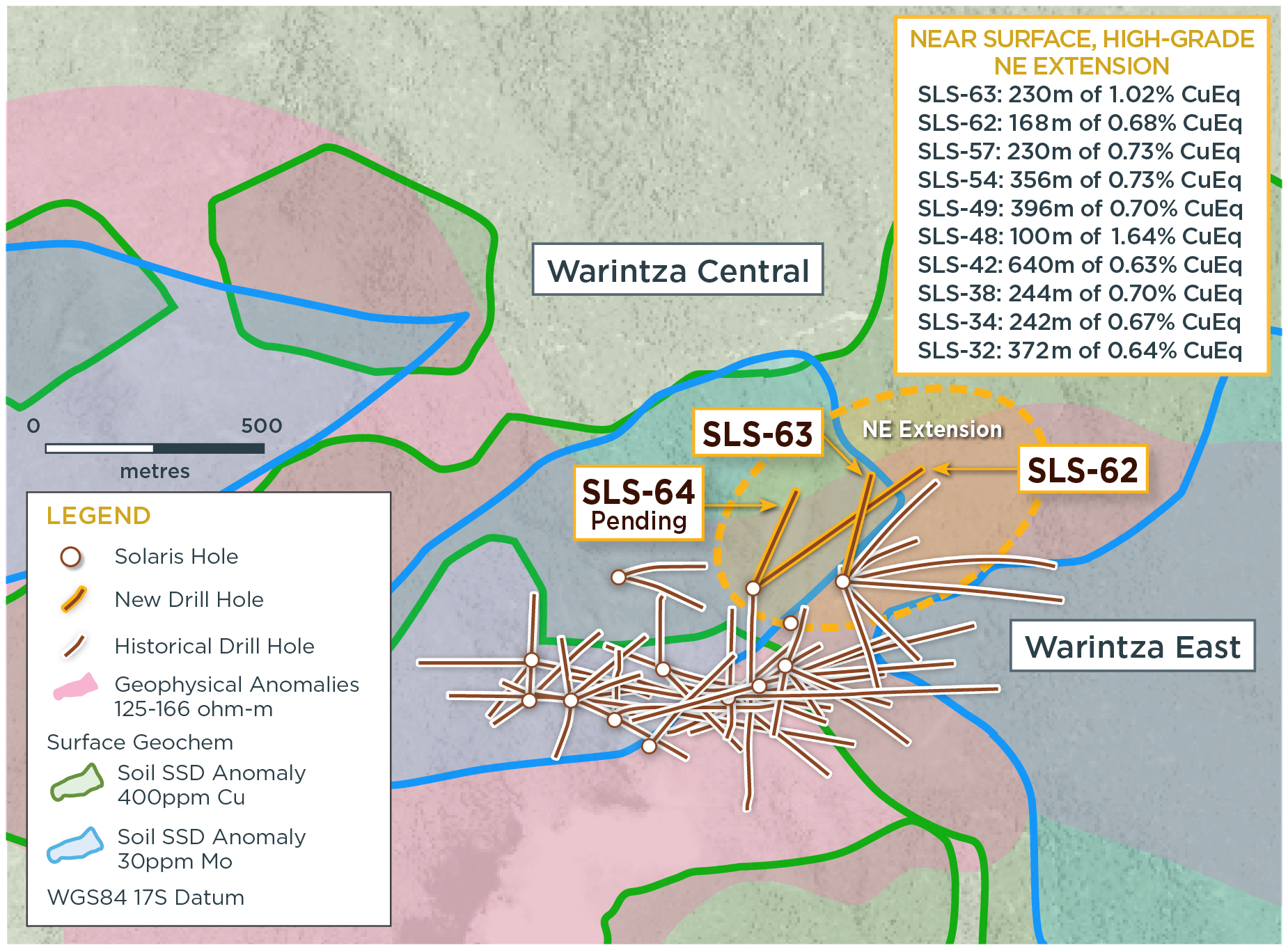

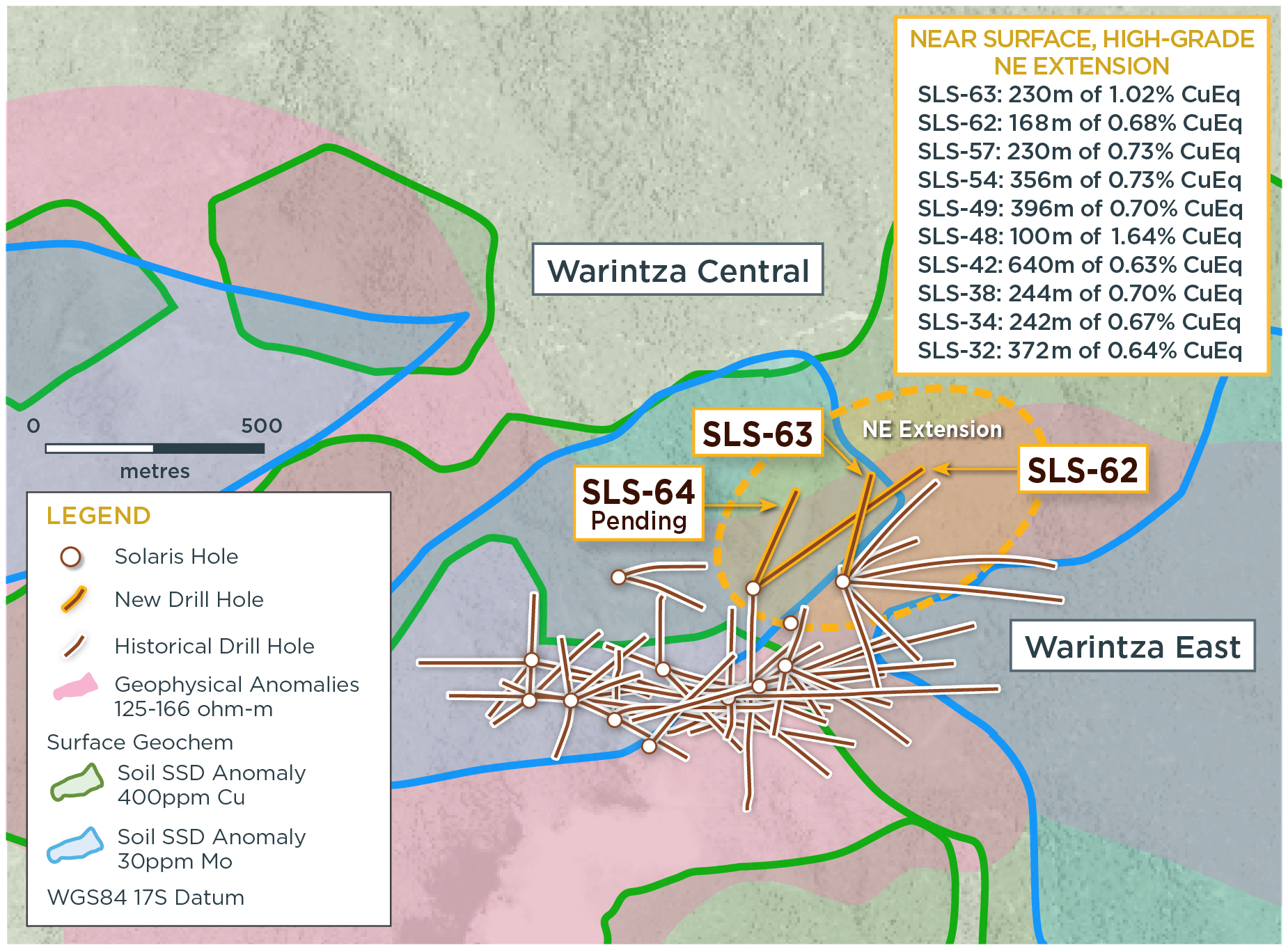

- SLS-62 was collared at the northern limit of Warintza Central and drilled northeast into an open volume, returning 168m of 0.68% CuEq¹ from 102m depth within a broader interval of 900m of 0.45% CuEq¹ from surface, expanding on prior drilling further to the east

- This hole represents the first follow-up to SLS-48, collared from the same pad but drilled to the south, which returned 100m of 1.64% CuEq³ from 50m depth within a broader interval of 852m of 0.56% CuEq³ (refer to press release dated Feb 28, 2022)

- SLS-63 was collared at the northeastern limit of the Warintza Central grid approximately 200m to the east and drilled into an open volume to the north-northeast, returning 230m of 1.02% CuEq¹ from 118m depth within a broader interval of 472m of 0.76% CuEq¹ from surface

- This hole follows on SLS-57, which was drilled northeast from the same pad, returning 230m of 0.73% CuEq¹ from 56m depth within a broader interval of 926m of 0.61% CuEq¹ from surface and SLS-54, drilled to the south and returning 356m of 0.73% CuEq³ from 50m depth within a broader interval of 1,093m of 0.56% CuEq³ from surface (refer to press releases dated May 26 and Apr 4, 2022)