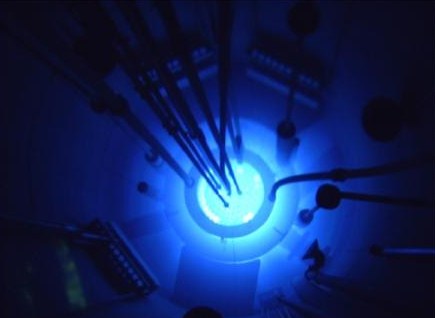

Under the terms of the 1993 government-to-government nuclear non-proliferation agreement, the United States and Russia agreed to commercially implement a 20 year program to convert 500 metric tons of HEU (uranium 235 enriched to 90 percent) taken from Soviet era warheads, into LEU, low enriched uranium (less than 5 percent uranium 235). This initiative was named the Megatons to Megawatts program.

To date 463.5 metric tons of bomb-grade HEU have been recycled into 13,345 metric tons of LEU – enough material to produce fuel to power the entire United States for about two years.

Overall, the blending down of 500 tonnes of Russian weapons HEU will result in about 15,000 tonnes of LEU over the 20 year lifespan of the program. This is equivalent to about 152,000 tonnes of natural U, or just over one year’s global demand.

The Megatons to Megawatts Program was supplying roughly 50% of the US’s LEU demand. Mining accounted for eight percent with the rest coming from other sources (rapidly depleting utility and government stockpiles).

Currently, the electricity for 1 in 10 American homes, businesses, schools and hospitals is generated by Megatons to Megawatts fuel.

The U.S. has 104 nuclear reactors operating, this is the largest fleet of nuclear reactors in the world making the U.S. the world’s largest uranium market. In 2011 the US nuclear reactor fleet required 55 million pounds of uranium.

The mined supply of uranium in the U.S., in 2011, was about four million pounds.

US Uranium Facts & Figures – as published May 2012

2011 Domestic Uranium Production Report’ by the U.S. Energy Information Administration (EIA):

- Total uranium drilling in 2011 was 10,597 holes covering 6.3 million feet, 47 percent more holes than in 2010;

- Expenditures for uranium drilling in the United States for 2011 were $54 million in 2011, an increase of 20 percent compared with 2010;

- U.S. uranium mines produced 4.1 million pounds U3O8 in 2011, 3 percent less than in 2010;

- Total production of U.S. uranium concentrate in 2011 was 4.0 million pounds U3O8, 6 percent less than in 2010;

- Total shipments of uranium concentrate from U.S. mill and ISL plants were 4.0 million pounds U3O8 in 2011, 22 percent less than in 2010;

- U.S. producers sold 2.9 million pounds U3O8 of uranium concentrate in 2011 at a weighted-average price of $52.36 per pound U3O8.

World Uranium Market

According to a recent report from the International Atomic Energy Agency (IAEA) and the Organization for Economic Cooperation and Development (OECD), by the year 2035:

“World nuclear electricity generating capacity is projected to grow from 375 GWe net (at the end of 2010) to between 540 GWe net in the low demand case and 746 GWe net in the high demand case, increases of 44% and 99% respectively.

Accordingly, world annual reactor-related uranium requirements are projected to rise from 63,875 tonnes of uranium metal (tU) at the end of 2010 to between 98,000 tU and 136,000 tU by 2035. The currently defined uranium resource base is more than adequate to meet high-case requirements through 2035 and well into the foreseeable future.

Although ample resources are available, meeting projected demand will require timely investments in uranium production facilities. This is because of the long lead times (typically in the order of ten years or more in most producing countries) required to develop production facilities that can turn resources into refined uranium ready for nuclear fuel production.”

Conclusion

Make no mistake; there is no shortage of uranium in the ground. What is in short supply is mined uranium.

It’s obvious, that starting very soon, and continuing for at least a decade (the time needed to develop, permit and construct a uranium mine), there is going to be a significant shortfall of uranium supply. Where is the US, and the rest of the world, going to source its needed uranium from?

Perhaps the most relevant questions for investors in the junior resource space are who is going to, in the very short term, commence production? And, who is positioned to help fill the looming supply gap?

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.