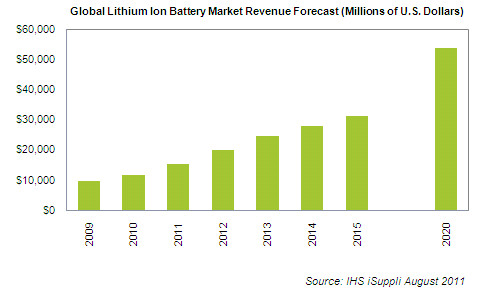

Lithium Ion batteries aren’t just for cars and mobile computing. For months, I highlighted the growing use of lithium-ion batteries for energy storage solutions. Tesla Motors (TSLA) known for making top notch electric cars is making a major move into building battery systems aimed at residences, commercial buildings and for power companies.

These batteries could provide the answer for intermittent energy sources like sun or wind which is dependent on the weather. Solar or wind is great but what happens when the sun goes down or the wind isn’t blowing. Tesla believes they can provide the solution through rechargeable lithium ion batteries that can be placed in homes or businesses storing energy and providing stability for intermittent renewable sources. Tesla has spent millions of dollars in battery research for their electric cars, now management believes that they can use that technology outside of the automobile sector.

Last night, Tesla announced the Powerwall, derived from the batteries used in the Model S car that can be bought for $3,500. The batteries are connected from one’s residence to Tesla through the web in case power goes out.

Tesla is showing the world that their ambitious battery technology research could be disruptive across many sectors including the auto and energy space. Tesla Motors could be soon known as Tesla Solutions, not only disrupting the car industry but completely changing homes, businesses and utilities.

Many investors ask me have they missed the boat when it comes to the battery sector. I believe the market is still in its stage of infancy and should ramp up quickly once the $5 billion battery plant aka “GigaFactory”, is built near Reno, Nevada. Below is a recent photo of the beginning of the construction in the middle of the Nevada desert.

Tesla believes that this large factory could bring down the cost of the lithium ion battery packs to make it more affordable for the average consumer. Its hard to compete with Tesla (TSLA) and that is why it is such a high price stock. So where does the real opportunity lie? The real question is where will the raw material needed for these Tesla batteries come from? Does Tesla have any off-take arrangements yet?

To my knowledge I have not heard any deals between the giant Tesla company and the small junior lithium and graphite miners trading at miniscule valuations. I expect that to change in the near term as junior lithium and graphite companies receive capital for development from deep pocketed end users such as Tesla and Samsung.

Major investment interest for the junior lithium and graphite miners as battery makers look to secure supply of the raw materials needed to make a battery work. Demand could double over the next decade for these batteries. What junior lithium and graphite miners should you consider?

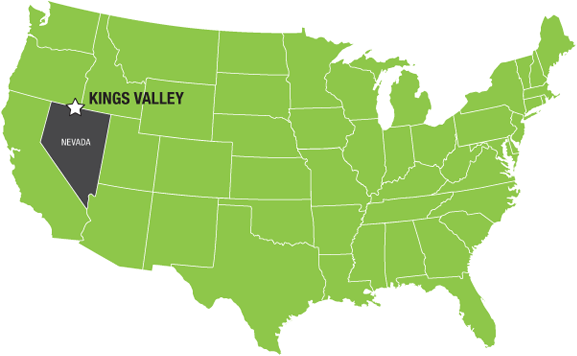

In the lithium sector, my only holding over the past couple of years has been Western Lithium. For years I have told you that Western Lithium (WLC.TO or WLCDF) could be the major source of lithium for the electric batteries used in cars and smart grids. Western Lithium owns the Kings Valley Lithium Deposit in northern Nevada which is one of the largest assets in the world of this critical resource.

Western Lithium recently released an important development on the lithium processing. They produced 99.8% high quality lithium carbonate in the first trial run at its demonstration plant. This could cause major interest from potential strategic partners who have already expressed interest to partner with the company to accelerate development of the asset. These end users need a domestic and secure supply.

Western Lithium’s CEO Jay Chmelauskas said, “…The lithium market now appears ready for Western Lithium to accelerate the development of its Nevada lithium deposit as a new major supply source. Nevada is emerging as the world’s largest lithium battery manufacturing center and provides potential synergies for Western Lithium to establish its business locally and to become integrated with the global battery supply chain.”

See the full news release on the lithium carbonate produced at their demo plant by clicking here…

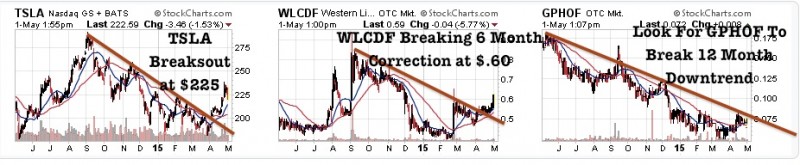

The chart on Western Lithium is excellent over the past two years and appears to be forming a classic bullish flag. Another round of accumulation like we saw in 2014 could be on the agenda. The base is almost one year in the making. The stock is just beginning to come off the bottom of the flag and breaking over the 200 day moving average. Look for a golden crossover of the 50 and 200 day moving average to confirm the next move higher. The recent breakout at $.60 could mean the consolidation over the past six months is over.

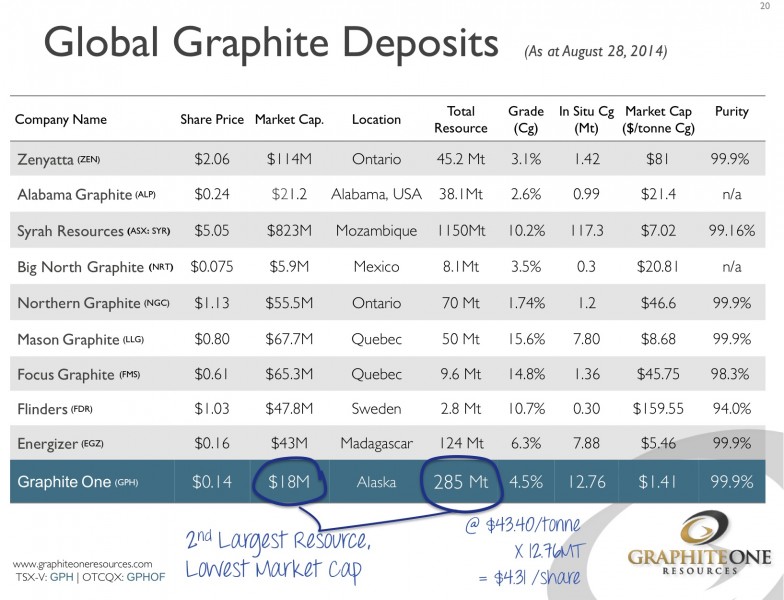

In graphite, I have been accumulating Graphite One (GPH.V or GPHOF) who owns the largest published graphite resource in the United States.

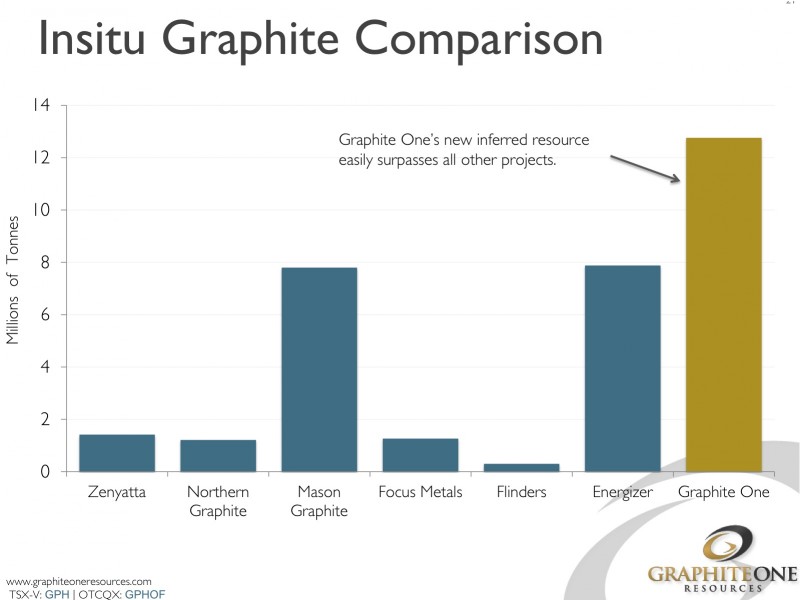

Watch Graphite One (GPH.V or GPHOF) in Alaska who just released an updated mineral resource estimate of an indicated 17.95 million tonnes of 6.3% graphitic carbon (Cg) and 154.36 Million tonnes of 5.7% Cg. This news makes Graphite One the largest published graphite resource in the United States. The grade improved considerably and so did the indicated resource. There is high grade graphite at the surface and the deposit remains open. Graphite One is planning to use this resource to publish a maiden NI 43-101 Preliminary Economic Assessment on the Graphite Creek Deposit. See the full resource estimate news release byclicking here.

I became interested in their Graphite Creek Project near Nome, Alaska. Alaska is financially supportive of mining and with the case in other junior developers has pledged to finance the infrastructure capital expenses.

Investors can purchase Graphite One near all time lows and get it near the cheapest prices to date. They have put a lot of work into potentially one of the biggest large flake graphite deposits in North America which is amenable to low cost open pit scenarios. Look for a breakout above the downtrend on GPHOF at $.08.

Graphite One just announced that they received a report on the distinguishing features of their large flake graphite which could have a positive impact on the upcoming PEA. Significant research will need to be followed up to confirm these findings on the graphite which included that “naturally occurring graphite in the shape of spheres and close to the size ranges of interest for lithium ion battery-grade graphite was seen in all drill-hole concentrate samples…As this may impact the strategic direction of the Company, Graphite One is now assessing the Stage B Report to determine the next steps in incorporating the results into the PEA.” See the full news release on these findings by clicking here…

Graphite One may be undervalued as it owns the 2nd largest resource in its peer group yet has a ridiculously low market cap located in the US which sources all of its graphite supplies from foreigners.

In conclusion, Tesla (TSLA) is building a $5 billion battery factory in Nevada as they see huge growth. They must secure the raw materials specifically lithium and graphite. Undervalued mining equities may soon see injections of capital for secured off-take of the materials in the near term.

Disclosure: I own Western Lithium and Graphite One. Graphite One is a current website sponsor, Western Lithium was a website sponsor. Please do your own due diligence as conflicts of interest apply. This is not a recommendation to buy or sell any securities.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.