This is set to be a big week for mining earnings, as some of the world’s biggest mining companies will begin to show the market exactly how much this commodity boom is helping. This week will see the top five western diversified mining companies report earnings, and investors should be watching for record profits that could drive dividend payouts to match.

Analysts estimates show that the top five miners may have raked in a combined $85 billion in the first half of 2021, double the number from 2020. Of course, lockdowns and supply chain meltdowns had serious effects on earnings last year. As processes slowed to a halt and demand dropped off a cliff, mining companies mainly were sitting on their hands like the rest of the economy.

However, the latter part of 2020 saw engines start up and restrictions lifted in many mining-friendly jurisdictions, and 2021 has accelerated the commodity price gains from last year.

The first to report on Wednesday will be Rio Tinto Group and is expected to announce $22 billion in profits for the first half of the year, equalling the same amount as its total profits in 2020.

Other companies such as Glencore, Anglo American, and Vale SA were also expected to post massive profits for the first six months of 2021, and possibly their highest-ever numbers for the six months to June period, according to estimates from analysts compiled by Bloomberg.

The sector has seen a revival of its activities faster than most other sectors of the economy as the industry has been one of the primary beneficiaries of the recovery stimulus injected into the global economy. With trillions of dollars in recovery packages going out, demand for commodities has bounced off 2020 lows to skyrockets higher every single month. Demand for commodities like iron ore, aluminum, steel, and copper are driving prices higher every week while inflation pressures continue to spread through the economy.

This bull run for commodities has been a huge gift for mining companies who have the tailwind of demand and higher prices for their production to account for big profits.

Ben Davis, an analyst at Liberum Capital, said, “This should be a pretty much stellar set of results all round. We’re expecting record dividends from BHP and Rio, while Anglo and Glencore also have the potential to surprise.”

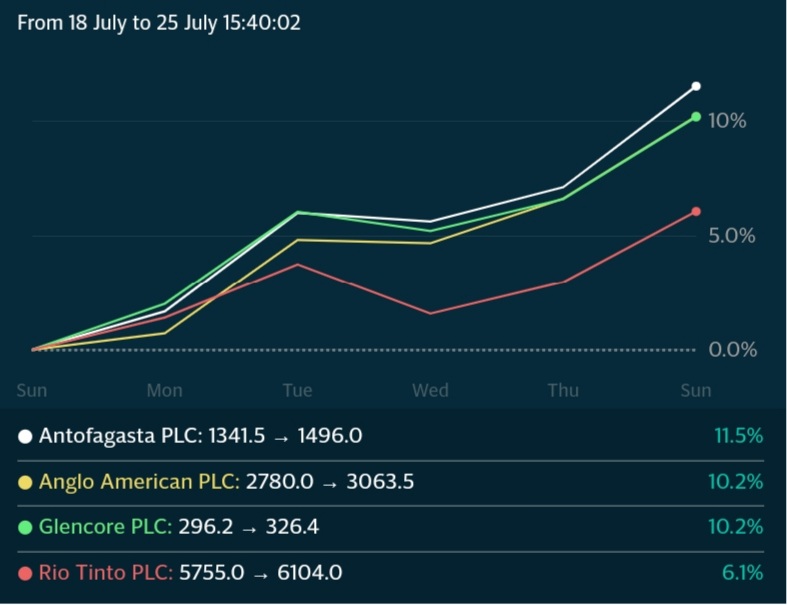

Stocks have been on a tear lately, up double digits in some cases in a single week, so there may be room to move higher on earnings news. Freeport-McMoRan already hinted at its blockbuster results when it announced it had wiped out $5 billion in debt over the last 12 months, blasting past a target month ahead of the planned schedule.

A record dividend was also paid out by Anglo American Platinum Ltd. (79% owned by Anglo American) on Monday of $3.1 billion, equal to 100% of first-half headline earnings. In a significant understatement, CEO Natascha Voljoes said the company was in a “strong financial position” and that the company was able to deliver “industry-leading returns.”

Everyone is set to benefit from higher profits from miners this year, beyond stakeholders and investors in the companies themselves. Government should also see higher tax receipts from miners, who contribute significantly to the global economy and often up to a third of any given domestic economy in many regions like South and Central America, and Africa.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.