By now, most readers invested in the Lithium (“Li“) sector know about brine deposits, especially those located in South America’s “Lithium Triangle” (Chile, Argentina & Bolivia). And, many are familiar with conventional hard rock mining for Li, most of which takes place in western Australia.

However, readers likely know very little about a third source of potential Li supply; from claystone deposits. One small company betting on a technology solution to unlock its mineral wealth is Cypress Development Corp. (TSX-V: CYP) / (OTCBB: CYDVF). 49.5 M shares outstanding @ C$0.185 = C$ 9 M market cap. C$1.5 M in cash.

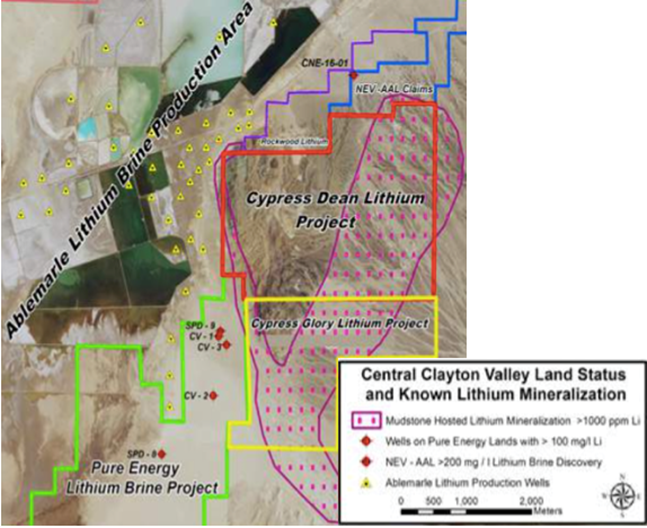

Cypress controls 100% of the contiguous Dean and Glory claim blocks covering an area totaling 4,220 acres in Clayton Valley, Nevada, immediately east of Albemarle’s Silver Peak Li operations and Pure Energy Minerals’ project (PEA-stage, C$330 M after-tax NPV(8%) on its southwest boundary. Management believes that the consistent nature of the currently known Li mineralization is highly encouraging for both the potential size and potential resource extraction methodologies. (see corporate presentation, but please return!)

To date, all of Cypress’ drilling has been on the Dean property where a 9-hole drill program was completed earlier this year. But, a recent press release explains that Cypress plans to drill 12 holes totaling 4,000 feet. The 2017 fall program will be divided between the Dean and Glory projects…. Upcoming drill results represent an important near-term catalyst for the company.

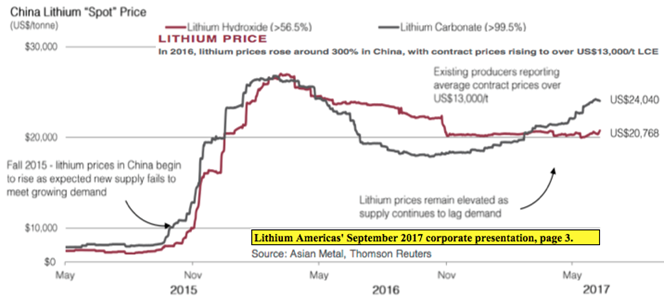

Li Prices up 200% — a Game Changer For Unconventional Li Deposits

What readers have probably heard about what I call “unconventional Li deposits” (i.e. not brine or hard rock) is true, there’s currently no meaningful commercial-scale production from claystone deposits anywhere in the world. However, it’s very important to recognize one crucial observation…. Li prices have roughly tripled in just the past 2 years. In fact, spot prices in China have quadrupled, (see chart below) currently perched above US$ 20k/metric tonne, at or near all-time highs.

Today’s very strong Li prices are a game changer, greatly incentivizing the world to invent a better mousetrap. The exciting thing in my view is that more and more mousetraps are being built and tested. Not just methods to extract Li from claystone, but dozens of Li brine processing technologies, some of which could be amenable to unconventional Li deposits.

Simply put, if or when a commercial technology or technologies to exploit unconventional Li deposits is developed, the value of claystone properties such as those held by Cypress could soar.

We’ve seen this movie before…. Consider the oil shale industry 10-15 years ago when the benefits of horizontal drilling were first becoming known. Speculators started grabbing acres surrounding known fracking hotspots, (not knowing how much, if any, hydrocarbon abundance was in place) initially paying $100-$200/acre. Within a few years, the best located acres were trading at $10,000-$20,000/acre.

Unlike outright speculation on oil shale, in Cypress’ case we already know there’s Li in the ground, possibly high-grade compared to brine deposits, possibly large tonnage compared to hard rock deposits. What we don’t know yet is if it’s technically and environmentally feasible to separate the Li from the clay, mud and other materials and profitably sell it. So, again, that’s the primary risk of investing in Cypress Development Corp. A big risk, but a known risk that can be weighed against other risks that Li juniors face.

There is another notable risk factor. Access to water in Nevada is extremely important. In Clayton Valley, and many other arid parts of the State, it can be very difficult to obtain water rights. However, Cypress might not have the same risk exposure as peers looking to exploit traditional brine resources. The Company does not propose to tap Li-saturated brine that a neighboring party could claim to own or control.

Cypress will need access to process water, not the minerals (lithium/boron/potassium) in the water– a big difference. And, the amount of water required would presumably be far less (and probably recyclable) because Cypress would not be filling giant solar evaporation ponds like Albemarle’s nearby Silver Peak processing facilities.

Neighbor Lithium Americas’ Delivering New PFS in Mid-2018…

So, how close is the industry to solving these complex technical & environmental challenges of commercial extraction of Li from claystone deposits? In my opinion, closer than many might guess, but with the important caveat that each deposit is unique. For example, Lithium Americas (TSX: LAC) / (OTCQX: LACDF) has a clay deposit, the Lithium Nevada project, (formerly Kings Valley) that was actively explored, developed and promoted in 2009-2013, when the company was called Western Lithium USA Corp.

A Preliminary Feasibility Study (“PFS“) on Kings Valley was completed in 2012, and a pilot plant running Kings Valley ore operated successfully in Germany for years. A substantial amount of effort and capital was deployed, but with a Li price in the US$5,000/t area, LAC decided not to pursue the project. Fast forward to 2017, LAC is developing a new production flow sheet that will incorporate a number of operational improvements, but by far the biggest enhancement to the project’s actual economics will be a much higher long-term Li price assumption.

As I write this, LAC just committed to delivering a brand new PFS by June 30, 2018, and commented,

“While proprietary, much of our work relies on the application of commercially available solutions that could be deployed quickly and reliably.” Also, according to LAC management, “…the Lithium Nevada Project’s Li clay resource is the largest known lithium resource in the U.S.”

This suggests, in my opinion, that LAC will be putting out a PFS next year that contains a Net Present Value (“NPV”) in the hundreds of millions of U.S. dollars. The market will take notice, and since LAC’s market cap is currently ~C$ 1 billion (due almost entirely to the company’s JV with SQM on a world-class Li brine project in Argentina), LAC should meet with success in attracting global battery & car manufacturers, among others, to the table to talk about strategic investments and off-take agreements.

Will Global Geoscience & Bacanora Prove Clay Deposits Economic?

Bacanora Minerals (TSX-V: BCN) has done a tremendous amount of work on unconventional Li deposits. In its case, in Mexico, on the Sonora Lithium clay deposit. Management is close to delivering a Bank Feasibility Study (“BFS“). Bacanora has been operating a pilot plant for over 2 years and reportedly has the kinks worked out. Japanese trading giant Hanwa is a strong financial backer and has a robust off-take agreement in place with Bacanora.

Nevada neighbor Global Geoscience Ltd. (ASX- GSC) is an Australian-listed junior with a clay deposit in Nevada. It is finishing up a PFS on its Rhyolite Ridge Lithium-Boron Project that has an estimated 3.4 million tonnes of Li carbonate. Unlike Cypress’s project, Rhyolite Ridge’s economics rely on the co-production of boric acid. This is not necessarily a good or bad thing; it just highlights that each project is unique. GSC shares have nearly quadrupled in the past year.

Bacanora’s market cap is ~C$ 190 M. Global Geoscience’s market cap is ~C$ 310 M. Both are making steady progress towards unlocking the value of their unconventional Li deposits. I believe that positive developments for these and other unconventional Li companies will provide a flow of really good news for Cypress. The Company has about 49.5 M shares outstanding post the recently closed capital raise. Its market cap is just ~C$ 9 M.

I strongly believe that with big news from Lithium Americas, Bacanora Minerals and Global Geoscience next year, Cypress will be on the radar screens of a number of global Li players, both financial & strategic companies.

MGX Minerals (TSX-V: XMG) is another technology-backed unconventional Li deposit winner that grabbed the attention of investors in 2017. Its stock price is up ~500% in the past year. MGX is harnessing technology to extract Li from oilfield brine wastewater. Like LAC, BCN & GSC, MGX is not in operation. MGX’s market cap is about C$ 80 M.

Cypress; in the Right Place at the Right Time and a Cheap Valuation

First Cypress has to prove up an attractive maiden resource, then it simply needs to continue following in the footsteps of Lithium Americas, Bacanora & Global Geoscience as those companies publish a PFS and/or a BFS, lock-in large strategic/financial partners and off-take agreements. But fear not, none of the clay deposits will be in large-scale production anytime soon, so they won’t even put a dent in a possible supply crunch around the turn of the decade, and won’t put a cap on Li prices!

Make no mistake, Cypress’ projects are earlier-stage than the companies I’ve mentioned, but in some respects might not be higher risk. For example, the Dean and Glory projects would probably have lower strip ratios than many global Li projects (both conventional & unconventional).

Management Team is Amazing for a Small Company

Typically, small companies have trouble attracting big talent, but not so in this case. Why? Because smart people saw the opportunity, they saw what I’m describing in this article, basically, they saw the writing on the wall…. there’s not going to be enough Lithium! All potential commercial-scale Li sources will be pursued to the ends of the earth. And, with the Li price at US$20k/t+ vs. US$5k/t, the “when” can’t come fast enough.

That’s why Bill Willoughby, PE, PhD joined the Company this year. What better person to have as CEO than a rock star, PhD mining Engineer during a once in a lifetime opportunity like this? (the paradigm shift from ICE- powered to EV). Bill has nearly 30 years’ experience at natural resource development companies. Will this be his greatest success to date? Dr. Willoughby was kind enough to provide the following quote, an exclusive for this article,

“We feel our project is unique due to its location and physical traits. To our knowledge, Clayton Valley has the only deposits of lithium claystone that are situated next to an existing brine operation. Besides location, our deposit is shallow, flat-lying soft rock in which the lithium appears readily soluble. With the large apparent size, we’ve seen from our drilling and the lateral extent of the deposit, we believe all these factors combine to a unique opportunity to develop a significant new source of lithium.”

In addition, the Cypress team has used, and continues to work with, very well-known and respected ALS / Chemex in Reno, NV and SGS lab in Ontario.

Cypress is sitting on Li–bearing property that could be worth a hell of a lot more than its C$ 9 M market cap. This will not be an overnight success, a near-term commercial-scale producer, but actual production is not what’s required for a higher valuation. What’s needed is a credible path towards that end, management is on that path and working diligently.

All 9 previous holes at Dean encountered significant Li values within claystone, which ranged up to 1,790 ppm Li (1,790 mg/L Li) and averaged 900 ppm Li (900 mg/L Li) throughout the average drill-depth of 243 feet. Mineralization outcrops at surface, and average Li mineralization thickness is greater than 210 feet. The program covered an area measuring about 12,000 feet in length by 4,000 feet in width. The Li-bearing claystone is considered open in all directions.

South of the Dean claim block, extensive sampling by Cypress on the Glory claims identified Li mineralization in surface exposures of claystone which ranged up to 3,800 ppm Li (3,800 mg/L Li) over 9,500 feet along the same trend encountered on the adjoining Dean claims. Results suggest a strong possibility of continuous mineralized volume of a highly leachable Li-rich claystone at surface on the Glory project.

The goal of the work on both properties is to substantiate the potential to produce Li directly from the mineralized claystone with a low-cost and environmentally friendly approach, without the need for roasting or other costly mining and complex treatments. Cypress is proceeding with additional leach studies to determine the amount of Li extraction possible from the claystone and provide further data on the feasibility of a large-scale leach extraction method.

So, to recap so far; in my opinion it seems reasonable that Cypress will be able to come up with a maiden mineral resource estimate in the next 6 months. Further, based on historical samples, drilling and other exploration, there’s reason to believe that the maiden resource could be sizable and relatively high-grade. The claystone mineralization is soft and near-surface, so there’s no doubt that ore would be easy and low-cost to extract. The main risk is that there is no known technology that can process Cypress’ Li deposits cost effectively and in an environmentally friendly manner.

From the latest Cypress press release, quote,

“Cypress believes its claystone deposit in Clayton Valley has the potential to contain a significant resource of lithium, and may have physical and logistical features that could make it a productive, long-term source of lithium. In addition to the ongoing drilling program, Cypress is continuing studies to determine the exact nature and distribution of the lithium mineralization in the claystone, and identify an effective means of extraction.”

Conclusion

Boy this time next year, there could be two half-billion dollar Li clay projects in Nevada! Either or both project owners might have lined top Battery or EV manufacturers to drive them forward. Notice I haven’t even mentioned Nevada’s Tesla, there’s no need, it could be anyone, literally dozens and dozens of companies. If so, will tiny Cypress Development Corp. (TSX-V: CYP) / (OTCBB: CYDVF) still be valued at C$ 9 M?

Although years away from commercial-scale production, Cypress is year(s) ahead of unconventional Li deposits that have not been staked, permitted for initial exploration, sampled or had preliminary testing or metallurgy done…. Remember, each deposit is unique, and most high-grade Li deposits might not be nearly as amenable as Cypress’ Dean and Glory projects to potential exploitation due to distance from infrastructure, depth of deposit, grade, continuity, chemistry (concentration of coincident deleterious elements) jurisdiction, and other factors.

Cypress Development is a company worthy of further investigation by readers. Here are some places to go for further information.

JuniorStockReview by Brian Leni P.Eng

Ahead of the Herd article by Rick Mills

The Stateside Report by Vince Marciano

Energy & Gold Ltd. Website by Scott Armstrong

Disclosures: The content of this interview is for illustrative and informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Cypress Development Corp. and the Company was an advertiser on [ER]. By virtue of ownership of the Company’s shares and it being an advertiser on [ER], Peter Epstein is biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.