Eloro Resources (TSX:ELO) has announced the final assay results from an 11-hole, 5,267.7-meter definition drill program at its Iska Iska silver-tin polymetallic project in southwestern Bolivia.

Tom Larsen, CEO of Eloro commented in a press release: “I am very pleased with the continuation of significantly higher-grade silver equivalent results from the latest definition drilling program, compared to the initial mineral resource estimate (“MRE”) starter pit area model as previously reported (see Eloro press release dated Oct 17, 2023). These new results highlight the potential to upgrade and expand the higher-grade resource in the Santa Barbara starter pit area. Tin is proving to be an important metal contributor to these upgraded silver equivalent results. This can enhance NSR values and increase tonnage in future MRE studies. As an example, Hole DSB-63 located in the Northeast section of the Santa Barbara starter pit area, recognized more as a Polymetallic (Ag-Zn-Pb) Domain, returned 0.51% tin over a 23.02-meter drill intercept with a total silver equivalent value of 205.57 g/t. There is more and more evidence of high temperature sulphidation centres being identified as feeders within the open pit area resulting in upgraded tin and silver values. Higher density definition drilling in the initial Santa Barbara open pit envelope is consistently proving up higher grades as drill density is improved.”

The drill program focused on upgrading and expanding the project’s higher-grade polymetallic inferred mineral resource, which contains an estimated 132 million tonnes grading 24.3 g/t silver, 1.11% zinc and 0.50% lead. This equates to 72.06 g/t silver equivalent at a net smelter return (NSR) cutoff of $25 per tonne. The net NSR value of this resource is $34.40 per tonne, which is 3.75 times the estimated operating cost of $9.20 per tonne.

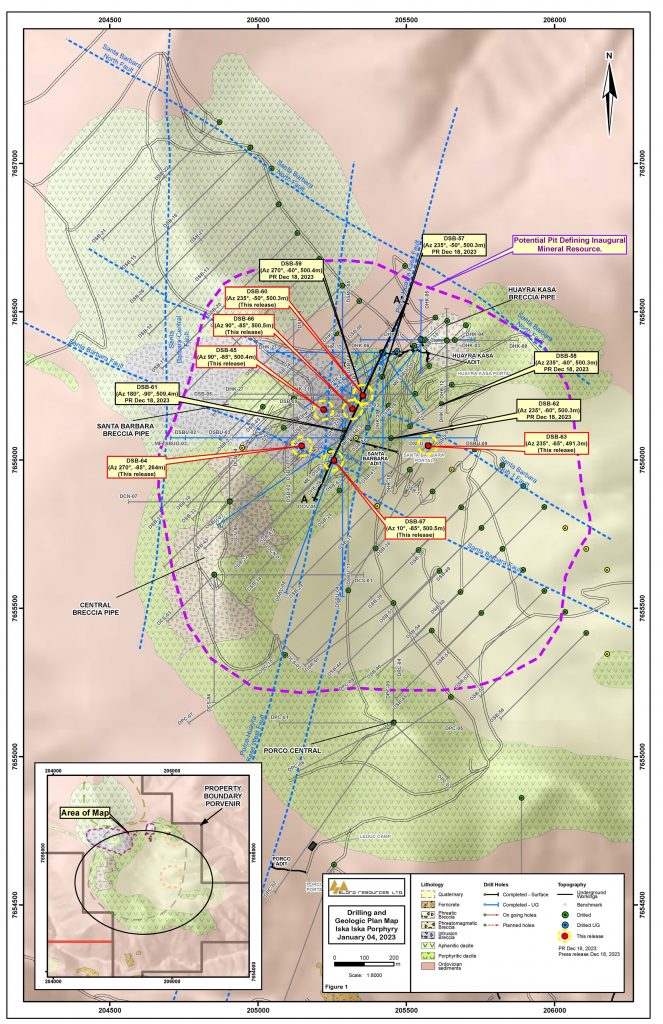

Several holes also tested the adjacent tin-silver-lead domain, where high silver values have previously been obtained along with tin. Drill hole locations targeted areas to upgrade and expand the higher-grade zone along and across strike near the potential starter pit area.

Assay results confirm the drill program has expanded the higher-grade tin and silver zones, especially to the west where little previous drilling has occurred. This highlights the potential to expand the current mineral resource, particularly for tin.

Initially, the preliminary economic assessment planned for Iska Iska was to focus solely on the polymetallic resource, with tin as a major exploration target. However, the new drill results suggest potential to significantly expand the higher-grade tin resource west of the potential pit and incorporate it into the preliminary economic assessment.

The technical report for Iska Iska’s initial mineral resource estimate noted higher-grade areas are also the most thoroughly drilled. Improving drill density across the deposit could increase grades due to better sample density, which recent results suggest is likely.

Dr. Osvaldo Arce, P.Geo. General Manager of Eloro’s Bolivian subsidiary Minera Tupiza S.R.L. and an expert on Bolivian mineral deposits also commented in the press release: “The definition drilling is confirming a strong high-grade Ag-Sn association, which is common in the southern Bolivian Tin Belt, including in large systems at Cerro Rico de Potosi, Animas-Siete Suyos-Chocaya and Tatasi deposits that occur along NW-SE striking structural corridors, the same geological environment that is present at Iska Iska. Recent drilling results have outlined upgraded tin and silver values from near surface down to at least 500m in vertical extent, principally in the sulphide zone. Geophysical information and deep drilling indicate that tin-silver mineralization may extend to depths of 1km or more. Tin mineralization in these zones has been remobilized and redeposited throughout the deposit by brecciation in favorable rock types, especially medium grained porphyritic dacite and intrusion breccia which are the most widespread lithologies at Iska Iska. Moreover, tin-polymetallic mineralization can be locally extensive/continuous as occurs in hole DSB-67, where 477m of the 500m drilled averages about 0.1% Sn, with almost no waste material. This high-grade continuous polymetallic mineralization forms commonly subhorizontal vein-parallel banding along north-northwest trending shear zones, indicating multiple episodes of fracture opening and mineral precipitation.”

Highlights from the results are as follows:

- Hole DSB-66 above also returned other well mineralized intersections including:

- 24.67g Ag/t, 1.08% Zn, 0.83% Pb and 0.08% Sn (94.46g Ag eq/t) over 86.39m, and

- 7.46g Ag/t, 2.51% Zn, 1.02% Pb and 0.06% Sn (129.90g Ag eq/t) over 74.85m

- Hole DSB-65 intersected 118.86g Ag/t*, 0.35% Zn, 0.35% Pb and 0.15% Sn (152.29g Ag eq/t*) over 81.28m including a very high-grade sample of:

- 5,080g Ag/t, 0.12 g Au/t, 0.26% Zn, 1.34% Pb, 1.53% Cu and 1.27% Sn (4,746.46g Ag eq/t) over 1.46m

- This very high-grade sample highlights the potential for Iska Iska to host extraordinary grades within the overall extensive mineralized system.

- Hole DSB-63, the eastern most hole in the definition drill program, intersected a significant Sn intersection of 23.37 g Ag/t, 1.77% Zn. 1.22% Pb and 0.51% Sn (205.57g Ag eq/t) over 23.02m. This area is in the Polymetallic (Ag-Zn-Pb) Domain where Sn values have typically been low. This suggests potential to extend the higher-grade Sn zone further east.

- The definition drill program has expanded both the higher-grade Sn and Ag zones especially to the west where there has been only limited previous drilling. These new data highlight the potential to upgrade and expand the mineral resource particularly by outlining a significant higher-grade Sn resource to include for consideration in the preliminary economic assessment (“PEA”).

Hole DSB-66 intersected several long well mineralized intervals as follows:

- 57.62g Ag/t, 1.26% Zn, 0.94% Pb and 0.12% Sn (139.94g Ag eq/t) over 136.11m from 137.75m to 273.86m including:

- 136.81g Ag/t, 2.00% Zn, 1.38% Pb and 0.17% Sn (255.19g Ag eq/t) over 34.77m from 187.64m to 222.41m

- 24.67g Ag/t, 1.08% Zn, 0.83% Pb and 0.08% Sn (94.46g Ag eq/t) over 86.39m from 288.92m to 375.31m including:

- 69.37g Ag/t, 0.41g Au/t, 1.88% Zn, 3.68% Pb and 0.32% Sn (272.27g Ag eq/t) over 6.08m from 307.15m to 313.23m,

- 23.59g Ag/t, 2.14% Zn, 1.57% Pb and 0.15% Sn (159.64g Ag eq/t) over 6.15m from 328.23m to 334.38m, and

- 99.40g Ag/t, 1.60% Zn, 1.06% Pb and 0.10% Sn (187.52g Ag eq/t) over 12.24m from 360.02m to 372.26m

- 7.46g Ag/t, 2.51% Zn, 1.02% Pb and 0.06% Sn (129.90g Ag eq/t) over 74.85m from 415.85m to 490.70m

- 10.80g Ag/t, 0.12 g Au/t, 4.96% Zn, 1.49% Pb and 0.06% Sn (229.62g Ag eq/t) over 16.86m from 430.99m to 447.85m

- 13.86g Ag/t, 4.20% Zn, 2.35% Pb and 0.34% Sn(277.75g Ag eq/t) over 7.76m from 457.31m to 465.07m

Hole DSB-65 collared 100m west of hole DSB-66 intersected the highest-grade silver sample intersected thus far at Iska Iska in an 80+m wide well mineralized zone as follows:

- 118.86g Ag/t, 0.35% Zn, 0.35% Pb and 0.15% Sn (152.29g Ag eq/t) over 81.28m from 353.49m to 434.77m including:

- 5,080g Ag/t, 0.12 g Au/t, 0.26% Zn, 1.34% Pb, 1.53% Cu and 1.27% Sn (4,746.46g Ag eq/t) over 1.46m from 362.53m to 363.99m

- Cutting of this very high Ag sample to 1,000g Ag/t based on a statistical probability plot yields a still high average for the 81.28m interval of 45.58 g Ag/t with an overall grade of 87.80 g Ag eq/t

- This very high-grade sample highlights the potential for Iska Iska to host extraordinary grades within the overall extensive mineralized system.

Hole DSB-67 collared 200m south-southwest of DSB-66 intersected a wide zone of mineralization grading 8.17 g Ag/t, 1.40% Zn, 0.48% Pb and 0.06% Sn (79.08g Ag eq/t) over 236.13m from 240.04m to 476.17m including higher grade zones of:

- 2.17g Ag/t, 0.16 g Au/t, 2.65% Zn, 0.52% Pb and 0.06% Sn (118.18g Ag eq/t) over 9.03m from 249.09m to 258.12m and

- 28.10g Ag/t, 4.25% Zn, 1.67% Pb and 0.17% Sn (245.05g Ag eq/t) over 19.45m from 434.06m to 453.51m

Hole DSB-60 intersected a 158.58m long zone of lower grade mineralization with higher-grade zones as follows:

- 16g Ag/t, 0.66% Zn, 0.41% Pb and 0.09% Sn (63.23g Ag eq/t) over 158.58m from 15.33m to 173.91m including:

- 23.31g Ag/t, 1.18% Zn, 0.56% Pb and 0.16%Sn (105.56 g Ag eq/t) over 6.16m from 34.99m to 41.15m and

- 115.54g Ag/t, 1.45% Zn and 1.67% Pb (201.17g Ag eq/t) over 4.54m from 139.32m to 143.86m

Hole DSB-63, the eastern most hole in the definition drill program, intersected a significant Sn intersection of 23.37 g Ag/t, 1.77% Zn. 1.22% Pb and 0.51% Sn (205.57g Ag eq/t) over 23.02m from 446.10m to 469.12m. This area is in the Polymetallic (Ag-Zn-Pb) Domain where Sn values have typically been low. This suggests potential to extend the higher-grade Sn zone further east.

Hole DSB-64, the southwestern most hole in the definition drill program, intersected 113.33g Ag/t and 0.12 g Au/t (110.97 g Ag eq/t) over 22.91m from 35.22m to 58.13m and 172.37 g Ag/t and 0.17% Pb% (161.78g Ag eq/t) over 13.46m from 135.83m to 149.29m. This hole was terminated at 240m due to faulting short of its planned depth of 500m.

| Table 1: Diamond Drill Results as of January 11, 2024, Santa Barbara Deposit, Iska, Iska |

||||||||||

| SANTA BARBARA DEFINITION DRILLING | ||||||||||

| Hole No. | From (m) | To (m) | Length (m) | Ag | Au | Zn | Pb | Cu | Sn | Ag eq |

| g/t | g/t | % | % | % | % | g/t | ||||

| DSB-60 | 15.33 | 173.91 | 158.58 | 16.00 | 0.04 | 0.66 | 0.41 | 0.03 | 0.09 | 63.23 |

| Incl. | 34.99 | 41.15 | 6.16 | 23.31 | 0.05 | 1.18 | 0.56 | 0.05 | 0.16 | 105.56 |

| Incl. | 56.29 | 65.40 | 9.11 | 12.95 | 0.04 | 0.95 | 0.57 | 0.02 | 0.24 | 103.35 |

| Incl. | 139.32 | 143.86 | 4.54 | 115.54 | 0.04 | 1.45 | 1.67 | 0.02 | 0.05 | 201.17 |

| 178.30 | 179.91 | 1.61 | 20.90 | 0.04 | 0.05 | 0.16 | 0.33 | 0.27 | 74.56 | |

| 184.41 | 185.96 | 1.55 | 41.00 | 0.23 | 0.09 | 0.04 | 0.31 | 0.24 | 84.44 | |

| 196.56 | 211.64 | 15.08 | 13.66 | 0.05 | 0.01 | 0.02 | 0.12 | 0.34 | 76.21 | |

| 217.59 | 223.68 | 6.09 | 15.22 | 0.03 | 0.93 | 0.02 | 0.01 | 0.19 | 81.42 | |

| 228.13 | 229.67 | 1.54 | 8.40 | 0.02 | 1.09 | 0.13 | 0.02 | 0.06 | 60.78 | |

| 240.25 | 243.25 | 3.00 | 53.30 | 0.14 | 0.18 | 0.01 | 0.08 | 0.08 | 68.41 | |

| 258.30 | 259.77 | 1.47 | 56.20 | 0.13 | 0.01 | 0.06 | 0.06 | 0.10 | 69.24 | |

| 265.84 | 268.83 | 2.99 | 56.23 | 0.03 | 0.07 | 0.09 | 0.12 | 0.11 | 74.36 | |

| 280.84 | 286.97 | 6.13 | 139.57 | 0.03 | 0.07 | 0.25 | 0.12 | 0.02 | 134.78 | |

| 302.01 | 306.51 | 4.50 | 135.36 | 0.03 | 0.18 | 0.17 | 0.11 | 0.24 | 174.44 | |

| 315.62 | 336.69 | 21.07 | 15.95 | 0.03 | 0.33 | 0.42 | 0.02 | 0.21 | 75.11 | |

| 353.25 | 359.30 | 6.05 | 77.11 | 0.35 | 0.24 | 0.32 | 0.26 | 0.44 | 165.36 | |

| 371.34 | 375.78 | 4.44 | 61.40 | 0.06 | 0.06 | 0.04 | 0.31 | 0.27 | 106.97 | |

| 458.92 | 463.72 | 4.80 | 25.11 | 0.05 | 0.03 | 0.01 | 0.07 | 0.18 | 56.96 | |

| 468.20 | 471.30 | 3.10 | 8.20 | 0.11 | 0.03 | 0.02 | 0.19 | 0.33 | 70.19 | |

| 474.34 | 475.91 | 1.57 | 4.80 | 0.16 | 0.04 | 0.02 | 0.56 | 1.06 | 202.69 | |

| DSB-63 | 33.75 | 35.25 | 1.50 | 5.60 | 0.01 | 0.01 | 3.38 | 0.00 | 0.12 | 105.60 |

| 67.09 | 79.28 | 12.19 | 5.15 | 0.01 | 0.84 | 0.63 | 0.01 | 0.01 | 50.68 | |

| 83.82 | 88.41 | 4.59 | 13.22 | 0.02 | 1.68 | 0.50 | 0.01 | 0.02 | 85.89 | |

| 97.49 | 103.51 | 6.02 | 7.13 | 0.01 | 0.94 | 0.27 | 0.00 | 0.01 | 47.54 | |

| 117.06 | 129.16 | 12.10 | 14.85 | 0.02 | 1.23 | 0.59 | 0.01 | 0.02 | 73.77 | |

| 197.04 | 219.80 | 22.76 | 8.30 | 0.09 | 1.32 | 0.39 | 0.02 | 0.01 | 65.18 | |

| 228.98 | 239.60 | 10.62 | 3.49 | 0.12 | 1.09 | 0.26 | 0.01 | 0.01 | 49.07 | |

| 257.63 | 260.56 | 2.93 | 6.82 | 0.05 | 1.68 | 0.34 | 0.00 | 0.01 | 74.06 | |

| 331.33 | 332.85 | 1.52 | 4.70 | 0.01 | 1.65 | 0.30 | 0.01 | 0.01 | 70.84 | |

| 344.91 | 346.43 | 1.52 | 7.40 | 0.64 | 1.85 | 0.29 | 0.02 | 0.01 | 79.75 | |

| 446.10 | 469.12 | 23.02 | 23.37 | 0.08 | 1.77 | 1.22 | 0.01 | 0.51 | 205.57 | |

| DSB-64 | 35.22 | 58.13 | 22.91 | 113.33 | 0.12 | 0.00 | 0.08 | 0.00 | 0.05 | 110.97 |

| 135.83 | 149.29 | 13.46 | 172.37 | 0.03 | 0.00 | 0.17 | 0.01 | 0.03 | 161.78 | |

| 159.89 | 167.39 | 7.50 | 75.91 | 0.06 | 0.00 | 0.17 | 0.01 | 0.10 | 88.68 | |

| 177.98 | 191.38 | 13.40 | 5.22 | 0.06 | 0.00 | 0.04 | 0.00 | 0.37 | 74.68 | |

| 209.43 | 212.34 | 2.91 | 7.31 | 0.04 | 0.00 | 0.01 | 0.00 | 0.55 | 109.77 | |

| 255.80 | 264.00 | 8.20 | 5.91 | 0.25 | 0.00 | 0.03 | 0.00 | 0.37 | 75.08 | |

Table 1 (con’t)

| Hole No. | From (m) | To (m) | Length (m) | Ag | Au | Zn | Pb | Cu | Sn | Ag eq |

| g/t | g/t | % | % | % | % | g/t | ||||

| DSB-65 | 17.95 | 22.46 | 4.51 | 190.56 | 0.16 | 0.00 | 0.06 | 0.00 | 0.22 | 210.39 |

| 74.18 | 108.83 | 34.65 | 36.45 | 0.01 | 0.35 | 0.03 | 0.08 | 0.05 | 54.09 | |

| 119.38 | 143.30 | 23.92 | 15.92 | 0.02 | 1.03 | 0.18 | 0.06 | 0.09 | 70.40 | |

| 167.56 | 173.57 | 6.01 | 6.01 | 0.01 | 1.04 | 0.16 | 0.02 | 0.04 | 53.72 | |

| 188.68 | 191.66 | 2.98 | 5.01 | 0.01 | 0.19 | 0.00 | 0.02 | 0.25 | 57.12 | |

| 211.21 | 212.67 | 1.46 | 5.00 | 0.01 | 0.66 | 0.05 | 0.01 | 0.62 | 143.90 | |

| 229.00 | 230.49 | 1.49 | 2.00 | 0.13 | 0.01 | 0.01 | 0.01 | 0.72 | 135.92 | |

| 244.25 | 245.78 | 1.53 | 45.00 | 0.02 | 0.04 | 0.01 | 0.19 | 0.14 | 67.42 | |

| 256.27 | 257.86 | 1.59 | 18.00 | 0.06 | 0.03 | 0.04 | 0.22 | 0.21 | 57.11 | |

| 268.44 | 274.47 | 6.03 | 4.45 | 0.04 | 0.04 | 0.03 | 0.00 | 0.28 | 58.54 | |

| 289.59 | 291.11 | 1.52 | 4.00 | 0.01 | 0.34 | 0.01 | 0.01 | 0.23 | 58.20 | |

| 294.19 | 306.70 | 12.51 | 68.35 | 0.10 | 0.02 | 0.04 | 0.17 | 0.18 | 94.41 | |

| 314.23 | 327.86 | 13.63 | 67.04 | 0.07 | 0.12 | 0.05 | 0.08 | 0.08 | 79.03 | |

| * | 353.49 | 434.77 | 81.28 | 118.86 | 0.03 | 0.35 | 0.35 | 0.05 | 0.15 | 152.29 |

| *Incl. | 362.53 | 363.99 | 1.46 | 5080.00 | 0.12 | 0.26 | 1.34 | 1.53 | 1.27 | 4746.46 |

| 445.27 | 500.40 | 55.13 | 12.87 | 0.02 | 0.45 | 0.33 | 0.01 | 0.19 | 69.06 | |

| Incl. | 448.33 | 454.33 | 6.00 | 37.40 | 0.01 | 0.85 | 1.75 | 0.02 | 0.63 | 219.35 |

| *cut | 353.49 | 434.77 | 81.28 | 45.58 | 0.03 | 0.35 | 0.35 | 0.05 | 0.15 | 87.80 |

| *cut | 362.53 | 363.99 | 1.46 | 1000.00 | 0.12 | 0.26 | 1.34 | 1.53 | 1.27 | 1156.06 |

| DSB-66 | 55.20 | 89.53 | 34.33 | 4.01 | 0.02 | 1.40 | 0.58 | 0.03 | 0.11 | 87.33 |

| Incl. | 83.73 | 89.53 | 5.80 | 1.73 | 0.07 | 2.34 | 1.14 | 0.02 | 0.23 | 153.05 |

| 112.22 | 124.22 | 12.00 | 10.92 | 0.01 | 1.32 | 0.87 | 0.03 | 0.23 | 119.07 | |

| 128.70 | 130.21 | 1.51 | 1.00 | 0.01 | 3.92 | 0.91 | 0.02 | 0.24 | 204.44 | |

| 137.75 | 273.86 | 136.11 | 57.62 | 0.02 | 1.26 | 0.94 | 0.02 | 0.12 | 139.94 | |

| Incl. | 187.64 | 222.41 | 34.77 | 136.81 | 0.03 | 2.00 | 1.38 | 0.02 | 0.17 | 255.19 |

| 288.92 | 375.31 | 86.39 | 24.67 | 0.04 | 1.08 | 0.83 | 0.01 | 0.08 | 94.46 | |

| Incl. | 307.15 | 313.23 | 6.08 | 69.37 | 0.41 | 1.88 | 3.68 | 0.03 | 0.32 | 272.27 |

| Incl. | 328.23 | 334.38 | 6.15 | 23.59 | 0.01 | 2.14 | 1.57 | 0.01 | 0.15 | 159.64 |

| Incl. | 360.02 | 372.26 | 12.24 | 99.40 | 0.02 | 1.60 | 1.06 | 0.03 | 0.10 | 187.52 |

| 415.85 | 490.70 | 74.85 | 7.46 | 0.03 | 2.51 | 1.02 | 0.01 | 0.06 | 129.90 | |

| Incl. | 430.99 | 447.85 | 16.86 | 10.80 | 0.12 | 4.96 | 1.49 | 0.02 | 0.06 | 229.62 |

| Incl. | 457.31 | 465.07 | 7.76 | 13.86 | 0.01 | 4.20 | 2.35 | 0.01 | 0.34 | 277.75 |

| DSB-67 | 0.00 | 8.80 | 8.80 | 9.14 | 0.05 | 0.00 | 0.13 | 0.00 | 0.38 | 81.25 |

| 39.30 | 72.63 | 33.33 | 18.18 | 0.03 | 0.00 | 0.06 | 0.00 | 0.19 | 52.14 | |

| 80.22 | 84.76 | 4.54 | 44.96 | 0.06 | 0.00 | 0.09 | 0.00 | 0.12 | 63.71 | |

| 99.82 | 143.38 | 43.56 | 47.01 | 0.03 | 0.10 | 0.41 | 0.07 | 0.08 | 70.03 | |

| 158.46 | 208.33 | 49.87 | 19.97 | 0.13 | 0.87 | 0.70 | 0.03 | 0.08 | 78.49 | |

| 212.91 | 215.94 | 3.03 | 2.01 | 0.10 | 0.90 | 0.52 | 0.02 | 0.04 | 53.08 | |

| 223.53 | 226.53 | 3.00 | 1.25 | 0.07 | 1.86 | 0.32 | 0.02 | 0.03 | 78.69 | |

| 240.04 | 476.17 | 236.13 | 8.17 | 0.05 | 1.40 | 0.48 | 0.01 | 0.06 | 79.08 | |

| Incl. | 249.09 | 258.12 | 9.03 | 2.17 | 0.16 | 2.65 | 0.52 | 0.02 | 0.06 | 118.18 |

| Incl. | 434.06 | 453.51 | 19.45 | 28.10 | 0.07 | 4.25 | 1.67 | 0.01 | 0.17 | 245.05 |

Note: True width is approximately 80% of core length. Silver equivalent (Ag eq) grades are calculated using 3-year average metal prices of Ag = US$22.52/oz, Zn = US$1.33/lb , Pb = 0.95/lb and Sn = US$12.20/lb, and preliminary metallurgical recoveries of Ag = 88%, Zn = 87%, Pb= 80% and Sn = 50%. Au and Cu assay results are provided as they are of potential economic interest however these values are not included in the Ag eq calculation as metallurgical recovery has not yet been established for these elements. In selecting intervals, a cutoff grade of 30 g Ag eq/t has been used. Lower grade material may be included in intersections where geological continuity is warranted.

| Table 2: Summary of Diamond Drill Hole Coordinates for Holes Reported at Iska Iska as of January 11, 2024. | |||||||

| SUMMARY DIAMOND DRILLING ISKA ISKA | |||||||

| Hole No. | Type | Collar Easting | Collar Northing | Elev | Azimuth | Angle | Hole Length (m) |

| Santa Barbara Surface Definition Drill Holes Reported | |||||||

| DSB-60 | S | 205356.5 | 7656220.6 | 4239.8 | 235° | -50° | 500.3 |

| DSB-63 | S | 205575.4 | 7656049.8 | 4111.7 | 235° | -65° | 491.3 |

| DSB-64 | S | 205145.0 | 7656048.0 | 4305.3 | 270° | -85° | 264.0 |

| DSB-65 | S | 205222.7 | 7656170.0 | 4315.4 | 90° | -85° | 500.4 |

| DSB-66 | S | 205318.0 | 7656172.0 | 4251.7 | 90° | -85° | 500.5 |

| DSB-67 | S | 205256.7 | 7655998.9 | 4264.1 | 10° | -85° | 500.5 |

| TOTAL | 2757.0 | ||||||

| S = Surface UG=Underground; collar coordinates in metres; azimuth and dip in degrees. Total drilling completed since the start of the program on September 20, 2020, is 103,198,5m in 148 drill holes (34 underground holes and 114 surface holes). | |||||||

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.