Canadian gold miner Fury Gold Mines (TSX:FURY) announced on Monday that it has reached an agreement with Newmont Corporation (TSX:NGT) to acquire Newmont’s 49.978% interest in the Éléonore South gold project in Quebec, Canada for CAD$3 million (approximately US$2.2 million).

As part of the deal, Fury Gold will also purchase around 30.4 million shares of Sirios Resources held by Newmont for investment purposes, spending CAD$1.3 million (nearly US$960,000) to do so.

Tim Clark, CEO of Fury Gold Mines, commented in a press release: “We value the strong relationship with Newmont and are confident that this transaction is a positive outcome for both companies. Our team has historically ranked the ESJV as one of our more prolific targets for discovery. As such, we are excited to now have 100% ownership as we expect this to provide a clearer pathway for more exploration and potential upside in returns for our investors from this project consolidation and investment in Sirios.

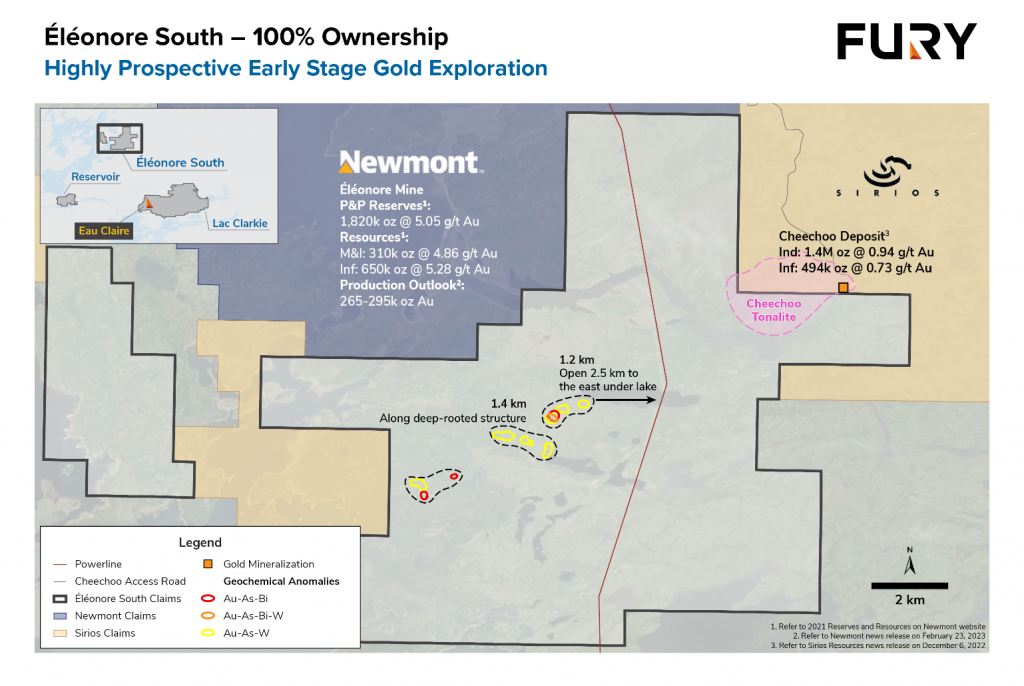

The Éléonore South project is located in a region with significant gold deposits. Newmont’s Éléonore gold mine lies to the north, while Sirios Resources’ Cheechoo deposit is positioned to the east.

Previous exploration at Éléonore South has identified two types of gold mineralization – high-grade structurally-controlled quartz veins hosted in sedimentary rocks, similar to Éléonore, and lower-grade disseminated intrusion-related gold mineralization akin to Cheechoo. Numerous untested gold anomalies remain throughout the property and will be a priority for Fury Gold.

At Cheechoo’s JT and Moni prospects, historical drilling has intercepted intervals including 53.3 meters of 4.22 g/t gold, 6.0 meters of 49.50 g/t gold and 23.8 meters of 3.08 g/t gold. Several of these holes require follow-up drilling and remain open.

The acquisition comes after Newmont announced plans last week to divest six non-core assets, including Éléonore, to pay down debt. The other assets are the Musselwhite and Porcupine mines in Ontario, the Coffee project in Yukon, and a 70% stake in the Havieron joint venture with Greatland Gold in Western Australia.

Newmont said it intends to focus on its portfolio of Tier 1 assets and emerging Tier 1 assets, sequencing development projects and enhancing capabilities to advance its pipeline of gold and copper projects. It has identified an additional $500 million in cost and productivity improvements.

By 2028, Newmont is targeting 6.7 million ounces of gold production and 8.3 million gold equivalent ounces. Average annual sustaining capital expenditure of $1.5 billion is expected over the next five years, along with average development capital of $1.3 billion per year.

Fury Gold Mines is a Canada-focused gold exploration company with projects in Quebec and British Columbia. It also holds a 59.5 million share position in Dolly Varden Silver Corp, representing 22% of issued shares.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.