Liberty Gold (TSX:LGD), has reported promising new assay results from the ongoing 2023 Reverse Circulation (RC) drilling scheme at the prestigious Black Pine Oxide Gold Project in southeastern Idaho.

Jason Attew, President and CEO of Liberty Gold commented in a press release: “We are excited to have found high-grade mineralization in a sparsely drilled area within our resource model, which has implications for resource expansion across the project area. We are working hard on the modeling in anticipation of a further resource update at the end of this year.”

Covering 15,000 meters out of the scheduled 32,000 meters of RC drilling for this year, Liberty Gold has made significant strides in its exploration. To expedite the drilling results for the latter half of the year, the company has introduced a third RC rig this June. The proactive move precedes an anticipated updated mineral resource estimation needed to back a Pre-Feasibility Study (PFS).

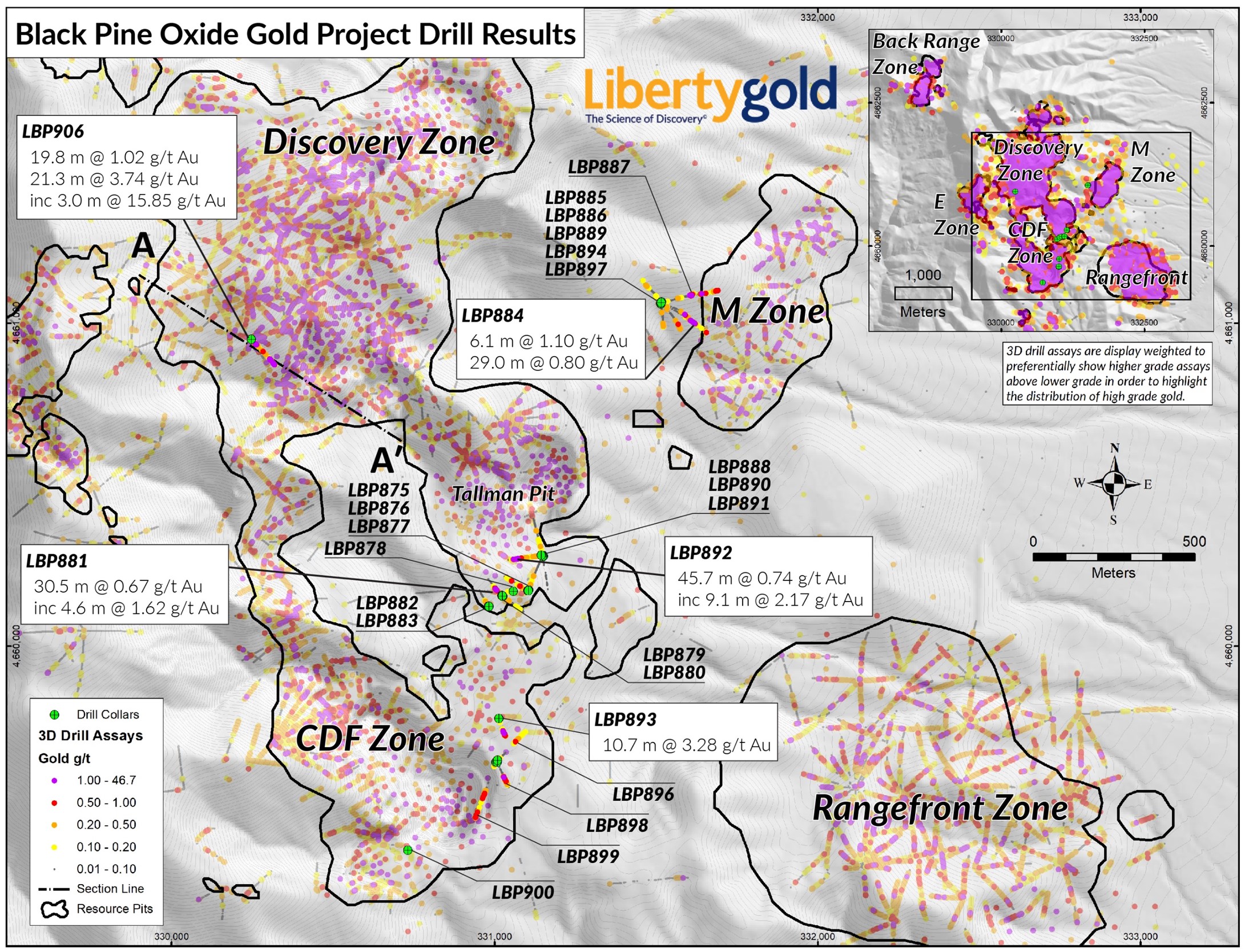

The recent drilling endeavour is concentrated on multiple zones: the Back Range Zone, Discovery Zone, M Zone West, and the notable CD-Tallman ‘corridor.’ The venture includes testing the historic surface waste rock dumps within this corridor.

In the Discovery Zone, one of the standout highlights includes results from LBP906, showing an impressive 3.74 grams per tonne gold over 21.3 meters, with a notable 15.85 g/t Au over 3.0 meters. Astonishingly, assays for LBP906 have brought back outstanding oxide gold results from an area that was formerly modelled as waste rock. An additional four holes in the same area are pending results.

The primary aim of the 2023 infill drill program is to convert ounces currently categorized as inferred into the indicated classification and to ensure no gaps in the drill coverage along the edges of the resource pits. To this end, one drill is targeting additional holes next to the Discovery Zone, where a substantial gap in drill coverage at depth is observed. Preliminary visuals from this drilling venture look promising, with assay results pending.

Drilling activities in the CD-Tallman Corridor have provided some intriguing highlights too. Assay outcomes from 18 RC holes in this area show that a significant chunk of the surface waste backfill material contains gold above a 0.1 g/t Au cut-off. Particularly encouraging is the finding of localized zones with as high as 8.58 g/t Au of oxide material in hole LBP893. Further drilling efforts are underway to better characterize the gold grade distribution in the waste rock material and fill the drill gaps in the underlying bedrock mineralization.

The M Zone, specifically its western part, has also given cause for optimism. Recent drilling results from this zone indicate the gold mineralizing system could potentially extend across a broader area. In response, Liberty Gold plans to resume drilling in the M Zone in Q3, building on existing drill roads and pads to test the projection of this promising trend.

DISCOVERY ZONE HIGHLIGHT TABLE

| Hole ID (Az, Dip) (degrees) | From (m) | To (m) | Intercept (m) | Au (g/t) | Au Cut-Off | Hole Length (m) | Target |

| LBP906 (145, -62) | 38.1 | 57.9 | 19.8 | 0.59 | 0.15 | 263.7 | Disco Highwall |

| incl | 45.7 | 48.8 | 3.0 | 1.34 | 1.00 | ||

| and | 185.9 | 205.7 | 19.8 | 1.02 | 0.15 | ||

| incl | 187.5 | 195.1 | 7.6 | 1.68 | 1.00 | ||

| and | 233.2 | 254.5 | 21.3 | 3.74 | 0.15 | ||

| incl | 233.2 | 253.0 | 19.8 | 4.01 | 1.00 | ||

| and incl | 234.7 | 237.7 | 3.0 | 15.85 | 5.00 |

*Please refer to the full table at the link above for complete results. Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Gold grades are uncapped. Au (g/t) = grams per tonne of gold.

CD-TALLMAN HIGHLIGHT TABLE

| Hole ID (Az, Dip) (degrees) | From (m) | To (m) | Intercept (m) | Au (g/t) | Au Cut-Off | Material Type | Hole Length (m) | Target |

| LBP881 (330, -45) | 16.8 | 47.2 | 30.5 | 0.67 | 0.15 | Bedrock | 121.9 | CD to Tallman |

| including | 32.0 | 33.5 | 1.5 | 1.11 | 1.00 | |||

| including | 38.1 | 42.7 | 4.6 | 1.62 | ||||

| LBP892 (260, -45) | 13.7 | 27.4 | 13.7 | 0.23 | 0.15 | Fill | 152.4 | CD to Tallman |

| and | 77.7 | 123.4 | 45.7 | 0.74 | ||||

| including | 99.1 | 108.2 | 9.1 | 2.17 | 1.00 | |||

| including | 117.3 | 120.4 | 3.0 | 1.35 | ||||

| LBP893 (160, -70) | 0.0 | 10.7 | 10.7 | 3.28 | 1.00 | Fill | 190.5 | CD to Tallman |

| and | 102.1 | 153.9 | 51.8 | 0.52 | 0.15 | Bedrock | ||

| including | 126.5 | 128.0 | 1.5 | 1.13 | 1.00 | |||

| LBP898 (160, -70) | 7.6 | 13.7 | 6.1 | 0.22 | 0.15 | Fill | 214.9 | CD to Tallman |

| and | 115.8 | 129.5 | 13.7 | 0.57 | Bedrock | |||

| including | 123.4 | 125.0 | 1.5 | 2.20 | 1.00 |

*Please refer to the full table at the link above for complete results. Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Gold grades are uncapped. Au (g/t) = grams per tonne of gold.

M ZONE HIGHLIGHT TABLE

| Hole ID (Az, Dip) (degrees) | From (m) | To (m) | Intercept (m) | Au (g/t) | Au Cut-Off | Hole Length (m) | Target |

| LBP884 (115, -45) | 170.7 | 176.8 | 6.1 | 1.10 | 0.15 | 304.8 | M Zone |

| including | 172.2 | 173.7 | 1.5 | 1.93 | 1.00 | ||

| and | 184.4 | 213.4 | 29.0 | 0.80 | 0.15 | ||

| including | 185.9 | 187.5 | 1.5 | 3.33 | 1.00 | ||

| LBP887 (80, -45) | 144.8 | 158.5 | 13.7 | 0.51 | 0.15 | 300.2 | M Zone |

| including | 155.4 | 158.5 | 3.0 | 1.05 | 1.00 | ||

| and | 202.7 | 213.4 | 10.7 | 0.66 | 0.15 | ||

| including | 210.3 | 211.8 | 1.5 | 1.67 | 1.00 |

*Please refer to the full table at the link above for complete results. Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Gold grades are uncapped. Au (g/t) = grams per tonne of gold. M Zone lies at the lowest structural level of the deposit such that carbonaceous material is frequently encountered at the base of the oxide zone leading to reduced cyanide solubility at depth.

Other Highlights

- Current drilling is largely focused on resource conversion to support an update to the mineral resource model at the end of 2023, which will feed into the proposed pre-feasibility study. Results to date have confirmed the potential value-add of this strategy, with the drill out of additional gold mineralization both within and peripheral to the current resource pits.

- Additionally, one drill rig is being used for exploration step-out and new target evaluation within the currently permitted area. This includes testing of the Rangefront South Target area, which is currently being drilled in the south-east corner of the project. This zone is modeled as the SE faulted extension of the large CDF mineral trend and has only one drill hole, LBP708, (51.8 m at 0.57 g/t Au) into the zone to date (see press release dated December 13, 2022).

- The amendment to the existing Plan of Operations continues in the evaluation process with the Federal and State agencies. Once approved, this amendment would allow the Company to conduct broad step-out and new-target exploration drilling across a large area surrounding the current permit area.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.