In the world of copper mining, where sentiment can shift overnight, Solaris Resources (TSX:SLS) (OTCQB:SLSSF), with its Warintza copper project in southeastern Ecuador, stands as a beacon for immediate upside potential.

Solaris’ shares have taken a 65% hit since 2021 highs despite continuing to deliver amazing resource growth drill results and making significant new discoveries on the project. This is due to a number of factors weighing on shares including an upcoming Presidential election overhang, a slump in copper prices, macro weakness, coupled with Equinox unloading their SLS shares due to their own intensive capital spending needs. Analysts are confident that the worst is now over, forecasting $20 average target prices, and here’s why.

Ecuador’s Political Transition with Stable Mining Outlook

Despite upcoming elections, the country is a great place to operate offering a robust framework for mining investment with regulatory and tax stability and investment protection provided for in the form of an Investment Contract, which Solaris ratified in December 2022.

The country also boasts Latin America’s fastest permitting regime and lowest effective tax rates, even as other nations in the region grapple with growing discontent and rising taxes. Ecuador is a US dollar economy with minimal inflation and solid existing infrastructure, which translates to lower capital intensity.

Recently, Wheaton Precious Metals made a strategic $300 million purchase of a gold stream for Lumina Gold’s Cangrejos Project in Ecuador. The specifics of this deal may not be directly relevant to copper, but it certainly casts light on the mining landscape in Ecuador. As the country prepares for an upcoming presidential election, the deal proves Ecuador’s mining sector’s resilience and continued appeal.

In this climate, WPM’s $300 million investment in an Ecuadorian company that has a market cap of $200 million and requires an additional billion to grow is indicative of confidence in the country’s mining regime.

Warintza: A Golden Goose

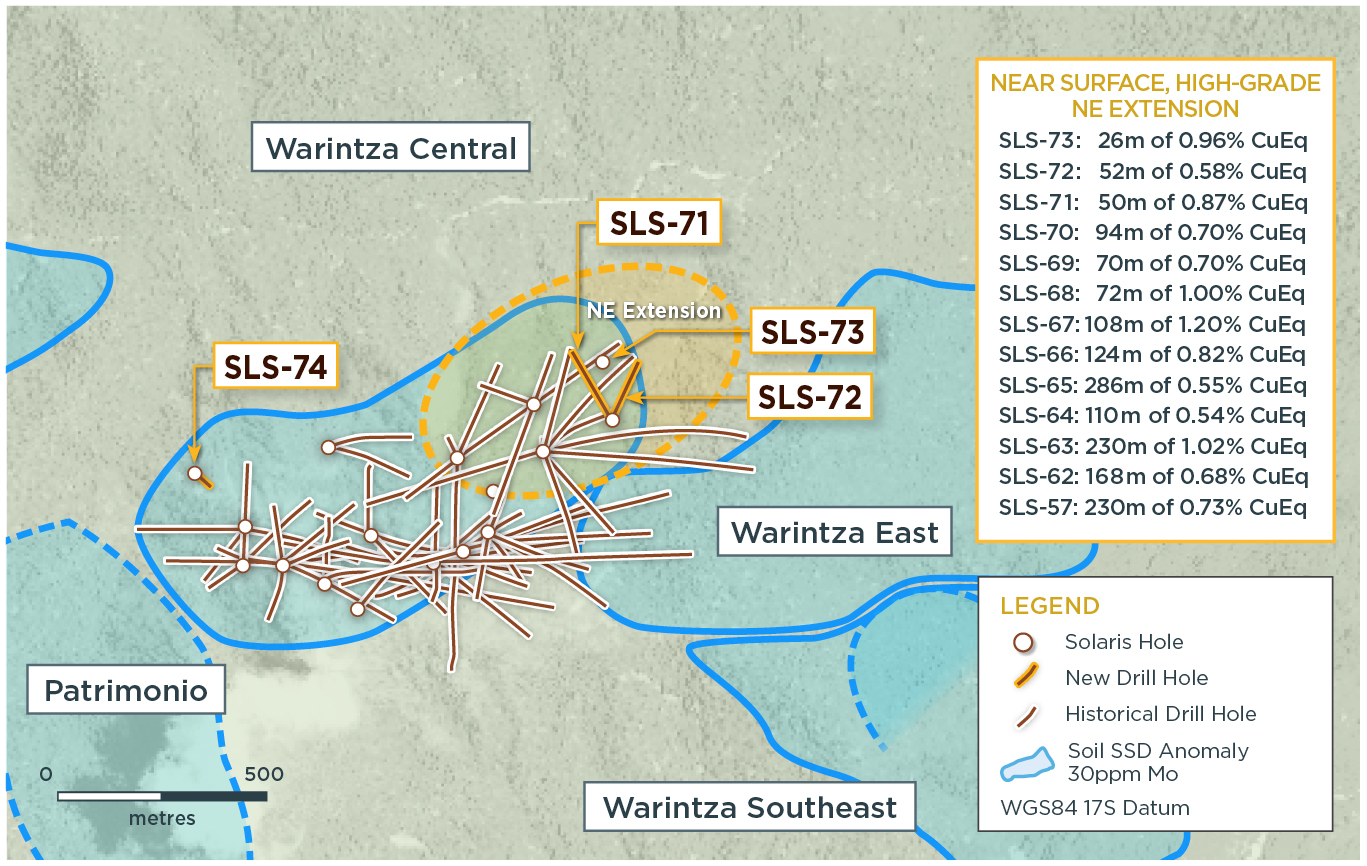

Solaris’ Warintza Project is world-class by any measure. With limited high-quality copper assets remaining, Warintza offers a tantalizing proposition to copper bulls. Positioned in a region rich with undeveloped copper porphyries with access to nearby primary infrastructure, the location alone is enough to turn heads.

Solaris issued a 43-101 resource in April 2022 for the Warintza Central deposit of 1.5 billion tonnes of copper at a CuEq grade of 0.5% including a high-grade starter pit of 287 million tonnes at a CuEq grade of 0.8%.

Over the last 18 months, the deposit has significantly grown with an updated mineral resource expected around year-end to incorporate new drilling with an expected resource growing to 2-3 billion tonnes.

What’s most important to the company is: 1) all new drill holes encountered mineralization at or near-surface which is rare amongst copper development assets, and (2) drilling continues to intersect grades in-line with the most recent 43-101 resource – the same resource that once had SLS trading at 2x its current levels

Most recently, the company announced two new discoveries on the project, known as Patrimonio and Warintza Southeast, both located just outside the 43-101 resource offering major growth potential once again bringing the grand total to six major deposits within the Warintza porphyry cluster. This follows after the original Warintza Central deposit discovered by the late David Lowell in 2000, and Solaris discoveries at Warintza West (February 2021), Warintza East (July 2021), and Warintza South (January 2022). Sulphide minerals at Patrimonio include pyrite, chalcopyrite, and molybdenite, with total sulphide abundances up to 10% – as much as two times higher than previously logged at Warintza Central, where the majority of the resource is located.

Valuation Disconnect

With analyst consensus on the current 43-101 resource showing a net present value (NPV) of $4.0 billion at an 8% discount rate, and a current SLS market cap of $620 million, the price to net asset value (P/NAV) stands at a mere 0.2x. Even for cautious investors, the downside risk at this valuation seems remarkably low, especially before the updated resource due at year-end. The strategic value of high-grade copper tonnage at surface with minimal strip seems to be ignored by the market presenting an attractive opportunity for buyers seeking a high-reward, low-risk asset.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.