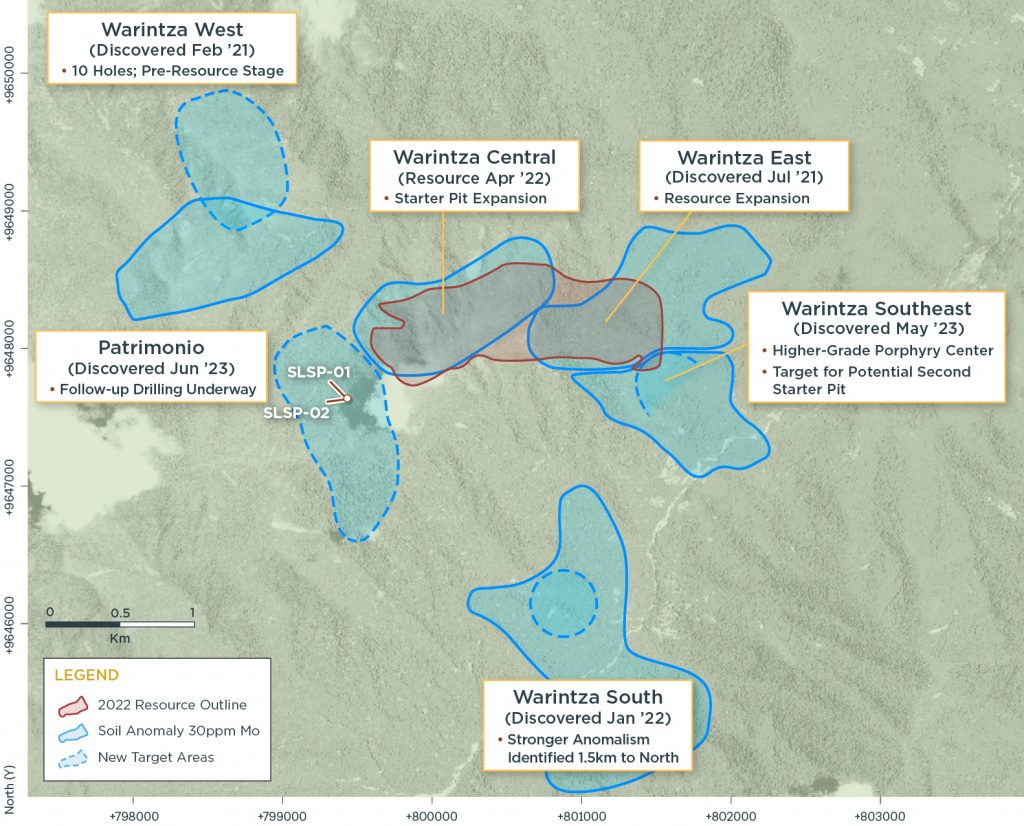

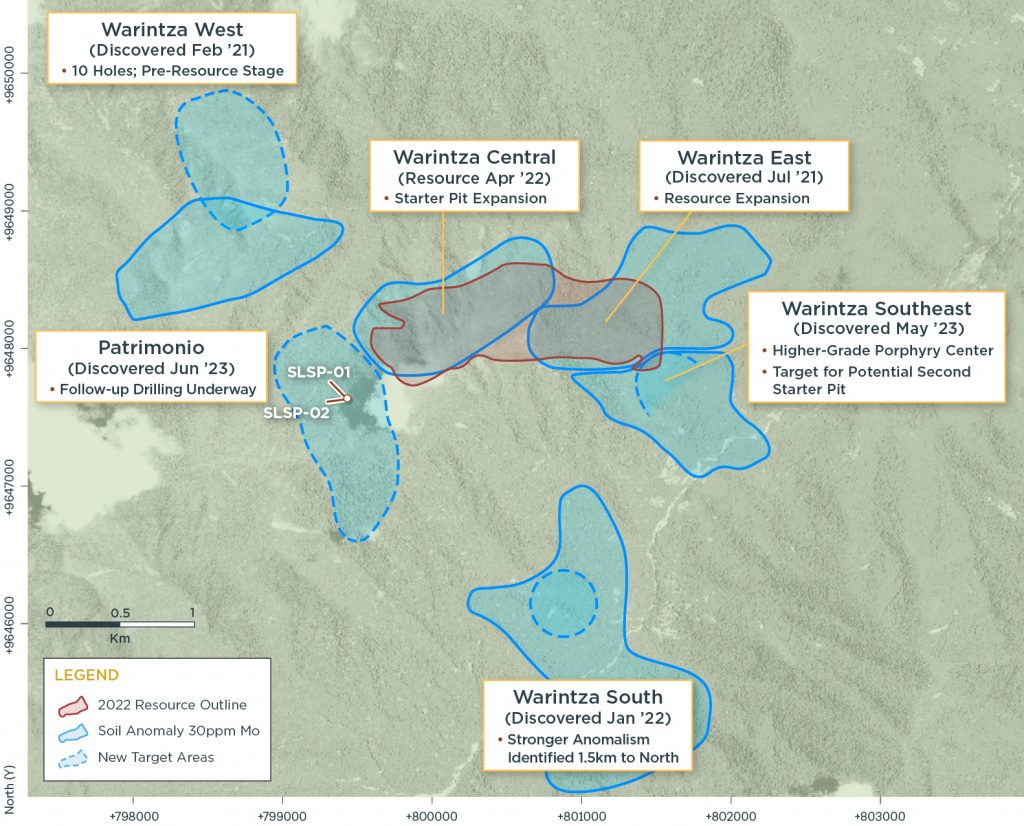

Solaris Resources (TSX:SLS)(NYSEAmerican:SLSR) has announced an In-Pit Mineral Resources Estimate (MRE) for its Warintza Project in southeastern Ecuador. The ongoing mineral resource drilling encompasses over 30,000 meters in the second half of 2024, targeting open extensions and upgrading mineral resources to support the Pre-Feasibility Study (PFS) set for the second half of 2025. Concurrent district exploration programs are also targeting complementary discoveries from an expanded portfolio of epithermal gold/silver and porphyry copper targets.

Mr. Javier Toro, Chief Operating Officer, commented in a press release: “We are very pleased to be able to release this standalone MRE which draws on our combined years of experience with open pit copper projects in the Americas. This new MRE provides a solid foundation for future updates and a robust mine plan with a low strip ratio, simple metallurgy and clean concentrates. In support of the PFS, we are doing further technical, infill and extensional drilling into open areas within and adjacent to the pit shell.”

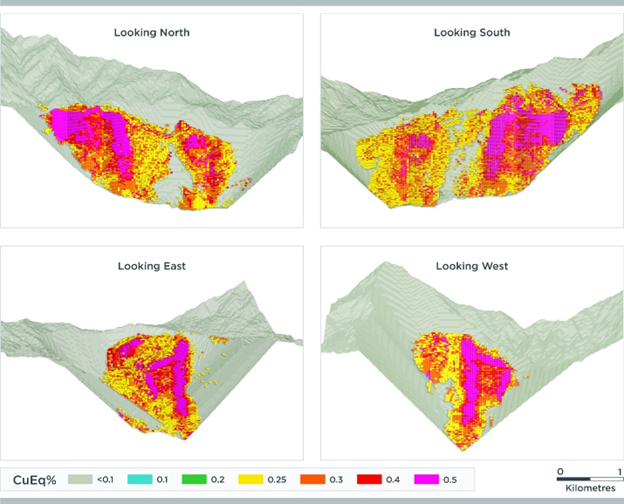

The In-Pit Mineral Resources at Warintza include 232 million tonnes (Mt) at 0.64% copper equivalent (CuEq) in the measured category and 677 Mt at 0.49% CuEq in the indicated category, resulting in a total of 909 Mt at 0.53% CuEq in measured and indicated categories. An additional 1,426 Mt at 0.37% CuEq is inferred at a base case cut-off grade of 0.25% CuEq. At a higher cut-off grade of 0.50% CuEq, the resources include 157 Mt at 0.76% CuEq in the measured category and 269 Mt at 0.69% CuEq in the indicated category, totaling 427 Mt at 0.71% CuEq in measured and indicated categories, with an additional 177 Mt at 0.62% CuEq in the inferred category.

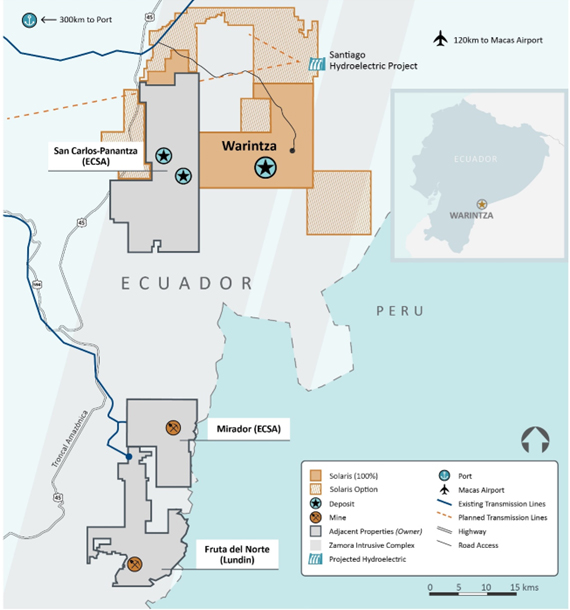

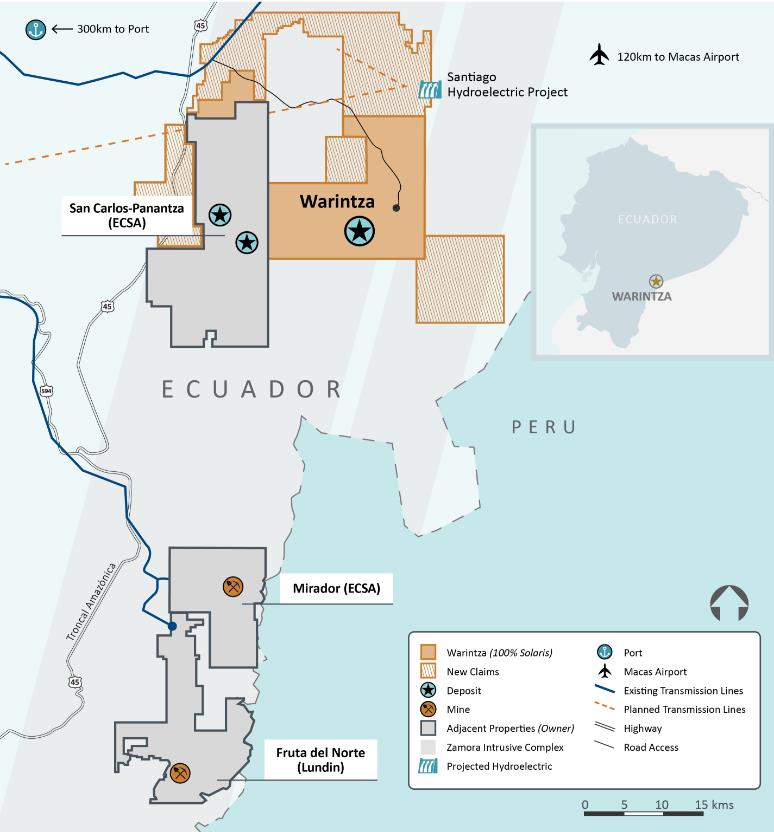

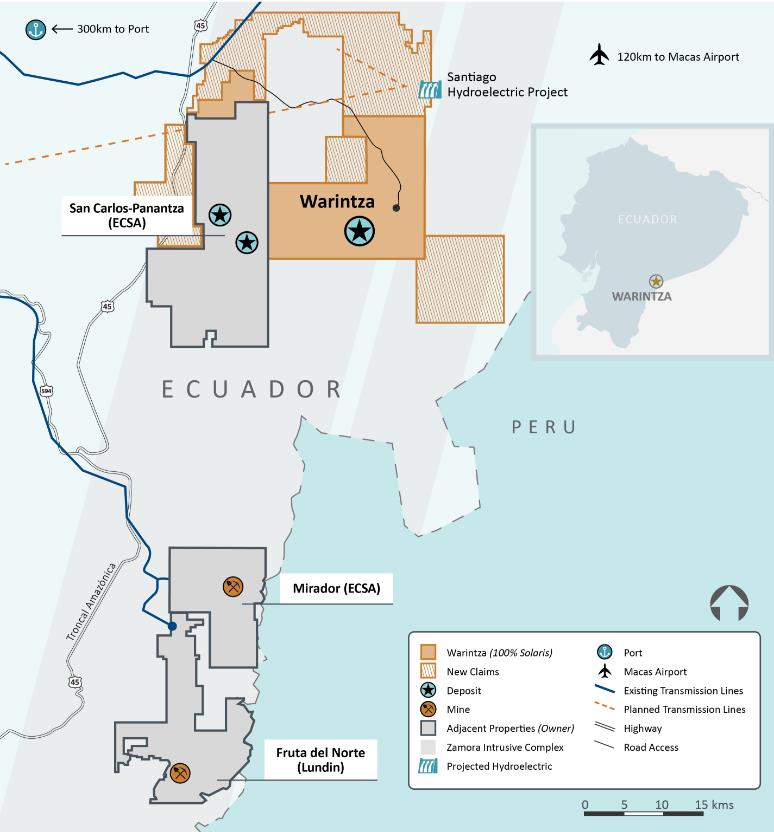

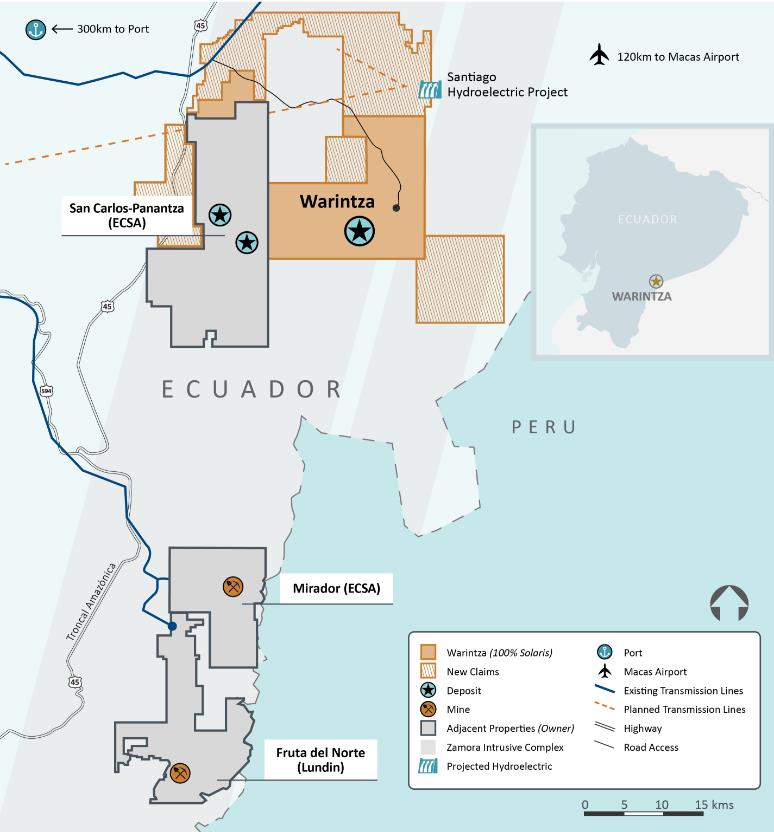

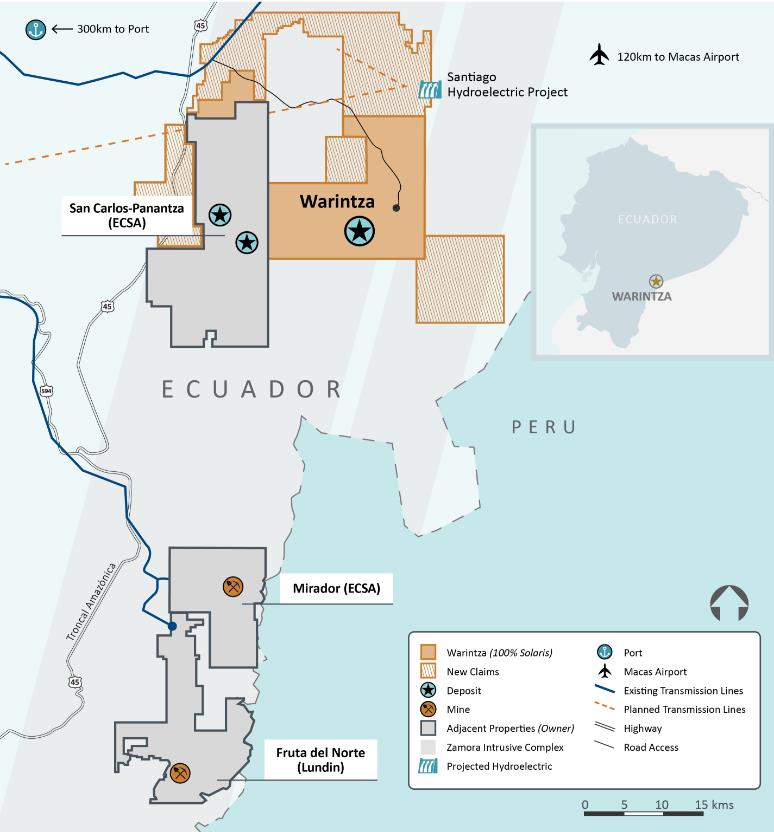

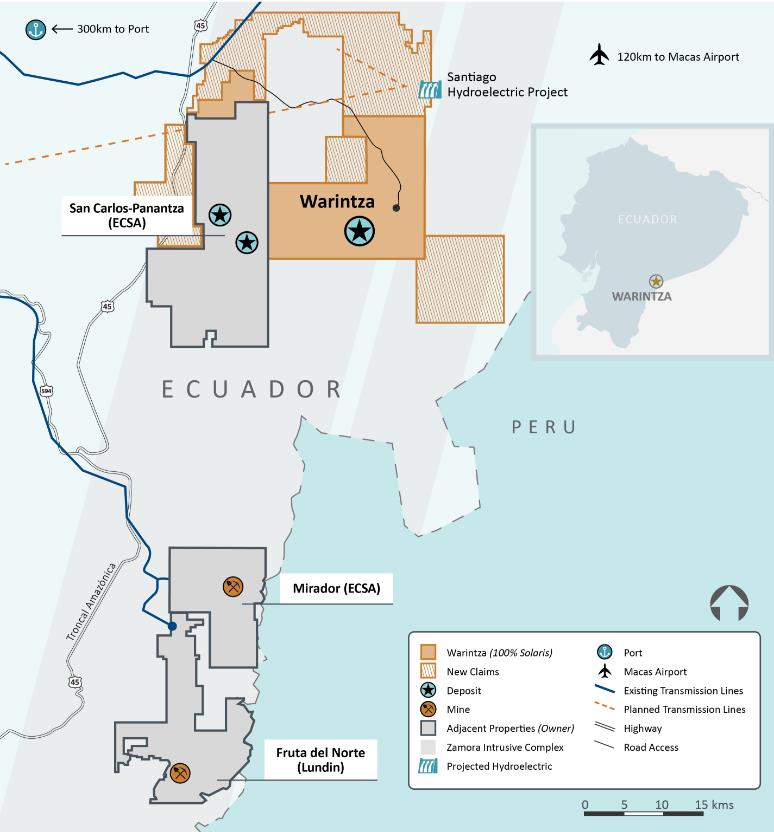

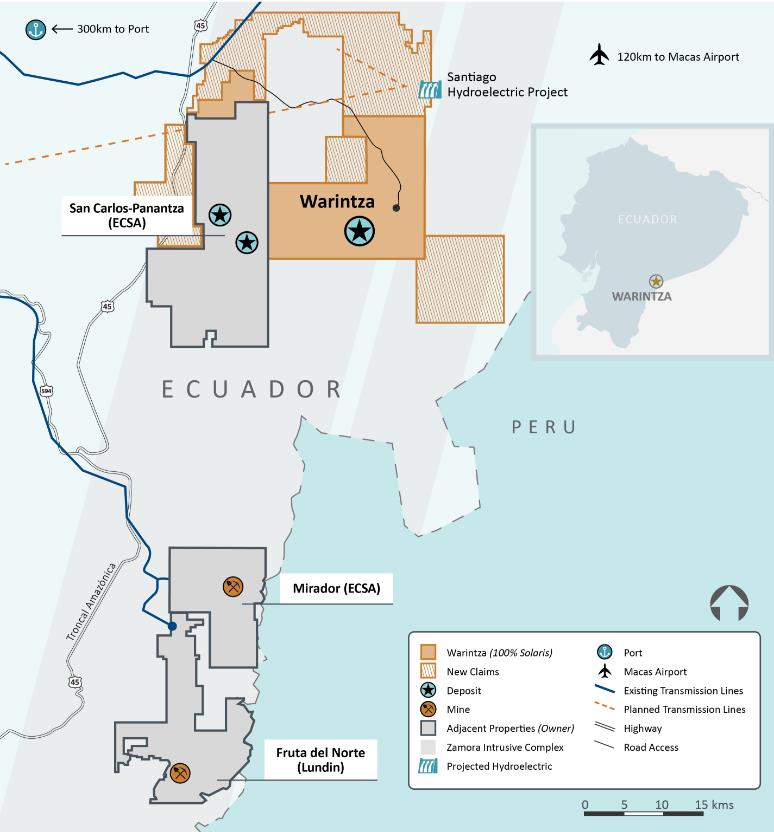

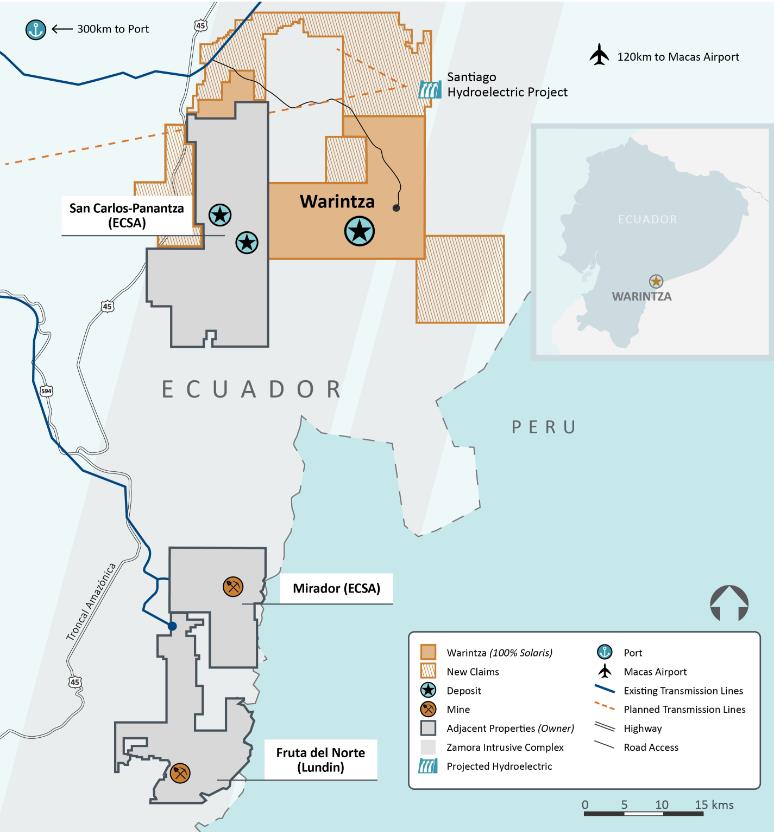

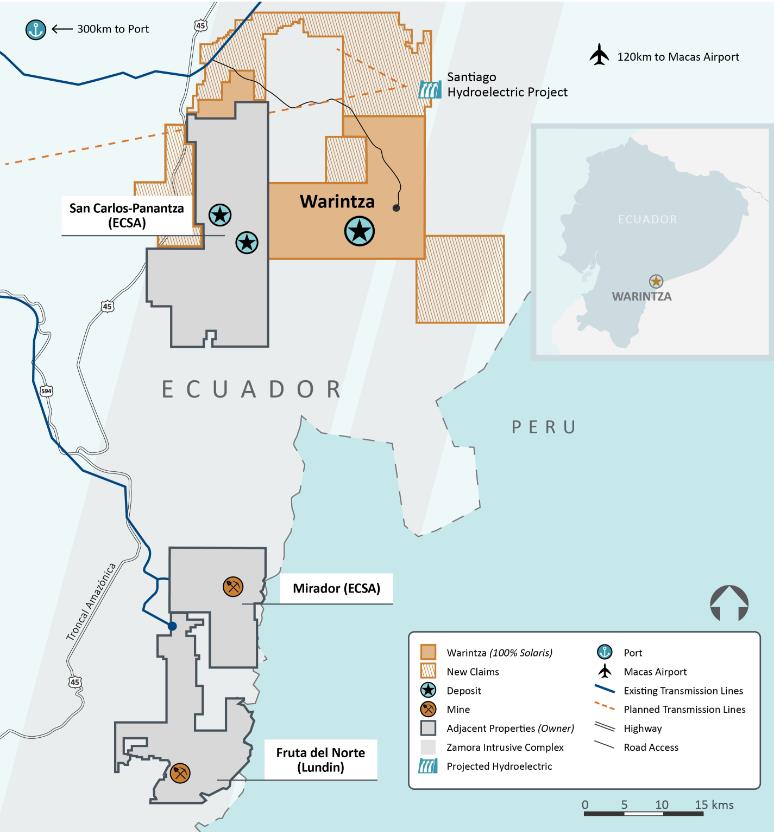

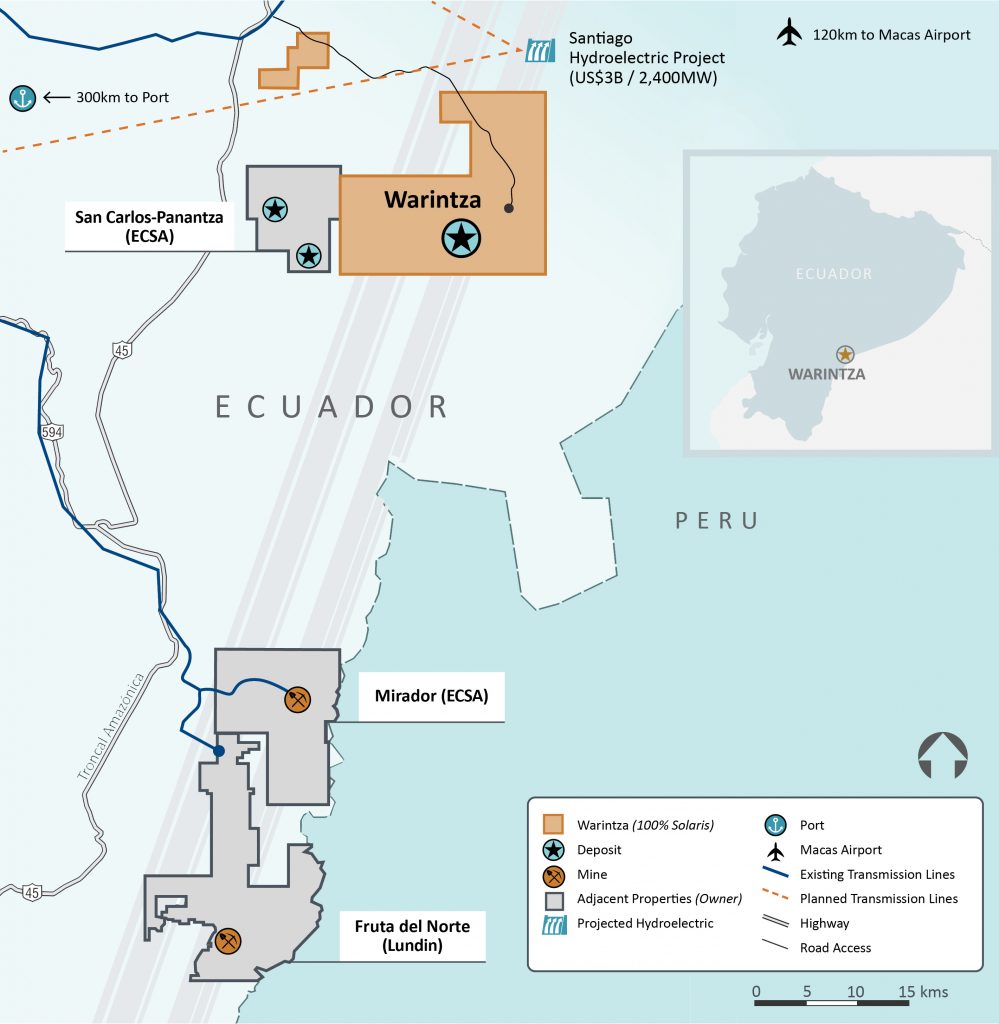

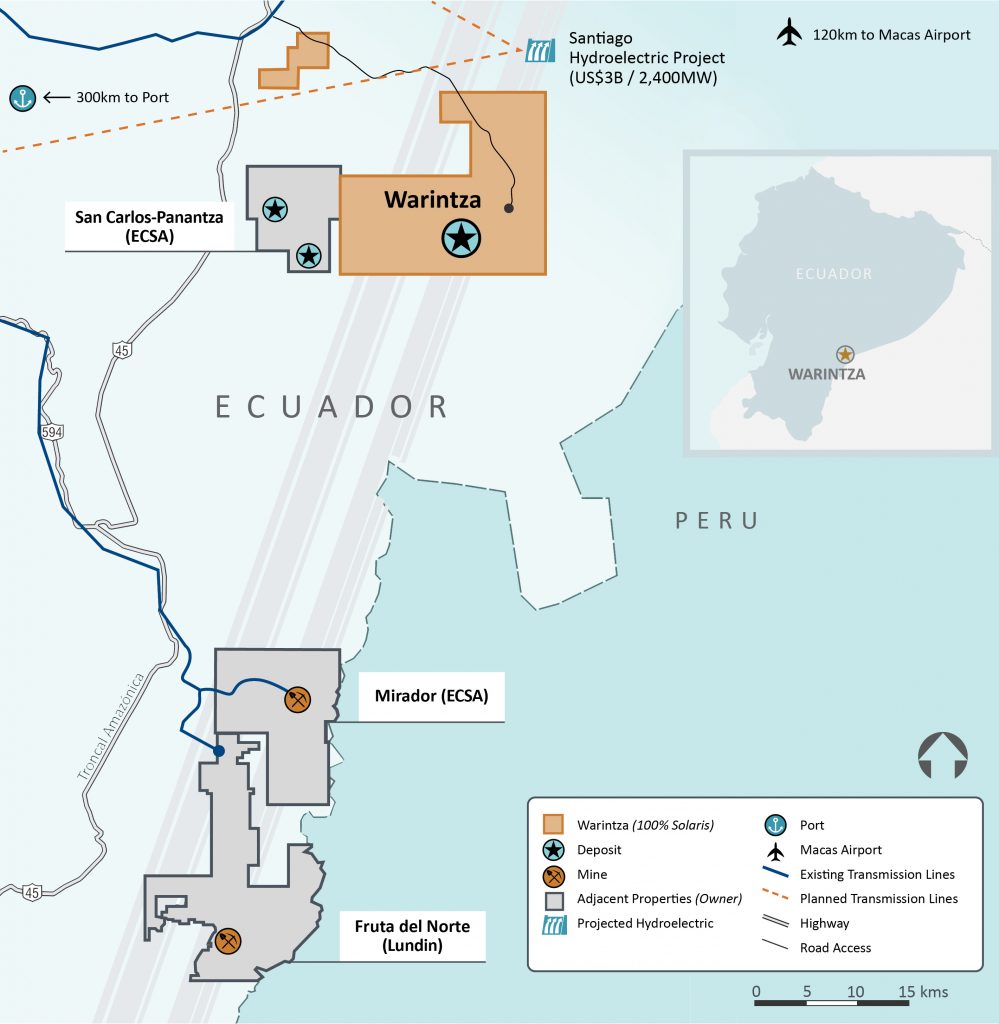

Warintza is strategically located at a low elevation within the southeast Ecuador mining district. The site benefits from a direct highway connection to Pacific ports and access to low-cost hydroelectric grid power, with potential further development at the adjoining Santiago G8 project. The region has seen significant socioeconomic improvement from mining exploration and development over the past decade.

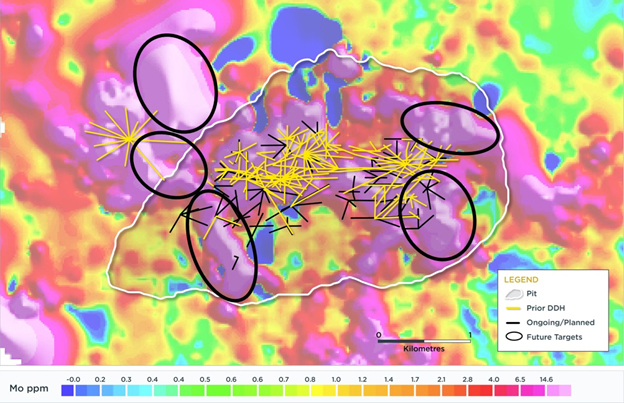

The 2024 drilling program involves 60,000 meters, with over 30,000 meters planned for the second half of the year. This drilling will be conducted from 140 holes on 80 platforms to provide improved coverage, targeting open lateral extensions, upgrading mineral resources, and converting remaining uncategorized blocks within the pit shell to support the PFS in 2025. Additionally, metallurgical, geotechnical, and hydrogeological drilling is ongoing.

Complementary district exploration efforts are also underway. Fieldwork is targeting epithermal-style gold-silver mineralization south of Caya-Mateo, where recent sampling has returned values between 4 and 12 grams per tonne (g/t) of gold. Field crews are also focused on mapping and sampling combined geophysical and geochemical porphyry copper targets.

Highlights from the results are as follows:

Table 1: Warintza Mineral Resource Estimate Sensitivity

| Cut-off | Category | Tonnage | Grade | |||

| CuEq (%) | (Mt) | CuEq (%) | Cu (%) | Mo (%) | Au (g/t) | |

| 0.15% | Measured | 246 | 0.61 | 0.45 | 0.02 | 0.05 |

| Indicated | 836 | 0.44 | 0.30 | 0.02 | 0.04 | |

| M&I | 1,082 | 0.48 | 0.34 | 0.02 | 0.04 | |

| Inferred | 3,135 | 0.27 | 0.20 | 0.01 | 0.04 | |

| 0.25% (Base Case) |

Measured | 232 | 0.64 | 0.47 | 0.02 | 0.05 |

| Indicated | 677 | 0.49 | 0.34 | 0.02 | 0.04 | |

| M&I | 909 | 0.53 | 0.37 | 0.02 | 0.05 | |

| Inferred | 1,426 | 0.37 | 0.27 | 0.01 | 0.04 | |

| 0.35% | Measured | 207 | 0.68 | 0.50 | 0.03 | 0.06 |

| Indicated | 497 | 0.56 | 0.40 | 0.02 | 0.05 | |

| M&I | 704 | 0.60 | 0.43 | 0.02 | 0.05 | |

| Inferred | 640 | 0.47 | 0.34 | 0.02 | 0.05 | |

| 0.50% (Higher Grade) |

Measured | 157 | 0.76 | 0.56 | 0.03 | 0.06 |

| Indicated | 269 | 0.69 | 0.50 | 0.03 | 0.05 | |

| M&I | 427 | 0.71 | 0.52 | 0.03 | 0.06 | |

| Inferred | 177 | 0.62 | 0.45 | 0.02 | 0.07 | |

Notes to Table 1:

- The Mineral Resource Estimate was prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014.

- Reasonable prospects for eventual economic extraction assume open-pit mining with conventional flotation processing and were tested using Whittle and Minesight pit optimization software with the following assumptions: metal prices of US$4.00/lb Cu, US$20.00/lb Mo, and US$1,850/oz Au; operating costs of US$1.50/t+US$0.02/t per bench mining, US$5.0/t milling, US$1.0/t G&A, and recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork.

- Metal price assumptions for copper, molybdenum and gold are based on a discount to the lesser of the 3-year trailing average (in accordance with US Securities and Exchange Commission guidance) and current spot prices for each metal.

- Mineral Resources include grade capping and dilution. Grade was interpolated by ordinary kriging populating a block model with block dimensions of 25m x 25m x 15m.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Copper-equivalent grade calculation for reporting assumes metal prices of US$4.00/lb Cu, US$20.00/lb Mo, and US$1,850/oz Au, and recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork and includes provisions for downstream selling costs. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

- The Mineral Resources estimate was prepared by Mario E. Rossi, FAusIMM, RM-SME, Principal Geostatistician of Geosystems International Inc., who is an Independent Qualified Person under NI 43-101. The Mineral Resources estimate is at a base case of 0.25% CuEq¹ cut-off grade and other estimates at varying cut-off grades are included only to demonstrate the sensitivity of the Mineral Resources estimate and are not the QP’s estimate of the Mineral Resources for the property.

- In Mr. Rossi’s opinion, there are currently no relevant factors or legal, political, environmental, or other risks that could materially affect the potential development of Mineral Resources.

- All figures are rounded to reflect the relative accuracy of the estimate and therefore may not appear to add precisely.

- The effective date of the mineral resource estimate is July 1, 2024.

Endnotes

- Copper-equivalence grade calculation for reporting assumes metal prices of US$4.00/lb Cu, US$20.00/lb Mo, and US$1,850/oz Au, and recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork and includes provisions for downstream selling costs. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources Inc. (TSX: SLS)(NYSEAmerican:SLSR) recently reported drill results from its ongoing 2024 drilling program at the Warintza Project in southeastern Ecuador. The latest findings include the final assays for the upcoming updated mineral resource estimate, anticipated later this month.

- Drill hole SLSE-36, positioned at the southeasternmost platform at Warintza Southeast, revealed 148 meters of 0.72% copper equivalent (CuEq) within a larger interval of 325 meters of 0.51% CuEq from the surface. This hole remains open in strong mineralization, with the final 34 meters averaging 0.90% CuEq.

- SLS-77, located on the northern boundary of the Northeast Extension of Warintza Central, returned 108 meters of 0.70% CuEq from near the surface within a broader interval of 273 meters of 0.57% CuEq from the surface.

- SLS-78, drilled from a new platform 100 meters to the west, showed 78 meters of 0.70% CuEq within a larger interval of 114 meters of 0.65% CuEq from a depth of 72 meters before hitting low-grade granodiorite.

- SLS-79, drilled from the same platform at a steeper inclination, returned 78 meters of 0.60% CuEq from near the surface within a broader interval of 248 meters of 0.50% CuEq, ending in strong mineralization.

- SLST-03, drilled approximately 300 meters south of Warintza Central at the Trinche platform, aimed to convert undefined waste within the expected pit shell. This hole returned 312 meters of 0.62% CuEq within a larger interval of 1,028 meters of 0.30% CuEq from the surface.

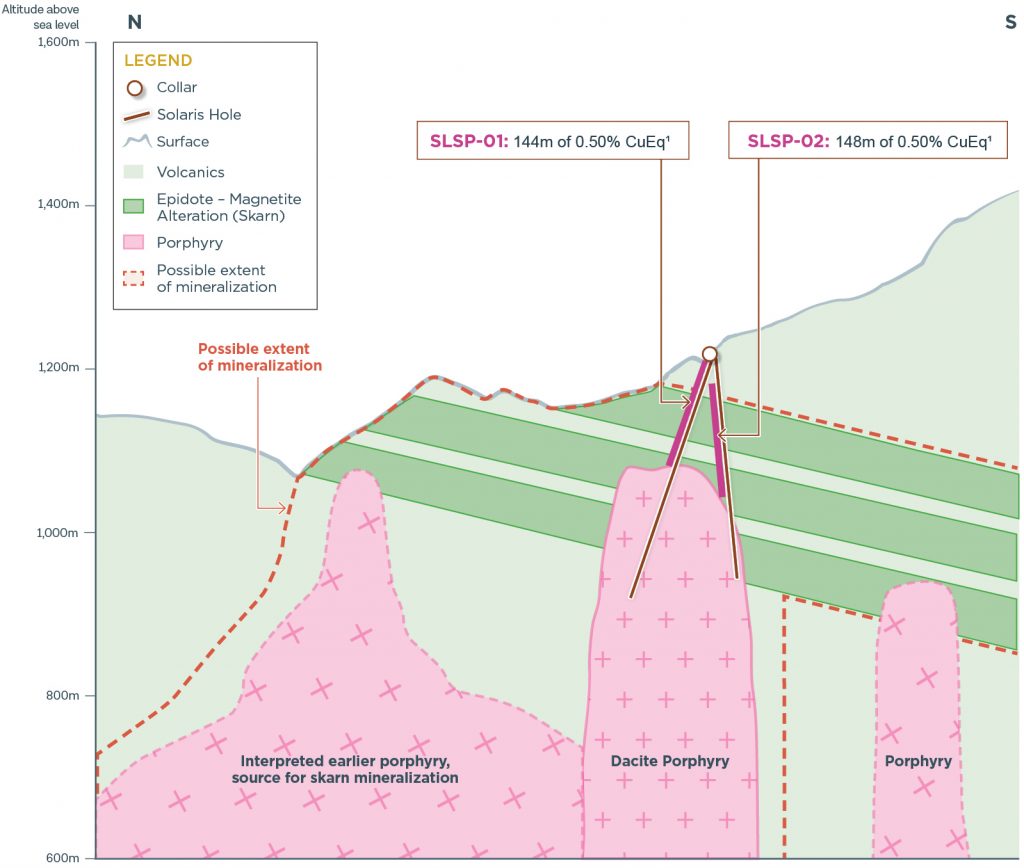

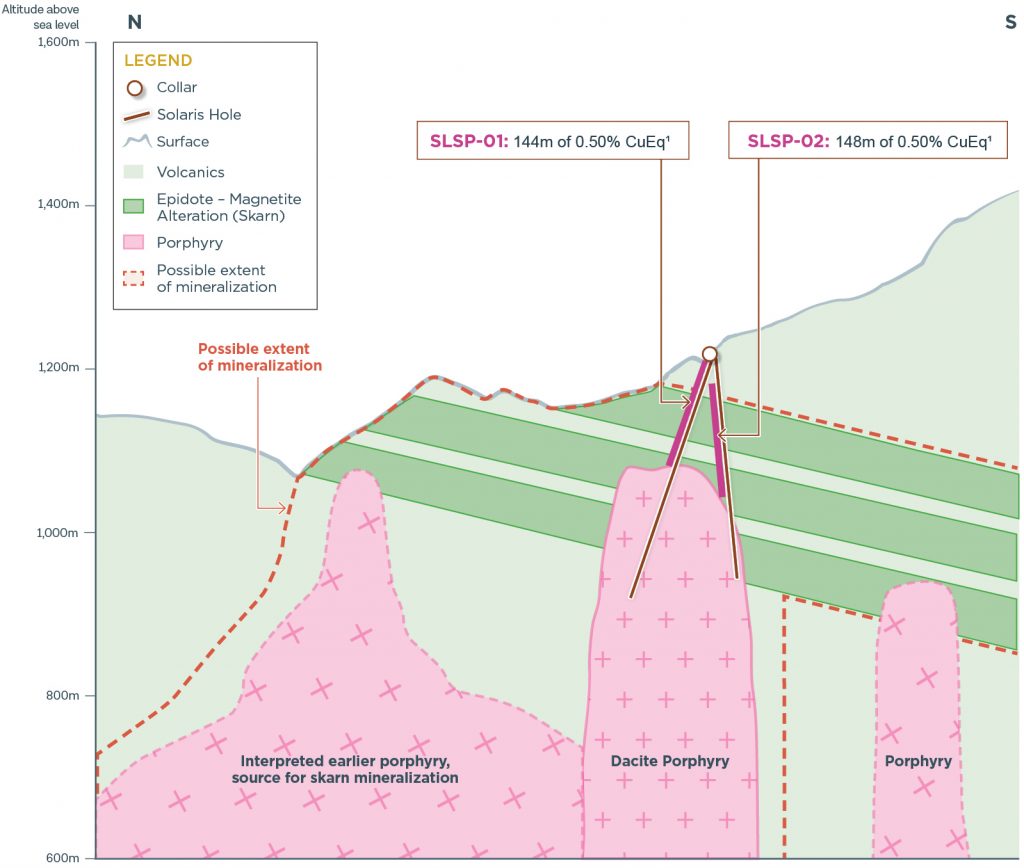

- Patrimonio hole 04, consistent with holes 01 and 02, intersected a roughly 150-meter thick tabular zone of replacement mineralization dipping shallowly to the west. The source of this mineralization has not yet been found. SLSP-03, collared at a higher elevation, intersected a low-grade layer in the host lava sequence before passing into a barren, post-mineral porphyry that intruded and displaced the targeted mineralized layer. Mineral alteration zoning and geochemistry suggest that the core of the mineralized system lies to the south.

The 2024 drill program has recently expanded to 60,000 meters, comprising 140 holes from 80 platforms, providing significantly improved drilling coverage. By the end of June, 27,000 meters in 74 holes were completed. Seven rigs are targeting over 8 kilometers of drilling in July, facilitated by improved site logistics from infrastructure development.

Current drilling focuses on Patrimonio exploration, resource extension at Warintza Southeast, and infill and technical drilling to support the Prefeasibility Study (PFS) in the second half of 2025. This includes geotechnical holes that are expected to provide insights into the geology of the Caya-Mateo epithermal gold and silver target area.

Solaris Resources’ continued efforts at the Warintza Project underscore its commitment to expanding and defining the mineral resources within this promising area. The anticipated updated mineral resource estimate will likely provide further clarity on the potential and future development of the Warintza Project.

Other results include:

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-79 | July 09, 2024 | 15 | 263 | 248 | 0.41 | 0.02 | 0.05 | 0.50 |

| Including | 54 | 132 | 78 | 0.52 | 0.01 | 0.05 | 0.60 | |

| SLS-78 | 72 | 186 | 114 | 0.54 | 0.02 | 0.07 | 0.65 | |

| Including | 93 | 171 | 78 | 0.58 | 0.02 | 0.08 | 0.70 | |

| SLS-77 | 0 | 273 | 273 | 0.43 | 0.02 | 0.10 | 0.57 | |

| Including | 21 | 129 | 108 | 0.56 | 0.02 | 0.10 | 0.70 | |

| SLSE-36 | 0 | 325 | 325 | 0.40 | 0.02 | 0.05 | 0.51 | |

| Including | 177 | 325 | 148 | 0.58 | 0.03 | 0.07 | 0.72 | |

| Including | 291 | 325 | 34 | 0.76 | 0.03 | 0.08 | 0.90 | |

| SLSP-04 | 30 | 204 | 174 | 0.25 | 0.02 | 0.06 | 0.35 | |

| Including | 104 | 152 | 48 | 0.30 | 0.02 | 0.08 | 0.43 | |

| SLSP-03 | 0 | 310 | 310 | 0.10 | 0.01 | 0.04 | 0.14 | |

| SLST-03 | 16 | 1044 | 1028 | 0.24 | 0.01 | 0.03 | 0.30 | |

| Including | 646 | 958 | 312 | 0.51 | 0.02 | 0.06 | 0.62 |

Notes to table: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 – Collar Locations

| Hole ID | Easting | Northing | Elevation (m) |

Depth (m) |

Azimuth (degrees) | Dip (degrees) |

| SLS-79 | 800197 | 9648470 | 1340 | 263 | 270 | -88 |

| SLS-78 | 800197 | 9648469 | 1340 | 220 | 270 | -65 |

| SLS-77 | 800439 | 9648493 | 1271 | 324 | 320 | -85 |

| SLSE-36 | 801529 | 9647848 | 1154 | 325 | 220 | -85 |

| SLSP-04 | 799364 | 9647811 | 1526 | 309 | 145 | -60 |

| SLSP-03 | 799349 | 9647450 | 1627 | 310 | 40 | -65 |

| SLST-03 | 800192 | 9647550 | 1592 | 1123 | 330 | -50 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

Solaris Resources (TSX:SLS)(NYSEAmerican:SLSR) has issued a statement to address false and misleading claims made by anti-mining NGOs regarding the social license of its Warintza Project in southeastern Ecuador. The company emphasizes that the Warintza Project resides on the ancestral lands of the Warints and Yawi communities, which have been officially registered and defined by the Ecuadorian government since 2002. These communities are the sole legal entities with rights and authority over these lands.

The International Labor Organization has recognized the Warints and Yawi as the sole titleholders of their ancestral lands. It has also acknowledged the legality of the Strategic Alliance, a governance structure created by Solaris to ensure community consent for the Warintza Project. This Alliance is managed by an Advisory Board of Directors comprising company representatives and democratically elected members from each community.

The Ecuadorian Ministry of Environment has conducted two consultation processes, confirming that the Warints and Yawi communities are directly influenced by the Warintza Project. These consultations have successfully facilitated the project’s progression from initial exploration to advanced exploration, following an Environmental Impact Assessment and the issuance of an Environmental License.

Solaris has obtained explicit consent for the project from the Warints and Yawi through formal community agreements. These agreements include an Impact and Benefits Agreement signed in 2020 and subsequently updated in 2022 and 2024 to reflect the project’s growth and commitment to its host communities. Notably, all surrounding communities contribute employees to the project, and many have expressed interest in partnering with Solaris regarding their own lands.

In March 2024, Solaris signed a trilateral cooperation agreement with the Interprovincial Federation of Shuar Centers (FICSH), the highest authority representing 143,000 Shuar indigenous people, and the Alliance for Entrepreneurship and Innovation of Ecuador. This agreement was signed in the presence of senior Ecuadorian government officials. Mr. David Tankamash, President of FICSH, commented at the time, “We support the Warints and Yawi communities and reject the efforts of foreign NGOs who act against the will and interest of our members.”

Solaris cautions shareholders and investors against the misinformation propagated by NGOs and other third parties. The company reiterates its commitment to transparency and encourages interested parties to seek accurate information directly from them.

Mr. Froilan Juank, President of the Yawi Shuar Center, commented: “We are the legitimate registered owners of the Ancestral Lands on which the Warintza Project resides and we have the right and have chosen, through our General Assembly, to participate in the Project through our Strategic Alliance and Impact and Benefits Agreement.”

Mr. Agustin Kayak, Trustee of the Warints Shuar Center, stated: “We and the Yawi community have decided to move forward with the Warintza Project. We are the owners of the lands where Warintza is located. We work together, the two communities of Warints and Yawi, for the well-being and development of our people.”

Mr. Emmanuel Delaune, Manager of Ecuadorean state-owned mining company, Empresa Nacional Minera, stated: “Solaris is an example to follow with its Warintza Model, which contributes to the local development of the Shuar communities through transparency, citizen participation, environmental stewardship and social development. These are the principles by which Solaris has earned the necessary credentials to operate in this area of Ecuador.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

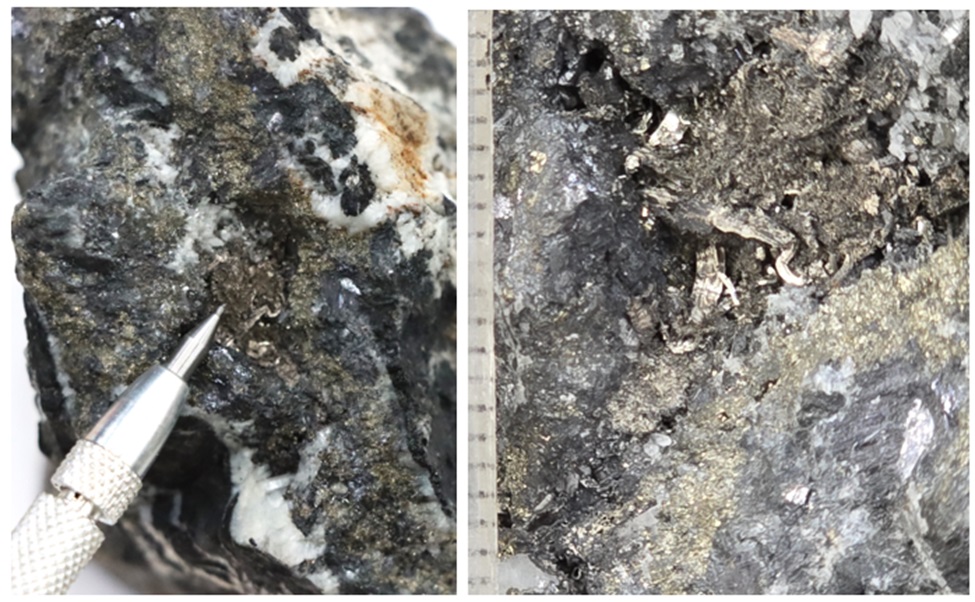

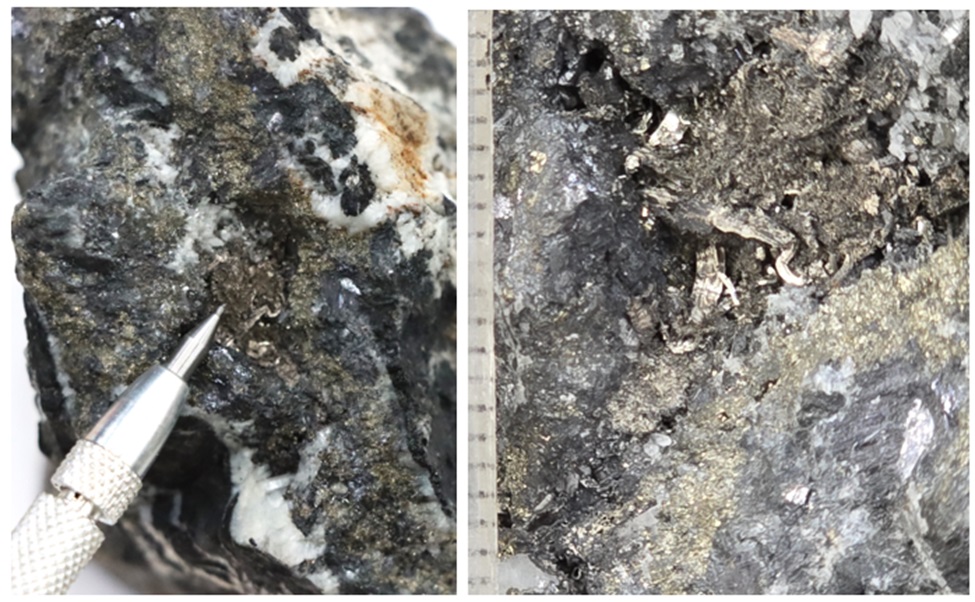

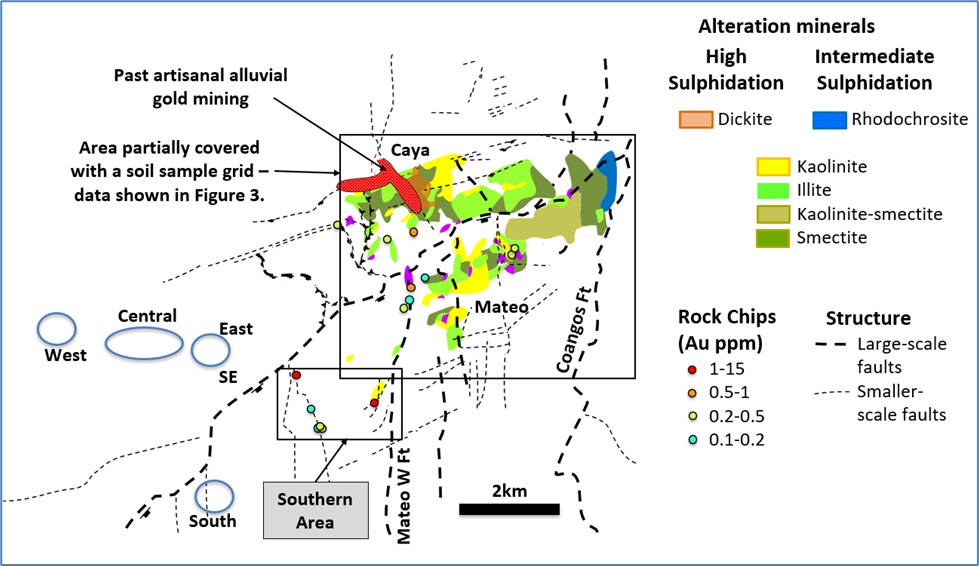

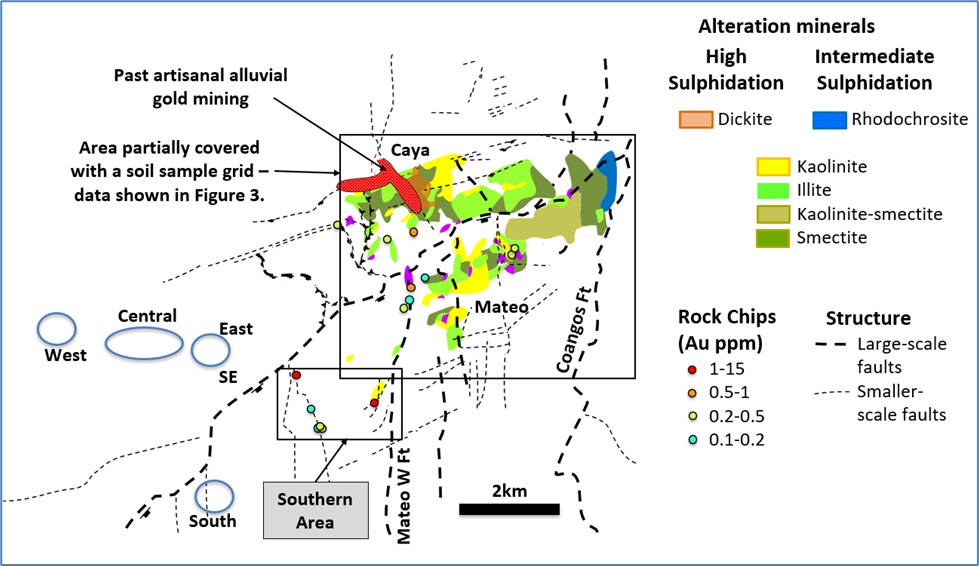

Solaris Resources (TSX:SLS) (NYSEAmerican:SLSR), has reported the discovery of significant precious metal deposits, which have substantially expanded the known area of epithermal-style mineral alteration. Initially concentrated in the Caya area, this mineralization has now been traced through the adjacent Mateo target and several kilometers further south. The expansion was identified through reconnaissance rock-chip sampling in the newly explored southern region. This sampling program yielded impressive results, with assays revealing up to 11,570 grams per tonne of silver (g/t Ag) and 12.3 grams per tonne of gold (g/t Au) across a 30-centimeter section of breccia outcrop.

These findings represent a major breakthrough in Solaris’ exploration activities at the Warintza Project. In response to these promising results, the company has intensified its fieldwork efforts to further delineate and refine potential drilling targets. Solaris anticipates commencing exploration drilling in this newly discovered area either towards the end of the third quarter or early in the fourth quarter of 2024.

Highlights from the results are as follows:

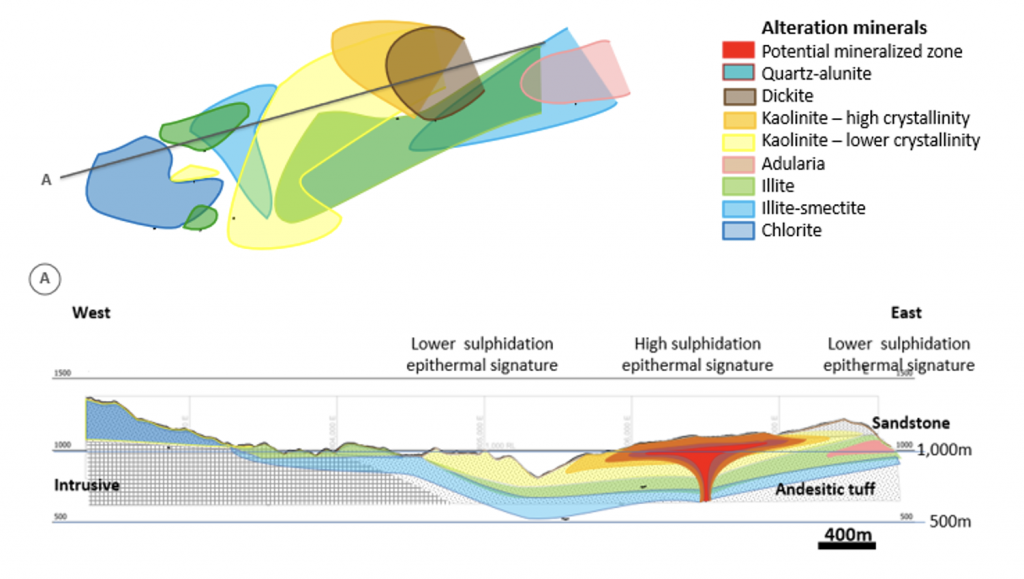

- Ongoing regional exploration east of the Warintza cluster has expanded the area of interest for epithermal mineralization from the Caya-Mateo area several kilometres to the south (Figure 2)

- Epithermal deposits can be genetically related to porphyry systems and host rich concentrations of gold and silver, with this association well documented in southeastern Ecuador

- The newly-sampled southern area is affected by minor fault splays off a major regional fault thought to be of Jurassic age, with kilometer-scale displacement across it

- This fault separates intrusive-dominated geology to the west hosting the Warintza porphyry cluster from primarily volcanic-sedimentary geology to the east hosting epithermal mineralization

- The footwall (western side) of this fault forms the margin of an adjacent north-south pull-apart basin filled with volcanic-sedimentary sequences

- Initial reconnaissance rock-chip sampling in this area has returned values of up to 11,570 g/t Ag and 12.3 g/t Au across 30cm of breccia outcrop with exceptionally high concentrations of epithermal pathfinder elements (Figure 1)

- In addition to the above, sporadic high gold values of between 4 g/t and 9 g/t, with silver values up to 150 g/t, in rock chip sampling have also been returned, with anomalous pathfinder values consistently occurring over an area 1km by 2km

- The working exploration concept is that these samples represent high-level expressions of an intermediate sulphidation epithermal system at depth

- Detailed mapping and sampling of this area has commenced, with vectors from geochemical data and mineral alteration to be used to refine targets

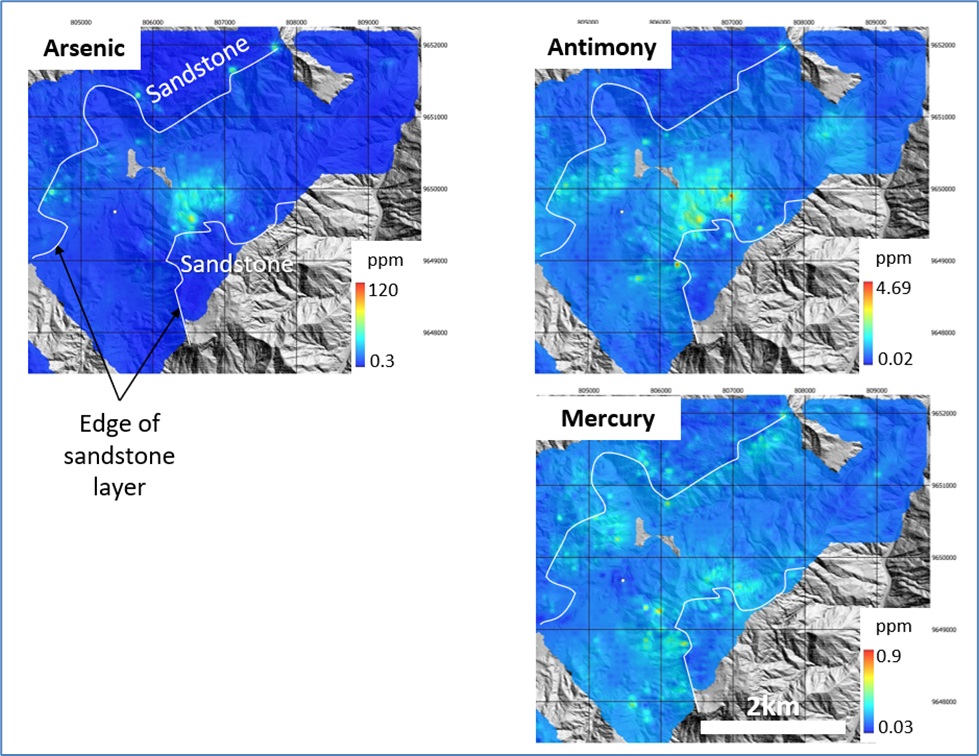

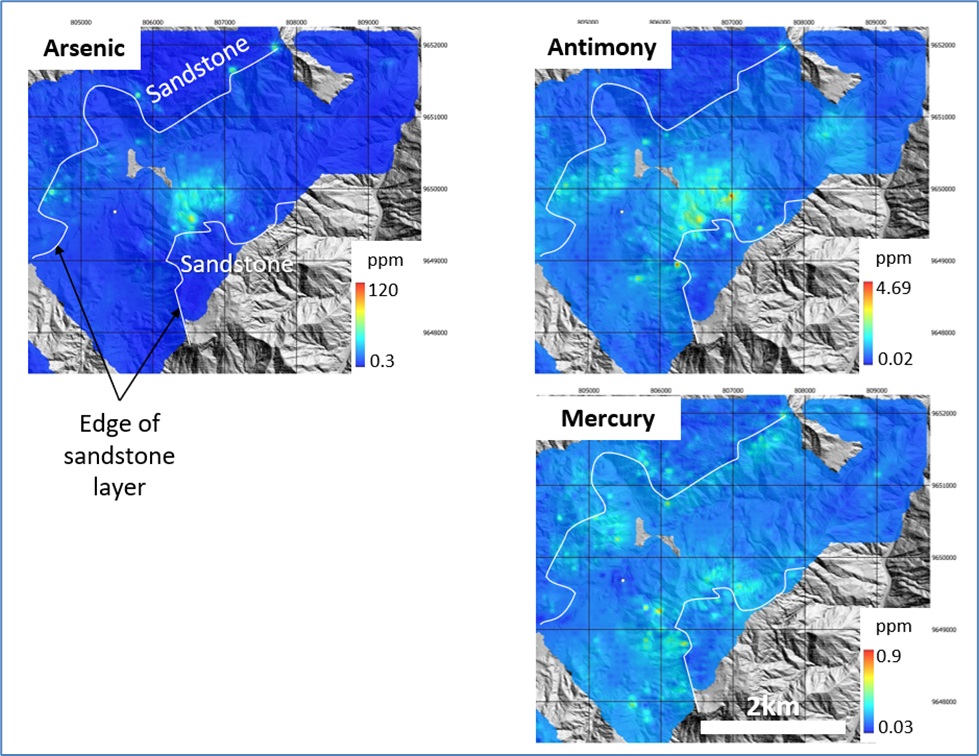

- Separately, recent sampling and spectral mapping in the Caya-Mateo target area have outlined pathfinder element and alteration anomalies at the margins of overlying sandstones (Figure 3)

- Mateo requires follow-up programs to extend coverage southeast over this large target area and establish metal and alteration zonation to define its core

- A series of geotechnical holes previously planned in Caya-Mateo to support Pre-Feasibility technical studies near the epithermal target area, are expected to commence in July and are expected to provide valuable exploration data

- Initial exploration drilling at Caya, Mateo and the new southern area will be planned on the basis of the ongoing exploration work and scheduled for late Q3/24 – early Q4/24

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources Inc. (TSX:SLS)(NYSEAmerican:SLSR) has announced an expansion of its 2024 drilling program at the Warintza Project in southeastern Ecuador, doubling the planned meterage from 30km to 60km. The expansion is supported by the company’s recent financing and significant productivity improvements resulting from past infrastructure investments, improved logistics, and optimized processes at the project site.

Mr. Javier Toro, Chief Operating Officer, commented in a press release: “We are very pleased to have doubled the planned drilling for the Warintza project which will contribute to future growth and improved confidence in resources while also providing technical data for mine design and mine planning purposes to support technical studies. The forthcoming mineral resource estimate update in July will reflect two years of additional drilling from the prior estimate in 2022, with drilling continuing through the end of the year.”

The company has reported additional drill results as its 2024 drilling program ramps up. Drill hole SLSE-33, collared on the southern margin of Warintza Southeast and drilled at a steep inclination northeast, returned 81m of 0.73% CuEq¹ from near surface within a broader interval of 544m of 0.50% CuEq¹ from surface, bottoming in mineralization. SLSE-35, collared from a central platform at Warintza East and drilled east, returned 189m of 0.50% CuEq¹ from surface within a broader interval of 580m of 0.42% CuEq¹, remaining open in mineralization with the last 10m averaging 0.41% CuEq¹.

Solaris Resources has been able to ramp up drilling with six rigs completing 7.7 km in May, and a seventh rig is expected to be added soon. The company aims to challenge the prior peak drilling rate achieved with 12 rigs in 2021, primarily due to improved logistics from infrastructure investments, construction of on-site facilities, and trail networks connecting new drilling platform locations, along with process optimization.

The expanded drilling program will target open lateral extensions of mineralization beyond the pit, including into the Patrimonio target area, improve drilling density, and support technical studies. The company is also on track to release an updated mineral resource estimate in early July.

Ongoing regional exploration efforts have expanded the footprint of epithermal-style mineral alteration from the Caya area into the adjacent Mateo porphyry target, located 6km east of the Warintza cluster. Field crews have also been active on the newly-acquired adjacent claims, with further details to be provided in subsequent releases.

To ensure the accuracy of the sample assay results, Solaris Resources Inc. has implemented a quality control/quality assurance (QA/QC) program that includes the insertion of blind certified reference materials (standards), blanks, and field duplicate samples. Logging and sampling are completed at a secured company facility located on site, with drill core being cut in half on site and samples securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru, and Vancouver, Canada, for analysis, with selected pulp check samples sent to Bureau Veritas lab in Lima, Peru, for independent verification. Both ALS Labs and Bureau Veritas lab are independent of Solaris Resources Inc.

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) |

To (m) |

Interval (m) |

Cu (%) |

Mo (%) |

Au (g/t) |

CuEq¹ (%) |

| SLSE-35 | June 11, 2024 | 0 | 580 | 580 | 0.33 | 0.02 | 0.04 | 0.42 |

| Including | 0 | 189 | 189 | 0.41 | 0.02 | 0.04 | 0.50 | |

| SLSE-34 | 0 | 522 | 522 | 0.28 | 0.02 | 0.03 | 0.36 | |

| Including | 66 | 318 | 252 | 0.31 | 0.02 | 0.03 | 0.40 | |

| SLSE-33 | 6 | 550 | 544 | 0.40 | 0.02 | 0.06 | 0.50 | |

| Including | 54 | 135 | 81 | 0.60 | 0.02 | 0.07 | 0.73 |

Notes to table: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 – Collar Locations

| Hole ID | Easting | Northing | Elevation (m) |

Depth (m) |

Azimuth (degrees) |

Dip (degrees) |

| SLSE-35 | 801485 | 9648192 | 1129 | 580 | 90 | -80 |

| SLSE-34 | 801483 | 9648241 | 1170 | 523 | 40 | -80 |

| SLSE-33 | 801532 | 9647848 | 1154 | 550 | 50 | -85 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS; NYSEAmerican:SLSR) has announced the successful closing of its bought deal equity offering and a private placement, raising aggregate gross proceeds of approximately $53.9 million. The funds will be used to support the company’s ongoing exploration and development activities at its flagship Warintza Project in southeastern Ecuador and other regional exploration initiatives.

The bought deal equity offering, which closed on June 10, 2024, saw the company issue 8,222,500 common shares, including the full exercise of the over-allotment option by the underwriters, at a price of $4.90 per share. The offering generated gross proceeds of $40,290,250 and was completed pursuant to an underwriting agreement dated May 27, 2024, between Solaris Resources Inc. and a syndicate of underwriters led by National Bank Financial Markets, RBC Capital Markets, and BMO Capital Markets, acting as Joint Bookrunners.

In addition to the bought deal, the company also closed a private placement, issuing 2,795,102 common shares at the same price of $4.90 per share, raising an additional $13,696,000 (US$10,000,000). This private placement represents the drawdown of the second equity tranche of Solaris Resources Inc.’s previously announced offtake financing package.

The net proceeds from both the bought deal and private placement will be allocated to fund an expanded exploration and infill drilling program at the company’s Warintza Project, which boasts a world-class copper resource with significant expansion and discovery potential. The funds will also be used to enhance regional exploration activities, including fieldwork on ten recently awarded exploration concessions, as well as for working capital and general corporate purposes.

Solaris Resources Inc. continues to advance its impressive portfolio of copper and gold assets in the Americas. In addition to the Warintza Project in Ecuador, the company holds a series of grass roots exploration projects with discovery potential in Peru and Chile, and maintains significant leverage to increasing copper prices through its 60% interest in the La Verde joint-venture project with a subsidiary of Teck Resources in Mexico.

The successful completion of the bought deal equity offering and private placement demonstrates the strong investor confidence in Solaris Resources Inc.’s assets and growth strategy. The company remains well-positioned to capitalize on the growing global demand for copper and other precious metals, while continuing to advance its exploration and development activities in the Americas.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS)(NYSEAmerican:SLSR) on April 17, 2024 reached a significant milestone for its flagship Warintza Copper Project in southeastern Ecuador. The company signed an updated Impact and Benefits Agreement (IBA) with the Shuar communities of Warints and Yawi, reflecting the continued growth and advancement of the project and reaffirming the communities’ support for responsible development. Here’s what’s behind the agreement and why it is such a major milestone for the project and the country.

The updated IBA followed the Ecuadorian government’s publication of a manual demanding prior consultation with surrounding communities for existing and new mining projects. This agreement built upon the strategic alliance formed between Solaris and the Shuar communities in August 2019, which has fostered direct and transparent dialogue regarding all project-related activities.

The Warintza deposit, discovered by David Lowell in 2000, sat dormant for two decades due to a breakdown in social acceptance from local communities. In mid-2019, Solaris undertook extensive dialogue to understand and resolve the root causes of conflict, leading to the signing of initial impact and benefits agreements in 2020 and 2022.

Key highlights of the updated IBA include explicit community consent for the Warintza Project, legally binding and ensuring the communities are informed and engaged throughout the project’s lifecycle. The agreement also includes commitments and benefits to the communities, such as impact mitigation measures, local employment and training opportunities, education and skills training programs, investments in community infrastructure, and financial benefits and compensation for the use of ancestral lands.

The IBA is governed by an elected Board of Directors that operates as a regional task force, monitoring project activities, communicating with employees, and ensuring accountability of the commitments made between the State, Community, and Company.

Solaris president and CEO Daniel Earle stated, “The signing of this updated impact and benefits agreement marks a significant milestone in the social advancement of the Warintza project through our pioneering participatory mining model for sustainable resource development.”

The timeline of agreements between Solaris and the Shuar communities includes a Memorandum of Understanding signed in January 2019, the first Impact and Benefits Agreement in September 2020, an updated agreement in March 2020 for project advancement and scope expansion, and the completion of an Environmental Impact Assessment on the project in late 2022.

The updated IBA ultimately demonstrates Solaris Resources’ commitment to responsible and inclusive mining practices, ensuring that local communities are involved and benefit from the Warintza Copper Project’s advancement.

Ms. Sonsoles García, Minister of Production, Foreign Trade, Investment and Fisheries, commented, “We value this initiative of Solaris because it strengthens positive community relations and provides for the integration of the local population in productive and sustainable activities. This allows the inclusion of a traditionally displaced population, which is a priority for us. It is also aligned with the priority we have as a National Government of territorial development and good use and management of resources.”

Mr. Daniel Earle, President & CEO, commented, “The signing of this updated IBA builds on the foundation of good faith dialogue and trust that led to the formation of a Strategic Alliance partnership with our host communities and original IBA in 2020. This marks a significant milestone in the social advancement of the Warintza Project through our pioneering Participatory Mining model for sustainable resource development.”

Mr. Agustin Kayuk, leader of the Shuar Warints Center and member of the Board of Directors of the Strategic Alliance, commented, “The signing of this updated IBA strengthens the working relationship with Solaris and brings greater opportunities for the development of our communities. The decision is supported by a permanent relationship with the Company based on mutual respect and transparent dialogue, as well as a history of positive impacts generated for our people. We look forward to continuing our relationship and playing an integral role in the advancement of the Project.”

Mr. Vicente Froilan Juank, leader of the Shuar Yawi Center and also a member of the Board of Directors of the Strategic Alliance, commented, “The updated IBA brings further support and new opportunities for our people. When Warintza advances, our communities advance with it. Since the signing of the inaugural IBA in 2020, and with the help of the Ecuadorian state, the local impacts in job creation, community infrastructure, and development of programs in health, education, skills training, entrepreneurship, and innovation have been evident in our daily lives.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) (NYSEAmerican:SLSR) has announced the termination of a previously proposed minority equity investment aimed at expanding the company’s Warintza Project in Ecuador.

The proposed investment, which would have supported both the growth of existing operations and the potential acquisition of a neighboring property, was initially announced four months ago. However, despite the anticipation of timely approval due to the minority nature of the investment and its focus on critical minerals, the transaction has not yet received the necessary regulatory clearance from Canadian authorities.

Solaris’ share price has also risen by over 35% since the initial announcement, making the terms of the investment, which included a 14% premium at the time, no longer financially advantageous for the company. This price increase, while positive in isolation, has been outpaced by similar companies in the sector due to the ongoing uncertainty surrounding the regulatory process in Canada.

The company has expressed disappointment in the delay, citing the evolved regulatory environment and heightened political sensitivity surrounding Canadian investments in foreign assets. The combination of these factors, coupled with the increasingly unattractive terms of the deal, has led Solaris to conclude that terminating the investment is the most prudent course of action to protect shareholder interests.

Despite this setback, Solaris remains financially secure, with sufficient funds to support its planned activities at the Warintza Project through 2025. This includes the ongoing exploration of a recently acquired 40,000-hectare area adjacent to the existing project site, which has already shown promising geological and geophysical similarities to the mineral-rich Warintza cluster.

Furthermore, the company has access to an additional US$40 million in funding through an existing offtake financing agreement. With these resources, Solaris intends to focus on maximizing shareholder value through a targeted strategy that prioritizes long-term growth and flexibility.

Solaris has also reiterated its commitment to the Warintza Project timeline, with an Environmental Impact Assessment expected to be delivered in the second half of 2024 and a Pre-Feasibility Study in the second half of 2025. These milestones are crucial steps in the development of the project, and Solaris remains optimistic about the potential of Warintza to become a significant source of critical minerals.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources Inc. (TSX:SLS)(NYSEAMERICAN:SLSR) has shared an operations update for its Warintza copper project in southeastern Ecuador. The update highlights improved productivity and cost savings under new Chief Operating Officer Javier Toro, as well as the appointment of top consultants to support the Environmental Impact Assessment (EIA) and Pre-Feasibility Study (PFS).

Mr. Javier Toro, COO, commented in a press release: “We are excited with the improvements we have made at site where our team is approaching record monthly drilling rates with significantly fewer rigs than at prior peaks. We are also pleased to be making progress in advancing studies and work programs to support the completion of the EIA in H2/24 and PFS in 2025. Warintza is a very unique project given its global scale and location in a mining district adjacent to infrastructure at low elevation.”

Drilling Ramps Up, Targeting 30km in 2024

Drilling at Warintza continues to accelerate, with six rigs completing over 5,400 meters in April, close to setting a new monthly record for the project. Solaris has budgeted a minimum of 30 kilometers of resource growth and infill drilling for 2024. Some of these holes will also provide technical data for mine design and planning to support upcoming technical studies.

The updated mineral resource estimate remains on track for completion at the end of June and release in early July. It will be completed by leading porphyry specialist Mr. Mario E. Rossi of Geosystems International Inc., who also conducted the previous estimate.

EIA Targeted for H2 2024, PFS for H2 2025

Solaris has engaged ESSAM Cía. Ltda., an Ecuadorian environmental consulting firm accredited by Ecuador’s Ministry of Environment, to finalize and submit the EIA for the Warintza exploitation phase. ESSAM has experience supporting Ecuador’s largest copper and gold mines. The EIA submission is targeted for the second half of 2024, building on over three years of baseline environmental monitoring, data collection and studies.

To support the PFS planned for the second half of 2025, Solaris has appointed leading international consulting firms:

– Ausenco Engineering for metallurgical studies, process plant design, and infrastructure assessments

– Knight Piésold Consulting for detailed technical studies and engineering designs for the pit, waste rock facility, and tailings management facility

– AMC Consultants and Minsys Mining Systems for mine scheduling and trade-off studies to optimize mine plans

Improved Site Productivity and Cost Savings

Infrastructure development, logistics optimization, and improved practices at the Warintza site have significantly increased productivity and efficiency. This has enabled a 26% reduction in drilling costs to US$229 per meter and generated substantial savings compared to the Q1 2024 budget.

Current Funding and Future Plans

As of March 31, Solaris held an unaudited cash balance of approximately US$29 million. An additional US$40 million is expected from the previously announced offtake financing package. These funds are expected to support the planned 2024 and 2025 work programs. Upon closing the strategic investment announced in January, Solaris plans to expand activities and continue the consolidation of the land package surrounding Warintza.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

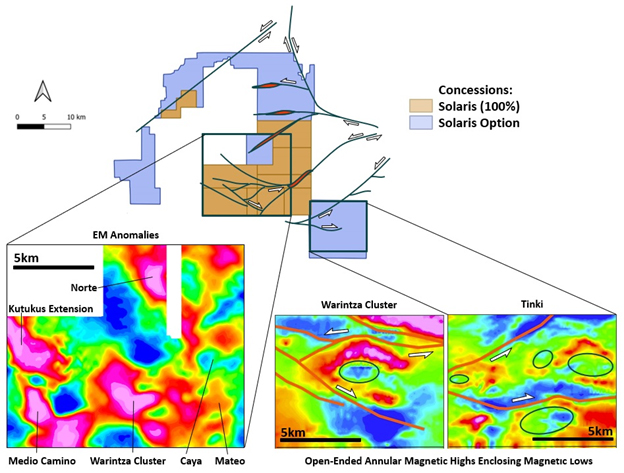

Solaris Resources (TSX: SLS)(NYSE:SLSR) has recently been awarded an option by Empresa Nacional Minera (ENAMI EP), Ecuador’s state-owned mining company, to acquire up to a 100% interest in 10 new exploration concessions. These concessions, covering approximately 40,000 hectares, are strategically located adjacent to the company’s existing Warintza Project and the San Carlos-Panantza porphyry copper-molybdenum deposits within the mineral-rich Zamora belt. This region is known for hosting some of Ecuador’s largest copper and gold mines to the south.

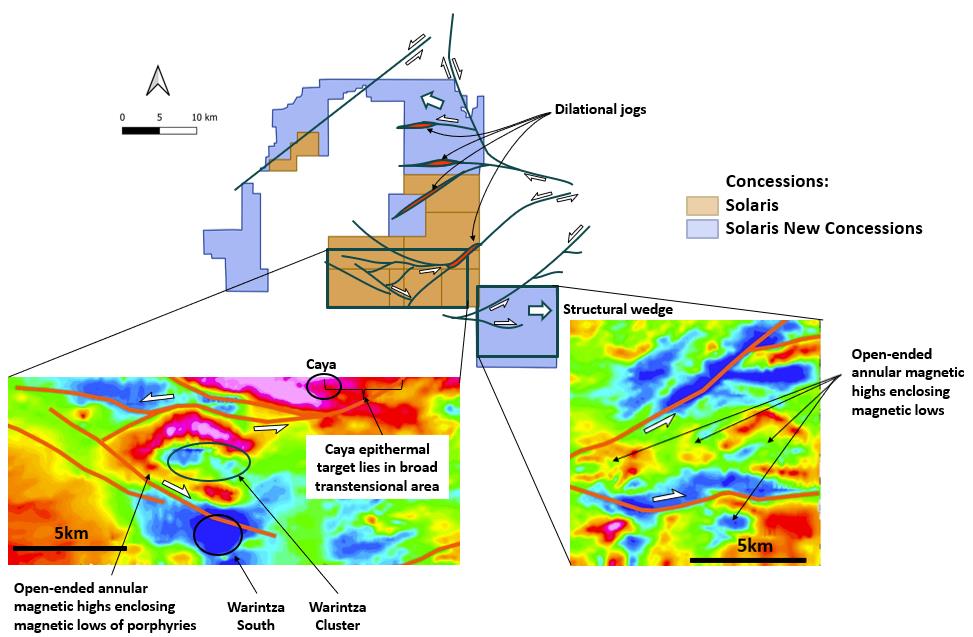

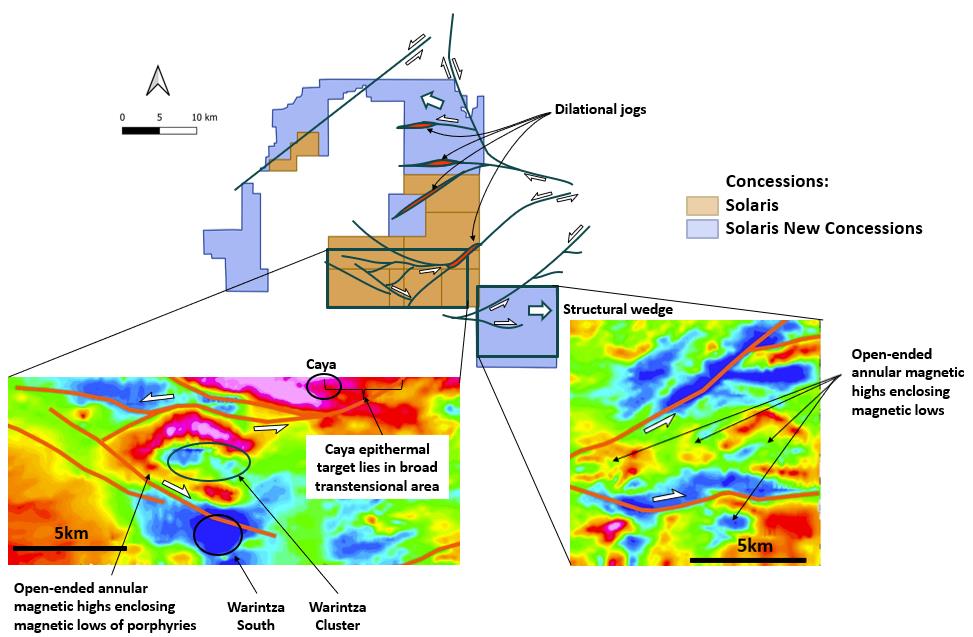

The newly acquired concessions are believed to hold significant potential for porphyry copper and epithermal gold deposits. This assessment is based on a comprehensive analysis of multiple layers of data, including Solaris’ extensive heliborne magnetic survey. The survey results, a portion of which is shown in Figure 2, reveal several promising indicators of mineral deposits.

Porphyry copper targets within the new concessions are characterized by open-ended annular magnetic highs surrounding magnetic lows and erosional depressions. These features are consistent with the outcropping deposits found within the Warintza porphyry cluster, suggesting a high likelihood of mineral presence.

Structural interpretation of the area supports the potential for epithermal gold deposits within dilational jogs and pull-apart basins. These geological settings are common for gold deposits in the Zamora belt and bear similarities to the Caya epithermal target, which was previously announced by Solaris in a press release dated April 23, 2024.

To expedite the exploration process, Solaris plans to deploy two field crews on the ground in May. These teams will begin conducting fieldwork to gather more detailed data and assess the mineral potential of the newly acquired concessions.

The terms of the agreement with ENAMI EP include an upfront payment of US$0.25 million, a proposed exploration program of up to US$25 million over the exploration phase, and the exclusive option for Solaris to acquire the claims from ENAMI EP at a price to be determined by independent experts. This agreement follows similar awards by ENAMI EP to subsidiaries of Barrick Gold Corporation and Hancock Prospecting Pty Ltd, which have committed to investing up to US$148 million in exploration programs in Ecuador.

Solaris’ acquisition of these new exploration concessions demonstrates the company’s commitment to expanding its presence in Ecuador’s thriving mining sector. With the promising potential for porphyry copper and epithermal gold deposits, Solaris is well-positioned to capitalize on the region’s mineral wealth and contribute to the country’s economic growth.

As fieldwork commences and more data becomes available, the mining industry and investors alike will be closely monitoring Solaris’ progress in unlocking the value of these new exploration concessions.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) (NYSEAMERICAN:SLSR) has shared the initial results from its 2024 drilling efforts and provided an update on exploration at its Warintza Project in southeastern Ecuador. These early results include intersections of 150 meters of 0.67% copper equivalent (CuEq) within a broader section of 384 meters of 0.51% CuEq, and another segment measuring 284 meters of 0.53% CuEq starting near the surface.

The drilling operations, which intensified during the first quarter despite the rainy season, are part of a large-scale plan to both expand and upgrade the mineral resources at the project. With six rigs currently operating across multiple zones including Warintza Central, East, and Southeast, the company expects the drilling to continue throughout the year. This effort is also accompanied by exploratory drilling at the newly discovered Patrimonio site and regional exploration at the promising Caya epithermal gold target.

In terms of the 2024 drilling campaign specifics, January saw 700 meters drilled, which increased to 1,800 meters in February and 3,800 meters in March. The company anticipates reaching 5,200 meters by the end of April. Overall, Solaris plans to complete at least 30 kilometers of drilling this year, with an updated report on mineral resources expected by the end of June.

Solaris has secured the necessary funds for its 2024 and 2025 exploration programs through an offtake financing package announced in December last year. As of the end of 2023, the company reported having around US$39 million in cash and equivalents. It expects an additional US$40 million from its financing activities, further bolstered by a strategic investment finalized in January 2024. However, the details of this investment are still under review by Canadian regulators.

In addition to its drilling program, Solaris is also focusing on the Caya epithermal gold target. Recent field work at this site has highlighted a 5 km by 3 km gold anomaly located northeast of Warintza East. Soil samples have outlined a significant area of gold and other pathfinder elements indicative of epithermal mineral deposits. The alteration patterns and mineral assemblages found at Caya suggest a high-sulfidation epithermal system, a style of mineralization known for hosting significant gold deposits.

The exploration team has recently expanded its soil sampling grid to include areas affected by historical artisanal mining, which could offer insights into the broader mineral potential of the region. The company plans to use additional spectral analysis to better understand the alteration patterns in the volcanic sediment layers covering the target area. Further details on these findings are expected to be reported in June.

Highlights from the results are as follows:

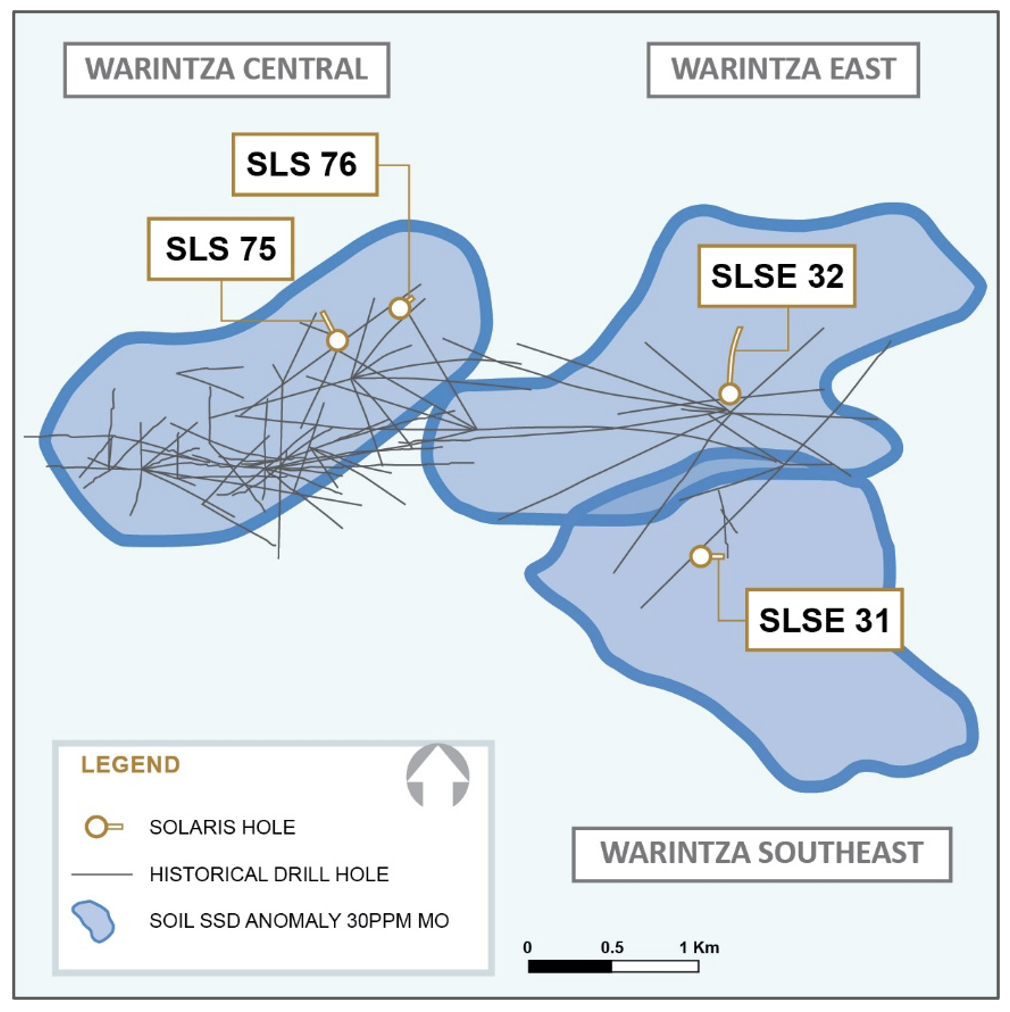

- SLS-76 was collared on the northeastern limit of the Northeast Extension zone and drilled northwest, returning 150m of 0.67% CuEq¹ within a broader interval of 384m of 0.51% CuEq¹, before the hole was terminated in lower grade mineralization

- SLSE-31 was collared on the southern margin of Warintza Southeast and drilled east to the ~300m depth capacity of the KD-200 rig, returning 284m of 0.53% CuEq¹ from near surface, with the final 10m averaging 0.75% CuEq¹ and remaining open for extension drilling with a larger rig

- SLS-75, drilled northeast from a new 200m step-out platform at Northeast Extension zone, returned 26m of 0.52% CuEq¹ and 46m of 0.66% CuEq¹ within a low-grade section from surface with a post-mineral dyke before a final 62m mineralized interval averaging 0.51% CuEq¹

- SLSE-32 was collared on the northern margin of Warintza East and drilled north, returning 380m of 0.31% CuEq¹ from surface within a broader interval of 634m of 0.27% CuEq¹ where the hole cut the contact of the primary host lithology with bordering lower grade volcanic rock

- Exploration drilling is underway at Patrimonio to follow up on the discovery holes (144m of 0.50% CuEq¹ and 148m of 0.52% CuEq¹, respectively – refer to press release dated September 12, 2023) while field crews expand sampling coverage over the highest grade part of the anomaly to the south and down-dip of the replacement mineralization to locate the potential porphyry source

- Regional exploration programs are underway at the promising Caya epithermal gold target, located 6km to the northeast of Warintza East, where field crews are expanding sampling and alteration mapping to the west to cover an area where evidence of historical artisanal mining has been identified

- Funded for 2024 and 2025 programs with the offtake financing package announced in December, with plans to aggressively expand activities and consolidate the surrounding district with funds from closing the strategic investment announced in January

Solaris Resources (TSX:SLS)(NYSEAmerican:SLSR) and the Shuar communities of Warints and Yawi have recently signed an updated Impact and Benefits Agreement (IBA) for the Warintza Project. This agreement signifies a step forward in the project’s evolution, reflecting its continued growth and advancement.

The IBA is a key part of Solaris’ Community Social Relations (CSR) program, recognized as a leading practice within the Ecuadorian mining industry. It guarantees the Shuar communities’ backing for Warintza throughout all stages, from exploration and development to production. Importantly, the agreement also formalizes commitments to several key areas.

First, that Solaris Resources will uphold the social and cultural practices of the Shuar communities. Second, the company will take steps to minimize or eliminate any negative impacts the project may have. This could include environmental or social disruptions. To maximize community participation in the project, Solaris will provide opportunities for employment, education, and skills training. The agreement also includes financial benefits for the Shuar communities.

The Warintza Project is expected to deliver significant advantages to local communities. These include job creation and business development opportunities. The project will also improve access to appropriate healthcare, including emergency services. Additionally, the agreement includes measures to develop community infrastructure and provide educational and skills training programs.

The updated IBA also fosters greater involvement from the Shuar communities in the project’s development. This collaboration establishes a framework to address shared concerns regarding the project’s impact on their lives and the well-being of their communities.

Beyond local benefits, the Warintza Project is anticipated to generate tax revenue for the Ecuadorian government. Solaris has reiterated its commitment to operating sustainably and responsibly by minimizing environmental impact and maintaining open communication with local communities.

Ms. Sonsoles García, Minister of Production, Foreign Trade, Investment and Fisheries, commented, “We value this initiative of Solaris because it strengthens positive community relations and provides for the integration of the local population in productive and sustainable activities. This allows the inclusion of a traditionally displaced population, which is a priority for us. It is also aligned with the priority we have as a National Government of territorial development and good use and management of resources.”

Mr. Daniel Earle, President & CEO, commented, “The signing of this updated IBA builds on the foundation of good faith dialogue and trust that led to the formation of a Strategic Alliance partnership with our host communities and original IBA in 2020. This marks a significant milestone in the social advancement of the Warintza Project through our pioneering Participatory Mining model for sustainable resource development.”

Mr. Agustin Kayuk, leader of the Shuar Warints Center and member of the Board of Directors of the Strategic Alliance, commented, “The signing of this updated IBA strengthens the working relationship with Solaris and brings greater opportunities for the development of our communities. The decision is supported by a permanent relationship with the Company based on mutual respect and transparent dialogue, as well as a history of positive impacts generated for our people. We look forward to continuing our relationship and playing an integral role in the advancement of the Project.”

Mr. Vicente Froilan Juank, leader of the Shuar Yawi Center and also a member of the Board of Directors of the Strategic Alliance, commented, “The updated IBA brings further support and new opportunities for our people. When Warintza advances, our communities advance with it. Since the signing of the inaugural IBA in 2020, and with the help of the Ecuadorian state, the local impacts in job creation, community infrastructure, and development of programs in health, education, skills training, entrepreneurship, and innovation have been evident in our daily lives.”

Solaris Resources (TSX:SLS)(NYSEAmerican:SLSR) is gearing up for its debut on the NYSE American. The move involves the discontinuation of its listing on the OTCQB Venture Market, transitioning the trading of its common shares to a more prominent platform under the new ticker symbol “SLSR” starting April 19, 2024. This strategic shift aims to provide Solaris with enhanced visibility and accessibility to a broader base of institutional and retail investors.

The company, which will continue to be listed on the Toronto Stock Exchange under the ticker “SLS”, does not require its shareholders to take any immediate actions regarding this transition. However, those who have purchased shares through the OTCQB are advised to check their accounts to ensure their holdings are updated with the new ticker symbol following the change.

Recent Developments and Strategic Investments

Earlier this year, on January 11, Solaris announced a significant financial boost through a private placement investment from Zijin Mining Group Co., Ltd., amounting to approximately $130 million. This deal resulted in the issuance of over 28 million common shares at a price of $4.55 each, a 14% premium over the closing price on the TSX the day before the agreement was finalized. This transaction marked a substantial endorsement from Zijin, which now holds about 15% of Solaris’ common shares on a fully diluted basis.

Daniel Earle, President and CEO of Solaris, praised the partnership, highlighting Zijin’s remarkable growth and expertise in the mining sector, which spans across 16 countries. The collaboration is set to advance the development of Solaris’s flagship Warintza Project in southeastern Ecuador, with funds also earmarked for general corporate purposes.

The closing of the private placement is contingent upon several conditions, including approvals from the TSX, under the Investment Canada Act, and from relevant authorities in China. Furthermore, the agreement grants Zijin the right to nominate a director to Solaris’s board as long as it maintains at least a 5% shareholding. Zijin also secures rights to maintain its ownership percentage through future securities purchases under specific conditions.

Trilateral Cooperation for Community Development

Additionally, on March 1, Solaris Resources further demonstrated its commitment to sustainable practices by entering a trilateral cooperation agreement aimed at supporting the Shuar communities in Ecuador. This initiative, involving the Interprovincial Federation of Shuar Centers and the Alliance for Entrepreneurship and Innovation, focuses on various developmental programs ranging from health and education to sustainable mining practices.

The collaboration aligns with ongoing efforts to promote economic and social advancement within these indigenous territories, which are integral to the Warintza Project’s success. The comprehensive support from this agreement encompasses health care, education, and business development programs tailored to the needs of the Shuar people, fostering a supportive relationship between the corporation and the community.

As Solaris Resources transitions to a new stage of corporate and community development, the company remains focused on leveraging strategic partnerships and maintaining its commitment to sustainable mining practices, positioning itself for future growth in the global mining sector.

Solaris Resources (TSX: SLS) (OTCQB:SLSSF), on March 1, 2024, entered into a trilateral cooperation agreement with the Interprovincial Federation of Shuar Centers (FICSH) and the Alliance for Entrepreneurship and Innovation (AEI) of Ecuador. The signing ceremony took place during the Prospectors & Developers Association of Canada (PDAC) convention. What does the agreement mean for the company and the communities in which its Warintza Project operates?

The agreement aims to foster economic and social development in Shuar communities represented by FICSH, including the Warints and Yawi communities, which host Solaris’ Warintza Project on their lands. The collaboration will focus on programs in health, education, skills training, entrepreneurship, innovation, and sustainable mineral resource development.

FICSH, established by the Ministry of Social Welfare of Ecuador in 1964, is the largest and highest authority among Shuar indigenous organizations. It represents 50 associations, comprising 500 Shuar communities and approximately 143,000 Shuar indigenous people.

AEI is an independent non-profit organization dedicated to promoting entrepreneurship and innovation as the foundation for Ecuador’s productive development. Solaris has been a member of AEI’s network of public, private, and academic actors since 2021.

Mr. Froilan Juank, President of Yawi Center and member of the Board of Directors of the Strategic Alliance, commented in a press release: “The Shuar communities of Warints and Yawi support this agreement which follows from our request for FICSH to represent us and our interests and extend benefits to other member communities. We reject the false statements made by foreign non-governmental organizations (NGOs) and the Shuar Arutam People’s Associations (PSHA) which ignore our voice and speak against our interests. We are the legitimate registered owners of the Ancestral Lands on which the Warintza Project resides and we have the right and have chosen, through our General Assembly, to participate in the project through our Strategic Alliance and Impact and Benefits Agreement.”

Mr. David Tankamash, President of FICSH, commented in a press release: “Our work aims to improve the quality of life and access to opportunities for our member Shuar Centers. We support the Warints and Yawi communities and reject the efforts of foreign NGOs who act against the will and interest of our members. This agreement, which has been approved by the will of the FICSH General Assembly, is important for inclusive and sustainable mineral resource development. The Solaris model proves the Shuar nation can partner in development opportunities on our lands. We deserve the opportunities indigenous nations have in other parts of the world and foreign NGOs must respect our choices.”

The key programs under the cooperation agreement include:

- Health: Training and support for providing medical services in remote communities, in collaboration with the Ministry of Public Health.

- Education: Training and support for developing and delivering intercultural education in remote communities, in partnership with the Ministry of Education.

- Production: Training and technical assistance related to agricultural and business development, project management, and accounting.

- Artisanal mining: Environmental, safety, and technical training and support for the formalization of artisanal mining in FICSH territories.

The agreement also demonstrates Solaris Resources Inc.’s commitment to engaging with local communities and promoting sustainable development in the regions where it operates.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The copper mining industry plays a crucial role in the global economy, with South America being a significant contributor to the world’s copper supply. As the demand for copper continues to grow, driven by the increasing need for renewable energy and electric vehicles, exploration projects in this region have gained momentum along with some of the biggest investment interest in the past few years . In 2024, there are a few important companies actively engaged in copper exploration across various countries in South America, with promising results and future prospects.

Freeport McMoRan in Peru

Freeport McMoRan, a leading copper producer, operates the Cerro Verde copper mine in Peru. However, the company is projected to face challenges in 2024, with sales volumes expected to decrease to 1.13Blb (512,559t) of copper, compared to 1.20Blb sold in 2023. This decline is attributed to lower grades at Cerro Verde and mill recoveries falling below those in the same period of 2022. Despite these challenges, Freeport McMoRan remains committed to its operations in Peru and continues to explore opportunities for growth and optimization.

Lundin Mining Corporation: Consistent Performance and Expansion

Lundin Mining Corporation has demonstrated consistent performance in its copper exploration and production activities across South America. In the second quarter of 2023, the company produced 10,697 tonnes of copper and approximately 13,000 ounces of gold in concentrate. The Chapada mine in Brazil, one of Lundin’s key assets, achieved higher recoveries, resulting in increased copper production compared to the prior year quarter.

Looking at Lundin’s historical performance, the company produced 249,659 tonnes of copper on a consolidated basis in 2022, which was within the guidance range of 250,000 to 274,000 tonnes. In 2023, Lundin Mining achieved a record consolidated copper production of 314,798 tonnes, surpassing the guidance range of 300,000 to 320,000 tonnes.

For the three-year period from 2024 through 2026, Lundin Mining has provided production guidance for copper, with a range of 366,000 to 400,000 tonnes. This guidance is largely in line with the company’s 2023 production guidance, indicating a likely stable outlook for Lundin’s copper exploration and production.

Solaris Resources: Strategic Investments and Resource Expansion

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has proven itself as one of the most important exploration companies in South America over the past few years, with significant developments at its Warintza Project in Ecuador. The company is preparing for a major mineral resource estimate update, expected in late Q2 2024, which will leverage extensive drilling data to potentially enhance resource size and grade at Warintza Central, East, and Southeast.

In a strategic move, Solaris also announced plans to list its common shares on the NYSE American stock exchange, securing funding for exploration and development programs in 2024 and 2025. Additionally, the company received a significant investment from Zijin Mining, a major Chinese company, which provided crucial capital for ongoing activities at the Warintza Project and highlighted the project’s potential.

Zijin Mining’s investment, announced on January 11, 2024, involves the purchase of approximately 28,481,289 common shares of Solaris Resources at a subscription price of $4.55 per share, representing a 14% premium to the closing price of the common shares on the Toronto Stock Exchange (TSX) on January 10, 2024. Upon closing of the investment, Zijin Mining will own approximately 15% of the common shares on a fully diluted basis.

The investment from Zijin Mining is expected to be used by Solaris Resources to advance and develop the Warintza copper project primarily. This strategic partnership provides financial security for Solaris Resources and the expertise and growth potential of Zijin Mining, one of the most successful major mining companies in the world.

Solaris Resources continues active drilling with six rigs, focusing on resource expansion, infill drilling, and exploration beyond the current resource zones\[2\].

Copper exploration in South America remains strng in 2024, with companies like Freeport McMoRan, Lundin Mining Corporation, and Solaris Resources actively engaged in resource expansion, strategic partnerships, and sustainable operations. As the demand for copper continues to grow, driven by the global shift towards renewable energy and electric vehicles, these projects will be watched ever more closely for major announcements.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The Warintza Project in southeastern Ecuador, operated by Canadian copper mining company Solaris Resources (TSX:SLS) (OTCQB:SLSSF), has become a model for sustainable mineral exploration and development. Solaris adheres to a “Participatory Mining” model that engages government, communities, and the company in an alliance governing the strategic socio-economic development alongside the project. This inclusive approach is based on transparency, dialogue, and building trust between stakeholders with the goal of improving quality of life in a sustainable manner.

For example, the company has explicit community consent for the Warintza Project through legally-binding community agreements with the Warints and Yawi Shuar communities that host the Project on their Ancestral Lands. These Ancestral Lands are legally-defined and have been registered with the Government of Ecuador since 2002. The timeline of agreements includes:

- January 2019: Memorandum of Understanding signed with the Warints and Yawi communities

- September 2020: Impact and Benefits Agreement, the first signed in the country with Shuar communities

- March 2020: Impact and Benefits Agreement for Project advancement and scope expansion

- Late 2022: Completed an Environmental Impact Assessment on the Project

This formal consent demonstrates the strong relationship and trust built between Solaris and the local communities through open dialogue and mutually beneficial partnerships. The participatory model ensures the indigenous populations are informed, engaged, and ultimately benefit from the development of their ancestral territory.

Solaris’ commitment to sustainability is also embedded in its policies and participation in the UN Global Compact. They strive to minimize environmental impacts by going beyond required guidelines, using robust monitoring, and integrating protection into daily practices. Compliance with regulations, biodiversity management, community involvement, efficient resource use, responsible waste management, and education on best practices foster environmental stewardship. Proactive efforts like their greenhouse gas reduction plan and partnerships demonstrate Solaris’ dedication.

Central to the sustainability strategy is the Citizen Participation Process where local populations are informed of potential impacts and can provide input that gets incorporated into environmental studies. This participatory mechanism for consultation and dialogue ensures community engagement and consent, legitimizing the project. Solaris maintains high corporate governance standards so decisions align with their core values of sustainable development.

The 2024 drilling program at Warintza recently commenced, with plans to have six rigs operating by February. An updated mineral resource estimate is expected by late Q2/24, likely showing major growth. Drilling will continue beyond this as permitted, with some holes serving other purposes like metallurgical testing. Exploration is also underway regionally to define additional drill targets.

Solaris also recently closed US$40 million in financing, including equity and initial drawdown of their debt facility, to fund 2024-2025 baseline programs. The major C$130 million strategic investment by Zijin Mining Group will allow aggressive expansion of programs this year to significantly advance the project. The partnership with successful global miner Zijin will provide technical expertise and capacity to realize Warintza’s potential as a premier copper district.

Solaris’ ethical, sustainable model aligned with their financing strategy demonstrates a promising approach for the future of mineral development. The Warintza Project aims to create value responsibly and improve local communities, setting a positive example for the industry.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) is preparing for a significant update to its mineral resource estimate for its flagship Warintza Project in southeastern Ecuador. The announcement, made in early January, comes in the middle of an ongoing drilling program and broader developments aimed at advancing the project towards potential development. What’s next for the project, and what are investors waiting for in 2024?

Mineral Resource Estimate Update in Sight

Investors and stakeholders are now waiting for the updated mineral resource estimate, expected in late Q2 2024. This revision will leverage nearly double the drilling data compared to the previous estimate, potentially leading to substantial growth in resource size and grade. The focus areas include Warintza Central, East, and Southeast, where drilling has targeted resource expansion and infill drilling.

A key aspect of the update is the incorporation of a “common pit shell,” which considers the economic viability of extracting all resources within a defined open pit. This approach provides a more realistic picture of the potentially mineable portion of the deposit and is will be critical for future development planning.

Active Drilling Campaign

Solaris is currently executing an ambitious drilling program for 2024, utilizing six drill rigs. This program serves a dual purpose:

- Resource expansion and infill drilling: This component directly supports the upcoming mineral resource estimate update by gathering additional data to refine geological understanding and resource definition.

- Exploration beyond the current resource: Drilling extends outwards from known zones, targeting areas with promising indications of copper mineralization. This proactive approach aims to identify new zones that could contribute to further resource growth in the future.

Beyond Warintza Central, exploration efforts are ongoing in other prospective areas within the project’s broader footprint. These regional activities add another layer to the ongoing exploration story at Warintza.

NYSE American Listing and Financial Backing Signal Confidence

In another significant development, Solaris announced plans to list its common shares on the NYSE American stock exchange. This move is expected to broaden the company’s investor base, particularly attracting interest from the U.S. market.

Financially, Solaris secured funding for its 2024 and 2025 exploration and development programs, ensuring continued momentum at Warintza. This financial backing highlights the company’s commitment to advancing the project and realizing its full potential.

The company’s progress at the Warintza Project received a significant boost in January 2024 with a strategic investment of $130 million from Zijin Mining Group Co., Ltd., a major Chinese mining company. This financing agreement provides crucial capital for ongoing exploration and development activities and represents a strong vote of confidence in the project’s potential.

Under the terms of the deal, Zijin acquired approximately 28.5 million common shares of Solaris at a subscription price of $4.55 per share, representing a 14% premium to the market price at the time. This translates to an ownership stake of roughly 15% for Zijin, granting them a seat on the Solaris board of directors.

The importance of this financing is threefold:

- Financial Security: The $130 million injection directly supports the company’s ambitious plans for 2024 and 2025, including the ongoing drilling program, resource estimation update, and potential future studies. This financial security allows Solaris to focus on advancing the project without immediate funding concerns.

- Strategic Partnership: Zijin’s expertise in developing large-scale copper projects offers valuable insights and potential collaboration opportunities for Solaris. This partnership could prove crucial in navigating the complexities of future development stages.

- Market Validation: The significant investment from a major player like Zijin serves as a strong validation of Warintza’s potential. This positive endorsement could attract further interest from investors and stakeholders, broadening the project’s support base.

Overall, the Zijin financing deal represents a critical milestone for Solaris and the Warintza Project and secures the necessary resources for continued progress.

The Warintza Project also holds the potential to bring significant benefits to Ecuador. Responsible development post-exploration could create many more jobs, stimulate the local economy, and generate tax revenue for the government. Solaris has continued to emphasize its commitment to operating in a sustainable and responsible manner, minimizing environmental impact and engaging with local communities.

Looking Ahead: Milestones and Continued Progress Expectations

The release of the updated mineral resource estimate in late Q2 2024 stands as a major milestone for the Warintza Project. This event will provide valuable insights into the project’s size, grade, and economic potential. Depending on the results, further studies such as preliminary economic assessments or feasibility studies could follow, outlining a potential path towards development.

Solaris remains focused on advancing the Warintza Project through ongoing exploration, resource definition, and potential future development activities. With a significant update on the horizon, active drilling underway, and a secured financial position, the world is watching for the next news update.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has launched an extensive 2024 drilling and exploration program at its Warintza copper-gold project in southeastern Ecuador, aiming to substantially increase the current mineral resource estimate, make additional new discoveries, and advance infrastructure and engineering studies to further derisk what it hopes will become Ecuador’s next major mining operation.

With six drill rigs slated to be spinning by month’s end, Solaris is wasting no time following up on the successes of last year’s drilling efforts which outlined wide zones of high-grade mineralization over a 5km strike. The priority targets are the open-ended higher grade core at Warintza Central, extending the strike length and depth at the Warintza East discovery, and delineating an initial resource at the Warintza Southeast discovery made last fall.

An updated mineral resource estimate incorporating almost twice the results of the previous estimate is expected by late Q2. The additional data, especially from East and Southeast, could substantially increase the overall resource scale and grade. Warintza’s position among the ranks of major global copper projects may soon be cemented if this is the case.

But Solaris isn’t resting on this plan, with plans to keep drilling through the updated resource estimate and an aim of completing at least 30,000 additional meters focusing on further growth opportunities by yearend 2024. This includes tightening the drill pattern in some areas with room for optimization, as well as collecting data for preliminary metallurgical, geotechnical and hydrological studies to support future scoping and feasibility studies.

Systematic Regional Exploration Underway to Make Next Big Discovery

On a parallel track beyond the main Warintza deposits, field crews have mobilized to several earlier-stage regional targets with hopes of making Solaris’ next big porphyry discovery elsewhere on its large concession package outside of Warintza Central. Initial soil sampling and mapping programs over the past two years have revealed a number of intriguing copper-molybdenum anomalies that could indicate the presence of additional blind porphyries underlying the sandstone cover prevalent in the basin.

The immediate focus is on the Mateo prospect, where recent sampling outlined a sizable 3km x 1.4km copper-in-soils anomaly coincident with sandstone outcrops. Further infill soil sampling and possibly some initial geophysical surveys are planned over the coming months to refine the targets for an eventual maiden drill campaign later this year or early 2025. Several other early-stage regional targets are also on the agenda for Solaris’ exploration team.

Well-Funded for Full Campaign

With a recent $130 million strategic investment from China’s Zijin Mining Group now in hand, Solaris is well-funded to potentially ramp up and accelerate its plans over the next two years. In fact, beyond the six rigs currently operating, the company has targets to get as many as ten rigs spinning by the end of 2024 to systematically test the full breadth of what it has now in its crosshairs – a district-scale opportunity centered around Warintza but extending across its vast concession holdings in Ecuador.

Zijin identified world-class potential after taking a 15% stake in Solaris Resources, and, in addition to providing critical capital, Zijin also brings substantial technical expertise and experience to the table as one of China’s preeminent mining firms operating globally.

With renewed financial backing and drills now turning, Solaris Resources is intent on methodically unlocking the full promise of its Ecuadorian property package in 2024. The company’s near-term resource growth drilling, regional exploration campaigns, infrastructure studies, and new high-profile partnership with Zijin Mining set the stage for what could prove a potentially company-making year. Investors can likely expect a steady stream of news flow over the coming year, and further updates to this copper growth story.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has announced the start of its 2024 drilling program at the Warintza copper-gold project in southeastern Ecuador. The company plans to have six drill rigs operating by the end of February as part of an aggressive exploration and resource expansion campaign this year.

The first drill rig has begun turning at the Warintza East zone, with a goal of significantly increasing the project’s mineral resource estimate. An updated estimate is expected in late Q2 2024, incorporating nearly double the previous meterage. Solaris aims to demonstrate major growth potential at the Warintza Central, East and Southeast zones within a common open pit shell.