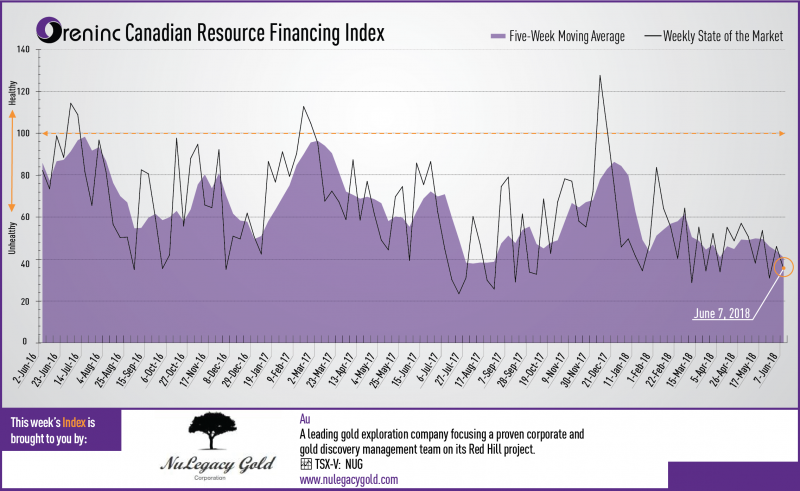

Last week index score: 45.96

This week: 35.42

Zinc One Resources (TSX-V: Z) reported the final drill results from the high-grade zinc discovery in the Mina Chica zone of its Bongará zinc project in north-central Peru.

The Oreninc Index fell in the week ending June 8th, 2018 to 35.42 from 45.96 a week ago as financings decreased, and broker action stayed away.

Gold spent the week flirting again with the US$1,300/oz level in the run up to the G7 summit in Canada, with US president Donald Trumplooking to pick a fight with anyone that would pay him attention as he also prepares for a summit meeting with North Korean leader Kim Jong-un. Despite the trade sabre-rattling, those watching the precious metals space are waiting for the outcome of the US Federal Reserve Market Committee (FOMC) meeting this coming week and any indications related to further interest rate increases.

Financings and broker activity continue to be sparse as Oreninc’s Kai Hoffmann showed at the 121 Mining Investment Conference in New York last week, as interest in the mining sector continues in a funk.

On to the money: total fund raises announced halved to C$50.8 million, a two-week low, which included no brokered financings and no bought deal financings. The average offer size fell to C$2.0 million, an eleven-week low whilst the number of financings fell to 25, a two-week low.

Gold closed up at US$1,298/oz from US$1,293/oz a week ago. Gold is now down 0.36% this year. The US dollar index closed down a tad at 93.53 from 94.15 a week ago. The van Eck managed GDXJ closed down a smidge at US$32.78 from US$32.80. The index is down 3.96% so far in 2018. The US Global Go Gold ETF increased to US$12.95 from US$12.71 a week ago. It is now down 0.46% so far in 2018. The HUI Arca Gold BUGS Index closed down at 178.83 from 179.15 last week. The SPDR GLD ETF continued to sell off and closed its inventory down at 828.76 tonnes from at 836.42 tonnes a week ago.

In other commodities, silver closed up at US$16.78/oz from US$16.41/oz a week ago. Copper’s gain accelerated as it closed up at US$3.30/lb from US$3.09/lb last week. Oil continued to lose ground as it closed down slightly at US$65.74 a barrel from US$65.81 a barrel a week ago.

The Dow Jones Industrial Average saw a strong rebound to close up at 25,316 from 24,635 last week. Canada’s S&P/TSX Composite Index also saw a winning week to close up at 16,202 from 16,043 the previous week. The S&P/TSX Venture Composite Index also closed up at 775.22 from 765.94 last week.

Summary:

- Number of financings decreased to 25, a two-week low.

- One brokered financing was announced this week for C$8.0m, a one-week high.

- No bought-deal financings were announced this week, a one-week low.

- Total dollars nearly halved to C$50.8, a two-week low.

- Average offer size dropped to C$2.0m, an eleven-week low.

Financing Highlights

Nouveau Monde Graphite (TSX-V: NOU) opened an C$8.0 million private placement @ C$0.30 with Eight Capital and Haywood Securities as co-lead agents.

- Syndicate including Canaccord Genuity and Desjardins Securities.

- Each unit comprised of one share and half a warrant exercisable @ C$0.40 for two years.

- Net proceeds for capital allocations related to Nouveau Monde’s graphite demonstration plant in Saint-Michel-des-Saints.

Major Financing Openings:

- Nouveau Monde Graphite (TSX-V: NOU) opened a C$ 8 million offering underwritten by a syndicate led by Eight Capital on a best effortsbasis. Each unit includes half a warrant that expires in 24 months.

- MGX Minerals (CSE: XMG) opened a C$ 7.01 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months. The deal is expected to close on or about June 18th.

- GoviEx Uranium (TSX-V: GXU) opened a C$ 6.06 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months.

- Golden Dawn Minerals (TSX-V: GOM) opened a C$ 5.4 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months.

Major Financing Closings:

- Troilus Gold (TSX-V: TLG) closed a C$ 10.01 million offering underwritten by a syndicate led by GMP Securities on a bought deal basis.

- Almaden Minerals (TSX: AMM) closed a C$ 9.44 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis. Each unit included half a warrant that expires in 48 months.

- GoviEx Uranium (CSE: GXU) closed a C$ 6.06 million offering on a best efforts basis. Each unit included a warrant that expires in 36 months.

- Troilus Gold (TSX-V: TLG) closed a C$ 5.75 million offering on a best efforts basis.

Company News

Zinc One Resources (TSX-V:Z) reported the final drill results from the high-grade zinc discovery in the Mina Chica zone of its Bongará zinc project in north-central Peru.

- High-grade zinc mineralization is about 200m long and 120m wide.

- Highlights included 21m @ 27.5% Zn in hole MCH-18-041.

Analysis

With a new high-grade zinc discovery, this phase of drilling has been very successful, adds to the potential of the project, even though the size potential of the Mina Chica zone will have to wait for a future drilling programme. And with only a small portion of the 6km mineralized trend tested, there is a lot more exploration (and results) to come in the future.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

3. Eldorado Gold Corp. (TSX: ELD)

If you were to sum up the story of the bull market in metals in two words, then “Chinese demand” might rank as high as any other pairing. Though, as some point out, Chinese demand won’t support commodity prices forever. China’s GDP growth from 1978 to 2005 was a staggering 9.5% a year.

Yet for all the success that North American miners have had because of China, Vancouver’s Eldorado Gold, in February 2007, became the first North American company to successfully construct and operate a gold mine there when it began production at the Tanjianshan mine in Qinghai Province. This probably didn’t come as a surprise to many Eldorado shareholders as the company has shown an ability to produce at a low cost in various political and economic environments. In addition to China, the company operates in Turkey, Brazil, the United States and Greece, all while keeping its operating costs between $390 and $410 an ounce. Eldorado Gold is a favourite of Desjardins Securities analyst Brian Christie who, last week, raised his price target by $0.75 to $22 (U.S.) and maintained a “buy” rating.

Eldorado’s growth has been remarkable; from just over $179 million in revenue in fiscal 2007 to $791 million in fiscal 2010. The company has also been an earnings machine, putting more than $200 million to the bottom line in 2010. And, 2011 is shaping up to be another stellar year for Eldorado, an emerging intermediate gold producer that takes its name from a legendary city of gold.

4. Guyana Goldfields Inc. (TSX: GUY)

El Dorado, the “Lost City of Gold“, has fascinated and eluded explorers since the days of the Spanish Conquistadors. The story of El Dorado was born through a combination of myths and legends. Dating back to the 1500s, the story originated from the Muisca people who spoke of a golden city hidden in remote South America. The promise of an ancient city of gold enticed European explorers to search for El Dorado for more than two centuries. The geographical location of the mysterious city has morphed along with the myths and legends over the years. Gold coins, precious stones, and streets paved with gold are thought to be located somewhere in Columbia, Venzuela or Guyana.

Sir Walter Raleigh searched for the elusive city in 1595 and reportedly found it. He described El Dorado as a city on Lake Parime far up the Orinoco River in Guyana where “every stone they picked up promised either gold or silver“. The city was actually marked on English maps until its existence was disproved by Alexander von Humboldt during his Latin-America expedition in the early 1800s. Though many have searched and failed to find this city of gold, no evidence of such a place has ever been found.

One TSX listed company, Guyana Goldfields, has certainly not let the past failed efforts to find El Dorado prevent them from finding gold in Guyana. The company has been operating in Guyana successfully for 15 years and now boasts a resource estimate of just over 6.6 million ounces of gold from 2 different projects. UBS analyst Dan Rollins likes the company. On July 25th Rollins wrote, “Given the company’s attractive valuation, market capitalization of less than $1 billion, near-term production potential from Aurora and exploration potential at Aranka, we believe Guyana Goldfields could be an acquisition target for an intermediate or mid-cap producer seeking to expand its presence in South America.”

MiningFeeds.com recently connected with Claude Lemasson, President and COO of Guyana Goldfields, for an exclusive interview – CLICK HERE – to read more.

5. Strike Gold Corp. (TSX-V: SRK)

2G is short for second-generation wireless telephony technology. Three primary benefits of 2G networks over their predecessors were that phone conversations were digitally encrypted; 2G systems were significantly more efficient; and 2G introduced data services for mobile like SMS text messages. What does 2G have to do with a newly listed TSX-V junior? Strike Gold is going after “2 Gs”; specifically, gold and graphite. An interesting proposition considering gold and graphite are two of the hottest sectors in mining today. There is another obscure 2G Strike Gold reference, but we’ll get to that in a moment.

On September 1st, 2011, Strike Gold announced an agreement to acquire a 100% interest in the Deep Bay East and Simon Lake Graphite Properties both located in northern Saskatchewan. Some historic drilling and trenching was completed at Deep Bay East and the exploration identified some high grades of graphite across thick intervals including 35 meters grading 8.58% graphitic carbon. About the acquisition, Geoff Balderson, Strike Gold’s president & CEO, remarked, “We are delighted to have secured these two properties and give our shareholders investment exposure in what many believe to be such a promising resource sector.” The news of the acquisition sent Strike’s shares up 36.8% from $0.24 to $0.38. Perhaps not surprising when you consider Northern Graphite (TSX-V:NGC), a junior exploration company that completed a $0.50 IPO just 4 months ago, last closed at $1.35.

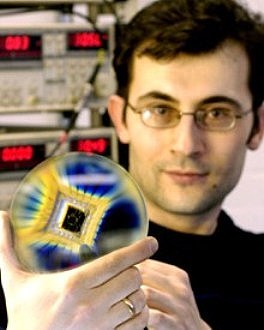

In 2010, scientists at the University of Manchester won the Noble Prize in Physics for isolating graphene. Graphene is a one-atom-thick planar sheet of densely packed carbon atoms; think of it as an atomic-scale chicken wire made of carbon atoms and their bonds. Scientists around the world believe that graphene is a strong candidate to replace silicon and other materials in semiconductor chips. Moore’s Law observes that the density of transistors on an integrated circuit doubles every two years. Transistors run computers and, you guessed it, 2G networks. Science has pushed the capabilities of existing transistor materials to the edge. Silicon transistors, for example, are thought to be close to the minimum size where they can remain effective. Graphene transistors can potentially run at faster speeds and cope with higher temperatures theoretically extending Moore’s Law for many years to come.

Dr. J.T. Janssen, a researcher at UK’s National Physical Laboratory states, “We’ve laid the groundwork for the future of graphene production, and will strive in our ongoing research to provide greater understanding of this exciting material. We have taken a huge step forward, and once the manufacturing processes are in place, we hope graphene will offer the world a faster and cheaper alternative to conventional semiconductors.”

For 10 Most Interesting Gold Stocks – Part 3 – CLICK HERE.

Graphite is one of fourteen critical minerals that were identified by a recent report by the European Commission as being under “supply risk”.

According to the United States Geological Survey (USGS), world production of natural graphite in 2008 was 1,110 thousand tonnes (kt), of which the following major exporters are: China (800 kt), India (130 kt), Brazil (76 kt), North Korea (30 kt) and Canada (28 kt). The mineral graphite is one of the eight allotropes of carbon. The most common allotrope being diamonds. While diamonds are a girl’s best friend could graphite become an investor’s best friend? Greg Bowes, President and CEO of Northern Graphite certainly thinks so and points to graphene, a next-generation material made from graphite.

Graphene is a one-atom-thick planar sheet of carbon atoms that are densely packed in a honeycomb crystal lattice. It can be thought of as an atomic-scale chicken wire made of carbon atoms and their bonds. Scientists around the world believe that graphene is a strong candidate to replace semiconductor chips. Moore’s Law observes that the density of transistors on an integrated circuit doubles every two years. But silicon and other existing transistor materials are thought to be close to the minimum size where they can remain effective. Graphene transistors can potentially run at faster speeds and cope with higher temperatures. Graphene could be the solution that will allow computing technology to continue to grow in power whilst shrinking in size, extending the life of Moore’s law by many years.

Northern Graphite, based in Ottawa, recently closed a $4 million initial public offering at $0.50 per unit and began trading on the TSX-V Exchange on April 20th, 2011. And so far so good. The company’s shares took-off and hit a high of $1.55 in early June and have since settled back to the $1.20 range. Northern Graphite’s principal asset is the Bissett Creek graphite project located 100km east of North Bay, Ontario. The Company has completed an NI 43-101 preliminary assessment report on the project and anticipates that it will be in a position to begin construction of the mine early in 2012, subject to positive results from the bankable final feasibility study and the availability of financing.

MiningFeeds.com recently sat down with Northern Graphite’s top executive Greg Bowes to talk about the company’s future prospects and to learn more about the project.

To provide some context for our readers, why should an investor be looking at graphite mining as an opportunity?

Lithium and rare earths have demonstrated that it is possible to make money with minerals other than precious and base metals. Now investors are looking for other strategic minerals that are undervalued and, in our opinion, graphite is one of them. Graphite industrial demand is growing 5% per year due to the effect of growing demand in China and India for traditional steel and auto markets. Since 2005, the price of graphite has increased by almost three times. New uses like lithium ion batteries, fuel cells, nuclear and solar are all big graphite users and will create more demand as these technologies become more widely adopted. Currently, China produces 70% of the world’s graphite and its production and exports are expected to decline like in the situation of the rare earth elements.

Please tell us about your project?

Northern Graphite has a large resource, located in Canada close to infrastructure, with simple open pit mining and metallurgy. The deposit will produce high value, high growth, flake graphite. The company expects to have a bankable feasibility and permitting done and start construction in the first part of 2012.

What are some of the challenges associated with developing and mining graphite?

In our case, not many. Our project involves simple mining methodologies and metallurgy. As mentioned before, our project is close to infrastructure and with no environmental issues.

Who are the dominate players in the industry and, once mined, how is graphite bought and sold?

China, in general terms is the dominant player since they produce 70% of the world’s supply. Most other mines outside of China are owned by large private industrial companies. There are only two public companies in North America with graphite development projects. There is no spot market for graphite, prices are negotiated between buyers and sellers but it is a very large and efficient market. Prices for the most common grades are published in industrial minerals magazine.

In 2010, scientists at the University of Manchester won the Noble Prize in Physics for isolating graphene. Please tell our readers about graphene and what applications it might be used for.

Graphene is transparent in infra-red and visible light, flexible, and stronger than steel. It conducts heat 10 times faster than copper and can carry 1,000 times the density of electrical current of copper wire. Graphene is expected to be a revolutionary material that could change the technology of semiconductors and LCD touch screens and monitors, create super small transistors and super dense data storage, increase energy storage and solar cell efficiency, and will transform many other applications. According to a professor at Georgia Tech University, there are nearly 200 companies, including Intel and IBM, currently involved in graphene research. In 2010 graphene was the subject of approximately 3,000 research papers and the European Union and South Korea have each recently started $1.5 billion efforts to build industrial scale, next generation display materials using graphene.

Having just listed on the TSX-V Exchange in April of this year, what are your plans for the balance of 2011 and beyond?

We are working towards a new resource estimate for next month; and, a bankable feasibility study and hopefully a strategic partnership by the end of the year. Next year, we would like to have our permitting completed in early 2012 and construction start-up shortly thereafter.

This interview is featured in the article 5 Critical Mineral Stocks to Watch – CLICK HERE – to read more.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan