K2 Gold (TSXV:KTO), has reported the completion of its 2023 Reverse Circulation (RC) drilling program at the Wels Project. Situated in west-central Yukon, the Wels Project is 60km south of Newmont’s Coffee gold deposit and 23km east of a road-accessible staging area. The team overseeing the Wels Project is composed of experts who have previously contributed to significant projects in the Yukon, including the development of Kaminak’s Coffee Gold deposit, now owned by Newmont, and Underworld Resources’ White Gold deposit, currently under the ownership of White Gold Corporation.

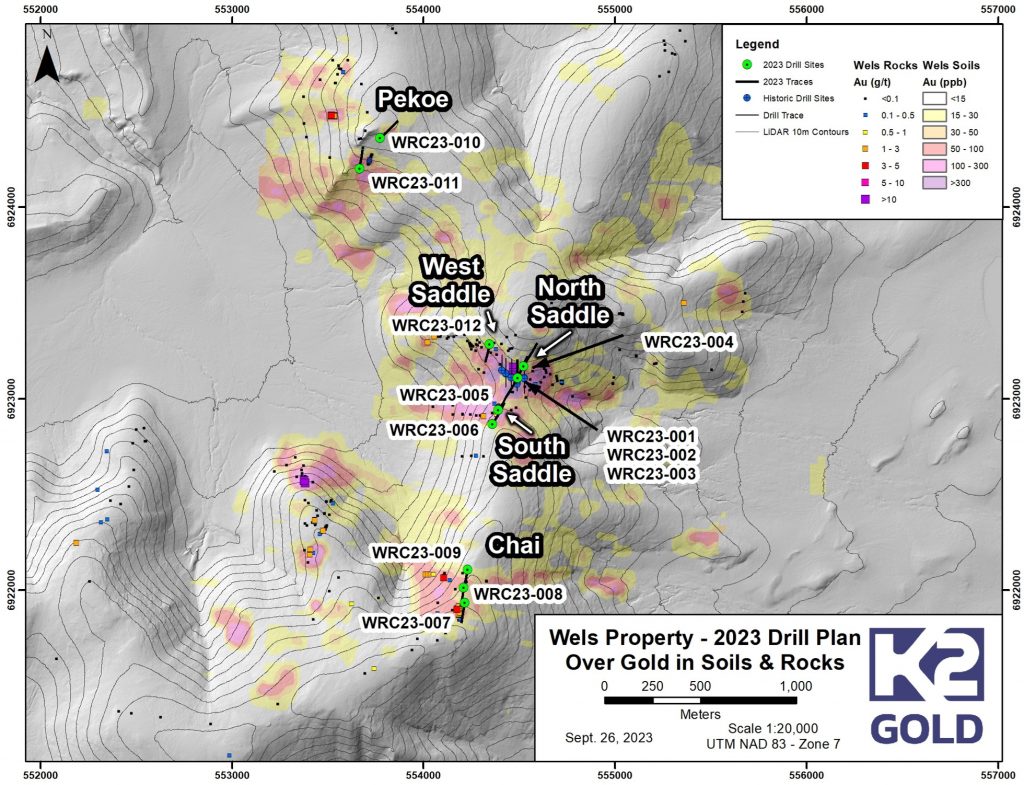

The drilling campaign achieved a total of 1,961 meters across 12 drill holes. The Wels Project is distinguished by its high-grade, structurally controlled gold system, showing similarities to other high-profile projects in Yukon’s White Gold district, including Newmont’s Coffee Project and White Gold Corporation’s Golden Saddle deposit.

Anthony Margarit, President and CEO of K2 Gold commented in a press release: “The 2023 RC drill program was designed to test 5 target areas across the property. A combination of efficient drilling, and logistics led to a 25% increase in metres drilled and allowed K2 to drill 2 holes more than planned. A total of 12 holes were drilled, with mineralization observed in all holes, several of which test kilometre-scale structures. We look forward to releasing assay results to the public in the near future.

John Robins, Executive Chairman K2 Gold also commented: “Wels bears striking similarities to the Coffee Gold deposit we discovered in 2010. Similar to what we saw in the early days of exploration at the Coffee project extensive kilometre-scale gold-in-soil anomalies with associated arsenic and antimony + strong geophysical anomalies are localized around fault corridors which control mineralization, the same characteristics are observed at the Wels property.”

The geology of the Wels Project features a high-angle, WNW-trending fault system, and all types of rocks at the site have demonstrated mineralization in drilling, trenching, or surficial sampling. Previous drilling initiatives focused mainly on the granite-hosted Saddle target, where they found high-grade gold intersections. The 2023 drilling was specifically planned to test various soil and trench gold anomalies, along with electromagnetic Very Low Frequency (VLF) geophysical anomalies throughout the property.

Starting at the Saddle target, the drilling efforts aimed to cover the entire section, ranging from North Saddle to South Saddle. Neither of these areas had been drilled before. A total of 1,042.42 meters was drilled across this section. The drilling operations then moved to Chai and Pekoe targets, both of which had not been drilled previously and indicated high-grade gold in soil, rock, and trench samples. At Chai, three holes covering 432.82 meters were completed, and at Pekoe, two holes comprising 338.33 meters were drilled. The final 147.83-meter hole was drilled at West Saddle, more than 100 meters away from the main Saddle target where K2 had previously drilled.

All the drilled holes revealed structurally controlled pyrite-arsenopyrite mineralization and quartz veining across various types of rock, including granite, diorite, gabbro, quartzite, and siltstone.

K2 Gold maintains a 90% vested interest in the Wels Project. The remaining 10% is owned by Go Metals Corporation as part of a joint venture agreement. Under the agreement, K2 Gold is responsible for funding the project through the completion of a preliminary economic assessment. Subsequent project expenditures will be funded on a 90/10 proportionate basis between K2 Gold and Go Metals, with K2 Gold serving as the project manager. The property is also subject to a 3% Net Smelter Return (NSR), of which 2% can be acquired by K2 under specified terms.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

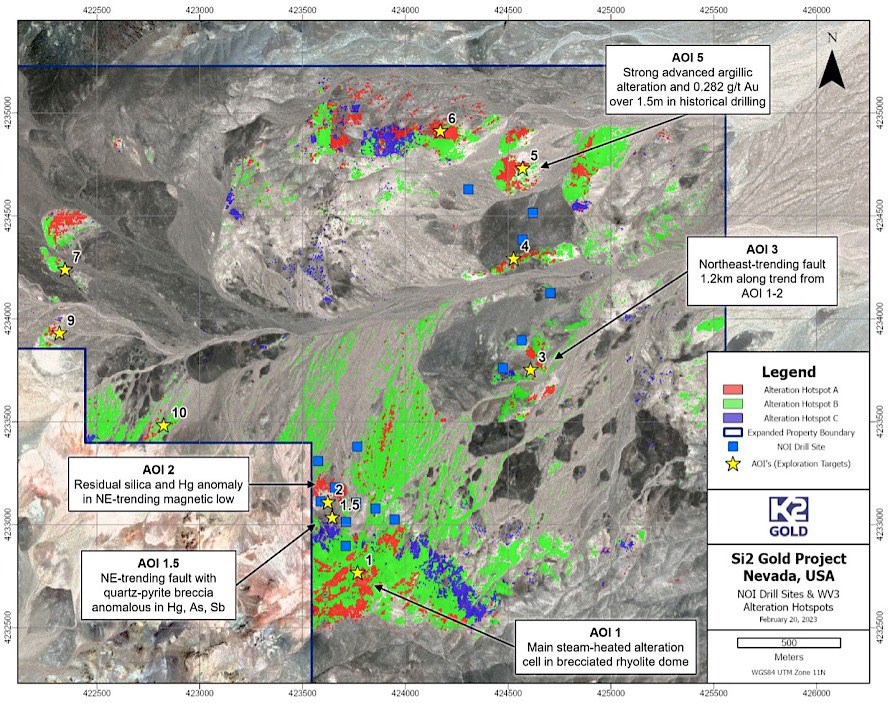

K2 Gold Corporation (TSXV:KTO) has launched its 2023 diamond drilling program at the Si2 Gold Project, aiming to extract at least 2,500 meters of diamond drill core. The program will concentrate on the “areas of interest” (AOI), specifically AOI1, AOI1.5, and AOI2 target zones. Drill holes are strategically designed to intersect the steeply northwest-dipping fault structures believed to be responsible for the extensive steam-heated alteration and mercury anomalism documented by K2 at the surface. These fault structures are thought to be the primary fluid channels within the system, potentially carrying mineralizing hydrothermal fluids.

Anthony Margarit, President, and CEO of K2 Gold, commented in a press release: “Since acquiring the Si2 project in January 2022 the Team at K2 has rapidly advanced the understanding of the project geology and defined very compelling targets. We are excited to get this drill program underway. The aim of the program is to test fault structures which control the extensive steam-heated surficial alteration we see at surface. We are targeting these structures at depth in order to sample the potentially gold bearing ‘boiling zone’ of the epithermal system.”

The drilling will target depths of at least 100 meters below the surface and beyond. The Si2 Gold Project is situated in Esmeralda County, Nevada, roughly 60 kilometres northwest of Tonopah, Nevada, and 20 kilometres northwest of Allegiant Gold’s Eastside deposit (1.4Moz Au, 8.8 Moz Ag). The project boasts road accessibility and encompasses 118 BLM lode claims spanning 986 hectares, with 65 claims under option from Orogen Royalties Inc. (TSXV: OGN). The claims cover an 8 square kilometre area characterized by steam heated alunite-kaolinite-buddingtonite alteration within a sequence of felsic to intermediate volcanic rocks displaying brecciation and a high mercury anomaly.

Additionally, K2 Gold announced the allocation of 2,775,000 incentive stock options to select Directors, Officers, Employees, and Advisors of the company. The options can be exercised at $0.15 per share for a period of five years from the grant date, with 25% vesting upon grant and subsequent 25% vesting every three months. The options were granted according to K2’s shareholder-approved stock option plan and adhere to the policies of the TSX Venture Exchange and any relevant regulatory hold periods.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan