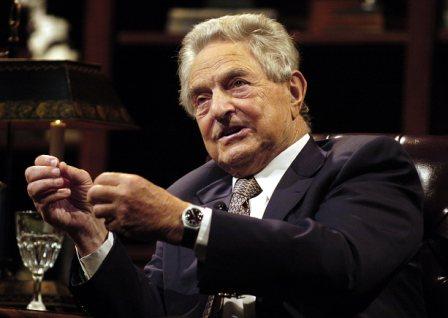

On May 16th, 2011 it was reported that U.S. investment billionaire and former gold advocate George Soros, through Soros Fund Management, sold nearly $800 million of gold during the first quarter after the precious hit a record high of $1,577 an ounce on April 30th, 2011. This roughly accounted for 5.3 million ounces of physical gold and caused some to openly question if this was the transaction that signaled the end of bull market in gold and gold equities.

But not so fast. A little digging shows that Soros’ fund actually added gold equities to their holdings during Q1 2011 including notable Canadian listed companies including Barrick Gold (TSX:ABX), Eldorado Gold (TSX:ELD), and Goldcorp (TSX:G). Soros believes, as do many industry professionals, that gold equities should benefit directly from the marked appreciation in the price of gold by generating strong cash flow from ongoing gold sales. In turn, shareholders of gold equities should enjoy the rising capital value of their shares alongside any dividend streams flowing to those shareholders.

So why have gold equities lagged behind the rising price of the metal itself in term of performance? The reason is that many analysts expect much lower prices for gold over the next three or four years. “People don’t believe that gold prices are staying up,” said Charles Oliver, a portfolio manager at Sprott Asset Management. But Oliver is not a disbeliever. The Sprott fund manager is sticking to his 2008 prediction that the price of bullion will hit $2,000 an ounce by April, 2012.

6. B2Gold Corp. (TSX:BTO)

Another Bema? If B2Gold, a company founded in 2007 by the former executives and management of Bema keeps its current pace, the second time around might be a whole lot quicker. Bema, of course, was acquired by Kinross Gold in 2007 in a friendly takeover valued at CDN$3.5 billion. Surprisingly, B2Gold actually stumbled out of the gate; shares of the company fell from over $2 immediately after going public, to a low of $0.35 during the height of the financial crisis. Since then, however, the company has rebounded and then some. B2Gold expects to produce approximately 135,000 ounces of gold in 2011 and the company’s shares are now trading at just over $4.

A quick look at their growing portfolio of properties shows that B2Gold has inherited Bema’s international flavor; Bema had producing gold mines in Russia, Chile and South Africa as well as development projects in Russia and Chile. The company operates two producing gold mines in Nicaragua and has exploration and development projects in Colombia. This diversification, coupled with the operational track record of B2Gold’s management and lower than expected production cost, led Macquarie Capital analyst Michael Gray to call B2Gold, “One of our top picks amongst mid-tier gold producers”. Gray recently gave the company an “outperform” recommendation.

MiningFeeds.com connected with Clive Johnson to discuss the evolution of Vancouver’s mining capital markets and the prospects for B2Gold – CLICK HERE – for the exclusive interview.

7. Trelawney Mining and Exploration Inc. (TSX-V:TRR)

Made in Ontario. Perhaps that is the mission statement of Trelawney Mining, if not, maybe it should be. Trelawney Mining is not exploring the distant corners of the world looking for the next big discovery. Rather, the company, based in Toronto, Ontario, is very comfortable in their own back yard so to speak. The company’s collection of gold properties, four and counting, are all located in Northern Ontario where the company is actively exploring and mining high-grade narrow vein systems.

Trelawney targets projects that have past expenditures, contain resources that are within trucking distance to custom mills, do not require major capital investment in infrastructure; and, hold the promise of exploration potential. Effectively, Trelawney looks to succeed where others may have failed. Many previous operators of high-grade narrow vein structures in Northern Ontario are thought to have lacked the underground operating experience to develop and operate such resources. And in some cases, these types of assets may have not meet the parameters for large scale operators.

On July 11th, 2011 Trelawney announced the intended takeover of Augen Gold (TSX-V:GLD) a Toronto-based junior that owns the Jerome Mine. The company’s bellwether mine contains a NI 43-101 Inferred gold resource of 1.03 million ounces (18.7 million tonnes grading 1.7 grams per tonne). Trelawney originally offered 0.066 of a Trelawney share for each outstanding share of Augen Gold but has since sweetened the pot to 0.0862 of a Trelawney share. Augen’s board is in support of the deal and recommend that shareholders tender their shares to the increased offer. After the news of the takeover offer, Mark Serdan, a portfolio manager with BMO Asset Management, noted that Trelawney Mining may itself be an attractive takeover candidate given its growing resource base in Northern Ontario. Will a niche strategy focused on the rugged and beautiful land Tom Thomson solemnized in art prove to be of interest to a possible suitor? Like an artist’s legacy, only time will tell.

For 10 Most Interesting Gold Stocks – Part 4 – CLICK HERE.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.