Atex Resources Inc. (TSXV:ATX) has shared the partial assay results for the final two drill holes, labelled as ATXD-24 and ATXD-22B, of its Phase III drill program at the Valeriano Copper-Gold Project in the Atacama Region, Chile.

Raymond Jannas, President, and CEO of ATEX, commented in a press release: “This is a great way to finish the Phase III program and has us excited to restart drilling in the fall and continue where we left off with Phase III. Hole ATXD-24 is a very significant hole as it intersected Early Porphyry further west than anticipated demonstrating that the Central Trend is wider than anticipated in this area. We look forward to completing this hole in the fall and are especially excited to follow up and test the continuity of this wider part of the Central Trend.”

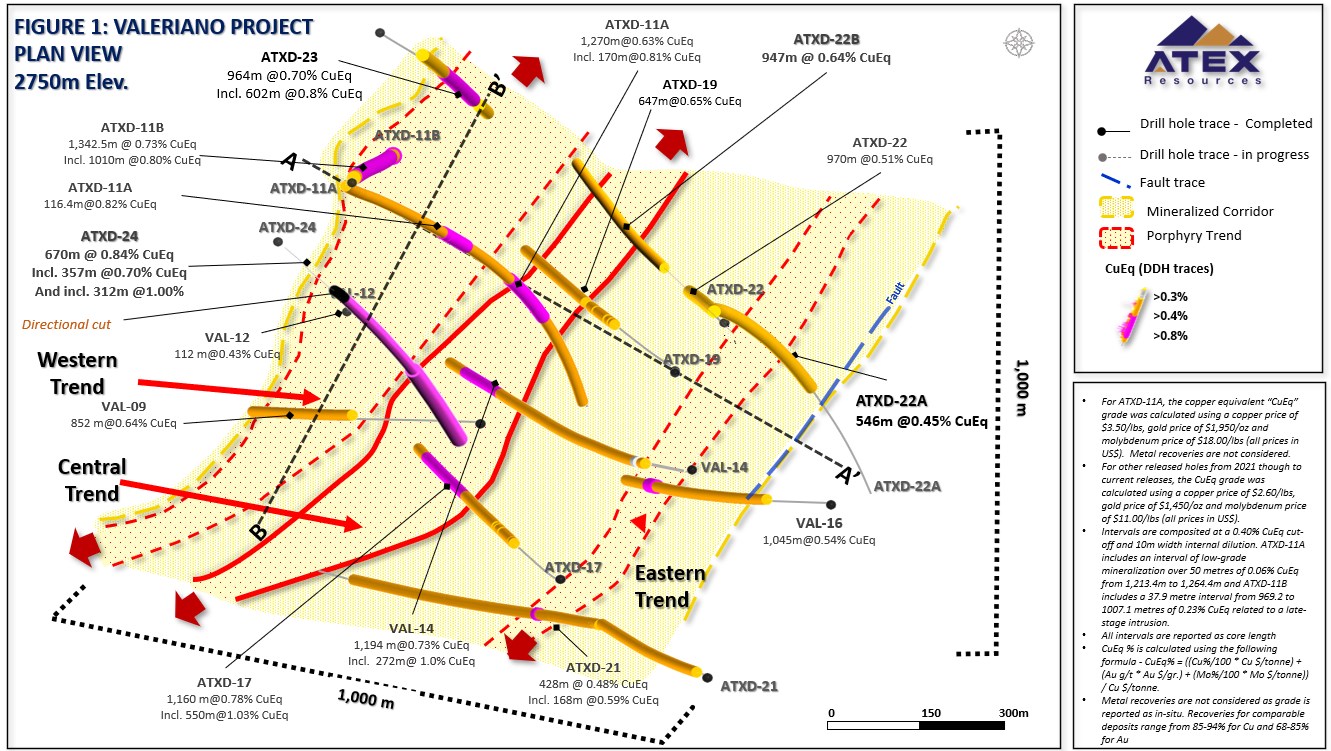

Drill hole ATXD-24, was positioned towards the southeast across the eastern boundary of the Western trend and angled towards the Central Trend. The hole’s incline was adjusted using directional drilling tools to engage the Central Trend more efficiently. In an interval between 1,050 and 1,173 metres, three separate runs were performed with the directional tool. A partial core recovery within this segment was achieved. Notably, mineralization grading above 0.40% CuEq commenced above this segment, from 964 metres to the top of the directional cut at 1,050 metres. This interval produced 86.0 metres of 0.45% CuEq (0.34% Cu, 0.1 g/t Au, and 70 ppm Mo).

ATXD-22B, the other drill hole, was temporarily halted at the program’s completion. It featured potassic altered, chalcopyrite bearing RMB, and included visible chalcopyrite and bornite mineralization zones. The drilling of this hole will resume in Phase IV.

The Phase III program began in October 2022 and concluded in late May 2023, resulting in a total of 12,513 metres of drilling, distributed among eight holes, with four originating from the surface and four more from pre-existing holes.

Notably, Phase III marked a series of execution milestones for the project, including the completion of the deepest drill hole to date (ATXD-11B, reaching 2,190.5 metres), and a 100% completion rate on drill holes. The use of directional drilling led to an approximate saving of 3,000 metres of surface drilling. Phase IV, scheduled to begin in October 2023, is intended to build on Phase III’s success.

Looking ahead, Atex plans to use the Phase III data to revise the copper-gold mineral resource statement for the Valeriano Project and to generate an updated NI-43 101 compliant technical report. Furthermore, metallurgical tests using core samples from the Phase III program are being conducted by Atex in collaboration with Libertas Metallurgy and Base Met Labs of Kamloops BC, with completion expected by Q3.

Highlights from the results are as follows:

- ATXD-24 intersected 670 metres of 0.84% Copper Equivalent “CuEq” (0.60% Cu, 0.24 g/t Au & 101 ppm Mo) including,

- 312 metres of 1.00% CuEq (0.50% Cu, 0.37 g/t Au and 11 ppm Mo), in Early Porphyry within the Central Trend, from 1,530 metres to where the hole was paused at a depth of 1,842.4 metres at the end of the drill season (Figure 1).

- The high-grade, Early Porphyry was intersected earlier in the hole than anticipated, widening the Central Trend by approximately 70 metres to the west.

- ATXD-24 was planned to reach 2,200 metres in depth and will be completed as part of the Phase IV drill program.

- ATXD-22B intersected 947 metres of 0.64% CuEq (0.49% Cu, 0.15 g/t Au and 74 ppm Mo) in mineralized rock milled breccia “RMB” from 668 metres to the bottom of the hole at 1,615 metres.

- ATXD-22B ended in mineralization and with the grade improving towards the bottom of the hole. The hole was planned to reach a depth of 2,100 metres and will be completed as part of the Phase IV program.

Table 1. ATXD-24 and ATXD-22B Results

| Hole ID | From | To | Interval (2) (3) | Cu | Au | Mo | CuEq(1) |

| (metres) | (metres) | (metres) | % | g/t | ppm | % | |

| ATXD-24* | 1,173.0 | 1,842.4 | 670.0 | 0.60 | 0.24 | 101 | 0.84 |

| incl. | 1,173.0 | 1,530.0 | 357.0 | 0.50 | 0.18 | 121 | 0.70 |

| incl. | 1,530.0 | 1,842.4 | 312.4 | 0.73 | 0.30 | 77 | 1.00 |

| ATXD-22B* | 668.0 | 1,615.1 | 947.1 | 0.49 | 0.15 | 74 | 0.64 |

- The CuEq grade was calculated using a copper price of $2.60/lb, gold price of $1,450/oz and molybdenum price of $11.00/lb (all prices in US$). Metal recoveries are not considered as grade is reported as in-situ. Recoveries for comparable deposits range from 85-94% for Cu and 68-85% for Au. CuEq is calculated using the following formula – CuEq% = ((Cu%/100 * Cu $/tonne) + (Au g/t * Au $/gr.) + (Mo%/100 * Mo $/tonne)) / Cu $/tonne.

- Intervals are composited at a 0.40% CuEq cut-off and unless otherwise stated a maximum of 10 metres of internal dilution.

- All intervals are reported as core lengths as the true lengths of the intervals are unknown at this time.

Table 2. Phase III Results Summary

| Hole ID** | From | To | Interval2 | Cu | Au | Mo | Cu Eq | Hole Length and Objective |

| (metres) | (metres) | (metres) | (%) | (g/t) | (ppm) | (%) | ||

| ATXD-11A | 860.0 | 2,130.0 | 1,270.0 | 0.43 | 0.21 | 52 | 0.63 | 2,130 m – daughter from VALDD-11. Tested Western and Central Trends |

| incl. | 1,048.0 | 1,213.4 | 165.4 | 0.51 | 0.2 | 105 | 0.73 | |

| and | 1,376.0 | 1,492.4 | 116.4 | 0.56 | 0.3 | 95 | 0.82 | |

| Incl. | 1,376.0 | 1,393.3 | 17.3 | 0.73 | 0.3 | 39 | 1.01 | |

| and incl. | 1,450.0 | 1,470.0 | 20.0 | 0.64 | 0.3 | 308 | 1.06 | |

| and | 1,698.0 | 2,130.1 | 432.1 | 0.48 | 0.3 | 12 | 0.71 | |

| incl. | 1,698.0 | 1,868.0 | 170.0 | 0.54 | 0.3 | 11 | 0.81 | |

| also incl. | 1,730.0 | 1,752.0 | 22.0 | 0.66 | 0.4 | 11 | 0.95 | |

| and | 1,816.7 | 1,836.0 | 19.3 | 0.56 | 0.5 | 10 | 0.94 | |

| and | 1,854.0 | 1,868.0 | 14.0 | 0.6 | 0.5 | 11 | 1.00 | |

| and | 2,100.0 | 2,130.1 | 30.1 | 0.53 | 0.2 | 19 | 0.73 | |

| ATXD-21 | 846.0 | 1,274.0 | 428.0 | 0.31 | 0.2 | 56 | 0.48 | 1,838 m – Drilled from surface. Tested above Eastern Trend didn’t reach Central Trend |

| incl. | 850.0 | 902.0 | 52.0 | 0.34 | 0.2 | 73 | 0.53 | |

| incl. | 1,020.0 | 1,044.0 | 24.0 | 0.32 | 0.2 | 38 | 0.52 | |

| incl. | 1,084.0 | 1,252.0 | 168.0 | 0.41 | 0.2 | 60 | 0.59 | |

| and | 1,492.0 | 1,532.0 | 40.0 | 0.27 | 0.1 | 68 | 0.41 | |

| ATXD-11B | 848.0 | 2,190.5 | 1,342.5 | 0.46 | 0.31 | 43 | 0.73 | 2,190.5 m – Daughter from VALDD-11. Discovery hole on Western Trend |

| incl. | 1,078.0 | 2,088.0 | 1,010.0 | 0.5 | 0.35 | 29 | 0.8 | |

| incl. | 1,438.0 | 2,088.0 | 650.0 | 0.46 | 0.44 | 13 | 0.83 | |

| incl. | 1,864.0 | 2,086.0 | 222.0 | 0.46 | 0.58 | 13 | 0.94 | |

| incl. | 1,964.0 | 2,086.0 | 122.0 | 0.47 | 0.65 | 14 | 1.01 | |

| ATXD-22 | 630.0 | 1,600.0 | 970.0 | 0.38 | 0.1 | 99 | 0.51 | 1,712 m – Drilled from surface – Mother hole between Central and Eastern Trends |

| incl. | 1,016.0 | 1,128.0 | 112.0 | 0.57 | 0.14 | 212 | 0.77 | |

| and | 1,426.0 | 1,568.0 | 142.0 | 0.4 | 0.11 | 55 | 0.51 | |

| ATXD-23 | 782.0 | 1,746.0 | 964.0 | 0.48 | 0.24 | 78 | 0.70 | 2,050.5 m – Drilled from Surface testing Western Trend extension |

| incl. | 1,130.0 | 1,732.0 | 602.0 | 0.5 | 0.37 | 11 | 0.80 | |

| incl. | 1,612.0 | 1,732.0 | 120.0 | 0.45 | 0.54 | 3 | 0.90 | |

| and | 1,858.0 | 2,050.1 | 192.1 | 0.24 | 0.4 | 4 | 0.56 | |

| ATXD-22A | 921.4 | 1,468.0 | 546.7 | 0.32 | 0.08 | 173 | 0.45 | 1,871 m – daughter from ATXD-22 testing Eastern Trend |

| ATXD-24* | 1,173.0 | 1,842.4 | 669.4 | 0.60 | 0.24 | 101 | 0.84 | 1,842.4 m – Collared above Western trend and stopped in Central Trend |

| incl. | 1,173.0 | 1,530.0 | 357.0 | 0.50 | 0.18 | 121 | 0.70 | |

| incl. | 1,530.0 | 1,842.4 | 312.4 | 0.73 | 0.30 | 77 | 1.00 | |

| ATXD-22B* | 668.0 | 1,615.1 | 947.1 | 0.49 | 0.15 | 74 | 0.64 | 1615.1 m – Daughter out of ATXD-22 towards Central Trend |

* Holes ATXD-24 and ATXD-22B were paused at end of Phase III

**Please see Company releases noted below for full details on Phase III results:

- ATXD-11A – Released Feb 07, 2023

- ATXD-21 – Released Feb 27, 2023

- ATXD-11B & ATXD-22 – Released March 30, 2023

- ATXD-23 & ATXD-22A Released June 05, 2023

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.