Azarga Metals Corp. [TSX-V: AZR] owns a 60% interest (with a call option to move to 100%) of the Unkur Copper-Silver project (“Unkur”) in eastern Russia. Unkur is a high-grade deposit that was actively drilled and defined during the Soviet era. It had several mineral resource estimates done, but none were (are) NI 43-101 compliant. The following interview of CEO, President & Director Dorian “Dusty” Nicol conveys the excitement management has about its maiden mineral resource estimate. [Corporate Presentation] [Prior article on AZR]. Readers should note the progress (execution) of the Company since my initial interview of Mr. Nicol last year.

Peter Epstein [ER]: Please describe Azarga Metals to readers unfamiliar with the story.

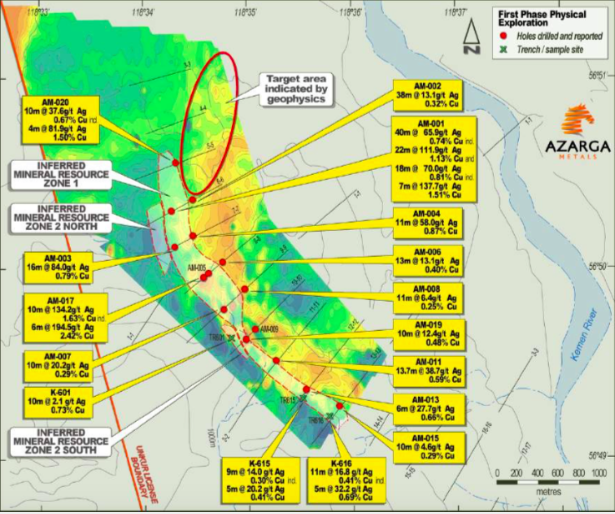

CEO Dusty Nicol: Azarga Metals Corp. is a C$9 million market cap company listed on the TSX-V (ticker: AZR). It owns 60% of the Unkur Copper-Silver project in eastern Russia. We acquired the project mid-last year and have already delivered a maiden NI 43-101 Resource estimate based on the first Phase of drilling we did. It shows 42 million metric tonnes containing around 380,000 tonnes (840 million pounds) copper equivalent, (or 124 million ounces silver equivalent), in the Inferred category. We believe our maiden Resource is one of the larger ones put out by a copper or silver junior in the past few years. And, the Resource has plenty of growth potential because it’s open in multiple directions and down dip.… a very good start!

[ER]: The maiden Resource press release came as a surprise, many thought more time, money & drilling would be required. How did Azarga reach this milestone so quickly

Dusty: Yes, we get asked that a lot, there was historical exploration done on the deposit back in the 1960s / 1970s, including drilling & trenching. That work and various historical [non-43-101 compliant] resource estimates indicated that Unkur had the potential to be a copper-silver deposit of global significance, and what I mean by that is, much larger than what’s reflected in our maiden Resource. We didn’t simply ‘twin’ historical holes. We carefully considered prior exploration data and our own interpretation of the geology, and formulated a plan for the project’s first modern physical exploration program.

The presence of the historical data really improved our efficiency because it meant that the maiden Resource could be derived from only 16 diamond core drill-holes plus four trenches. Having said that, I want to emphasize that while we used historical data to guide our exploration, our Resource estimate is based entirely on our own verified data. The total spend for that first Phase leading to the maiden Resource was around US$1.5 million.

[ER]: Speaking of historical data, are there important takeaways regarding, “Soviet era” exploration drilling? How do recent drill results compare to historical records?

Dusty: Well, if we look at the areas where our new work overlapped with the old, we can honestly say that we have been pleasantly surprised by both grade and thickness. That means we’re getting increasingly confident around that notion that this could be a world-class deposit. Importantly, our Resource only covers around half of the historically known strike length. That portends plenty of potential upside. Also, we found some things that the historical data didn’t cover, for instance, there are multiple layers of ore, not just a single zone. Around a quarter of our maiden Resource comes from a second layer (referred to as Zone 2). Having a second zone, maybe multiple mineralized zones, again suggests that we could be onto something really big.

[ER]: What are some near-term catalysts over the remainder of the year?

Dusty: Before I answer directly, there’s more to say about the Resource that defines how we are moving forward. The majority of the deposit is located near surface, including two higher grade pods of mineralization, plus as mentioned, the Resource is open in multiple directions and down dip. This leads us to a two-pronged strategy. We will continue our physical exploration, which we expect will lead to a transformational increase in the Resource after our second Phase of work.

Simultaneously, we will be considering economic and engineering aspects in terms of scoping study and PEA work. So, catalysts this year include; more drilling results, results from geophysics and metallurgical testing, likely a new Resource estimate, and the results of a PEA or internal scoping study. So, there should be plenty of action and news flow! Right now we’re planning the Phase two work program and should be ready to approve and kick it off in the next 30-60 days.

[ER]:Presumably you’re comfortable with Russian country risk. What can you share with readers about your views on Russia (eastern Russia)?

Dusty: I speak five languages and as a 40-year veteran geologist, I have worked just about everywhere. I’ve worked in really hard places in terms of terrain, weather and permitting. Alaska is one — so is the high Andes of South America — but Unkur’s location in eastern Russia is not. We have no trouble getting to site or getting rigs in. The site is only 7 kilometers from a railway and it has a 220KvA powerline running over it…. Russian is fast becoming my sixth language!

By the way, I think the location has one extraordinary advantage that no one talks about, and that’s the package of incentives provided to promote investment in Russia’s far east. There are tax incentives and royalty reductions, but the most important thing is the Far East Development Fund (“FEDF”). It’s essentially a development bank specifically set up for the region. It offers debt and equity funding on preferential terms for projects such as ours. Examples of companies that are working with the FEDF include Amur Minerals, Eurasian Minerals and Polymetal Intl. Plc.

We have a strong presence in Russia. In fact, I’m the only full-time employee who’s not Russian. Our entire technical team at site and small administrative team in China is Russian. In addition, we have a strong presence in Moscow through our Moscow-based Director and his business associates & contacts. Also, a significant percentage of our shareholder base is Russian. As a result, I’m very comfortable operating in Russia and I really think that the issue of ‘country risk’ is more one of perception than one of substance. I’m finding Russia no more difficult to operate in than most other jurisdictions, and in fact in many ways I’m finding it easier.

[ER]: Azarga Metals’ press release was quite detailed, can you summarize factors (other than size, grade and jurisdiction) that readers might benefit from focusing on?

Dusty: Yes, as I said before two important features of the Resource are; (1) most of it is near surface, including the two higher grade pods of mineralization – i.e., think ease of mining and economic benefit. These pods could be amenable to lower-cost open pit mining and could be mined earlier, thus helping accelerate capital payback, and (2) it’s open in both directions along strike and down dip – i.e., think growth potential!

[ER]: Can you explain to readers the exclusive opportunity Azarga has to consolidate 100% of the project (via a call option on the remaining 40% Interest)?

Dusty: Yes, we have a call option over the remaining 40% that can be exercised if/when the Resource reaches 2 million tonnes of contained copper equivalent, with 70% in the Measured & Indicated categories. The price of the call will be either a mutually agreed upon valuation or based on an independent fairness opinion. We have a clear path to consolidate the project and are working towards the milestone to do so.

[ER] Thank you for your time and good luck on Phase 2 drilling later this year.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.