At the close of US trading Monday April 3, gold futures remained 1% below their three-month high from Monday of last week. Since dipping into the $1190s on March 10 however, the price for one ounce of gold is up 4.8%. So far in 2017, the US dollar index has traded 1.5% to 4.8% below its January 3 high of 103.82. Talk of rate rises by key Fed officials, however, kept the dollar’s slide from worsening further.

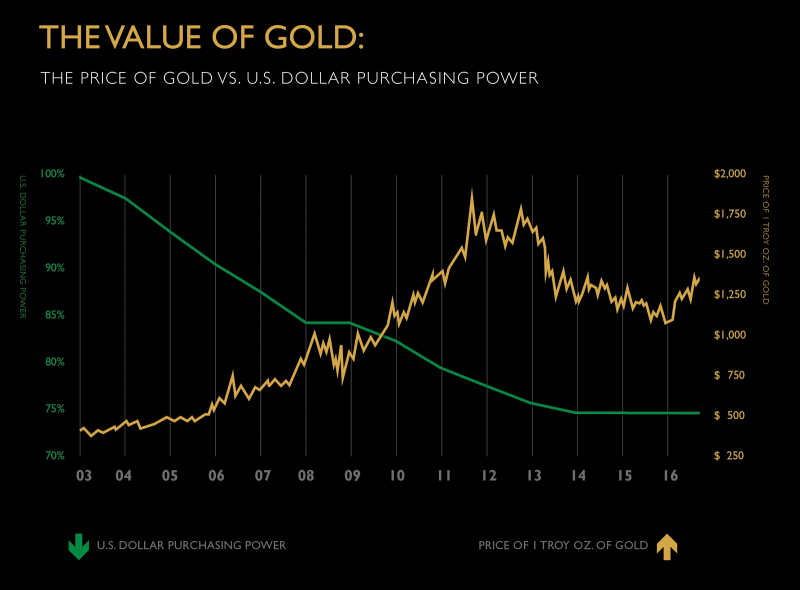

Throughout the fourteen years shown in the Dollar Purchasing Power chart below, the purchasing power of the US dollar has dropped by 25%. Back in 2007, one US dollar could buy 87% of the things it could in 2003, and now it has remained at 75% since 2014. Retirement account contributions typically slow during recession years, as they did from 2007 to 2009. Rising consumer prices could have a similar effect if wage inflation doesn’t keep up.

The gold IRA and precious metals pricing information on the page with the original chart shows the same plateau in purchasing power since 2014, resulting from a change in monetary policy since the first round of quantitative easing (QE) in the US started during the 2008-09 recession.

Since the last round of QE ended in October 2014, the United States Fed has been looking for signs to raise rates, and strengthening economic factors have given it a reason to do so.

That is, according to what Chicago Fed President Charles Evans said Monday March 27, when he told Bloomberg he was expecting as many as three rate hikes in 2017. Ever vigilant to changing economic conditions however, Evans said this depended on inflation expectations remaining strong, and that any change from positive trends would take his expectation down to only two rate hikes this year. That same week, Dallas Fed President Robert Evans had a dovish tone, speaking about adjusting the pace of rate hikes to ease off monetary accommodation gradually. He also mentioned the need to keep an eye on inflation though, saying that tightening will continue to occur before the Fed reaches its 2% inflation mandate.

Philadelphia Fed President Patrick Harker expressed dovish comments this week as well, reaffirming on Monday April 3 other officials’ comments about scaling back the Fed’s portfolio of Treasury bonds and mortgage-backed securities. Last Friday, William Dudley, the President of the New York Fed, said that the $4.5 trillion dollars of assets amassed during the Fed’s QE programs would be allowed to mature rather than be sold off abruptly.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.