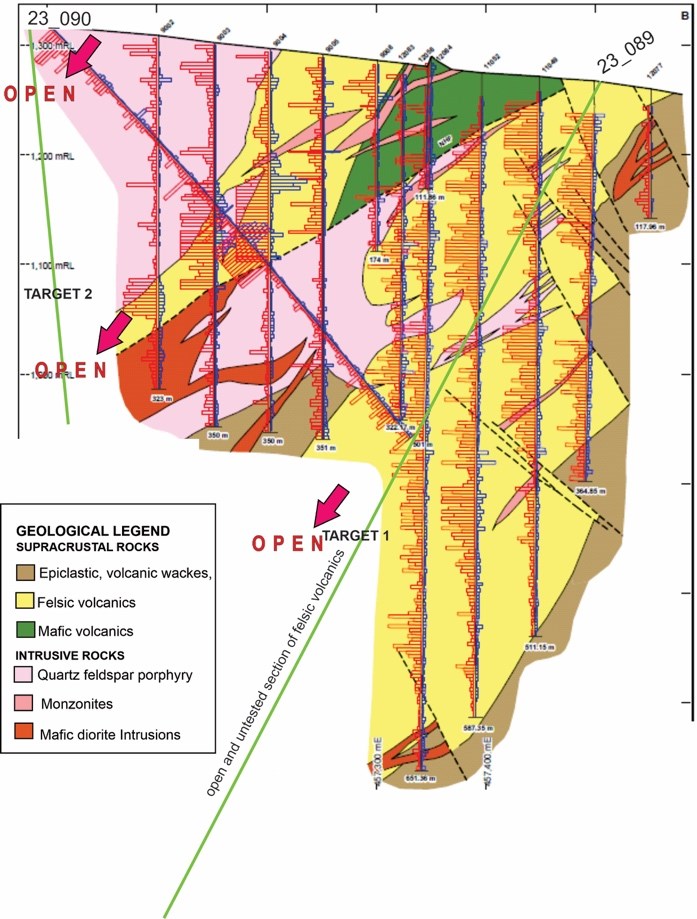

Carlyle Commodities (CSE:CCC) has commenced its Phase 1 diamond drilling at the Newton Gold Silver Project in British Columbia. The Phase 1 program will test numerous high-priority targets to increase tonnage and ounces at Carlyle’s current NI 43-101 resource calculation. The first focus will be to test multiple zones of felsic volcanic host rock outside of the current pit-constrained resource calculation to discover new mineralization zones.

The first Phase 1 initial drill targets include:

- Drill site 1: Targets continuity of the well mineralized main felsic domain, which remains open. This will be completed by a 500 meter to 1,000 meter drill hole through the current resource and extending to untested sections of the felsic domain.

- Drill site 2: Targets a potential felsic domain starting at surface and extending into a second felsic domain which remains open along trend. Geological modelling suggests that these may represent three stacked mineralized felsic domains.

- Drill site 3: Targets an additional felsic domain more than 100 metres outside of the current resource. Historical DDH 12-076 returned 171m of 0.69 Au and 2.1 Ag (288-459m) which has not been followed up on.

Mr. Jeremy Hanson, VP Exploration commented in a press release: “We are very excited to begin this first phase of drilling. We have a number of high-priority domains to test. Our modeling is indicating that these mineralized felsic domains extend significantly outside of the current resource and with potential for discoveries of new zones of mineralization.”

Carlyle President and Chief Executive Officer, Morgan Good, also commented: “We believe momentum is building across the junior resource equity markets. Carlyle’s timing with its Phase 1 diamond drill program to test high potential targets looks to position the Company well.”

Issuance of Shares and Options Grants

The company also announced that it had issued 78,606 shares of Carlyle Commodities Corp. at $0.16875 per share to two strategy and business consultants Carlyle has engaged. The shares were issued according to the terms of consulting agreements, equal to the lowest permitted price by the applicable policies of the Canadian Securities Exchange.

Carlyle Commodities also issued 1,000,000 options to a consultant for the company for the purchase of up to 1,000,000 shares according to the company’s Omnibus Equity Incentive Plan. All options were vested immediately and are exercisable for a period of five years at a price of $0.31 per share.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.