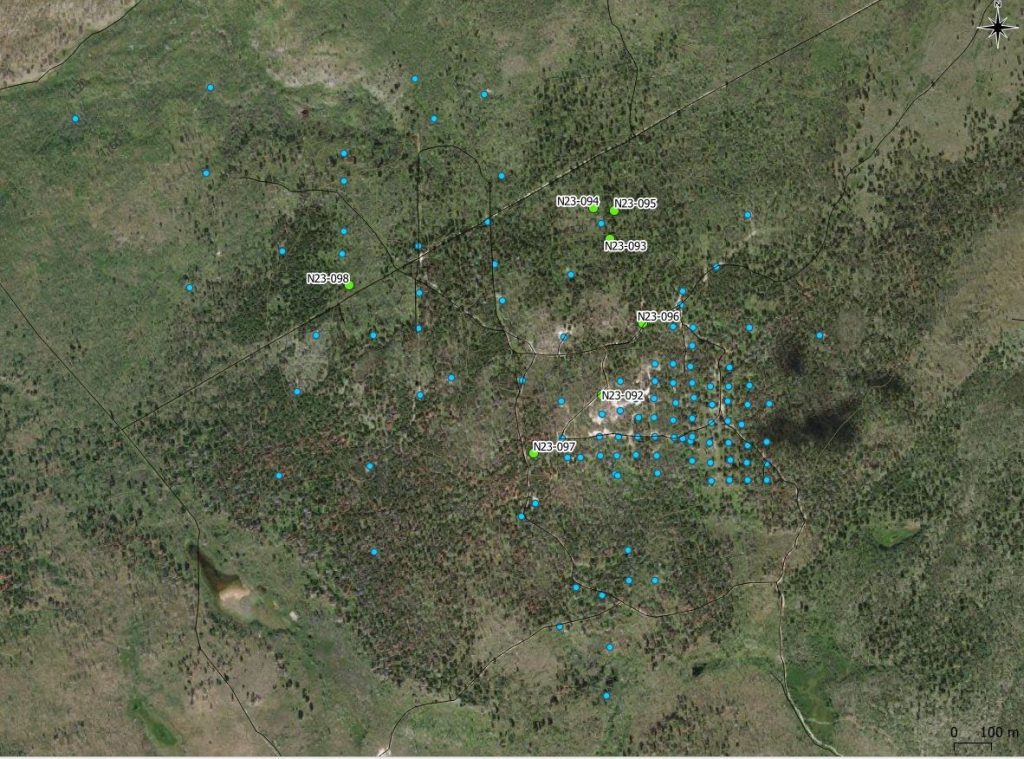

Carlyle Commodities (CSE:CCC) has completed a new diamond drill program at the Newton Gold Project located in British Columbia, Canada. The drill program totalled 840.3 metres across 7 drill holes and tested multiple high-priority targets with the goal of expanding the current mineral resource estimate.

Morgan Good, President and Chief Executive Officer, commented in a press release: “We are very pleased with this efficient 7-hole drill program and the professional work of our team. All holes successfully intersected our primary targets. We look forward to our results and continuing to advance the Newton project in 2024.”

Jeremy Hanson, VP of Exploration, also commented: “We are excited about the holes we completed, there was a lot of productive activity completed in a short time frame. The drill team tested a variety of high-potential targets where much of the core contained strongly altered rocks, disseminated and veined sulphides. We are certainly looking forward to our results and getting back on the ground.”

The Newton Gold Project contains an inferred mineral resource estimate dated June 13, 2022 of 861,400 ounces of gold and 4,678,000 ounces of silver at an average grade of 0.63 g/t gold using a 0.25 g/t gold cut-off grade across 42,396,600 tonnes.

The targets for the latest 7-hole drill program included surface geochemical anomalies, open mineralization from previous drilling, and mineralized volcanic and intrusive rocks. The intention was to potentially expand the existing inferred resource, identify new zones of mineralization, and test for higher-grade mineralization near surface.

All drill holes successfully intersected altered and mineralized lithologies including felsic and mafic volcanic rocks and quartz porphyry intrusions which host the gold mineralization at Newton. Sulphide minerals were also intersected which are commonly associated with gold mineralization at the project.

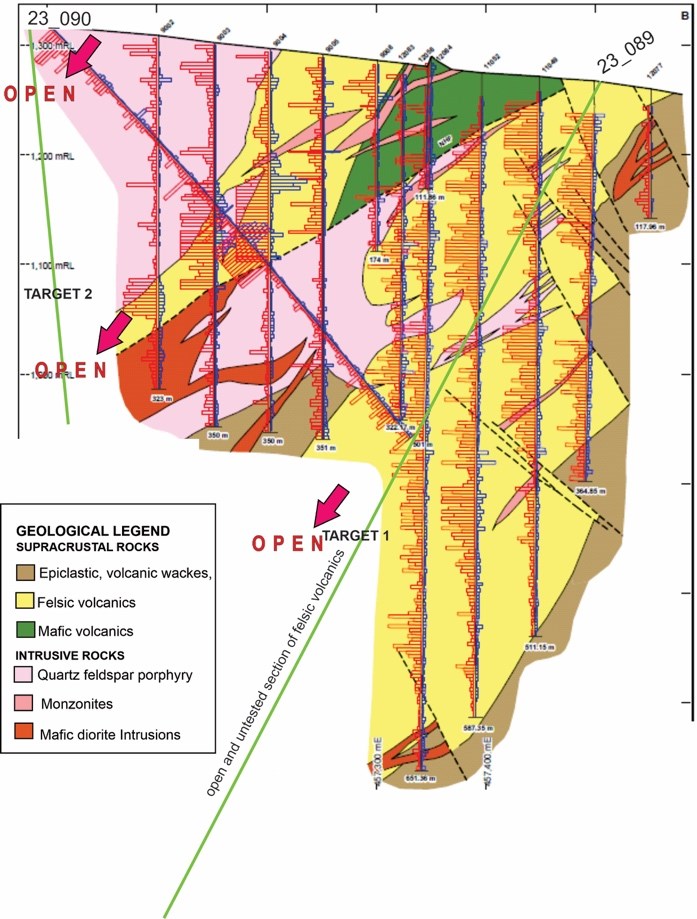

The Newton Gold deposit remains open in multiple directions with room to expand the resource size and grade. The current resource occupies just 7% of a broad induced polarization anomaly that measures the sulphide content of rocks. Areas for immediate follow-up include south and southwest of the current resource where previous drilling has intersected mineralized volcanics that are not part of the current resource. Extensions of the mineralization are also open down dip to the southwest.

The majority of the large sulphide-bearing altered area defined by historically induced polarization surveys remains underexplored. Previous limited drilling beyond the area of densest drilling to the northwest returned significant gold intersections indicating potential for additional resources.

All drill core samples have been sent to Bureau Veritas laboratories for analysis and assay results are expected within weeks. Once received the results will be incorporated into planning the next phase of exploration and drilling at the Newton Gold Project.

Highlights from the program are as follows:

- The Newton Gold Project is a large, bulk tonnage, low – to intermediate-sulphidation, epithermal gold deposit with nearly 35,000 m of drilling exploring and developing the historical resource, primarily between 2009-2012.

- Updated pit-constrained inferred mineral resource contains 861,400 oz of Au, and 4,678,000 oz of Ag with an average grade of 0.63 g/t Au, a cut off of 0.25 g/t Au throughout 42,396,600 tonnes.

- The Newton Gold Project encompasses more than 24,000 ha.

- The Updated Newton Resource Calculation occurs within an 800 x 400 m area defined by drilling to depths of approximately 500 m with majority of the holes not exceeding 300 m depth.

- Underlying the deposit, a large IP anomaly measures 4 km x 2 km and covers an area greater than 7 km2 – yet the existing inferred mineral resource occupies slightly over 0.5 km2 or just 7% of the anomaly.

- Gold and associated base metal mineralization precipitated in extensive zones of strong quartz-sericite alteration as well as in mafic volcanic and clastic sedimentary rocks and along fault and fracture zones.

- The alteration assemblages and metal associations at the Newton Gold Project are similar to the Blackwater gold project deposit of Artemis Gold Inc. (“Artemis“). The Blackwater gold project, which is in construction phase, is located approximately 185 km northeast of Newton, where it is one of Canada’s largest open-pitable gold deposits and one of the world’s largest environmental assessment approved gold development projects. Blackwater has a measured + indicated resource estimated at 11.7 million ounces Au and 122 million ounces of Ag.

Table 1 – Drill collar table

| Hole_ID | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| N23-092 | 457108 | 5738816 | 1321 | 0 | -90 | 258 |

| N23-093 | 457130 | 5739235 | 1324 | 0 | -90 | 105 |

| N23-094 | 457086 | 5739318 | 1307 | 0 | -90 | 109 |

| N23-095 | 457142 | 5739312 | 1310 | 0 | -90 | 92 |

| N23-096 | 457218 | 5739009 | 1333 | 0 | -90 | 87 |

| N23-097 | 456925 | 5738660 | 1291 | 0 | -50 | 135 |

| N23-098 | 456430 | 5739111 | 1276 | 0 | -90 | 54 |

Hole N23-092

Hole N23-092 was drilled 50 metres north of hole 10016 where the inferred mineral resource remains open to the northwest along a broad corridor. The hole was drilled to a depth of 258 m and intersected strongly altered quartz feldspar porphyries intruding altered felsic volcanic rocks with disseminated and fracture-controlled pyrite.

Holes N23-093, N23-094, and N23-095

Holes N23-093, 94, and 95 were drilled approximately 350 – 450m north of the NI 43-101 inferred mineral resource boundary, around historical hole 10030. Hole 10030 intersected 24 metres of 0.83 g/t Au from 18.0 – 42.0 metres in propylitic altered mafic volcanics associated with an IP chargeability anomaly. As such, this area represents a potential higher grade near surface area of significant interest.

The Company drilled three holes around hole 10030, triangulating 50m step outs to the northeast, southwest, and northwest of this hole to investigate possible continuation of this mineralization. These holes were also plotted based on gold-in-soil geochemical anomalies and elevated IP chargeability anomalies proximal to hole 10030. All three holes intersected propylitic altered mafic volcanics with disseminated and fracture-controlled sulphides from surface to the approximate total depth of 100m in each hole.

Hole N23-096

Hole N23-096 was drilled more than 100 meters north of the inferred mineral resource where historic trenching, rock and soil sampling all returned significant gold values at surface. The hole was drilled to 87 metres and intersected very strongly altered felsic volcanics with disseminated and fracture-controlled sulphides to a depth of 24 metres. The hole cut altered mafic volcanics from 24 to the total length of 87 metres, including small metre scale felsic intrusive.

Hole N23-097

Hole N23-097 was drilled immediately west of the inferred mineral resource where mineralization is open and begins at surface, demonstrated in historic trenching and drilling. The hole was drilled to a depth of 135 metres and intersected strongly altered quartz feldspar porphyry with disseminated and fracture-controlled sulphides as pyrite – chalcopyrite ± sphalerite veinlets.

Hole N23-098

Hole N23-098 was drilled 750 meters northwest of the inferred mineral resource targeting a gold-in-soil geochemical anomaly proximal to historic drill holes that intersected felsic volcanics and quartz feldspar porphyry. This hole was drilled to 54.0 metres and intersected altered quartz feldspar porphyry with disseminate and vein hosted pyrite.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Carlyle Commodities (CSE:CCC) has commenced its Phase 1 diamond drilling at the Newton Gold Silver Project in British Columbia. The Phase 1 program will test numerous high-priority targets to increase tonnage and ounces at Carlyle’s current NI 43-101 resource calculation. The first focus will be to test multiple zones of felsic volcanic host rock outside of the current pit-constrained resource calculation to discover new mineralization zones.

The first Phase 1 initial drill targets include:

- Drill site 1: Targets continuity of the well mineralized main felsic domain, which remains open. This will be completed by a 500 meter to 1,000 meter drill hole through the current resource and extending to untested sections of the felsic domain.

- Drill site 2: Targets a potential felsic domain starting at surface and extending into a second felsic domain which remains open along trend. Geological modelling suggests that these may represent three stacked mineralized felsic domains.

- Drill site 3: Targets an additional felsic domain more than 100 metres outside of the current resource. Historical DDH 12-076 returned 171m of 0.69 Au and 2.1 Ag (288-459m) which has not been followed up on.

Mr. Jeremy Hanson, VP Exploration commented in a press release: “We are very excited to begin this first phase of drilling. We have a number of high-priority domains to test. Our modeling is indicating that these mineralized felsic domains extend significantly outside of the current resource and with potential for discoveries of new zones of mineralization.”

Carlyle President and Chief Executive Officer, Morgan Good, also commented: “We believe momentum is building across the junior resource equity markets. Carlyle’s timing with its Phase 1 diamond drill program to test high potential targets looks to position the Company well.”

Issuance of Shares and Options Grants

The company also announced that it had issued 78,606 shares of Carlyle Commodities Corp. at $0.16875 per share to two strategy and business consultants Carlyle has engaged. The shares were issued according to the terms of consulting agreements, equal to the lowest permitted price by the applicable policies of the Canadian Securities Exchange.

Carlyle Commodities also issued 1,000,000 options to a consultant for the company for the purchase of up to 1,000,000 shares according to the company’s Omnibus Equity Incentive Plan. All options were vested immediately and are exercisable for a period of five years at a price of $0.31 per share.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan