Article originally published on January 23rd, 2015.

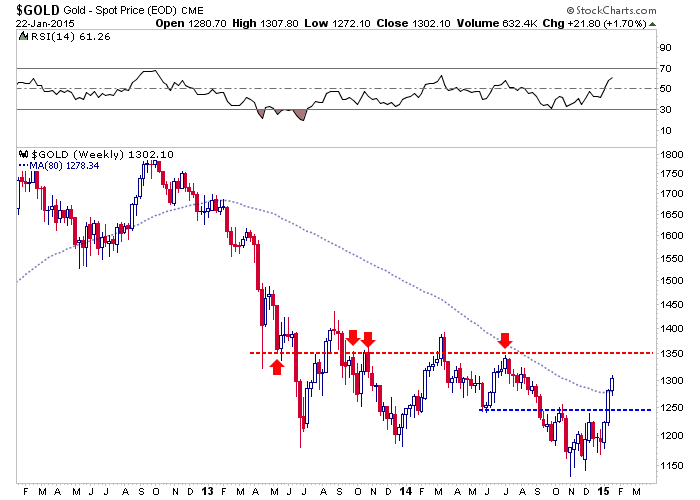

In recent days and weeks we noted key levels for Gold at $1250 as well as $1270-$1280. Over the past two weeks Gold easily cleared $1250 and continued to $1300. Today it is trading around $1290 and will close above its 80-week moving average for the second consecutive week. That last happened in late 2012. Gold continues to show strength and far more bullish than bearish signs.

The weekly candle chart below shows the key levels for Gold which are essentially $1250 and $1350. Gold should have strong support at $1250 while facing resistance at $1330-$1350. A weekly close above $1350 or monthly close above $1330 would signal to the remaining bears that the bear market is over.

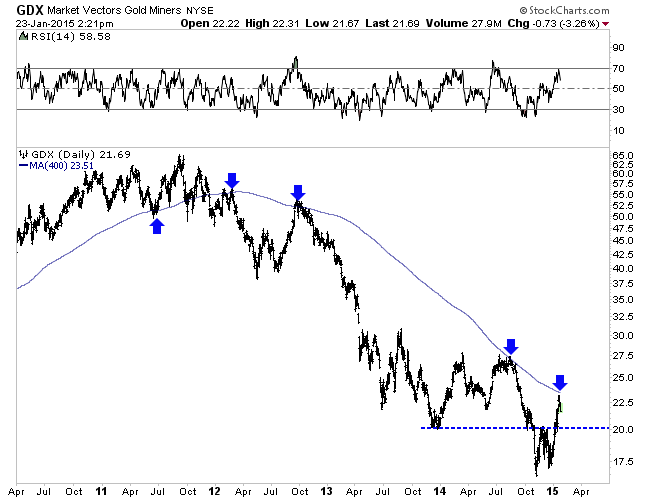

Moving to the stocks, the bellwether for the sector, GDX is backing off after nearly touching its 400-day moving average. We’ve often noted the importance of this particular moving average. The chart shows how the average has marked very important points over the last four years.

Going forward, the key support levels to watch would be $1250 Gold and $20 GDX while the key resistance levels are $1350 Gold and the 400-day moving average ($23.50) for GDX. A dip to or near those support levels would be a buying opportunity.

One catalyst for the next impulsive advance might be a correction in the US Dollar. Precious metals have performed exceedingly well as the greenback has rallied over 7% in the past six weeks and over 12% since October. Yet, public opinion recently touched a record high and the daily sentiment index recently hit 98% bulls. Gold is already trading near the equivalent of $1500/oz against foreign currencies. Any sustained US$ weakness could send metals and miners quite a bit higher. While I believe the bear market is over, I’ll be looking for more confirmation in the weeks and months ahead.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.