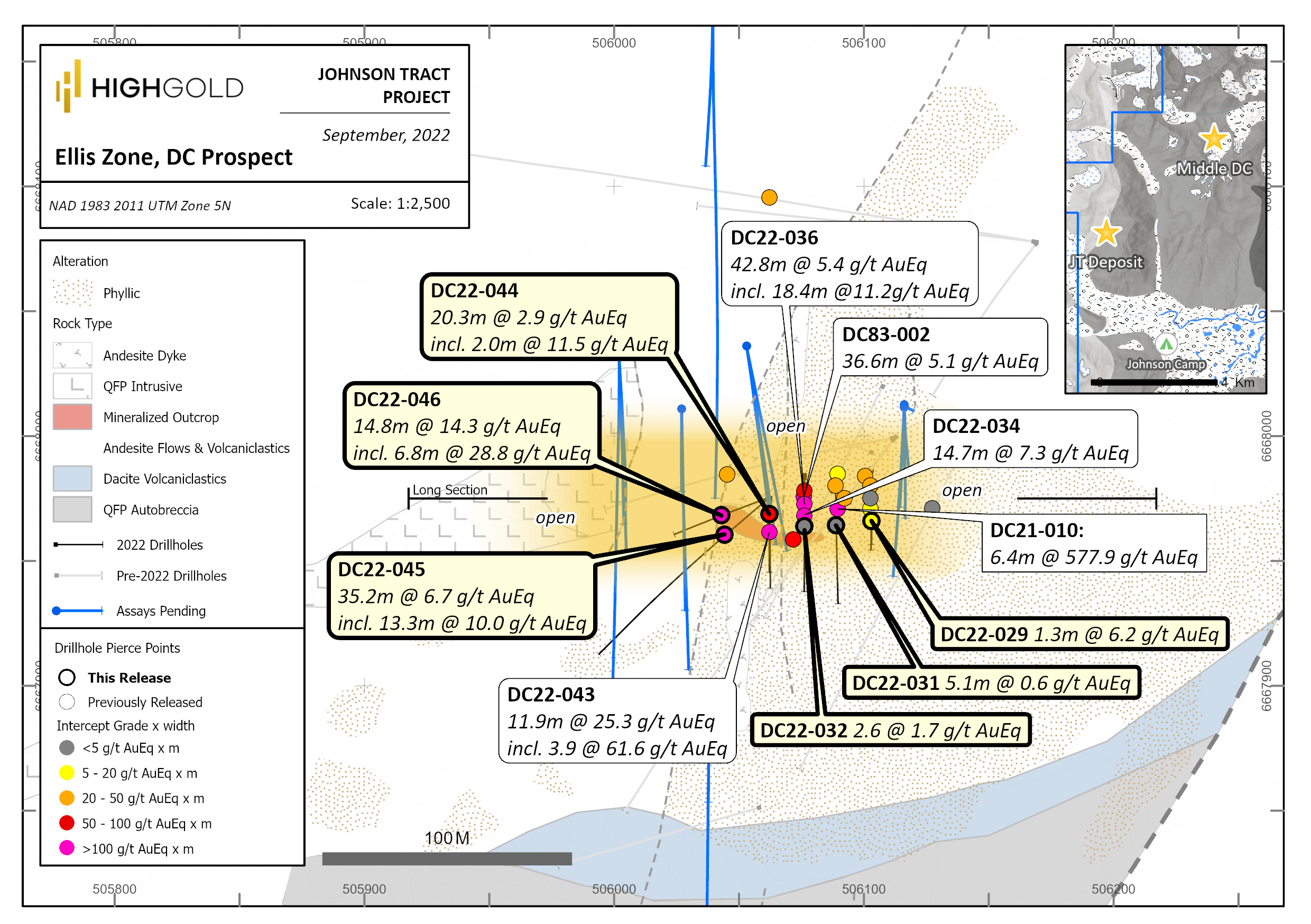

HighGold Mining (TSXV:HIGH) has reported new assay results from six additional drill holes testing the Ellis Zone at its Difficult Creek Prospect. Difficult Creek is one of several district-scale prospects being explored by HighGold on the Johnson Tract project in Southcentral Alaska, USA.

Darwin Green, CEO of HighGold, commented in a press release: “The Ellis Zone discovery continues to deliver excellent results with some of the strongest and widest intersections to date coming from the western limit of our drilling. We are very encouraged by the persistence of the Ellis Zone mineralization along strike and plan to keep stepping out in all directions as we continue expanding the known extents of the zone. While still very early days, it appears we are well on our way to defining a second deposit at Johnson Tract to compliment the existing high-grade +1Moz JT Deposit mineral resource that is also open to expansion.”

Diamond drilling in the Ongava Continuation zone continues, with fresh step-out holes being drilled on 25 meter centers. With 21.68 grams per tonne Au, 30 grams per tonne Ag, 0.61 percent Cu, and 4.20% Zn over 11.9 meters, these new intersections have extended the region’s broad, high-grade Ellis Zone mineralization nearly 50%.

The JT Deposit (DC Prospect) is located four kilometers northeast of the deposit and is characterized by a series of large gossan alteration zones that are similar in style to the +1Moz AuEq JT Deposit, which covers a 1.5 km x 3.0 km area in a broad northeasterly direction. Gold mineralization and widespread clay/anhydrite alteration are preferentially developed within dacitic to rhyolitic fragmental rocks that are capped by a shallowly dipping sequence of lesser altered andesite volcanics at higher elevations, hosting an epithermal vein field containing gold and silver.

The widespread amount of mineralization exposed in erosional windows by the topping andesite might allow for a large, partially blind mineralized system to be linked between the different DC Prospect zones along a strike length of 3 kilometers. Drilling began in late 2021, and near-surface bonanza-grade mineralization was discovered at 577.9 g/t Au and 2,023 g/t Ag over 6.40 meters in hole DC21-010.

During the off-season, subsequent geology modeling supported a north-northeast striking, steeply north-dipping trend to the mineralization that became the focus of the first 2022 drill program at what is now referred to as the ‘Ellis Zone.’

So far, a total of 36 drill holes have been completed at the Ellis Zone totalling 4,935 meters. Today’s release includes assay results for 6 new holes, making the total number of released holes 14. Drill hole lengths are usually 75 to 150 meters long and have been drilled in fan patterns of 12.5 to 25-meter grid spacing in order refine the geometry, geological controls and grade distribution better understand this promising new mineralized zone.

Mineralogy, veining and alteration at the main JT Deposit are similar to those located four km southwest. The main deposit has been defined from surface downward to a depth of 300 meters, with a strike length of 600 meters and an average true thickness of 40m.

Drilling has now defined the Ellis Zone mineralization over a strike length of approximately 125 meters and from surface to a depth of 100 meters with an average true thickness of 10 to 15 meters. An apparent shallow plunge to the southwest is now defined by the thickest and the greatest-grade intercepts, which suggest that there may be additional targets in this area. The Ellis Zone remains open along strike and at depth, as well as towards the east and west, and drilling continues in ever-increasing increments as confidence in the geologic model grows.

Drill Highlights of the Ellis Zone, DC Prospect are as follows:

Drillhole DC22-046

- 14.8m @ 10.14 g/t Au, 13.8 g/t Ag, 0.28% Cu, 5.97% Zn (14.3 g/t AuEq) including

- 6.8m @ 21.29 g/t Au, 25.1 g/t Ag, 0.55% Cu, 0.61% Pb, 10.70% Zn (28.7 g/t AuEq) including

- 1.5m @ 62.50 g/t Au, 10.5 g/t Ag, 0.77% Cu, 0.59% Pb, 10.59% Zn (70.0 g/t AuEq)

Drillhole DC22-045

- 35.2m @ 4.2 g/t Au, 6.1 g/t Ag, 0.12% Cu, 1.40% Pb, 3.19% Zn (6.7 g/t AuEq) including

- 1.9m @ 12.95 g/t Au, 37.7 g/t Ag, 13.51% Pb, 31.42% Zn (36.2 g/t AuEq), and

- 13.3m @ 7.81 g/t Au, 6.4 g/t Ag, 0.23% Cu, 1.31% Pb, 2.35% Zn (10.0 g/t AuEq)

Drillhole DC22-044

- 20.3m @ 1.72 g/t Au, 5.6 g/t Ag, 0.14% Cu, 1.46% Zn (2.9 g/t AuEq), in hole DC22-044, including

- 2.0m @ 8.34 g/t Au, 8.9 g/t Ag, 0.41% Cu, 4.00% Zn (11.5 g/t AuEq)

Table 1. Johnson Tract Project – DC Prospect – Ellis Zone – Significant Assay Intersections

|

Drill Hole |

From |

To |

Length |

Au |

Ag |

Cu |

Pb |

Zn |

AuEq |

|

(meters) |

(meters) |

(meters) |

(g/t) |

(g/t) |

% |

% |

% |

(g/t) |

|

|

DC22-029 |

31.3 |

32.6 |

1.3 |

6.10 |

6.5 |

0.01 |

0.02 |

0.04 |

6.2 |

|

DC22-031 |

29.2 |

34.3 |

5.1 |

0.31 |

6.7 |

0.03 |

0.10 |

0.23 |

0.6 |

|

DC22-032 |

28.0 |

30.6 |

2.6 |

0.24 |

3.2 |

0.10 |

0.59 |

1.96 |

1.7 |

|

And |

51.1 |

55.6 |

4.5 |

0.26 |

10.2 |

0.11 |

0.90 |

2.56 |

2.3 |

|

DC22-044 |

46.4 |

66.7 |

20.3 |

1.72 |

5.6 |

0.14 |

0.18 |

1.46 |

2.9 |

|

Incl |

52.8 |

54.8 |

2.0 |

8.34 |

8.9 |

0.41 |

0.44 |

4.00 |

11.4 |

|

DC22-045 |

4.6 |

57.1 |

52.5 |

2.95 |

5.5 |

0.10 |

1.01 |

2.38 |

4.9 |

|

Incl |

9.1 |

44.3 |

35.2 |

4.20 |

6.1 |

0.12 |

1.40 |

3.19 |

6.7 |

|

Incl |

9.1 |

11.0 |

1.9 |

12.95 |

37.7 |

0.08 |

13.51 |

31.42 |

36.2 |

|

Incl |

30.0 |

43.3 |

13.3 |

7.81 |

6.4 |

0.23 |

1.31 |

2.35 |

10.0 |

|

DC22-046 |

56.0 |

70.8 |

14.8 |

10.14 |

13.8 |

0.28 |

0.46 |

5.97 |

14.3 |

|

Incl |

56.0 |

65.7 |

9.7 |

15.34 |

20.0 |

0.42 |

0.60 |

8.58 |

21.3 |

|

Incl |

57.5 |

64.3 |

6.8 |

21.29 |

25.1 |

0.55 |

0.61 |

10.70 |

28.7 |

|

Incl |

57.5 |

59.0 |

1.5 |

62.50 |

10.5 |

0.77 |

0.59 |

10.50 |

70.0 |

True thickness for the reported intersections estimated at 50% to 90% of reported width. Gold Equivalent (“AuEq”) based on assumed metal prices of US$1650/oz for Au, US$20/oz for Ag, US$3.50/lb for Cu, US$1.00/lb for Pb and US$1.50/lb for Zn and payable metal recoveries of 97% for Au, 85% for Ag, 85% Cu, 72% Pb and 92% Zn.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.