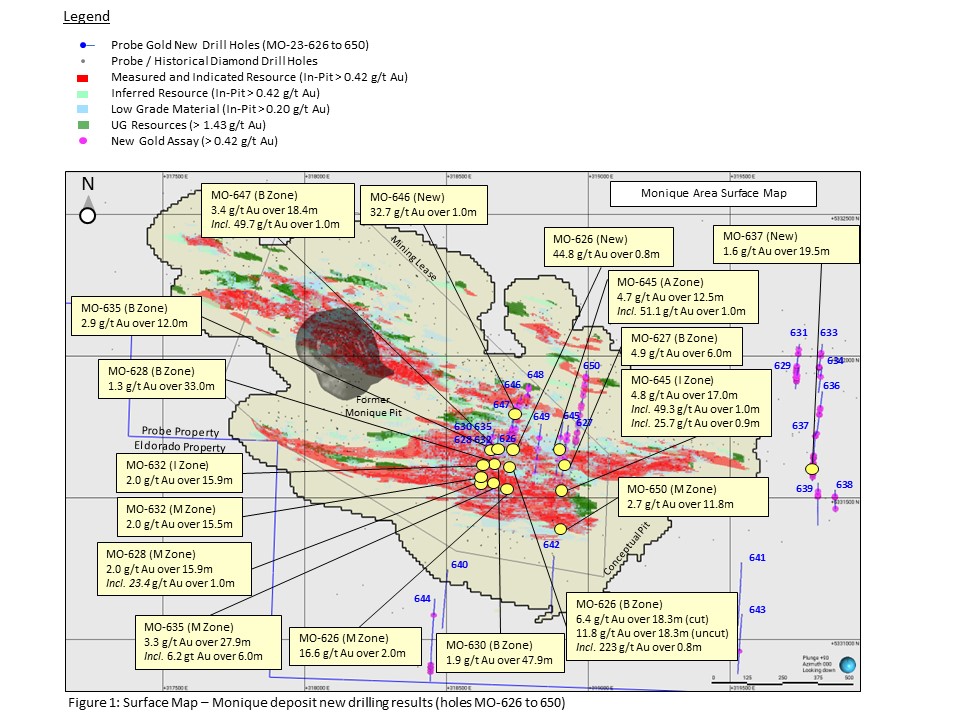

Probe Gold (TSX:PRB) has released the latest results from its 2023 drilling program at the Monique site, part of its Novador property near Val-d’Or, Quebec. The company, which owns the property entirely, reported significant findings from 25 drill holes, covering a total distance of 9,940 meters. These results indicate high-grade gold intersections along the strike, at various depths, and within the predicted gold zones of the Monique deposit, extending from the surface down to a depth of approximately 450 meters.

The recent drilling outcomes highlight notable gold grades and thicknesses, suggesting the ongoing expansion and consistent presence of gold mineralization at the Monique deposit. The identified gold trend zones at Monique are noted to be open for further exploration both along the strike and at greater depths.

Out of the 25 drill holes, 20 were aimed at expansion and infill drilling, intended to either identify or confirm in-pit mineralization. These holes yielded gold intercepts exceeding 0.42 grams per tonne (g/t) of gold, surpassing the cut-off grade set in the current resource estimate for the pit-constrained area. Notably, 17 of these holes revealed gold intercepts with a combined grade and thickness exceeding 10.0 g/t Au. Additionally, five exploration holes drilled south of the conceptual pit encountered parallel structures, with two of these holes showing lower-grade gold values.

The identified gold mineralization is predominantly linked to deformation zones crossing the deposit. These zones are characterized by an orientation ranging from 280° to 300° and a dip of 75° to 80° to the north. The gold presence is defined by a network of veins and veinlets composed of quartz, carbonate, albite, and occasionally tourmaline, along with disseminated pyrite in the surrounding altered rocks.

Since 2016, Probe Gold has been actively expanding its land holdings in the Val-d’Or East area of Quebec, which is known for its mining potential. The company now boasts a district-scale land package spanning 600 square kilometres, making it one of the largest landholders in the Val-d’Or mining camp. The Novador project, a subset of these holdings, covers 175 square kilometres and includes three previously operational mines: the Beliveau Mine, Bussière Mine, and Monique Mine. This project aligns with three regional mining trends.

The Val-d’Or area, recognized for its political stability and cost-effective mining operations, hosts several active mining companies and processing facilities. Across its properties in this region, Probe Gold reports gold resources totalling approximately 3.79 million ounces in the Measured and Indicated categories, and an additional 1.42 million ounces in the Inferred category, encompassing all trends and deposits within the area.

Highlights from the results are as follows:

- Multiple high-grade gold intercepts found within and around the Monique conceptual pit.

- Infill drilling continues to intersect thick gold zones inside the conceptual pit, yielding up to 6.4 g/t Au over 18.3 metres (11.8 g/t Au over 18.3 metres uncut, including 223 g/t Au over 0.8 metre); 3.3 g/t Au over 27.9 metres; and 1.9 g/t Au over 47.9 metres.

- Exploration and expansion drilling around and inside the Monique conceptual pit intersected new significant mineralization grading up to 16.6 g/t Au over 2.0 metres; 1.6 g/t Au over 19.5 metres; and 2.7 g/t Au over 11.8 metres.

- Over 70,000 metres of drilling have been completed at Novador in 2023. Drilling for this year is finished at Monique, and two drills are now active at Courvan.

- Planning a 30,000 metres expansion drill program for Q1 2024 at Novador.

| Hole Number | From (m) | To (m) | Length (m) | Gold (g/t) | Zone |

| MO-23-626 | 144.0 | 159.2 | 15.2 | 0.8 | New/Expan |

| MO-23-626 | 211.5 | 212.3 | 0.8 | 44.8 | New/Expan |

| MO-23-626 (cut) | 373.0 | 391.3 | 18.3 | 6.4 | B/Infill |

| MO-23-626 (uncut) | 373.0 | 391.3 | 18.3 | 11.8 | B/Infill |

| Including | 375.5 | 376.3 | 0.8 | 223.0 | B/Infill |

| MO-23-626 | 537.0 | 539.0 | 2.0 | 16.6 | M/Expan |

| MO-23-627 | 347.0 | 353.0 | 6.0 | 4.9 | B/Infill |

| MO-23-628 | 159.0 | 192.0 | 33.0 | 1.3 | B/Infill |

| MO-23-628 | 353.0 | 368.9 | 15.9 | 2.0 | M/Expan |

| Including | 360.0 | 361.0 | 1.0 | 23.4 | M/Expan |

| MO-23-629 | 70.0 | 102.0 | 32.0 | 0.7 | New/Expan |

| MO-23-630 | 152.0 | 154.0 | 2.0 | 9.8 | A/Infill |

| MO-23-630 | 223.0 | 270.9 | 47.9 | 1.9 | B/Infill |

| MO-23-631 | 136.0 | 153.0 | 17.0 | 0.6 | New/Expan |

| MO-23-632 | 250.8 | 255.4 | 4.6 | 2.5 | A/Infill |

| MO-23-632 | 263.0 | 273.8 | 10.8 | 1.6 | B/Infill |

| MO-23-632 | 308.2 | 324.1 | 15.9 | 2.0 | I/Infill |

| MO-23-632 | 447.0 | 457.5 | 10.5 | 2.0 | M/Expan |

| MO-23-633 | 143.0 | 154.0 | 11.0 | 1.2 | New/Expan |

| MO-23-635 | 238.0 | 250.0 | 12.0 | 2.9 | B/Infill |

| MO-23-635 | 348.0 | 349.5 | 1.5 | 9.5 | New/Expan |

| MO-23-635 | 365.0 | 372.0 | 7.0 | 2.4 | M North/Ex |

| MO-23-635 | 393.1 | 421.0 | 27.9 | 3.3 | M/Infill |

| Including | 401.1 | 407.1 | 6.0 | 6.2 | M/Infill |

| MO-23-637 | 122.0 | 141.5 | 19.5 | 1.6 | New/Expan |

| MO-23-639 | 59.0 | 60.5 | 1.5 | 18.9 | New/Expan |

| MO-23-645 | 239.5 | 252.0 | 12.5 | 4.7 | A/Infill |

| Including | 240.5 | 241.5 | 1.0 | 51.1 | A/Infill |

| MO-23-645 | 371.0 | 388.0 | 17.0 | 4.8 | I/Infill |

| Including | 382.1 | 383.1 | 1.0 | 49.3 | I/Infill |

| Including | 386.1 | 387.0 | 0.9 | 25.7 | I/Infill |

| MO-23-645 | 484.0 | 491.7 | 7.7 | 1.9 | M/Expan |

| Including | 484.9 | 485.8 | 0.9 | 11.9 | M/Expan |

| MO-23-646 | 242.0 | 243.0 | 1.0 | 32.7 | New/Expan |

| MO-23-646 | 326.0 | 327.5 | 1.5 | 8.8 | A/Infill |

| MO-23-647 | 25.5 | 27.0 | 1.5 | 6.2 | A/Expan |

| MO-23-647 | 397.4 | 415.8 | 18.4 | 3.4 | B//Infill |

| including | 414.8 | 415.8 | 1.0 | 49.7 | B/Infill |

| MO-23-647 | 467.0 | 470.5 | 3.5 | 3.3 | I/Expan |

| MO-23-647 | 547.5 | 564.0 | 16.5 | 1.8 | M/Expan |

| including | 561.0 | 564.0 | 3.0 | 6.4 | M/Expan |

| MO-23-648 | 83.0 | 103.0 | 20.0 | 1.5 | J/Expan |

| MO-23-649 | 319.0 | 338.5 | 19.5 | 1.6 | B/Infill |

| including | 324.0 | 325.0 | 1.0 | 23.6 | B/Infill |

| MO-23-650 | 249.9 | 257.0 | 7.1 | 1.6 | A/Expan |

| MO-23-650 | 618.3 | 626.3 | 8.0 | 3.2 | B/Expan |

| MO-23-650 | 724.8 | 736.6 | 11.8 | 2.7 | M/Expan |

| including | 726.8 | 728.8 | 2.0 | 8.8 | M/Expan |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.