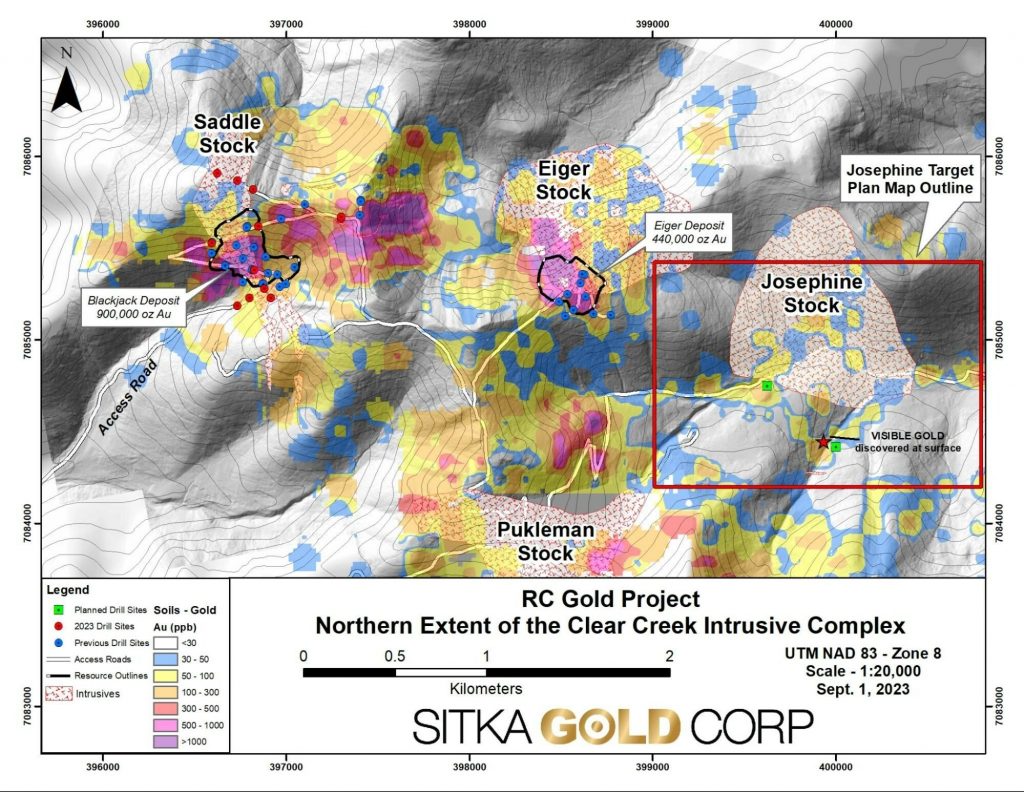

Sitka Gold (CSE:SIG) has commenced the maiden diamond drill testing of the Josephine intrusion, situated in the northern section of the Clear Creek Intrusive Complex (CCIC) on its RC Gold Project in Yukon’s Tombstone Gold Belt, roughly 100 kilometres east of Dawson City. This road-accessible project, spanning 376 square kilometres, is currently experiencing a diamond drilling exercise of up to 10,000 metres. Earlier this year, the project was noted to have an Initial Mineral Resource Estimate of approximately 1,340,000 ounces of gold with a grade of 0.68 g/t, beginning at the surface.

Cor Coe, Director and CEO of Sitka Gold, commented in a press release: “We are excited to be conducting the first ever diamond drilling of the Josephine intrusion, one of the six intrusions located in the Clear Creek Intrusive Complex (See Figure 1). The discovery of visible gold this summer in the altered rocks adjacent to the intrusion during geological mapping and subsequent prospecting, which identified gold-bearing sheeted veins both within the intrusion and in the adjacent altered rocks, highlights the potential of the Josephine intrusion. The intrusion is not well exposed at surface so we look forward to getting an initial look using the drill bit at the potential of the Josephine to be the third intrusion on the project to host a gold deposit.

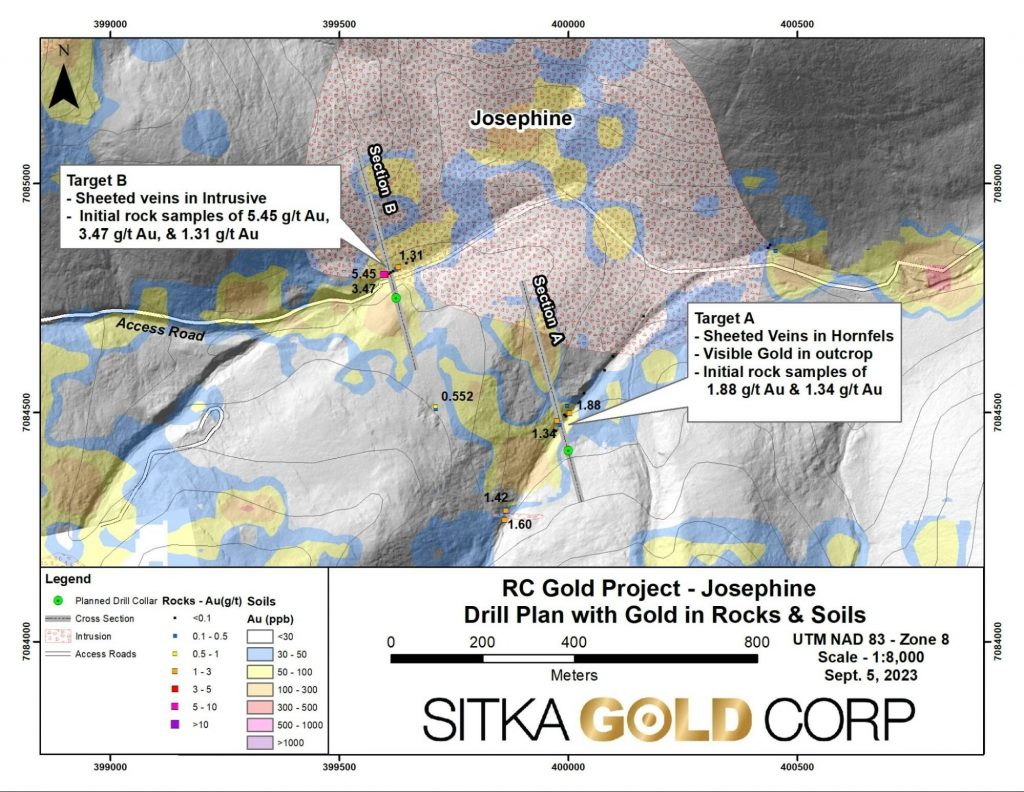

From the Josephine target, results for 30 out of 86 surface rock samples have been collected. The gold values in these samples varied between 0.003 g/t and 5.45 g/t. Notably, seven samples showed results surpassing 1.0 g/t Au, while thirteen samples displayed values exceeding 0.10 g/t Au.

The company has outlined plans for two drill holes to examine two targets, located roughly 500 metres apart, on the southern boundary of the Josephine intrusion. To facilitate the drilling tests for these specific targets, a second diamond drill rig has been dispatched to the RC Gold Project.

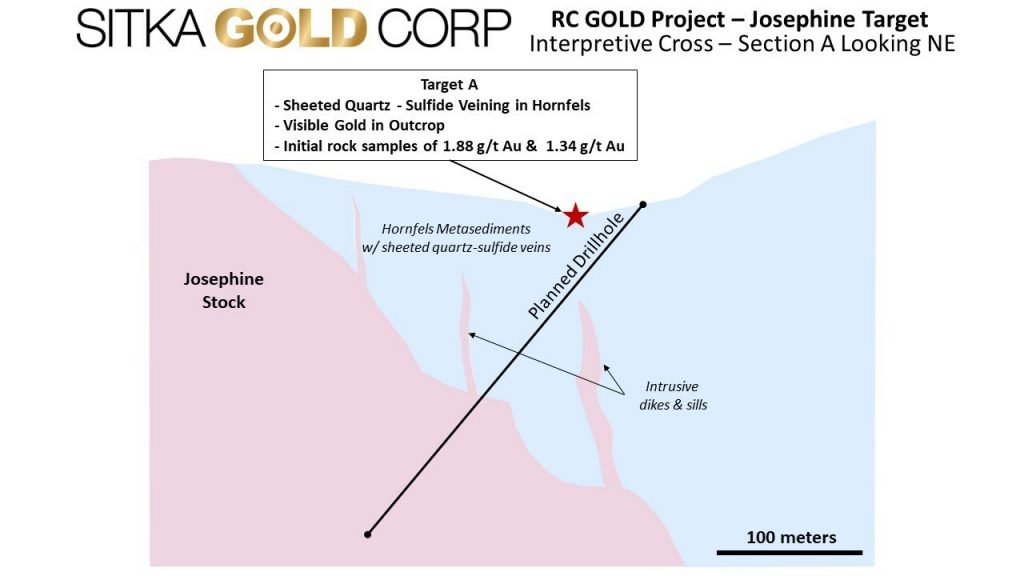

The first of these, dubbed Target A, is the site where geological surveys and prospecting previously identified visible gold at the surface. The prospected area revealed altered and mineralized metasedimentary rocks stretching about 500 metres south of the intrusion. This initial drill aims to evaluate the most profoundly altered rocks spanning an area of around 220 metres. These rocks are marked by abundant veining that contains arsenopyrite-pyrite and occasionally bismuthinite mineralization. The drill is also expected to encounter the obscured intrusive contact deeper down.

Meanwhile, Target B is positioned roughly 500 metres northwest of Target A. Here, an exposure of the Josephine intrusion was found alongside altered metasedimentary rocks in a creek base. Both these rocks and the intrusion itself were richly mineralized with veins comprised of arsenopyrite-pyrite, with occasional bismuthinite content. This preliminary drill is set to assess the Josephine intrusion at its southern contact.

To date, within its 2023 diamond drill venture at RC Gold, Sitka Gold has wrapped up 14 drill holes, amounting to nearly 6,000 metres. Reports for the other 9 drill holes, completed so far, are anticipated to be made public once received and organized.

Highlights from surface exploration:

- Target A

- Sheeted veins in altered metasedimentary rocks adjacent to intrusion returned values of 1.88 and 1.34 g/t gold

- Visible gold in outcrop

- Target B

- Sheeted veins in intrusive returned values of 5.45, 3.47 and 1.31 g/t gold

Table 2: RC Gold Inferred Mineral Resource Estimate

|

COG g/t Au |

Blackjack Zone |

Eiger Zone |

Combined |

||||||||

|

Tonnes |

Au g/t |

0z Au |

Tonnes |

Au g/t |

0z Au |

Tonnes |

Au g/t |

0z Au |

|||

|

0.20 |

35,798 |

0.80 |

921 |

32,523 |

0.45 |

471 |

68,321 |

0.63 |

1,391 |

||

|

0.25 |

33,743 |

0.83 |

900 |

27,362 |

0.50 |

440 |

61,105 |

0.68 |

1,340 |

||

|

0.30 |

31,282 |

0.88 |

885 |

22,253 |

0.55 |

393 |

53,535 |

0.74 |

1,279 |

||

|

0.35 |

29,065 |

0.92 |

860 |

17,817 |

0.60 |

344 |

46,882 |

0.80 |

1,203 |

||

|

0.40 |

26,975 |

0.96 |

833 |

14,506 |

0.66 |

308 |

41,481 |

0.86 |

1,140 |

||

|

Notes |

|

|

1. |

Mineral resource estimate prepared by Ronald G. Simpson of GeoSim Services Inc. with an effective date of January 19, 2023. Mineral Resources are classified using the 2014 CIM Definition Standards. |

|

2. |

The cut-off grade of 0.25 g/t Au is believed to provide a reasonable margin over operating and sustaining costs for open-pit mining and processing |

|

3. |

Mineral resources are constrained by an optimised pit shell using the following assumptions: US$1800/oz Au price; a 45° pit slope; assumed metallurgical recovery of 85%; mining costs of US$2.00 per tonne; processing costs of US$8.00 per tonne; G&A of US$1.50/t. |

|

4. |

Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

|

5. |

Totals may not sum due to rounding. |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.