Surge Copper (TSXV:SURG) has finalized a Purchase Agreement with Thompson Creek Metals Company Inc., a subsidiary of Centerra Gold Inc. This agreement grants Surge complete ownership of the Berg Property, in exchange for 21,221,165 of its common shares. As a result of this transaction, TCM will hold about 15% of Surge’s outstanding common shares. This Purchase Agreement supersedes the December 2020 Option Agreement between the two companies, which had previously allowed Surge to acquire a 70% interest in the Berg Property through a C$8 million investment over five years and the issuance of C$5 million in common shares to TCM.

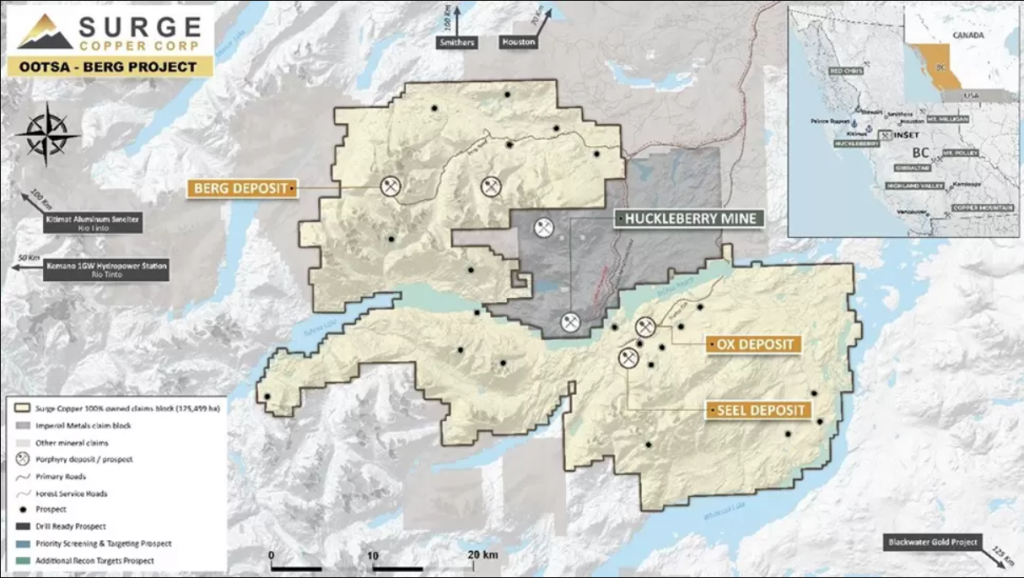

Leif Nilsson, Chief Executive Officer of Surge Copper, commented in a press release: “We are very pleased to be consolidating a 100% interest in the Berg Property, which firmly establishes our ownership position in the broader Berg-Huckleberry-Ootsa district, results in a more simplified ownership structure for all parties, and provides Surge with significantly more flexibility in future financing choices to advance its assets. Surge now holds a simple 100% ownership interest in a contiguous 125,499-hectare land package that hosts the Berg Project, for which we released a maiden NI 43-101 compliant PEA in June 2023, the Ootsa Project, for which we released an updated NI 43-101 mineral resource estimate in June 2022, and an extensive pipeline of exploration targets prospective for porphyry copper and associated breccia and hydrothermal vein style base metal and precious metal deposits. Looking forward, our goal is to continue to advance and de-risk this large, emerging critical minerals district and systematically explore the high-potential regional targets. We value our partnership with Centerra and look forward to welcoming them as a significant shareholder in Surge going forward.”

The Berg Property, encompassing 34,798 hectares, is adjacent to Surge’s existing mineral claims. The property features the Berg deposit, for which Surge publicized a Preliminary Economic Assessment (PEA) and a Mineral Resource Estimate (MRE) in June 2023. The PEA described a large-scale, stand-alone greenfield development project with a straightforward design and high outputs of critical minerals in a region with excellent infrastructure. Key findings from the PEA include a base case after-tax Net Present Value (NPV) of C$2.1 billion and an Internal Rate of Return (IRR) of 20%, predicated on long-term commodity price assumptions. The mine life is projected to be 30 years, with total payable production estimated at 5.8 billion pounds of copper equivalent. The updated mineral resource estimate includes a significant amount of copper, molybdenum, silver, and gold.

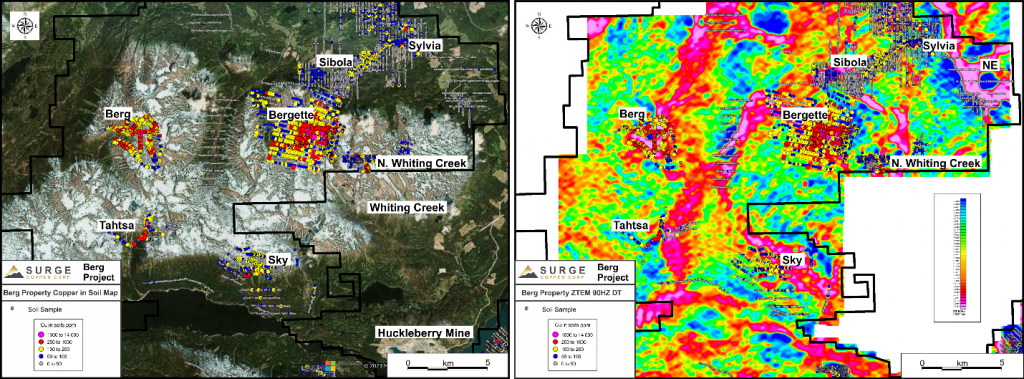

In addition to the Berg deposit, the Berg Property and the adjacent claims held by Surge house several early-stage exploration targets. These include the Bergette, Sibola, Sylvia, Tahtsa, North Whiting Creek, and Sky targets, each showing promising signs of mineralization, including copper, molybdenum, gold, and silver, as indicated by various drilling and surface exploration activities reported in 2022 and 2023. These findings were supported by regional airborne surveys, ground-based IP grids, and other earlier datasets.

The mining claims under the Purchase Agreement are valid until February 2032, with a current 5-year area-based permit extending until March 2027. This acquisition marks a significant expansion of Surge Copper Corp.’s mineral exploration and potential development activities.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.