‘In order to produce half a million cars a year…we would basically need to absorb the entire world’s lithium-ion production.’ – Elon Musk

“The skillsets that young people should learn about mining should apply to everything. We just need to do a better job of explaining to people in urban environments that the human activity of mining is absolutely fundamental to the way this planet is going to evolve. Completely and totally fundamental.” – Robert Friedland, Ivanhoe Capital

The future envisioned by industry leaders hinges heavily on the production of new materials to power and build the future. Leaders such as Elon Musk have been developing the blueprint for the future with electric cars, battery grids and renewable energy solutions. While, other leaders such as Robert Friedland are looking to supply the materials to build this future. Mr. Friedland makes the case and understands the story that is unrolling in real time. Mining is the critical component to meet the world’s demands for a sustainable future. The prerequisite for this future is mining and with every mineral discovery and development project, this future is coming closer.

Mr. Friedland is not the only miner that realizes the economy of tomorrow will require the development of new mining assets. Azincourt Energy Corp. (TSX-V: AAZ) is a Canadian junior exploration company that has been actively building their mining asset portfolio in anticipation of the future demand for minerals that will provide clean energy; from lithium to uranium to cobalt.

Azincourt Energy Chairman, Ian Stalker is an experienced mining executive that sees the writing on the wall when it comes to the materials and fuel that future technology will require. Mr. Stalker is a senior international mining executive with over 45 years of hands-on experience in resource development. Over his career Mr. Stalker has directed over twelve major mining projects, from exploration drilling to start-up, including gold, base metal, uranium and industrial minerals. He is currently CEO of LSC Lithium (TSX.V: LSC), and Chairman of Plateau Uranium (TSX.V: PLU), and is the former CEO of UraMin Inc., the London and Toronto listed public uranium company that was acquired by Areva for US$2.5 billion in August 2007. In a recent press release, Mr. Stalker outlined the current strategy for Azincourt.

“The lithium market is obviously very strong right now, and the near-term future for lithium demand remains extremely positive. Our decision to expand Azincourt’s focus to include lithium and other materials is something we feel strongly about. To get a foothold and exposure in this environment, at this time, is an important and strategic step for us.”

Azincourt recently acquired five lithiums projects in located in the Winnipeg River Pegmatite Field, Manitoba, Canada. Two of the projects, the Lithium One and Two projects, are adjacent to Quantum Minerals Corp.’s Cat Lake lithium project which includes a historical estimate from drilling in 1947 that defined 545,000 tonnes of 1.4 percent lithium oxide (Li2O). Drilling could prove up this ground.

Two other of the acquired lithium projects, the Lithman West and East projects are adjacent to the Tanco Mine lease property. These projects are part of the Winnipeg River pegmatite field which hosts numerous lithium-rich pegmatites or “hard-rock” lithium such as the Tanco pegmatite that has been mined at the Tanco mine since 1969 for spodumene, a major component for hosting lithium (Li), and other rare earth ores.

Azincourt has scheduled exploration work to begin in the spring of 2018, with a field program that includes detailed mapping of the known pegmatite outcroppings on the Lithium One and Lithium Two projects. This will be followed immediately by a comprehensive chip sampling program designed to generate targets for the drill programs anticipated at both properties during the summer of 2018.

Previous work in 2016 produced twelve samples between a range of 0.02 per cent to 3.04 per cent Li2O from the Eagle pegmatite, and up to 2.08 per cent Li2O. Select sampling will concentrate on the Eagle and FD5 pegmatites at Lithium Two, and on the Silverleaf pegmatite at Lithium One, which returned values as high as 4.33 per cent Li2O in the 2016 exploration program (see press release dated Feb. 1, 2018).

On Feb. 8, 2017, the company signed a non-binding letter of intent to acquire the BullRun erythrite project, a prospective cobalt property located six kilometres northwest of the town of Cobalt, Ont. (see press release date Feb. 8, 2018). Alex. Klenman, President and CEO of Azincourt Energy commented on the company’s strategy with this acquisition.

“We’ve been looking into adding a potential cobalt property as we grow our project portfolio, so we’re pleased to move to LOI on this. We are going to immediately begin a comprehensive due diligence process to gain as much understanding as we can on the potential of the project, and we hope to progress to the definitive stage in due course. In addition, we are actively reviewing other potential projects that will continue to strengthen the company in the growing clean energy space. We haven’t filled our want list yet, so we remain very active on the acquisition front.”

True to the company strategy, Azincourt announced a new project that is adjacent to the western edge of Plateau Uranium’s (TSX-V: PLU) Macusani Project in Peru. This project contains the high-grade Falchani discovery that includes consistent 3,000-3,500 ppm Li over 100m intercepts at depth, and U3O8 grades up to 500 ppm over 50m intercepts at surface. The plateau features areas of uranium-rich surface mineralization as well as lithium mineralization at depth.

Initial leach test results conducted by Plateau Uranium in December showed that 77-80% of contained lithium can be extracted from Falchani. Plateau’s Macusani Project is fast becoming one of the world’s largest undeveloped uranium-lithium districts. Although Macusani started life as a pure uranium story, exploration and metallurgical work has unearthed the lithium resource at depth.

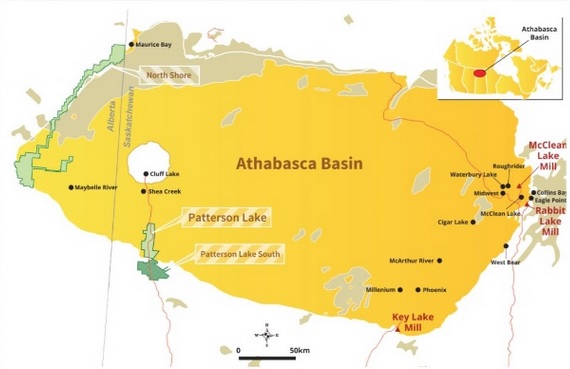

The company has been developing two projects in the Athabasca basin, in Northern Saskatchewan, home to the largest and highest grade deposits in the world, the Preston Project and the Patterson North Lake Property.

The Preston project comprises a large land position (approx. 121,249 hectares) strategically located to the south of NexGen Energy’s (TSX-V: NXE) Rook 1 project hosts the high grade Arrow deposit, as well as proximal to Fission Uranium’s (TSX: FCU) Patterson Lake South project host to the high grade Triple R deposit. The company has 15 drill target areas associated with eight prospective exploration corridors that have been successfully delineated through extensive geophysics.

The second project, The Patterson Lake North property “PLN” lies next to the northern edge of the Patterson Lake South property, owned by Fission Uranium Corp. (TSX-V: FCU) where uranium mineralization has discovered over 2.24 kilometres (east-west strike length) in four separate mineralized “zones.”

To date Azincourt has spent $3 million earning into PLN. Prior to Azincourt’s involvement, Fission spent approximately $4.7 million on exploration on PLN. There are three separate target areas that are drill-ready.

Azincourt Energy Corp. recently completed a private placement for gross proceeds of $1,655,000. In addition, the company has received an additional $1,215,009.48 in gross proceeds from the exercise of warrants over the past several weeks.

“We have more than enough funds to meet existing work requirements on our lithium and uranium projects for the next year or so, and further, the additional funding means we have upward flexibility in how we approach our work programs and portfolio expansion. Simply put, we can put more dollars into the ground, and into acquisitions,” said Mr. Klenman.

With ~69 million shares outstanding, cash in the bank, the company trading at 19 cents, the company has plenty of exploration news on the way, shares in Azincourt present a current opportunity.

While inventions and ideas grab the headlines, little attention is given to the fundamentals of building a clean energy future. Azincourt Energy Corp. (TSX-V: AAZ) has put together an impressive portfolio of mineral projects from lithium, uranium to cobalt; the minerals that will fuel the future. Azincourt Energy is in the early stages and with news on the way, investors should pay attention.

Clicker Here to Visit the Company’s Web Page: http://azincourtenergy.com/

*** The mineral reserve estimate cited above as part of the Lithium Two project is presented as a historical estimate which does not conform to current National Instrument 43-101 standards. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Although the historical estimates are believed to be based on reasonable assumptions, they were calculated prior to the implementation of National Instrument 43-101 standards. These historical estimates therefore do not meet current standards as defined under sections 1.2 and 1.3 of NI 43-101; consequently, the issuer is not treating the historical estimate as current mineral resources or mineral reserves.

***MiningFeeds.com was compensated for the creation and publication of this article. This does not constitute investment advice.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan