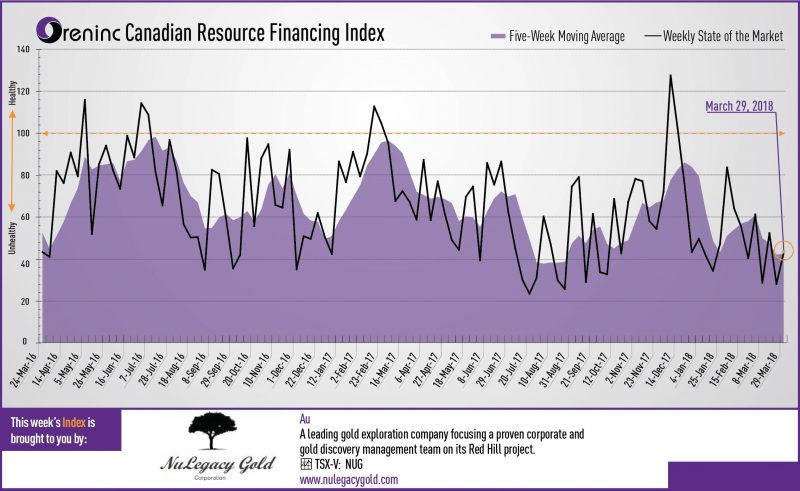

Last week index score: 28.01 (updated)

This week: 42.63

Zinc One Resources (TSXV:Z) received the first results from drilling at its Bongará zinc mine project in north-central Peru.

NuLegacy Gold (TSXV: NUG) said late winter storms deposited as much as three feet of snow on parts of its Red Hill property in the Cortez gold trend of Nevada, USA.

Prospero Silver (TSXV: PSL) announced the results of the third hole of a three-hole drill program at the Pachuca SE project in Hidalgo, Mexico.

Avrupa Minerals (TSXV: AVU) closed a private placement and raised C$550,000.

The Oreninc Index increased in the week ending March 30th, 2018 to 42.63 from an updated 28.01 a week ago as brokered and bought deal financings returned, even though it was a short week due to the Easter break.

Another swinging volatile week for gold as its recent fear trade boost subsided as US president Donald Trump deflated some of his trade tariff rhetoric. However, market analysts increasingly expect a gold breakout to occur, with the latest portent being that the gold/silver price ratio has gone past 80:1. This is the fifth time in the past 23 years that this has happened and on each previous occasion gold and silver equities exploded to the upside starting between 30-60 days later.

On to the money: total fund raises announced tripled to C$96.1 million, a four-week high, which included three brokered financings for C$13.3m, a two-week high, and two bought-deal financings for C$3.0 million, also a two-week high. The average offer size almost tripled to C$3.7 million, a four-week high.

Another range-bound volatile week for gold during which the yellow metal closed down at US$1,325/oz from US$1,347/oz a week ago despite hitting a mid-week high of US$1,353/oz. Gold is now up 1.74% this year. Meanwhile, the US dollar index closed up at 89.97 from 89.44 a week ago. The van Eck managed GDXJ also closed down at US$32.15 from US$32.78 last week. The index is down 5.80% so far in 2018. The US Global Go Gold ETF manged to hold its ground, dipping slightly to close down at US$12.71 from US$12.74 a week ago. It is down 2.31% so far in 2018. The HUI Arca Gold BUGS Index closed down at 175.41 from 176.86 last week. The SPDR GLD ETF saw some selling to close down at 846.12 tonnes from 850.54 tonnes a week ago.

In other commodities, the silver closed down at US$16.36/oz from US$16.56/oz a week ago. Copper recovered from its recent fall below the US$3.00/lb level to close up at US$3.02/lb from US$2.99/lb last week. Oil put in a losing week and closed down at US$64.94 a barrel from US$65.88 a barrel a week ago.

The Dow Jones Industrial Average showed signs of recovering from the trade-war potential resulting from Trump’s China tariffs announcement, to close up at 24,103 from 23,533 last week. Likewise, Canada’s S&P/TSX Composite Index got on the road to recovery to close up at 15,367 from 15,223 the previous week. The S&P/TSX Venture Composite Index closed down at 796.67 from 817.80 last week.

Summary:

- Number of financings grew to 26, a two-week high.

- Three brokered financings were announced this week for C$13.3m, a two-week high.

- Two bought-deal financings were announced this week for C$3.0, a two-week high.

- Total dollars jumped up to C$96.1m, a four-week high.

- Average offer size also grew to C$3.7m, a four-week high.

Financing Highlights

Asanko Gold (TSX: AKG) opened a US$17.6 million (C$22.79 million) offering on a strategic deal basis with Gold Fields, which will purchase 22.4 million shares @ US$0.79, a 9.9% interest.

- Asanko also entered into a JV with Gold Fields under which it will receive US$185 million for a 50% interest in its Asanko gold mine.

- Asanko will use the proceeds to repay US$164 million of debt with Red Kite.

Serabi Gold (TSX: SBI) announced a US$15 million strategic private placement with Greenstone Resources.

- 297.8 million @ 0.5 pence, a 29.82% interest.

- Funds will be used to undertake drilling to delineate additional resources and expand the life of mine at the Palito and Sao Chico projects, and advance the recently acquired Coringa project, all in Brazil.

- Serabi also opened a private placement for a minimum of US$8.0 million @ 3.6 pence undertaken by Peel Hunt.

Major Financing Openings:

- Asanko Gold (TSX:AKG) opened a C$22.79 million offering on a strategic deal basis.

- Serabi Gold (TSX:SBI) opened a C$18.46 million offering on a strategic deal basis.

- North American Nickel (TSXV:NAN) opened a C$15 million offering on a best efforts basis. Each unit includes half a warrant that expires in two years.

- Serabi Gold (TSX:SBI) opened a C$10.32 million offering underwritten by a syndicate led by Peel Hunt on a best efforts basis.

Major Financing Closings:

- Serabi Gold (TSX:SBI) closed a C$11.53 million offering underwritten by a syndicate led by Peel Hunt on a best efforts basis.

- Auryn Resources (TSXV:AUG) closed a C$10.08 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis.

- Skeena Resources (TSXV:SKE) closed a C$8.46 million offering underwritten by a syndicate led by PI Financial on a best efforts basis. Each unit included half a warrant that expires in two years.

- Chakana Copper (TSXV:PERU) closed an C$8 million offering underwritten by a syndicate led by Eventus Capital on a best efforts basis.

Company News

Zinc One Resources (TSXV: Z) received the first results from drilling at its Bongará zinc mine project in north-central Peru. Drilling commenced at the Mina Grande Sur and Bongarita zones where two portable drill rigs are currently operating. At Mina Grande Sur, 543m were completed in 33 holes with highlights including 5.5m @ 26.1% Zn in hole MGS18001. At Bongarita, 587m were completed in 36 holes with highlights including 11.5m @ 16.0% Zn in hole BO18005.

Analysis

The initial results are very optimistic and demonstrate the potential of the project by confirming its high-grade nature, particularly given that many intercepts start at or near surface. The results will contribute to the upcoming resource estimate and PEA planned for 2018.

NuLegacy Gold (TSXV: NUG) said late winter storms deposited as much as three feet of snow on parts of its Red Hill property in the Cortez gold trend of Nevada, USA making access to selected drill target areas difficult and dangerous. As a consequence, the company had to release a reverse circulation drill rig it contracted to begin drilling in late March and replaced it with a drill scheduled to arrive late April. Drilling will initially focus on following up on the 2017 success in the Serena and Avocado zones in areas with broad intervals of intense alteration, silicification and decalcification seen in several of the drill holes in this large exploration area.

Analysis

Freak weather can happen, but this event should only delay the company by a month.

Prospero Silver (TSXV: PSL) announced the results of the third hole of a three-hole drill program at the Pachuca SE project in Hidalgo, Mexico. Drilling confirmed the presence of highly anomalous silver values hosted by blind epithermal veining in three widely separated zones hosted by 7km of structures on the property. Hole 3 cut multiple zones of anomalous silver including 1.5m @ 121.3g/t Ag & 0.37g/t Au.

Analysis

Drilling of the Pachuca targets continues drilling the third of three initial projects funded by Fortuna Silver (TSX: FVI) in early stage proof of concept programs. The program successfully demonstrated that Pachua SE hosts blind epithermal veins with silver and gold mineralization. The next step will be to agree additional drilling to define the extent of mineralization in the veins.

Avrupa Minerals (TSXV: AVU) closed a private placement and raised C$550,000 and issued 6.9 million units @ C$0.08. Each unit consists of one share and one warrant exercisable @ C$0.12 for two years. The funds will be used for exploration mainly in Portugal and Kosovo.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan