B2Gold (TSX:BTO), a Canadian gold producer, has finalized a deal to obtain full ownership of the Gramalote gold project in Colombia. This acquisition involves purchasing the 50% stake of the project previously held by AngloGold Ashanti (NYSE:AU) with the transaction priced at $60 million.

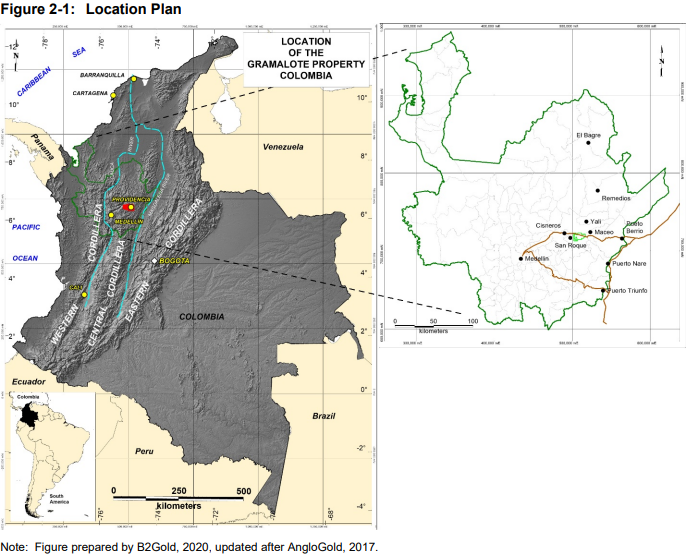

The Gramalote gold project, located 124km to the northeast of Medellin, underwent a pause in development during August of the previous year. This decision was due to preliminary outcomes from an optimized feasibility study, indicating that the project wasn’t meeting the joint venture’s criteria for mine development. Following this, the partnered companies debated over the project’s future. They eventually settled on selling Gramalote as the most suitable choice for both. However, they were unable to locate a third-party buyer.

B2Gold has clarified its intentions post-acquisition, emphasizing the advantages of bringing Gramalote under a singular ownership. This move is expected to pave the way for examining more affordable and higher-yielding developmental opportunities. The company highlighted that until now, the approach towards Gramalote was viewing it as a large-scale project with the potential to significantly increase production for both partnering entities. With this consolidation, B2Gold, headquartered in Vancouver, is set to delve into exploring diverse, smaller-scale developmental options in pursuit of cost-efficiency. Furthermore, a fresh study is on the horizon, scheduled to commence in the year’s last quarter, aiming for a preliminary assessment by mid-2024.

In terms of resource augmentation, B2Gold’s possession of Gramalote will incorporate an additional 2.11 million gold ounces of indicated mineral resources and 0.74 million gold ounces of inferred mineral resources.

AngloGold Ashanti, on the other hand, perceives this sale as an opportunity to sharpen its concentration on operational assets and potential projects ripe for development. The company shared these sentiments in a distinct announcement. Alberto Calderon, the Chief Executive Officer, expressed the company’s enduring dedication to Colombia, especially in light of their promising Quebradona copper and gold project. He stated, “AngloGold Ashanti remains a committed, long-term investor in Colombia with our exciting Quebradona copper and gold project and we look forward to playing a key role in developing of a modern, responsible mining sector in the country.”

The payment structure for the transaction has been broken down, with B2Gold scheduled to remit $20 million upon finalizing the deal. The remaining amount will be disbursed in segments, contingent on the attainment of specified milestones. An intriguing clause specifies that if the commercial production doesn’t kick off within half a decade post-transaction, B2Gold will owe nothing.

Gramalote holds a special place for B2Gold as its inaugural project during its exploration company phase. It made headlines in 2015 when it secured the first environmental permit in Colombia after a long hiatus of 35 years. This authorization presented a three-year window to address socio-environmental concerns, notably the relocation of artisanal miners and certain locals. Gramalote has also been dealing with a mining rights conflict with Canada’s Zonte Metals, which is still ongoing.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Vancouver-based B2Gold Corp. (TSX:BTO) is stepping into Canadian mining market with its first project in the country, investing nearly C$2 billion in a mine in southwestern Nunavut.

Prior to this, B2Gold’s mining operations were entirely international, with active sites in Mali, Namibia, and the Philippines. This year, however, marked a strategic shift for the company. In April, B2Gold acquired Sabina Gold and Silver Corp. along with its Back River Gold District in Nunavut for a reported C$1.2 billion.

The Back River Gold District spans an 80-kilometre belt featuring six gold properties. Among these, the Goose property is currently under development. B2Gold has announced plans for the Goose deposit, aiming to manage it as a combined open pit and underground operation. The property is recognized as one of the highest-grade undeveloped gold properties globally, as per a B2Gold investor presentation.

The company’s latest construction update revealed a budget of C$890 million for the new mine. Over the winter, B2Gold transported the necessary construction equipment to the site via an ice road. The company is also building a mill, expected to be operational by the first quarter of 2025.

B2Gold had initially projected a capital expenditure of C$800 million for the project, but recently decided to invest an additional C$90 million. This increased funding aims to hasten underground mining operations to boost the mine’s annual gold production during its first five years. The company anticipates an average annual production of around 300,000 ounces per year.

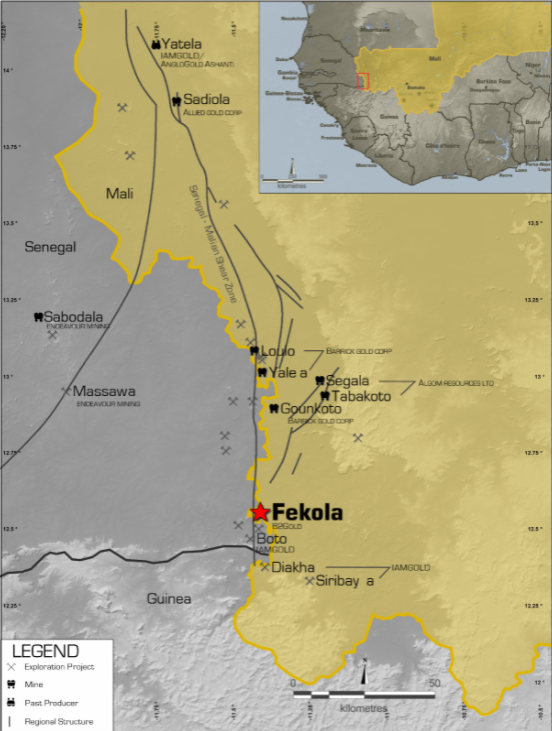

As of 2020, B2Gold operates three mines: the Fekola mine in Mali, the Masbate mine in the Philippines, and the Otjikoto mine in Namibia. The Fekola mine is the company’s largest, producing over 400,000 ounces of gold each year. The Masbate mine, an open-pit mine, produces upwards of 200,000 ounces of gold annually, while the Otjikoto mine, a combined open pit and underground mine, produces between 150,000 and 200,000 ounces of gold annually.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

AngloGold Ashanti (NYSE:AU) and B2Gold (TSX:BTO) have put the $925 million Gramalote Colombian gold project on track to go up for sale by the end of the year. The companies reviewed alternatives for the project located in the northeastern department of Antioquia, but decided that it is in all stakeholders’ best interest to sell the project. This was noted in a third-quarter results report from B2Gold.

In August, the project was put on hold due to preliminary results from an optimized feasibility study suggesting that the project didn’t meet the joint venture’s investment thresholds. This meant the project could not be advanced to mine development. With the study completed, divesting became the best option for both companies.

Feasibility studies aim to evaluate the economic viability of a project and suggest a path to mine development. However, without a successful study, projects lose their value over time and may end up costing more than projected to develop.

For AngloGold Ashanti, selling the company is also a preferred option. The sale could allow AngloGold to focus on bigger assets, primarily the Guebradona gold-copper project in Colombia, valued at $1.4 billion. After a refusal from the environmental regulator ANLA to reopen the application for an environmental license for the project due to lack of information, the company will resubmit in 2023.

The mine could also become the country’s largest copper development with an estimated production of 137 million pounds copper concentrate per year with a phase one mine life of 22 years. The company has shifted focus to from its home country to other mines in Australia, Ghana, and Latin America in recent years. This strategy comes as the industry in South Africa has continued to shrink with soaring costs, power cuts, and geological challenges creating too many headwinds for many miners to make projects economically feasible.

Copper exploration has come to the forefront as a priority for the industry as a green technology and energy transition continues to speed up. Copper is used for a wide range of applications from wiring and construction to automobiles, renewable energy, and new medical technologies.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

B2Gold’s (NYSE:BTG) strong 2021 production numbers are overshadowed by its underperforming Gold Miners Index (GDX) by nearly 20%.

The drop was partly due to a record comparative earnings year in 2020 as well as perceived risk in Mali. If recent sanctions do not impact mining operations, B2Gold’s price could start to better reflect its solid fundamentals.

Low cost producer with strong cash position

Annual production for FY2021 was 1.04M oz. with all-in sustaining costs (AISC) between $870 and $910. AISC for FY2022 are projected to be $1,010-$1,050 due to inflationary pressures. Even so, B2G is poised to remain among the lowest cost producers in the industry.

2021 cash flow from operations is estimated at $650M. The strong cash position with virtually no debt gives the company options for exploration and M&A. $29M has been allocated to grassroots exploration for 2022, highlighting their ambition to continue to grow by drilling.

In the words of chief executive Clive Johnson, “we’ve always been very entrepreneurial, yet we’re very good at the bricks and mortar of our business…. We’ll do deals that other companies may not do.”

Perceived Mali risks but no impact on production

Over half of B2Gold’s production comes from the Fekola Mine in Mali, where regulatory and geopolitical events have been an ongoing theme.

There was a military coup in May which, while not impacting operations, created some negative investor sentiment regarding one of Africa’s biggest gold producers. The government’s revocation of an exploration permit for B2Gold’s Menankoto property also caused negative market reaction. Although a permitting agreement was reached in December, recent sanctions on the country imposed by the Economic Community of West African States (ECOWAS) raise the possibility of supply disruptions.

Nonetheless, Fekola exceeded 2021 production estimates with 567,795 oz. and CEO Clive Johnson maintains that it will withstand supply disruptions and meet 2022 targets.

Image source: b2gold.com

Underexplored jurisdictions

Part of B2Gold’s strategy is to operate and develop in jurisdictions which, while relatively underexplored, are often perceived as higher risk compared to, for instance, Canada, Nevada, or Australia. As Clive Johnson states, “a core part of our strategy is to go where others fear to tread.”

Aside from core operations in Mali, The Philippines, and Namibia, the company has exploration projects in Uzbekistan and Finland as well as a JV development in Colombia. In July 2021, they signed exploration contracts in Egypt.

In the face of perceived geopolitical risks, Johnson highlights the solid economic foundation gold miners brought to countries during COVID and anticipates B2Gold’s experience and reputation will set it apart.

Valuation fundamentals

B2Gold offers one of the highest dividends in the industry (4.38%). It is trading at 8.67 times earnings and has healthy current and quick ratios of 4.89 and 2.90, respectively. Price to forward earnings and price to cash flow are both below industry averages.

If perceived Mali risks begin to ease and gold continues to show a strong hand in volatile markets, B2Gold’s value could start to be better reflected in the price.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is an insider or shareholder of one or more of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan