Mining companies often have their hands full with multiple projects spanning locations in different regions, countries, and sometimes continents. This can create complications for operations, but if the company has the right management and operational experience, having a variety of projects on the go at the same time can be a serious benefit.

Typically driven by low commodity prices, large mining companies are beginning to shift away from project diversification to focus on their best projects to increase competitiveness. By doing this, many companies believe that it will allow them to compete more effectively in specific sectors and make the most of what they have. While this can be effective for some, having a range of projects complementing each other, while maintaining focus on one or two flagship projects has proven to be a successful format for others.

Having a portfolio of projects is also necessary so that holdings are sufficiently diversified and exploration does not have to stop when one project is not moving forward. While it is good to have many projects, focus is also necessary for the proper and effective execution of any mining strategy. For a company like Solaris Resources operating in the Americas, a diversification strategy has been beneficial for their exploration and production efforts, but they have been able to balance this with a particular focus on one mine.

Flagship Status

The Warintza Mine in Ecuador discovered by David Lowell has been the flagship project for Solaris since its inception, and exploration and development has been focused on there for some time now. With the news of the added drill holes and capacity coming, the company is preparing to double down on that success while bringing out the best in the work being done there with ESG principles and particular zero-carbon project planning.

Getting Everyone Involved

The emphasis on consultation, local employment, educational practices, and ESG principles has made Warintza not just the flagship of the Solaris portfolio, but an example in the industry of how things can be done the right way while ensuring stakeholder success at every level. Prior to beginning work on the site, thorough consultation was done with the Shuar Nations of Warints and Yawi, to establish trust and transparency from the outset. In any long-term effort, starting off on the right foot is essential. This consultation process ensured that the project would get off to a good start while maintaining open communication with the local community. Transparency was also ensured by acquiring full permitting, and no Administrative Silence was allowed.

Considering the diversity and robust mining infrastructure, Ecuador is perfectly placed to complement the company’s work and extensive employment opportunities have been extended in the local and surrounding communities. The project is bringing jobs to the area while making everyone feel good about the work they are doing. The result is a community that understands the impacts and benefits of the project, was involved with the planning, and is able to directly benefit from its success. This win-win approach is not just good messaging, but part of the operational ethos of the company for the project, and has helped the company deliver transparency, education, and inclusion from the start.

History

The mine itself was discovered by David Lowell in 2000 but was largely dormant since 2001. At the time, Ecuador was a frontier jurisdiction with no commercial mining industry. Things began to change in 2014 when the government shifted its policy in the wake of the collapse of the oil sector to encourage mineral development. The change was fuelled by Lundin Gold acquiring the Fruta del Norte project, 45 km south of Warintza, and developing it in a socially and environmentally responsible manner. This improved sentiment toward mining development and created conditions for Solaris to successfully restart a dialogue with the communities surrounding its Warintza Project in 2018. After extensive dialogue with local and surrounding communities, the root causes of conflict were resolved, and by mid-2019, an innovative CSR program was instituted. By the time 2020 rolled around, the company had signed an Impact and Benefits Agreement with community stakeholders after a government-sponsored prior consultation process, and Solaris Resources was able to restart exploration on the project in earnest.

Looking Back

When tracking the company’s progress, it might be helpful to do so by following the trajectory of the stock over the past 8 months. After listing as a spin-out of Equinox Gold, Solaris’ mission began to explore and develop the Warintza Project in Ecuador. Once results started to come in, a pattern began to emerge:

- July 18, 2020: Solaris lists at $1.50.

- August 10, 2020: SLS-01 returned 567m @ 1.0% Cu-Eq effectively extending mineralization to depth below historical drilling, averaging 200m and improved upon the estimated resource grade of 0.56% Cu. Price: $2.43.

- September 28, 2020: SLS-02 returned 660m @ 0.97% Cu-Eq which confirmed further extension of higher-grade mineralization relative to historical drilling. SLS-03 returned 1,010m @ 0.71% Cu-Eq and collared 426m east of the first two holes, and further improved upon depth-extent of known mineralization. Price: $4.30.

- November 23, 2020: Three drill assays (including the first campaign at Warintza West) included SLS-04 returning 1,004m @ 0.71% Cu-Eq, SLS-05 returning 918m @ 0.5% Cu-Eq, SLS-06 returning 884m of 0.50% Cu , further extended mineralization relative to historical depth. Price: $5.72.

- January 14, 2021: SLS-07 returned 1,067m @ 0.60% Cu-Eq, bottoming in mineralization beyond the 150m depth of the corresponding historical hole, and SLS08 returned 454m @ 0.62% Cu-Eq both effectively extending mineralization to the north and northeast. Price: $6.59.

- February 16, 2021: SLSW-01, the first hole drilled at Warintza West, returned 798m @ 0.31% CuEq (0.25% Cu, 0.02% Mo, and 0.02g/t Au), extending mineralization to Warintza West. Price: $6.90.

- February 22, 2021: SLS-10 returned 600m @1.00% Cu-Eq, SLS-11 returning 668m @ 0.57% Cu-Eq), SLS-12 returning 736m @ 0.74% Cu-Eq, and SLS-13 returning 462m @ 1.00% Cu-Eq. Price: $7.27.

- March 22, 2021: SLS-14 returned 922m @ 0.94% CuEq, SLS-15 returned 1,002m of 0.60% CuEq from near surface, SLS-16 returned 958m of 0.77% CuEq from near surface, extending mineralization between east & west. Price: $8.70.

Contrary to the common narrative of many miners that list and consistently lose value as their discovery efforts return less than expected or nothing, the company’s story appears to be the exact opposite based on the eight-month period they have been a public company.

Moving Forward

The project has turned out exceptionally well for the company, and last month Solaris made it clear that it wants to expand on the success it has had so far by doubling the rig count and beginning to drill new holes, all while maintaining that commitment to the community and the ESG principles the project was planned with. The company’s press release highlighted some of the recent impressive results from the 20,200 metres that have been drilled so far at the mine:

- Three additional holes at Warintza Central, as detailed below, have returned long intervals of high-grade mineralization, with the highest grades starting from the surface, and extending mineralization between the eastern and western drilling and stepping out to the southwest.

- SLS-14 was collared on the western side of Warintza Central and drilled into an open volume to the east, returning 922m of 0.94% CuEq¹ (0.79% Cu, 0.03% Mo, and 0.08 g/t Au) from the surface, including 850m of 0.98% CuEq¹ (0.82% Cu, 0.03% Mo, and 0.08 g/t Au), significantly extending the limits of mineralization.

- SLS-15 returned 1,002m of 0.60% CuEq¹ (0.52% Cu, 0.01% Mo, and 0.04 g/t Au) from surface, including 694m of 0.67% CuEq¹ (0.57% Cu, 0.02% Mo, and 0.05 g/t Au) within a broader interval of 1,229m of 0.56% CuEq¹ (0.48% Cu, 0.01% Mo, and 0.04 g/t Au), stepping out to the southeast and extending mineralization to depth.

- SLS-16 returned 958m of 0.77% CuEq¹ (0.63% Cu, 0.03% Mo, and 0.06 g/t Au) from near surface, including 486m of 0.84% CuEq¹ (0.70% Cu, 0.03% Mo, and 0.07 g/t Au), extending mineralization between the eastern and western drilling at Warintza Central.

- To date, 20,200 metres have been drilled at Warintza Central in 25 holes of which results have been reported for 16; drilling is ongoing with six rigs currently operating and increasing to 12 by mid-year

Source: Solaris Resources

Each project has built on the success of the last, and as they expand, each step continues to pour more fuel into a tank driving the company from one milestone to the next. Not only do they stand to benefit from the expansion of the project, but from all of the future compounded gains from the Warintza mine. Drilling thus far has generated significant value for the company and stakeholders involved at every level, and with more drilling to come, one has to assume that the compounded results of that work will reflect positively on the company and stock for the foreseeable future and beyond. Lately, the stock has been balancing between $8 and $10, but with this range being tested frequently with changes of 10% or more in a single daily session, it seems investors are ready for a price above $20 or $30 now.

With the recent insider-buying activity from Solaris Chairman Richard Warke and a management team that has invested over $100M in less than a year in both private placements and on the open market, the Solaris story is proving to be a powerful one. The company has seen its share price reflect its significant progress in a very short amount of time, and it seems that the potential for moving forward is also driving much of the vigour from investors.

Potential

The company’s current market cap sits at just below $1 billion, and any breakthrough could mark a psychological shift in how the company is perceived as a result of the value generated by the Warintza project in particular. Solaris has ongoing discovery drilling that is aimed at discovery potential in 2021, meaning big news for the company may lie ahead with any discoveries this year. The Warintza Project has proved that the company’s efforts are being well-spent in the past year and that work has taken the company further than ever before.

Although progress has been made, with the expansion of the project and the focus on expanding at the same time, the company may be looking at future valuations several times greater than current levels only taking into account current rates of return. If the new drill holes and discovery plans continue at this pace or better yet accelerate, the future of the project and the company will be very bright indeed.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

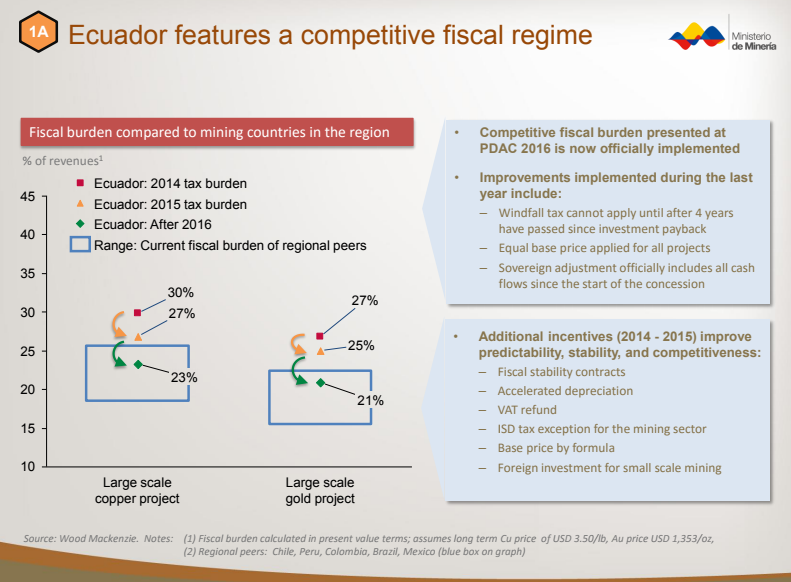

If you mention Ecuador in mining circles, you will get some raised eyebrows and mumbled cuss words from Canadian mining executives. This is because of Ecuador’s reaction in 2013 that looked like resource nationalism which resulted in a moratorium on mining activity and a hefty tax on profits. Ecuador’s infamous windfall profits tax and a series of other unfavorable provisions made almost any mining project unprofitable

The windfall profits tax was a 70-per-cent levy on excess profits, the terms of which, such as what are excess profits, had previously been subject to negotiation between company and government, leading to an uncertain business environment.

However, lessons were learned and Ecuador hopes to position itself as the up-and-coming mining investment destination in Latin America. The Ecuadorian government hired consultants Wood Mackenzie to provide recommendations and the country is adopting them quickly.

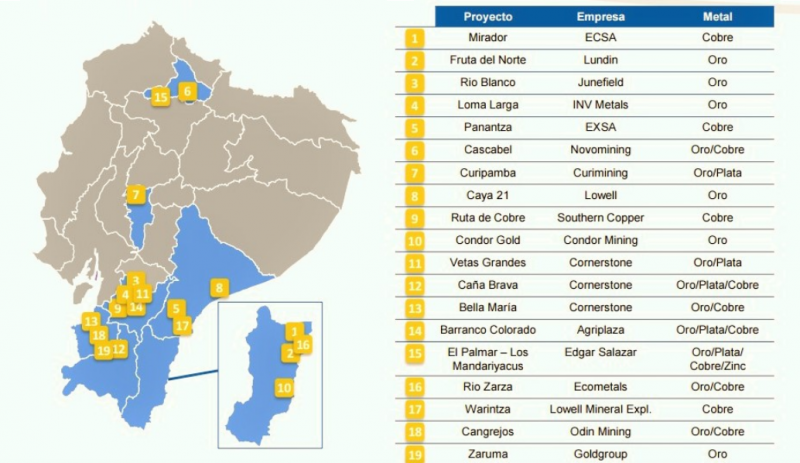

Ecuador, which depends on crude oil for half its national budget, is seeking to drum up more foreign investment after the recent crude price slump slashed government revenue. The government in 2015 separated the mining ministry from its oil ministry and announced plans to promote 36 projects to produce gold, copper and molybdenum estimated to be worth US$200bn.

It started in 2013 when Kinross Gold (TSX: K) walked away from the negotiating table after two years of fruitless talks with the Ecuadorian government over the investment conditions for the Fruta del Norte (FDN) project, one of Latin America’s biggest undeveloped gold deposits.

It also didn’t help that shortly before, IAMGOLD (TSX: IMG) had sold its Loma Larga project and left the country, and shortly afterwards, International Minerals sold its Río Blanco gold project and also said goodbye.

Kinross’ decision telegraphed to investors that negotiations with Ecuador were difficult and indicated to the country that its mining framework was not working. In exasperation and desperation, Kinross sold the construction-ready Fruta del Norte in 2014 for US$240 million, close to a quarter of what it paid to acquire the project in 2008.

Kinross bet on FDN and lost. The same year that Lundin Gold (TSX: LUG) bought the project, Ecuador embarked on a mission to make its mining framework more competitive and attractive.

Lundin obtained approval for the FDN environmental impact study in October 2016 and in December signed an exploitation agreement and an investment protection contract with the government. Construction of the 340,000 ounces per year mine has begun.

Lenin Moreno, who took office as President in May 2017, wants to attract US$4.6 billion in investment over his term in office for large-scale mining projects from companies including Lundin Gold, EcuaGold Mining, INV Metals, EcuaCorriente, Cornerstone Capital Resources (TSX-V: CGP), BHP Billiton and China Explorcobres. The investments hope to quadruple employment in the mining industry through 2022, according to Wood Mackenzie.

Two Chinese-owned mines are due for startup in the near term; the large-scale Mirador copper mine, controlled by the CRRC-Tongguan consortium, and the smaller Río Blanco, now operated by Junefield Mineral Resources.

There is a resurgence in exploration with several junior mining companies increasing activity in the country. Ecuador is looking to create a mining venture exchange. The plan is to link trading in junior mining stocks on the Toronto and Quito exchanges as part of a bid to finance US$488 million in exploration, the mining ministry said.

“We’re democratizing the industry. Local investors will be able to invest in mining, which is becoming a prosperous sector,” says deputy industrial mining secretary Henry Troya. “We’re building a sustainable industry.”

Other countries have gone down this road; Peru’s pioneering Lima venture exchange managed to list a dozen exploration companies at its height, including Karmin Exploration (TSX-V: KAR), Duran Ventures (TSX-V: DRV) and Red Eagle Mining (TSX-V: R). Santiago followed its example with its own venture exchange in 2014. However, with scant data on these exchanges, the scale of participation from Peruvian and Chilean retail investors is yet to be proved.

Ecuador has started to awarding exploration concessions after a hiatus of some six years, mines minister Javier Cordova told Mining Journal. Ecuador has overhauled its mining concessions registry and 237 concessions have been awarded to date to local and international mining companies, according to the ministry.

The ministry aims to boost mining exploration investment to US$600 million by the end of the year according to the newspaper El Telégrafo, citing Troya’s presentation at a mining conference in Quito. At least 27 companies have set up offices in Ecuador this year, including BHP Billiton, Newmont Mining, Fortescue Metals Group, Hancock Prospecting and Newcrest Mining.

The ministry is tracking mining exploration projects including Codelco-Enami JV Llurimagua and Cornerstone’s Cascabel. Ecuador’s mining chamber is further pushing the government to change both a tax on windfall profits and a capital gains tax to make the industry more competitive.

Improvements to the tax code that were implement in 2016 include: windfall tax cannot apply until after four years have passed since investment payback and an equal base price applied for all projects. These are some reforms and there is plenty of way to go.

With big pushes, often come big push backs, the question remains whether Ecuador can commit to mining reform and development without a backlash from its residents, it has happened in the past.

Mining is cyclical and investors need to make hay while the sun shines. Timing is everything and it appears senior Canadian mining companies are missing out on a period of economic optimism in the Ecuadorian mining industry after bearing the brunt of an unreceptive local climate in the past. Ecuador has made significant reforms and be sure there will be a lot of exploration news coming out of this region.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan