In recent days the market has moved from expecting a rate cut by January 2020 to now expecting as much as three rate cuts by then. As a result both Gold and gold stocks launched higher, forming a “three white soldiers” bullish reversal pattern.

Last week and in previous writings, we noted the importance of the actual rate cut for Gold and gold stocks. Their performance in both nominal and relative terms usually takes hold after the actual cut.

Now, the question is, is this a rally or a bull market? (There is a difference even though financial media talks about multi-year bull moves as “rallies.”)

The start of a new rate cut cycle hasn’t always produced a bull market in precious metals. For example, after the rate cuts in 1989 and 1995 Gold rallied by only 12% and 18%. Fortunately for us bulls, the current context is totally different but I digress.

The stock market will answer the question.

There has never been a real bull market in precious metals without Gold outperforming the stock market (excluding the 1985-1987 period during a 50% decline in the US Dollar).

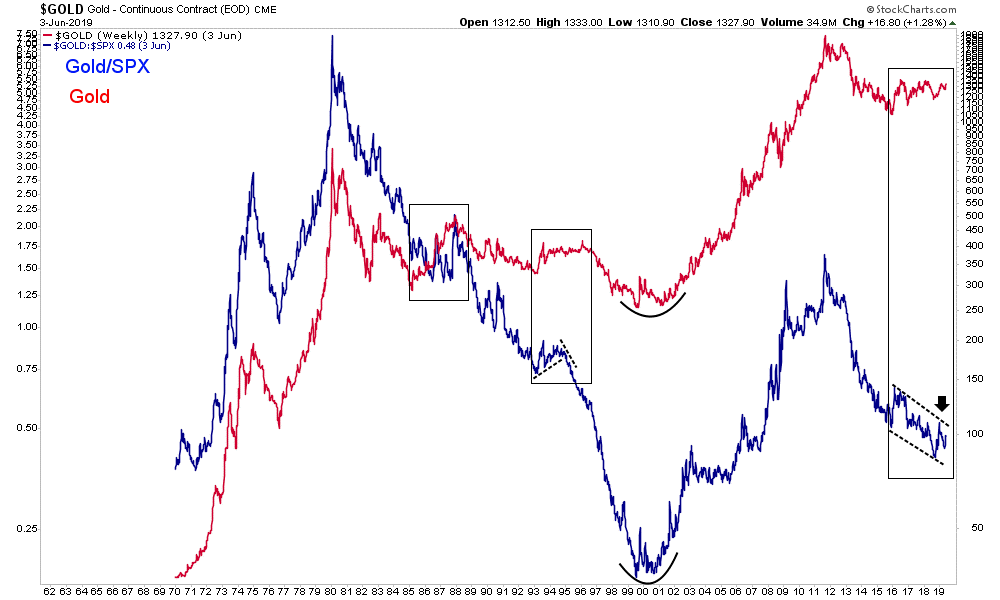

The chart below plots Gold (red) and Gold against the stock market (blue).

As you can see, during the 1970s and 2000s, the Gold/S&P 500 ratio rose alongside Gold. That wasn’t the case in the mid 1980s, the mid 1990s and the past few years.

If the Fed rate cuts and other measures are able to successfully revive the U.S. economy and stock market then Gold isn’t going to receive enough capital inflows to sustain a bull market. On the other hand, if the U.S. economy slips into recession and the stock market experiences a real bear market then Gold should have enough fuel to retest its all time highs.

In the scenario in which the stock market and economy stabilize and recover, Gold can still perform well. Fed rate cuts and the like could push it past $1400/oz and potentially to $1500/oz.

How the Gold/S&P 500 ratio performs will inform us on the sustainability of that move. It will tell us if it’s just a rally or the start of a real bull market.

The gold stocks are nearly as historically cheap and hated as they’ve ever been. They could make quite a run on a clean breakout in Gold through the wall of resistance at $1375/oz, which we think is more likely than not. To learn what stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

Jordan Roy-Byrne CMT, MFTA

June 7, 2019

The widely-held mega-cap stocks that dominate the U.S. markets recently finished reporting their Q4 2018 financial results. Because the tenor of stock markets changed radically last quarter, this latest earnings season is more important than usual. An extreme monster bull market suddenly rolled over into a severe near-bear correction in Q4. How major corporations fared offers insights into whether a young bear is upon us.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the U.S. Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

While 10-Qs with filing deadlines of 40 days after quarter-ends are required for normal quarters, 10-K annual reports are instead mandated after quarters ending fiscal years. Most big companies logically run their accounting on calendar years, so they issue 10-Ks after Q4s. Since these annual reports are larger and must be audited by independent CPAs, their filing deadlines are extended to 60 days after quarter-ends.

So the 10-K filing season just wrapped up last Friday, revealing how the biggest and best U.S. companies were doing in Q4 2018. They are the stocks of the flagship S&P 500 stock index (SPX). At the end of Q4 they commanded a gigantic collective market capitalization of $22.2t! The vast majority of investors own the big U.S. stocks of the SPX, as some combination of them are usually the top holdings of nearly every fund.

The major ETFs that track the S&P 500 dominate the increasingly-popular passive-investment strategies as well. The SPY SPDR S&P 500 ETF, IVV iShares Core S&P 500 ETF, and VOO Vanguard S&P 500 ETF are among the largest in the world. This past week they reported colossal net assets running $262.4b, $160.5b, and $103.2b respectively! Overall stock-market fortunes are totally dependent on big U.S. stocks.

Q4 2018 proved extraordinary. Leading into it, the SPX hit a dazzling all-time record high in late September about a week before Q4 arrived. That extended an extreme monster stock bull to 333.2% gains over 9.5 years, the 2nd-largest and 1st-longest in all of U.S. stock-market history! But as I warned days after that euphoric peaking, the Fed’s unprecedented quantitative-tightening campaign would finally ramp to full speed in Q4.

Stock markets artificially inflated by $3625b of Fed QE over 6.7 years couldn’t react well to Fed QT finally starting to unwind that epic monetary inflation. With QT hitting $50b per month starting in Q4, the stock markets indeed wilted. Over the next 3.1 months into Christmas Eve, the SPX plummeted 19.8%! That was right on the verge of a new bear market at -20%. The SPX suffered its worst December since 1931, -9.2%.

That sure looked like a young bear market, really freaking out traders. But since those deep and ominous lows, the SPX has soared 19.3% at best in a massive rally! That has reversed nearly 4/5ths of the total correction losses largely suffered in Q4. This looked and acted like a classic bear-market rally, rocketing higher to eradicate fear and restore universal complacency. New-bear worries have shriveled to nothing.

Given Q4 2018’s colossal stock-market inflection and subsequent huge rebound, whether the SPX narrowly evaded the overdue-bear bullet or not is supremely important. Bear markets exist for one reason, to maul overvalued stocks back down below historic fair-value levels. So how the major U.S. corporations actually fared last quarter, how large their earnings were compared to their stock prices, offers essential bull-bear clues.

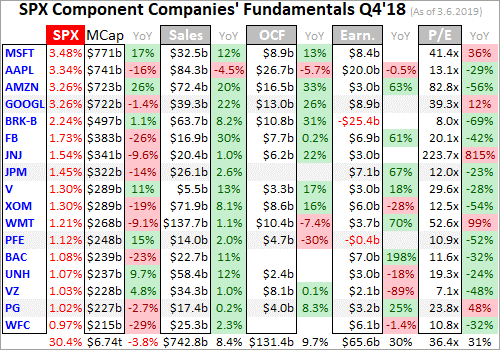

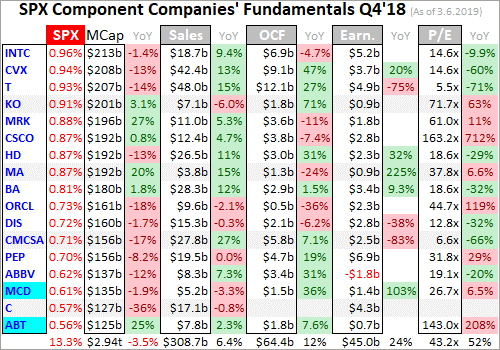

Every quarter I analyze the top 34 SPX/SPY component stocks ranked by market cap. This is just an arbitrary number that fits neatly into the tables below, but is a dominant sample of the SPX. At the end of Q4, these American giants alone commanded fully 43.7% of the SPX’s total weight! Their $9.7t collective market cap exceeded that of the bottom 437 SPX companies. Big U.S. stocks’ importance cannot be overstated.

I wade through the 10-K or 10-Q SEC filings of these top SPX companies for a ton of fundamental data I dump into a spreadsheet for analysis. The highlights make it into these tables below. They start with each company’s symbol, weighting in the SPX and SPY, and market cap as of the final trading day of Q4 2018. That’s followed by the year-over-year change in each company’s market capitalization, a key metric.

Major U.S. corporations have been engaged in a wildly-unprecedented stock-buyback binge ever since the Fed forced interest rates to deep artificial lows during 2008’s stock panic. Thus the appreciation in their share prices also reflects shrinking shares outstanding. Looking at market-cap changes instead of just underlying share-price changes effectively normalizes out stock buybacks, offering purer views of value.

That’s followed by quarterly sales along with their y/y changes. Top-line revenues are one of the best indicators of businesses’ health. While profits can be easily manipulated quarter to quarter by playing with all kinds of accounting estimates, sales are tougher to artificially inflate. Ultimately sales growth is necessary for companies to expand, as bottom-line profits growth driven by cost-cutting is inherently limited.

Operating cash flows are also important, showing how much capital companies’ businesses are actually generating. Using cash to make more cash is a core tenet of capitalism. Unfortunately many companies are now obscuring quarterly OCFs by reporting them in year-to-date terms, lumping in multiple quarters together. So the Q4 2018 OCFs shown are mostly calculated by subtracting Q3’18 YTD OCFs from full-year ones.

Next are the actual hard quarterly earnings that must be reported to the SEC under Generally Accepted Accounting Principles. Lamentably companies now tend to use fake pro-forma earnings to downplay real GAAP results. These are derided as EBS profits, Everything but the Bad Stuff! Certain expenses are simply ignored on a pro-forma basis to artificially inflate reported corporate profits, often misleading traders.

While we’re also collecting the earnings-per-share data Wall Street loves, it’s more important to consider total profits. Stock buybacks are executed to manipulate EPS higher, because the shares-outstanding denominator of its calculation shrinks as shares are repurchased. Raw profits are a cleaner measure, again effectively neutralizing the impacts of stock buybacks. They better reflect underlying business performance.

Finally the trailing-twelve-month price-to-earnings ratios as of the end of Q4 2018 are noted. TTM P/Es look at the last four reported quarters of actual GAAP profits compared to prevailing stock prices. They are the gold-standard metric for valuations. Wall Street often intentionally conceals these hard P/Es by using the fictional forward P/Es instead, which are literally mere guesses about future profits that often prove far too optimistic.

These are mostly calendar-Q4 results, but some big U.S. stocks use fiscal quarters offset from normal ones. Walmart, Home Depot, and Cisco have quarters ending one month after calendar ones, so their results here are current to the end of January instead of December. Oracle uses quarters that end one month before calendar ones, so its results are as of the end of November. Offset reporting ought to be banned.

Reporting on offset quarters renders companies’ results way less comparable with the vast majority that report on calendar quarters. We traders all naturally think in calendar-quarter terms too. Decades ago there were valid business reasons to run on offset fiscal quarters. But today’s sophisticated accounting systems that are largely automated running in real-time eliminate all excuses for not reporting normally.

Stocks with symbols highlighted in blue have newly climbed into the ranks of the SPX’s top 34 companies over the past year, as investors bid up their stock prices and thus market caps relative to their peers. Overall the big U.S. stocks’ Q4 2018 results looked impressive, with good sales and profits growth. But that masks a sharp slowdown from prior quarters that will be exacerbated as the corporate-tax-cut transition year ends.

2018 was a banner year for corporate earnings because of Republicans’ massive corporate tax cuts. The Tax Cuts and Jobs Act was signed into law on December 22nd, 2017 to go into effect on January 1st, 2018. Its centerpiece was slashing the U.S. corporate tax rate from 35% to 21%, which naturally boosted reported profits. But 2018’s four quarters were the only ones that would experience anomalous TCJA growth.

Q4 2018 was the last quarter comparing year-over-year growth between a pre-TCJA quarter and post-TCJA quarter. That major discontinuity distorted corporate-earnings growth. Profits soared last year not just because companies were doing better, but because they were paying taxes at much-lower rates. But starting in Q1 2019, that TCJA-transition boost is gone forever. Normal same-tax-regime y/y comparisons will return.

But before we get to all-important corporate earnings and resulting valuations, let’s work our way through these tables. Thanks to the SPX’s brutal 14.0% plunge in Q4, this leading broad-market stock index lost 6.2% last year. The biggest and best US companies fared a little better, with the collective market cap of the top 34 sliding 5.2% y/y. These elite corporations had average market-cap losses running 3.6% y/y.

That certainly isn’t calamitous, but the deceleration is neck-snapping! In the prior four quarters starting in Q4 2017, the SPX’s top 34 components saw enormous average YoY market-cap gains of 29.2%, 14.6%, 23.5%, and 24.2%. Make no mistake, Q4’18 saw a massive and ominous stock-market inflection. The severe near-bear correction’s selling pressure was even heavier in smaller SPX stocks below the top 34.

That pushed the top 34’s share of the SPX’s total weighting to 43.7%, a big increase from Q4 2017’s 41.8%. The more capital concentrated in fewer stocks, the riskier the entire stock markets become. Big down days driven by company-specific news in highly-weighted individual stocks can drag down the entire stock markets. A great example occurred in mighty Apple just after Q4 ended, when it warned on weak Q4 sales.

For years Apple had been the largest U.S. stock by market cap, commanding the highest ranking in the SPX and SPY. Just after 2019’s first trading day closed, Apple cut its Q4 revenue guidance by 7.7% from its own midpoint given 2 months earlier. The next day AAPL stock collapsed by 10.0%, which pummeled the entire SPX 2.5% lower in its worst loss so far this year. When a top U.S. stock sneezes, markets catch a cold.

Falling stock markets exert a strong negative wealth effect. Both consumers and corporations get scared as stocks suffer big and fast drops, so they pull in their horns on spending. That left all kinds of economic data covering parts of Q4 weaker than expected, sometimes shockingly so. Lower spending weighs on corporate revenues, as fewer people buy less goods and services. Would the top 34’s Q4 2018 sales reflect this?

On the surface these biggest-and-best U.S. companies looked immune. Their total Q4 sales of $1051.6b still climbed an impressive 4.2% YoY in the stock markets’ worst quarter since Q3 2011. These companies averaged big sales growth of 7.4% y/y, which was surprisingly robust given the stock-market carnage. Yet even that good top-line growth still reflects a major slowdown for the top 34 from the past year’s pace.

In the preceding four quarters, the SPX’s top 34 component stocks averaged y/y revenues growth way up at 10.8%, 14.0%, 14.0%, and 11.5%. So Q4’s was a serious deceleration, which may be an ominous portent for 2019. Q4’s revenues growth may be overstated too. Nearly 2/3rds of the SPX’s spending-sapping Q4 plunge came in December alone, after much of the surge in holiday shopping was already over.

If big U.S. companies’ sales growth continues slowing or even starts shrinking in 2019, corporate-profits growth will collapse. While Q1 2019’s earnings season doesn’t start for another 5 weeks or so, plenty of companies have warned that they see revenues slowing much more than Wall Street expected. If Q4 2018 was indeed a major stock-market trend change from bull to bear, corporate results will continue deteriorating.

The mega-cap companies dominating the SPX and American investors’ portfolios also enjoyed strong operating-cash-flow-generation growth in Q4. Their collective OCFs surged 11.5% y/y to $195.8b. Individual companies enjoyed average OCF gains of 10.8% y/y. That looks great on the surface, but just like sales it represents a sharp slowdown from huge y/y OCF growth seen in the prior four quarters.

Starting in Q4 2017 the SPX top 34’s operating cash flows averaged growth of 17.0%, 52.5%, 30.3%, and 20.6% YoY. So Q4’18’s still-strong OCF growth actually decelerated by almost 2/3rds from the precedent of the prior year. That was the prevailing theme of Q4’18 results, good numbers but already slowing fast from the rest of 2018’s even though last quarter had easy annual comparisons across those corporate tax cuts.

Actual corporate profits among these elite U.S. companies are critical to prevailing valuations. The price-to-earnings ratio is the classic measure of how expensive stock prices are. It simply divides companies’ current stock prices by their total earnings per share over the last four reported quarters. So profits are really the only corporate results that matter for valuations, making their growth trends the most important of all.

Interestingly the top 34 SPX components’ total GAAP profits actually shrunk 1.4% y/y to $110.6b in Q4! That doesn’t make sense given their total revenues growth of 4.2%, which earnings should’ve amplified. But a couple big factors played into that surprising decline. After the Tax Cuts and Jobs Act was passed near the end of 2017, companies had to make huge adjustments to overpaid or underpaid taxes on their books.

These are called deferred tax assets and liabilities, which would suddenly be valued very differently under the new corporate-tax rules. So as I analyzed last year, the top 34 SPX companies ran a staggering $209.2b of TCJA adjustments through their earnings in Q4’17! Thus that earlier comparable quarter to Q4 2018 was a mess in GAAP-earnings terms. Q4 2017 was probably the most-distorted quarter in SPX history.

But with about half those one-time TCJA adjustments resulting in profits gains and half in losses, the net impact to overall SPX-top-34 earnings in Q4 2017 was essentially a wash at +$2.7b. That merely boosted overall Q4 2017 profits by 2.5%. A far-more-important factor in Q4’18’s YoY earnings decline came from a single company, Warren Buffett’s Berkshire Hathaway. It was the 5th-largest SPX component as 2018 ended.

BRK suffered a catastrophic $25.4b GAAP loss last quarter! That was almost entirely due to the sharp stock-market decline, which hammered Berkshire’s gigantic investment portfolio lower. It suffered $27.6b of non-cash losses that now have to be run through quarterly earnings. A new accounting rule now requires that unrealized capital gains and losses must be flushed through the bottom line, really irritating Buffett.

In BRK’s 2018 annual report he wrote “As I emphasized in the 2017 annual report, neither Berkshire’s Vice Chairman, Charlie Munger, nor I believe that rule to be sensible. Rather, both of us have consistently thought that at Berkshire this mark-to-market change would produce what I described as “wild and capricious swings in our bottom line.” … Wide swings in our quarterly GAAP earnings will inevitably continue.”

“That’s because our huge equity portfolio – valued at nearly $173 billion at the end of 2018 – will often experience one-day price fluctuations of $2 billion or more, all of which the new rule says must be dropped immediately to our bottom line. … Our advice? Focus on operating earnings, paying little attention to gains or losses of any variety.” Berkshire’s operating earnings were $5.7b in Q4’18, soaring 71.4% y/y!

If BRK’s epic unrealized capital loss is ignored, total SPX-top-34 earnings would’ve surged 23.2% y/y in Q4 2018. On average these top 34 SPX companies reporting profits in both Q4 2017 and Q4 2018 averaged similar 27.8% y/y gains. But the same sharp-deceleration story seen in revenues and OCFs also applies here. The previous four quarters saw far-stronger average growth of 137.0%, 45.9%, 44.5%, and 53.8% y/y!

The massive swings in Berkshire’s enormous investment portfolio are going to distort overall corporate profits in all future quarters with significant SPX gains or losses. We’ll have to watch that going forward, and adjust for it if necessary. But overall corporate profits will be much cleaner in coming years with the TCJA transition year of 2018 behind us. Apples-to-apples comparisons will once again become the norm.

The major slowdown in big U.S. companies’ revenues, operating cash flows, and earnings growth in Q4 2018 is certainly ominous. Especially since the majority of the SPX’s plunge last quarter came relatively late in December. But the most-important thing for attempting to divine whether that monster bull remains alive and well having merely suffered a severe correction, or a young bear is underway, is how valuations look.

These top 34 SPX companies that earned GAAP profits over the past four quarters averaged trailing-twelve-month price-to-earnings ratios way up at 39.7x as Q4 ended! That’s 29.4% above Q4 2017’s average a year earlier, and well into dangerous bubble territory. Over the past century-and-a-quarter or so, U.S. stock markets have averaged 14x earnings which is fair value. Twice that at 28x is where bubble territory begins.

Despite remaining scary-high, big U.S. companies’ average valuations did moderate considerably in Q4. The prior four quarters saw the SPX top 34’s average TTM P/Es run 30.6x, 46.0x, 53.4x, and 49.0x. So the severe near-bear correction definitely did some real work in mauling valuations down. And the P/Es in these tables are as of the end of Q4, which of course didn’t yet reflect the solid y/y growth in Q4 earnings.

By the end of February the top 34 SPX companies’ average TTM P/Es had further dropped to 26.4x, still very expensive but no longer bubble levels. That includes these Q4 results and is even despite the SPX’s powerful rebound rally out of late December’s near-bear lows. So the situation today is nowhere near as dire as at the end of Q4’18 on the valuation front. But that doesn’t mean stock markets are out of the woods.

Bear markets exist because stocks get too expensive leading into the ends of preceding bulls. At 14x fair value it takes 14 years for a company to earn back the price investors are paying for it. The reciprocal of that is a 7.1% return, which is mutually beneficial for both investors with surplus capital and companies that need it. Once extreme bubble valuations birth bear markets, they don’t hibernate until stocks are cheap.

Throughout all of 2018 the U.S. stock markets were trading at extreme bubble valuations. Then in Q4 that severe 19.8% correction hammered the SPX to the verge of formal bear territory. The rebound since has all the hallmarks of a massive bear-market rally. Wall Street’s oft-cited belief that Q4’s plunge was more than enough to restore balance to these stock markets isn’t credible. Bears don’t stop with stocks still expensive!

Historical bear markets after major bulls nearly always maul prevailing US-stock-market valuations back down to cheap levels at 7x to 10x earnings in TTM P/E terms. With the top U.S. stocks averaging 39.7x as Q4 waned and 26.4x at the end of February, the valuation-mean-reversion work still has a long way to go. It is certainly not safe to assume no bear is coming until the SPX trades under 14x, which is far lower.

The SPX soared 11.1% YTD by the end of February, hitting 2784.5. Merely to get to fair value at 14x earnings, not even overshoot to the downside, the SPX has to fall to 1476.6! That’s another 46.7% under this week’s levels! And if corporate earnings actually start retreating this year, the SPX downside targets will fall proportionally. Big bears are normal and inevitable after big bulls, as I explained in depth in late December.

Nearly a decade of Fed-QE-goosed bull market has left traders forgetting how dangerous bears are. The SPX’s last two bears were a 49.1% decline over 2.6 years ending in October 2002, and a 56.8% plunge in 1.4 years climaxing in a stock panic to a March 2009 low! With the big U.S. stocks sporting extreme bubble valuations all of last year, and still near bubble valuations now, it’s hard to believe we aren’t in a young bear.

If that proves true, investors need to lighten up on their stock-heavy portfolios, or at least put stop losses in place. Cash is king in bear markets, since its buying power grows. Investors who hold cash during a 50% bear market can double their holdings at the bottom by buying back their stocks at half-price. But cash doesn’t appreciate in value like gold, which actually grows wealth during major stock-market bears.

Gold investment demand surges as stock markets weaken, as we got a taste of in December. While the SPX plunged 9.2%, gold rallied 4.9% as investors flocked back. The gold miners’ stocks which leverage gold’s gains fared even better, with their leading index surging 10.7% higher. The last time a major SPX selloff awakened gold in the first half of 2016, it soared 30% higher fueling a massive 182% gold-stock upleg!

Absolutely essential in bear markets is cultivating excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. While Wall Street will deny this likely young stock-market bear all the way down, we will help you both understand it and prosper during it.

We’ve long published acclaimed weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q4, we’ve recommended and realized 1076 newsletter stock trades since 2001. Their average annualized realized gain is +16.1%! That’s nearly double the long-term stock-market average. Subscribe today for just $12 per issue!

The bottom line is big U.S. stocks’ Q4 2018 results looked impressive on the surface. Good annual growth in sales, operating cash flows, and even earnings excluding Berkshire’s huge mark-to-market losses appeared to buck Q4’s major stock-market selloff. But these growth rates all suffered sharp decelerations from those seen in preceding quarters, suggesting a slowdown is underway. That’s a real problem for stock markets.

Valuations remain dangerously high, deep into bubble territory at the end of Q4. And even after the Q4 earnings were included by late February, near-bubble valuations persisted. That means the likely bear has barely started its stock-price-mauling work to mean revert expensive valuations. On top of that, 2018’s anomalous corporate-tax-cut-transition growth rates are history. All this will continue to pressure stock prices.

Adam Hamilton, CPA

March 11, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

The major silver miners’ stocks have been largely abandoned this year, spiraling to brutal multi-year lows. Such miserable technicals have exacerbated the extreme bearishness plaguing this tiny contrarian sector. While profitable silver mining is challenging at today’s exceedingly-low silver prices, these miners are chugging along. Their recently-reported Q3’18 results show their earnings are ready to soar as silver recovers.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Companies trading in the States are required to file 10-Qs with the US Securities and Exchange Commission by 40 calendar days after quarter-ends. Canadian companies have similar requirements at 45 days. In other countries with half-year reporting, many companies still partially report quarterly.

Unfortunately the universe of major silver miners to analyze and invest in is pretty small. Silver mining is a tough business both geologically and economically. Primary silver deposits, those with enough silver to generate over half their revenues when mined, are quite rare. Most of the world’s silver ore formed alongside base metals or gold. Their value usually well outweighs silver’s, relegating it to byproduct status.

The Silver Institute has long been the authority on world silver supply-and-demand trends. It published its latest annual World Silver Survey covering 2017 in mid-April. Last year only 28% of the silver mined around the globe came from primary silver mines! 36% came from primary lead/zinc mines, 23% copper, and 12% gold. That’s nothing new, the silver miners have long produced less than a third of world mined supply.

It’s very challenging to find and develop the scarce silver-heavy deposits supporting primary silver mines. And it’s even harder forging them into primary-silver-mining businesses. Since silver isn’t very valuable, most silver miners need multiple mines in order to generate sufficient cash flows. Traditional major silver miners are increasingly diversifying into gold production at silver’s expense, chasing its superior economics.

So there aren’t many major silver miners left out there, and their purity is shrinking. The definitive list of these companies to analyze comes from the most-popular silver-stock investment vehicle, the SIL Global X Silver Miners ETF. In mid-November at the end of Q3’s earnings season, SIL’s net assets were running 6.6x greater than its next-largest competitor’s. So SIL continues to dominate this tiny niche contrarian sector.

While SIL has its flaws, it’s the closest thing we have to a silver-stock index. As ETF investing continues to eclipse individual-stock picking, SIL inclusion is very important for silver miners. It grants them better access to the vast pools of stock-market capital. Differential SIL-share buying by investors requires this ETF’s managers to buy more shares in its underlying component companies, bidding their stock prices higher.

In mid-November as the silver miners were finishing reporting their Q3’18 results, SIL included 23 “Silver Miners”. Unfortunately the great majority aren’t primary silver miners, most generate well under half their revenues from silver. That’s not necessarily an indictment against SIL’s stock picking, but a reflection of the state of this industry. There aren’t enough significant primary silver miners left to fully flesh out an ETF.

This disappointing reality makes SIL somewhat problematic. The only reason investors would buy SIL is they want silver-stock exposure. But if SIL’s underlying component companies generate just over a third of their sales from silver mining, they aren’t going to be very responsive to silver price moves. And most of that ETF capital intended to go into primary silver miners is instead diverted into byproduct silver miners.

So silver-mining ETFs sucking in capital investors thought they were allocating to real primary silver miners effectively starves them. Their stock prices aren’t bid high enough to attract in more investors, so they can’t issue sufficient new shares to finance big silver-mining expansions. This is exacerbating the silver-as-a-byproduct trend. Only sustained much-higher silver prices for years to come could reverse this.

Silver miners’ woes are really exacerbated by silver’s worst performance in decades. In mid-November silver sunk to a 2.8-year low of $13.99. That naturally dragged down SIL to a similar 2.7-year low. But relative to gold which usually drives it, silver was faring far worse. The Silver/Gold Ratio sunk to 85.9x in mid-November, meaning it took almost 86 ounces of silver to equal the value of a single ounce of gold.

The SGR hadn’t been lower, or silver hadn’t been more undervalued relative to gold, since all the way back in March 1995! That’s pretty much forever from a markets perspective. With silver languishing at an exceedingly-extreme 23.7-year low relative to gold, it’s hard to imagine it doing much worse. So the silver miners are weathering one of the toughest environments they’ve ever seen, which we have to keep in mind.

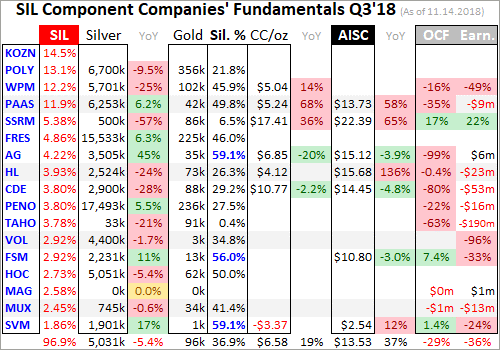

Every quarter I dig into the latest results from the major silver miners of SIL to get a better understanding of how they and this industry are faring fundamentally. I feed a bunch of data into a big spreadsheet, some of which made it into the table below. It includes key data for the top 17 SIL component companies, an arbitrary number that fits in this table. That’s a commanding sample at 96.9% of SIL’s total weighting!

While most of these top 17 SIL components had reported on Q3’18 by mid-November, not all had. Some of these major silver miners trade in the UK or Mexico, where financial results are only required in half-year increments. If a field is left blank in this table, it means that data wasn’t available by the end of Q3’s earnings season. Some of SIL’s components also report in gold-centric terms, excluding silver-specific data.

The first couple columns of this table show each SIL component’s symbol and weighting within this ETF as of mid-November. While most of these stocks trade on US exchanges, some symbols are listings from companies’ primary foreign stock exchanges. That’s followed by each miner’s Q3’18 silver production in ounces, along with its absolute year-over-year change. Next comes this same quarter’s gold production.

Nearly all the major silver miners in SIL also produce significant-to-large amounts of gold! That’s truly a double-edged sword. While gold really stabilizes and boosts silver miners’ cash flows, it also retards their stocks’ sensitivity to silver itself. So the next column reveals how pure these elite silver miners are, approximating their percentages of Q3’18 revenues actually derived from silver. This is calculated two ways.

The large majority of these top SIL silver miners reported total Q3 revenues. Quarterly silver production multiplied by silver’s average price in Q3 can be divided by these sales to yield an accurate relative-purity gauge. When Q3 sales weren’t reported, I estimated them by adding silver sales to gold sales based on their production and average quarterly prices. But that’s less optimal, as it ignores any base-metals byproducts.

Next comes the major silver miners’ most-important fundamental data for investors, cash costs and all-in sustaining costs per ounce mined. The latter directly drives profitability which ultimately determines stock prices. These key costs are also followed by YoY changes. Last but not least the annual changes are shown in operating cash flows generated and hard GAAP earnings, with a couple exceptions necessary.

Percentage changes aren’t relevant or meaningful if data shifted from positive to negative or vice versa, or if derived from two negative numbers. So in those cases I included raw underlying data rather than weird or misleading percentage changes. This whole dataset together offers a fantastic high-level read on how the major silver miners are faring fundamentally as an industry. They are hanging in there quite well.

Production is naturally the lifeblood of the silver-mining sector. The more silver and increasingly gold that these elite miners can wrest from the bowels of the earth, the stronger their fundamental positions and outlooks. These top 17 SIL miners’ overall silver production slipped 2.2% YoY to 75.5m ounces in Q3’18. But their shift into more-profitable gold mining continued, with aggregate production up 1.6% YoY to 1.4m ounces.

According to the Silver Institute’s latest WSS, total world silver mine production averaged 213.0m ounces per quarter in 2017. So at 75.5m in Q3, these top 17 SIL components were responsible for 35.4% of that rate. There is one unusual situation that slightly skewed this result. SSR Mining, which used to be known as Silver Standard Resources, saw its silver production plummet 57% YoY as its lone silver mine is depleting.

The winding down of SSRM’s old Pirquitas silver mine is proceeding as forecast and has been going on for some time. This once major silver miner is morphing into a primary gold miner, which accounted for a record 94% of its revenue in Q3. Excluding SSRM, the rest of these top SIL silver miners saw their silver production retreat an immaterial 1.3% YoY. That’s pretty impressive given this year’s collapse in silver prices.

Q3’s average silver price was just $14.96, down a major 11.2% YoY. That was far-worse performance than gold, with its quarterly average merely sliding 5.3% lower between Q3’17 to Q3’18. Considering how miserable this silver-price environment is with the worst relative performance to gold in decades, the major silver miners are doing well on production. They continue to hold out for silver mean reverting higher.

Silver is likely so down in the dumps because it effectively acts like a gold sentiment gauge. Generally big silver uplegs only happen after gold has rallied long enough and high enough to convince traders its gains are sustainable. Then the way-smaller silver market tends to start leveraging and amplifying gold’s moves by 2x to 3x. But gold sentiment was so insipid over this past year that no excitement was sparked for silver.

Unfortunately at these bombed-out silver prices the economics of silver mining are way inferior to gold mining. The traditional major silver miners are painfully aware of this, and have spent years actively diversifying into gold. In Q3’18, the average percentage of revenues that these top 17 SIL miners derived from silver was just 36.9%. That’s right in line with the prior 4 quarters’ 39.3%, 35.3%, 36.8%, and 36.3%.

Silver mining is every bit as capital-intensive as gold mining, requiring similar large expenses for planning, permitting, and constructing mines and mills. It needs similar heavy excavators and haul trucks to dig and move the silver-bearing ore. Similar levels of employees are necessary to run these mines. But silver generates much lower cash flows due to its lower price. Consider hypothetical mid-sized silver and gold mines.

They might produce 10m and 300k ounces annually. At last quarter’s average prices, these silver and gold mines would yield $150m and $363m of yearly sales. Thus regrettably it is far easier to pay the bills mining gold these days. So primary silver miners are increasingly becoming a dying breed, which is sad. The traditional major silver miners are adapting by ramping their gold production often at silver’s expense.

With major silver miners so rare, SIL’s managers are really struggling to find components for their leading ETF. So in Q3’17 they added Korea Zinc, which is now SIL’s largest component at over 1/7th of its total weighting. In my decades of studying and trading this tiny sector, I’d never heard of it. So I looked into Korea Zinc and found it was merely a smelter, not even a miner. It really needs to be kicked out of SIL.

Every quarter since I’ve tried to dig up information on Korea Zinc, but its English-language disclosures are literally the worst I’ve ever seen for any company. Its homepage gives an idea of what to expect, declaring “We are Korea Zinc, the world’s one of the best smelting company”. I’ve looked and looked and the latest production data I can find in English remains 2015’s. I can’t find it from third-party sources either.

That year Korea Zinc “produced” 63.3m ozs of silver, which averages to 15.8m quarterly. That is largely a byproduct from its main businesses of smelting zinc, lead, copper, and gold. Korea Zinc certainly isn’t a major silver miner, and has no place in a “Silver Miners ETF”. No silver-stock investor wants to own a base-metals smelter! Korea Zinc should be removed, its overweighting reallocated to the rest of SIL’s holdings.

SIL investors ought to contact Global X to ask them to stop tainting their ETF’s utility and desirability with Korea Zinc. If they want it to be successful and grow, they need to stick with their mission of owning the major silver miners exclusively. Silver-stock exposure is the only reason investors would buy SIL. There is another situation investors need to be aware of with Tahoe Resources and its held-hostage Escobal mine.

Tahoe was originally spun off by Goldcorp to develop the incredible high-grade Escobal silver mine in Guatemala, which went live in Q4’13. Everything went well for its first few years. By Q1’17, Escobal was a well-oiled machine producing 5700k ounces of silver. That provided 1000+ great high-paying jobs to locals and contributed big taxes to Guatemala’s economy. Escobal was a great economic boon for this country.

But a radical group of anti-mining activists managed to spoil everything, cruelly casting their fellow countrymen out of work. They filed a frivolous and baseless lawsuit against Guatemala’s Ministry of Energy and Mines, Tahoe wasn’t even the target! It alleged this regulator hadn’t sufficiently consulted with the indigenous Xinca people before granting Escobal’s permits. They don’t even live around this mine site.

Only in a third-world country plagued with rampant government corruption would a regulator apparently not holding enough meetings be a company’s problem. Instead of resolving this, a high Guatemalan court inexplicably actually suspended Escobal’s mining license in early Q3’17! Tahoe was forced to temporarily mothball its crown-jewel silver mine, and thus eventually lay off its Guatemalan employees.

That license was technically reinstated a couple months later, but the activists appealed to a higher court. It required the regulator to study the indigenous people in surrounding areas and report back, and then needs to make a decision. The government also needs to clear out an illegal roadblock to the mine site by violent anti-mine militants, who have blockaded Escobal supplies and physically attacked trucks and drivers!

So Escobal has been dead in the water with zero production for 5 quarters now, an unthinkable outcome. This whole thing is a farce, a gross miscarriage of justice. I hope this isn’t a stealth expropriation, that Guatemalan bureaucrats will get their useless paperwork done sooner or later and let Escobal come back online. Within a year, Escobal’s silver production should return to pre-fiasco levels of 5700k ounces a quarter.

At that rate, Escobal would retake the throne of being the world’s largest primary silver mine! It would boost overall SIL-top-17 production by a massive 7.6%. Last year no one expected this unprecedented Escobal debacle to last very long, as the economic damage to Guatemala was too great. But as it drags on and on, TAHO stock has been decimated. It slumped to a brutal all-time record low in mid-November.

Sadly for long-suffering TAHO shareholders, management capitulated. In mid-November they agreed to sell the company to Pan American Silver at rock-bottom prices despite a 55% premium over that all-time low. That’s devastating for TAHO investors but a steal for PAAS, which is SIL’s 4th-largest component at 11.9% of its total weighting. That keeps Escobal’s huge production in SIL if PAAS can finesse its reopening.

Unfortunately SIL’s mid-November composition was such that there wasn’t a lot of Q3 cost data reported by its top component miners. A half-dozen of these top SIL companies trade in South Korea, the UK, Mexico, and Peru, where reporting only comes in half-year increments. There are also primary gold miners that don’t report silver costs, and a silver explorer with no production. So silver cost data remains scarce.

Nevertheless it’s always useful to look at what we have. Industrywide silver-mining costs are one of the most-critical fundamental data points for silver-stock investors. As long as the miners can produce silver for well under prevailing silver prices, they remain fundamentally sound. Cost knowledge helps traders weather this sector’s left-for-dead unpopularity without succumbing to selling low like the rest of the herd.

There are two major ways to measure silver-mining costs, classic cash costs per ounce and the superior all-in sustaining costs. Both are useful metrics. Cash costs are the acid test of silver-miner survivability in lower-silver-price environments, revealing the worst-case silver levels necessary to keep the mines running. All-in sustaining costs show where silver needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of silver, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q3’18, these top 17 SIL-component silver miners that reported cash costs averaged $6.58 per ounce. While that surged 35.3% YoY, it still remains far below today’s anomalously-low silver prices.

There are a couple of extreme cash-cost outliers that are skewing this average, but offsetting each other. SSRM’s depleting silver mine is producing less with each passing quarter, forcing fewer ounces to bear the fixed costs of mining. Its crazy-high $17.41 per ounce in Q3 isn’t normal. But on the other side of this is Silvercorp Metals, which produces silver in Chinese mines yielding enormous base-metals byproducts.

Selling those and crediting their value across the silver ounces mined dragged down SVM’s cash costs to an unbelievable negative $3.37 in Q3! Excluding these extreme outliers, the rest of the SIL top 17 saw average cash costs of $6.40. That’s not too far above the past 4 quarters’ $4.86, $4.66, $5.05, and $3.95. As long as silver prices remain over those low levels, the silver miners can keep the lights on at their mines.

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain silver mines as ongoing concerns. AISCs include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current silver-production levels.

These additional expenses include exploration for new silver to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee silver mines. All-in sustaining costs are the most-important silver-mining cost metric by far for investors, revealing silver miners’ true operating profitability.

In Q3’18 these top 17 SIL miners reporting AISCs averaged $13.53 per ounce, which also surged 39.0% YoY. Again that was skewed in both directions by SSRM’s extremely-high $22.39 on Pirquitas’ depletion and SVM’s exceedingly-low $2.54 on those huge base-metals byproducts. Without them, the rest of the top 17 averaged $13.96 AISCs. That was much higher than the past 4 quarters’ $9.73, $10.16, $10.92, and $10.93.

The lower production was definitely a factor, which is inversely proportional to per-ounce costs. Silver-mining costs are largely fixed quarter after quarter, with actual mining requiring roughly the same levels of infrastructure, equipment, and employees. So the lower production, the fewer ounces to spread mining’s big fixed costs across. The major silver miners also reported lower ore grades, exacerbating the decline.

Nevertheless, the top 17 SIL miners’ AISCs both with and without the outliers still remained under silver’s weak average $14.96 price in Q3. So even with silver faring its worst relative to gold in decades thanks to devastated sentiment, the silver mines were profitable. And interestingly the closer AISCs crowd the prevailing silver prices, the more profits leverage the miners have to silver mean reverting much higher.

In mid-November silver and SIL slumped to their lowest levels since back in January and March 2016. That was early in a new silver bull which emerged from conditions like today’s where silver was despised. Over 7.6 months between December 2015 and August 2016, silver soared 50.2% higher as gold surged in its own new bull. And with silver moving again, investors eagerly started returning to the battered silver stocks.

Thanks to that silver-bull upleg, SIL skyrocketed 247.8% higher in just 6.9 months in essentially that first half of 2016! That ought to give embattled silver-stock investors some hope. All it will take to turn silver stocks around is a typical gold-driven silver upleg, and then they will soar again. The reason that silver miners’ stocks blast dramatically higher with silver is their high inherent profits leverage to silver prices.

Assume another 50% silver upleg, which is pathetically small by historical standards, from silver’s recent secular low in mid-November. That would catapult silver back up to $21 per ounce for the first time since July 2014. At Q3’18’s top-17-SIL-stock average AISCs of $13.53, profits were just $0.47 per ounce at $14 silver. But at $21 assuming stable AISCs, they would soar an astounding 1489% higher to $7.47 per ounce!

You better believe silver-stock prices would skyrocket with that kind of earnings growth. The higher their AISCs, the greater their upside profits leverage. Now consider this same 50% silver upleg using the rolling-past-4-quarter top-17-SIL-stock average AISCs of $10.43 per ounce. That implies the $3.57 profit seen at $14 silver would only balloon 196% to $10.57 per ounce at $21 silver. So higher costs aren’t necessarily bad.

As long as AISCs are below prevailing silver prices, the major silver miners can weather anything. The closer their AISCs creep to silver, the greater their earnings growth when silver mean reverts higher. So the major silver miners’ upside from here is truly explosive as silver recovers, just like back in early 2016. And silver will power much higher soon as the record silver-futures shorts of early September continue to be covered.

While all-in sustaining costs are the single-most-important fundamental measure that investors need to keep an eye on, other metrics offer peripheral reads on the major silver miners’ fundamental health. The more important ones include cash flows generated from operations, GAAP accounting profits, revenues, and cash on hand. As you’d expect given the miserably-low silver prices, they were on the weak side in Q3.

Operating cash flows among these SIL top 17 reporting them fell 23.0% YoY to $830m, which is totally reasonable given the 2.2%-lower silver production and 11.2%-lower average silver prices. Sales fell 9.5% YoY to $2717m, with some of the silver-side weakness offset by the 1.6%-higher gold production. And cash on hand fell 9.8% YoY to a still-hefty $2419m, giving these silver miners plenty of capital to weather this storm.

The hard GAAP accounting profits looked pretty ugly though, plunging to a $243m loss from being $88m in the black in Q3’17. But most of those losses didn’t reflect operations. TAHO alone wrote off a massive $170m for the impairment of Escobal, which reflected an estimated restart date of the end of 2019. Coeur Mining reported a smaller $19m writedown for one of its mines. These two non-cash charges alone were $189m.

Without them GAAP profits would’ve sunk from $88m in Q3’17 to a milder $54m loss in Q3’18. That’s still poor, but not unexpected given the lowest silver prices seen in almost several years. Again silver-mining earnings will soar if not skyrocket as silver inevitably mean reverts higher from here. All it takes for silver to surge in major bull-market uplegs is for gold itself to power higher, and huge gold upleg fuel abounds now.

The silver-mining stocks are doing way better fundamentally than they’ve been given credit for. Their higher Q3’18 mining costs still remained below the recent deep silver lows. And the compressed gap between their AISCs and low prevailing silver prices guarantees epic profits upside as silver recovers and mean reverts higher. That will attract back investors fast, catapulting silver stocks up sharply like in early 2016.

While traders can play that in SIL, this ETF has problems. Its largest component is now a base-metals smelter of all things! And the great majority of its stocks are primary gold miners with byproduct silver production. The best gains by far will be won in smaller purer mid-tier and junior silver miners with superior fundamentals. A carefully-handpicked portfolio of these miners will generate much-greater wealth creation.

The key to riding any silver-stock bull to multiplying your fortune is staying informed, both about broader markets and individual stocks. That’s long been our specialty at Zeal. My decades of experience both intensely studying the markets and actively trading them as a contrarian is priceless and impossible to replicate. I share my vast experience, knowledge, wisdom, and ongoing research through our popular newsletters.

Published weekly and monthly, they explain what’s going on in the markets, why, and how to trade them with specific stocks. They are a great way to stay abreast, easy to read and affordable. Walking the contrarian walk is very profitable. As of Q3, we’ve recommended and realized 1045 newsletter stock trades since 2001. Their average annualized realized gains including all losers is +17.7%! That’s double the long-term stock-market average. Subscribe today and take advantage of our 20%-off holidays sale!

The bottom line is the major silver miners’ fundamentals remain solid based on their recently-reported Q3’18 results. They continue to mine silver at all-in sustaining costs below even mid-November’s deep silver lows. Their profits will multiply dramatically as silver rebounds higher driven by gold’s own upleg and record silver-futures short covering. Investment capital will flood back in, catapulting silver stocks up violently.

So traders need to look through the recent forsaken herd sentiment to understand the silver miners’ hard fundamentals. These left-for-dead stocks are seriously undervalued even at today’s low silver prices, let alone where silver heads during the next major gold upleg. Silver can’t languish at extreme anomalous multi-decade lows relative to gold for long. And once it catches a bid, silver stocks will really amplify its upside.

Adam Hamilton, CPA

November 23, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

Graceland Updates 4am-7am

https://www.gracelandupdates.com

https://gracelandjuniors.com

https://gudividends.com

|https://guswinger.com

https://gublockchain.com

Email:

stewart@gracelandupdates.com

stewart@gracelandjuniors.com

stewart@gudividends.com

stewart@guswinger.com

admin@gublockchain.com

November 20, 2018

- After breaking upside from a double bottom pattern, gold continues its solid price action. More good times lie directly ahead for precious metals investors, because Chinese New Year buy season begins very soon.

- Please click here now. Double-click to enlarge. Note the solid position of my key 14,7,7 Stochastics indicator on this daily gold chart.

- The U.S. stock market’s “traditional end of the year rally” is turning into a veritable turkey shoot for the bears. Gold seems immune to the action, suggesting that unseen inflationary pressures may be larger than most investors realize.

- Please click here now. Double-click to enlarge. Investors need to understand that as the business cycle matures, volatility in the stock market rises.

- Any decline could be the start of a bear market. A “buy the dip” approach to the market becomes a death trap as corporate earnings peak, rates rise, GDP peaks, and inflation gains attention.

- The bottom line: U.S. stock market bears crack the whip, and late cycle price chasers take a horrific trip!

- Please click here now. Morgan Stanley’s top currency analysts believe the dollar has peaked against most of the currencies it recently rallied against. Hedge fund “superman” Ray Dalio is talking about a 30% dollar devaluation. He proposes monetizing the U.S. government’s huge debt as a “final solution.”

- I’ve suggested a “Plaza Accord 2.0” is going to happen. I believe U.S. President Trump will lead preliminary discussions about it from behind closed doors at the upcoming G20 meeting.

- Please click here now. As empires peak and then die, the peak usually comes with the nation enveloped in a state of “war worship.”

- Massive amounts of money are borrowed by the government to fund the madness, but even that isn’t so enough, so more is extorted via “taxes” from struggling citizens.

- In the case of America, more than 25% of the government’s gargantuan debt is easily attributable to war worship.

- The final nail the U.S. government’s debt coffin likely came when instead of cutting the capital gains tax to zero and beginning a Treasury monthly gold buy program, the government decided to impose tariff taxes to “boost growth and make trade fair.”

- Import tariffs are the best form of taxation, but only when used instead of income and capital gains taxation. In this case, tariffs are layered on top of income and capital gains taxes. The bottom line: Instead of becoming a super-sized version of Switzerland, America risks becoming a stagflationary wasteland.

- Ray Dalio speaks of “other currencies” rising to prominence as the dollar fades. He says he doesn’t want to be specific about it though. Is that because gold is one of those currencies?

- The U.S. stock market has begun collapsing, inflation is on the move, and junior miners should be looking good. Are they?

- For the answer to that question, please click here now. Double-click to enlarge. Most of the world’s smallest resource companies are in the Canadian CDNX index.

- It’s the best indication of the overall health of the global junior mining and junior energy sectors. I highlight key buy and sell action points on my www.gracelandjuniors.com website for many of the CDNX component stocks. This is a look at the signals for the index itself.

- There’s no significant buy signal yet, but in early 2019 as inflation likely moves higher and U.S. GDP declines, a “America, it’s time to usher in the new year with a new and not so exciting era of substantial stagflation!” welcome mat will be rolled out.

- I expect to get a major buy signal for the entire junior mining sector as that happens.

- Please click here now. Double-click to enlarge. I’m impressed with the price action of GDX on this daily chart.

- Note how quickly GDX has surged back above the neckline of that pesky H&S top pattern after breaking down. That’s positive action and now there’s a bull wedge in play too!

- Please click here now. Double-click to enlarge this long term GDX “Trigger Time” chart.

- Investors also need to watch the price of Barrick (ABX-NYSE) closely. If it can close above $14.00 on Friday of this week, that will be a major buy signal, and Barrick is my most important lead indicator for GDX and the entire senior gold stocks sector.

- All gold stock investor eyes need to be laser-focused on the $22.50 zone for GDX, because if GDX can stage two consecutive Friday closes above that price, I will have a massive buy signal in play!

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

The mega-cap stocks that dominate the US markets are just finishing another monster earnings season. It wasn’t just profits that soared under Republicans’ big corporate tax cuts, but sales surged too. That’s no mean feat for massive mature companies, but sustained growth at this torrid pace is impossible. So peak-earnings fears continue to mount while valuations shoot even higher into dangerous bubble territory.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the US Securities and Exchange Commission, these 10-Qs contain the best fundamental data available to investors and speculators. They dispel all the sentimental distortions inevitably surrounding prevailing stock-price levels, revealing the underlying hard fundamental realities.

The deadline for filing 10-Qs for “large accelerated filers” is 40 days after fiscal quarter-ends. The SEC defines this as companies with market capitalizations over $700m. That currently includes every single stock in the flagship S&P 500 stock index, which includes the biggest and best American companies. As Q2’18 ended, the smallest SPX stock had a market cap of $4.1b which was 1/225th the size of leader Apple.

The middle of this week marked 39 days since the end of calendar Q2, so almost all of the big US stocks of the S&P 500 have reported. The exceptions are companies running fiscal quarters out of sync with calendar quarters. Walmart, Home Depot, Cisco, and NVIDIA have fiscal quarters ending a month after calendar ones, so their “Q2” results weren’t out yet as of this Wednesday. They’ll arrive in coming weeks.

The S&P 500 (SPX) is the world’s most-important stock index by far, weighting the best US companies by market capitalization. So not surprisingly the world’s largest and most-important ETF is the SPY SPDR S&P 500 ETF which tracks the SPX. This week it had huge net assets of $271.3b! The IVV iShares Core S&P 500 ETF and VOO Vanguard S&P 500 ETF also track the SPX with $155.9b and $96.6b of net assets.

The vast majority of investors own the big US stocks of the SPX, as they are the top holdings of nearly all investment funds. So if you are in the US markets at all, including with retirement capital, the fortunes of the big US stocks are very important for your overall wealth. Thus once a quarter after earnings season it’s essential to check in to see how they are faring fundamentally. Their results also portend stock-price trends.

Unfortunately my small financial-research company lacks the manpower to analyze all 500 SPX stocks in SPY each quarter. Support our business with enough newsletter subscriptions, and I would gladly hire the people necessary to do it. For now we’re digging into the top 34 SPX/SPY components ranked by market capitalization. That’s an arbitrary number that fits neatly into the tables below, and a dominant sample.

As of the end of Q2’18 on June 29th, these 34 companies accounted for a staggering 42.6% of the total weighting in SPY and the SPX itself! These are the mightiest of American companies, the widely-held mega-cap stocks everyone knows and loves. For comparison, it took the bottom 431 SPX companies to match its top 34 stocks’ weighting! The entire stock markets greatly depend on how the big US stocks are doing.

Every quarter I wade through the 10-Q SEC filings of these top SPX companies for a ton of fundamental data I dump into a spreadsheet for analysis. The highlights make it into these tables below. They start with each company’s symbol, weighting in the SPX and SPY, and market cap as of the final trading day of Q2’18. That’s followed by the year-over-year change in each company’s market capitalization, a critical metric.

Major US corporations have been engaged in a wildly-unprecedented stock-buyback binge ever since the Fed forced interest rates to deep artificial lows during 2008’s stock panic. Thus the appreciation in their share prices also reflects shrinking shares outstanding. Looking at market-cap changes instead of just underlying share-price changes effectively normalizes out stock buybacks, offering purer views of value.

That’s followed by quarterly sales along with their YoY changes. Top-line revenues are one of the best indicators of businesses’ health. While profits can be easily manipulated quarter-to-quarter by playing with all kinds of accounting estimates, sales are tougher to artificially inflate. Ultimately sales growth is necessary for companies to expand, as bottom-line earnings growth driven by cost-cutting is inherently limited.

Operating cash flows are also important, showing how much capital companies’ businesses are actually generating. Using cash to make more cash is a core tenet of capitalism. Unfortunately most companies are now obscuring quarterly OCFs by reporting them in year-to-date terms, which lumps in multiple quarters together. So these tables only include Q2 operating cash flows if specifically broken out by companies.

Next are the actual hard quarterly earnings that must be reported to the SEC under Generally Accepted Accounting Principles. Late in bull markets, companies tend to use fake pro-forma earnings to downplay real GAAP results. These are derided as EBS earnings, Everything but the Bad Stuff! Companies often arbitrarily ignore certain expenses on a pro-forma basis to artificially boost their profits, which is very misleading.

While we’re also collecting the earnings-per-share data Wall Street loves, it’s more important to consider total profits. Stock buybacks are executed to manipulate EPS higher, because the shares-outstanding denominator of its calculation shrinks as shares are repurchased. Raw profits are a cleaner measure, again effectively neutralizing the impacts of stock buybacks. They better reflect underlying business performance.

Finally the trailing-twelve-month price-to-earnings ratio as of the end of Q2’18 is noted. TTM P/Es look at the last four reported quarters of actual GAAP profits compared to prevailing stock prices. They are the gold-standard metric for valuations. Wall Street often intentionally obscures these hard P/Es by using the fictional forward P/Es instead, which are literally mere guesses about future profits that often prove far too optimistic.

Not surprisingly in the second quarter under this new slashed-corporate-taxes regime, many of the mega-cap US stocks reported spectacular Q2’18 results. For the most part sales, OCFs, and earnings surged dramatically. The big problem is such blistering tax-cut-driven growth rates are impossible to sustain for long at the vast scales these huge companies operate at. Downside risks are serious with bubble valuations.

The elite market-darling mega tech stocks continue to dominate the US stock markets. Most famous are the FANG names, Facebook, Amazon, Netflix, and Alphabet which used to be called Google. Apple and Microsoft should be added to those rarified beloved ranks. Together these half-dozen companies alone accounted for nearly 1/6th of the SPX’s entire market cap! That’s an incredible concentration of capital.

This highlights the extreme narrowing breadth behind this very-late-stage bull market. At the month-end just before Trump’s election victory in early November 2016, these same tech giants weighed in at 12.3% of the SPX weighting compared to 16.4% today. And if you go all the way back to this bull’s birth month of March 2009, MSFT, GOOGL, AAPL, and AMZN weighed in at 5.4%. FB and NFLX weren’t yet in the SPX.

Ever more capital is crowding into fewer and fewer stocks as fund managers chase the biggest winners and increasingly pile into them. And these 6 elite mega techs’ Q2’18 results show why they are widely adored. Their revenues rocketed 30.3% YoY on average, more than doubling the 14.0% growth in this entire top-34 list! Excluding these techs, the rest of the top 34 only grew their sales by 10.0% or a third as much.

That vast outperformance is reflected in their market-cap gains too, which again normalize out all the big stock buybacks. Overall these top SPY companies’ values surged 23.5% higher YoY, nearly doubling the 12.2% SPX gain from the ends of Q2’17 to Q2’18. But these top 6 tech stocks’ stellar average gains of 57.5% YoY dwarfed the rest of the top 34’s 16.2% annual appreciation! These stocks are loved for good reason.

The same is true on the profits front, with AAPL, AMZN, GOOGL, MSFT, FB, and NFLX trouncing the rest of these biggest US stocks. These 6 tech giants saw staggering average earnings growth of 289.1% YoY, compared to 30.9% for the rest of the top 34. That former number is heavily skewed by Amazon’s results though, as its profits skyrocketed an astounding 1186% from $197m in Q2’17 to $2534m in Q2’18.

Netflix had a similar enormous 484% YoY gain in earnings from a super-low level. Interestingly the rest of these big 6 tech stocks saw average growth of just 16.0% YoY, only about half that of the rest of the top 34. That proves the enormous surge in mega-cap-tech stock prices over this past year wasn’t driven by earnings as bulls often claim. Stock-price appreciation has far outstretched profits growth, an ominous sign.

In conservative hard trailing-twelve-month price-to-earnings-ratio terms, the big-6 tech giants sported an incredible average P/E of 107.3x earnings exiting Q2! That is deep into formal stock-bubble territory over 28x, which is itself double the century-and-a-quarter average fair value of 14x in the US stock markets. Again AMZN and NFLX are skewing this way higher though, with their insane 214.8x and 263.9x P/E ratios.

P/Es are the annual ratio of prevailing stock-price levels to underlying profits. So they can be viewed as the number of years it would take a company to earn back the price new investors today are paying for it. A stock bought at 200x earnings would take 200 years to merely recoup its purchase price through profits, assuming no growth of course. Buying at these heights is crazy given humans’ relatively-short investing lifespan.

Assuming people start investing young at 25 years old and retire at 65, that gives them about 40 years of prime investing time. So buying any stock above 40x implies a time horizon well beyond what anyone actually has. And provocatively even excluding the crazy P/Es of Amazon and Netflix, the rest of these big 6 tech stocks still average extremely-high 41.2x P/Es. And ominously that is right in line with market averages.

Without those elite tech leaders, the rest of these top 34 SPY stocks had average TTM P/Es of 41.0x when they exited Q2. History has proven countless times that buying stocks near such extreme bubble valuations has soon led to massive losses in the subsequent bear markets that always follow bulls. So these stock markets are extraordinarily risky at these valuations, truly an accident waiting to happen.

When stocks are exceedingly overvalued, the downside risks are radically greater than upside potential. After everyone is effectively all-in one of these universally-held mega tech stocks, there aren’t enough new buyers left to drive them higher no matter how good news happens to be. And these investors who bought in high and late can quickly become herd sellers when some bad news inevitably comes to pass.

Q2’18’s earnings season has already proven this in spades despite the extreme euphoria surrounding the stock markets and elite tech stocks in particular. Fully 3 of the 4 beloved FANG stocks showed just how overbought stocks react to news. The recent price action in Amazon, Netflix, and Facebook following their Q2 results is a serious cautionary tale for investors convinced mega tech stocks can rally indefinitely.

Everyone loves Amazon, but it is priced far beyond perfection. Its stock skyrocketed 75% YoY to leave Q2 with that ludicrous P/E of 214.8x. When any stock gets so radically overbought and overvalued, it has a tough time moving materially higher no matter what happens. Normally stocks shoot higher on blowout quarterly results as new investors flood into the strong company. But Amazon couldn’t find many buyers.

After the close on July 26th Amazon reported a monster blowout Q2. Its earnings per share of $5.07 was more than double analysts’ estimate of $2.50! Revenues, operating cash flows, and profits rocketed up an astounding 39.3%, 93.5%, and 1186.3% YoY. AMZN’s revenue guidance for Q3 at a midpoint running $55.8b also hit the low end of Wall Street expectations. Any normal stock would soar the next day on all that.

But while Amazon stock mustered a decent 4.0% gain at best the next day, that faded to a mere +0.5% close. AMZN was priced for perfection, so not even one of its best quarters ever was enough to bring in more buyers. Everyone already owns it, so who is left to deploy new capital? AMZN slumped 1.7% over the next several trading days, though it has since recovered to new record highs with the strong stock markets.

Netflix was the best-performing large US stock over the past year, skyrocketing 162% higher between the ends of Q2’17 to Q2’18! It had an absurd TTM P/E of 263.9x leaving Q2, more extreme than Amazon’s. But man, investors love Netflix with a quasi-religious fervor and believe it can do no wrong at any price. So Wall Street was eagerly anticipating NFLX’s Q2 results that came out after the close back on July 16th.

And they were really darned good. EPS of $0.85 beat the expectations of $0.79. On an absolute basis, sales and profits soared 40.3% and 484.3% YoY! Netflix did report negative operating cash flows, but it has been burning cash forever so that was no surprise. Yet despite these strong results this priced-for-perfection market-darling stock plunged 13%ish in after-hours trading! Good news wasn’t good enough.

Investors weren’t happy because subscriber growth was slowing. NFLX reported 5.2m net new streaming subscriptions in Q2, below the 6.3m expected and 7.4m in Q1. Netflix itself had provided earlier guidance of 1.2m US adds, but the actual was way short at 0.7m. So NFLX stock plummeted as much as 14.1% the next trading day before rebounding to a still-ugly -5.2% close. It couldn’t rally on great Q2 financial results.

And universally-held big stocks not responding favorably to quarterly results can quickly damage traders’ euphoric enthusiasm for them. The selling in Netflix’s stock gradually cascaded following that big hit on Q2 results. Over the next couple weeks, NFLX dropped 16.4% from its close just before that Q2 earnings release! The mega tech stocks aren’t invincible, and are very risky trading so high with everyone all-in.

With the possible exception of mighty Apple, Facebook was widely considered the least risky of the elite tech stocks as Q2 ended. Its 32.5x P/E was almost low by mega-tech standards, only bested by the 17.9x of Apple which is in a league of its own. FB reported after the close on July 25th, and shared great results led by a modest EPS beat of $1.74 compared to $1.72 expected. But the absolute gains were really big.

Facebook’s sales, operating cash flows, and profits soared 41.9%, 17.5%, and 31.1% YoY! That top-line revenue growth in particular was huge, nearly the best out of all these top 34 SPY stocks. And FB’s profits were growing so fast that it was the only elite mega-tech stock to see its TTM P/E actually decline YoY, retreating 14.2%. So FB looked much safer fundamentally than the other FANG stocks dominating the SPX.

But Facebook’s stock effectively crashed in after-hours trading immediately after those Q2 results, falling as much as 24%! The reason? It guided to slowing sales growth in Q3 and Q4 in the high single digits. FB was obviously priced for perfection and universally owned too, leaving nothing but herd sellers when anything finally disappointed. The next day FB stock plummeted a catastrophic 19.0%, stunning investors.

That wiped out an inconceivable $119.4b in market capitalization! That was the worst ever seen in one day by any single company in US stock-market history. More than ever investors and speculators need to realize that their beloved FANG stocks along with MSFT and AAPL aren’t magically exempt from serious selloffs. When any stocks are way overbought and wildly overvalued, it’s only a matter of time until selling hits.

Without these mega tech stocks, the US stock markets never would’ve gotten anywhere close to their current near-record heights. The flood of investment capital into Netflix over this past year was so huge it catapulted that company well into the ranks of the top 34. Its symbol is highlighted in light blue, along with a few other stocks, because it is new in the SPX’s top 34 in Q2. Outsized tech gains can’t happen forever.

Interestingly I found something else in their quarterly reports I haven’t yet seen discussed elsewhere. The total debt of these top 6 mega tech stocks soared an average of 36.5% higher YoY! That is way beyond the rest of the top 34 excluding the giant banks which have very-different balance sheets. Those other 18 top-34 SPY companies saw total debt only climb 6.0% YoY. Mega-tech debt is rocketing at 6.1x that rate!

While the elite tech stocks do have huge cash hoards, their spiraling debt is ominous. With the Fed deep into its latest rate-hike cycle, the carrying costs of debt are rising fast. With each passing month and each bond companies roll over, their interest expenses increase. At best those will cut into their profits, which will push their nosebleed P/Es even higher. They will have to slow debt growth and eventually pay back much.

We are talking huge amounts, $588.2b of total debt across Apple, Amazon, Google, Microsoft, Facebook, and Netflix alone! The main reason most of these companies are ramping their debt so fast is to finance massive stock buybacks propelling their share prices higher. They will have to really slow or even stop their huge buyback campaigns if their total debt or the carrying costs on it grow too large, a serious threat now.

These top 34 SPX stocks collectively had an extreme average trailing-twelve-month price-to-earnings ratio of 53.4x leaving Q2! That is nearly double historical bubble levels, exceedingly dangerous. There are far-higher odds the next major move in these hyper-expensive stock markets will be down rather than up. The next couple quarters face very different psychology and monetary winds than this rallying past year.

In both Q3 and Q4 last year, traders were ecstatic over the Republicans’ record corporate tax cuts that were excitingly nearing. In Q1 and Q2 this year, traders were dazzled by the incredible profits growth largely driven by sharply-lower taxes. While that will continue to some extent in Q3 and Q4 this year, the initial exuberance has mostly run its course. Big US stocks are facing tougher comparables going forward.

But the real threat to these bubblicious extreme stock markets is the Fed’s young quantitative-tightening campaign. It started imperceptibly in Q4’17 to begin unwinding the staggering $3625b of quantitative-easing money printing the Fed unleashed over 6.7 years starting in late 2008. Total QT in Q4’17 was just $30b. But it grew to another $60b in Q1’18 and then another $90b in Q2’18. And it is still getting bigger.