There is a clear point of cyclical investment plays: buy when then market is down, sell when the market is up. The downside? No one really knows when the dawn is about to break, and for investors in Sierra Leone’s mining sector, it’s only getting darker out there.

Recent weeks have brought news of mismanagement, assault, creative accounting and fleeing investors from the Marampa iron-ore project in Sierra Leone. There, Gerald Metals, a US-based commodities group, have struggled to reward investor confidence by failing to remove Marampa from care and maintenance despite the improvement in iron ore prices. Earlier in the year, Gerald’s key partners Shanghai Pengxin Investment Co Ltd. pulled out. Voting with their chequebooks, a number of Gerald’s lead creditors also jumped ship last week.

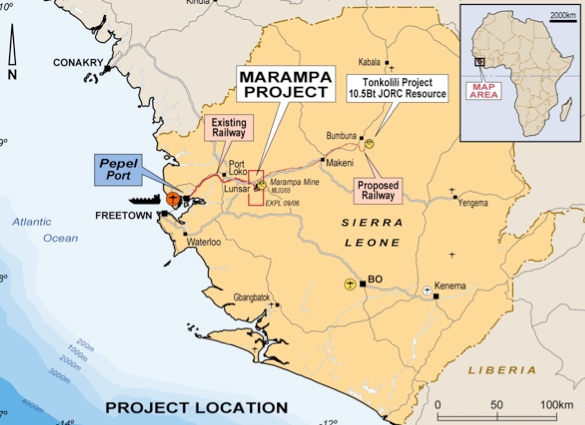

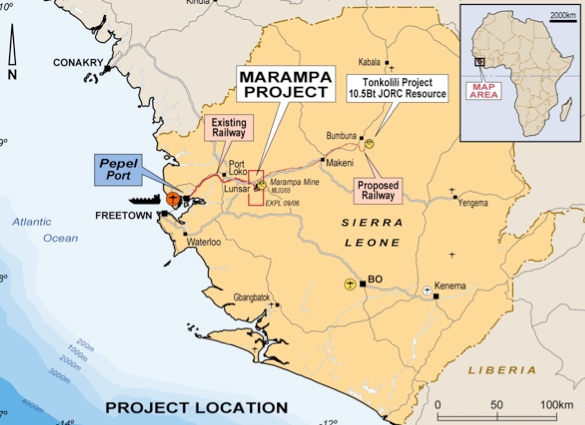

The problems for Marampa could only be getting worse. To market its product, Gerald Metals has sold investors on a promise of producing a higher grade of steel through a joint-venture with another local mine. In addition to relying on the rail network built to support the Tonkolili mine, Gerald Metals has trumpeted an agreement to blend the output from Marampa with that of Tonkolili to produce a higher quality, and higher value product. It was a very good idea.

The trouble: Tonkolili’s owners are now in almost as much trouble as Gerald.

In an email to investors at the tail end of 2017, Tonkolili’s operators, Shandong Iron & Steel Group Co, a Chinese outfit, explained that the company was going through a period of ‘financial hardship’ and would be suspending operations [1]. Shandong took ownership of Tonkolili in the wake of the collapse of its previous owner, African Minerals. The mine was placed in care and maintenance in 2014 as a result of Shandong, then owners of just 25% of Tonkolili, cutting the purse strings just as the mine required expansion. Shortly afterwards, Tonkolili’s owners went into administration and Shandong snapped up the remaining 75% at a fire-sale price [2].

But just like Gerald Metals’ at Marampa, Shandong have failed to deliver as majority owners of a previously minority share. Talk on the ground in Freetown suggests that not only is Shandong in financial difficulty, the company hasn’t actually been exporting anything out of Sierra Leone for almost four months. All the while, a half-laden ship is left anchored and rusting at Pepel Port at a demurrage cost in excess of $15,000 per day.

Of course, the issues we are seeing at Shandong and at Gerald Metals point to a much more worrying concern. What is going on with the due diligence procedures that the Government of Sierra Leone undertakes in the tendering process for mining licences? In an economy desperately in need of stable management of staple assets, the Government does not have the luxury of entrusting the state’s greatest resource pots to incompetent operators. Marampa and Tonkolili are two of the country’s biggest potential revenue earners: one is run by an accountant and his investors are leaving in droves; the other is quicker to cut and run than to stay and fight.

Oddly, spirits at these companies remain high. A punchy press release issued before Christmas by Brendan Lynch, CFO of Gerald Metals and formerly of collapsed Indian group Zamin Ferrous, thanked banks for their ongoing support of the Marampa project. But that faith, and indeed those thanks, may be short-lived.

Even with credit lines secured, if diminished, Gerald’s investors must now surely need to be reassured that the problems at Tonkolili will not affect assurances given over Marampa. It is hard to see how concrete pledges over any production targets, jobs or revenue projections can be given with the chief means of export and refinery in such dire straits. And there’s more to come. The full force of the Cape Lambert law suit is yet to be seen, and with Gerald Metals still needing to raise more than $50 million of investment to restart work at Marampa, the creditors will have reason to worry. One of those creditors, Dr. Adesola Adeduntan, the CEO of First Bank of Nigeria, recently met with President Bai Koroma [3]. If any assurances were given over the state of Government checks and balances on the private sector, examples like Marampa give plenty of reasons for that confidence to wear thin.

And as these questions begin to mount, and answers fail to convince, we cannot ignore the spectre of the authorities should their attention be drawn once again to Sierra Leone. It would be naïve to suggest that the Serious Fraud Office (SFO) and National Crime Agency (NCA) based out of the United Kingdom will not have any irregularities on their radar following the summer’s bribery drama at Sierra Rutile [4]. All foreign investors in Sierra Leone must toe a very careful line.

So as news this week tells us that Sierra Leone’s Ministry of Finance and Economic Development is planning to set up a task force to help the government ‘better manage revenue received’ from its mining sector, we may well ask where its priorities should fall. Given recent performance issues, I believe its first task should be looking at failing assets under foreign ownership. It is a scandal that is robbing the country of development, the people of jobs and the government of revenues that it badly, badly needs. Perhaps then there’ll be fewer smiles at Gerald Metals and Shandong when a little accountability comes knocking.

by Linus Booker

It is said that the most valuable commodity in Sierra Leone is diamonds. But in my experience, one commodity is priceless: trust. Contracts move, governments are ousted and money changes hands all the time, but the one thing you cannot buy in Sierra Leone is trust.

I’ve been based in Geneva from most of this year, but have been on a project in Freetown for the last 10 weeks. The talk of the town is all about how the creditors attached to one of the biggest foreign-owned mining investors here may be about to discover the value of trust the hard way. But if this blows up, knowing where to place the blame may raise as many questions about creative accounting as it does about management.

First, some context: there is a vast iron ore mine in the east of Sierra Leone that has the potential for 40 years of mining. The Marampa mine was first developed by London Mining, the erstwhile giant of African mining, before being snapped up and developed by one of Frank Timis’s companies when London Mining went bust. After the iron-ore price crashed in 2014, things went very quiet at Marampa before ownership quietly transferred to company called ‘SL Mining’ owned by Connecticut-based Gerald Metals. The iron ore price has since recovered, but production is yet to resume at Marampa. What’s more, lingering concerns over how Gerald secured the Marampa licence in the first place has meant that scrutiny on the ground is mounting by the day.

Since mid-November there have been concerns voiced in the local newspapers in Sierra Leone about Gerald Metals. Articles have variously claimed that Gerald Metals is under serious pressure from the government over its dismal performance, or claimed that Gerald Metals is about to lose its mining licence. Wednesday’s news from Freetown tells us Gerald Metals has some support of the government, but for many observers this too will raise more questions than it answers.

Since Gerald Metals first acquired the licence at Marampa, rumours of foul-play have surrounded the company. Their near-overnight acquisition of the mine in March this year did not go unnoticed by newspapers here in Sierra Leone, with the kindest criticism being raised over inexperience of the new management. Given the problems restarting production at Marampa, it does seem fair to ask what faith should be placed in Gerald’s CEO, Craig Dean, who trained as a forensic accountant at Deloitte, not in metals trading, not even in mining.

For creditors, keeping an eye on the Deloitte connection may be sensible. Deloitte currently represents Gerald Metals. The accountancy firm has enough trouble on the African continent already, and by all accounts, the scandal surrounding the Steinhoff empire is yet to run its full course. Newspapers are already suggesting that an investigation into Deloitte’s compliance with international audit standards is around the corner.

And those checks may come sooner rather than later. Why? Well, according to reports online, Gerald’s credit lines for Marampa are up for review.[1] Banks like BNP Paribas, Credit Suisse, Deutsche Bank and Credit Agricole will be weighing the merits of renewing the $225m float currently attached to Marampa. Presumably in response to mismanagement of Marampa, the creditors have already decreased their exposure following an initial float of $300m for Gerald in 2014. So, any news of accounting irregularities, added to the fact that production at Marampa remains dormant, could spell real trouble for Gerald’s credit lines. With BNP Paribas still smarting from the $8.9 billion fine it received for its ties with Cuba, Iran and Sudan, this is no time for their compliance teams to risk another scandal on the books.

So, Gerald may have been given a stay of execution from the Government of Sierra Leone, but it remains to be seen if their creditors will be so merciful.

[1] http://www.tfreview.com/news/

Linus Booker is principal consultant with Chavenage Mining Consultants, an independent practice he established in 2005. Previously a contractor with a number of blue-chip extractive firms, Linus has worked in Zambia, Russia and Sierra Leone, and is currently based between London and Zurich. He is married with three children.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan