As I have explained in my previous post on the world gold production, the share of major gold producing countries in the world gold production decreases. But what about the relative production from major gold miners?

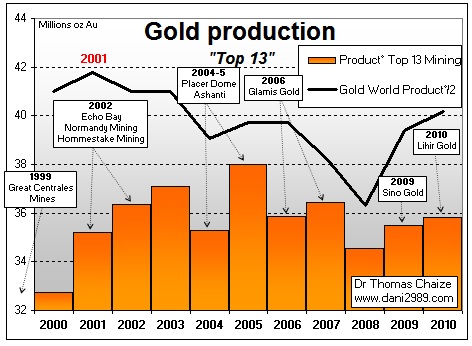

As shown in the chart below, world gold production has decreased since 2001 (black line). Similarly, the gold production of the thirteen largest gold miners in the world (orange line) has decreased since 2006. This time shift can be explained by the acquisitions that major gold producers have made on many smaller gold producers around the world. Through acquisition they were able to increase their production temporarly but this does not change the fact that, overall, their respective world gold production is decreasing.

Here are some of the main takeovers of gold producers since 1999: Great Central Mining, Echo Bay (Canada), Normandy (Australia), Hommestake (oldest gold mine in the United States which survived the great depression in 1929), Placer Dome (Canada, founded in the early 19th century), Ashanti (South Africa, producing gold since 1897), Glamis Gold (Canada), Sino Gold (Australia), and Lihir Gold (Australia).

Despite these major takeovers, accounting for tens of billions of dollars, the relative production from major gold producers around the world has declined since 2008. It decreased from 47% in 2007 to 44.5% in 2010. The increase in the world gold production observed since 2008 is the result of smaller gold mines going into production (gold miners producing less than 500,000 ounces of gold per year).

In summary, the growth of world gold production since 2008 arises from a mosaic of small producers. This “atomization” of world gold production into less rational small production requires a high gold price. Smaller producer countries and smaller gold miners have stabilized world gold production in the short term (1-3 years). However, this is not enough to revive global production which is still below its level of 2001 despite the rise in gold prices over the past 10 years.

The takeover of the largest gold mine in the world by a major copper producer in Zambia is symptomatic of the situation of the major gold miners. The large scale gold deposits are increasingly rare and large gold miners are “forced” to produce more and more copper, zinc, lead, silver, molybdenum or uranium.

From the article entitled, “Gold Production of Large Gold Miners” by Dr. Thomas Chaize author of the Mining and Energy Newsletter. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan