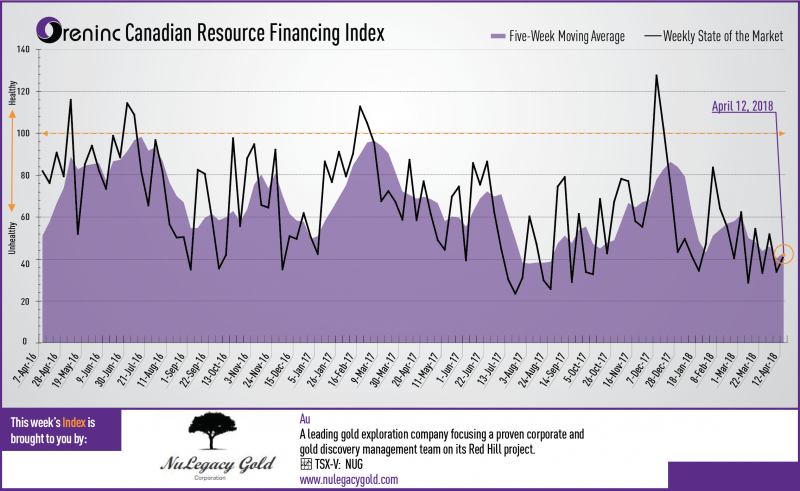

Last week index score: 33.86

This week: 41.32

Zinc One Resources (TSXV:Z) announces the final drill results from the Bongarita mineralized zone at its Bongará zinc mine project in north-central Peru.

We recently uploaded 43 CEO Elevator pitches to our Youtube channel! We also uploaded two videos of Brent Cook of Exploration Insights walking the floor of PDAC talking rocks with Morgan Poliquin of Almadex Minerals and Kevin Heather of Regulus Resources – go check them out!

The Oreninc Index rose in the week ending April 13th, 2018 to 41.32 from 33.86 a week ago as brokered action returned to the market.

Market volatility experienced another twist as tensions in Syria notched up, this time due to an alleged chemical weapons attack by the ruling regime of Bashar al Assad on the rebel-held town of Douma and the promise of pending punitive action by US president Donald Trump who warned that “missiles will be coming” (that subsequently occurred in the early hours of Saturday morning).

As a result, there was safe haven precious metals buying.

On to the money: total fund raises announced almost fell by half to C$166.0 million, a three-week low, which included three brokered financings for C$12.2 million, a two-week high, and one bought deal financing for C$5.0 million, a four-week high. The average offer size dropped to C$2.4 million, a three-week low.

Another volatile week for gold which saw the yellow metal close up at US$1,346/oz from US$1,333/oz a week ago with a mid-week high of US$1,353/oz. Gold is now up 3.33% this year. Meanwhile, the US dollar index closed down at 89.80 from 90.10 a week ago. The van Eck managed GDXJ gained more than a dollar to close up at US$33.49 from US$32.39 last week. The index is down 1.88% so far in 2018. The US Global Go Gold ETF also saw strong growth to close up at US$12.81 from US$12.51 a week ago. It is down 1.54% so far in 2018. The HUI Arca Gold BUGS Index closed up at 184.32 from 177.59 last week. The SPDR GLD ETF continued to see buying action and closed up at 865.89 tonnes from 859.99 tonnes a week ago.

In other commodities, silver closed up at US$16.65/oz from US$16.38/oz a week ago. Copper showed a slight increase to close at US$3.07/lb from US$3.05/lb last week, a week that saw the CRU World Copper Conference in Santiago, Chile and various presenters talk about the shortage of new copper mine projects coming through. Oil saw strong gains to close up at US$67.39 a barrel from US$62.06 a barrel a week ago.

The Dow Jones Industrial Average closed up at 24,360 from 23,932 last week. Likewise, Canada’s S&P/TSX Composite Index grew to 15,273 from 15,207 the previous week. The S&P/TSX Venture Composite Index closed up at 795.94 from 769.15 last week.

Summary:

- Number of financings increased to 28, a four-week high.

- Three brokered financings were announced this week for C$12.2m, a two-week high.

- One bought-deal financing was announced this week for C$5.0m, a four-week high.

- Total dollars dropped to C$66.0m, a three-week low.

- Average offer size also dropped to C$2.4m, a three-week low.

Financing Highlights

Maya Gold & Silver (TSXV: MYA) announced a non-brokered private placement of C$25.0 million through the issuance of 7.6 million shares @ C$3.30.

- No warrants will be issued.

- The net proceeds will be used to continue the development and expansion of the Zgounder silver mine in Morocco. Maya plans to begin building a second mine at Zgounder that will increase production capacity to 2,000 tpd by 2021.

Major Financing Openings:

- Maya Gold & Silver (TSX-V: MYA) opened a C$25-million offering on a best efforts basis. The deal is expected to close on or about April 13th.

- Critical Elements (TSX-V: CRE) opened a C$5-million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. Each unit includes half a warrant that expires in 24 months. The deal is expected to close on or about May 1st.

- Avino Silver & Gold Mines (TSX: ASM) opened a C$5-million offering underwritten by a syndicate led by Fitzgerald Canada on a best efforts basis. The deal is expected to close on or about April 27th.

- Noront Resources (TSX-V: NOT) opened a C$4.2-million offering on a best efforts basis.

Major Financing Closings:

- Orezone Gold (TSX: ORE) closed a C$44.92-million offering on a best efforts basis.

- Amarillo Gold (TSX-V: AGC) closed a C$5.16-million offering on a best efforts basis. Each unit included half a warrant that expires in 24 months.

- Aguia Resources (TSX-V: AGRL) closed a C$5-million offering underwritten by a syndicate led by Echelon Wealth Partners on a bought deal basis. Each unit included half a warrant that expires in 36 months.

- Noront Resources (TSX-V: NOT) closed a C$4.2-million offering on a best efforts basis.

Company News

Zinc One Resources (TSX-V: Z) announces the final drill results from the Bongarita mineralized zone at its Bongará zinc mine project in north-central Peru.

- 36 holes for 583m were drilled at Bongarita. Very fine-grained zinc mineralization, mostly as silicates exclusively hosted by soils, has been delineated over about 7,500m2.

- Two portable rigs continue to drill at Mina Chica and Mina Grande Sur.

- Highlights included 2.4m @ 42.8% Zn

- Zinc One also announced its first ever drill results that confirmed a high-grade zinc mineralized zone at Mina Chica, about 200m east of Bongarita.

- Highlights included 16.5m @ 35.6% Zn.

Analysis

The drilling at Bongarita has confirmed that the amount of mineralized soils should be similar in size and grade to the historical resource. The company believes that drill data along with the previous pit and channel sampling data, will provide enough data to delineate a resource. Combined with the positive first results from Mina Chica, the Bongarita project is shaping up to have significant zinc potential from surface, which bodes well for the possibility of a mine being developed in the future.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan