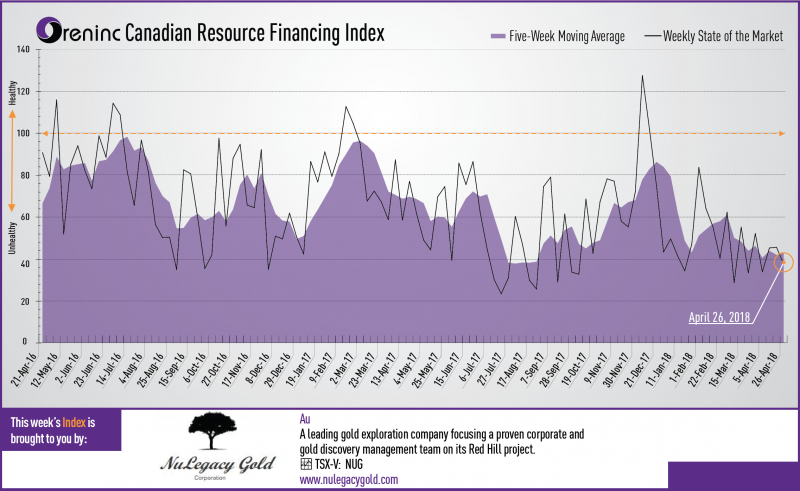

Last week index score: 45.59 (updated)

This week: 37.75

Oreninc: Interview Session with Mickey Fulp – Episode 22 now live

The Oreninc Index fell in the week ending April 27th, 2018 to 37.75 from an updated 45.59 a week ago as the number of deals fell despite some broker action returning.

A calmer and less volatile week all round with the presidents of North and South Korea meeting for the first time in decades, thawing tensions over the north’s nuclear ambitions, whilst in the US, president Donald Trump eased his position on sanctions against Russian aluminium producer Rusal. Maybe spring is in the air and the world is feeling more positive.

Another range-bound week for gold, this time ending in negative territory as the US dollar strengthened, although there are signs that gold stocks are starting to strengthen.

On to the money: total fund raises announced more than quadrupled to C$96.3 million, a four-week high, which included one brokered financing, a four-week low, and one bought deal financing, also a four-week low. The average offer size also more than quadrupled to C$4.8 million, a four-week high. However, the number of financings decreased to 20, a four-week low.

Gold closed down at US$1,324/oz from US$1,336/oz a week ago. Gold is now up 1.63% this year. Meanwhile, the US dollar index continued to strengthen and closed up at 91.54 from 90.31 a week ago. The van Eck managed GDXJ gave up ground and closed down at US$33.03 from US$33.49 last week. The index is down 3.22% so far in 2018. The US Global Go Gold ETF also fell to close down at US$12.99 from US$13.04 a week ago. It is down 0.12% so far in 2018. The HUI Arca Gold BUGS Index closed down at 182.04 from 184.18 last week. The SPDR GLD ETF saw a growth week as its inventory grew to 871.20 from 865.89 tonnes where it had been for nine-days straight.

In other commodities, silver’s recent growth spurt deflated and closed down at US$16.51/oz from US$17.11/oz a week ago. Copper also gave up a lot of ground as it closed down at US$3.06/lb from US$3.15/lb last week. Oil consolidated despite a slight loss on the week to close down at US$68.10 a barrel from US$68.40 a barrel a week ago.

The Dow Jones Industrial Average lost some ground and closed down at 24,311 from 24,462 last week. Canada’s S&P/TSX Composite Index put in a strong growth week as mining stocks showed growth to close at 15,668 from 15,484 the previous week. The S&P/TSX Venture Composite Index closed down at 783.76 from 804.96 last week.

Summary:

- Number of financings decreased to 20, a three-week low.

- One brokered financing was announced this week for C$15m a three-week low.

- One bought-deal financing was announced this week for C$15m, a three-week low.

- Total dollars nearly doubled to C$96.3m, a three-week high.

- Average offer size grew to C$4.8m, a three-week high.

Financing Highlights

SilverCrest Metals (TSX-V: SIL) announced a C$15 million bought deal financing

Syndicate of underwriters led by PI Financial and Cormark Securities for 7.1 million shares @ C$2.10.

- 15% over-allotment Option.

- Net proceeds will be used to continue exploration and drilling to deliver an updated resource estimate and maiden Preliminary Economic Assessment for the Las Chispas project in Sonora. Mexico.

Major Financing Openings:

- Africa Energy (TSX-V: AFE) opened a C$57.98 million offering on a best efforts basis. The deal is expected to close on or about May 4, 2018.

- Silvercrest Metals (TSX-V: SIL) opened a C$15 million offering underwritten by a syndicate led by PI Financial on a bought deal basis. The deal is expected to close on or about May 18, 2018.

- Pacton Gold (TSX-V: PAC) opened a C$4 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months. The deal is expected to close on or about May 22, 2018.

- Max Resource (TSX-V: MXR) opened a C$3.75 million offering on a best efforts basis. Each unit includes half a warrant that expires in 24 months.

Major Financing Closings:

- Nemaska Lithium (TSX-V: NMX) closed a C$99.08 million offering on a best efforts basis.

- Trilogy Metals (TSX-V: TMQ) closed a C$31.48 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis.

- Stina Resources (TSX-V: SQA) closed a C$12.5 million offering on a best efforts basis. Each unit included half a warrant that expires in 36 months.

- Ashanti Gold (TSX-V: AGZ) closed a C$2.64 million offering on a best efforts basis.

Company News

Prospero Silver (TSX-V: PSL) provide an update on planned exploration work on its Mexican projects for 2018.

- The key objective is to complete first-pass, proof-of-concept drill testing of three projects in the Altiplano belt of northern Mexico: Bermudez, Buenavista and Trias. Neither Trias or Bermudez have been drilled before.

- About 6,000m of diamond drilling is planned.

- A 4th hole for Pachuca SE project may be drilled once drilling is complete at the projects above.

Analysis

Having recently announced a fund raise, the work plan shows that Prospero will continue to drill test the targets it has identified via its geological hypothesis for discovering large, blind silver deposits. Whilst the news release did not explicitly state that its strategic partner Fortuna Silver (TSX:FVI) would co-fund this exploration program, that seems likely given the technical success of the 2017 exploration program and that Fortuna has yet to select a project to joint-venture under its strategic agreement with Prospero.

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

www.miningdealclub.com

MEET US AT THE INTERNATIONAL MINING INVESTMENT CONFERENCE

MAY 15-16, 2018, VANCOUVER, CANADA

Oreninc Presentation: Tuesday, May 15th, 1:00 – 1:20pm

SPDR Gold Shares is an ETF that tracks the performance of gold in the financial markets. It is denominated by the ticker GLD and is one of the most widely watched gold indicators. The gold price is influenced by a unique set of factors. These include interest rates, the strength of the USD, supply and demand, etc. For casual traders, it’s important to know that gold is the go-to investment when equities markets sour.

When geopolitical uncertainty rocks the financial markets, investors typically flock to gold as a safe-haven asset. It tends to perform strongly when stock prices are volatile, and when the USD is weak. A strong dollar is a disincentive to gold investors, since gold is a dollar-denominated asset that appreciates when the precious metal is more affordable to foreign buyers.

GLD provides one access point to investments in gold (there are many options available), and it is priced at a fraction of the gold price. For example, GLD was trading around $127.62 per share (April 16, 2018), above both the 50-day moving average of $126.15, and the 200-day moving average of $123.13. This clearly illustrates that gold is bullish. Corroborating evidence is available from the anaemic performance of US stock markets.

- The Dow Jones has a year to date return of -0.43%

- The S&P 500 Index has a year to date return of 0.22%

- The NASDAQ Composite Index has a year to date return of 3.72%

Poor Stock Market Performance Feeds Gold Price

The 2018 performance of stock markets is precisely the cannon fodder that commodities like gold need to appreciate. When traders and investors are pulling their money from the stock market, they are either investing it in fixed-interest-bearing securities or shifting resources to gold stocks and physical gold.

The current price of gold (April 16, 2018) is $1,349.10 per ounce on the Comex. Gold was priced at around $1,316.10 on 2 January 2018, and it has consistently appreciated ever since. In percentage terms, gold is up 2.5% for the year to date. This represents the opposite of what we are seeing in equities markets, and it holds true from a theoretical perspective.

Commodities trading options include a wide range of choices These include physical assets, futures contracts, options, exchange traded funds, CFDs, stocks, and even binary options. Gold ranks as one of the most commonly traded commodities and has been a store of value for millennia. Its price is determined by supply & demand considerations, and it is heavily influenced by monetary policy (interest rate hikes), political considerations, and the strength of the USD. A useful barometer of USD strength or weakness is the US dollar index, DXY. This indicator tracks the performance of the greenback against a trade-weighted basket of currencies including the SEK, CAD, GBP, EUR, CHF, and JPY.

Trump and Oil Boosted Gold Prices in 2017

US stock markets have floundered in 2018, and gold is in the black. If we extrapolate back to 2017, gold traded at around $1,151 per ounce in January 2017 and by the end of the year it closed at over $1,309 per ounce. That represents a 13.8% appreciation in the gold price. Equities markets also defied gravity in 2017, with double digit gains for major bourses. It appears that confidence in gold was boosted by uncertainty with oil prices and additional uncertainty related to Trump’s election as president. We have seen a tempering of these concerns as time progressed, and gold has stabilized while equities markets have retreated.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan