Honey Badger Silver (TSXV:TUF) recently announced steps towards a critical acquisition in Chile, the Cachinal De La Sierra Silver-Gold Project(Cachinal) that significantly advances the company’s aim to build a high-value portfolio of silver assets. The acquisition once finalized brings a quality project with an existing resource in Chile’s Antofagasta Region, a mineral-rich area famous for high-grade deposits.

This accretive addition to Honey Badger Silver’s portfolio is also in a favourable jurisdiction in close proximity to Austral’s Guanaco mine and mill complex which present compelling synergies for the project’s advancement to production.

MiningFeeds spoke with Honey Badger Silver’s Non-Executive Chair, Chad Williams, about the acquisition and the company’s distinctive strategy that sets it apart from most other silver companies:

So we’ll start off with Honey Badger’s current focus, Cachinal and why it could become a cornerstone asset for the company.

Chad: It’s one more step in the execution of our business plan and fulfilling our vision of being a high-quality go-to silver stock. And what Cachinal has is a resource.

If you envision, if you will, creating a company that will be worth a billion dollars when the silver price hits $100 an ounce. So we can discuss why we think silver’s going to go there. But clearly, silver is a long way from there today.

And I know how to do that because I used to run a gold exploration company called Victoria Gold. And during the financial crisis, we acquired the Dublin Gulch project in the Yukon. We paid $8 million for it. When everybody else was in the fetal position, we thought it was a buyer’s market, just like it is now.

We were very aggressive by it. And now Victoria Gold is a multi-billion dollar company. Now, obviously, they’ve executed their business plan and built a mine. They’ve done lots of really good things, but the point is that we are going to continue to be aggressive and add value, while everybody else is hiding under their desks.We want to be seen as an active ETF, an Exchange Traded Fund, whereby an investor can, let’s say, participate in the price of silver because an ETF can hold a lot of silver bullion or silver stocks, but we’re different in the sense that we’ll be accumulating silver assets and managing them. We’ll be adding value to them. In some instances, they’ll be accretive to the point of selling, while in others, we’ll be spinning off royalties. There are all kinds of things we can do to create value.

Cachinal is a roughly 20 million-ounce silver deposit in Chile, one of the best jurisdictions and mining-friendly. Additionally, it’s located very close to Austral Gold’s Guanaco mill. And we are in very good standing with Austral Gold. Think of Honey Badger as a big sister company to Austral Gold. The location makes ultimate logistic sense and I don’t think the market really understands how important that mill is or will be to our future.

To go back to the ETF analogy, the Cachinal acquisition adds an element of diversification to a portfolio essentially focused in Canada correct?

That’s definitely one favourable aspect to it. What really sets Honey Badger Silver apart from the field is its three-tiered portfolio strategy of aggregating diversified silver assets at various stages of advancement including royalties and streams utilizing the balance sheets of others. This allows us to advance and derisk assets while trading at a net present value similar to valuing a commodity ETF. That’s category one. Category two is ounces in the ground and Cachinal is a great example of that.

The third category ’is the exploration-development of high-quality assets, which Plata is a great example of and Clear Lake is another very good example. So we’ve got assets in the Yukon, Ontario, and Chile, which if you look on a global scale, are three jurisdictions that always rank in the top 10. They’re very attractive jurisdictions for mining.

And for Cachinal specifically, with a historical resource place, is there a timeline for the property?

So obviously, our focus right now is closing the transaction and things are going well on that front. One of the benefits, ironically, is that Chile is in the opposite season. So while it’s getting colder here in North America, it’s actually starting to get warmer there, allowing for work to be done then. It’s a little bit more advantageous to do it in the period say September to July.

Now, as for the timeline, that will be determined with the assistance of Austral Gold. We’ll determine what the right course of action is. They absolutely would like to have some of the mill feed from Cachinal right now.

And so we’ve had very preliminary discussions. In a best-case scenario, we could conceivably be producing some cash flow and revenue within 18 months from that. And of course, the reason that could work is because of, and I keep repeating myself, the proximity and the desirability of Austral Gold and their mill; it has water access and tailings capacity etc.

So that’s why Cachinal is a very important strategic acquisition for us. In fact, I will add that even though Aftermath, the vendors, decided to sell Cachinal, they agreed to sell it to us because they know that our relationship with Austral Gold can unlock a tremendous amount of value from the Cachinal asset.

There’s been a lot of change in Latin America recently, but Chile and Gabriel Boric are very supportive of foreign investment and he understands the mining industry and resource development. Have you also looked at other projects in Chile before, or possibly in the future? Is this the start of a new frontier for Honey Badger’s future acquisitions?

So you touched on a few points. Chile has always been on the mining-friendly side for almost 30 years now, and been highly attractive to foreign investment. There were the spots with nationalization in the sixties and seventies but for as long as I’ve been in,the industry, Chile’s always been a very favourable jurisdiction. We were fortunate enough to listen to President Boric’s presentation in Ottawa, right after he met with Prime MinisterTrudeau.

And I was incredibly impressed by him. He’s 36 years old. I have been very skeptical of politicians generally. And I quite frankly don’t even want to meet with them most of the time. But they announced the presentation, and I wanted to make sure that we weren’t going to do something improper. And I was so pleased with this presentation, as you mentioned, it’s very pro-investment.

He emphasized, “We need investment. We need industries. We need foreign investment, capital investment. And mining is right at the top of our list, especially investments related to electric vehicles, battery matters, that kind of a thing.” So one thing that’s also very interesting in Chile: Chile has been a location wherein if you staked or acquired claims, the holding costs were very low.

And so the large company just aggregated and held onto huge tracts of land. Okay. the recent government changed those rules. It doesn’t matter, but in the future, the land payments are going to go off. For us, Cachinal makes no material difference because we don’t have that much land there. For some of these large, let’s call them, multinational organizations, they have millions of acres. And that becomes a problem. And that’s going to free up some land for companies like us.

So to answer your question, yes, Chile is definitely going to be an area of focus for us. Now, Chile doesn’t have a big history of silver. It’s not a very silver-rich country. And generally, although there are some silver deposits, Cachinal is one that is a so-called gold-silver project, but there’s no doubt that Chile and also Argentina will be important locations for us in the future. So watch this space.

What are some of the important catalysts for the company in the coming months and quarters?

To continue to be outrageously active in terms of looking at acquisitions. As mentioned, it’s a buyer’s market. We don’t face competition in our size range at the current time anyway. So look for more net asset value for share accretive deals. In terms of our message, we want to make sure that people understand that we’re not an exploration company.

We’re not a royalty company. We’re not a mining company. In essence, we’re a little bit of all of that. And if you like silver, then you’re going to love Honey Badger. We’re all very much of the opinion that Silver’s going to go higher, including, obviously Eric Sprott who is a major investor. And so it’s going to take a little while for our, let’s call it our harvest.

Let’s say we’re making wine here. We’ve just spent the last year harvesting and it’s going to take a little while for the wine to get its maximum flavor. And so investors need to be a little bit patient, but I want them to know that we’re very busy – we are shareholders too. And we’re going to be very focused on creating value, including through marketing. We continue doing a lot of marketing like this, for example. Meeting with investors to make sure that they understand that we’re busy.

If potential investors or current investors want to learn more about Honey Badger, how should they go about that and get in touch with you or the company?

Obviously, on Honey Badger Silver’s website, there’s a link and a little box there. We call it a connector where you can get in touch with management and you can ask management for all kinds of information. You can even express interest in financing the firm if you want or in terms of buying stock.

So just go to our website, we’re a very open and transparent company and welcome any inquiries from anyone that’s interested in learning about the world of Honey Badger Silver.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Honey Badger Silver (TSXV:TUF) announced on June 10, 2022, that it had entered into a non-binding term sheet to acquire a 100% interest in the Cachinal De La Sierra Silver-Gold Project from Aftermath Silver Ltd. The Cachinal Project is located in the Cachinal de la Sierra areas in the Antofagasta region of Chile. The proposed transaction includes an exclusivity period that ends on August 15, 2022, and the companies are working to finalize a definitive agreement on or before this date.

Chad Williams, Director and Non-Executive Chair of Honey Badger Silver, commented in a press release: “We are very pleased to announce a further accretive addition to our growing portfolio of silver assets. Cachinal is a significant known silver resource located in a favorable jurisdiction. Moreover, its proximity to Austral’s Guanaco mine and mill complex may offer substantial synergies to advancing Cachinal to production in a timely manner. We believe Cachinal will be transformational for Honey Badger. We were also greatly encouraged and inspired by a recent speech delivered by H.E. Gabriel Boric, President of the Republic of Chile, at an event hosted by the Canadian Council for the Americas. During this event, Mr. Boric strongly signalled his commitment to property rights, and the rule of law in addition to welcoming direct foreign investment. Chile’s long-standing partnership with Canada to generate economic growth and jobs for all was reiterated in meetings with Prime Minister Trudeau during his visit.”

Cachinal Project Highlights

- Open-pit Indicated Resource of 15.03 Moz of silver grading 97 g/t of silver and 20.05Koz of gold grading 0.13 g/t gold;

- Open-pit Inferred Resource of 0.41 Moz of silver grading 73 g/t of silver and 0.43Koz of gold grading 0.07 g/t gold;

- Underground Indicated Resource of 1.29 Moz of silver grading 182 g/t of silver and 1.65Koz of gold grading 0.22 g/t gold;

- Underground Inferred Resource of 2.07 Moz of silver grading 180 g/t of silver and 2.18Koz of gold grading 0.19 g/t gold;

- Proximity to Austral Gold Limited’s (“Austral Gold”) operating Guanaco Mine and Mill complex, located just 16 km to the south;

- Good potential to confirm and incrementally expand existing resources and discover additional mineralization on the property and in the region.

The mineral resource was independently prepared by SRK Consulting (Canada) Inc. in a technical report filed on Aftermath’s SEDAR profile at www.sedar.com, with an effective date of August 10, 2020 and prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”).

Transaction Summary

The Term Sheet contemplates that Honey Badger or an affiliate will acquire all of the issued and outstanding shares of Minera Cachinal S.A., a wholly-owned subsidiary of Aftermath, according to the following terms:

- Share Payment: C$1,000,000 in shares of Honey Badger payable at closing and priced at the greater of: (i) the volume weighted average share price of the Honey Badger common shares on the TSXV for a period of thirty (30) trading days immediately preceding the date of announcement of the transaction and (ii) the maximum discounted price allowed under the policies of the TSXV.

- Cash Payments: a) C$400,000 payable at closing, b) C$452,000 six months after closing, c) C$400,000 on May 21, 2023 and d) C$400,000 eighteen months after closing.

- Royalty: Honey Badger shall grant a 1% Net Smelter Return Royalty with a complete buyback option at Honey Badger’s sole discretion for a purchase price of C$8,500,000;

- Production Payments: Upon commencement of commercial production, Honey Badger shall pay in cash or shares at Aftermath’s option, C$0.50 per payable silver ounce produced at the Cachinal Project, capped at C$2,000,000 in payments.

The detailed terms and conditions of the proposed transaction will be set out in definitive documentation to be negotiated between the parties, which will contain customary representations, warranties and covenants of the parties as well as customary indemnities and closing conditions. There can be no assurance that the proposed transaction will be completed on the terms contemplated, or at all. Readers are referred to the section below entitled: “Cautionary Note Regarding Forward-Looking Information”.

While the Term Sheet is non-binding, the parties have agreed to a mutual break fee of C$250,000 in the event a definitive agreement is not entered into prior to the expiry of the exclusivity period due to a party’s action or inaction, subject to certain exceptions outside the control of the parties. The proposed transaction will be subject to regulatory approval, including the approval of the TSX Venture Exchange (the “TSXV”).

Cachinal Asset Overview

Cachinal is a low-sulphidation epithermal deposit located in the Paleocene Gold Belt of northern Chile, which hosts several significant gold and silver deposits, including Yamana Gold’s El Penon Low Sulfidation Epithermal gold–silver mine and Austral Gold’s Guanaco gold-silver mine-complex, just 16 kilometers to the south. Shallow drilling at Cachinal has defined the current mineral resources principally to a depth of 150 metres below surface and provides sufficient evidence to interpret the presence of high-grade shoots within the vein system extending below the base of a potential open pit.

Cachinal Location

The Cachinal silver-gold project is located in Chile’s Antofagasta region (Region II). The project is located about 40 km east of the Pan American Highway, in a nearly flat plain at an elevation of around 2,700 metres above sea level, 16 km north of Austral Gold’s Guanaco gold-silver mine and mill complex.

Cachinal NI 43-101 Resource Estimate

The Cachinal Mineral Resource was documented in a technical report prepared following the guidelines of NI 43-101 and Form 43-101F1, and in conformity with the generally accepted CIM “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” (2019) by SRK Consulting (Canada) Inc., authored by independent qualified persons Glen Cole, P.Geo of SRK Consulting, and Sergio Alvarado Casas, CMC of Geoinvest SAC E.I.R.L. (Chile), on behalf of Aftermath Silver Ltd., with an effective date of August 10, 2020.

| RESOURCE CLASSIFICATION |

MATERIAL TYPE | TONNES (MT) |

SILVER (G/T) |

GOLD (G/T) |

SILVER (MOZ) |

GOLD (KOZ) |

| Indicated | Open Pit | 4.83 | 97 | 0.13 | 15.03 | 20.05 |

| Underground | 0.22 | 182 | 0.22 | 1.29 | 1.65 | |

| TOTAL | 5.05 | 101 | 0.13 | 16.32 | 21.70 | |

| Inferred | Open Pit | 0.17 | 73 | 0.07 | 0.41 | 0.43 |

| Underground | 0.36 | 180 | 0.19 | 2.07 | 2.18 | |

| TOTAL | 0.53 | 145 | 0.15 | 2.48 | 2.61 |

Notes on the Cachinal Mineral Resource Estimate:

- For complete details on the Cachinal Mineral Resource estimate, please refer to the NI 43-101 technical report titled “Independent Technical Report for the Cachinal Silver-Gold Project, Region II, Chile”, by Qualified Persons G. Cole, (P.Geo) of SRK Consulting (Canada) Inc. and S. Alvarado Casas, of Geoinvest SAC E.I.R.L. (Chile), dated September 11, 2020 with an effective date of August 10, 2020, filed on the Aftermath Silver SEDAR profile.

- Cachinal mineral resources were classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014).

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- All figures have been rounded to reflect the relative accuracy of the estimates.

- Cut-off grades are based on metal price assumptions of US$22.00 / ounce of silver and US$1,550 / ounce of gold, and metallurgical recoveries of 85% for both silver and gold using milling and cyanide leaching.

- The portion of the Mineral Resources that has been determined to be amenable to extraction through open-pit methods was reported to a cut-off of 30 g/t silver equivalent.

- The open-pit Mineral Resource is constrained within Lerchs-Grossman optimised pit shells that assume mining dilution & losses of 2.5%, 50-degree overall slope angles, mining costs of $2/t rock, general and administrative costs of $2/t rock, processing costs of US$15/t for processing using milling and cyanide leaching.

- The portion of the Mineral Resources deemed to be amenable to extraction through underground methods are reported at a cut-off of 150 g/t silver equivalent. This assumes a mining cost of US$90/t, general and administrative costs of $2/t and a processing costs of US$15/t.

Past Work at Cachinal

The Cachinal deposit was mined from underground workings during the 20th century. Drilling by previous owners of the project since 2005 has delineated near-surface silver mineralization associated with a network of steeply dipping, north-to-northwest trending low-sulphide quartz veins.

The epithermal veins and breccias have been recognized by trenching and drilling over a strike length of at least 2 kilometers and are known to have been mined to a depth of at least 300 meters. They range in thickness from a few centimetres to 2 meters, reaching up to 20 meters locally at the intersection of two structures. The main veins trend north-northwest and northwest with a secondary set trending east-northeast to east-west, best developed at the southern end of the deposit.

Technical information in this news release has been approved by Glen Cole, P.Geo., a Principal Consultant (Resource Geology) with SRK Consulting (Canada) Inc. and qualified person for the purposes of National Instrument 43-101.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Mining is one of the most important and oldest industries in the world. It is responsible for extracting valuable resources from the earth that are used to create everything from consumer goods to infrastructure. As with any critical industry, mining has a responsibility to operate in a way that is socially and environmentally responsible. This is known as ESG governance, or corporate social responsibility (CSR) in mining.

ESG Principles

In general, good ESG governance in mining includes four key principles:

- Respecting the human rights of employees, contractors, and local communities

- Minimizing environmental impacts

- Operating in a transparent and accountable manner

- Building strong relationships with local communities

Mining companies focus on ESG in order to create long-term shareholder value and minimize reputational risks. In recent years, there has been an increased focus on ESG among institutional investors and rating agencies. This is because ESG factors can have a material impact on a company’s financial performance.

ESG governance is important for a number of reasons. First, it is the right thing to do. Mining companies have a responsibility to operate in a way that is socially and environmentally responsible. Second, good ESG governance can help mining companies create long-term shareholder value. Third, it can help minimize reputational risks. And finally, ESG factors can have a material impact on a company’s financial and operational performance. Companies that are governed with a responsible and sustainable focus will be better positioned to weather challenges and capitalize on opportunities in the future.

Honey Badger Silver’s Commitment to ESG

Honey Badger Silver (TSXV:TUF) is a Canadian mining company that is committed to good ESG governance. The company has implemented a number of policies and procedures to ensure that it operates in a socially and environmentally responsible manner.

The company has reported that it is actively engaged in pursuing an environmental, social, and governance core strategy to create sustainable, and future-oriented value for shareholders. Honey Badger is demonstrating a commitment to effective and equitable governance, through a board of directors and management that represent leading experts in capital markets, geological expertise, and mineral advancement.

Chad Williams, Director and Non-Executive Chair, believes that “ESG must be viewed as relevant at all stages of the mining cycle if we are to be able to safeguard the future of our natural resources and promote biodiversity. To ensure that our people, partnerships and communities thrive as our business grows, we must have a system in place that gauges the board’s effectiveness to fulfill its responsibilities to the Company’s shareholders, as well as to social and environmental best practices, including the fight against climate change and the global collaborative goal to achieve net zero carbon emissions by 2050.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Silver prices have swung to new highs as investors weigh risks and equity sell-offs. Prices have swung from trading over US$25 in March to hit a YTD high of US$26.38, and after a pullback at the end of that month, another price spike in April brought it back to those highs. From an April high of US$25.91, prices have hit a low of US$22.52.

However, despite the pullback, silver has begun to trade more like its safe-haven sibling gold. But while gold is often held as a hedge against risk and inflation, silver has applications beyond that. It’s used in solar panels, water filtration, and a variety of other industrial applications. So, while it may not be as popular as gold, it certainly has its place in a portfolio.

For investors looking for silver stocks, the current sell-off has provided opportunities to value plays with massive upside as silver prices rise again.

Honey Badger Silver (TSXV:TUF)

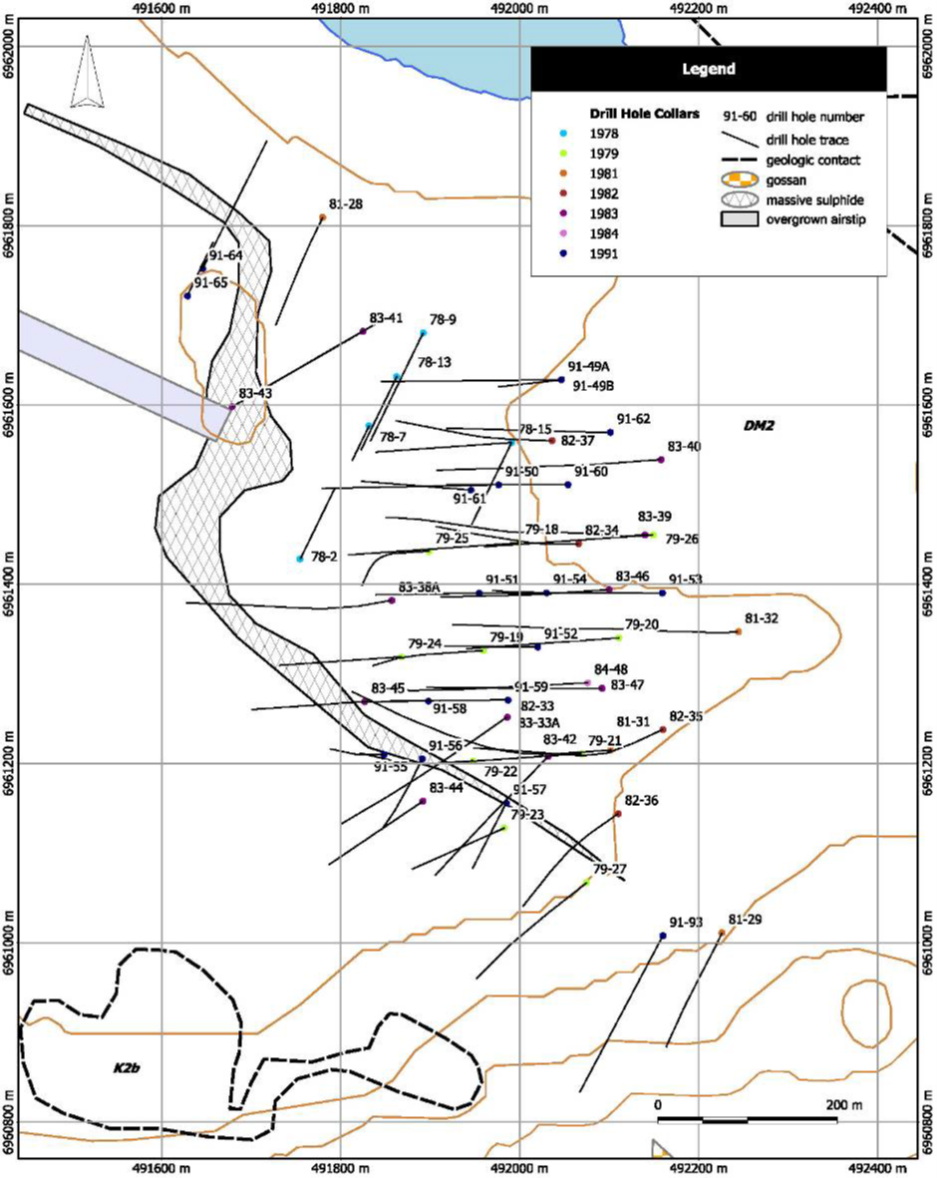

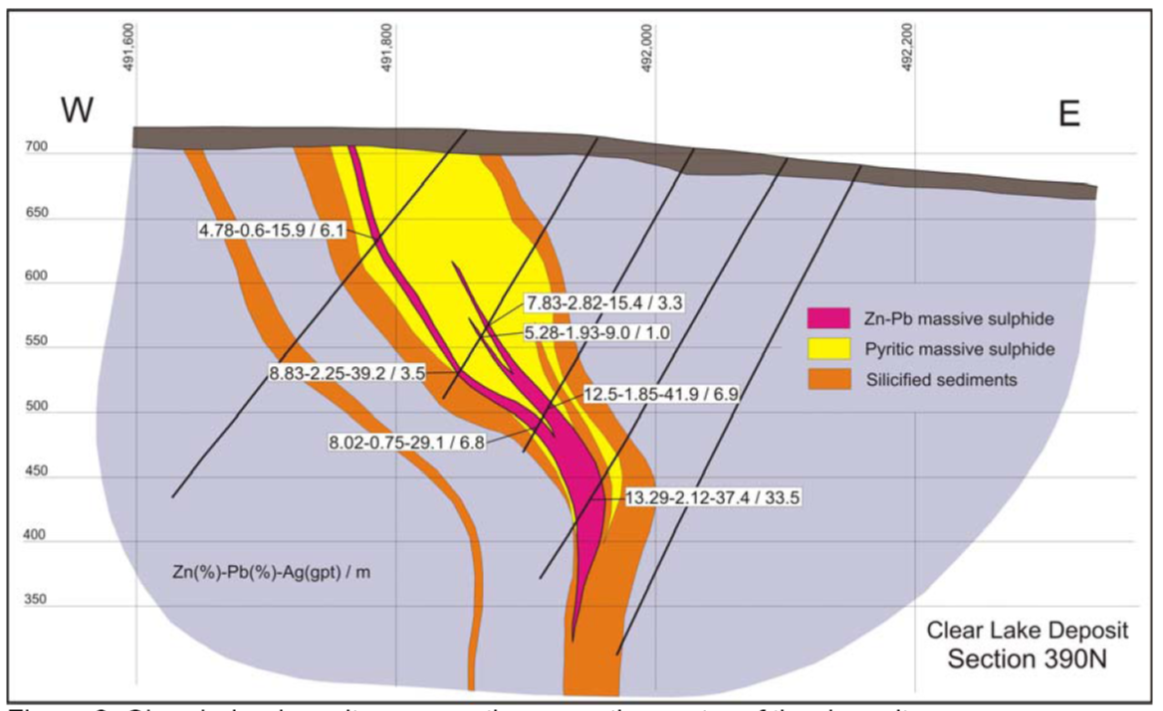

Honey Badger Silver, a junior mining company based in Canada, has had a string of announcements during silver’s turnaround. Most recently, the company announced on March 29 that it had acquired a 100% interest in the Clear Lake deposit in the Whitehorse Mining District of the Yukon.

The transaction is subject to a 1% net smelter return royalty on all metals except silver. The Clear Lake deposit is known to be an important source of zinc and lead but holds mostly silver. With the acquisition, Honey Badger Silver Inc. is becoming the owner of a historic resource of 5.5 million ounces of silver.

This acquisition was an important addition to Honey Badger Silver’s portfolio, as it works to enter more silver properties at different stages of production in order to allow it to offer investors high exposure to silver prices. The company continues to conduct asset evaluations.

The historical resources were reported in a NI-43-101 technical report dated February 23, 2010, and were 43-101 compliant at the time the agreement was signed.

Americas Gold and Silver (TSX:USA)

Americas Gold and Silver is based in North America and owns several producing sites, including the San Rafael mine in the Cosalá operations in Sinaloa, Mexico, which includes the Galena Complex from Idaho, US

During its quarterly earnings call on March 17, the firm revealed its complete 2021 results and addressed the disappointment seen at its Relief Canyon Mine, which failed to go into commercial operation in 2021 owing to metallurgical difficulties. The company is confident, however, due to the reopening of Cosalá and the rising silver price. Its most recent Q1 production results also showed an output of 300,000 silver ounces and 1,274,000 silver equivalent ounces.

New Pacific Metals (TSX:NUAG)

New Pacific Metals is a precious metals explorer and builder. Its main business at the moment is its Bolivian Silver Sand project, which it developed. The firm has two additional silver properties in Bolivia: Silverstrike and Carangas. New Pacific is exploring Silver Sand and Carangas for 2022.

New Pacific Metals released two news stories about exploration at Carangas in February: one announcing a grade of 78 grams per metric ton (g/t) silver and the other sharing the discovery of gold mineralization. However, until silver’s price surge in March, the company’s share price did not experience significant gains. In April, the company also announced intersections of 229 g/t silver at the Silver Sand project, and guidance that it expected to complete 15,000 meters of drilling by the end of April.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

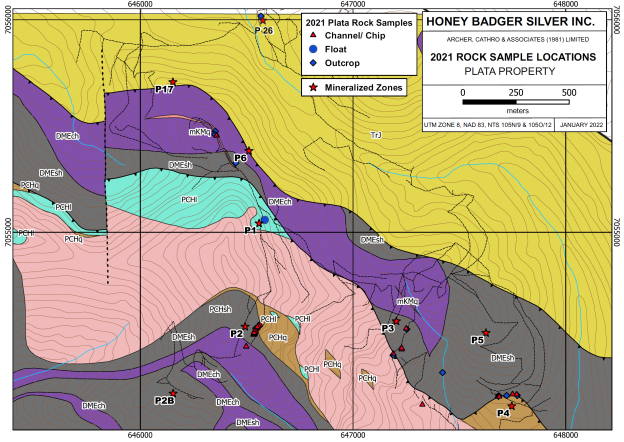

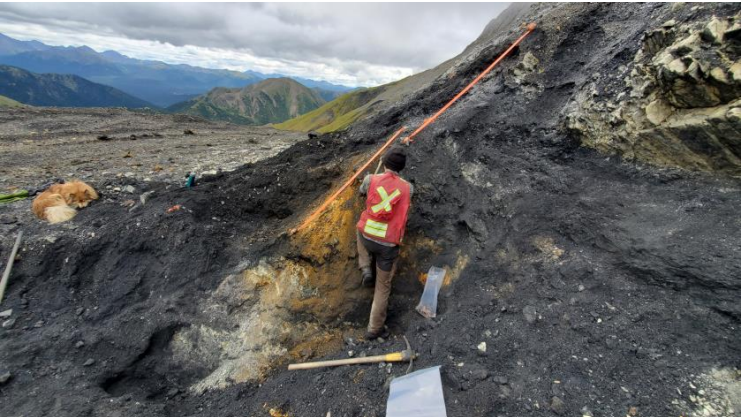

Honey Badger Silver (TSXV:TUF) announced on May 16, 2022, that a 10-year class 3 quartz mining land use approval has been granted by the Yukon Government in Canada at the high-grade Plata Silver Property. Honey Badger will be allowed to perform ground exploration activities for up to 300 diamond drill and 300 reverse circulation holes, for a total length of 30,000 metre, significant trenching and bulk sampling, and road construction to be able to define areas of mineralization on the property.

Exploration permits are critical in order to continue the development of a project and without them, a company is unable to move forward. This is a significant milestone for the company as it can now focus on moving the project toward high-grade discoveries and development.

Chad Williams, Chairman of Honey Badger Silver, commented in a press release: “Plata has produced high-grade silver from small-scale mining in the past and currently hosts 32 showings(1), many of which have returned high-grade silver, lead and zinc values, from drilling and trenching. We are looking forward to unlocking the extraordinary potential we believe Plata possesses.”

Honey Badger Silver also recently announced it had acquired a 100% interest in the Clear Lake Deposit, in the Whitehorse Mining District in Yukon. The acquisition was another critical step for the company toward its strategy of entering more silver properties with high optionality at different stages of production to allow it to offer investors high exposure to silver prices.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Honey Badger Silver Inc. (TSXV:TUF) announced on Tuesday, March 29 that it had acquired a 100% interest in the Clear Lake deposit in the Whitehorse Mining District of the Yukon.

The transaction is subject to a 1% net smelter return royalty on all metals except silver. The Clear Lake deposit is known to be an important source of zinc and lead but holds mostly silver. With the acquisition Honey Badger Silver Inc. is becoming the owner of a historic resource of 5.5 million ounces of silver.

Honey Badger Chairman Chad Williams said: *The Clear Lake acquisition represents a milestone as we acquire, on an extremely value-accretive basis, a quality asset with in-situ silver resources in one of the best mining jurisdictions in the world, where we are currently active at our higher-grade Plata silver project. This acquisition demonstrates our stated strategy of identifying and executing highly accretive targeted silver acquisitions. Clear Lake not only provides our shareholders with exposure to silver resources but also offers the possibility of unlocking value from the significant zinc and lead endowment, which is not of primary interest to Honey Badger, in a royalty/stream spin-off or even potentially other innovative instruments, such as a commodity-linked non-fungible token (“NFT”) – watch for more news on this front.”

This acquisition represents an important step in fulfilling the company’s strategy of entering more silver properties at different stages of production that will allow it to offer investors high exposure to silver prices. As part of the strategy. Honey Badger continues to conduct asset evaluations.

The historical resources were reported in a NI-43-101 technical report dated February 23, 2010 and were 43-101 compliant at the time the agreement was signed.

Inferred historical resource prepared by SRK Consulting in 2010 in accordance with National Instrument 43-101 (“NI 43-101”) of 5.5 million ounces of silver at 22 grams per tonne, plus 1.3 billion pounds of zinc grading 7.6% zinc and 185 million pounds of lead grade 1.08%(A)(B);

Figure 2: Cross-Section of Clear Lake Deposit, SRK Technical Report, 2010(A)

Being a silver deposit but also a zinc and lead deposit, the company is exploring different options to make the best use of the historic Clear Lake resource.

The Clear Lake deposit includes 1.3 billion pounds of zinc and 185 million pounds of lead so Honey Badger is considering the possible sale of royalties on the zinc and lead or other means. It also presents potential to gradually expand existing resources and discover additional mineralization on the property.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Honey Badger Silver (TSXV:TUF), a Canadian pure play silver company, announced last week that it has engaged Archer, Cathro, and Associates to complete a 3D geological modelling study to help develop and refine targets at the Plata Silver Property in east-central Yukon. Plata Silver is a 5,690 hectare property at which recent analysis showed compelling target areas for follow-up. The company expects results of the analysis to be released in coming weeks, after currently interpretations are finalized.

Chairman of Honey Badger Silver, Chad Williams stated in a press release, “Plata has produced high-grade silver from small-scale mining in the past and currently hosts 32 showings(2), many of which have returned high-grade silver, lead and zinc values, from drilling and trenching. My site visit to Plata last summer served to highlight the great potential of this property and we are delighted to be partnered with Archer Cathro, a highly regarded and sophisticated group of geoscientists that have had tremendous success in the Yukon over the past forty years. We look forward to leveraging their deep knowledge to identify the most prospective targets at Plata and in planning our Summer 2022 program.”

Following the extremely successful findings from the Company’s 2021 Field Program at Plata, which uncovered Keno Hill-style high-grade silver-lead-zinc values from a number of prospects that were evaluated and mapped, this study was commissioned. The Plata and Keno Hill regions, according to Archer Cathro geologists, have many similarities.

The second-largest silver producer in Canada is Keno Hill, located 165 kilometers west of the Plata Silver Property. Between 1913 and 1989, it produced more than 200 million ounces of silver at an average grade of 44 oz/t (oz/t). Alexco Resource Corp., which owns and runs the majority of Keno Hill’s historic mining operations, restarted concentrate production and shipments in the first quarter of 2021, with commercial output expected to begin shortly.

The following is a recap of highlights from the 2021 Plata Summer Work Program:

- Assays received confirmed the presence of Keno Hill-style high-grade silver including:

- 16,887 g/t silver and 67.99% lead from a rock sample (float) at the P1 Zone, 4,300 g/t silver, 22.00% zinc and 46.40% lead over 1.0 metre from a channel sample at the P2 Zone and 2,720 g/t silver, 72.63% lead from a rock sample (outcrop) at the P26 Zone associated with Type I veins;

- 4,500 g/t silver, 7.26 g/t gold and 24.13% lead over 0.85 metres from the Aho Zone, which extends over 800 metres along strike, associated with Type II veins;

- 5,190 g/t silver, 4.24 g/t gold, 24.4% lead and 3.62% zinc- obtained from composite grab samples from approximately 90 historic ore bags.

- The property hosts 32 hard rock showings that have seen minimal past exploration as well as eight strong multi-element soil anomalies suggesting additional zones along trend that have seen little to no follow-up work, which offer excellent potential for new discoveries.

Source: Honey Badger Silver

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As 2022 rolls on, investors are looking for edge anywhere they can get it. With current uncertainty in commodities markets and the mining industry, there are few unique opportunities left. However, investors looking for a pure-play silver company in a stable mining jurisdiction may have any option in Honey Badger Silver (TSXV:TUF) (OTC:HBEIF).

Honey Badger is a public Canadian pure-play silver mining company headquartered in Toronto, Ontario, engaged in the identification, acquisition, development and integration of cumulative silver ounce transactions. Silver’s resiliency and safe-haven asset status during a period of intense struggle for the mining industry overseas could give investors plenty of alpha in the coming quarters.

The company has a dominant land position in Ontario’s Thunder Bay Silver Historic District, which covers 16,800 hectares. The Honey Badger group of properties covers some of the most productive veins in the Thunder Bay silver district. Honey Badger also has advanced projects in the southeastern and south-central Yukon, positioning it as a premier silver company.

Honey Badger’s mission is to produce silver and other precious metals safely, sustainably and profitably. The company and its highly experienced team is focused on being the world’s leading producer of precious metals, thus creating value for its shareholders through engineering, innovation and sustainable development.

The Thunder Bay Silver Project

The Honey Badger land parcel in Thunder Bay is home to 12 high-grade mines that have had a historical production of 1,667 million ounces of silver.

The company’s Silver mountain/Mink property is located approximately 50 meters south of the Silver Mountain group of deposits, which produced 700,000 ounces of silver between 1888 and 1903. Its geological history and the general geological setting of this project make it in a primary target for the discovery of high grade polymetallic silver mineralization (cobalt, zinc and lead)

Polymetallic silver deposits are found in two main districts of Ontario; the Timiskaming near the town of Cobalt (the Cobalt Silver District); and the northwestern Lake Superior near the town of Thunder Bay (the Thunder Bay Silver District).

A report filed with the Bureau of Mines in 1913 (REPORT OF THE BUREAU OF MINES VOL. XIX., PART II., The Cobalt-Nickel Arsenides and Silver Deposits of Temiskaming (Cobalt and Adjacent Areas), WILLET G. MILLER, Provincial Geologist , 1913) compared minerals from the Port Arthur silver mines (Thunder Bay, ON) with those from the Temiskaming veins (Cobalt, ON) and found the following points in common:

- Native elements: Native silver, native bismuth, graphite .

- Arsenates: cobalt flower, annabergite.

- Sulfides: Argentite, zinc blende, galena, pyrite, marcasite, pyrrhotite, chalcopyrite, copper gaze.

The geological attributes of the area and spatial distribution of the polymetallic silver mines, the samples, suggest a good potential to discover new high-grade polymetallic silver veins in the region.

Promising discoveries have been made in exploration programs that Honey Badger began in 2018:

- Random samples* taken at the property’s 12 historic mines returned up to 1,503 g/t silver and 14.94% zinc.

- Drilling identified multiple zones of near surface cobalt mineralization with no arsenic (0.26% cobalt over 10.8 meters in BM-18-004) and high grade silver mineralization (1254 g/t silver in BM-18-006).

Source: Honey Badger Silver

Honey Badger Announces Third Silver Assay Results

Honey Badger recently announced rock, chip and rock sample analysis results from the 2021 field program at its 5,690-hectare Silver Property, 100% owned by Honey Badger, located in west-central Yukon.

Highlights of silver, lead and zinc assays from trench and chip sampling at the P2 Zone are listed below:

- 4,300 g/t silver, 46.4% lead and 22% zinc over 1.0 meter

- 1,775 g/t silver, 48.78% lead and 13.35% zinc over 1.2 meters

- 1,140 g/t silver, 24.16% lead and 16.41% zinc over 2.49 meters

- 12,806 g/t silver, 76.08% lead and 3.70% zinc over 0.10 meter

Highlights of silver, gold, lead and zinc assays from rock samples collected from outcrop and float material at the P1, P6 and P26 Zones are listed below:

- P1 Zone: 16,887 g/t silver, 0.18 g/t gold, 67.99% lead and 0.83% zinc (float)

- P6 Zone: 7,950 g/t silver, 1.55 g/t gold, 57.66% lead and 0.99% zinc (outcrop)

- P6 Zone: 4,510 g/t silver, 6.91 g/t gold, 25.73% lead and 2.05% zinc (float)

- P26 Zone: 2,720 g/t silver, 0.32 g/t gold, 72.63% lead and 0.43% zinc (outcrop)

These latest results, in conjunction with the first two batches of assay results previously reported confirm:

- high-grade silver in Type I veins at the P1, P2 and P26 Zones , and

- high -grade gold-bearing silver in Type II veins at the Aho and P6 Zones,

- very high-grade silver and gold was mined by historic miners

Source: Honey Badger Silver

Honey Badger Reports Second Batch of Yukon Silver Program Assays

The company also recently reported assays out of its Yukon Silver Program;

Highlights of silver, gold, lead and zinc Assays from five channel and chip samples collected from the Aho zone at Plata are listed below:

- 4,500 g/t silver, 7.26 g/t gold, 24.13% lead, 0.83% zinc over 0.85 meters;

- 3,480 g/t silver, 4.63 g/t gold, 23.79% lead, 2.05% zinc over 1.6 meters;

- 1,546 g/t silver, 3.28 g/t gold, 5.04% lead, 0.09% zinc over 1.45 meters;

- 868 g/t silver, 5.30 g/t gold, 7.47% lead, 1.95% zinc over 1.93 meters; and

- 202 g/t silver, 3.69 g/t gold, 1.12% lead, 10.1% zinc over 1.32 meters.

In addition, gold assays have been received for five composite grab samples of hand sorted material collected from 90 ore bags left behind by historic miners at Plata. These are reported below in conjunction with silver, lead and zinc assays previously reported by the Company on December 13, 2021:

- 4.25 g/t gold, 5,190 g/t silver, 23.4% lead and 3.62% zinc;

- 7.56 g/t gold, 4,820 g/t silver, 13.15% lead and 2.78% zinc;

- 6.24 g/t gold, 4,000 g/t silver, 20.97% lead and 3.41 g/t zinc;

- 2.67 g/t gold, 3,500 g/t silver, 17.5% lead and 3.07% zinc; and

- 5.61 g/t gold, 2,930 g/t silver, 10.5% lead and 2.26% zinc.

Plata lies within the Tintina Gold Belt and displays numerous similarities to the world-class Keno Hill Mining Camp, Canada’s second largest primary producer of silver, located 165 km west of the Plata Silver Property. Keno Hill produced more than 200 million ounces of silver at an average grade of 44 ounces per ton (oz/t) of silver from approximately thirty-five vein deposits between 1913 and 1989 (1).

Source: Honey Badger Silver

As the conflict in Ukraine rages on and global markets stumble, assets like silver, and silver mining stocks may be one of the best places to park money for the long-term. As a result, Honey Badger Silver (TSXV:TUF) (OTC:HBEIF) may be the ultimate pure-play silver mining stock for 2022.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

A silver stone.

A silver stone.

When you think of junior mining companies, what comes to mind? A small business exploring and waiting for their big discovery before finally starting production? Maybe an organization without large capital commitments, land, or other assets? This might be true of most junior miners but is so far from the mark for Honey Badger Silver, that one has to wonder why they are even considered ‘junior’ in the first place.

Honey Badger has shown it can produce year after year and judging by their financial reporting since 2018, you can get the idea that they know where to focus their efforts. The Canadian company has created a strategy centred around a large mine in the Historical Thunder Bay Silver District in Ontario, Canada. Their land position of 16,800 hectares in the region is the dominant one and allows them to take advantage of some of the most productive silver-bearing veins of the Rabbit Mountain group of deposits. Nothing is holding the company back, and competition is thin, to say the least.

Full Speed Ahead

The investment comes with the added benefit of funding an expansion of the exploration of the company’s Thunder Bay silver portfolio and for general working capital purchases. Production increases should follow as well, returning the investment to Sprott’s pocket as well as anyone who is wise enough to jump in with him.

Investors Agree

Beyond management holdings and those buying shares piece by piece, high-profile investor Eric Sprott is also all-in on Honey Badger Silver. A new placement from the investor going all-in on junior mining companies of $1 million is the ultimate vote of confidence from an investor who knows exactly what he’s doing. Investors buying shares now can only be learning from the smart money now and will be able to reap the rewards down the line when it continues to rise.

Making Room

Sprott’s decision to add $1 million to a $3 million placement prompted Honey Badger Silver’s chairman Chad Williams to voluntarily reduce his subscription to the stock, according to him, to, “accommodate high demand from other investors”. He now holds 9.9% of the company, undiluted.

In Good Company

Honey Badger Silver is in good company when it comes to those chosen to be a part of Sprott’s investment portfolio. Going beyond institutions, he placed his faith in another top miner last year, First Majestic Silver. The investment was for 5 million shares worth $78 million, proving that when you know the answer, your portfolio will surely follow.

Buying Up Property

Honey Badger isn’t slowing down, as made evident by their March 15th announcement that they have acquired three advanced silver-focused properties located in southeast and south-central Yukon, Canada. The acquisition will help the company diversify its property portfolio and begin producing in multiple regions of the country. The expectation is that the acquisition will close on or before April 30, proving that the company is ready to continue its expansion and put its capital to good use.

Looking Down The Road

Looking into the future is impossible, but forecasts are made a lot easier by extrapolating from current trends. Let’s take a look at how it’s going so far. The stock has touched all-time highs, acquisitions are en route, and the company is well-capitalized to continue its production and expansion. If the trends of the past few years continue, Honey Badger stock is only at the bottom of a very long upward trend, and even shareholders with relatively small stakes stand to benefit from any more wins.

Although the company is a junior miner in name, it operates like a seasoned and much bigger player, controlling and exploring 100% of one of the most valuable silver properties in the country (and the world). Clearly that isn’t enough for Honey Badger Silver, who we will continue to follow closely.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan