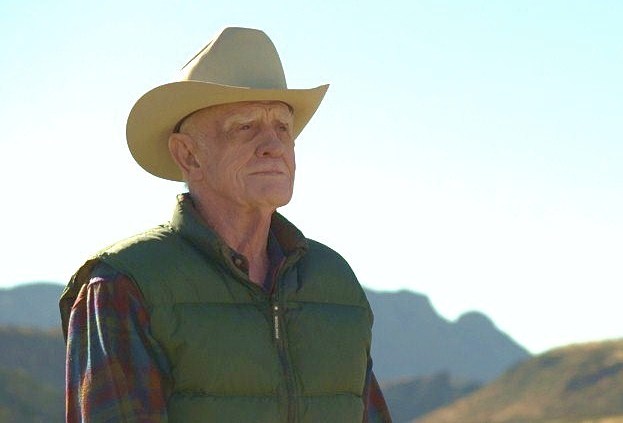

The Atascosa Ranch is walking distance from the US/Mexico border, just outside of Nogales, Arizona. It’s owned by Dave Lowell, an affable 84-year-old man who’s spent the past 75+ years hunting for buried treasure. Today, he’s known as the most successful mining explorationist of the past century, having discovered an unprecedented seventeen ore bodies, including the world’s largest copper mine.

J. David Lowell was born February 28, 1928, to a modest family, not too far from Atascosa (the ranch belonged to his uncle at the time). Lowell was first exposed to mining at age 7, when his father, a mining engineer, put him to work. When Lowell pursued his college education at Arizona and then Stanford, he concurrently worked at mines and on exploration programs. Not too long after he had completed his degrees, Lowell had become one of the foremost experts on copper deposits.

Lowell is probably best known today for co-authoring the Lowell-Guilbert Model, a guide to large, low-grade porphyry copper deposits published in 1970. Throughout most of his career, Lowell used the model to locate some of the most profitable mineral finds in the history of mining, such as the 1981 discovery of the Escondida deposit in Chile. Containing hundreds of billions of dollars worth of ore, Lowell and his colleagues found it at the cost of a mere $2.5 million.

Lowell is modest about his success. But he offered a theory as to why major mining companies don’t make discoveries as efficiently as prospectors like Lowell. Major mining companies have a “don’t make mistakes” approach, which “doesn’t fit at all with the profile of the mad scientist who discovers mines,” he said. “When something like one in five hundred good-looking targets will become a mine, a successful explorationist needs permission to be wrong four hundred and ninety-nine times.” Here he paused. “If there’s anything my career says about me, it’s that I’m very good at being wrong.”

Despite being a pro about being wrong, Lowell does admit to limitations. Having “no taste for shareholder relations,” he recalled giving a presentation to investors in 1995 that resulted in the share price of one of his companies falling from $35 to $15 during the time it took him to finish his talk. The shares recovered shortly thereafter.

On the changing impact of technology on mineral exploration over the span of his lifetime, Lowell holds that it’s been “very little.” He believes that “geophysics has been very oversold,” instead favoring “drill holes and geochemistry… The best guide to ore is ore.” Lowell also voiced doubts that technology would be able to revolutionize mineral exploration the way 2D and 3D Seismic has for the oil and gas business, at least in the near future.

The commodities super-cycle is in tact, Lowell believes. There’s elasticity in mining companies’ profit margins, he told us, but not in the demand for the underlying commodities they produce. For that reason, large, undeveloped, low grade copper deposits will need to be put into production, sooner than later.

When asked about his favourite jurisdictions for exploration currently, he told us he favors Chile, Peru, New Guinea, Mongolia, Nevada, and some parts of Africa. But he qualified his dispositions by recalling that attractive jurisdictions are constantly changing. “Places like Arizona were very attractive as a place to explore for copper deposits, and now Arizona is about as bad as Venezuela,” he chuckled.

When we moved on to the role luck has played in his career, Lowell avoided answering directly. Instead he responded that “minefinders who make one discovery are much more likely to find another.” His basic philosophy is that of persistence, and it shows — his career is equally productive after retirement age as it was before.

Lowell is developing several projects, including a titanium-iron deposit in Paraguay, which he believes is the largest of its kind in the world. Other active projects are under wraps for now, as to avoid competition. Investors who rode his Arequipa Resources shares from .20 to $30.00 in 1995 will surely be watching Lowell’s upcoming public ventures. An autobiography is also in the works.

It was an honor to spend time with Dave at his ranch, and we’re pleased to share some video, pictures, and sounds of the day. We hope you enjoy the following short film about the greatest outlier and maverick the mining industry has known in recent memory, J. David Lowell.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.